In a perfect world, parents and educators (not to mention society itself) would work hard to make sure that our children are financially literate.

In that utopian ideal, money skills would be considered just as important as reading, writing, and arithmetic, infants would cut their teeth on money books, and not knowing how to budget would have the same stigma as being illiterate.

Unfortunately, the real world simply doesn’t work like that.

Society encourages debt rather than budgeting, and who wants to have to work on paying off debt with high interest when you don’t have to, schools barely touch on financial skills, if they cover them at all, and parents who never learned money skills themselves don’t even know that they need to teach their children this stuff.

I know that I wasn’t taught this stuff in school. Were you?

It’s up to individuals to recognize that their skills are lacking before they can even start to fill the gaps.

Parents ought to start helping their young children to learn basic money skills, even if they themselves never learned them.

Table of Contents

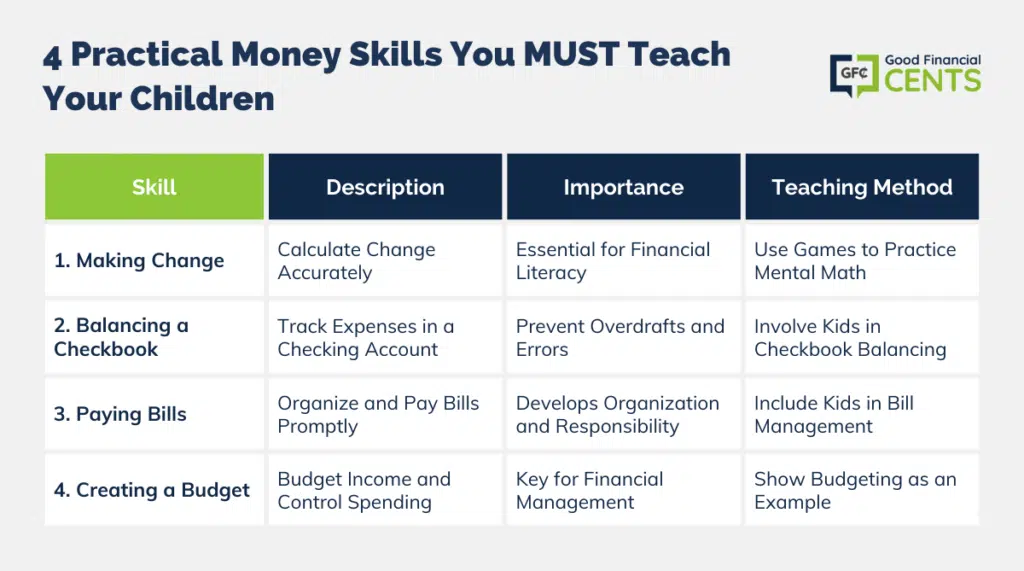

Here are four of the most basic practical money skills that everyone should have and how to teach them to your children (you can also check out some great tips on how to make a lot of money fast to help start saving for all the expenses that come along with this little army you have created!)

1. How to Make Change

Several years ago, I was buying lunch at a fast food restaurant when the bill came to $12.65. I handed the cashier a twenty and then realized I probably had some change in my pocket. She had already entered the bill tendered amount in her cash register when I handed her the change. She looked from the twenty to the change and then handed me back my 65¢ as she started putting together my $7.35 in change. “I just can’t do the math,” she said.

Unfortunately, these sorts of moments are all too common. Calculators and cash registers that do the math for you, along with our society becoming more cashless, have brought about a generation who can’t make change.

The problem with an inability to make change is that it represents an issue of innumeracy (the mathematical equivalent of illiteracy). Individuals who cannot easily subtract 12 from 20 in their heads are vulnerable to scams, unscrupulous people, and their own mathematical mistakes. Feeling comfortable adding and subtracting money is the very first skill necessary for financial literacy.

How to teach this skill: There are plenty of children’s toys and games created for the purpose of learning how to make change. You can practice these with your children in order to introduce the concept of denominations of money as well as methods for making change and double-checking your mental math.

2. How to Balance a Checkbook

I once worked with a woman who did not keep a check register.

Every day, she would call her bank to check her balance. (This was in the bad old days before every bank was online).

If she found out she had money in her account, she’d feel free to spend it, even though she knew she had checks and other charges that had not yet cleared.

In short, she spent all of her money at least twice because she didn’t keep track of her account.

This was a particularly irresponsible example of not keeping tabs on a checking account, but I’ve met more than my share of individuals whose idea of balancing a checkbook was to subtract $100 from the balance the bank stated they had—just to cover for uncleared charges—and assume that they were good.

But not staying on top of your checking account is an excellent way to overdraw it, as my co-worker seemed to do on a bi-weekly basis. In addition, it’s impossible to track and plan for spending if you never write down your credits and expenses, much less balance your checkbook.

Finally, even though the bank is generally going to make fewer mistakes than you will, it doesn’t mean a bank error is impossible. If you never balance your checkbook, you won’t ever pick up on their mistakes.

How to teach this skill:

When your children have learned how to do multi-digit addition and subtraction (around 3rd or 4th grade), ask them to help you with both recording your deposits and purchases and adding and subtracting them. As they get older, include them in your checkbook balancing, showing them what bank statements (either paper or digital) look like and how to use them in order to balance your checkbook.

3. How to Pay Bills

For most people, the problem with this particular skill is that you know nothing about it until you are out on your own and have to pay bills for the first time. The skill of bill paying is really all about the organization: you need to be able to keep track of the bills as they come in, know exactly when you have to pay them in order to avoid late fees or delinquencies, and keep records of what you’ve paid. That kind of organization can be a struggle even for an otherwise financially savvy new billpayer.

Of course, the biggest aspect of bill paying has to do with making sure you have enough money to pay them each month. For those who are just thrown into the adult world of paying bills, avoiding spending temptations to make sure that the bills get paid can be tough. Young adults often learn the hard way that they need to hold onto their paychecks rather than blow them every weekend.

How to teach this skill:

By including your children in the bill-paying habit, they’ll get a chance to learn this skill and practice it before it can actually impact their finances and credit.

4. How to Create a Budget

Knowing how to budget your income is clearly an important skill that many of us are lacking. However, it is not exactly like the other three skills in this list in that it is much harder to teach and master. Budgeting requires tracking your expenditures, setting goals, planning your finances, and disciplining yourself to stay on target. This is in no way a simple process and even veteran budgeters may find that they have to revisit their budgeting strategy over and over again to find what will work for them.

How to teach this skill:

The real skill in budgeting is learning how to adapt to changing finances, whereas the rest of these skills are fairly static. So if you show your children how you keep track of your expenses, make plans for future expenses, keep needs clear from wants, and roll with the unexpected financial punches, they’ll have a good sense of what they will need to do in their own homes one day.

In addition, having them practice budgeting on a small scale with allowance money will give them great opportunities to prepare for bigger budget challenges.

Final Thoughts – Practical Money Skills are a Must

Managing money is just as important a life skill as learning table manners or being able to read.

But often, parents are uncomfortable with money themselves, and so they don’t teach their children these skills.

It doesn’t have to be that way.

Help prepare your children for their future by making money skills something you teach at home. You’d hate for them to learn about money on the street or on television, right? Allowance money will give them great opportunities to prepare for bigger budget challenges.

Great article.

We usually buy products/services after we have the money and we don’t delay the payment. Most reoccurring services are set for auto-payment.

This proverb has helped relieve much stress:

Do not withhold good from those to whom it is due,

when it is in your power to act.

Do not say to your neighbor,

“Come back tomorrow and I’ll give it to you”—

when you already have it with you.

“Show children where you file paper bills until it’s time to pay them, and include them in putting bill pay reminders on the calendar. ”

If we did this but have an emergency or interruption (our son is due anytime now), who will check the mail, collect the bills, get the stamps, mail out the payments? Isn’t it cleaner, simpler, safer just to pay as you go?

Great Article.

Looking get my child to put money away for his future.

I think the more parents make it part of their responsibility to teach their kids about finances, the better off the kids will be with money (regardless of career path). And like you said, even if you never were great with money, there’s still a duty to teach your kids good financial skills. What better time to start than when you have kids? I can’t imagine a better motivating factor.

I agree with you that budget is a must to control your overspending and at the same time to monitor your expenditure.

If you can nail steps three and four, you have done pretty well. Most grown-ups struggle with these two. My four year old daughter knows the basic concepts of currency and that it has value. (yes, she likes doing chores for money) I also intend on teaching her technical analysis as soon as possible:)

Most of us try to teach our children the things they need to know to go out into the world and be productive adults. Sad to say there are young adults that can’t make change or even write out a check. I also think there should be mandatory classes in the schools that teach finances. If parents aren’t going to teach their children, someone needs to. Very good article, an article all parents need to read!

Great ideas! Thanks so much for taking time to share about investing in your children. I wish we could clearly grasp how important child rearing is. We rarely think of how important simple things such as teaching about money are in raising up the next generation!

The saddest thing to see today is teens who can’t count change, or even read analog clocks. My parents did a great job of teaching me how to count money, so that wasn’t a problem. The bad part is that we were barely taught how to count money in school. It wasn’t until I took Accounting in high school that my teachers really even talked about finances. Its quite sad, I think financial classes should be mandatory in school.

I taught my kids money management by turning the grocery budget over to them when they were still in grade school. I gave them the circulars to our (2) local grocery stores and our biweekly food budget (all fifty dollars of it). They learned meal planning, money management and frugality. They also learned that living on eggs (we have chickens) and pb&j sandwiches can be done, but careful planning can provide for a much better dining experience. They are 25 and 28 now and (mostly) make good financial decisions. They also had household chores and a very small allowance. To supplement their income they started their own housecleaning business as soon as the oldest got her driving permit. Saving 75% of their income allowed the oldest to purchase a nice used car, with cash, when she hit 18. Parents need to teach children their own values on money, or they will pick up bad habits from peers, television, etc. They will stray from your lessons when they first leave home, but will have the skill set to become financially responsible adults.

that is very good for you and your children.

Those are great suggestions! I think it’s super important to involve the children in daily finances – paying bills, purchasing things, saving money etc. It’s critical that they learn these life skills before they leave the nest.

These are wonderful things to teach kids. I have four of my own and will be striving to teach them these things,especially since my parent’s didn’t and it took me a long time to get a handle on my finances. Thanks for sharing!

Great article. As a parent of two younger boys (and one that is an adult with less than perfect money skills) I think that you are right on target here. I would add that the principles of A) saving for a rainy day, B) spending less than you earn, and C) being cautious of lifestyle creep as income rises should be worked into the topics above.

Thanks for a great newsletter.

You’re absolutley right. The schools aren’t doing it so parents must. I think it is a good idea to give a child a fixed amount of cash every week, but don’tlet them convince you to give them any more if they run out. That way they won’t learn to become reliant on others to bail them out when they run into financial difficulties when they are older.

@ Jon

I was a finance major in college and I still wasn’t stop some of the basic things that kids (and adults) need to succeed financially. Financial education needs to be ramped in our country ASAP.

I agree that teaching children the basics of personal finances is so important and too often overlooked. I was pleasantly surprised the other day when I went shopping with my niece/nephew and they started doing the math of my purchases and how much change I should be getting. At first I was shocked but pride quickly took over to know that these guys are learning about money at such an early age. At lunch we discussed careers that were build on making a % of someone else’s earnings… my nephew decided he wanted to be a sports agent so we had some fun with that. We topped off our outing with them calculating the tip! Making it fun for them can be easy and they learned so much more from that afternoon then simply whipping out a calculator.

@ Julie

That’s such a great story about your niece and nephew!