Long-term goals aren’t easy to achieve. But why?

Could it be that motivation wanes over time? Perhaps external circumstances change. Maybe it has to do with the feasibility of the goals.

Many people have trouble sticking to something over the course of a single year let alone several years or decades.

Perhaps that’s why long-term goals – like most financial goals – are so difficult to achieve.

Table of Contents

- Why Long-Term Financial Goals Are Important

- 1. Capture Your Long-Term Goals in Your To-Do List.

- 2. Don’t Bury Your Long-Term Goals.

- 3. Dedicate Certain Days of the Week to Long-Term Goals.

- 4. Prioritize Your Long-Term Goals Properly.

- 5. Discover and Focus On Your Motivations.

- Long-Term Goal Examples (Using SMART framework)

- My Lifetime Goals

- The Bottom Line – Long-Term Financial Goals

- Here’s Your Homework

- FAQs – Long-Term Financial Goals

How do we fight against whatever it is that holds us back from achieving these financial goals? Is it possible to win?

Yes. It is.

Today I’d like to share with you some ways you can achieve your long-term financial goals. I won’t claim it will be easy, but it will be worthwhile.

So whether you need to pay off debt, build an emergency fund, save for your kids’ college education, or invest for retirement, here are some ways you can make it hap’n, cap’n.

Why Long-Term Financial Goals Are Important

Long-term financial goals provide direction and motivation for your financial decisions. By defining your long-term goals, you will have a clear picture of what you want to achieve and what steps you need to take to get there. Setting long-term financial goals can help you:

- Stay focused on your priorities: Setting long-term financial goals will help you prioritize your financial decisions and avoid getting distracted by short-term financial needs or impulses.

- Achieve Financial Stability: Long-term financial goals can help you create a safety net, build wealth, and prepare for unexpected events such as medical emergencies or job loss.

- Enjoy the Benefits of Compound Interest: Investing in long-term goals, such as retirement or education, can help you take advantage of the power of compound interest and grow your wealth over time.

1. Capture Your Long-Term Goals in Your To-Do List.

Long-term goals of the financial sort are usually more like projects than individual tasks.

For example, if you want to pay off your debt, chances are that you don’t just have one credit card to pay off – you might have three credit cards, a vehicle loan, and a student loan to overcome (if not more).

“Pay off debt” would be the project. “Pay off Visa #1” would be the task.

The truth is that without writing down your projects and tasks within a task management system of some type, you’re much less likely to accomplish your long-term goals.

There’s just something about seeing your long-term goals on paper (or on a screen) that makes them real. The very act of writing them down is a type of commitment.

Give it a whirl. Write down your long-term financial goals and review them on a regular basis.

2. Don’t Bury Your Long-Term Goals.

It’s not enough to write down your long-term financial goals. Additionally, you need to make them readily available to your eye.

One idea that I’ve found works well is to write down your goals on a whiteboard where you can’t help but see them. But that’s not for everybody.

The point is that you need to find a way to see your long-term goals in the context of all your other goals (namely, your short-term goals).

Don’t bury your long-term goals. They’re important too!

3. Dedicate Certain Days of the Week to Long-Term Goals.

One helpful tip I derived from Strategic Coach was to dedicate certain days of the week to certain goals. This has proved to be very helpful in my own life, and I believe it will in yours, too.

For example, you could dedicate a certain day of the week to managing your finances and brainstorming ways to improve your financial future. Perhaps you have a day off of work that would work best for you.

Now, I can hear you saying, “Oh Jeff, if I only had a day for such tasks – I’m way too busy with other stuff!” That’s fair.

But here’s the thing, you don’t just have to make this day about finances – you can make it about your other long-term goals too. Add in health, family, and other areas of responsibility.

Consider this day (or these days) of the week to be all about bettering yourself and your life. Can’t you make time for that?

4. Prioritize Your Long-Term Goals Properly.

When it comes to long-term financial goals, you need to properly prioritize them. There are some preliminary goals that should only take you less than a month, like setting up a budget and cutting expenses, but we’ll leave that for another article.

What are some common long-term financial goals and in which order should you complete them? Generally, I recommend you complete the following long-term financial goals in the order they are displayed below:

Build Your Emergency Fund

Think of your emergency fund as the foundation of your financial future. Without some liquid money, you’re going to be out of luck when a financial disaster strikes. Believe me, they happen.

Your car engine might explode. Your kneecap might explode (ouch). Your water heater might explode. There are so many things that can explode . . . and it’s not easy to just walk away from those explosions while keeping your cool. It’s stressful!

But you know what would make those situations a little less stressful? You guessed it: an emergency fund baby!

Wipe Out Your Debt

Once you have your foundation in place, it’s time to knock out that debt. This can take several years or a few months – it depends on how much debt you have and how quickly you can shovel money at it.

Write down all of your debts and attack them one by one. It’s easier that way.

Start Investing for Retirement

Now it’s time to start investing for your latter years. Why? It’s possible that your earning potential can go down when you’re physically unable to work. Who knows, you might have a self-sustaining business upon reaching retirement age, but don’t count on it. Invest for the future!

Helping people retire well is what I do.

Start Saving for Other Long-Term Goals

This might include saving for your kids’ college education, purchasing a new vehicle, saving for a home renovation, changing careers, or another goal that will take some time.

By prioritizing your long-term goals in the proper way, you can ensure that should you experience a slump in income, you aren’t wiped out due to a lack of financial planning.

5. Discover and Focus On Your Motivations.

I’m convinced that one of the main reasons people don’t accomplish their long-term goals is because they really haven’t discovered their motivations.

For example, everyone knows it’s a good idea to pay off debt. It’s a financial goal that’s been embedded in our minds by countless financial advisors. But unless you discover your motivation for paying off debt, chances are you’ll give up before you achieve your goal.

In fact, if you’re paying off debt for the sake of paying off debt, you might as well give up now. You’re not going to be motivated enough to get the job done.

Instead, focus on some common motivations that can become your motivations. Here are some great reasons why people want to pay off debt:

- To Not Have to Pay Interest on Their Purchases

- To Free up Money for Vacations

- To Free up Money for Investing in Retirement

- To Not Have to Worry About Those Bills

- To Reduce the Amount of Stress in Their Lives

- To Free up the Time It Takes Managing Debt to Focus On Family

These are just a few of the motivations of others. What’s your motivation?

Assign a motivation for every long-term goal you have. Otherwise, you’re just trying to accomplish your long-term goals for the sake of accomplishing them – that’s not a real motivating factor if you ask me!

Long-Term Goal Examples (Using SMART framework)

Long-term financial goals can take many forms, depending on your values, aspirations, and time horizon. Here are some examples of long-term financial goals in the SMART framework:

Example 1: Save for Retirement

Specific: Save $1 million by age 65 for retirement.

Measurable: Save $500 per month in a retirement account.

Achievable: Based on current income and expenses, it is feasible to save $500 per month for retirement.

Relevant: Retirement is a long-term financial goal that aligns with personal values and aspirations.

Time-bound: Achieve this goal by age 65.

Example 2: Pay off Debt

Specific: Pay off $30,000 in credit card debt.

Measurable: Pay $500 per month towards credit card debt.

Achievable: Based on current income and expenses, it is feasible to pay $500 per month towards credit card debt.

Relevant: Paying off debt is a long-term financial goal that aligns with personal values and aspirations.

Time-bound: Achieve this goal within 5 years.

Example 3: Invest in Education

Specific: Save $50,000 for a child’s college education.

Measurable: Save $200 per month in a 529 college savings plan.

Achievable: Based on current income and expenses, it is feasible to save $200 per month for a college education.

Relevant: Investing in education is a long-term financial goal that aligns with personal values and aspirations.

Time-bound: Achieve this goal in 18 years.

Example 4: Buy a House

Specific: Save $100,000 for a down payment on a house.

Measurable: Save $1,000 per month in a high-yield savings account.

Achievable: Based on current income and expenses, it is feasible to save $1,000 per month for a down payment.

Relevant: Buying a house is a long-term financial goal that aligns with personal values and aspirations.

Time-bound: Achieve this goal in 5 years.

Example 5: Start a Business

Specific: Launch a profitable business in the next 5 years.

Measurable: Develop a business plan and secure funding within the next 12 months.

Achievable: Based on current skills and experience, it is feasible to develop a business plan and secure funding within the next 12 months.

Relevant: Starting a business is a long-term financial goal that aligns with personal values and aspirations.

Time-bound: Launch the business within the next 5 years.

| LONG-TERM GOAL | SPECIFIC | MEASURABLE | ACHIEVABLE | RELEVANT | TIME-BOUND |

|---|---|---|---|---|---|

| Save for Retirement | Save $1 Million by Age 65 for Retirement. | Save $500 per Month in a Retirement Account. | Based on Current Income and Expenses, It Is Feasible to Save $500 per Month for Retirement. | Retirement Is a Long-Term Financial Goal That Aligns With Personal Values and Aspirations. | Achieve This Goal by Age 65. |

| Pay off Debt | Pay Off $30,000 in Credit Card Debt. | Pay $500 per Month Towards Credit Card Debt. | Based on Current Income and Expenses, It Is Feasible to Pay $500 per Month Towards Credit Card Debt. | Paying Off Debt Is a Long-Term Financial Goal That Aligns With Personal Values and Aspirations. | Achieve This Goal Within 5 Years. |

| Invest in Education | Save $50,000 for a Child’s College Education. | Save $200 per Month in a 529 College Savings Plan. | Based on Current Income and Expenses, It Is Feasible to Save $200 per Month for College Education. | Investing in Education Is a Long-Term Financial Goal That Aligns With Personal Values and Aspirations. | Achieve This Goal in 18 Years. |

| Buy a House | Save $100,000 for a Down Payment on a House. | Save $1,000 per Month in a High-Yield Savings Account. | Based on Current Income and Expenses, It Is Feasible to Save $1,000 per Month for a Down Payment. | Buying a House Is a Long-Term Financial Goal That Aligns With Personal Values and Aspirations. | Achieve This Goal in 5 Years. |

| Start a Business | Launch a Profitable Business in the Next 5 Years. | Develop a Business Plan and Secure Funding Within the Next 12 Months. | Based on Current Skills and Experience, It Is Feasible to Develop a Business Plan and Secure Funding Within the Next 12 Months. | Starting a Business Is a Long-Term Financial Goal That Aligns With Personal Values and Aspirations. | Launch the Business Within the Next 5 Years. |

Need More Long-Term Goal Examples?

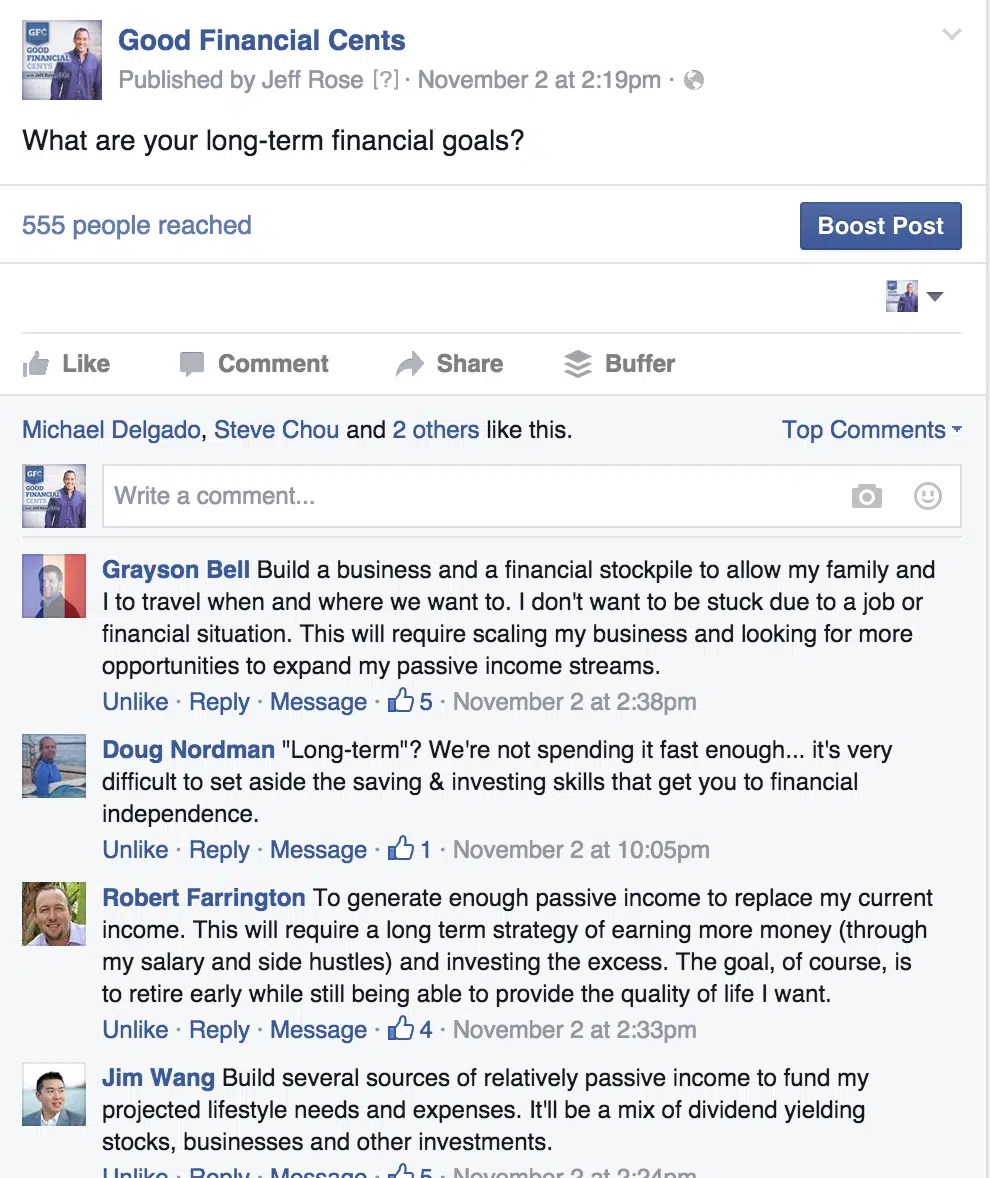

Knowing I’m not the only goal-setting freak that exists in this world, I asked fans from the Good Financial Cents Facebook page what their long-term goals are (big shout to the Fincon community for contributing, too!).

Fincon Community Long-Term Goals

Here’s a great list of examples of long-term goals:

Bob Lotich at SeedTime.com says:

[I want] to provide a comfortable life for my family, to have enough cash to maintain a flexible lifestyle, and to use everything else to financially support charities and organizations that are making a huge impact on the world.

Ryan Guina at TheMilitaryWallet.com says:

[I want] to become financially independent. What this means to me: to have no consumer or mortgage debt and have enough resources in savings and investments to cover my everyday living expenses without relying upon income from my job. This will provide more freedom in pursuing activities based on fulfillment vs. the need to generate revenue.

Larry Ludwig at InvestorJunkie.com says:

[I want] to be financially free. I define it specifically as to accumulate $10,000,000 in investment assets that can generate at minimum 4% per year of income.

Teresa Mears at LivingOnTheCheap.com says:

[I want] to support myself, both now and in retirement, and enjoy life. What else is there?

Steve Chou at MyWifeQuitHerJob.com says:

[I want] to generate enough income so that I can spend more time with my family and be there for the kids. Growing up, my parents worked their butts off so I could go to a good school but I didn’t see them very often during the week. With my kids, I’m going to send them to a good college and always be present.

Grayson Bell at DebtRoundup.com says:

[I want to] build a business and a financial stockpile to allow my family and I to travel when and where we want to. I don’t want to be stuck due to a job or financial situation. This will require scaling my business and looking for more opportunities to expand my passive income streams.

Robert Farrington at TheCollegeInvestor.com says:

[I want] to generate enough passive income to replace my current income. This will require a long-term strategy of earning more money (through my salary and side hustles) and investing the excess. The goal, of course, is to retire early while still being able to provide the quality of life I want.

My Lifetime Goals

Long-term goals can be difficult to articulate but deserve to be written down. I previously shared my lifetime goals on this post. Looking them over I recognize I would make a few tweaks, but; for the most part, they still align with what I want to achieve in life. Here’s a look:

1. Spiritual Leader of My Household: I want my kids to see me first as a God-loving father who puts his faith first before success. I want to continually love and support my wife and do so in a Godly manner.

2. Live a Long and Filling Life With My Wife and Family: Raise my kids with the philosophies of working hard, but not sacrificing “work” for what you love; love first; and treating people with respect (Golden Rule)

3. Have Several Multiple-System Driven Businesses That Produce >$100,000 a Month of Passive Income.

4. Live in Multiple Countries (5+) For an Extended Period of Time (Minimum 3 Weeks) With Entire Family

5. Inspire Over 1,000,000 People to Invest in Themselves: This can be through traditional investing (Roth IRA, 401(k), obtaining a higher degree or certification, or investing in a small business.

6. Be a Successful Entrepreneur and Best-Selling Author of Numerous Works: I want to be recognized as a hard worker who puts his family and faith first.

The Bottom Line – Long-Term Financial Goals

Setting long-term financial goals is an important step towards achieving financial stability and building wealth. By defining your values, aspirations, and time horizon, you can create a roadmap that aligns with your priorities and guides your financial decisions.

Remember to monitor your progress, stay motivated, and seek professional advice when needed. With discipline and perseverance, you can achieve your long-term financial goals and secure your financial future.

Here’s Your Homework

I want you to implement at least one of these strategies for reaching your long-term goals over the next year. When the year is over, write me. Tell me how well the strategy worked out for you. I want you to put your heart and soul into one or more of these strategies.

Why? I want you to see success.

Make it hap’n, cap’n!

FAQs – Long-Term Financial Goals

It’s important to strike a balance between saving for your long-term financial goals and meeting your short-term needs. You can achieve this by creating a budget that allocates some of your income towards both short-term and long-term goals.

This way, you can address your immediate financial needs while also making progress towards your long-term goals.

Staying motivated to achieve your long-term financial goals can be challenging, especially if your goals are several years away.

One way to stay motivated is to break your long-term goals into smaller, manageable milestones. Celebrate each milestone as you reach it, and use the progress you’ve made as motivation to keep going.

Regularly monitoring your progress towards your long-term financial goals is essential to staying on track.

You can use financial planning tools and software to track your progress and adjust your plan as needed. You can also work with a financial advisor or planner to evaluate your progress and make any necessary adjustments to your plan.

Yes, it’s important to be flexible and adjust your long-term financial goals as your situation changes. Life is unpredictable, and unexpected events can impact your financial situation. Review your financial plan regularly and adjust it as needed to ensure that it aligns with your current situation and goals.

Need some more long-term goals? Check out The Top 10 Good Financial Goals That Everyone Should Have. If you’re a baby boomer, check out 5 Financial Goals for Baby Boomers.

Thank you for this great article! I have been a financial fool for too long (not the Motley type either). I want to say to anyone who is feeling overwhelmed by their financial situation – YOU CAN overcome it. I have been broke all my life despite having good paying jobs. I had to take a good hard look at MYSELF and take full responsibility.

I let “lifestyle creep” and keeping up with Joneses ruin me, I thought because I made more, I was obligated to be the one to step up, shell out money for others. Mostly I was irresponsible and let money burn a hole in my pocket, always treating myself to just one more thing, then scrambling to pay my “boring”obligations. I had yet to learn the joy of being financially sound and leading a simple life. I was caught up in the game that everyone else made me feel I had to join in on. Suddenly I found myself deep in debt and unable to afford anything but trying to stay ahead of the debt. Frankly I suffered from suicidal thoughts because I could not see a way out. The only way to get out is to do what Jeff says above. One baby step at a time — and most importantly is to change your ATTITUDE about money and your SELF-PERCEPTION. Don’t jump on every bandwagon and don’t feel obligated to accept every invitation or every trend to shell out money you don’t have. Don’t follow the crowd down the path of ruin. I am seeing the light at the end of the tunnel and I want to tell anyone here who is feeling the pinch — YOU CAN DO IT! Thank you for this great road map and inspiration!

Hi Jeri – Thank you for weighing in. You’re proof that anyone can make dramatic improvements in their finances by making a series of changes in habit and outlook. If you’re making good money, now’s the time to make those improvements! Unfortunately, a lot of people don’t realize this until the hit on a career crisis, and are forced to cut back and make lifestyle changes. Good work Jeri!

Breaking down your bigger goals into a series of smaller goals is a strategy I always advise. Hitting milestones along the way lets you celebrate the accomplishments, measure progress, and delivers motivation to continue to the next milestone. And, before you know it, your goal is achieved!