The best identity theft protection services can help you prevent all kinds of fraud and financial mayhem, such as someone hacking into your brokerage account or using your information to file a tax return in your name.

Better yet, many of the top companies that offer identity theft protection extend up to $1 million dollars in identity theft insurance that can cover financial losses if you’re ever a victim of fraud.

Table of Contents

With that in mind, it’s smart to compare the best identity theft protection service providers so you can sign up for this protection before you need it. Read on to learn which of the best identity theft protection services we recommend, how their plans work, and where each one shines.

Our Picks for Best Identity Theft Protection

- Identity Guard: Best Budget Protection

- LifeLock: Best Mobile App

- ReliaShield: Best Family Coverage

- ID Shield: Best Free Trial

- ID Watchdog: Best for 401(k) and HSA Fraud

Best Identity Theft Protection – Company Reviews

Without this type of protection, your sensitive personal details and financial information may be susceptible to theft and fraud, making you an easy target for hackers and thieves. The company reviews below can help you find the best identity theft protection services for your needs.

Identity Guard was chosen as our best budget pick based on the broad range of coverages offered in their basic plan. For just $7.99 per month, individuals can get protective benefits such as $1 million in insurance for stolen funds and fraud, dark web monitoring, a U.S.-based dedicated case manager, and more.

The company’s scanning is backed by IBM Watson, a supercomputer that uses artificial intelligence to find and analyze fraud patterns and warn customers faster.

Individuals who want the most robust coverage possible will also get a good deal with their Premier plan, which is only $25 per month. This plan includes every kind of fraud protection you can think of, plus the benefit of three-bureau credit monitoring, credit and debit card monitoring, 401(k) plan and investment account monitoring, sex offender registry monitoring, monthly credit score reports, and more.

LifeLock offers comprehensive identity theft coverage in three different tiers, all of which include up to $1 million in identity theft insurance for lawyers and experts and cybersecurity via Norton 360. That said, each tier of coverage also offers $25,000, $100,000, or $1 million in coverage for stolen funds reimbursement as well. Another stand-out feature of LifeLock is its 60-day money-back guarantee, which applies when you select the annual payment option for your coverage.

This company’s mobile app is also the highest-rated out there, with 4.6 out of 5 stars in the App Store and 4.5 out of 5 stars on Google Play. This can be important for consumers who want to receive notifications and keep an eye on their identity theft protection on the go.

ReliaShield offers identity theft protection plans for individuals and families, and their plans for individuals start at just $7.99 per month or $87.99 per year. Also, note that all of ReliaShield’s plans come with $1 million in stolen funds and expense reimbursement coverage.

All family plans also include free coverage for all children in the home who are under 18 — including monitoring social media accounts and public records — making ReliaShield a good option if you want to set up identity theft prevention for your dependents.

We also like the fact that ReliaShield offers three plans to choose from, including a top-tier ReliaShield Elite plan with Social Security number monitoring, three credit bureau monitoring, bank account takeover monitoring, credit card application monitoring, and more.

IDShield is another credit monitoring company to consider, and doing so is made easy thanks to their free trial. This company lets you enjoy identity protection and credit protection for 30 days before you commit to your plan. If you’re unhappy with their services or you want to switch to a different company, you can simply cancel before 30 days are up.

This company offers individual and family plans that include only your TransUnion credit report, but you can also select plans that include monitoring of all three bureaus. Each of their plans also comes with $1 million in identity theft insurance coverage as well as credit bureau monitoring, social security number and court records monitoring, dark web monitoring, and credit score tracking and reporting.

ID Watchdog is worth considering if you want the most amount of identity theft insurance possible, particularly if you have a lot of money in your 401(k) or a Health Savings Account (HSA). Both of this company’s plan options come with $1 million in identity theft insurance, but the ID Watchdog Premium plan adds an additional $1 million in coverage for stolen funds from a 401(k) or HSA.

Other perks offered by the top-tier plan include financial accounts monitoring, integrated fraud alerts, social account takeover alerts, a private VPN, and a password manager. Family plans also let you set up a credit freeze on your dependent’s Equifax credit report.

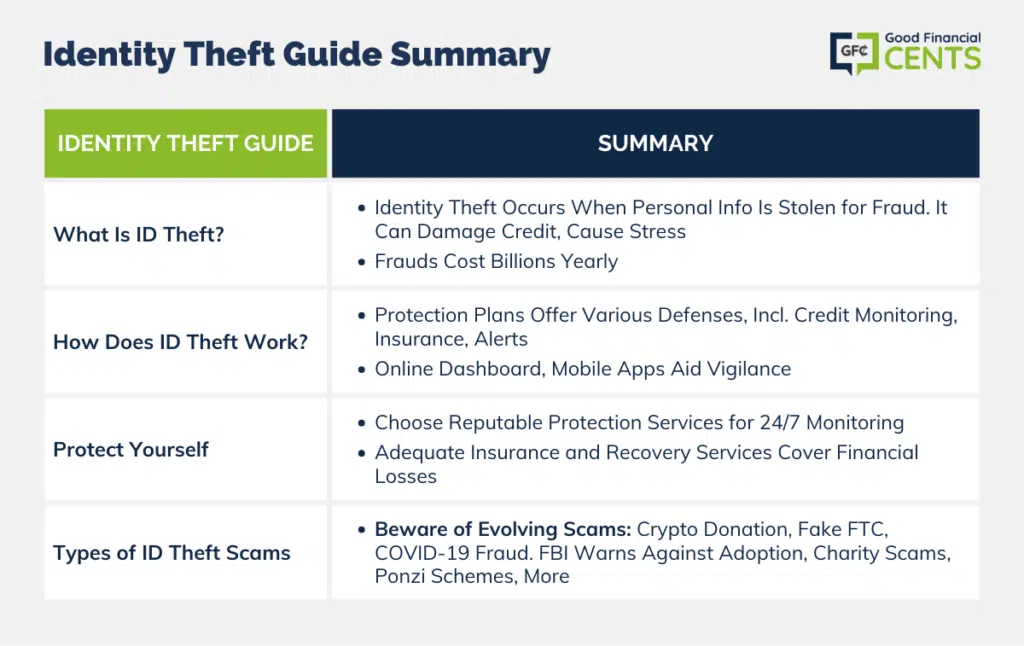

Identity Theft Guide

Whether your goal is avoiding identity theft scams online or securing some identity theft protection insurance, the best identity theft monitoring services can help you along the way. Keep reading to learn how identity theft works, how identity theft companies can help you prevent fraud, and what to do when your identity is stolen.

What Is ID Theft?

According to government resources, identity theft takes place when someone steals your personal information to commit any type of fraud. They may use that information to apply for a credit card or payday loan in your name, or they could file your tax return and try to get your refund. Not only can ID theft damage your credit file, but it can cause victims of identity theft considerable stress as they work to restore their identity.

Unfortunately, identity theft is becoming more costly each year, and fraudsters are still finding new ways to get their hands on personal details, such as your driver’s license or SSN, which they can use to commit fraud. The 2022 Identity Fraud Study from Javelin* revealed that fraudulent activity and data breaches cost consumers $43 billion in losses in 2021 alone.

The report also shows that total identity fraud losses climbed to $56 billion (USD) in 2021 and that hackers and identity thieves have increasingly moved toward contacting their victims directly to ensnare them.

As the report from Javelin says, “A noteworthy characteristic of identity fraud scams is that consumers often recall the moment they interacted with a criminal through a text, call, or email.”

How Does ID Theft Protection Work?

ID theft protection companies offer plans that include various levels of protection from fraud. Common inclusions in ID theft prevention plans include credit bureau monitoring, dark web monitoring, Social Security number monitoring, social media monitoring, identity theft insurance, real-time bank account monitoring, fraud alerts, and even malware protection or antivirus software.

Generally speaking, consumers pick a plan that applies to themselves and their family members, and they begin enjoying ID theft protection right away. While consumers can still lean on old-fashioned identity theft protection strategies like checking their credit reports for errors (or more modern cybersecurity strategies such as enabling two-factor authentication), an ID theft company will work on their behalf around the clock and notify them of suspicious activity.

Most identity theft protection companies offer an online dashboard, and many also have their own mobile app. Consumers can use both of these platforms to keep an eye on any changes to their credit reports or to find out if anyone is trying to withdraw money or open a new account in their name.

Many ID theft services contact their clients through email alerts, but some will send fraud alerts via text or their mobile app.

How to Protect Yourself From Identity Theft

If you have been wondering how identity theft destroys your credit score and are looking for a way to prevent it, your best bet is to sign up for ID theft protection with one of the providers we highlighted in this guide. By paying for identity protection services, you get 24/7 monitoring of your accounts, which can lead to the discovery of signs of fraud right away.

In the meantime, make sure the plan you select comes with a considerable amount of identity theft insurance and recovery services. This type of protection can cover your financial losses if you wind up being a victim of fraud, as it can pay for expenses like lawyer fees and reimbursement of stolen funds.

If you’re looking for ways to repair your credit history, however, you may need to look in a different direction. For example, you may be wondering how to fix errors on your credit report or how to remove collections from your credit report.

Maybe you want to know how to dispute your credit report or want to look into a credit score simulator to see how decisions could affect your score.

These are questions you should ask of the best credit repair companies instead of an ID theft protection service.

Types of ID Theft Scams

When it comes to the types of identity theft scams, there are endless possibilities to be aware of. The Federal Trade Commission (FTC) frequently lists the latest ID fraud scams on its website, and here are some of the latest:

- Crypto donation scams

- Credit repair companies stealing personal data

- Hackers pretending to be the FTC

- COVID-19 identity fraud scams

- Phishing scams via phone, text, or email (this can be reported to the Anti-Phishing Working Group at [email protected])

The Federal Bureau of Investigation (FBI) also offers information on common identity theft scams to be aware of. Some of the scams listed with the FBI include:

- Adoption scams

- Advance fee scams

- Charity and disaster fraud scams

- Elder fraud scams

- Internet auction fraud

- Ponzi schemes

From here, the list goes on and on. If you have been wondering why you should check your credit report regularly, the endless number of scams out there is a good indication that you need to protect yourself. Ultimately, this is why you should sign up for identity theft protection services that work on your behalf 24 hours a day.

How We Found the Best Identity Theft Protection Services

To find the best identity theft protection services, we looked for companies that offer diverse plans to choose from. We only selected companies that offer at least $1 million in identity theft insurance, and we went with providers that offer plans for both individuals and families.

While the quality of ID theft plans was considered for this ranking, we also looked at the total cost for monthly or annual plans. Ultimately, we selected the ID theft companies that offer the most services and best value for the money spent.

Summary of the Best Identity Theft Protection Services July 2024

- Identity Guard: Best Budget Protection

- LifeLock: Best Mobile App

- ReliaShield: Best Family Coverage

- ID Shield: Best Free Trial

- ID Watchdog: Best for 401(k) and HSA Fraud

Bottom Line: Top 5 Identity Theft Protection Services 2024

In today’s digital age, safeguarding your personal information is crucial. The top identity theft protection services of 2024 offer a shield against evolving fraud threats.

Identity Guard stands out with comprehensive coverage starting at $7.99/month, powered by AI-driven scanning. LifeLock excels in mobile app ratings, with plans featuring up to $1 million insurance and Norton 360 cybersecurity. ReliaShield caters to families, providing $1 million in coverage and child protection at affordable rates.

ID Shield offers a risk-free trial period and various plans, including credit monitoring. ID Watchdog specializes in 401(k) and HSA fraud protection with additional coverage. Stay vigilant with these services to thwart cybercriminals and their constantly evolving tactics.