Mortgages are complicated and confusing, and second mortgages are doubly complicated and confusing

A second mortgage can be an extremely useful tool for your wealth, or it can become a financial trap. Before you head into the world of second mortgages, there are a couple of different things you should think about.

Table of Contents

Read on for an overview of second mortgages and advice to help you determine whether or not you should consider a second mortgage.

What Is a Second Mortgage?

A second mortgage can be a valuable borrowing vehicle in certain circumstances. Here’s how you can benefit from a second mortgage.

How a Second Mortgage Works

A second mortgage is basically a loan using your home equity as collateral. If you own your home, whether you have a mortgage attached to the property or not, you may be able to secure a second loan by liberating the equity that has built up over the years.

Generally speaking, real estate increases in value, so while a typical mortgage can stretch out for up to 30 years, the principal owed on the house steadily falls while the value of the house appreciates.

To find out how much you can possibly qualify to borrow on your home, you need to find out how much equity is in your home. This is calculated by estimating the market value of the property and subtracting the payments made towards your first loan so far.

Lenders may be willing to allow you to borrow anywhere from 60% to 80% of your equity, which works out to roughly $54,000 to $72,000.

One unique kind of second mortgage is a cash-out refinance. This replaces your old mortgage with a new mortgage. With the new mortgage, it’s slightly larger than the original amount. The larger mortgage will give you a one-time cash payment.

What Are Second Mortgages Used For?

As you can see, a second mortgage can really represent a sizable chunk of cash, but what are they used for? Well, you can use a second mortgage for anything from funding a child’s education to making repairs on your home.

If you are going to take on additional debt, it should be for something worthwhile. A vacation, however, deserved, might be better to save for slowly than to take on the cost of a home equity loan.

Another option can be to avoid Private Mortgage Insurance.

It’s almost always worth avoiding PMI if you can.

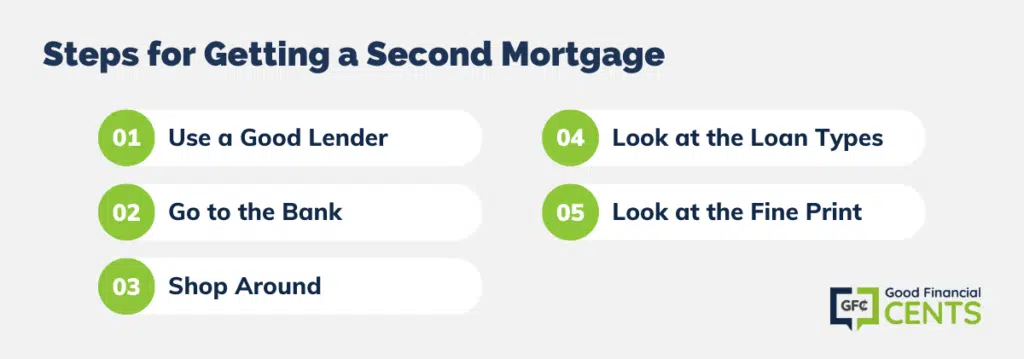

Getting a Second Mortgage

Now that you understand how a second mortgage mortgage works, we can continue with the process. If you’ve decided that you want to take out a second mortgage on your house, we can help you with the route you should take.

Use a Good Lender

It is an unfortunate truth that there are unscrupulous people and businesses in the world. One of the best options for making sure you are getting a good rate with your mortgage company is to shop around different mortgage lenders.

This is why we recommend using LendingTree for your second mortgage. LendingTree will shop several different lenders for home equity loan rates and allow you to screen who you apply with.

They are also able to work with you whether you choose a separate home equity loan or decide to do a cash-out refinance mortgage. You can learn more in our LendingTree review.

- Our Rating

- BBB Rating A-

- Best for Multiple Lenders

- Loans Available Home Equity, Refi, HELOC

Steps You Can Take To Get the Best Loan

If it’s been some years since you’ve taken out a mortgage, you might want to brush up on some of the lingo that you’re going to see.

1. Go to the Bank: The obvious first place to start is with your bank or mortgage company that holds the FIRST mortgage. More than likely, they will be happy to give you a second mortgage (assuming you have a decent credit score and history with the organization). It will almost make the payments on the second mortgage easier because you already write one check to the bank for your mortgage, so you won’t forget to write a second one (hopefully).

2. Shop Around: After you’ve talked with your current bank or mortgage company, you can continue to look around for other banks and lenders. More than likely, you didn’t go with the first lender you quoted with the original mortgage, so why would you go with the first on your second mortgage? Once you’ve met with several different loan offers at various established, you can sit down and decide which one works best for you.

There are a few things you should consider, aside from interest rates (although it’s the most important factor), before picking out a second mortgage.

3. Look at the Loan Types: Are they fixed rates or adjustable? This is going to have a huge impact on the amount of interest that you pay over the course of your loan.

4. Look at the Fine Print: Are there any balloon payments attached to the loan? Be sure to look at every aspect of the mortgage before you sign any paperwork. Otherwise, you could pay thousands of dollars that you didn’t expect to pay.

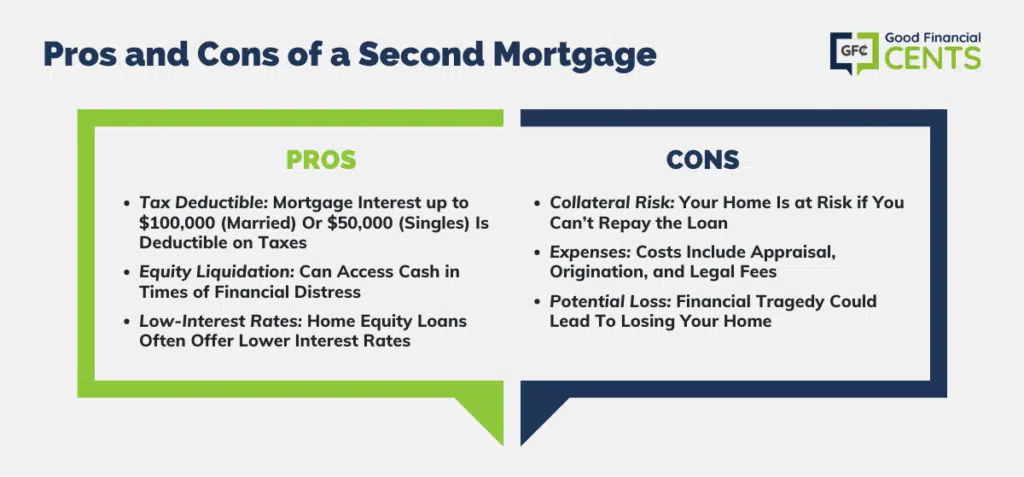

Pros and Cons of a Second Mortgage

Pros of a Second Mortgage

- Deductible: The good news about a second mortgage is that mortgage interest of up to $100,000 of the principal for married couples and $50,000 for singles is deductible on your tax return as well. Although this is meant to be a combined mortgage interest on both your mortgage loans, it is still a great deduction, especially if your first mortgage is closer to the end of its life and so has a relatively small portion of interest payments left.

- Liquidation: Another (possible) pro of taking out a second mortgage is the ability to liquidate the equity in your home. If you are on the verge of bankruptcy and you need to get access to cash to pay off high-interest loans and back taxes, taking a home equity loan might not be a bad trade.

- Low interest: The interest payable on a home equity loan is usually lower than other types of debt because it offers the lender the security of your house. Depending on your situation, this could be an excellent way to lower the amount of debt you have and save you money on monthly interest.

Cons of a Second Mortgage

Taking out a second mortgage is not without its drawbacks.

- Your home Is collateral: For instance, you need to remember that even though the loan does provide you with the cash you want, it comes at the cost of putting your house up for grabs in the event you cannot make good on the loan. While we hope it never happens to anyone, it’s not uncommon for some financial tragedy to strike and for a person to lose their house because of a second mortgage.

- Expense: A second mortgage is also not without its costs. You have to pay for an appraisal on your house, loan origination, and other legal fees associated with an ordinary loan, so although there is a lower rate of interest, there are other costs to consider.

If you don’t remember from when you first got a mortgage, the house appraisal and legal fees can add up to be quite a hefty bill. While this probably isn’t going to completely change your decision on a second mortgage, you should at least calculate it into the costs beforehand.

If you’re one that has a rough relationship managing debt, I would strongly have you reconsider taking out a second mortgage to pay off debt.

You first have to fix the root of the problem, which is most likely – you. A second mortgage is not the answer for everyone, so think about all the factors before making your final decision.

I hear a lot of stories of people who took out a second mortgage to pay off some debts. Sure, the lower interest rate can be very attractive. Why wouldn’t you want to pay lower rates?

Getting a second mortgage to pay off credit card debt or some other consumer debt is only a temporary band-aid.

Alternatives to a Second Mortgage

Figure

For those looking for extra capital to use for things such as home improvements or debt consolidation, a Home Equity Line of Credit (HELOC) is another option.

A HELOC allows you to borrow money against the equity you have accrued in your home. For example, if you bought your home for $300,000 but it is now worth $330,000, you could borrow $30,000 to use for things such as kitchen or bathroom improvements.

Borrowing funds is always a big decision and should only be taken with great consideration. But, a HELOC can be a great alternative to a second mortgage.

For those who are interested in learning more about HELOC, Figure could be a good place to start. This new company is innovating the HELOC game with AI-based approval that streamlines the application and appraisal process.

Other Alternatives

Think of the second mortgage as an emergency lifeboat in this situation. Hopefully, you never need it, but you’ll be grateful for it if you do.

If you are staring at bankruptcy but don’t want to go with a second mortgage but are still looking for a good way to lower your interest amounts, you can always go with a personal loan.

If you prefer to go the way of a personal loan rather than a second mortgage, here are some ideas on where to get a personal loan that is best for you, according to Good Financial Cents.

While this might seem like a smart strategy, one thing you never do is borrow against your home to pay off credit cards. I cringe every time I hear of someone pondering that.

That is a major no-no in my book. You are much better off getting a credit card with 0% APR on balance transfers to pay off the old cards. You save tons of money, and honestly, it’s normally a lot easier.

Our Experience With a Second Mortgage

We recently took the plunge and built our dream home. Along the way, we learned a lot in the building process, especially when it comes to the mortgage loan process.

Our first home was bought while I was in Iraq, so I cashed in on my veteran status using the VA home loan. With our dream home, we were short the 20% down payment that we needed to avoid PMI (Private Mortgage Insurance).

While we could have used the VA loan again (for refinancing, not for first-time home purchases), it was actually cheaper to do the traditional loan process and take out a second mortgage.

Second Mortgages, Friend or Foe?

Because of all the risks associated with a second mortgage, they have gained an awful reputation among homeowners, but if done carefully, they can be an excellent tool.

Just like with every other part of your finances, a second mortgage isn’t something that should be done lightly.

Spend some time looking at your financial situation and weigh your options.

Bottom Line: Key Considerations for Second Mortgages

Navigating second mortgages demands careful consideration. These loans leverage home equity, offering financial benefits like lower interest rates and potential tax deductions. Calculating equity, exploring loan types, and scrutinizing fine print are vital steps. Pros include tax deductions, liquidity, and lower interest rates. Yet, the cons involve risking your home and additional expenses. Alternative options like HELOCs or personal loans exist.

Prioritize responsible financial management, avoiding quick fixes like using home equity for credit card debt. Second mortgages can be advantageous when approached with caution and strategic planning. Remember, informed decisions pave the path to financial stability and success.