Money is what makes the world go around. Love it or hate it, money is important. The problem is most young adults are entering the “adult world” with almost no idea how to manage their money.

As my son just turned 18 months old, he’s still a little too young to understand and appreciate the value of money.

But it’s still on my mind about how I’m going to teach him to appreciate and value the importance of money and money-saving tips as he gets older.

Table of Contents

While I’m sure that things are destined to change as time progresses, here are a few of the things that I feel will be beneficial when he is old enough to appreciate them:

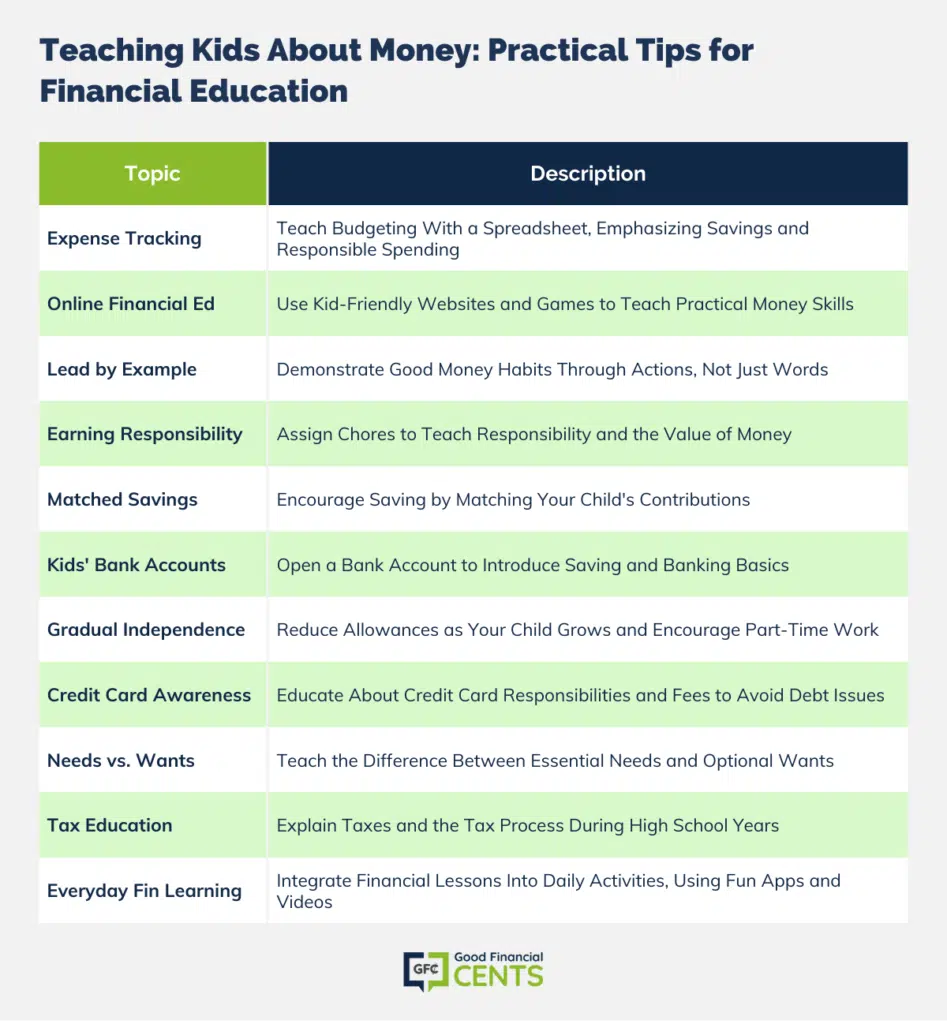

Show Them What You’re Working With

Currently, my wife and I use a basic Excel spreadsheet to keep track of all our monthly expenses and our monthly cash flow. I think it will be truly beneficial to sit down with our son to kind of show him what we have coming in versus what we have coming out.

We would then show him what we contribute towards our savings account, what we tithe, and also retirement savings.

This way we show him that every dollar that comes in is not spent, and a good chunk goes toward either the savings account or saving for his college education.

Most kids have no idea how their parents manage their money. They don’t know where the money is coming from or where the money is going.

The first step in teaching your kids the value of money is showing them how you use it. Show your children how much you spend in certain areas or how much money you save each month.

Get Techy

Nowadays there are many money education sites that can teach kids the basics of money.

One example that comes to mind is kids.gov. Before they plan to work for money, they must be comfortable with the real thing. They need to touch dollars and coins, count them, stack them, and learn that they are concrete things.

What kid doesn’t like to play games? There are dozens of excellent games out there that can teach them about money and finances.

Walk the Talk

Kids watch more than they listen to lectures. You might be the greatest money manager in the world, but if you don’t show and tell your kids about what you’re doing, they can’t learn from you.

Make Allowances Count

Growing up my parents gave me basic chores of just mowing the lawn and taking out the trash, and the only thing I really got paid for was the lawn.

I think, though, that incorporating other weekly tasks for my son to do, will give him both a sense of responsibility and also an appreciation for the money he earns for the task he does. Go beyond spending money.

Require kids to save, invest, and donate. They need to learn money isn’t just for spending.

The older your child is, or depending on their maturity level, you can add more chores or give them more responsibility. While there is nothing wrong with giving your children money or gifts, not making them work for something in their life can leave them without a sense of money.

You don’t have to force them to do everything around the house. You can give them options.

Once they have reached a certain age, you can start offering them opportunities. You can still require them to do the basic chores around the house. Find some additional things to do around the house, and let them decide if they want to take up those jobs for money or pass.

Play Match Maker

Just like a 401(k) match, you can add to their savings total. That should give them an incentive to fill their piggy banks. Don’t forget about the grandparents! Let them match, too.

As your child gets older (or even when they’re still young), you can open up a bank account for them. There are plenty of banks that offer savings accounts for kids.

In fact, there are some banks out there that offer decent APY for the kid’s savings accounts. Not only can you teach them about saving money, but you can teach them how banks work and some of the advantages of finding a good savings account.

There are a lot of banks out there where you can open an account in a matter of minutes.

Be Nice, Just Not Too Nice

Even if you can afford to give your kid a comfortable allowance, don’t. By about age 12, kids should do small-paying jobs for friends or family members. At 16 they’re capable of getting summer jobs and saving for their own expenses.

No matter how you do it, teaching your child the value of money is imperative to their financial success. Give your child the tools they need to become a financial champion!

Get Out the Credit Card

As soon as your child turns 18 (probably even before), they are going to be flooded with credit card offers. Do you know how many offers you get in the mail? Now imagine getting those offers as an 18-year-old.

Before your child is hit with those “magic cards,” make sure they understand the responsibility and fees that come along with the credit card.

I’m sure you’ve heard stories of college students who racked up thousands of dollars in debt after they got their first credit card (and that’s what the credit card companies are hoping for). Don’t let your child be another one of those stories.

Regardless of how you feel about credit cards, make sure your kid has the information they need.

Need vs Want

One of the most important things you can teach your child (and you can get started at a young age) is the difference between a “need” and a “want.”

Walk them through the differences between a need (heat, food, water, etc.) and wants (gadgets, candy, etc.). When you’re walking through the grocery store aisle, there are plenty of ways you can show your kids the differences between the two.

Talk About Taxes

Once your kid is wandering the high school halls, it’s a good time to explain taxes and how they operate.

You don’t have to be a CPA to explain taxes to your kid. Show them how much you pay for taxes. Walk them through the process and explain the various kinds of taxes you have to pay every year.

Teaching Kids About Money

For a lot of parents, they don’t think about teaching their kids about money. They are more concerned with keeping them happy and healthy, which is great, but you should also help them understand finances and the importance of managing them.

It doesn’t all have to be sitting down and looking at numbers on a budget. You can turn a grocery store trip into a lesson. There are fun apps and videos you can use with your children.

Great post. I agree that teaching kids financially is extremely important. I mean this subject is what could scope our future for us. Too many people this day and age are clueless about how to build and maintain good credit. I feel that high schools need to have financial education class where they teach kids about how to build credit, use credit cards, etc.. If schools are not teaching their children, then us parents have to. My daughter will be 2 in February. She is too young to teach now, but by the time she is 13 or 14, you can be sure that she will know a lot about credit cards and credit. Check out my blog where we talk extensively about increasing your credit score and credit card relief.

Jeff –

I agree with many of the ideas here, and strongly believe that your kids will emulate your behavior. You’ve probably figured this out by now, but your kids pick up on EVERYTHING you do. That is a challenge in itself, especially after a long day of work!

One of the things I’ve done with my kids is to take them to the bank once per month to deposit any savings they’ve accumulated, which usually amounts to $5 or less. Because rates are so low and I wanted to teach the value of compounding, I committed to matching their deposits at the end of the year, as long as the money stays in the account. They have the option of withdrawing money to spend as they see fit, but they will not get a match on any of those funds. As it turns out, they’re pretty excited about seeing a penny of interest on their statements.

So far, so good.

Kevin

Hi Jeff this is a really great topic to discuss and i was surprised to read beautiful comments from everybody. I think this is the smartest thing to teach our kids nowadays. It’s very appropriate to start teaching kids to be responsible as young as possible a they will learn to keep it and live with it while they grow up.

I’m a big proponent of kids an allowance to earn money. The more chores they do the more they get, up to a limit. Kind of like the real world. But they should not get rewarded for making their bed, cleaning their room or clearing dishes from the table. Things like that are part of being a family member.

Also, for school and stuff when they get older its good to give them a limit for their clothes. Let’s say $100 for new school clothes. Then if they want to spend $150, then they need to come up with the $50 themselves.

Children need the opportunity to learn the value of money. They’ll never learn it if they never have to make it with their own money.

This is my new frontier as well. I have a good handle on my own finances, as well as personal finance experience and tips for grown ups. But when it comes to teaching my young children about money, I’m trying my best….but looking to keep trying more effective ways of getting the message through 🙂

My son has some chores he has to do as part of our family and some he does to earn money. If he doesn’t do those, he doesn’t earn money.

He then must put some money in spend, save and give. We let him spend his spend money on what he wants (within reason). He is learning to save his money up for something he wants.

We also bought Dave Ramsey’s Financial Peace, Jr., and he learned quite a bit from that and also enjoyed it.

Personally now that our son is 12 its a lot easier. He has to “earn” his allowance as nothing in life is free. He has to then save 20% and tithe 10% so he know the value of saving and giving. When he goes to the store and ask for things my wife and I say sure you can get it. How much money have you saved? Usually he starts to think if a video game, shoes, hat etc is worth the money (his money) he worked for. Another key is letting your actions speak louder then words. Show your kids that you work, that you save, and that you don’t always just buy things because you want them. Its like telling your kids not to smoke when they see you smoking. You are better off showing them the behavior!

Great post Jeff! I have a 2 year old daughter and yes we do want to give them the moon but you are right…we need to discipline ourselves and our kids otherwise they will end up “spoilt”.

We have to teach them how money works, which won’t be easy at first. If it is something like a toy they want, then they need to somehow earn it through adding some sort of value they provide in which they feel they deserve the toy because they have earned it through their own efforts.

You can teach them this responsibility which will make them value, appreciate and be more grateful when they get the toy. You can implement some allowance and savings plan for them as well.

It is good when we as parents can start early with this process and “bend the tree when it’s still young” and give them the proper foundation when it comes to money and spending habits.

Remember they will grow older and might get influenced through their friends and the media. Also the educational system and schools does not teach kids really about money. They mainly focus on training kids on how to work for their money…there is a reason for that.

If you want to find out the reason how the educational system is setup and what their real agenda is, then suggest you go to this website:

I hope I added some value with helping you teach your kids how to manage money.

Wow, you have gotten some really great responses here.

I don’t have kids, but I worked for a financial planner that was great at talking with his kids about money. I think the biggest thing is to have the conversation with your kids. So many parents don’t want to talk about it with their spouse, much less their kids.

I think avoiding statements like “We can’t afford that” is a good idea. Actually explain why you shouldn’t spend money on that particular item.

I was hoping you had some ideas! : ) We have three daughters (10, 6 and 4) and they developed an expectation that we were going to buy them candy every time we went to the store, provide the older two weekly school “ice cream day” money, etc. We have really cut back on these things, not just to teach the value of money, but to address some bigger issues of appreciation and gratefulness. We have had a difficult time coming up with ways for them to learn money value that really seem to work. I look forward to reading the other comments for ideas we can try. I never learned growing up about money management and really want my kids to avoid my same mistakes.

Kids need to learn your money values. Kids your son’s age can start learning money mechanics (counting, value, kinds of money and etc). It’s a step by step process with you demonstrating, explicitly teaching and showing and giving them a chance to learn how to use money as a tool.

Check out my Grandma Rie’s money camp posts on FamilyMoneyValues blog. I’m trying to do a better job teaching my grandkids than I did my kids.

http://blog.familymoneyvalues.com/category/money-camp/

Jeff,

As someone else mentioned, kids to need to start by emulating you. So when you and Mandy decide that you don’t want to buy something (for yourselves), explain to the kids WHY (as in “we would rather not spend money on something useless, but save it for XYZ”).

It’s always helpful when kids can come to their own conclusions about money, and not be preached to about it.

And as you said, it helps to say “no” sometimes, and even that “we can’t afford it”. Because even if you can “technically” afford it, sometimes money should be better spent elsewhere. I could buy my son new Legos all day long, but should we REALLY be spending another $40 an yet ANOTHER set of Legos, when he already has boxes and boxes of them?

I have also made it a point to help them understand how utilities work – how much water and heating oil and electricity costs. I bring them down to the basement and show them the oil tank, show them how the boiler kicks on when we run the hot water, and how much it costs to fill up that tank with oil (which is depressing for ME to contemplate these days!).

It just seems that education is better than nagging about money. Kids are smarter than we think.

The best lessons I ever learned about money were from my father who grew up very poor (< – he really WAS one of those kids with no shoes). My father started off at a young age (about five as I can recall) with an allowance. I believe it was about 50 cents or so when I was five back in 1976. I got 3 dimes and 4 nickels. "Looked" like a lot back then!

Straight away he had 3 jars where the money went. 1 jar represented 10% for the church tithe. And it was very important that I put that money in the jar myself, not him. He would point to what 10% represented – – and I would take one of my nickles and plunk it in the jar. I also scooped that out every Sunday, put it my pocket, and put it in the offering basket each week at church.

That left me with 45 cents.

Next, he said I had to put money in savings (50% of what was left and you always rounded UP when it was an uneven number!) This was something I wasn't allowed to touch – it sat in my bedroom on the dresser for me to look at each day too – but he made sure he kept his promise that every time it got to $1.00 – – he took me to Mercantile Bank in St. Charles, Missouri and had me deposit that into an account. Again, it was important that I physically took that money and put it in the jar myself as well as to deposit that money at the bank myself.

Last, the remaining jar (other 50%) was for whatever I wanted to spend my money on. I loved Jolly Ranchers and they were 3 cents a piece at Kroger's. He never made me feel guilty about what I spent my money on. It was mine to spend as I wanted. Again, I took my own money and paid people myself – not him – when I went to buy things.

Eventually, I learned things… like I could give up the Jolly Ranchers and could buy a Snickers for 30 cents. That meant I had to weigh out what I wanted. My father was good about showing me choices.

This went on for years.

I also remember when I failed to do a chore and my sister did my chore. So my father told me that since the work had to get done and someone else had to do my work, I not only had to pay my sister the money for doing my job (ugh – who wants to do that?) but I didn't get my allowance that week. That meant I had to take the money from my precious savings jar and hand it to my sister (again, myself). And my father made ME write an IOU to my savings so that when my next allowance came around, I had to pay back my IOU first. That meant very little money for me to spend on what I wanted.

I grew up with a great sense of what money was, felt comfortable handling it myself, understood the risk I took when I didn't do a job well, etc. I take nothing for granted now – nothing.

I have a healthy relationship with money and have never felt persuaded that I have to have what everyone else has (i.e iPads, etc.) when there are other things I would much rather do with my money like donate it to those in need or use it for traveling, etc.

Good luck with your son and thank you for the courage you shared in asking for advice on the topic. Not sure if this will help you or not, but it's how I grew up.

Sheryl Brown

Jeff,

I am a big fan of Sammy Rabbit (itsahabit.com). The books and music are terrific and they helped turn my daughter into a saver instead of a spender when she was about 5. And even though she’s a teenager now, she and her friends recognized the music when I recently was reviewing the latest CD.

It goes by so fast – you’re smart to start now!

Our daughter is only 4 months old but I already have running lists in my head about teaching her good skills. I’m actually buying her a piggy bank for her first Christmas gift. I plan on teaching her to live below her income, I think this is huge. I want her to know when she starts making her own money that it’s important to save and to put money into savings before she spends a cent, something I’m just learning the importance of now. I want her to know not all debt is bad (school/mortgage/car etc), as long as she has a plan to pay it back and it doesn’t get out of control. I will teach her how to use a credit card appropriately and I will make sure she knows how to budget from a very young age… I could keep going…