The concept of a family trust—also known as a revocable living trust—isn’t very well understood by many people. The differences between a trust and a simple will, for instance, are frequently confused.

While it’s somewhat more time consuming—and therefore, more expensive—to have a family trust prepared than a will, there are significant benefits of the trust for many individuals.

I have many clients that feel that they “have to set up a trust“. I think many want to avoid probate at all costs. Please keep in mind that probate is NOT a four letter word.

I don’t want to discourage you from setting up a family trust, but it’s not a requirement in every situation.

How a Family Trust Functions

A family trust is a legally binding document that covers an individual’s assets during one’s lifetime and specifies the terms of dispersing those assets after one’s death or incapacity.

The person establishing the trust—generally referred to as the grantor—transfers all of his/her assets so that the trust itself is the owner, not the individual.

In practical terms, the distinction is a technical one; the grantor will still have full control over and use of all his his/her assets.

A trustee—the person(s) who will carry out the terms—is appointed at the time that the trust is formed, but has no role until the grantor is deceased or incapacitated. The trustee can be a family member, close family friend or even a financial institution (think bank for brokerage firm).

I’ve had clients select all the above to be their primary trustee or successor trustee. Keep in mind that choosing a financial institution as a trustee will be the most costly.

The cost can be justified as these institutions specialize in these matters where a family friend may be burdened with all the responsibilities that trust brings on.

The terms of the trust—and the exact assets included—can be changed at any time. For example, if a new car is purchased, it can be added to the trust.

This is true with all significant purchases and sales of tangible property (homes, vehicles, etc.) and intangible assets (securities and other financial investments). Similarly, the identities of the trustee(s) and beneficiaries can be changed by the grantor at any time.

What also can be changed is how the assets are dispersed. For example, you could set up the family trust to disperse the assets at various ages of your surviving child.

The could get 1/3 of the income at age 45. The other 1/3 at 55. And the final disbursement at age 65. This is just one example of the thousands of possibilities of how a family trust can be set up.

Just to make sure I covered my bases, I reached out to a friend and colleague Adam Lawler of Adam B. Law Firm, LLC. Here’s what he had to add:

In my world, a “family trust” normally refers to a joint tenancy revocable trust (think husband and wife) as grantors (settlors), trustees, and beneficiaries (trustee and beneficiary during lifetimes). When just one individual is involved, it’s normally called a living trust, revocable trust, grantor trust, etc.

FYI- the initial trustee is almost always (99.99%) the grantor/settlor of that trust. The professional fiduciaries normally only enter the picture after death and if no competent kid, uncle, etc are around.

Types of Family Trusts

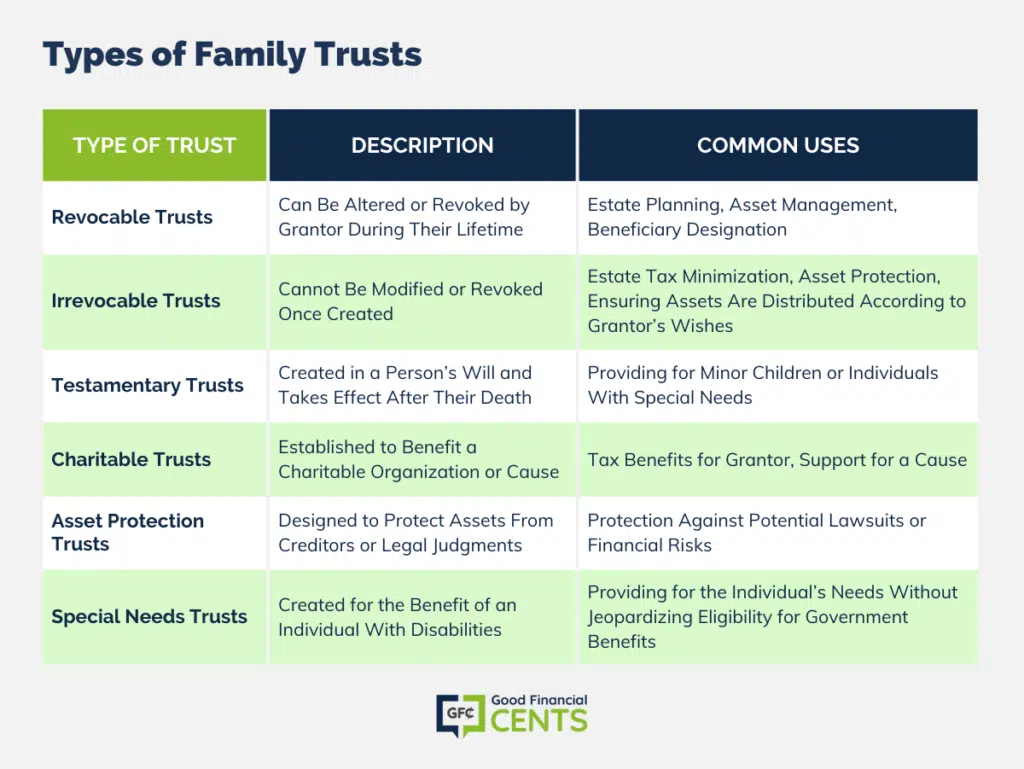

To make estate planning a bit more confusing, there are different types of revocable trusts. For example, an A-B trust is designed for situations where a married couple wants to provide ongoing support for the surviving spouse and also ensure that their children eventually will receive some portion of the estate when both spouses pass away. An A-B trust allows the surviving spouse to use the income generated from the trust, and when the second spouse passes away, any remaining assets are split between the children.

That is just one example of a trust you could choose to set up for your family. Here are other examples:

Benefits of a Family Trust

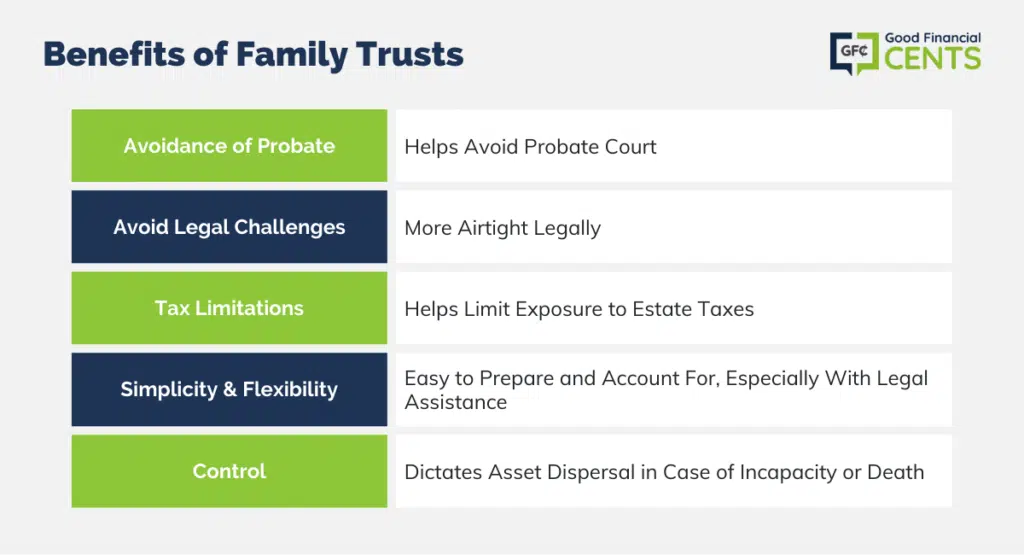

Among the numerous advantages of a family trust are:

- Avoidance of the probate process. If the grantor dies, the estate can avoid probate court, a substantial benefit over a simple will, where probate is commonplace for any assets not specifically enumerated.

- Avoidance of legal challenges of asset dispersal. A family trust is essentially airtight legally, another potential advantage over a simple will.

- Limitation of exposure to estate taxes, as part of a proper estate planning process.

- Simplicity and Flexibility. A family trust is a relatively easy document to prepare and account for, particularly with the help of an estate planning attorney. Transferring asset ownership to the trust is an easy task. The ability to amend and adjust the terms at any time makes it a very versatile vehicle.

- Control. The terms of the trust dictate exactly what will be done with your assets in the event you are incapacitated or deceased. The trustee must carry out your instructions to the letter, or face civil suits and possibly criminal prosecution.

Managing a Family Trust

Once a family trust has been established, it is important to properly manage and maintain it to ensure that it continues to meet its intended purpose. This section will cover some of the key aspects of managing a family trust, including the responsibilities of the trustee, making changes to the trust, and the tax implications of a family trust.

Responsibilities of the Trustee

The trustee is responsible for managing the assets held in the family trust and distributing them to the beneficiaries according to the terms of the trust. This includes managing investments, paying bills, filing tax returns, and communicating with beneficiaries about the status of the trust. The trustee is held to a fiduciary standard, which means they are legally obligated to act in the best interests of the beneficiaries.

Changes to the Trust

While family trusts are designed to be relatively permanent, there may be circumstances that require changes to be made to the trust. Common reasons for changes to a family trust include changes in the family’s circumstances, changes in tax laws, or changes in the investment landscape. Any changes to a family trust must be made in accordance with the terms of the trust and the applicable laws and should be done in consultation with an experienced estate planning attorney.

Tax Implications of a Family Trust

Family trusts can have significant tax implications, both for the grantor and the beneficiaries. Income earned by the trust is typically subject to income tax, and any distributions made to beneficiaries may also be subject to taxes.

Additionally, there may be estate tax implications when assets are transferred into or out of the trust. It is important to work with a qualified tax professional to understand the tax implications of a family trust and to ensure that the trust is structured in a way that minimizes tax liability.

Abusing Trusts for Tax Purposes

It’s also important to note the IRS is very aware of how individuals misuse trust to avoid pay taxes. Don’t operate under the assumption you’re smarter than the government on this.

Proper management of a family trust is essential to ensuring that it continues to provide the intended benefits for the grantor and beneficiaries.

By understanding the responsibilities of the trustee, the process for making changes to the trust, and the tax implications of the trust, individuals can make informed decisions about how to manage their family trust.

The Bottom Line – What a Family Trust Does

A family trust is a relatively simple and inexpensive, but potentially powerful legal vehicle, with many benefits for a wide swath of individuals.

The family trust essentially makes certain that your assets will be allocated as you wish, should something happen to you and makes certain that the beneficiaries that you designate will have access to their inheritance—in the manner you intend—quickly and fully. The peace of mind in that fact alone may be enough to recommend the process.

I hired a local attorney to draft our will and testamentary trust, but there are online options that are cheaper. One example is NOLO.

If you haven’t set up a will yet or are interested in a FREE Living Trust, give them a try.

My parents set up a partial piece of their property in a family trust under their name and in their last few weeks wished for all descendants be part of the inheritance. They have passed and all of us, their children agree since we are all up in our years and the land and build will make a very pleasant campground which has been enjoyed for over 40 years. One out of state family member is a lawyer and is convinced to set up an LLC which are becoming popular. My research estimates retaining an instate lawyer each and every year. First to define and file, as well as all the future filings, then to to review and keep members/directors up to date on legal challenges regrading what if scenarios, injuries/trespassing, insurances, etc. Followed by constant vigilance and updates on legislative proposals and changes in the works affecting LLC trusts and members. All of that could be exciting to participate in and educational for generations to come. But, might it be easier and legally more protective to the many multiple descendants which are at the door step, to keep the original trust in place, not dissolved, since it is an infinite individual and fully describes yesterday’s, today’s and tomorrow’s wishes. Shouldn’t that document survive and suffice the government and allow the children’s children to form their own simplified caretaker position similar to an equestrian natural domain.

Absolutely loved this! Our Newf is 147 pounds. He isn’t allowed to have a water bowl in the house as my kitchen turns into pond when he dumps it. So, in the winter, because we have the heat on, he will wake me up 5 times a night to be let out, not to pee, but to get a drink.We find Newf hair in the butter and in our dinner. The kids are having a hard time determining if it is from our Newf or their Dad. But, I have gotten very good at picking the fur out of ediable things before anyone sees it. : )

How is a family trust implemented once the grantor is deceased? Is this taken care through a local County Treasurer or Aduitor’s office. What do the trustees have to do to leagally receive the assets specified in the trust? Thank you for your response.

Is the house, which is set up under the trust, protected from Medicaid?

If the owner is enrolled in NY Medicaid and is required to be in a Long Term Care Facility how does this impact a Medicaid Lien?

Hi Harvey – You need to consult with an elder care attorney. Your question is completely a legal matter that I can’t address.

I’ve been married for 39 going 40yrs. Our assets consists of 2 real estate (primary home and rental here in Ca.), 401k, IRA, husband’s stock options and my life insurance (term 100k and 500k universal), husband only has work life insurance.

I’m 60 retired and he’s 62 plans to work until 65. Husband does not know how to spend money wisely. Will family trust protect our assets if we decide to divorce?

You’ve got a complicated situation. Make an appointment with an attorney and discuss everything. The divorce puts a big question mark over the whole situation, so it will have to be considered from different angles.

Just wondering, It has been 4 years since our mom died. I am the trustee for the family trust. The family home has been sold, and assets disbursed equally between all 4 kids. There is a second piece of property, a cottage in Northern WI. Two sisters have indicated they want nothing with it. That was made plain when my parents were constructing the trust. So the property is now the responsibility of just my brother and me. We share expenses equally. My question is this,”when I die what happens to the ownership of the cabin. Does the ownership remain with my family. My husband and I have one adult daughter, who would assume the partial responsibility. Thank you. Mary

Hi Mary – If it’s listed in the trust, it’ll be distributed according the the specifications provided. If it’s not in the trust, you and your brother need to create a legal agreement for the cottage. You MAY be required to get waivers from your two sisters. This is a legal issue, and it will require an attorney, particularly since there are four siblings. Don’t rely on verbal agreements.

We had a irrevocable family trust drawn up by an elder lawyer about 4-1/2 years ago. We went to my moms financial advisor at Wells Fargo Bank and he was to handle her funds. My mom has been in (2) assisted living facilities and about six months ago we took her out and she is living with us. We were told that there is a (5) year look back for medicaid. The person who was handling my moms account has left Wells Fargo Bank and when we inquired about the trust we were told that there was not a trust set up??? When we sold my moms house the checks were made out to a family trust and for the last 4-1/2 years we were lead to believe that the trust was set-up. What recourse do we have.

Thank you

Debbie

Hi Debbie – You’re going to have to set up a meeting with management at Wells Fargo. But before you do, you’ll need to assemble any/all of the financial documents you have, including any correspondence from Wells Fargo. If that doesn’t help, you’ll need to hire an attorney. Is it possible that the money went directly to the assisted living facilities?

I set up a family trust. How will the money be dispersed from the trust to the family? My electronic business is in the trust and how will the income from the business be dispersed to my children? Will they receive a check as I do now? Can they sell my house that has a 100K equity and receive the 100k and/or can the trust disperse the money to them?

Hi James – That information should be spelled out in the trust, or included if you’re creating the trust. Generally speaking, the income will flow into the trust, then be distributed to the beneficiaries according to the specifications in the trust. Same with the house, it will be sold by the trust, then distributed according to the trust rules.

very interested in a family trust. Can I transfer the family home to the trust if there is still a mortgage? and if so how does the house title and loan get transferred to the family trust. We also have a business love to a voide ome of the tax’s

Be very careful. Most mortgages have a clause that any transfer is a breach of contract and the note becomes due immediately. Look at your mortgage or get an attorney who knows what he is doing. A business can be transferred to a Trust but it depends on the type of business. For example, in some states law practices and accounting practices cannot be owned by these artificial entities or non-lawyers or non-cpas. But most other businesses can be easily transferred.

I want to form a family trust, i want to know how it is form, what is required to form it, how is it managed and what are the tax implication to it.

Hi Tezz – It’s important to understand that a family trust isn’t just one method. There are different types of family trusts you can set up, including how you fund it. It’s best to sit down with a trust attorney and let him or her know what it is you want to do, and let them tell you what kind of trust to set up. From there, you can include just about any type of details that you want.

When my dad was alive, he and my mom created a family trust. He passed away in 2002. One of my brothers (there are 3 of us) passed away in 2009. My mom would like to change the trust so that his third of the assets are dispursed to all of her grandchildren equally instead of only to my deceased brother’s two sons, but she doesn’t think she can change the terms of the trust. As one of the grantors who created the trust, shouldn’t she be able to make that change?

Great post. It has been very helpful for me. Thanks!

Hi Michelle – It’s best to assume nothing. Whether or not your mom can make the change will depend on the specific provisions in the trust and on trust laws in your state. Your best course of action is to consult with the attorney who helped prepare the trust, or another competent trust attorney in your state.

Prior to the passing of my father, he put his house and other items in a trust. I and my step-mother’s sister are the trustees. My stepmother has requested that I sign paperwork because she wants to sell the house and buy a new one. What are the questions I need to ask to ensure his will/request is kept true to his wishes?

S

Hi Suzanne – I can’t recommend specific questions, but I strongly recommend that you review the trust agreement thoroughly, then schedule a meeting with the attorney who prepared it. The questions you will need to ask will depend on the trust itself, as well as the laws in your state. You really need this to be interpreted by an attorney. It’s that important.

Our Dad passed 25yrs ago… We as a whole have shared ownership of Our house. I’m now looking for other options to safe keep Our house… Would a Trust be the way to go?

Hi Vicky – When you say “our”, the first think I thought of is that you all have to agree to what you’re going to do with it. Whether or not you do a trust will depend on what you want the trust to do. For example, what is it you feel you need to protect it from, and who and how many people will it be passed onto in the event you and the other owners die. You should sit down with a trust attorney (who is knowledgeable about trusts in your state) to see if it will be an advantage, or if there will be any unexpected limitations.

I learned a lot about family trusts by reading this article. I like how you explained that a family trust is a legally binding document that covers an individual’s assets after one’s death. I hope that I can find good financial services that can help my family and I to create my grandmas trust before she passes away.

My dad had a family trust set up and after he got cancer, right before he died,the trust was changed and my sister and I were not on it anymore. My dads wife was his caregiver and the trustee. It has been 6 years since he died. I don’t think he would have changed it I think his wife did it and we didn’t get a thing. Can I do anything now? Isn’t it set up so that when you get sick it’s already set and shouldn’t be able to be changed at that point?

Hi Alison – That’s going to be tough, I’m not going to lie. It will depend on the laws in your state, as well as the circumstances surrounding the trust and any changes made to it. Do you have a copy of the original trust? Or the final trust? The passing of six years will make it harder to reconstruct. If a lot of money is at stake, you should strongly consider consulting with a trust attorney in your state. This will be complicated…

what if the grantor is moved to a nursing home — does the trust go toward these expenses and is the family trust then depleted?

Hi Judy – It all depends on what the trust documents say about that situation. The language in trusts is very specific, and should provide options for the situation you’ve described. Read the documents if you have them, or consult with the attorney who prepared them.

In the event of a nursing home stay and the trust says do not pay for nursing home care is the grantors stay at the nursing home terminated an other plans have to be made

Hi Andrew – Without seeing the trust it’s impossible to say. If the language specifically excludes nursing home care, there has to be a reason why that was put in there. Was the purpose of the trust mainly to pass money onto heirs? You should check with the attorney who prepared the trust.

CAN A COUSIN BE PART OF MY FAMILY TRUST IF WE HAVE THE SAME GREAT GRANDFATHER

Hi Maria – You can make anyone part of a trust, even a non-family member. Just be sure to set it up in the trust agreement with your attorney. Individual state laws can vary, and are sometimes tricky.

If a home is placed in a family trust, would it still be possible for the grantor to get a mortgage if necessary?

If a home is placed in a trust, and you want to get a loan against it, you will have difficulty because most bank loan officers are unfamiliar with trusts. There are also income tax consequences that may impact your decision so you need to speak to your tax adviser. Probably not a good idea to put something in a trust if you it is not clear of loans.

Great post, Jeff.

There are plenty of ways to avoid probate (especially payable on death & transfer on death) but a trust would have greatly simplified the legal process of caring for my father’s finances. By the time his Alzheimer’s symptoms emerged, it was way too late.

Wouldn’t hurt to mention that a family trust would also keep your affairs private at death, unlike a will which has to go through probate.

The bit about limiting your exposure to estate taxes is especially important, given the uncertainty in the tax realm at the moment, with the fiscal cliff approaching. As it is, starting next year the estate tax is set to revert to a 55% rate and a $1 million exemption. Just something to keep in mind when deciding whether to set up a family trust – http://www.rapidtax.com/blog/index.php/changes-to-the-estate-tax-for-2011/

How would one create a family trust? Can it be done through Quicken Willmaker?