It is too easy in today’s world to just settle for what is happening around us. Especially when it comes to how we are spending our money, or in some cases, where we are getting our money from.

It’s easy on a Saturday night to go out and spend $100 dollars on dinner, and try and slowly forget about it the next day.

If anyone were to walk up to you on the street and ask you how much money you spent the past week, you would most likely be able to give them a ballpark figure.

Ready to find out more? Sign up for a free Credit Sesame account now.

Table of Contents

Why You Need Credit Sesame

Back to that ballpark figure. In most cases, the ballpark number would be below the true amount that you had spent that week. I played this game with myself just the other day and asked myself how much money I had spent in the past week.

I thought about what I had done and said about $250. I felt like this was a great answer and maybe even a little higher than what the actual figure would be.

I then proceeded to look through my checking account statement as well as a credit card statement to find out that I had spent closer to $400. I had literally forgotten three meals that I had eaten out, as well as a trip to the gas station I had neglected to include in my total.

Moral of the story being, it’s easy to slide a card for payment as part of a daily routine without thinking of the actual expense behind the action.

Similarly to this situation is when it comes to debt that we have, whether it is credit card debt, car loans or even a mortgage loan. We just accept the fact that this is the loan that we have and settle with paying it off in a conventional way.

By the conventional way, I mean making my payment to the credit card company every month, which in most cases the majority of Americans are not paying off the balance, rather they are paying the minimum payment and, therefore, being charged interest on their expenditures.

The same for a car loan, what if you took the car loan out four years ago when your financial situation was less certain than it is now?

Did you find a way to lower that interest rate so that you would not be overpaying for the car, or did you just accept the terms and continually overpay for the car even though you could lock in a better interest rate today?

Introducing Credit Sesame

There are other options than simply sticking with the plan that you have because you feel that finding a different loan agreement would be too much hassle or high risk. This is not the case with Credit Sesame.

Credit Sesame, like many other sites out there, will let you put all of your financial information into their website such as income, all debt expenses including the terms of your current loans, as well as other budget information.

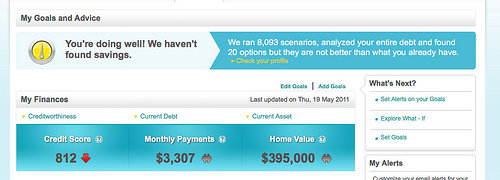

You will then have access to your credit score as well as graphical representations of how you are spending your money.

After you have entered all of this information so that Credit Sesame will be able to assess your credit standing as well as the free cash flow you have to pay for different types of loans, they will run a credit optimization report for you.

Credit Sesame Credit Optimization

Credit optimization is a fancy term for seeing if you are eligible for better loan terms than you are currently paying.

This is where Credit Sesame sets itself apart from any other budgeting website that I have encountered. The ability to get better loan terms could end up saving you lots of money in the long run.

For example, let’s say you have a car loan with $40,000 dollars left on the loan. You are currently paying a five percent ten-year loan on the car.

Your payment based on these terms will be approximately $425 per month which would have you paying roughly $51,000 on the car loan.

Now, let’s say you have been able to improve your credit score and have a more stable financial situation, you could have your credit situation optimized by Credit Sesame, and they offer you a 10 year 3.5% loan.

You would be able to take this new loan and pay off the $40,000 you owe on the car and would be making the payments on this new loan through Credit Sesame to a bank.

After you have optimized your credit, you would now be making approximately a $395 payment only paying $47,000 for the same car!

You could be saving yourself thirty dollars a month on your car payment or approximately $360 a year.

Overall you will end up paying almost $4,000 less for the exact same car.

This small example will also be able to apply on a larger scale for your home loan, or any student loans you are currently paying.

Let Credit Sesame Do The Work

Credit Sesame will search hundreds of banks all over the U.S to find a bank that is willing to make this better type of loan for you.

The best part is the whole process is free to you until you make a loan. Even after you make a loan, you are not paying any more to Credit Sesame, they will be getting paid from the bank for finding more loans for the bank.

This is the greatest part about Credit Sesame, they only make money when they end up saving you money!

Debt Optimization Through Credit Sesame

Debt optimization in the past has been a long grueling process having to drive around to all of your local banks and apply for different loans.

The process was so tedious and drawn out that the majority of Americans would rather just pay the extra money than go out and find themselves a better deal.

Now, with Credit Sesame, the same process is as easy as entering your information into a web page, and Credit Sesame will do all of the legwork for you.

It is time to take control of your finances today, and Credit Sesame can lead the way for you.

You Might Forget, They Won’t

Another cool thing about Credit Sesame is their email alerts that keep you updated to any changes on your goals or credit profile.

Below is an actual screenshot of a recent email that I received reminding me to check my updated Experian credit score.

My Experience With Credit Sesame

We recently built a new home and locked in a 30-year rate at 5%, which at the time we were tickled with. Not even nine months later, rates dropped and we refinanced to a twenty-year mortgage at 4.25%. Never in my life would I ever think that I would refinance again.

Earlier that year, the stock market started to teeter, which it seems like it’s been doing every day here lately, and once again, rates started to fluctuate.

I kept meaning to call my mortgage broker to ask him about rates, but it always seemed like something got in the way. Then one day I received one of those handy emails from Credit Sesame that said,

“Based on your situation, it may be possible for you to refinance and save hundreds dollars”.

After reading the email, I immediately, and I mean literally immediately, called my banker to find out if it was really a possibility for us to refinance again.

It didn’t take him long to get back to me to inform me that we could lock in a fifteen-year mortgage at 3.375%. After doing some quick calculations, and factoring in closing costs, it was a no-brainer.

The extra couple hundred bucks a month wouldn’t hurt us and the idea of having our house paid off before our oldest son graduated high school was very, very enticing and that’s what we did.

Can it get even more exciting than that? It can…..

Being the numbers freak that I am, I had to plug the numbers into a mortgage calculator to see how much in interest we would be saving.

| The magic number was $70,185.17. |

Over $70,000 from getting an email from my friends at Credit Sesame. I heart them. 🙂

I know Credit Sesame can do many other things for many other people, but for me, I’m thankful for signing up and getting informed about refinancing. If you’re like me and you need a friendly reminder every once in a while, this service is the way to go.

Credit Sesame Wrap-Up

Overall, a service like Credit Sesame can be very helpful for a lot of people.

For me personally, other than our home and our car, that is the only debt we have so other than offering my credit score, it didn’t do a whole lot.

If you want to give Credit Sesame a try, I encourage you to check them out. Remember, it’s free. Hard to pass that up 🙂

How We Review Mortgage Lenders

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment.

Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Credit Sesame Review

Product Name: Credit Sesame

Product Description: Credit Sesame is a financial platform that offers free credit score monitoring, credit reports, and personalized financial recommendations. It helps users understand their credit health and provides tools to improve their financial well-being.

Summary of Credit Sesame

Credit Sesame is a comprehensive financial platform designed to empower individuals to take control of their credit and finances. The company offers users access to their credit scores and credit reports from major credit bureaus, such as Experian. This information is updated regularly, allowing users to track their credit health over time.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Free Credit Score Monitoring.

- Personalized Financial Recommendations.

- User-Friendly Mobile App.

Cons

- Limited Credit Bureau Coverage.

- Potential for Advertisements and Offers.

- Basic Credit Education Resources.