If you want to earn more money but don’t have much upward mobility in your career, finding part-time work can be smart and profitable. When you get a job to fill your evening or weekend hours, you can earn money in your spare time and add to your bottom line.

Unfortunately, traditional part-time jobs aren’t nearly as sexy as they sound. The problem with most part-time jobs is the level of commitment they require. If you find traditional work at a retail store or restaurant, for example, you’re expected to clock in on certain days and commit to certain working hours.

Uber – The Ultimate Side Hustle

Surge Pricing Can Add Up Quickly

Meet New People and Learn Something Every Day

How Much Do Uber Drivers Make?

What Are Some of the Pitfalls of Driving for Uber?

What Are the Insurance Considerations for Uber Drivers?

What Do You Need to Get Started?

If you have a family to support and already have a full-time job, adding yet another huge commitment is often untenable. And, let’s face it – part-time work with a traditional employer isn’t everyone’s cup of tea.

Fortunately, modern technology has made it easier for people to find part-time work that fits in with their busy lives. Websites like TaskRabbit.com, for example, connect job-seekers with individuals hiring out errands. Online hubs like Care.com, on the other hand, connect childcare providers and homeowners with would-be babysitters and house-sitters.

Then there’s Uber – the premier rideshare app that’s changing how public transportation works all over the globe. While it certainly has competitors (think: Lyft), Uber is one of the most flexible side hustles anyone can find. Keep reading to learn more about driving for Uber and how to get started.

The Popularity of Uber

As of September 2016, Uber had more than 8 million users worldwide. Approximately 160,000 people were active drivers for Uber as of early last year, and more than 2 billion Uber rides have taken place thus far. Uber is also active in more than 400 cities worldwide, although other cities and geographic regions are ripe for a mix-up in their local transportation scene, too.

All in all, Uber has dominated this industry and continues to grow in terms of reach and popularity. Why? Mostly because it’s so darn convenient for consumers.

Where our parents grew up hailing cabs and waiting impatiently on sidewalks, the younger generation will age knowing they can summon a car with a few clicks on a smartphone app. While this is bad news for the traditional taxi industry, this is excellent news for both side hustlers and consumers.

Why?

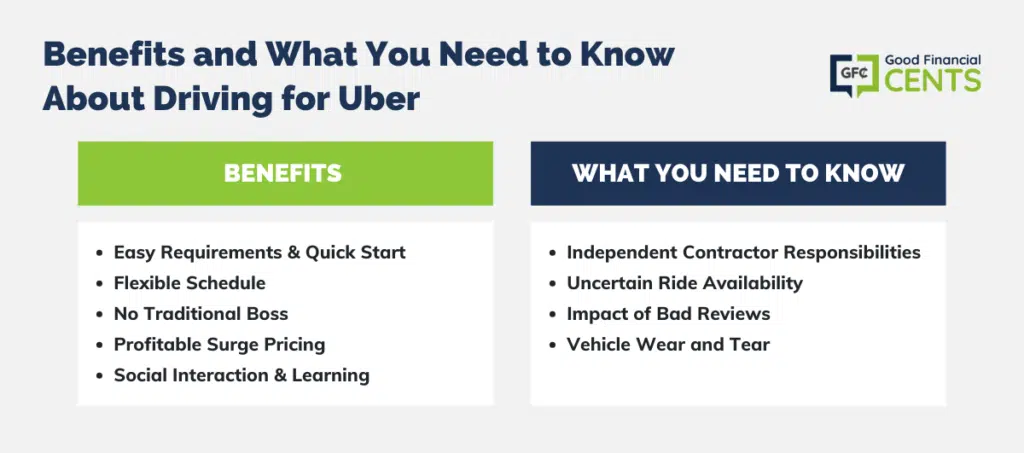

Benefits of Driving for Uber

Where a traditional job might limit your hours and pay substantially, driving for Uber makes it possible to work more if you want – and potentially earn more. Here are some of the biggest benefits you’ll get when you rideshare as a part-time gig:

Uber Requirements Are Fairly Easy to Meet, and You Can Get Started Quickly

If you have a decent car, a clean driving record, and a smartphone, chances are good you’ll get approved to drive for Uber. You must also be at least 21 years old, have at least three years of driving experience, and be able to pass a background check.

When it comes to your ride, requirements vary depending on the level of Uber service you intend to provide (UberX. Uber XL, UberSELECT, or UberBLACK). With each, however, your car must be a 2001 model or newer, and usually a 2004 or newer. In certain cities, like New York, your car model must be at least 2011 or newer. Make sure to check with Uber for model requirements in your city and state. No matter where you live, your car must have up-to-date tags and plates, with no exceptions.

If you don’t have a car that will qualify – or simply need a new one – Uber can help in that respect as well. Through relationships with Enterprise, Hertz, and Xchange Leasing (an Uber company), you can lease the car you intend to use for your Uber business. Best of all, these leasing agreements come with low deposits and flexible terms. Some (not all) also include the insurance you’ll need as a rideshare driver as part of the deal.

Create Your Own Schedule

The best part about driving for Uber is the fact you can absolutely create your own schedule. As an Uber driver, you never have to work specific days or hours. When you’re ready to work, all you have to do is turn your smartphone app on and wait for a job. And when you’re done working or need a break, you turn your app off to let the company know you’re no longer available. It’s as simple as that.

By and large, the flexibility this job offers is its biggest benefit. Imagine being able to work any hours or days of your choosing, without even having to decide ahead of time. Let’s say you’re extremely busy with kid’s activities and birthday parties one week, but have almost nothing on the schedule the following week. You could easily take a week off and then double your hours the next week.

You can also turn the app on to work for a few hours then turn it off to eat dinner with your family or pick your kids up for school. In that respect, Uber really is the perfect part-time gig. You can earn $15 – $20 per hour on average, but only work the exact hours you want.

You Don’t Have a Real Boss

Another real perk that comes with being an Uber driver is the fact you don’t really have a boss. You need to meet certain requirements to drive for sure, but you’re mostly left alone after that.

Surge Pricing Can Add Up Quickly

While Uber offers standard pricing to consumers most of the time, high-volume events create something called “surge pricing.” By picking up a few rides with surge pricing, you can earn a lot more per hour and add to your bottom line.

Surge pricing is considered somewhat elusive to some and can even be unpredictable, but it mostly occurs in areas around popular events – when people arrive or when an event ends. For example, a giant concert with 50,000 people in attendance might trigger surge pricing as hundreds of people pour out of the venue and call for an Uber car. If you position yourself to pick up riders during and after these events, you can earn a lot more money over time.

You Meet New People and Learn Something Every Day

Imagine working part-time at Walmart or a local restaurant. You drive there every day, clock in, and schlep away at your work until it’s finally time to go home. You might meet interesting people at times, but you’re stuck indoors with the same scenery day after day. Over time, this kind of scenario can get rather old – especially when you’re working part-time in addition to a regular 9-5 job.

As an Uber driver, on the other hand, you get to meet new people and see interesting landscapes every day. Your first ride in the morning might take you into a brand new neighborhood you didn’t even know about, or introduce you to an area of your city you didn’t know existed. Plus, you’ll meet plenty of interesting characters and hear plenty of fun stories as you drive total strangers around. It’s inevitable.

What You Need to Know About Driving for Uber

While driving for Uber is a solid gig you can count on, there are a handful of downsides and specific details you should know about before you sign up. Like any other job, driving for Uber isn’t perfect. Here’s why:

As an Independent Contractor, You are Responsible for Taxes, Collecting Receipts, Tracking Mileage, and Insuring Your Vehicle.

No matter how awesome driving for Uber might seem, there are notable downsides that come with working as an independent contractor. For starters, you’re solely responsible for your tax bill, including paying quarterly tax payments if applicable. Second, it’s your job to track the mileage on your vehicle and collect receipts for gas and vehicle upkeep. Last but not least, you’re required to purchase and maintain an adequate level of automobile insurance as required by your state.

Rides Are Never Guaranteed

Having the ability to work flexible hours is a huge benefit when you become an Uber driver, but that doesn’t mean your ideal work hours will always be flush with riders. While it may not happen all the time, there might be times when you’re ready to work but don’t have anyone to drive around. And when you’re not driving, you’re not earning money.

Bad Reviews From Riders Can Lead to Termination

While driving for Uber lets you earn money without having a real boss, employment does hinge on your ability to get positive reviews from riders. If you get enough negative reviews – or your rating falls below 4 stars – that can be cause for termination in some cases.

Vehicle Wear and Tear Can Be Significant if You Drive a Lot

In addition to paying for gas, upkeep, and insurance, Uber drivers will also experience significant wear and tear on their cars. This wear and tear is the common result of adding additional mileage to a vehicle over time. Add to that a general increase in the cost of maintaining a vehicle due to a greater need for oil changes and tune-ups.

The Bottom Line

Unlike other jobs which require you to commit to certain working hours or days, Uber is extremely flexible. You can even try it out for a few weeks to see if you like it, then switch to something else if you change your mind. You have nothing to lose, and a whole lot of money to gain.

If you’re interested in driving for Uber, you can sign up to get started here.

Driving For Uber: Expert Interview with Harry Campbell of TheRideShareGuy.com

Interested in learning more? To get the inside scoop, we interviewed Harry Campbell from TheRideShareGuy. As the premier expert on all things Uber, Harry offers a treasure trove of information for anyone considering driving for Uber.

Question 1: How much do Uber drivers really make these days?

A. There’s a lot of variability but most Uber drivers make around $15-$20/hr. I like to target the most profitable times and places to drive though so my earnings are usually higher. You can make a lot more by driving on Friday/Saturday nights and during big holidays like Halloween and New Year’s Eve.

Question 2: What are some of the common misconceptions about Uber drivers, how they earn money, and how much they make?

A. Uber drivers might average around $15-$20/hr but they’re also responsible for all of their expenses, so that includes gas, maintenance, and even taxes.

Question 3: What are some of the pitfalls of driving for Uber?

A lot of drivers get into this business looking to make a few hundred dollars a week but they actually have all the same reporting requirements of a small business. Since drivers are independent contractors, they have to worry about things like tracking their mileage, rideshare insurance, and taxes. Fortunately, there are lots of companies looking to help drivers with things like free mileage tracking.

Question 4: What are some of the biggest benefits of driving for Uber?

A. I like to tell people Uber is probably the most flexible job in the world. You can literally log on and off of the app whenever you want. Once you’re online you can do as many or as few rides as you want. I can’t think of a single other job in the world that provides that much flexibility. Whenever drivers are polled, flexibility is one of the top reasons why people say they work for Uber.

Question 5: Can an Uber driver also drive for Lyft?

A. Since drivers are independent contractors, you can (and should) drive for both Uber and Lyft. Many savvy drivers sign up for both services to take advantage of the sign-up bonuses but also to diversify their income.

Question 6: What are the insurance considerations for Uber drivers?

A. Personal auto insurers will not cover drivers if you’re using your car on Uber or Lyft. Fortunately, there are more and more ‘rideshare insurance’ options coming out every day. These policies only cost a little bit more but provide full coverage whenever Uber isn’t covering you.

Question 7: What advice would you give someone looking into driving for Uber?

A. The nice thing about driving for Uber is that it’s easy to get started. The Uber driver requirements are pretty simple and as long as you can pass a background check, and have a smartphone and a car, you should be good to go!

Question 8: What does someone who wants to drive for Uber need to get started?

A. You really just need a car and a smartphone. You can sign up for Uber online and have your background check going in short order. But even if you don’t have a car, Uber is now offering rideshare leasing options and rentals that are very flexible and come with unlimited mileage.

Have you ever considered driving for Uber? Why or why not?

Very Good

Am very interested, how can earn extra money ,apart from my normal driving pay job.

Hi Martino – Try one of these.

I am very interested in doing this type of driving job however my fear is what if I have a crazy person like a killer in my car… what then? Does Uber have those strong plastic dividers which separate the passenger and driver? Thanks for any response you can provide.

Hi Virginia – I can’t say if they do or they don’t. But given that driving for Uber is a subcontracting arrangement, my guess is that you’d have to buy that on your own. It’s worth looking into with Uber though. They may have some reimbursement, or even an alternative that could work even better.

without an extensive knowledge of the local area, some gps device would appear to be essential. how often can you rely on a customer to know the route to his destination. What if the customer is drunk and belligerent an refuses to pay? .

Hi Bill – First, you shouldn’t be picking up drunk and belligerent passengers. As far as refusing to pay, they have to pay when they order the ride, so there’s no way for them to not pay. But as to them knowing how to get to their destination, they often won’t, and that’s why you need the GPS at all times.

I had no clue about the leasing options with certain companies if you wanted to drive with Uber. That’s some super valuable perks they’re providing there – ones that you wouldn’t think about first hand when thinking of this as a side hustle.

I can’t believe how popular Uber has become. Alot of college people stand by it, you hear it in plenty of songs and it has literally became a household name

We probably all know people who drive for Uber, which makes it easier to decide if it’s the right thing to do.

It is important to consider not just the positives of a prospective job but also the negatives! Thanks for informing everyone, this was a great article to read!

Very informative post. I may consider this since I have some downtime here and there in the evenings.