Thinking about converting your retirement account to a Roth IRA? It’s easy to see why the Roth IRA is so incredibly popular.

Contributions to a Roth IRA are made with income that has already been taxed, meaning there’s no initial tax benefit, but the money you have in a Roth grows tax-free over time.

Roth IRAs don’t come with Required Minimum Distributions (RMDs) at age 73 like a traditional IRA either, so you can continue letting your money grow until you’re ready to access it.

When you do decide to take distributions from a Roth IRA, you won’t have to pay income taxes on that money. You already paid income taxes before you contributed, remember?

These are the main benefits of a Roth IRA that set this account apart from a traditional IRA, but there are plenty of others. With all of this in mind, it’s no wonder so many people try to convert their traditional IRA into a Roth IRA at some point during their lives.

But, is a Roth IRA conversion really a good idea? This kind of conversion can certainly be lucrative over time, but you should definitely weigh all the pros and cons before you decide.

Table of Contents

- When Would You Want to Convert to a Roth IRA?

- When Would You Not Want to Convert to a Roth IRA?

- Roth IRA Conversion Rules You Need to Know

- What Is the Backdoor Roth IRA and How Does It Work?

- Modeling IRAs in Your Own Plan

- The Deadline to Convert a Roth IRA

- Steps to Convert an IRA to a Roth IRA

- Converting IRA or 401k to Roth IRA After Age 60

- Roth IRA Conversion Examples

- Summary of Converting a Roth IRA

- FAQs on Roth IRA Conversions

When Would You Want to Convert to a Roth IRA?

Converting an existing traditional IRA or another retirement account to a Roth IRA can make sense in many different situations, but not all the time. At the end of the day, the value of this investing strategy depends on your unique situation, your income, your tax bracket, and the financial goal you’re trying to accomplish in the first place.

The most important detail to understand is that, when you convert another retirement account to a Roth IRA, you will have to pay income taxes on the converted amounts.

It can make sense to pay these taxes now to avoid more taxes later on, but that depends a lot on your tax situation now and what your tax situation may be like later in life.

The main scenarios where converting to a Roth IRA can make sense include:

- You will likely be in a higher tax bracket than you are now. If you are finding yourself in an especially low tax bracket this year or simply expect to be in a much higher tax bracket in retirement, then converting a traditional IRA to a Roth IRA can make sense. By paying taxes on the converted funds now — while you’re in a lower tax bracket — you can avoid having to pay income taxes at a higher tax rate once you reach retirement and begin taking distributions from your Roth IRA. (Not sure about your future tax brackets? Use the NewRetirement Planner to approximate your future taxable income, rates, expenses, and more. This comprehensive tool puts the power of planning in your own hands.)

Lifetime tax prior to performing Roth conversions

- You have financial losses that can offset tax liability from the conversion. Converting another retirement account into a Roth IRA will require you to pay income taxes on the converted amounts. With that in mind, it can make sense to work on a Roth IRA conversion in a year when you have specific losses that can be used to offset your new tax liability.

- You don’t want to begin taking distributions at age 73. If you don’t want to be forced to take RMDs from your account at age 73, converting to a Roth IRA can also make sense. This type of account doesn’t require RMDs at any age. (You can use the NewRetirement Planner to help you assess your income needs. See your taxable income for every future year and assess whether you need the income to cover expenses.)

- You’re moving to a state with higher income taxes. Imagine for a moment you’re gearing up to move from Tennessee — a state with no income taxes — to California — a state with income taxes as high as 12.3% In that case, it could make sense to convert other retirement accounts to a Roth IRA before you make the move and begin taking distributions.

- You want to leave a tax-free inheritance to your heirs. If you have extra retirement funds and worry about your heirs facing tax liability on an inheritance, converting to a Roth IRA can make sense. According to Vanguard, “The people who inherit your Roth IRA will have to take annual RMDs, but they won’t have to pay any federal income tax on their withdrawals as long as the account’s been open for at least 5 years.”

These are just some of the instances where it can make sense to convert another retirement account into a Roth IRA, but there may be others. Also note that, before you do anything drastic or begin a conversion, it can be smart to speak with a tax advisor or financial planner with tax expertise.

At the very least, be sure to model the conversion as part of a comprehensive written retirement plan. The NewRetirement Planner enables you to try out specific conversion strategies in the context of your entire financial situation. Assess the conversion on your tax liability, net worth at longevity, and cash flow.

When Would You Not Want to Convert to a Roth IRA?

Considering a Roth IRA conversion comes with immediate tax consequences, there are plenty of scenarios where doing one doesn’t make any sense.

There are also plenty of personal situations where a Roth IRA conversion would likely go against a person’s long-term goals. Here are some of the scenarios where a Roth IRA conversion could be a costly waste of time:

- You’re going to have an extremely low income in retirement. If you have reason to believe you’ll be in a much lower income tax bracket in retirement, then a Roth IRA conversion may not leave you better off. By not converting another retirement account to a Roth IRA, you can avoid paying taxes now at a higher rate for the conversion, and instead pay income taxes on your distributions at a lower rate in retirement.

- You don’t have extra money for the conversion. Because converting another retirement account to a Roth IRA requires you to pay income taxes on those converted funds now, this move is a poor choice in years when you are short on extra money lying around to pay more taxes.

- You may need the money sooner rather than later. Withdrawals on money that was part of a Roth IRA conversion are subject to a five-year holding period. This means you would have to pay a penalty on that money if you chose to take distributions within a five-year period after the conversion.

Again, these are just some of the scenarios where you would want to think long and hard before converting another retirement account to a Roth IRA. There are plenty of other situations where this move wouldn’t make any sense, and you should speak with a tax professional before you move forward either way.

Or, make sure you fully understand your projected income, expenses, and savings situation before doing a conversion. The NewRetirement Planner gives you a detailed insight into all aspects of your financial future.

Roth IRA Conversion Rules You Need to Know

Though there are income limits that apply to contributing to a Roth IRA, these income limits do not apply to Roth IRA conversions. With that in mind, here are some important Roth IRA conversion rules you need to learn and understand:

Which Accounts Can You Convert?

While the most common Roth IRA conversion is one from a traditional IRA, you can convert other accounts to a Roth IRA. Any funds in a QRP that are eligible to be rolled over can be converted to a Roth IRA.

60-Day Rollover Rule

You can take direct delivery of the funds from your traditional IRA (check made payable to you personally), and then roll them over into a Roth IRA account, but you must do so within 60 days of the distribution. If you don’t, the amount of the distribution (less non-deductible contributions) will be taxable in the year received, the conversion will not take place, and the IRS 10% early distribution tax penalty will apply.

Trustee-to-Trustee Transfer Rule

This is not only the easiest way to work the transfer but it also virtually eliminates the possibility that the funds from your traditional IRA account will become taxable. You simply tell your traditional IRA trustee to direct the money to the trustee of your Roth IRA account, and the whole transaction should proceed smoothly.

Same Trustee Transfer

This is even easier than a trustee-to-trustee transfer because the money stays within the same institution. You simply set up a Roth IRA account with the trustee who is holding your traditional IRA, and direct them to move the money from the traditional IRA into your Roth IRA account.

Additional Details to Be Aware Of

Note that, if you don’t follow the rules outlined above and your money doesn’t get deposited into a Roth IRA account within 60 days, you could be subject to a 10% penalty on early distributions as well as income taxes on the converted amounts if you’re under the age of 59 ½.

And, as we already mentioned, you’ll have to pay income taxes on converted amounts regardless of which rule you choose to follow above. You’ll report the conversion to the IRA on Form 8606 when you file your income taxes for the year of the conversion.

What Is the Backdoor Roth IRA and How Does It Work?

If your income is too high to contribute to a Roth IRA outright, the Backdoor Roth IRA offers a potential workaround. This strategy has consumers invest in a traditional IRA first since these accounts don’t come with income limitations in terms of who can contribute. From there, a Roth IRA conversion takes place, letting those high-income investors take advantage of tax-free growth and future distributions without having to pay income taxes later on.

A Backdoor Roth IRA can make sense in the same scenarios any Roth IRA conversion makes sense. This type of investment strategy intends to help you save money on taxes later at the cost of higher taxes now, in the year you make the conversion.

The big disadvantage of a Backdoor Roth IRA is a whopping tax bill, you’re hoping to lower your tax liability in the future. That’s a noble goal but, once again, the Backdoor Roth IRA only makes sense in situations where tax savings can truly be realized.

Modeling IRAs in Your Own Plan

Interested in a Roth IRA, but aren’t sure if it is right for you? Try modeling it in your own plan.

The NewRetirement Planner is the most powerful and comprehensive modeling tool available online. It’s for people who want clarity about their choices today and their financial security tomorrow. It gives people the ability to discover, design, and manage personalized paths to a secure future. Helping you make smart decisions about your money, including whether or not you should do a Roth conversion, is the heart of the tool.

You have two options for how to model conversions in the NewRetirement Planner:

Model Individual Conversions

Once you have set up all aspects of your plan (a really thorough inventory of your current and future income, expenses, and savings), you can try modeling a specific conversion that you think would be advantageous.

- In Money Flows, you can specify the account from which the money will be withdrawn, the amount you wish to convert, the age when you want to do the conversion, and your projected rate of return on the converted money.

- Once saved, you can immediately see if the conversion resulted in a change to your out-of-savings age, estate value, or lifetime tax liability.

- And, you can review charts to assess your tax liability in the year you do the conversion, the impact on income from RMDs, and more.

Lifetime tax after performing Roth conversions

Use the Roth Conversion Explorer

The Roth Conversion Explorer is a modeling tool within the NewRetirement Planner.

If you are not sure when or if you should do a Roth conversion, you might start with this tool. It will analyze all aspects of your plan, running hundreds of scenarios, to generate a conversion strategy that could increase your estate value at your longevity.

The Deadline to Convert a Roth IRA

The deadline for converting funds from a traditional IRA to a Roth IRA is the tax-filing deadline for the year in which the conversion is made. This is typically April 15th of the following year. This means that if you make a conversion in 2022, the deadline for reporting the conversion on your tax return would be April 15, 2023.

As I mentioned earlier, it’s also important to note that there is a deadline for recharacterizing a Roth conversion, which is October 15th of the year following the conversion. This means that if you converted a traditional IRA to a Roth IRA in 2022, you would have until October 15th, 2023 to undo the conversion by recharacterizing it back to a traditional IRA.

Steps to Convert an IRA to a Roth IRA

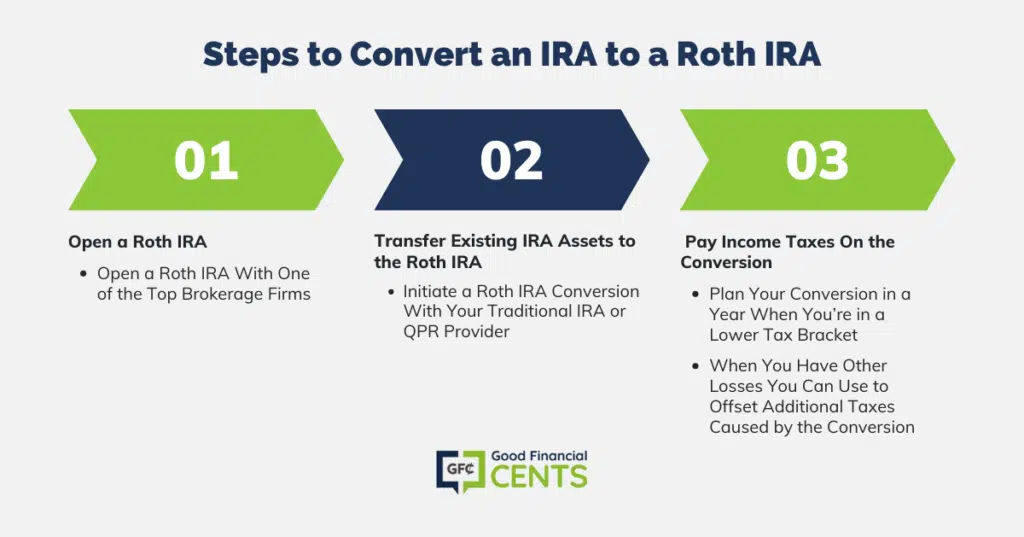

If you think a Roth IRA conversion would be a good move on your part, here are the steps you’ll want to take.

1. Open a Roth IRA

First, make sure you open a Roth IRA with one of the top brokerage firms. We think TD Ameritrade is one of the best Roth IRA providers out there due to the fact you pay $0 per trade and $0 per year. However, you should also check out top Roth IRA providers like Betterment, Ally, M1 Finance, and Vanguard.

2. Transfer Existing IRA Assets to the Roth IRA

Next, you’ll want to initiate a Roth IRA conversion with your traditional IRA or QPR provider. Remember that, if you choose to accept the funds with a check, you have 60 days to move the money into your Roth IRA account. You can also have the funds moved via a trustee-to-trustee transfer or even using the same brokerage account, and this is often easier since the move should theoretically be taken care of on your behalf.

3. Pay Income Taxes On the Conversion

The major downside of a Roth conversion is that you will be paying taxes on the amount converted in the current year, and depending on your income tax bracket and the amount you’re converting, the tax bite could be substantial. With that being said, you will hopefully plan your conversion in a year when you’re in a lower tax bracket, or when you have other losses you can use to offset additional taxes caused by the conversion.

Converting IRA or 401k to Roth IRA After Age 60

Converting an IRA to a Roth after age 60 is possible, but it must be done properly in order to avoid tax penalties. The first step is to consult with a tax professional or financial advisor who can help you determine if this conversion makes sense for your specific situation.

Once the decision has been made to proceed, you will need to complete paperwork with your IRA custodian that requests the transfer of funds from your traditional IRA account into your Roth IRA account.

Depending on your age and other factors, you may also need to pay taxes on some or all of the money transferred from the traditional IRA. When the conversion is complete, you’ll have access to tax-free withdrawals from your Roth account once you reach the age of 59 1/2 and have held the account for at least five years.

Roth IRA Conversion Examples

Whenever you’re dealing with numbers, it’s always helpful to demonstrate the concept with examples. Here are two real-life examples that I hope will illustrate how the Roth IRA conversion works in the real world.

Example 1

Parker has a SEP IRA, a Traditional IRA, and a Roth IRA totaling $310,000. Let’s break down the pre-and post-tax contributions of each:

- SEP IRA: Consists entirely of pre-tax contributions. The total value is $80,000 with pre-tax contributions of $12,000.

- Traditional IRA: Consists entirely of after-tax contributions. The total value is $200,000 with after-tax contributions of $40,000.

- Roth IRA: Obviously all after-tax contributions. The total value is $30,000 with total contributions of $7,000.

Parker is wanting to only convert half of the amount in his SEP and Traditional IRA to the Roth IRA. What amount will be added to his taxable income in 2023?

Here’s where the IRS pro-rata rule applies. Based on the numbers above, we have $40,000 in total after-tax contributions to non-Roth IRA. The total non-Roth IRA balance is $280,000. The total amount that is desired to be converted is $140,000.

The amount of the conversion that won’t be subject to income tax is 14.29%; the rest will be. Here’s how that is calculated:

Step 1: Calculate the non-taxable portion of total Non-Roth IRA’s: Total after-tax contributions / Total Non-Roth IRA Balance = Non-Taxable %:

$40,000 / $280,000 = 14.29%

Step 2: Calculate the non-taxable amount by converting the result to Step 1 into dollars:

14.29% x $140,000 = $20,000

Step 3: Calculate the amount that will be added to your taxable income:

$140,000 – $20,000 = $120,000

In this scenario, Parker will owe an ordinary income tax of $120,000. If he is in the 22% income tax bracket, he will owe $26,400 in income taxes or $120,000 x .22.

Example 2

Bentley is over the age of 50 and in the process of changing jobs. Because his employer had been bought out a few times, he has rolled over his previous 401k into two different IRAs.

One IRA totals $115,000 and the other consists of $225,000. Since he’s never had a Roth IRA, he’s considering contributing to a nondeductible IRA for a total of $7,000 and then immediately converting in 2023.

- Rollover IRAs: Consists entirely of pre-tax contributions. Total value is $340,000 with pre-tax contributions of $150,000.

- Old 401k: Also consists entirely of pre-tax contributions. Total value is $140,000 with $80,000 pre-tax contributions.

- Current 401k: Plans out maxing it out for the rest of his working years.

- Non-deductible IRA: Consists entirely of after-tax contributions. The total value will be $7,000 of after-tax contributions and we will assume no growth.

Based on the above information, what will be Bentley’s tax consequence in 2023?

Did you notice the curveball I threw in there? Sorry – I didn’t mean to trick anybody – I just wanted to see if you caught it. When it comes to converting, old 401(k)s and current 401(k)s do not factor into the equation. Remember this if you are planning on converting large IRA balances and have an old 401(k). By leaving it in the 401(k), it will minimize your tax burden.

Using the steps from above, let’s see what Bentley’s taxable consequence will be in 2023:

- Step 1: $7,000/ $346,000 = 2.02%

- Step 2: 2.02 X $7,000 = $141

- Step 3: $7,000 – $141 = $6,859

For 2023, Bentley will have a taxable income of $6,859 of his $7,000 Traditional IRA contribution/Roth IRA conversion, and that’s assuming no investment earnings. As you can see, you have to be careful when initiating the conversion.

If Bentley had gone through with this conversion and didn’t realize the tax liability, he would need to check out the rules on recharacterizing his Roth IRA to get out of those taxes.

Examples are useful, but what is right for you?

Using these examples, it is time to try modeling Roth conversion as part of your own financial future. The NewRetirement Planner enables you to run different scenarios and see the impact on your finances.

Summary of Converting a Roth IRA

If you meet certain criteria and don’t mind facing a larger-than-average tax bill during the conversion year, a Roth IRA conversion could absolutely make sense.

However, you should absolutely weigh the pros and cons of this move before you pull the trigger, and you should definitely set aside the time to speak with a professional who can help you walk through the tax implications.

A Roth IRA conversion can help you avoid taxes later in life when you would really benefit from some tax-free income but don’t jump in blindly. Research everything you can about Roth IRA conversions and alternative ways to save more for retirement, and make sure any decision you make is an informed one.

FAQs on Roth IRA Conversions

The main benefit of converting to a Roth IRA is that the funds in the account can grow tax-free and qualified withdrawals will also be tax-free. Additionally, there are no required minimum distributions for a Roth IRA, which can provide more flexibility in retirement planning.

There are no age restrictions on converting to a Roth IRA, however, the taxes will be due on the conversion

There is no limit to how much you can convert to a Roth IRA, however, you will have to pay income tax on the money you convert.

If you are under 59 1/2 years old and withdraw money from a traditional IRA prior to retirement, you will be charged a 10% penalty. Converting to a Roth IRA does not trigger the penalty.

Yes, you can convert your 401(k) to a Roth IRA, but you’ll have to pay taxes on the amount you convert and certain steps need to be followed.

There is no specific deadline for converting funds from a traditional IRA to a Roth IRA, you can do it at any time. However, you need to report the conversion on your tax return for the year in which you made the conversion. Keep in mind, that regardless of when the conversion is done, the taxes on the conversion will be due for that year.

Enjoyed reading your article. But, felt that you didn’t address the limbo that we are in 2022. If I take a hypothetical example of Traditional IRA having say a$1 million, for a high income person, say making 500k/year, just to get him classified as high income under proposed BBB. If he has after tax contributions of say $200k and the rest is deferred earnings. If he converts the entire Tradfitional IRA to ROTH in 2022, what happens? Will he have an addition to his income of $800k with $200k non-taxable going to ROTH? Isn’t the BBB prohibiting the conversion of the after tax money in Traditional IRA to Roth? If that happens and they make it retroactive to January 1, 2022 as rumored, will he then have to just withdraw before April 15, 2023 the $200k after tax and pay 10% penalty if under 59.5 age and no penalty if over 60 years age? In that case he will lose the tax deferral on future earnings had he left that money in traditional IRA, right? Is there a way for him to avoid that by reversing the $200k roth conversion? Is that allowed? It would be nice if you can cover thse issues for people that want to do the conversion in 2022. I will appreciate it if you directly reply to me by email as well. Thanks.

I have Self Directed Traditional and ROTH Accounts at an SDIRA Custodian. Can I do a ROTH conversion of an Illiquid Asset from the Traditional to ROTH account? The investment I want to convert is a Debt only asset (no Equity component) generating a fixed 8% dividend. It has a fixed FMV from year to year. I know I will pay Tax on the conversion. I am 75 retired.

In your article, you include the following quote from a Vanguard advisor giving advice on inherited IRAs. “According to Vanguard, ‘the people who inherit your Roth IRA will have to take annual RMDs, but they won’t have to pay any federal income tax on their withdrawals as long as the account’s been open for at least 5 years.’”

This quote is out of date in light of the SECURE Act. Except for a limited class of beneficiaries (spouses, disabled, etc.), there are no RMDs for inherited IRAs and all inherited IRAs must be fully distributed within 10 years.

I respectfully suggest that you update your article to account for the SECURE Act.

Jeff… one of the best articles on the subject!

In Jan 2020 I rolled over from my workplace 401K Fidelity Pre-87 and Post-86 the funds to a Fidelity Rollover IRA (pre-tax) and Roth IRA (after-tax), respectively. I also have a non-deductible Traditional IRA with T Rowe Price (TRP) which I would like to convert in its entirety to T Rowe Price Roth IRA. However with the pro-rata rule, my taxable income on the conversion amount would be much higher; if I didn’t have the Fidelity Rollover Account. So my questions relate to allowed workarounds to avoid the pro-rata rule. Possible workaround actions::

1) My workplace 401K does allow for a reverse roll over of my Rollover IRA and Roth IRA. So I can undo what was done in Jan 2020, and then go ahead with the TRP Roth conversion in this year. After the conversion, am I correct that then I can not go ahead and re initiate my previous 401K rollovers in 2020, as the pro-rata rules are calculated on the “end of year” values of all my (non Roth) IRA accounts. I believe I would have to wait until Yr 2021 for the workplace rollover; to avoid the pro-rata rule applying again?

2) If I don’t perform a reverse roll over, but go ahead with the non-deductible Traditional IRA to Roth IRA full conversion (or full distribution) of the fund (earning and after tax contribution). And pay the tax on the tax income. Since at the end of the Yr 2020, I would have a zero balance in my TRP Traditional IRA account and only the Fidelity Rollover IRA. I am correct that since the pro -rata rule applies to the “end of year” values of all my (non Roth) IRA accounts, and since I only will the Fidelity Rollover IRA with value; the the pro-rata rule would not apply.

Appreciate your help with my understanding of the application of the pro-rata rules and potential workarounds.

Shouldn’t this example you provide read “Consists entirely of PRE-tax contributions.” ?? Why are there $40K in “after-tax contributions” in a Traditional (vs ROTH) IRA?

“Traditional IRA: Consists entirely of after-tax contributions. Total value is $200,000 with after-tax contributions of $40,000.”

The case I can think of that he wasnt eligible for a pre-tax IRA contribution and it was before Roth so made a post tax contribution.

The other scenario is if this a work place 401k with mixed Roth and IRA money you could end up in that situation

Hi Jeff,

My husband and I need some advice on a Roth conversion. We need to know how much and when to convert the IRA’s to Roth’s. Perhaps more importantly we need to know if we should do it. We are thinking we should. So my question is who do we go to. We do our taxes on Turbo Tax, and haven’t had a tax accountant for several years. Also about how much should we expect to pay for the service.

Thanks for any advice you can offer. Love your website!

Linda

My husband is 70 years old, career military retiree, and retired from civilian job six years ago.

He has a 250k IRA and received first RMD $8549.

Is opening a Roth IRA an option for investing this RMD?

From what I have gathered, conversion of his current IRA. would eat up a third of the 250k. We have MM Accounts but I have no IRA. So we have to be cautious.

Hi Jeff,

I have been trying to find some info about the simplest way to convert a traditional IRA to a Roth for tax purposes. Our MAGI is above the income limits to contribute directly to a Roth and also above the limits for any tax benefits for a traditional. My plan this tax year is to save up my IRA money in a separate savings account until I have the $6000 and then deposit it all into the Traditional at once, wait till it clears, and then convert all the cash into my Roth. Last year I had complications trying to figure out wha my basis was regarding the conversion, as some of it was in mutual funds. Thanks for your advice.

~Jessi

I started to have IRA monies converted to a Roth IRA in 2018. But I was living in Arizona for the first 8 months then moved to Nevada the last 4 months. For state income tax filing, do I report zero to Arizona or do I report 2/3 of the conversion amount to Arizona? I know the full conversion amount is taxable to my Federal return. I have to file with California already because my old employer decided to pay me severance pay in 2018 even though I had not worked in California since 2017, i assume that should not complicate matters, i assume that zero of my conversion should be reported to California. Thanks.

Hi Jeff,

Thanks for the informative article.

I have a question for you. My old 401k has 120k and about 16k of that in Roth 401k.

I am 50 and not working this year, do you recommend converting that amount into a Roth account at my old 401k if they allow it(or roll it over elsewhere). If yes,then how much should I convert in order to minimize tax that I would need to pay from my savings. I don’t expect to make more than 10k this year if at all.

Thanks a bunch,

Pete

Hi Pete – Since you’re unemployed and have a very low income, this would certainly be the time to do a Roth IRA conversion. But there’s no way I can tell you online how much you should allocate to the conversion, or if you should even do it at all. I recommend sitting down with a tax preparer and coming up with the best number. There’s a lot involved, and the tax liability can be large. It may come down to how much you can afford to pay, especially since the tax will need to be paid outside the converted balance.

Can I contribute the maximum to a Roth IRA and do a conversion from a Traditional IRA to a Roth IRA in the same tax year?

Hi Lafille – You can. The conversion from the traditional IRA to the Roth is a separate event.

It triply makes sense for me to convert some of my Traditional IRA to ROTH because:

1) my income was relatively lower this year,

2) I have a basis, so some of the conversion is non-taxable, and

3) my account value is at a relative low.

I understand the pro-rata rule and how to calculate the non-taxable portion of an IRA conversion, but what date is used for calculating the value of my Traditional IRA? Is it based upon the date the conversion was made, or some other date, such as beginning of year or end of year?

Thank you,

Peter H.

Hi Peter – Should be as of the date of the conversion. That determines the amount converted, not the amount at the beginning of the year, or as of some other date.

I am retired. I converted an IRA to a Roth IRA and paid taxes last year on the amount of the converstion. However, now I am trying to calculate my MAGI for 2019, based on last year’s 2017 tax return. I have been reading that for purposes of calculating the 2019 MAGI, I can subsract from my AGI the amount of the Roth conversion. Where in the IRS Code or Publications can I find this provision? There is a disagreement in the online websites about whether the Roth conversion amount can be substracted from the AGI in computing the MAGI. Help! Thanks.

You’re right Linda, I looked on the IRS website and saw nothing conclusive on that. I recommend asking a CPA.

Can conversions taken out after 5 years be taxed if only the converted amount is taken?

Hi Karen – If I’m understanding your question correctly, yes, you should be able to withdraw the converted amount, since you’ll have paid taxes on that amount at the time of conversion.

Can I move money from my traditional IRA to my wife’s Roth IRA without getting a 10% penalty? I know I will have to pay the taxes but will there be the other 10% penalty because I didn’t put that money in an retirement account in my name before 60 days or does her roth ira count to not get penalized.

Hi Chad – You can’t. A retirement plan is yours only. Even if you’re married filing jointly, you and your wife have totally separate accounts.

I have been retired for many years, I have two traditional IRAs. Can I roll over one of the IRAs to a Roth? I know the tax is paid first. If this is possible, are the funds kept in an account and paid out as requested or can they remain & accrue interest until the funds are needed?

Hi Roselyn – You should be able to do the rollover/conversion from one IRA to a Roth IRA. And yes, you will have the choice to then either set up distributions, or to leave the money in the account to grow.

The following statement in this article is incorrect

Can I really take my money out of my Roth IRA at any time?

Because of the way Roth IRAs were set up and the fact that are contributed to with after-tax dollars, you can take your contributions out of your account at any time without penalty. However, the same cannot be said about your earnings. The amount of money you can take out without penalty is limited to the contributions you have made.

What part of the answer do you believe is wrong Alexander?

Hi,

Great article. Question about timing of rolling a simple IRA to a 401K and then being able to do a Roth IRA conversion (from traditional, after tax contribution). Is there a restriction on when you can do the Roth Conversion once the Simple has been rolled into the 401k? Will there be tax implications if both happen in the same tax year? Same fiscal year?

Thank you,

Patrick

Hi Patrick – There shouldn’t be. The rollover of the Simple IRA to the 401k is non-taxable, and you can do the Roth conversion at any time.

I currently have about 90k in a Roth IRA and 90k in a SEP. The sep balance is a this year’s contribution 50k and a 401k rollover. No profit has been made by the SEP. I hope to maintain at least 360k/year of income by accumulating rentals. Assuming the income scenario works out as planned I don’t see any advantage to keeping the money in the SEP. I think it makes sense to convert the SEP to a ROTH and pay the additional 30k of taxes. Do you see any red flags? Am I missing something?

Hi Brian – Nope. In fact it’s a great strategy. If you’ll have $360k in income in retirement from the rentals you’ll need a source of tax-free income the Roth will provide. But if you’re worried about land mines discuss it with a CPA. A $30k tax liability warrants a consultation fee of a couple hundred dollars.

Thank you very much for the article. I have a situation just like the one in your Example 1. I have 2 questions: 1) If I just convert my SEP IRA rollover account into the Roth IRA (i.e. close the account and move all of the money into my Roth IRA account), will the pro-rata rule still apply? 2) If I close my Traditional IRA account and convert it into the Roth IRA, I understand I have to pay some tax on the portion of after-tax contributions I made according to the pro-rata rule. But does this mean when I withdraw fund from my SEP IRA account in the future, some portion of the fund in it is tax free (tax paid)? Thanks.

Hi Dover – The pro-rata rules will apply to the SEP because it’s still an IRA. But I’m confused on your last comment. If you’re closing out your SEP and converting it to a Roth IRA, what will be left to withdraw from the SEP?

I file taxes as unmarried with no dependents. This year I am a full time employee. In 2 years I will be a full time student and will be in a much lower tax bracket.

I want to open a traditional IRA now and an account with my company’s 401K plan and receive the benefits this gives me this year. Then, in two years, once my tax bracket is lower, I would like to transfer these funds to a Roth IRA and pay the taxes due at the time of the conversion at the lower tax bracket.

Because my traditional IRA account will have been opened for 2 years, will I have to pay a 10% penalty, or only the taxes due? Is the total amount I transfer in 2 years to the Roth IRA subject to the $5,500 limit?

thanks,

Mia

Hi Mia – You’ll only have to pay the tax due on the converted balance based on your income in the year of conversion. There will be no penalty. Also, there is no dollar limit on the amount of the conversion. Good strategy you’re working out!

I am 65 years old. I rolled over 250K out of my company 401K to a Bank CD.

Can I convert this money to a Roth? If so can I use part of the money to pay the taxes owed when I convert? I still don’t understand how the tax amount owed are calculated.

Hi Ella – You can if the CDs are part of a rollover IRA account. If they were, the bank should be able to help you with the Roth conversion, including calculation of the tax you’ll owe for doing so.

Hey Jeff,

Just seeing this video for the first time today. Awesome video!

I had a question for you though. My gross income this year in 2018 will likely be over the $135,000 limit on account on selling an investment property which will net me over $60,000. I’m considering rolling over a previous employers’ 401K comprised of approximately $20,000. I would roll this over to a traditional ira and then immediacy you convert it to the Roth.

I am all for diversification though so my question is am I better off continuing to build this traditional Ira and then convert periodically once or twice per year or should I not bother with the Roth at all and just go with the traditional Ira? Or should I have the Roth, the traditional and possibly even dabble with some index funds as well? I understand the tax benefits of the Roth but I’m just wondering what would be be benefits of all strategies?

Hi Kevin – I’m not going to make investment recommendations, since I don’t know you. But as to the Roth conversion, you might want to hold off doing that this year. The property sale pushes you into a higher tax bracket, and that will raise the tax cost of the Roth conversion. Better to do it next year, or spread it out over future years. For most, a Roth conversion will be a smart strategy, but you’ll have to crunch the numbers to make sure it’s right for you.

I could not read all these comments to see if it came up, and I congratulate you on a good article!

My sticking point is that a myth was inadvertently supported – that is, that the Taxable Income that dictates your tax bracket will affect all of your taxable income (“If he is in the 28% income tax bracket, he will owe $33,600 in income taxes, or $120,000 X .28″).

In our progressive system, only the funds that exceed a given bracket-mark are subject to that rate. Even Billionaires pay the lower taxes in the lower brackets and only pay higher tax amounts on their taxable income in the higher brackets.

The pervasive and incorrect myth of ‘one tax on every dollar” and ‘high tax rates are bad’ is why voters do not understand how they are benefitting the affluent, charging themselves for the shortfall, and without even fathoming that their total income would have to be vastly greater than (say) $250k . . . in order for their taxable income to land them in that bracket. They see (say) $250k annual as reachable in their lifetimes, and think they protect themselves from paying a higher rate on the first and every dollar.

Specific to withdrawals from an IRA or Pension, correctly rolled into a ROTH – – only the part of the withdrawal (as regular income) that gets bumped into the next bracket incurs the higher bracket’s tax rate. This could be quite a small amount, compared to what just-that-chunk’s taxes would have been at the lower bracket rate. Everything under the higher bracket still only incurs that lower bracket’s rate (and funds over the higher bracket-mark *would have* incurred that previous rate, at the very least . . .). In many case, rolling into a ROTH when the withdrawal amount bumps you into the next bracket, is a very small difference.

Hi Jeff,

I am 61 and retires and my wife 57 and works very little. I have a rollover IRA, and a Roth and my wife also have a rollover IRA and a Roth. I intend to take a distribution of $72000/year from my rollover IRA to live on. Should I or my wife convert some $ every year from the rollover account into the Roth within 22/24% bracket. My rollover has larger sum than hers and I will take RMD in 9 years. What do you suggest?

Thanks,

Tam

Hi Tam – From a tax standpoint it really doesn’t matter because the tax liability will be the same either way. But since you’re closer to RMDs, you may want to go with your own accounts first, in case you have to spread the conversion out over several years to minimize the tax liability. You can convert your wife’s account later. But please talk to a CPA about this, since you’re obviously working with a very large amount of money.

Hello,

My wife and I are 66, retired, and in the process of converting traditional IRA money to Roth accounts. We haven’t tapped any of our IRAs yet as we’re living off of our pensions and other non-deferred savings, planning on taking SS when we turn 70.

Does it matter from whose traditional IRA we convert funds to our Roths? It doesn’t look like it but perhaps there’s something I haven’t thought of about it.

Thanks very much!

Richard

Hi Richard – Not really. You’ll be in the same tax bracket whether you convert your accounts or your wife’s. Unless you file separately, then you’ll have to consult with a CPA.

Thank you for this comprehensive article.

My wife has an IRA that has about 150K with about $25k non-deductible contributions. She is planning to open a solo 401K and rollover the pre-tax assets from her IRA to the solo 401K. The IRA will be left with the after tax assets (25K).

If she converts the after tax assets to Roth, does the IRS look at the balance of the IRA in the prior years and apply the pro-rata rule and calculate taxes or once the roll-over is done then the conversion is tax free?

Appreciate your comment.

That’s an outstanding question for a CPA. I’m somehow doubting the IRS will consider the separation without applying the pro-rata rules. It may depend on how the IRA trustee reports the rollovers. If the pretax contribs are one distribution, and the after tax are another – and it’s clearly noted – it may work. But talk to the IRA trustee about how it will be reported, then talk to a CPA about the Roth conversion.

Jeff,

Please don’t forget enrolled agents when talking about tax professionals.

Hi Keith – So true! EA’s aren’t CPA’s but from a tax prep standpoint they’re just as good.

Hi Jeff

I am retired and will be 70 1/2 December, 15, 2018. I have $57,000

in stocks and cash in a Traditional IRA that I am thinking about converting to a ROTH IRA. Can the stocks be moved to a ROTH IRA?

or must I sell them? (I will be paying the taxes from my savings.)

If I convert it before December 2018 must I still take my RMD?

Could you list the Pros an Cons of going through with this conversion?

Thank you, in advance, for any information you may give.

???? Louise

.

Hi Louise – If I understand this interpretation correctly, you’ll have to take an RMD on the traditional IRA, but the balance of the amount transferred can be converted. If so, the RMD portion would not be eligible for the Roth conversion. The tax consequences won’t change, since both the RMD and the conversion balance will be subject to tax. But please check with your tax preparer to make sure.

Does an inheritance IRA inherited from a non-spouse relative count against me in the pro-rata calculation or can I consider myself as having no IRAs if all I have is the inheritance IRA? All the contributions to the IRA prior to my inheriting it were pre-tax.

Thanks. Nice article.

Hi John, that’s an advanced question, and I’d direct you to a tax preparer (preferably a CPA). There are probably special provisions that will affect the outcome one way or another.

I have a healthy 401K. All saved with pre-tax funds. Since I’m over 60 and no longer working I’d like to begin the withdrawal process by moving 20K per year into my Roth. The 20K would be taxed at 12% in 2018. I’d like to max my bracket falling just short of the 22% bracket. is this possible? Can I roll over a partial amount from my 401K into my Roth? I’m looking to minimize my future mandatory withdrawal amount when I turn 70.

That’s an excellent strategy Ed, I’d even say it’s an example of the best example since you’re minimizing the tax bite. Yes, you can do a partial conversion from the 401k. If you’re looking to get just under the 22% bracket, crunch some numbers with your tax preparer and get as close as you can.

I converted all my funds of $20,000 in a traditional IRA to a Roth IRA in January 2018. I no longer own any traditional IRAs. In February 2018 if I make a nondeductible contribution of $6,500 and immediately convert this nondeductible IRA to a Roth IRA, will this trigger the pro rata rule for me from a tax viewpoint in 2018?

Hi Jill – The pro-rata rules have to do with taking early distributions from an IRA. In this case, all of your traditional IRAs have already been converted, and the new contribution is non-deductible. It shouldn’t apply.

Hi Jeff,

I hope this question is easy for you. Assume that my longstanding Traditional IRA contains $450,000, of which $45,000 is after-tax money that has remained the same amount for 12 years or so. I still file Form 8606 just to keep track of the $45,000 and let the IRS keep it in sight each year. If I elected a 100% cash distribution from the Traditional IRA and elect zero withholding, can i present $405,000 back into the same Traditional IRA as a Qualified Rollover within 60 days and deem it as 100% pre-tax money and present $45,000 as a Qualified Rollover into a newly-opened Roth IRA within 60 days and deem it as all after-tax money? . Thank you for your forthcoming answer.

Hi William – That looks like a backdoor attempt to circumvent the pro-rata rules. I can’t say that there’s a specific rule against it, but there is a blanket restriction against circumvention of IRS rules. You should discuss that with a CPA and/or the recipient plan trustee, but my guess is they’ll say no.

Thank you for the article.

What happens if I convert part of my traditional IRA to a Roth IRA and then die in less than five years? (My wife will be my primary beneficiary and my daughter will be my contingent beneficiary.)

Hi Larry – The Roth IRA transfers to your wife. She can move the money into a Roth of her own. She can take tax-free withdrawals after five years, and upon reaching age 59.5. If it then passes to your daughter, she will have to begin taking distributions from the plan based either on a five year payout, or a payout over her expected lifetime. No tax will be due on the amount of your contributions, but tax will be due on the earnings portion, unless at least five years have passed. No early withdrawal penalty either.

Jeff,

Great article and very informative. I just made a partial Roth conversion for 2017. Most of my current income is through investments, however I have a considerable sum between my wife and I in 401K and Traditional IRA. My question is if there is a limit to the number of partial Roth conversions in a 12 month period for both my wife and I? I believe the answer is that there are no limits to partial conversions but I have seen conflicting information. These would be within the same institution (Fidelity).

Thank you

Hi John – The limitation is on rollovers between traditional IRAs – one per year. There is no limit on the number of Roth conversions.

You don’t sleep much do you!!! Thank you for the reply Jeff.

My partial conversion that I mention was to bring my total tax up to the crossover of the AMT “sweet spot” and not a dollar more. So the tax I’m paying on this partial conversion is circa 28% (not great) but better than the top cap gains rate. I’m trying to do these conversions over the next 8 years with Trump’s tax bill as the AMT “sweet spot” looks like it will be increasing during this stretch until possible repeal which would allow me to do larger partial conversions again at circa 28%. Ideally I’d like to do these conversions while in retirement (before RMD’s) at a lower tax rate MAYBE so as to take advantage of Social Security if it’s still around (I’m 50). If the current traditional IRA/401K balances are $1.7M, do you think this is a prudent approach to try to do maybe half in conversions over the next 8 years and then look to see about the other half when my wife stops working at circa 57? I’m not working so she will have 8 more years to contribute in ROTH contributions and I have sufficient capital to pay the tax through my taxable accounts. I’m conflicted on how aggressive to be with the conversions near the AMT “sweet spot” crossover for this timeframe OR wait to see what tax rates will be after 8 years.

Hi John – You’re talking about $1.7 million in conversions, so there’s a lot to consider. I think you’ll need to decide this with an accountant. What’s more, the decision will have to be reviewed each year before proceeding. You’ve got a lot of variables there, including your wife’s income. It may come down to that the tax bite in some years is so high that the conversion isn’t worth doing. There’s too much going on to give a blanket answer. A miscalculation or unexpected event could cost you thousands in extra tax. Just a high altitude guess here, but I’m willing to bet the recommendation will be to wait until retirement, when income is presumably lower. But then you’re betting where tax rates will be. These are the complications.

Jeff,

Am I limited on the number of partial Roth conversions from a traditional IRA in a 12 month period? I am doing a partial conversion on 12/31/17 and looking to do multiple partial conversions throughout the year for BOTH my wife and I. Are there limitations here? Thanks!

Hi John – This point is confusing to a lot of people. The one time per year rule is on rollovers of a traditional IRA to another traditional IRA. Roth conversions don’t have a limit.

Great article. Thank you. Jeff. Also I have a question:

This year (2017), I rolled over (all) my traditional IRA to my company 401K, this was allowed by my company 401K managed by Vanguard. This rollover/transfer was done ~6 months ago between institutions: Edward Jones to Vanguard. I closed all my accounts in Edward Jones. A couple of months ago, I opened a new traditional IRA with Fidelity and made a non-deductible 2017 contribution of $5500. I also have a ROTH IRA with Fidelity. Questions:

1) Can I do an Traditional IRA (Fidelity) to ROTH IRA (Fidelity) conversion in the same year I did a total Traditional IRA (Edward Jones) rollover to 401K (Vanguard)?

2) Can I convert my Traditional IRA amount of $5500 to Roth-IRA (and pay any tax on interest made), if so dose it have to be converted before January 1st 2018, or am I OK to covert it before April 15, 2018 in order for it to be counted for 2017 Tax period? Or it doesn’t matter, as I can convert IRA to Roth for any amount, any time and any number of time regardless of tax year?

3) Would I receive a 1099R from institution making the transfer from IRA to Roth IRA?

4) Also I must fill out a IRS Form 8606 correct?

Thank you in advance for your comments.

Hi Waise – 1) You should be able to do the traditional to Roth coversion, even though you did the employer plan conversion earlier. 2) You must covert by Dec 31. 3) Yes, you should get a 1099R. 4) Yes on the 8606.

Hi,

Very helpful article. I have a 403(b) that I am wanting to convert to a Roth, but I am still employed. My employer does not contribute any to this plan, so I am trying to figure out the exact rules for converting while still employed. I will be 49 at the end of this year. I am stopping my 403(b) contributions in January and opening a separate Roth IRA that will be outside of my employer. I believe that all my contributions to the 403(b) have been pre-tax, so it should all be taxable when I convert if I have to move all at once. What are the requirements for conversion if you are still employed when converting?

Hi Michael – There are no specific rules if you’re still employed, but you have to make sure your employer will permit you to do the conversion to what I presume is an Roth IRA, not an employer 403(b) Roth.

Hi Jeff–

During 2016 I converted $100K from an SEP-IRA to five new Roth IRAs, and paid income tax on the $100K distribution. Even though I have had other Roth IRAs for over 20 years, are these new Roths (from the conversion) subject to the 5 year-rule for distributions? If so, what amounts exactly are subject to penalty or taxation?

Hi Kenneth – They’re not, but they will be subject to tax if you’re under 59.5. Only the investment earnings are subject to tax.

Hi Jeff, awesome article. Very helpful. I’d like to get your feedback…

Here is my scenario..

We file married filed jointly. My wife’s income for 2017 is around $250k and my income is $0. I made $250k in 2016. Now, since I am unemployed, I am trying use this time to convert some of my IRA to Roth. You mentioned that for IRA purposes our incomes are different; however, how will this impact us when we file married jointly. If I move $75k will i be paying 10% up to $18,650 and 15% between $18,651 and $75k – that’s it? In this scenario, I thought we would end up paying taxes on $325 (250k – my wife’s + $75k conversion). Based on the above scenario what would you recommend? Appreciate your response.

Hi Mark – The conversion will be based on your joint income, in this case $250,000, or $325,000 if you do the conversion. It will work out that you’ll pay your highest marginal tax rate on the converted balance. So if that’s 25%, then you’ll pay 25% on the conversion amount.

That’ll hurt, but it will probably be better than it would be if you were both working and had a joint income of $500k plus the conversion.

Hi Jeff,

Thanks so much for the great article. I would like your thoughts on my issue:

a) I have a Traditional IRA of $8,000 (all funded by non-deductible funds in 2016). This IRA resides with Mutual Fund Company A.

b) I opened a 2nd Traditional IRA in Oct. 2017 and fully funded it with $6500 (I am over age 50), also in non deductible funds. This IRA resides with Mutual Fund Company B.

I would like to move the IRA with Mutual Fund Company A over to Company B and immediately convert both funds to a ROTH IRA. My assumption is I can combine the account, and I only owe taxes on the GAINS made since the contributions were non-deductible.

Are my assumptions correct?

Hi Harold – since both IRA accounts were funded with nondeductible contributions, you are correct that only the gains on those accounts will be taxable.

I am planning to convert my Traditional IRAs to Roth IRA and tumble to your website while looking for tax info abouth the conversion. This article does answer some of my questions very well.I still have few questions. I really appreciate if you can give answers or point me the right place to start. My IRA contains both pre-tax and post-tax contributions. There are stocks, mutual funds, CDs and cash in my IRA account. I plans to do partial conversion each year for the next several years to minimize the tax. I have 3 questions:

1. How do I calculate the total Non-Roth IRA balance? Is this based on the values of the stocks, mutual funds and CDs and cash at the actual time of the conversion or at the end of that year?

2. I do have a Roth IRA which is more than 5-year old. Should I do the convert to this Roth IRA or should I open a new Roth IRA account for this conversion?

3. Since I will do the conversion for the next several years. Should I open a new Roth IRA for each year or just use the first converted Roth IRA account?

Thanks in advance.

Hi Chris – On #1, when you say “non-roth IRA balance”, do you mean the post tax contributions? If so, the amount will be the actual dollar amount of the contributions. So if you have $50k in a traditional IRA, and $10,000 of it are post tax contributions, that will be the non-taxable amount of the conversion. There’s no calculation to include investment earnings on those contributions (sorry!).

You can do the conversion into the existing Roth, but each conversion starts its own 5 year rule clock, so you won’t change the outcome, no matter what Roth account you do the conversions into.

As to opening a new Roth for each conversion, do that if it makes the process easier for you to understand. It will help, due to the 5 year rule on distributions.

I’d also recommend that you discuss your specific situation with an accountant since you have good questions.

Hi,

Here’s my question:

I’m preparing to leave my employer within the next month or so and retire. I have a rollover IRA with about $420K. I’m wondering if it would make sense to roll that IRA over into my existing company’s 401K plan (yes, it’s allowed) right now, while still employed, to be able to make future Roth IRA conversions in a more tax advantaged way. I do also have an existing Roth IRA, which would receive any converted monies.

I hope you see this message soon as I know time is of the essence since this option is only available to full time employees at my company and my tenure is very short.

Thank you

Hi Nat – Without knowing the details of your situation, I’m not in a position to say whether or not it would be to your benefit to rollover the IRA to the 401k. But you can do a conversion from the IRA too, unless there’s a specific tax benefit, which only your tax preparer would be able to tell you.

So I have a SEP IRA, a 401k and a roth IRA. Am I allowed to make yearly contributions to a SEP IRA, roll it all over into my employer 401k yearly, and continue to make yearly $5500 conversions to my roth IRA without any penalties?

Stepwise it would look something like this:

1) Max out 401k yearly.

2) Contribute to a SEP IRA.

3) Roll over SEP IRA into 401k

4) Deposit $5500 into a traditional IRA

5) Convert traditional IRA into roth IRA

Is that allowed?

Hi Tim – In theory, yes. But you’ll have to see if your employer plan will accept funds from the SEP IRA. They may not, and if they do, they might not accept them each year.

Let me start by saying that I’m not even remotely financially savvy. (The following will make that clear!) APPARENTLY, in August of 2005 I accidentally rolled over my ROTH IRA into a Rollover IRA (which, for all intents and purposes, as I understand it) is the equivalent of a Traditional IRA .

I needed a small amount of money to include in the down payment of my house, so, as instructed by the investment company holding this Roth IRA (the Trustee?), I liquidated the Roth IRA investments (mutual funds), withdrawing the total amount in August of 2005 and was told by the trustee that if I rolled this money back in within 60 days, that the IRS would not deem this withdrawal as a “distribution” for tax purposes. So – I did as instructed and “rolled over” these funds into a money market account, depositing the original amount, plus an extra couple of thousand less than a week later, thereafter making an immediate withdrawal of that few thousand for the house down payment. I was required to fill out a new application for this rollover, and I was told to check the box that said “Rollover”, which I did.

Apparently, however, there were 2 different boxes with the term “rollover” and I checked them both. What I was supposed to have done (but was not advised of this) was to check off the “rollover” box for the “Contribution Type” (Transaction type), which gave me the option of either: “Direct Rollover”, “Regular”, “Transfer”. But I was NOT, apparently, supposed to check off the “Rollover” box under the heading “Account Type”. “Account Type” gave the following 3 choices: “Traditional”, “Rollover”, “Roth”. Apparently I was supposed to have checked the “Roth” box under the “Account Type” heading.

As a result of my checking off the incorrect box, my post-tax contribution-funded Roth IRA turned into a Rollover (Traditional) IRA ! I just found this out – I was under the impression for the past 12 years that my IRA was still a Roth IRA.

I never made another contribution to this IRA, and since it’s been doing nothing but sitting in a money market account all this time, it only changed in value from August, 2005 to September, 2017 for a total increase in value of about $800 ($650 after annual maintenance fees).

In an effort to try to correct this situation, I want to do a “Roth Conversion” rolling over this “Rollover IRA” into a Roth IRA, paying taxes on the $650 income on my 2017 income tax return (I assume I will file IRS Form 8606).

Am I correct in assuming that I do not have to pay taxes on anything but the 12 years of income (less the annual maintenance fees) since all of the contributions were post-tax (having been contributed to my original Roth IRA and therefore never having been claimed as deductions on any income tax returns)?

Will the trustee send me a statement telling me the exact amount of the income over the past 12 years or do I have to figure this out myself? (It’s no problem as I still have all my statements)?

Will the trustee send me a statement of some kind which assumes that ALL the funds contributed to that “Rollover IRA” in 2005 were pre-tax (which is obviously NOT the case.)?

Am I further correct in assuming that I will not have to pay any penalty because it will be converted into a Roth IRA rather than simply being liquidated and transferred to me directly?

Hi Christine – Let me start by saying that you really need to sit down and discuss this situation with a CPA before proceeding. Here’s my guess as to how this will work:

Since the current IRA shows as a rollover IRA, that’s how the distribution will be reported by the current trustee for the rollover. The trustee is going to have to report this the way it exists, and that probably can’t be changed after 12 years.

But a CPA can file your tax return showing that the Roth contributions to the plan were post-tax. That means that they will not be considered taxable when you do the conversion.

But please discuss this with a CPA before proceeding. This is not an ordinary situation, and it will require special handling. There could be a quirk in the mix that changes the whole outcome either way.

Thanks Jeff. I’m making an appt. with a CPA right now.

Hi,

I am moving from IL to California in end of 2017.

I have a good sized IRA. I am thinking of doing a Roth conversion so I should pay state taxes for IL rather than CA. I also will not need to take RMD

Any thoughts

Hi Maya – It makes sense, as long as your tax rate in Illinois will definitely be lower than it will be in California. People often forget about state income taxes with conversions, but they do matter. You’re thinking right.

Hi,

Thanks for the great article. Love it. I have a question on the conversion tax basis calculation. I have a IRA account #1 (100% after tax contribution). I also have a company 401K & pension (100% pretax contribution). I want to convert all my IRA #1 to Roth at the START of the year. And, then convert my pension/401K to a new IRA account #2 LATER in the same calendar year (i am retired). Do i need to include the basis in new IRA #2 when i estimate my taxable income related to converting IRA #1 to Roth? Any thoughts / guidance are appreciated. Thanks

Peter

Hi Peter – Only the amount actually converted will be subject to income tax, net of the percentage that’s determined for non-deductible contributions. So new IRA will be used in calculating your pro-rata basis in the amount of the conversion, even though the account isn’t part of the conversion. Fortunately, the 401k balances won’t figure into the equation.

Jeff,

Thanks. I just want to make sure i understand your reply. Is the conversion basis calculation based upon the outstanding IRA basis at the time of conversion or at the end of the same tax year? Say it differently, if my Roth conversion is on January 1, do I use the IRA basis on January 1 or on December 31? If the answer is at the time of Roth conversion, then i should not include the basis in IRA #2 as it does not exist on January 1. If the answer is at the end of the tax year (regardless when i convert during the year), then i will have to wait one year before i convert 401K into new IRA # 2 as i don’t want to mix the two basis pools. Again, thanks for your help.

Peter

Hi Peter – According my research, it’s as of year end, not the date of conversion. That makes sense, since you’ll fill out the 8606 as part of your tax return for the year.

As to the 401k conversion, you should wait until the next tax year to do the conversion. If you do both in the same year, the converted balance will apply to the pro-rata calculation as well.

Please discuss this with your CPA before proceeding though. You’ve got a lot going on, and a mistake could be costly.

I have approximately $800,000 in a traditional IRA. I plan on retiring early just before I turn 61 years old. I plan on taking Social Security at age 65 or 66. Therefore I will have about four or five years where I will have a lower income. During those four or five years I will be living off of my rental income which I am still depreciating and therefore the rent doesn’t show up as much income on my taxes. During those four or five years I would like to convert some or all of my traditional IRA to a Roth IRA. The reason being is that I may not need my IRA money to live on and would like to bypass the RMDs and allow the account to grow for a very long time. I am considering converting an amount each year that would keep me under the 25% federal income tax bracket. Does this strategy make sense?

Hi Kent – It sounds like a solid strategy. Roth conversions are usually better done during retirement when your income is low, and that’s where you’ll be. Good luck with it.

Two questions: If converting a regular IRA to a Roth, do you have to convert the entire IRA? My entire IRA is taxable.

Also, I converted an IRA to a Roth somewhere around 2001 and was allowed to spread the taxes over four years. Is that still possible?

Hi Carol – No, you can do a partial conversion (or the whole account if you like). Not sure about the four year spread on paying the tax on the conversion, and think it’s not likely. 2001 was 16 years ago, so the rules may have been changed. Check with an accountant though, there are all kinds of unusual provisions buried in the tax code, so I could be wrong.

Hi,

I’ve recently retired and would like to start rolling funds out of my traditional IRA to a Roth. I understand the mechanics pretty well but I have a tax question. If I move a substantial amount out of the traditional IRA, I will have a corresponding tax liability. In order to avoid an under payment penalty, must I approximate my tax liability and make payment before filing?

Thanks

Greg

Yes Gregory, you should make a tax estimate shortly after doing the conversion in order to avoid a penalty. You’ve probably helped your cause waiting until retirement to do the conversion since your tax rate is probably lower. But discuss it with your tax preparer. Only someone who knows the details of your tax situation can tell you if the conversion will truly be a benefit to you.

I have a question about the pro-rata rule for married couples. I have both a traditional and Roth IRA. My wife has only a Roth IRA.

If she were to contribute to a traditional IRA without any tax deduction (since I have a 401k at work) and then convert it, does the pro-rata rule count my traditional IRA when taking into account how much is taxable?

Hi Jonathan – Your IRA and your wife’s IRA are separate accounts. Her’s doesn’t affect yours.

Thanks for the helpful piece…and of course, I have a follow-up question

When I was at my former firm, I had a Roth 401k that also had an employee match and profit share component. The employee match and profit share component were tax deferred. I rolled over these tax deferred dollars to a self-directed traditional IRA to take advantage of certain unique investment opportunities but don’t plan on expanding this pool of money. I now want to roll over the Roth 401k dollars from my former firm’s plan into an IRA. A few points

1. My AGI is over the maximum contribution limits for a Roth IRA

2. I just set up a solo 401k that has both a Roth and tax deferred component

My question is this: Ideally, I’d like to rollover my Roth 401k dollars from my old firm into a Roth IRA but it seems that because my AGI is above the limits, I could never make a contribution to this account. Is that correct?

If yes, perhaps I can rollover the old Roth 401k dollars to the Roth component on my new Solo 401k? Any insight is appreciated.

Hi Jonathan – You’re getting hung up on a common misunderstanding. Just because you earn too much to do a Roth IRA contribution doesn’t mean you can’t do a Roth IRA conversion. There’s no income limit to do a Roth IRA conversion, so you should be good. Check with your accountant if you’re unsure about anything.

Hello — thanks so much for all the helpful articles on your site!

Here is my question:

My husband and I have Roth IRAs currently in two different companies for more than 10 years each.

We are looking at moving from our current trustees to a new trustee (Vanguard).

Each of us will have two funds which will be the last of us to touch when needed in the far distant future.

Since we already have Roth IRAs and we will be moving them as Roth IRAs to a new trustee company, does the five year rule apply to the new trustee company or is that grandfathered from the old trustee company since they have been established Roths for more than a decade?

Thanks for the conversion math class — very helpful in assessing our situation of should we or should we not convert any of the rest of our funds before the deadline age of 70 1/2, giving us a generous timeline.

Hi Jeanie – The five year “clock” runs with the Roth itself, not with the trustee, so you should be fine.

Hello Jeff,

Currently I have a Traditional IRA Account with Vanguard. I have used it to roll over funds from 401K from my previous employer. In addition, I have I have made some deductible as well as some non deductible contributions to that Traditional IRA. I wanted to start implementing backdoor Roth IRA strategy starting 2018. In order to avoid tax liability, I was thinking I should convert the entire balance from my Traditional IRA account to my current employer’s 401K account. Then close out that specific Traditional IRA account. Then open a new Traditional IRA & Roth IRA Account and use those to carry out backdoor Roth IRA in 2018. Will this strategy avoid tax liability? Will 401K account accept rollovers from traditional IRA even if non deductible contributions have been made to the Traditional IRA account?

An alternative strategy was to leave the current Traditional IRA account as it is with Vanguard. Open up a new Traditional IRA & Roth IRA Account with Fidelity and carry out back door Roth IRA conversions starting 2018. Will this strategy result in tax liability?

Hi Prathamesh – Two things…Not all 401(k) plans accept IRA rollovers. In fact, most don’t. Even if they do, you might have an issue with the breakout between the tax-deductible and non-tax-deductible contributions. Second, it’s not likely that you will be able to entirely avoid paying income tax on the conversion. You will have to allocate at least some of the conversion balance to tax-deductible contributions, plus the investment earnings in the plan. You will pay tax based on that portion of the conversion balance that is moved to the Roth IRA. You should discuss your strategy with both your employer (the 401(k) plan administrator), and your tax preparer. You’ve got a lot that you’re planning to do there, and you need to make sure that you do it right.

Thanks for the easy to understand piece! Do you know of any requirement that says you can only convert to Roth IRA if you have previously converted all other balances? I saw the following mention of that in another article and it makes no sense, but not sure I didn’t miss something. Here is the quote:

One precondition to doing conversions on which the IRS and all planners agree upon is the following: Only clients who have already converted all their previous IRAs to Roths an important and frequently overlooked precondition — can take full advantage of the strategy.

Thanks!

Hi Heather – I’ve not seen anything that has that restriction. Without seeing the entire discussion I can’t even comment on it. What I do know is that people do partial conversions all the time, so I’d be really surprised if that turns out to be true.

Hi Jeff,

I will be 74 in 3 months, and I am working. Due to MAGI I was not eligible to convert from my traditional IRA to ROTH. However, when I retire, I guess the MAGI limitations go away, and I will begin converting. My question is whether there is an age limit for the conversion, or whether I can go on converting for rest of my life?

Thanks

Thanks for the very good detailed article on Roth conversion. I am 62 and lost my job last year, Andy may not get back to work. So my income will be low this year and will be the firs thing Year I will be eligible to contribute to Roth. I did not take advantage of back door contribution. After reading your article, I realize I can portion of convert my traditional IRA to Roth.

Can I do Roth conversion at any age? Meaning I don’t want to conver all of my IRA in one year, due to tax consequence. If I distribute it over 10-15 years, I will be past 71, I can take MRD Andy do a Roth conversion. Can I do it then?

Hi Mettur – You can do a Roth conversion at any age, and since you lost your job your income tax liability will be low. But you can still spread the conversion out over several years. But if I read your last sentence right, you can’t convert money received from required minimum distributions (RMD’s) – which I think is what you meant by “past 71”.

I am just over the income limit to make a full contribution to a Roth IRA. This will be my first IRA so I am new to this. I plan to contribute $5500 to a traditional IRA, then have it converted to a Roth asap so no (or minimal) dividends would be earned. However, I waited until last minute for the 2016 year to make the contribution. The contribution would be for 2016 and the conversion would take place for the 2017 year. Are there any tax implications for doing this? I assume that since the conversion won’t have any earnings that I wouldn’t be affected but not sure. I will have to repeat the process again here in a few months for the 2017 year as well. Thank you for your help.

Hi Chris – You should be good to go. You made a non-deductible traditional IRA contribution for 2016 and you’re doing the conversion in 2017. The only tax liability will be on any earnings accumulated in between the two events. (Unless some of the traditional IRA was deductible for 2016.)

Hello, Jeff,

Thanks so much for the helpful article and continued follow up in the comments. I have a similar question to the one asked by Allison back in February. I hold a Roth IRA and am looking to convert just this year’s (2016 tax year) contribution to a Traditional IRA (both with the same firm). I did not convert from Traditional to Roth. I have only ever held a Roth. The main reason I am looking to make this change (just for this year) is because I am married filing separately this year (due to personal and employment circumstances), meaning I am subject to the $10,000 limit, which I am well over. I am hoping to just undo my $5,500 deposit, deal with the minimal investment earnings, and not have to be subject to the annual 6% penalty. Had I realized I was going to get hit with the married filing separately income limit, I would have forgone an IRA deposit for this year and just set up a traditional and put in $5,500 into that. Unfortunately, I deposited the $5,500 for 2016 tax year into the Roth account about 9 months ago and am now trying to undo it prior to the April 18 deadline. Do you have any advice on what can be done? Thank you!

Matthew

Hi Matthew – Of course, we’re past the April 18 deadline, and out of the calendar year. I’d contact the IRA trustee and see what they recommend. Failing that, I’d discuss this with a CPA.

Nice article, thank you very much. it’s very informative.

I have a quick question, I just set up a non-deductible IRA account and plan to convert it to Roth IRA(Backdoor Roth). Since my account is non-deductible, so the process of converting to Roth IRA, It does not need to have federal taxes withheld on the amount of conversion. Am I right?

Thank you in advance for time.

Hi MRon – Though there will be no tax on the conversion, whether or not there will be withholding by the original IRA trustee will depend on how it’s set up. If you do a direct trustee-to-trustee transfer there are generally no withholding. But if you do an indirect transfer (money first goes to you personally, then you transfer it to the Roth trustee within 60 days) the first IRA trustee may withhold 10% or more of the amount transferred. Contact the first IRA trustee and find out what the process is.

Any firm worth its salt would never withhold without the client’s approval first.

Your representation of a Backdoor Roth IRA contribution does not clearly speak to the strategy so many use: a non-deductible Traditional IRA contribution and an immediate (next day) conversion to Roth.

I initiated an IRA to Roth conversion with my broker in 2016. I received a 1099R reporting the balance to be moved. But the deposit to the Roth was not made until January 2017! Does this still count as a Roth conversion or does it have to be completed by 12/31/16?

Hi Donna – Yes, conversions do need to be completed in the calendar year. But if the trustee makes the distribution in 2016, they will count it as a distribution for 2016. You should work with a CPA to see what options you have. I’m assuming you did an indirect transfer, and had the balance of the previous plan sent to you instead of to the Roth trustee.

I initiated a “tax year 2016” IRA to Roth conversion with my broker in 2016, but the distribution AND conversion happened in 2017. I did NOT receive a 1099R for 2016. My presumption is the income/conversion should all be reported in 2017, correct?

If that is correct, can I still do another “tax year 2017” contribution/converison between traditional and Roth? For tax purposes will that look like I contributed/converted double the allowable amounts?

Thank you for any guidance you can provide.