Estate planning is an often overlooked aspect of financial management, yet it’s one of the most critical actions you can take to secure your legacy and provide for your loved ones after you’re gone. While it’s a process commonly associated with the wealthy, in reality, it is a crucial step for anyone who wishes to have a say in how their assets are distributed and their matters are handled after their death.

Table of Contents

Essence of Estate Planning

At its core, estate planning is the process of designating who will receive your assets and handle your responsibilities after your death or incapacitation. Your “estate” encompasses all property owned by you at the time of death, including real estate, bank accounts, stocks, and personal property such as jewelry, vehicles, and artwork.

Objectives of Estate Planning

Estate planning aims to ensure beneficiaries receive assets in a manner that’s managed and timed to be in their best interests. It’s not merely about distributing wealth—it also addresses the management of your estate if you become incapacitated and designating who will care for minor children.

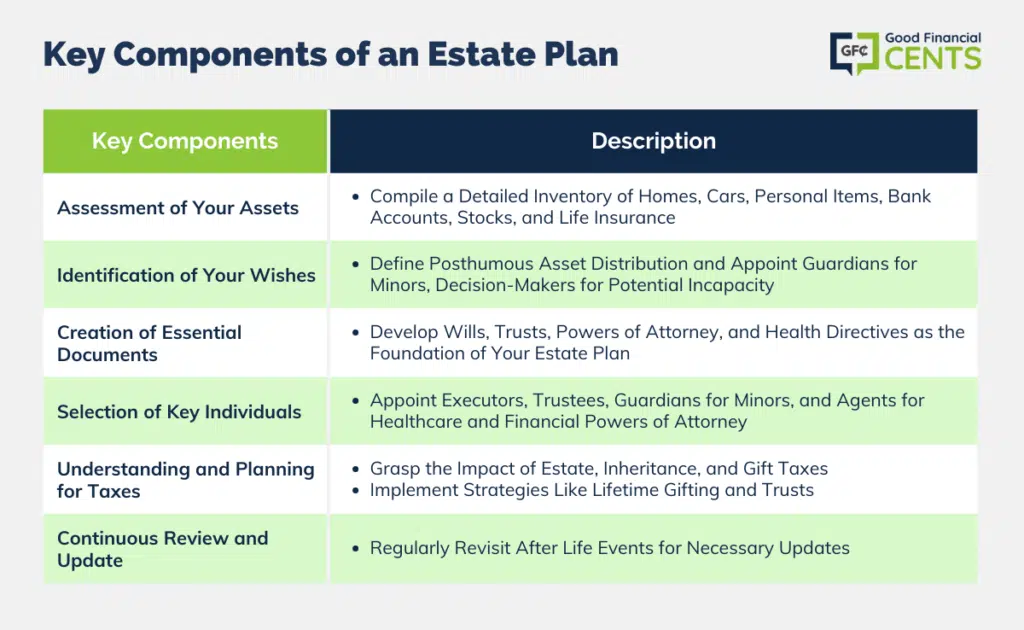

Key Components of an Estate Plan

- Assessment of Your Assets: Estate planning begins with a comprehensive inventory of all your assets. This includes tangible assets like homes, cars, and personal possessions, as well as intangible assets like bank accounts, stocks, and life insurance policies.

- Identification of Your Wishes: Determining what you want to happen to your assets after your death is a personal process. You must also consider who will manage your affairs if you’re incapacitated, and who will take care of your children if they are minors.

- Creation of Essential Documents: Various legal instruments are drafted to form the foundation of your estate plan. This includes wills, trusts, powers of attorney, and health care directives.

- Selection of Key Individuals: You’ll need to appoint trusted individuals to carry out your wishes. These include executors, trustees, guardians for your children, and agents for your healthcare and financial powers of attorney.

- Understanding and Planning for Taxes: A key part of estate planning is understanding how estate, inheritance, and gift taxes will affect your estate. Strategies such as gifting during your lifetime or creating certain types of trusts can be used to minimize tax liabilities.

- Continuous Review and Update: Life events such as birth, death, marriage, divorce, or significant changes in financial status warrant a review and possible update of your estate plan.

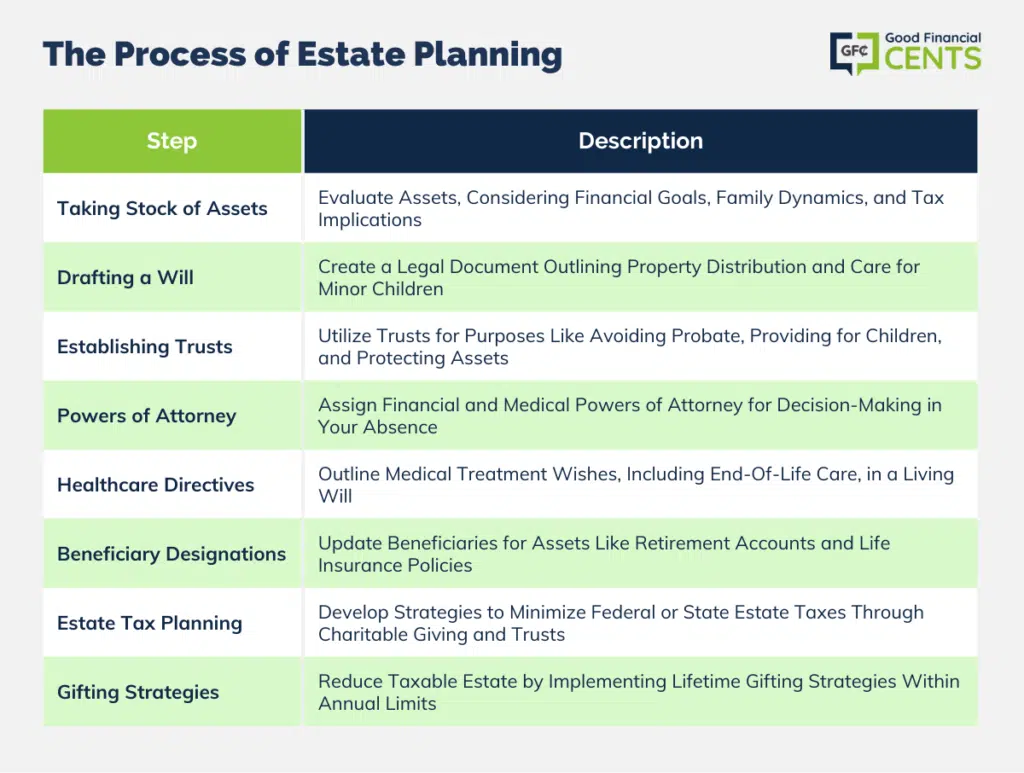

The Process of Estate Planning

The estate planning process involves taking stock of your assets, considering your family dynamics, financial goals, and the potential tax implications of inheritance. It requires making critical decisions about who should benefit from your estate and under what terms.

- Drafting a Will: Your will is a legal document that sets forth your wishes regarding the distribution of your property and the care of any minor children. It’s the most basic estate planning tool, and without it, the state will decide how your assets are distributed.

- Establishing Trusts: Trusts can be used for various purposes, such as avoiding probate, providing for minor children, or protecting assets from creditors. They come into play both during your life (living trusts) and after your death (testamentary trusts).

- Creating Powers of Attorney: A financial power of attorney allows someone you trust to handle financial matters on your behalf. Similarly, a medical power of attorney will enable you to appoint someone to make health-related decisions if you’re unable to do so.

- Healthcare Directives: Also known as a living will, a healthcare directive outlines your wishes for medical treatment if you’re incapacitated. This can include instructions for end-of-life care.

- Beneficiary Designations: Some assets, like retirement accounts and life insurance policies, bypass the will and go directly to whoever is named as the beneficiary. It’s important to keep these designations updated.

- Planning for Estate Taxes: If your estate is large enough to be subject to federal estate tax or state inheritance taxes, your estate plan should include ways to minimize these taxes, such as through charitable giving or establishing trusts.

- Gifting Strategies: Giving gifts during your lifetime can reduce your taxable estate. You can give a certain amount to each person every year without incurring a gift tax.

The Role of Probate

Probate is the court-supervised process of authenticating your will, paying off debts, and distributing your estate. Having a solid estate plan can streamline the probate process or, in some cases, allow your estate to avoid probate entirely.

Tax Implications and Estate Planning

Estate taxes, inheritance taxes, and gift taxes can significantly affect your estate, and strategic planning is necessary to minimize these taxes. Federal estate tax applies to large estates, while some states may have lower thresholds for estate or inheritance taxes.

The Importance of Trusts in Estate Planning

Trusts are a central feature of many estate plans. Beyond avoiding probate, they can provide tax benefits, protect assets from creditors, and ensure that assets are used in specific ways.

Special Considerations

- Digital Assets: In the digital age, it’s vital to consider how your electronic assets, such as digital photo libraries or cryptocurrency, will be handled.

- Business Ownership: If you own a business, your estate plan should address how your interest in the business will be managed or transferred.

- Philanthropy: If charitable giving is important to you, your estate plan can include mechanisms to support charitable organizations.

Conclusion

Estate planning is not just about distributing assets; it’s a comprehensive approach to managing your financial and personal affairs at the end of life. It provides peace of mind knowing that your wishes are documented and that your loved ones will be cared for according to your desires. The absence of a proper estate plan can lead to family conflicts, assets being distributed by state laws rather than your wishes, and potential financial losses due to taxes and legal fees.

By investing the time now to create a thorough estate plan, you’re not only ensuring that your legacy is preserved but also that your beneficiaries are protected from unnecessary complications and financial burdens. Remember, estate planning is not a one-time event but an ongoing process that should evolve as your life does. With thoughtful planning and regular updates, you can ensure that your estate plan accurately reflects your wishes and provides for your loved ones’ future.