HELOCs and home equity loans are valuable financial tools that enable you to access the equity in your home without the need to take a new first mortgage. Since the proceeds can be used for just about any purpose, you can take either loan to make improvements on your home, or to cover other expenses. These can include paying off credit card debt, financing your child’s college education, or even making the down payment on a vacation home.

But while a HELOC and home-equity loan both serve the same purpose, there are major differences in how they work and are repaid. We’re going to dive into those differences to help you decide which loan will work best for you.

Table of Contents

What Is a HELOC?

The Benefits of a HELOC

HELOC is an abbreviation for home equity line of credit. The “line of credit” part of the title is what distinguishes a HELOC from a home equity loan.

A HELOC is essentially a revolving line of credit that works much like a credit card, except that it’s secured by your home. Because it is, you’ll not only get the benefit of a larger credit line, but also a much lower interest rate than you can get on a credit card.

And since it is a revolving line of credit, you’ll pay interest only on the outstanding loan balance. For example, if your HELOC is for $50,000, and $10,000 is outstanding, you’ll pay interest only on $10,000.

Much like a credit card, as you repay the balance on your credit line, the available balance will be restored.

Still another benefit is that HELOCs usually have a lower interest rate than a home equity loan. And during the first few years of a HELOC, you’ll pay interest only on the outstanding loan balance. This will leave you with a much lower payment than you’d have with a home equity loan.

HELOC proceeds can be used for any purpose, whether to make improvements on your home, pay off debts, or finance major purchases.

To qualify for a HELOC, you’ll need to have substantial equity in your home. Most lenders will typically lend between 80% and 90% of the value of your home, reduced by the balance of your existing first mortgage.

If your home is worth $500,000, you currently have $300,000 loan on the property, and a lender will provide a HELOC at up to 80% of the value of your home, the HELOC can be set as high as $100,000 ($500,000 X 80%, minus $300,000 for the first mortgage).

The Downsides of a HELOC

As easy as HELOC terms can be, there are some downsides you need to be aware of:

The draw period. That’s the period of time during which you’ll have access to the credit line, after which the loan must be fully repaid. While the typical term of a HELOC can be 20 or 30 years, you’ll only be able to draw funds against the line for 10 or 15 of those years. After that, you’ll need to make payments, including both interest and principal, until the loan is fully repaid.

Variable interest rate. Though HELOCs do have lower interest rates than home equity loans, those rates are variable. That means the rate you’ll pay on your HELOC will rise when interest rates increase. Naturally, when the interest rate rises, your payment will also increase.

HELOCs can be reduced or frozen. A lender can reduce or freeze your HELOC under certain conditions. That can include a significant decline in your credit score or in the value of your home. For example, though your HELOC may be for $50,000, a drop in your credit score may cause the lender to freeze the line, denying you access to the unused portion of your line.

What Is a Home Equity Loan?

The Benefits of a Home Equity Loan

A home equity loan works much like a HELOC, except that it is a true loan, and not a revolving line of credit. You can think of it as a smaller version of your first mortgage. You’ll take a fixed loan amount, receive the proceeds at closing, then make regularly scheduled monthly payments until the loan is fully paid.

Because it is a fixed rate loan, the interest rate will be higher on a home-equity loan than it will be on a HELOC. But you will have the benefit of a fixed interest rate and monthly payment throughout the term of the loan.

Qualification for a home-equity loan works much the way it does with a HELOC. The lender will offer you access to between 80% and 90% of the value of your home, less the existing first mortgage balance.

You’ll also need to have good or excellent credit, as well as a stable income that will comfortably accommodate the new loan payment.

The Downsides of a Home Equity Loan

Like a HELOC, home equity loans have their own share of disadvantages:

Once the loan is taken, there are no more funds to access. This is unlike a HELOC where you can access the funds as needed, and even repay them ahead of time.

Higher cost than a HELOC. Though both loan types have closing costs, those costs are typically higher on a home equity loan. The interest rate will also be higher. While a HELOC may be available at, say, 4.75%, you may pay 6% for a home equity loan.

Higher monthly payments. HELOC payments are interest-only, at least during the draw period. However, home equity loan payments include both interest and principal, resulting in higher payments.

How a HELOC Compares With a Home Equity Loan

How a HELOC and a Home Equity Loan Are Similar

The primary similarity between a HELOC and a home equity loan is that both are loan programs designed to enable you to access the equity in your home.

This is generally a more cost-effective way to retrieve equity from your home than doing a cash-out refinance of your first mortgage. Not only may a cash-out refinance cost more than a HELOC or home equity loan in closing costs, but you may lose the benefit of an attractive interest rate if rates have gone up since the original loan was taken.

Both HELOCs and home-equity loans are also very flexible loan arrangements. You can either borrow the funds for a very specific purpose, like making an addition to your home, or to cover a series of expenses over several years.

How a HELOC and a Home Equity Loan are Different

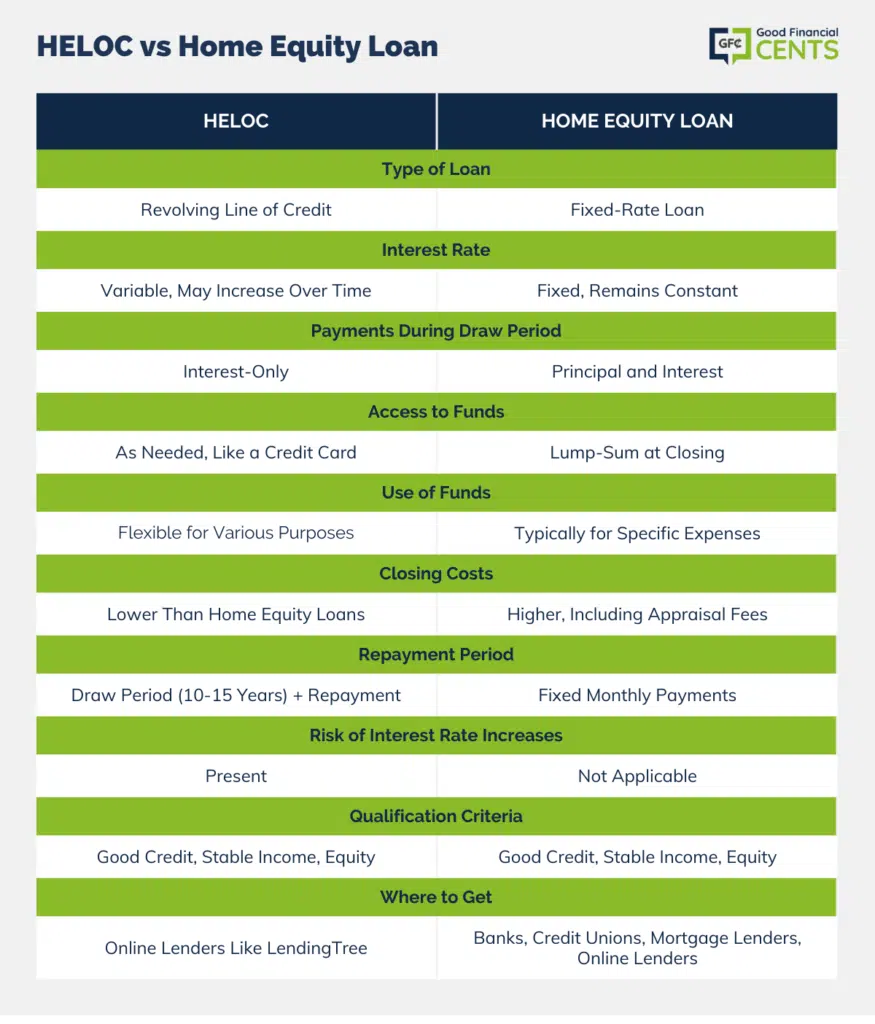

The main differences between a HELOC and home equity are loan funds access and repayment.

Where a home-equity loan is a one-time loan, generally designed for a specific purpose, a HELOC is a revolving credit arrangement. You can borrow money as you need it, repay it, and pay interest only on the outstanding balance.

A home equity loan requires full payment of interest and principal throughout the term of the loan. A HELOC requires only the payment of interest during the draw period. However, once the draw period is over, you will be paying a combination of interest and principal on a HELOC, which will make it much more like a home equity loan.

When to Choose a HELOC

You should choose a HELOC when…

- You want to tap the equity in your home and pay the absolute lowest rate and monthly payment possible.

- Your plan is to use the HELOC as a source of funds, above your emergency fund. There’s no specific purpose for the funds, but you want them available for major expenses as they arise.

- You’re okay with the variable rate arrangement, perhaps because you plan to keep the outstanding balance low or repay the line early.

When to Choose a Home Equity Loan

You should choose a home equity loan when…

- You need a large amount of money quickly, perhaps because you want to add an addition to your home or cover the cost of an upcoming wedding.

- You prefer the stability of a fixed interest rate and monthly payment.

- You plan to stay in your home for many years, giving you plenty of time to fully repay the home equity loan.

- You want to consolidate variable-rate loans, like student loans and credit cards, into a single fixed-rate loan.

Where to Get a HELOC or Home Equity Loan

LendingTree is the leading online loan marketplace in America. You can use the platform to get a new first mortgage, credit cards, student loans, car loans, business loans, and other types of financing, in addition to HELOCs and home equity loans. Scores of lenders make their products available on LendingTree, which makes it an excellent choice to search for and find the best HELOC or home equity loan arrangement for you.

Figure is a direct HELOC lender, offering loans on single-family residences and townhouses. You can get a HELOC from Figure for second homes and investment properties, in addition to primary residences. They’ll lend up to $250,000, and you must have a minimum credit score 680. The entire loan application takes place online, and rates start as low as 3.00% APR.

Quicken Loans (ACCORDING TO THEIR WEBPAGE, QUICKEN LOANS DOES NOT OFFER HELOCS. THERE IS NO MENTION OF HOME EQUITY LOANS.)

AmeriValue (THE WEBSITE IS EXTREMELY LIMITED, AND I COULD FIND NO EVIDENCE THEY OFFER ANYTHING OTHER THAN FIRST MORTGAGES, NOT HELOCS OR HOME EQUITY LOANS.)

The Bottom Line – HELOC vs Home Equity Loan

HELOCs and home equity loans offer homeowners flexible access to their home equity, but they have crucial differences. A HELOC is like a revolving credit line secured by your home, offering lower interest rates and payments based on the outstanding balance. In contrast, a home equity loan provides a lump-sum amount with fixed interest rates and monthly principal and interest payments.

Choosing between them depends on your financial goals. HELOCs suit those seeking flexibility and lower initial costs. Home equity loans are ideal for large, one-time expenses or consolidation with a preference for fixed rates.

Both options help you leverage your home’s equity, so pick the one aligned with your specific financial needs and objectives.