Before we had our first son I was terrified of how much it was going to increase our monthly expenses. I was already scrambling ideas in my mind on ways to make money fast to save for this new expense coming our way!

We were decent at managing our finances, but I suddenly felt that I had holes in all my pockets and all our money would just fall off into the new baby abyss.

I’m sure other families feel this pinch and are constantly looking for ways to save money.

While it’s rare eliminating a single expense will give you control over your finances, you can usually save a lot of money by combining savings from several different directions.

Try some of the following money-saving tips and use them to take charge of your budget.

Table of Contents

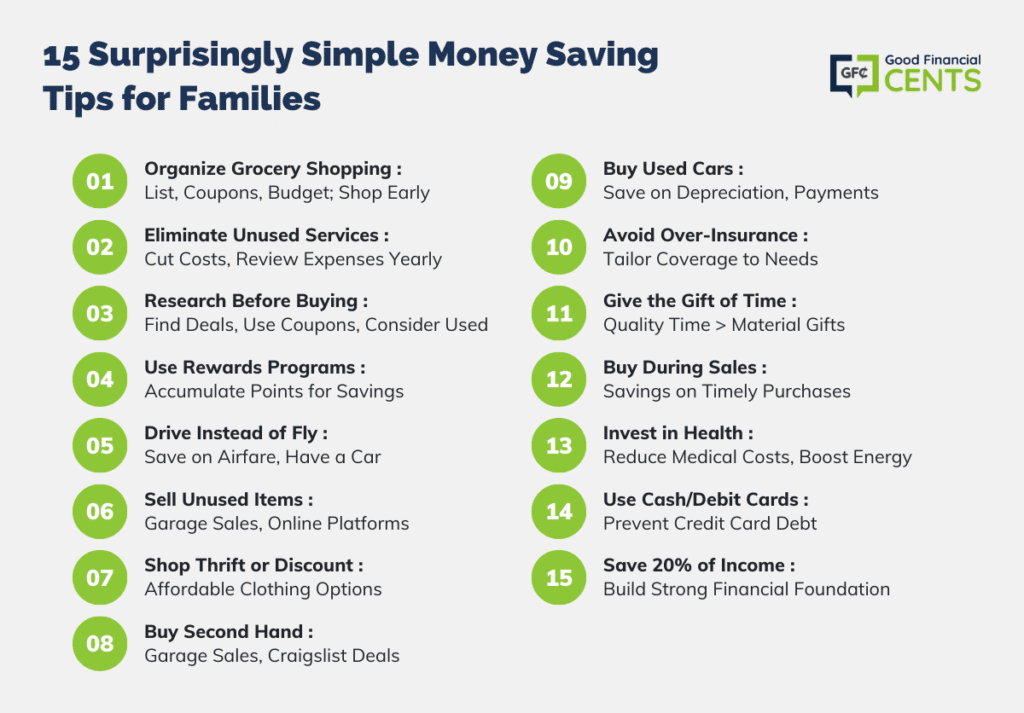

- 1. Organize Your Grocery Shopping

- 2. Eliminate One Service Each Year That You Can Do Without

- 3. Never Buy “Off the Shelf”

- 4. Participate In – And Use – Your Rewards Programs

- 5. Never Fly When You Can Drive

- 6. Sell What You No Longer Need

- 7. Buy Clothing in Thrift or Discount Stores

- 8. Never Buy New What You Can Get Second Hand

- 9. You Probably Don’t Need a New Car – Ever

- 10. Avoid Being Over-Insured

- 11. Give the Gift of Time

- 12. Buy When Everyone Else Is Selling

- 13. Take Better Care of Your Health

- 14. Shop With Cash or Debit Cards, Not With Credit Cards

- 15. Save a Minimum of 20% Of Your Net Pay

- Final Thoughts on 15 {Surprisingly Simple} Money Saving Tips for Families

1. Organize Your Grocery Shopping

The more organized you are when you go grocery shopping, the more money you can save. Have a list of items you need to buy, an envelope filled with related coupons, and a maximum budget you’re prepared to spend on the trip (this alone can keep you from overspending).

Also, try to shop early in the week when stores are the least crowded. Crowds mean added stress, and that’s never good for a budget-conscious shopper.

And one way to avoid stress is don’t take your 3 boys to the grocery store if you can avoid it. I made that mistake one time when I was in need of kale for my new juicing craze. Holy moly was that mistake! Thankfully I made it out alive but I’m certain a few more gray hairs popped up. 🙂

2. Eliminate One Service Each Year That You Can Do Without

The potential here is almost unlimited since most of us have services we hardly use or don’t ever use at all. It could be canceling a hardly used gym membership for one year, a landline telephone service the next, and cable TV the year after that.

It may only be $50 to $100 per month, but over the years it really adds up. The easiest way to do this is to have a constant budget going.

My wife is the queen at this so we’re always constantly reviewing what we’re spending our money on each month. I also do this with my businesses (financial planning practice and blog) to make sure I’m not spending money on tools or subscription services I’m no longer using.

3. Never Buy “Off the Shelf”

Any time you plan to buy something, especially something fairly costly, you should always do your homework first. Try the following:

- Surf the web to see who has the item at the lowest price, or if any sales are coming up.

- Check the website of the manufacturer and retailer to see if any coupons are available.

- See if you can buy the same item second-hand (more on that later).

By adding research to significant purchases, you can save hundreds of dollars each year. You don’t want to do this for small purchases otherwise you‘ll burn a lot of time on insignificant savings, but you might set a threshold of say, $50 and above.

The best example of this is how we saved thousands of dollars when we built our dream home. In some cases we saved 60-70% off the initial price we found on mirrors, lights, vanities, and a ton more.

4. Participate In – And Use – Your Rewards Programs

Many companies offer rewards programs, but not as many people participate in them. Sign up for them wherever possible, and keep tabs on your points.

Our first test with this was an Amazon credit card that gave us real money that we could use on Amazon.com. We let that accumulate until we actually needed something for the home which was great.

We signed up for a Southwest rewards card last year and we qualified for their Companion Pass which allows one passenger to fly for free. Between that and the reward points we’ve accumulated we’ve booked 7 roundtrip tickets and have been to Jamaica twice. Boom!

If you’re interested in using reward points for travel, check out this guest post on my blog that showed how you could get a family of 5 for free to Hawaii using reward points.

5. Never Fly When You Can Drive

Air travel has become so common that many people use it as a default choice whenever they travel. But if you are traveling with family, plan to drive instead of flying, especially if the trip is within a few hundred miles.

By driving, not only do you save the airfare of buying four airline tickets for a family of four, but you also have a car when you arrive. If you don’t think your family car is up to the task, you can rent a compact for $300-$400 per week, or roughly the cost of a single airline ticket to many destinations.

While you’re at it, sign up for programs such as Triple-A, to add even more savings to major travel purchases. You can save money on hotel stays, car rentals, restaurants, and travel attractions, in addition to other benefit’s the program offers.

6. Sell What You No Longer Need

Instead of throwing away items you no longer use, try selling them first to make some additional money. You can have a garage sale once or twice per year, and also sell on Craigslist or eBay. By doing this, you can often raise several hundred dollars per year.

In our area, we also have a Facebook community where you can sell stuff really quick. We’ve sold a couch for $150 that we bought at Ikea over 6 years ago for $400 in one day after we posted it to this Facebook group.

That couch has been through 3 kids and 1 dog and we still got a good amount for it. It definitely proves you can get cash for stuff you hardly use anymore.

7. Buy Clothing in Thrift or Discount Stores

You can buy a shirt or blouse that sells in a retail store for $30, for just $4 in a thrift store, or a $40 pair of pants for $5. Thrift stores don’t have the selection that retail stores have, but you can often come across the perfect item from time to time, sometimes barely used.

At a minimum, you can use thrift store shopping to supplement your regular retail shopping and save a small fortune in the process. This can be an especially good strategy for buying children’s clothing.

Since kids outgrow clothes so quickly, thrift stores offer an opportunity to buy good quality clothes at low prices. And then you won’t mind when they come home with ripped pants knees or shirts stained with red Kool-Aid.

If thrift stores aren’t your thing, then take a look at discount stores like T.J. Maxx or Marshall’s. I can remember buying a new tie for a wedding at Macy’s for $40 only to find the exact same tie at Marshall’s a few weeks later for half the price!

That’s when I knew that anytime I needed a new tie, dress shirt, polo, or shorts I would visit one of these places first.

Just recently I snagged a pair of cargo shorts for $25 that I saw in a department store for $60 a few days later.

8. Never Buy New What You Can Get Second Hand

Just as you should sell whatever you no longer use, others are doing the same all the time. Before you make a major purchase, first look into garage sales and estate sales in your area – you’ll be surprised at the stuff people are looking to unload.

Also, become a regular surfer on Craigslist – it’s like a perpetual garage sale where people are looking to sell anything you can imagine.

Best of all, all prices are fully negotiable! Take advantage of wherever and whenever you can. You’ll begin to realize that there’s practically nothing you need to buy new again.

9. You Probably Don’t Need a New Car – Ever

People often get on the new car treadmill early in life, then park there forever. But that’s an expensive way to live. New cars have the following premiums, and the sooner you can rid your life of them, the more money you’ll have:

- The Depreciation Factor: new car values drop like a rock right after you drive them off the dealer lot, and keep dropping for the first few years.

- A Permanent Car Payment: few people can afford to pay cash for a new car, and that brings a monthly payment into the mix. If you’re replacing your car every few years with a new one, you probably never go very long without a car payment.

- Higher Auto Insurance and Ad Valorem Taxes.

- More Interaction With Dealer Repair Shops, Which Are About Twice the Cost of an Independent Mechanic.

- Sunk Capital: a brand new $30,000 car is holding a lot more of your cash than a $5,000 used car.

Buy a used car for a few thousand dollars – or not more than you have in your bank account. The repairs will cost less than the annual outlay you’ll make for monthly payments on a new car.

You can also make extra money to put towards your savings and debt by driving around in your car! Check out how to become and Uber driver and pick up some extra cash when you have free time to cart some people around in your area!

10. Avoid Being Over-Insured

It’s virtually impossible to ensure against every potential risk, and you can go broke trying. For example, you don’t need prescription drug coverage if all you ever need is an occasional antibiotic.

Pay cash when you need a prescription, and lower your health insurance premium.

You also don’t need $1 million of life insurance if you only make $50,000 per year. Be sure that any insurance coverage you have roughly matches the reasonable possibility of a negative outcome.

11. Give the Gift of Time

We often give gifts to people who we can’t spend time with, either for a birthday or at the holidays. If time is less expensive than a gift, plan to spend some with the person or people you want to give something to.

An outing, a lunch, a dinner or even a quick cup of coffee could be worth more to a person than a physical gift. It also works wonders for building up relationships.

12. Buy When Everyone Else Is Selling

This concept should have universal application in your life. It can apply to investing – ie, buying after a market sell-off, so you can pick up investment bargains. But it can also apply to just about anything you might buy.

For example, since retail sales typically fall off in January, nearly everything goes on sale. Plan on doing the bulk of your buying in January rather than November and December.

This also has a strong seasonal application. For example, buy your winter clothing in late winter or early spring, when winter items go on clearance.

13. Take Better Care of Your Health

We all understand the importance of taking better care of your health as it relates to overall health and longevity, but it also has important financial considerations. By taking better care of yourself, you’ll spend less on dealing with the fallout of common illnesses like cold and flu.

You can save even more by avoiding controllable health conditions related to inactivity, obesity, smoking and other dangerous behaviors.

Still, another health-related factor is energy level. The better you feel, the more productive you’ll be, and that usually translates to more productivity on the job or in your business. Health and energy level are often closely correlated to income.

My wife and were both decent at working out but our diets were erratic. Earlier this year she started the Beach Body #21DayFix program and it has done wonders for the both us. Now we’re working out much more consistently and eating the healthiest we ever have.

14. Shop With Cash or Debit Cards, Not With Credit Cards

Yes, there are rewards programs that work in your favor with some credit cards, but credit cards also hold the potential of being used as an extension of your paycheck. That’s what happens anytime you allow a balance to slide from one month to the next.

When you do that, you’re adding interest to the cost of whatever you purchased, potentially wiping out any rewards-based savings.

With cash and debit cards you’re paying “cash on the barrel” and there’s no chance of getting into debt. That reality will also prevent the possibility of spending more money than you have.

15. Save a Minimum of 20% Of Your Net Pay

With all the money you will save from the previous 14 tips, you should be able to save up some money! This isn’t just about having money for its own sake – it‘s about eliminating the panic factor that often causes you to spend more money than you need to.

A well stocked high interest savings account creates options.

When you have options, you will have time to shop for the best deals, and when you find them, you’ll be able to pay for them. Having money enables you to save money in a way that living hand-to-mouth never can.

It takes you out of the state of crisis management and gives you control over your circumstances. And that’s what you need to have in order to properly care for your family.

What ways has your family found to save money?

Final Thoughts on 15 {Surprisingly Simple} Money Saving Tips for Families

Balancing family expenses can be daunting, especially with the addition of children. Implementing these practical tips can help stretch your budget and increase financial security.

From organized grocery shopping and eliminating unnecessary services to embracing rewards programs and second-hand purchases, these strategies alleviate financial stress.

Additionally, driving instead of flying, selling unused items, and taking better care of your health further contribute to savings.

Remember, it’s crucial to avoid over-insuring, shop wisely, and save at least 20% of your income. By adopting these practices, you’ll gain control over your finances and build a secure future for your family.

Very helpful insight

Great post! We already do a lot of these things, especially when it comes to grocery shopping, buying second hand items and saving 30% of our net income. It can take time to build up these habits, but once you start and stick to doing it, many of them feel like second nature. In fact, it’s often fun seeing how much you can save or if you can find an item for cheaper.

Great post, thanks for sharing. I particularly like “Eliminate One Service Each Year,” as we can often add add add luxuries and rarely take time to edit them down.

Having a baby HAS increased our costs, it’s true, but not as much as we’d have feared. We are doing our best to save money and be responsive about it, which works well so far. Really great advice, we are implementing at least half of them with great results

Poshmark is a great website for buying/selling clothing that I recently found and have enjoyed using as an alternative to Craiglist and Ebay. While it’s primarily geared toward women, it’s a great place to liquidate all of your closets and earn some extra cash at the same time. If you’re looking to buy, you can find great deals on used clothes, especially popular designers and even children’s clothing.

Great List! We get most of the boys clothes used as well. One thing my wife does is she keeps all of their old clothes that aren’t damaged in totes and saves them for the next boy. We have totes for each size in boys clothes from 0 – 8. Between our boys and our nephews some of these clothes have made it through 5 kids!

We don’t have a family yet, but my fiancee and I already follow most of your tips. I know two sets of couples – a frugal couple and a non-frugal couple – that have two kids each. The frugal couple spends roughly half of what the non-frugal couple spends a month on groceries and such.

The frugal couple uses cloth diapers and it saves them a ton of money.

These are some really good tips, Jeff, and many of which I’ve followed before. I’m a huge advocate for cutting cable TV, which seems to be an ever-growing expense given the near-monopoly that industry has in many markets. (The only time it’s really hard to cut is if you are a die hard sports fan.)

The only point I might disagree with is #14. I get the idea that some people may overextend themselves with credit cards, but I think people should focus more on becoming disciplined vs. getting rid of credit cards as a solution. Not only to credit cards provide 1-3% back on just about everything (free money), but you also have protection that a debit card isn’t going to give you, and money can’t be “lost forever” like it can with misplaced cash.

Again, this requires discipline, and I suppose if you KNOW you won’t be disciplined, maybe it makes sense to eliminate credit cards from your purchasing options.

One possible solution to this is to see if you can keep your credit card, but have the limit lowered to something very minimal, like $500-1,000. This will allow you to have the benefits of a credit card without risking the over extension of credit.

Cheers,

Eric Gati, CPA