If your credit score is low, don’t despair – there are plenty of things you can do to raise it.

While you might not be able to raise your score 100 points overnight, with a little dedication and effort, you can certainly see a significant improvement in a relatively short period of time. Here are some tips to get you started:

Table of Contents

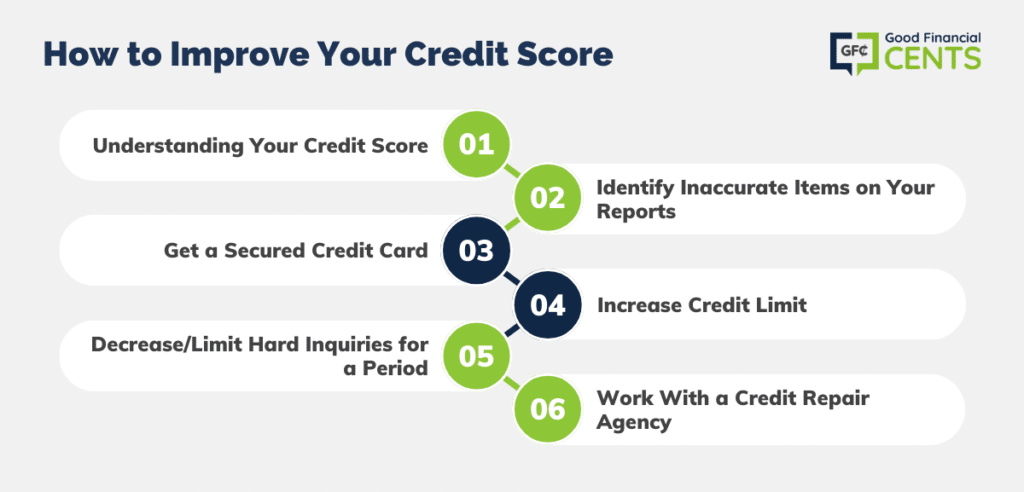

- How to Improve Your Credit Score

- 1. Understanding Your Credit Score

- 2. Identify Inaccurate Items on Your Reports

- 3. Get a Secured Credit Card

- 4. Increase Credit Limit

- 5. Decrease/Limit Hard Inquiries for a Period

- 6. Work With a Credit Repair Agency

- How Long Does It Take To Fix Your Credit Score?

- The Bottom Line – Raising Credit Scores Fast

- Raise Your Credit Score 100 Points FAQs

How to Improve Your Credit Score

1. Understanding Your Credit Score

Your credit score is a number that reflects the information in your credit report. Lenders use this number to assess your creditworthiness – in other words, how likely you are to repay a loan on time. The higher your score, the more attractive you are to lenders and the better your chances of being approved for loans and credit cards with favorable terms.

Check Your Credit Score

Most people don’t know their credit score until the time comes when they need it.

Don’t be one of these people!

Good credit scores are your passport to competitive interest rates for mortgages, cars, credit card offers, insurance premiums, and more. Maintaining a high credit score is worth it because it will save you the money you’d pay in higher interest rates.

Luckily, it’s simple to learn your credit score. I recommend the following companies:

| COMPANY | DATA SOURCE | PRICE |

|---|---|---|

| Experian | FICO | FREE |

| MyFICO | Experian, Transunion, Equifax | $15.95 |

| Credit Sesame | Transunion | FREE |

| Credit Karma | Transunion & Equifax | FREE |

Learn more about each of these companies:

What Affects Your Credit Score?

There are a number of different factors that go into your credit score, but the two most important are payment history and credit utilization. Payment history refers to your track record of paying back loans and other debts on time. Credit utilization is a measure of how much of your available credit you are using – the lower the better.

The best way to improve your credit score is to review your credit report. The score itself is not personal. Every American falls within the same range. However, the credit report is your unique financial history.

A credit report breaks down the following by weighted importance:

- Payment History (30%)

- Paying your credit card, student loan bills, etc., on time?

- Credit Utilization (30%)

- The ratio between credit available to you and how much of it you use

- Credit Age (15%)

- How long have credit lines been opened? Mortgage, credit cards, etc.

- Account Mix (10%)

- Variety of credit lines

- Credit Inquiries (10%)

- Too many hard inquiries don’t look good, i.e., applying for a bunch of credit cards at once

Where you get your credit report matters, which is why I strongly recommend Experian. You’re not only getting it directly from the source (Experian is one of the three credit reporting companies in America), but it’s free when you create an account!

We’ll discuss credit reports more in-depth later on, but for now, let’s move on to some other things you can do to raise your credit score.

2. Identify Inaccurate Items on Your Reports

One of the best ways to raise your credit score is to identify and dispute any inaccuracies on your credit reports. If there are any errors, outdated information, or incorrect account balances, get in touch with the credit bureau and have them corrected. This can take some time and effort, but it’s worth it in the long run.

According to CNBC, 1/3 of Americans have errors on their credit report, so you’re certainly not alone. And the most common error? Outdated information.

That’s why checking your credit report often is key to a good credit score.

You can get a free copy of your report from each of the major credit bureaus – Experian, Equifax, and TransUnion – once per year at AnnualCreditReport.com.

I recently requested my credit report, and it took less than 10 minutes to receive it. You will need to provide some basic information such as your name, address, Social Security number, and date of birth.

It’s a simple 3 step process and well worth your time. Once you receive your credit report, comb through it carefully and look for any inaccuracies. If you find anything that looks incorrect, raise a dispute with the credit bureau.

3. Get a Secured Credit Card

If you have bad credit, one of the best ways to raise your score is to get a secured credit card. This type of card requires you to put down a deposit that serves as collateral, but it can help you rebuild your credit by reporting your positive payment history to the credit bureaus.

Just make sure to use your card responsibly by only charging what you can afford to pay off in full each month, and try to keep your balance below 30% of your credit limit. Otherwise, you could end up doing more harm than good.

There are a few different secured cards to choose from, so compare your options and find one that best suits your needs.

A former intern of mine, Kevin, was able to increase his credit score by 100 points using a secured credit card. Here’s his story:

Kevin’s 100-Point Credit Score Increase Story (IRL Example)

As a junior and senior in college, I was always told that applying for a credit card could be my first step in the wrong direction.

With a credit card in hand, my parents worried I would spend money I couldn’t pay off and build a lifestyle I couldn’t really afford rather than learning to save money.

While these are legitimate concerns, I had to let them know I felt as if I had some control over my spending. My response was always the same:

“How would I know owning a credit card would hurt me financially until I was able to try for myself?”

What I Learned From Being Denied Credit Cards

When I was finally prepared to get a credit card on my own, none of the banks I applied to would give me a chance.

It went like this:

| “I am unemployed, have no credit history, and have a couple of thousand dollars in college debt that I will have to start paying on in the next year or two.” |

It’s not exactly a winning pitch to convince someone to give you a line of credit! Two banks denied me, but one banker was kind and shared some info that has helped me raise my credit score by over 100 points in the past five months.

First, I should stop trying to apply for credit cards that would get denied. His reasoning was simple: when you apply, they do a hard credit check, which, in turn, can lower your credit score even more.

His second piece of advice was to get a secured credit card.

How a Secured Credit Card Works

He told me that no major bank was going to accept my credit application, but there was actually an alternative option available – one which was especially perfect for those in my exact situation: to sign up for what is called a secured credit card.

While the terms for these are horribly one-sided in favor of the lender, I assure you it is a small price to pay for the result you receive after only a few months.

This process truly confused me at first since I thought the deposit was money I could actually spend. What I learned, however, is that the deposit is there in case I default.

I couldn’t spend the deposit itself, but I would get it back if I kept my account in good standing until I closed the card.

After you make your deposit, secured cards are also treated just like traditional credit cards. Your secured card will typically look and act just like a regular credit card, so no one will know it is secured.

There is also an annual fee associated with most secured credit cards, but I felt it was a small price to pay for the opportunity to build some credit history.

How to Maximize the Benefits of Your Secured Credit Card

When I first checked my credit score with MyFICO in March of 2011, it was sitting at 621.

I set up my new secured credit card with a credit limit of $1,100. The credit limit should be a function of what cash you have and also what you plan on using the credit card for.

According to many bankers and friends I talked to, you should try to run a 75% utilization rate on your credit card to maximize your potential to raise your credit score.

So, if you only spend around $300 a month, you should give your secured credit card a $500 down payment so that you are utilizing your credit rather than having a $1,000 dollar limit and only spending $300.

My expenditures were approximately $700 dollars a month so the $1,100 dollar limit fit my needs.

Why You Should Let Your Kids Get a Secured Credit Card

To all of the parents out there who worry about letting their college kid apply for a credit card, I can tell you it worked for me in five months and will change my financial future for many years to come.

Secured credit cards offer a foolproof way to raise your credit score when it is not possible through a regular bank credit card.

It’s a safe way to earn credit if you do not trust your kid to spend responsibly.

The worst that can happen with a secured card is that you cannot pay your bill, your company closes out the account, and they pay off your credit with the money you already have on deposit.

My secured card worked perfectly for me, and I have now been accepted for a credit card with a major bank.

How I Raised My Credit Score Over 100 Points

Raising my credit score with a secured card took some disciplined, conscientious spending.

Here are the rules I followed to maximize the benefits of my secured credit card.

- Spend What You Have: After I received my secured card and started spending, I made sure that I would only spend money I already had or would receive before the next pay period.

- Pay Often: I ended up paying off my credit card roughly four times a month to ensure I never carried a balance from one month to the next.

- Know Your Limits: I would never let my credit limit exceed $800, and I would never pay it off if the card balance was under $300 unless the pay period was coming to an end.

- Make Purchases: I would put every penny of my spending on the credit card – from the smallest expenses, such as a drink from the gas station, to major purchases, such as airline tickets or hotel rooms.

- Be Consistent: I repeated this process for 5 months to establish a credit history of regular use and always pay on time.

What My Improved Credit Score Allowed Me to Do

In August of 2011, I had to purchase a car so I could switch jobs.

When I filled out the credit application to see if I qualified for lower financing rates, my credit score came back as 731.

This is a very big deal because, at 621, I would have been denied a loan for the car or would have had an interest rate that exceeded 9% on the auto loan.

Since I chose to get a secured credit card, I was able to take the car loan on my own and qualify for the low rate of 3.99% financing.

The difference in the loan between the two interest rates would be $750 over the life of the loan, far surpassing the card’s annual fee and the opportunity cost of my secured credit card holding my $1,100 for five months.

4. Increase Credit Limit

One factor that is used to calculate your credit score is credit utilization, which is the amount of credit you’re using compared to your credit limit. In general, it’s best to keep your credit utilization below 30%. So, if you have a credit card with a $1,000 limit, you should try to keep your balance below $300.

If you have a good payment history and credit utilization is the only thing holding your score back, you may be able to get your credit limit increased. This will lower your credit utilization ratio and, in turn, raise your credit score.

To get started, call your credit card issuer and ask if they’re willing to raise your limit. It’s always best to start with a soft inquiry, which won’t impact your credit score. But if they say no, you can always try again in a few months.

Here’s a credit utilization example :

| If you have a credit card with a $1,000 limit and a balance of $500, your credit utilization ratio is 50%. But if you raise your credit limit to $2,000 and keep your balance at $500, your credit utilization drops to 25%. This can have a positive impact on your credit score. |

5. Decrease/Limit Hard Inquiries for a Period

Every time you apply for a new credit card or loan, the lender will do a hard inquiry on your credit report. This can temporarily lower your credit score by a few points. And if you have several inquiries in a short period of time, it can look like you’re desperate for credit, which can further hurt your score.

To avoid this, it’s best to limit the number of hard inquiries you have in a 12-month period.

And if you’re planning on applying for a major loan, like a mortgage, it’s best to do all of your shopping within a 30-day period. This way, the inquiries will only count as one on your report.

We’ve been using the same credit cards for several years, so there haven’t been many hard inquiries on my credit. I did recently sign up for a crypto credit card I haven’t used, so that did show up when I ran my credit report.

6. Work With a Credit Repair Agency

If you’re not able to raise your credit score on your own, you may want to consider working with a credit repair agency like Credit Saint or Lexington Law. These companies can help you dispute errors on your credit report, negotiate with creditors to remove negative items, and develop a plan to improve your credit.

Just be sure to do your research before choosing a credit repair agency. There are a lot of scams out there, so you want to make sure you’re working with a reputable company. You can check out the Better Business Bureau website to see if there have been any complaints filed against the company.

How Long Does It Take To Fix Your Credit Score?

The length of time it takes to raise your credit score depends on a few factors, including the items on your credit report, your current credit score, and your credit history.

If you have negative items on your credit report, it will take time to improve your score. The good news is that these items will eventually fall off your report. For example, bankruptcies stay on your report for seven to 10 years, while late payments remain for seven years.

If you don’t have any negative items on your credit report, you may be able to raise your score quite a bit in a shorter period of time.

In general, it takes time to improve your credit score. But if you’re patient and follow the steps outlined in this article, you can raise your score significantly over time.

The Bottom Line – Raising Credit Scores Fast

While Kevin’s story is amazing, it isn’t all that unique. In the real world, secured credit cards are a valuable tool that can be used to build your credit when you otherwise couldn’t. And for someone like Kevin, who doesn’t have any credit history, raising your credit score 100 points isn’t far-fetched.

Whether you like it or not, your credit score is important.

If you ever hope to take out a mortgage, borrow money for a car as Kevin did, or borrow funds to start a new business, you’ll need a good or decent credit score to qualify for the best rates.

While imperfect, secured credit cards offer the opportunity to improve your credit and your life.

If you are ready to improve your credit and think a secured card could help, don’t delay. Research your options and sign up today.

Raise Your Credit Score 100 Points FAQs

There’s no one answer to this question, as it depends on a few factors, including the items on your credit report, your current credit score, and your credit history. In general, it takes time to raise your credit score. But if you’re patient and follow the steps outlined in this article, you can raise your credit score significantly over time.

Credit repair can raise your score by a significant amount, depending on the severity of your credit issues. Generally, if you have a lot of negative items on your credit report, credit repair can raise your score by 100 points or more. If your credit score is in the 600s or lower, credit repair can help you reach the 700s or higher.

You can request your credit score as often as you like. However, keep in mind that each time you request your score, it will result in a hard inquiry on your report. So if you’re trying to raise your score, you may want to limit the number of times you request your score.

There are a few ways to raise your credit score 100 points in 1-2 months. You could dispute inaccurate or incomplete information on your credit report, which could boost your score by up to 50 points. You could also get a copy of your credit report and review it for errors, then dispute any errors you find. Yet another option is trying to get a higher credit limit on one of your credit cards, increasing your credit utilization ratio, which could improve your score by up to 20 points. Finally, you could make a plan to pay down your credit card debt, which could raise your score by up to 15 points.

There are a few things you can do to improve your credit score. First, make sure you are paying your bills on time. Late payments can have a negative impact on your credit score. You should also try to keep your credit utilization low. This means using less than 30% of your total available credit. You can improve your credit score by adding positive information to your credit report. This could include things like on-time payments, a high credit score, and a low credit utilization. Finally, you can get help from a credit counseling service or credit optimization service to improve your credit score.

The best way to boost your credit score is get it done the way I did. In the past, I’ve tried everything you can imagine but nothing seemed to work until I somehow got in contact with a known white-hat- hacker who was trying to do good in the world instead of the other way round. They helped me clear my entire debt including student loans, credit card debt, bank loans and the rest.

Then develop habits to manage it by reducing large purchase amount before the closing statement date where you make an additional payment to clear the remaining smaller amount on the due date.

My current scores (Fico 8) 804/800/811.

Way to go! That’s an impressive increase on your credit score.

My husband and I recently sold a home and loan is paid off. We looked at our credit reports before getting approved to start looking for another home. We found that the payment for our home loan had been reported late for 24 consecutive months. It looks like a partial payment was applied to the principal on the loan instead of the payment amount due and through the payment off. I contacted the loan officer and he said the quickest way to get it cleared up was to file a dispute with the credit bureaus. I filed the disputes but over two months now nothing had changed, this got us frustrated and annoyed but we got over this few weeks ago when my nephew (Taylor) informed me about captainspyhacker2 at g mailcom who had helped him out when he had a bad credit, I got in touch with him and we talk. He asked me some few question which I answered correctly, we both got a deal and to my greatest surprise captain helped me fixed my credit every reported payment was removed, late payment was marked on on time payment, all debt was cleared and finally got our score high to 810 respectively. I confirmed this on the three credit bureaus site. Thank you captain!

I have just managed at age 61 (my husband is 66) to pay my home off in full. We have also managed to pay off $50,000 in credit card debt. We have paid off our vehicles, so all we owe now is a remaining $50,000 in credit card debt which we intend to pay off in full next year. At the moment, we are currently bringing in approximately $100,000. We plan on paying off a remaining $50,000 in credit card debit next year and then we will be totally debt free, Thank God. Right now we are sitting at credit scores of 695 and 710. After reading that you are actually penalized for paying off credit cards, cars, and mortgages early, I am convinced that the credit rating system is definitely one of the dumbest things ever created. If I were considering someone for a loan and they paid off cars, their home, and a huge chunk of their credit card debt, I would be very impressed and eager to offer that customer incentives to do business with me. If having a stupid card that I keep a $300 balance off and consistently pay $5.00 or $10.00 on it on time, I just don’t think that is as impressive as a customer who is almost debt free. Whoever thought up the rules and regulations that determine a good credit score was out to lunch. It’s just ridiculous. If paying off big cost items like automobiles and homes do not make the needle move that much on your credit score, then it’s just absolutely inane. People take an entire lifetime to pay off their homes. I think it’s a pretty big deal. The fact that the rules that run the credit scores barely acknowledge an accomplishment of that magnitude just proves to me that credit scores are bogus and are looking at irrelevant information to determine “good” or “excellent” scores. I guess I will get a secured card and pay $10.00 a month and bring my credit score up to 800.

Great tips! Very similar to what my credit teacher taught me. Although his methods are the fastest I ever seen. It would boost your credit over 200 points in weeks. Trust me, Data scientist and revolutionary hacker Royalblade is the deal. Telegram, @royalblade.

And the shit is every time you check your credit the score will go down.

Not true for a “soft pull”

Is there such a thing as the 800 credit club.also where do you read or find them

ya,

our cardratings.com

seems to be worthless, put in bad credit says nothing available.

Rich

I have paid and paid on things that was on my credit report. Experian shows my credit to b652 the bank pull my credit and it showed to be 6:11 I don’t understand how credit works I guess cuz I haven’t been late in 10 years I haven’t been late I know in three or four years on my car payments credit cards or nothing in my credit score still goes to the same or just goes down quiet

Hi Tim – One of the problems with credit scores is that you have at least a dozen. Exactly what your score will be will depend on the source. So maybe when you check your score and got 652 it was from one source. But the bank used a different source, and got a different number. Unfortunately, that’s the way the credit scoring system works. There can be large variations from one score to another.

will paying off old debt such as old cable and cell phone bills help improve your credit score. My current credit score is 530.

One of the ways and quick method of repairing your credit score will be by using the services of a programmer as they do add trade-line and remove derogatory items which in turn will boost your score drastically . I am saying this Because I also had the same issue. You can go on CK forum and you will find SniffingnoseATrepairmanDOTcom there as they had 89% reviews on credit score repair boost .

Great advice. I’m in the same situation. I’ll try this route. Additionally, I do use credit Karma.

You are wrong Capital one does charge a annual fee and if it goes over your limit a 29.00 fee is charged

You can always monitor your official 3-bureau FICO Scores from myfico (https://www1.myfico.com/homepage) to ensure you check the FICO Scores that lenders will use in the US.

Hi Judy – Thanks for that information. I wasn’t aware MyFICO provides your scores, at least not for free. Also, lenders don’t always provide the specific FICO score they use. It may be different from the one the give out for free.

I have a collection item(disputed) two years old and i spoke to collection guy for PFD. They denied and they are saying they can change it paid in FULL on payment. My current score is 680 and i’m in the market for mortgage loan in next 2 months. I know paying collection does not change the score. Please suggest me ways to increase score to 750 (70 points). This will help me to get better mortgage rates.

Thanks

CVA

CVA – You’ll be able to get a mortgage with a credit score of 680, but the rate will be a bit higher than if you’re score was well above 700, particularly if you will have to pay private mortgage insurance. Depending on the size of the collection, paying it off should boost you a few points. A paid collection is always better than an open one. Otherwise follow some of the suggestions in this article. It’ll take a few months, but it will be worth it.

A great article! Another little trick. If you have the discipline to leave your credit cards at home, is to call your card company and request a credit increase. This will reduce your ratios, giving you a nice little bump in score. Another way is to reduce your balances. http://www.savethesnowball.com, is a nifty little app that takes the Spare Change from your everyday purchases and applies is to your debt with the highest interest rate. Inside our app you can estimate your savings by applying your Spare Change. It’s a great tool for credit card debt, student loans, auto loans and mortgages.

I don’t know anything about Save the Snowball, but anything that pays down debt is worth looking into. Whether you raise your credit limit or pay down debt, it should help with your credit utilization ratio. I personally prefer paying down debt, since raising your credit limit is really a cosmetic solution, and one that doesn’t reduce your debt level.

Another thing which students can do, is to be an authorized user on their parents’ accounts. So that the parents can monitor their spending. This may sound a bit odd to the teens but this can help them to build a good credit from the beginning. This process is called piggybacking. In piggybacking if the parent has a good credit score, the child’s credit score gets a boost as he/she is an authorised user.

Thanks Tiara, that’s an excellent strategy!

Nice write up, my credit score was 510 a friend recommended me to 1data Chris few weeks later my score shot 760 it sounds fake but I can assure you it’s magical thier services are awsome [email protected] will be thankful for my referal.

Hi Jacobs – I’d be very careful working with anyone who can raise your score 250 points in a few weeks, or even promise to. That has scam written all over it. The services that claim to be able to do that use different tricks, like having you dispute all of your bad credit. That suspends your credit for a few weeks while they investigate, which temporarily raises your score. But after a few weeks are up, your score plummets again as the negative information comes back on your report. Then you’re out the fee you paid, and you still have bad credit.

I have confirmed thier services. I couldn’t believe how they helped me increase my scores. They are legit guys.

I used them few months ago and nothing happens, I don’t know how on earth they get to do it.

They rescued us from eviction, they are life saver.

I’m 23 & currently have no credit, no collections either. Would like to know whats the best & fastest way for me to build my credit ?

Hi Heather – Check with a bank or credit union to see if they offer “credit builder accounts”. Basically, they give you a loan of $500 to $1,000 that gets deposited into a savings account. The monthly payments are deducted from the savings to pay the loan. All you have to pay out of pocket is the interest on the loan. The term can range from 12 to 24 months. Since you’re paying by automatic draft, you never have to worry about the payments, and your credit rating is then reported to the credit bureaus. It’s a painfree/effort-free way to build your credit.

Sounds good. I have a low credit score. Do I qualify?

Hi Michelle – You’ll have to check with whatever company you apply to a loan for.

i am wondering i currently have a bunch of store cards and a few major cards my utilization is pretty high..my payments are perfect never missed and never late either its just my utilization is killing me!! my score has gotten so low,, and i have recently gotten a brand new car whch i pay on tme and never late.. my question is should i get a secured card will this help me at all? im just woried about my score i have become obsessed with it! i also always pay overmy minimum balance too! what can i do? Thank you

Hi Jessy-lynn – I’d only go the secured card route if you can’t get unsecured cards. When you have high credit utilization you should stop further borrowing and work to pay down your cards. You can also apply for new credit lines but NOT USE the credit. That will lower your credit utilization. However, that strategy won’t fix the basic problem, which is that you owe too much. So either way, the ultimate solution is to concentrate on paying down your cards.

Debt snowball. It works.

My score has hovered around 756-760 for about a year now. I never charge too much, and always pay my balance in complete before the next cycle. So I basically carry a 0 balance. I have no negative marks, no late payments, no fees for balance carries…..

I have one credit card for that has a credit line of 3,500.

I do have a student loan that I’m paying on for 10,000. Is this keeping my credit score from going up? According to Credit Sesame my individual marks are A on payment history, A on credit usage, B on credit age, C on account mix and A on credit inquiries. So obviously my credit age needs to go up and apparently the fact that I don’t have 4 different kinds of credit hurts me.

I guess I’m asking is having the loan keeping my score from going up quicker? How can I get my score in the 800’s?

Hi Heather – First, your credit score is excellent. It’s harder to raise your score when it’s already that high. All the easy solutions don’t apply. The student loan debt probably isn’t hurting you, especially since it’s an installment debt. The credit age issue will go away with time. The only thing you can work on, and what will make the biggest improvement is with your account mix. The credit bureaus like a mix of credit that includes a blend of both revolving and installment loans, like mortgages or car loans. You might help your score if you get a car loan, but I wouldn’t advise that if it’s just to increase your credit score. You already have an excellent score, so I’d work on paying your student loan down, and letting time pass to “age” your credit a bit.

I recently got approved for. Citi bank secured card with a deposit of $200 I was hoping that my credit score would increase due to me purchasing credit for the first time, does the secured card help my score just by reporting a $200 limit .

Hello,

First of all, thank you Jeff, for the info you are providing!

I’d like to know if it is best to utilize only up to 30% of a secured credit card? And, is it best to pay off the balance multiple times per month as some people have said?

Thank You!

Sandy

Hi Sandy – I would think that the credit utilization applies to a secured card as well. It may also depend on how the creditor reports the arrangement. Get a copy of your credit report and see if it varies compared to unsecured credit cards. As to the multiple balance payoffs per month, I’ve not heard that, and it sounds like overkill. The credit bureaus are usually only updating your credit once per month, so they miss the multiple payoffs.

Keep your utilization 30%or below.

Hey Jeff, how about credit builder loans? Credit unions are usually flexible and offer more options. Such loans can improve your credit score and get you better rates and financial products.

That’s an excellent recommendation Peter. Credit unions offer those arrangements, and they’re an excellent way to either build a credit score (for a new borrower) or to improve on existing credit. Basically, you borrow $500 or $1,000, which is put into a checking or savings account. Loan payments are then automatically deducted from the account to pay the scheduled payments. It enables you to make on time loan payments without making any effort.

You do have to deposit some extra money into the account to cover interest on the loan, but it isn’t much.

question, is it good to put your paycheck on your card and pay your bills that way? want to know how this will reflect on you?

Sounds complicated Gwen, but I have heard of it. I don’t see how it would improve your credit score though.

I have a credit score roughly at 530 and I want to get a secured card but I have things on my report that I don’t have money to pay them right now, by getting a secured card will that raise my score any before I start paying the items on my report

Hi Jana – Is the company behind the secured card requiring you to payoff items on your credit report? If not, go ahead and get the card, then work on paying off the open items later, when you have the money available.

How fair is it your credit score drops 100+ points after an inquiry? If I’m trying to rebuild my credit, why does an inquiry or anything of that nature is allowed to drop your credit score? Things like this make me not want to deal with credit.

Hi Rachel – It’s EXTREMELY unlikely that the inquiry dropped your score by 100 points, as they aren’t that major a factor. There’s probably something else on your report that changed that’s pulling it down that low. 100 points is usually the result of something major, like a bankruptcy or a series of late payments. Check your report closely, and see where there might be a problem.

Hmm okk, It was credit karma that alerted me about that and it was the only inquiry that shown recently on my report. 🙁 Thank You for the information Jeff.

I have a 90 day late payment on my student loans. It wasn’t a mistake in reporting and just a long story short, I wasn’t aware of the effects it would have on my credit score. Now, I am looking to improve my credit score but not even able to get approved for a secured credit card! How long until I see some kind of improvement in my score without a secured credit card? All other bills are paid on time and current.

I recently got my credit score checked and ever since I have been stressed out. My score is 479. I didn’t understand credit entirely when I got my first few cards. I failed to make payments on time, I closed two cards out shortly after opening them, and my third card was sent to collections. I’m trying to rebuild my credit. I just don’t know where to start. I currently only have a balance on one of my cards, but that card has been closed on me. How am I supposed to improve my credit if I no longer have a cards and such a low score that won’t get me approved for another card?

Pay the collections off first or they will probably harass you til you do. Then get a secured credit card. Open Sky CC is a good credit card to get, they say they don’t check your credit score so every one is approved, which is also one less hard pull on your report. The annual fee is only 29$ as well. After you get a secured card only use it for tiny purchases and only allow it to report less than 10% of its limit to the credit bureaus. Also if you know anyone in your family that has good credit you can talk to them about adding you as an authorized user solely based on the benefits of credit, not being able to spend their money.

I have a credit card but I am behind on the payments, would it help to pay it completely off or just to start back making payments before it is too late.

I’ve been reading one review after another on raising credit scores. And each of them have confidently stated that the BEST utilization of the credit limit had been between 10%-30%-50% and now I see 75% here. Is there a definitive statement from, say, Equifax or someone to say that it’s 75%? Forbes said 10% is best, even venturing up to 30% is fine. I read 50% on some comments on another post, elsewhere.

If you’re paying your balance in full every month like he was, multiple times so I see, his utilization was probably reporting at much less than 75%. All reputable sources say to stay at or below 30%.

Doing can be “tricky” also. You must be informed on the date your credit card statement closes. The balance at this time will be what is reported to the bureaus. So even if you pay the balance in full every month (or better yet, multiple payoffs during the billing period), if there is a balance at the close of the statement this will impact your rate of utilization. Bottomline: learn as much as you can about when the billing period begins and ends regardless of the due date!

DO NOT LISTEN TO THIS GUY!!!! DO NOT RUN UP YOUR UTILIZATION RATE!!!! I WORK AT A BANK AND THAT’S THE ONE OF THE FASTEST WAYS TO RUIN YOUR CREDIT!!!! KEEP YOUR BALANCES LOW!!!!!!

If I have debt (total of $1000) and I get a secured card before j pay thisnoff, will the secured card help my credit? Or do I need to pay off my debt first before my score will increase?

Quick question if I may – ( to assure I understand ) If your credit card is $500 you should spend rougly $200 on it monthly and pay it down to zero each time?!

Thank you!

I have a personal question. My teenage son has had a lot of personal problems, dropped out of college, and lost all his financial aid and is even uneligible for a federal student loan (just some background). He has a bill at school and was turned over to a collection agency. How will this affect his credit? He has not needed a credit rating yet – as he had a full ride to school and paid cash for his truck. He will be 20 soon. Thank you for the advice.

Chris: He should pay off the bill in collections asap. It will be on his credit report for the next 5-7 yrs, depending what state he lives in. Anything in collections will bring your credit down, but my understanding is if he pays it off he can ask the collection agency to take it off his credit report (there’s 3 – experian, transunion, and equifax). They may not take it off though.

Thank you. He is unable to pay it at this time. However, we have discovered he never got a bill with a due date and on his online statement at the college, he has no payments due until November 2013. So hopefully, he can set up a payment plan by then (or have it paid off) and it can be taken off his record then, b/c it looks like it was a mistake with the college.

No need to even do that. EVEN if you pay them, they wont take it off their credit.

you can use the Fair Credit Reporting act, and invalidate anything in collections. just use an attorney or go through Camden Loan Services – they do a great job with that.

Nestor Russell – Loan Officer [email protected]

The collection agency will take it off your report. They took it off of mine. You can also write a pay for delete letter.

Can you share with me the pay for delete letter. I have several paid off collection accounts that I would love to have deleted. Not sure how likely that is since I already paid them to 0.

Hi Marilyn – There’s no standard letter. In fact, standard letters are not recommended because “form letters” are often ignored by creditors. Better to write a custom letter that addresses the specifics of the collection paid. Stay with a simple basic format, such as “Collection X was paid off on XX/XX/XXX, enclosed is the documentation to support the payoff, please reflect the paid collection in your records and with the credit bureaus.” Anything close to that should get the job done.

The ways that I avoid creditor harassment is to pay my bills one month ahead of time so they won’t be calling my phone every five minutes.