As retirement approaches, it’s common to regret not saving enough earlier, but it’s crucial to know that it’s never too late to start saving for your retirement.

While it might require some adjustments and a longer working period, taking immediate action and considering various savings options can help secure your financial future in retirement.

Data from the U.S. Census Bureau indicates that half of the female population and 47% of the male population within the 55 to 66 age group lack any savings for retirement.

While we are told to start investing early in life, many of us do not for one reason or another.

Over the years, I’ve talked to many individuals who “wished they would have saved more” and “wished they would have started earlier.”

There’s a sinking feeling when retirement is approaching, and all you have is regret for your past financial misdoings.

If you find yourself approaching retirement age and have not yet looked at your retirement needs or started saving for later in life, it’s not too late.

But….you need to take action NOW.

The longer you wait, the harder it will be.

Read on for some great tips to help you get started.

Table of Contents

- Know It Is Never Too Late

- Look At Your Current Situation

- Look at Savings Options

- Taking Advantage of Tax-Deferred Retirement Accounts

- Investing Strategies for the Late Starter

- Social Security and Retirement

- Look at Money Saving Options

- Creating a Dynamic Retirement Savings Plan

- The Bottom Line – Saving for Retirement – When Is “Late,” Too Late?

Know It Is Never Too Late

Many people who did not start saving when they were younger ignore the situation, thinking that it is now too late to get started.

This is not true.

While it certainly may be more of a challenge to save all the funds you will need, it can still be done.

I’ve had many people contact me in their 50s and, some well into their 60s, who have realized that they haven’t saved nearly enough. They fear that they will never be able to retire.

I’m quick to encourage them that retirement can become a reality, but they have to make changes immediately. They also have to realize that an early retirement is not a reality. They’ll have to work well into their late 60s and maybe 70s to make up for the shortfall.

Look At Your Current Situation

The first step you will want to take is to look at your current situation and determine how much money you will need to have saved to live a comfortable retirement. You can find retirement calculators on the Internet or work with a financial advisor to determine a figure.

Once you come to a number, you need to take action immediately and create a savings plan.

If you’re a chronic spender, it’s imperative to stop buying crap. Think you need the latest iPhone? Think again! You’ve lost that privilege when you failed to start an adequate savings plan.

Look at Savings Options

It will be critical for you to start saving as fast as you can. If you already have retirement accounts, you will want to make sure you are maxing out your yearly contributions. No exceptions.

You may be able to take advantage of pre-tax catch-up contributions, so be sure to check your account for details. Most accounts allow you to do this once you reach age 50.

You may also need to open additional accounts in order to save what you need. Many investors suggest looking at Roth IRAs as retirement savings options. No matter where you decide to invest your money, make sure you have a diversified portfolio that will guarantee a steady return on your contributions.

Taking Advantage of Tax-Deferred Retirement Accounts

Understanding IRA and 401(k) Contributions Limits and Benefits

Individual Retirement Accounts (IRAs) and 401(k)s are two of the most common types of tax-deferred retirement accounts. Both types of accounts allow your investments to grow tax-free until you make withdrawals in retirement, which can potentially put you in a lower tax bracket.

For an IRA, the contribution limit is $7,000 per year for 2024, with an additional $1,000 “catch-up” contribution allowed for those aged 50 and older.

Traditional IRAs may offer tax deductions on contributions, depending on your income and whether you or your spouse have a workplace retirement plan.

401(k) plans, on the other hand, have higher contribution limits—up to $23,000 per year, with a catch-up contribution limit of an additional $7,500 for those 50 and older. Contributions to a traditional 401(k) are made pre-tax, reducing your taxable income for the year you contribute.

Making the maximum allowable contribution to these accounts can significantly increase your retirement savings. Not only do you benefit from the tax deferral, but you also can potentially receive employer matching in a 401(k), which is essentially free money towards your retirement.

The Role of Health Savings Accounts (HSAs) In Retirement Planning

An often overlooked tool in retirement planning is the HSA, which is available to individuals with high-deductible health plans. HSAs offer a triple tax advantage: contributions are tax-deductible, the account balance grows tax-free, and withdrawals for qualified medical expenses are not taxed.

What many don’t realize is that after age 65, HSA funds can be withdrawn for any purpose without penalty, although withdrawals for non-medical expenses are subject to income tax—similar to a traditional IRA.

This makes HSAs a versatile addition to retirement planning, as they can provide a source of funds for healthcare expenses, which often increase as you age. However, the real benefit lies in using the HSA as an investment vehicle. Many HSA providers offer investment options similar to those found in an IRA.

By paying current medical expenses out-of-pocket and allowing your HSA to grow, you can build a substantial nest egg for future medical expenses or additional retirement income.

Maximizing contributions to these tax-deferred accounts can have a substantial impact on your retirement savings, especially if you’re starting late.

It’s essential to consider your current tax situation, expected retirement needs, and the potential growth of your investments when deciding how to allocate your contributions across these types of accounts.

Investing Strategies for the Late Starter

How to Approach High-Risk vs. Low-Risk Investments

The traditional investment approach suggests a gradual shift from high-risk to low-risk investments as you get closer to retirement. However, late starters might need to modify this strategy slightly to catch up.

While it may be tempting to go all-in on high-risk investments in hopes of getting a higher return, this can backfire if the market takes a downturn. Instead, late starters should consider a balanced approach.

High-risk investments, like stocks, can offer higher returns but come with more volatility. For those closer to retirement, a significant loss could be devastating, as there is less time to recover. However, excluding such assets entirely could result in a portfolio that doesn’t grow fast enough.

On the other hand, low-risk investments, such as bonds or fixed deposits, provide more stability but tend to offer lower returns. Having a portion of your portfolio in these types of investments can provide a buffer against market volatility.

The key is to find the right balance between high-risk and low-risk investments, taking into account your risk tolerance, the time you have until retirement and your retirement goals.

Late starters may need to lean a little more into riskier assets than they would if they had started saving earlier, but they should do so within a well-considered framework that still aims to protect against major losses.

The Importance of Asset Allocation in Catching Up

Asset allocation is the process of spreading your investments across various asset classes to mitigate risk while taking advantage of growth opportunities. For late starters, asset allocation becomes even more crucial, as they have a shorter time horizon to correct any missteps.

A diversified portfolio that is tailored to your specific time horizon and risk tolerance is essential. This might mean having a mix of stocks, bonds, real estate, and perhaps other assets like commodities or even alternative investments.

The exact mix will depend on individual circumstances, but the goal is to maximize returns without taking on undue risk. One strategy that may benefit late starters is the “bucket approach,” which involves dividing your investment portfolio into several “buckets” based on when you’ll need the money.

Money needed in the short term (less than five years) can be placed in very low-risk investments, while money that won’t be needed for a longer period can be invested in assets with a higher return potential, albeit with higher risk.

Additionally, late starters should pay attention to fees and expenses associated with their investments, as these can eat into returns over time. They should also be vigilant about rebalancing their portfolio regularly to ensure it remains aligned with their investment goals and risk profile.

Social Security and Retirement

When to Start Taking Social Security Benefits

You can start taking Social Security benefits as early as age 62, but doing so may result in a reduction of your monthly benefit. Full retirement age (FRA), the age at which you are entitled to 100% of your benefit, varies depending on your year of birth, but it falls between ages 66 and 67 for most people today.

If you delay taking benefits past your FRA, your benefits will increase by a certain percentage until you reach age 70, after which there is no further increase.

The decision of when to start taking benefits should be based on several factors, including your health, life expectancy, employment status, financial needs, and other sources of retirement income.

If you’re in good health and have a longer life expectancy, waiting to claim may result in a higher lifetime benefit. Conversely, if you need income sooner or have health issues that may reduce your life expectancy, claiming earlier might be more advantageous.

Strategies for Maximizing Social Security Payouts

There are several strategies to consider if you want to maximize your Social Security payouts:

- Delayed Claiming: As mentioned, delaying benefits past your FRA can result in larger monthly benefits. This increase can be as much as 8% per year, which is a substantial upside for those who can afford to wait.

- Spousal Benefits: If you’re married, you may be able to claim benefits based on your own work record or up to 50% of your spouse’s benefit, whichever is higher. Coordinating with your spouse on when to claim can maximize your combined benefits.

- Survivor Benefits: If you’re widowed, you may be eligible for survivor benefits based on your deceased spouse’s work record. You have the option to take survivor benefits early and switch to your own benefits later (or vice versa) if it results in a higher amount.

- Work Longer: If you haven’t reached your FRA and are still working, continuing to contribute to the Social Security system can increase your eventual benefit, especially if your later years of work replace years of lower or no income in your benefit calculation.

- Minimize Taxes: Up to 85% of your Social Security benefits may be taxable, depending on your combined income. Strategies that keep your taxable income in lower brackets can reduce the tax burden on your benefits.

- Check Your Earnings Record: Ensuring that your earnings history is accurate on your Social Security statement is vital since your benefit is calculated based on your 35 highest-earning years.

Each individual or couple’s situation is unique, and the strategy to maximize Social Security benefits should be personalized.

It may be beneficial to consult with a financial planner who can help navigate the complexities of Social Security and advise on the best course of action based on your specific financial situation and retirement goals.

Look at Money Saving Options

If you are getting a late start at saving, you may struggle to save the amount you need to each month. Here are some tips that might be helpful.

- Look at ways to make some extra money. Do you have a hobby or interest that you could turn into a part-time job, or do you have a skill that others are looking for? Be creative and see what you can come up with.

- Can you downsize? Look at your current living situation and determine whether or not you might be able to downsize. If you have kids who are now older and moved out, you may not need to stay in such a large home.

- Do you have large ticket items that you no longer need or use? If, for example, you have a boat, a camper, or other big ticket item that is not being used, now may be a good time to sell. Take the money and invest it in your retirement account.

Creating a Dynamic Retirement Savings Plan

Setting Realistic Savings Goals and Milestones

The first step in creating a retirement savings plan is to set realistic savings goals. This starts with understanding how much you’ll need to maintain your desired lifestyle in retirement.

Consider your life expectancy, health care costs, living expenses, and any plans for travel or hobbies. Many financial planners suggest aiming to replace around 70-80% of your pre-retirement income, but this can vary based on individual needs and goals.

After calculating the total amount needed for retirement, break it down into milestones. For instance, you might set a goal to save $100,000 by age 40, $300,000 by age 50, and so on.

These milestones can help you measure progress and make adjustments as needed. Remember to account for inflation, which can significantly impact your purchasing power in the future.

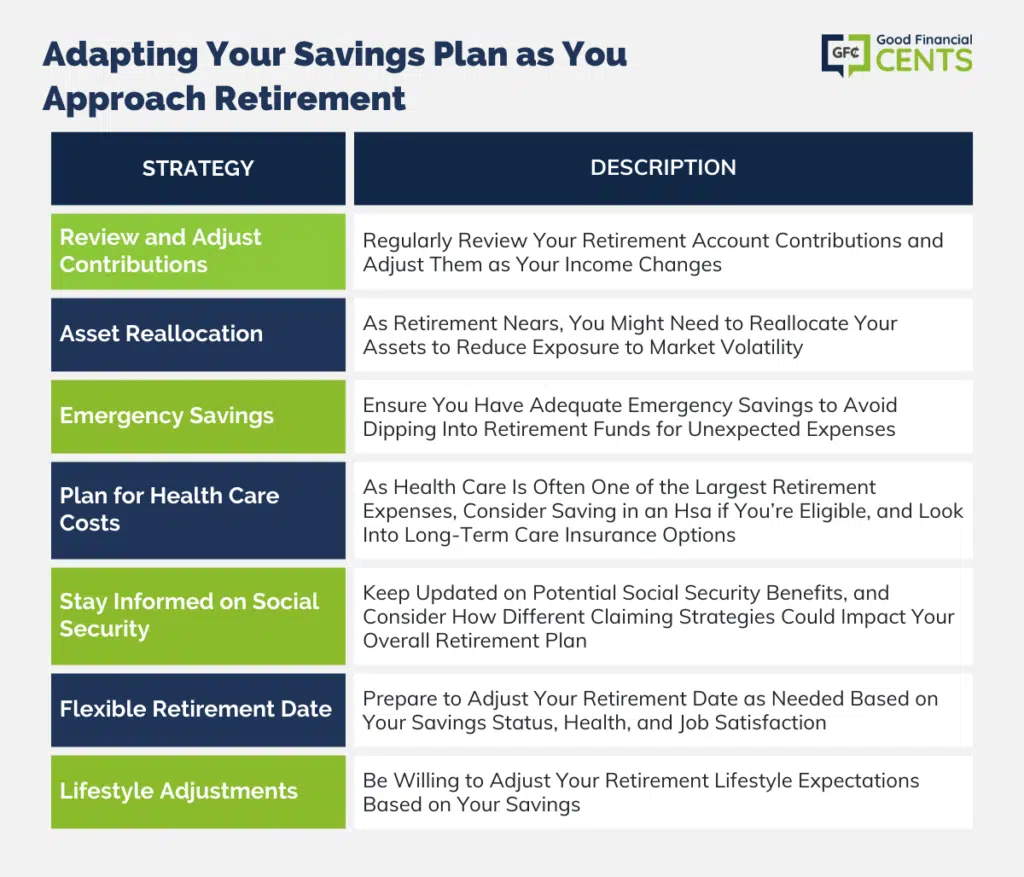

Adapting Your Savings Plan as You Approach Retirement

As you move closer to retirement, your savings plan will likely need adjustments. This might mean increasing contributions to retirement accounts as your income rises or scaling back if you encounter financial hardships.

- Review and Adjust Contributions: Regularly review your retirement account contributions and adjust them as your income changes. Maximize contributions to take advantage of tax benefits and employer matches, if available.

- Asset Reallocation: As retirement nears, you might need to reallocate your assets to reduce exposure to market volatility. This could involve shifting from stocks to bonds or other less volatile investment options.

- Emergency Savings: Ensure you have adequate emergency savings to avoid dipping into retirement funds for unexpected expenses.

- Plan for Health Care Costs: As health care is often one of the largest retirement expenses, consider saving in an HSA if you’re eligible, and look into long-term care insurance options.

- Stay Informed on Social Security: Keep updated on potential Social Security benefits, and consider how different claiming strategies could impact your overall retirement plan.

- Flexible Retirement Date: Be prepared to adjust your retirement date as needed based on your savings status, health, and job satisfaction. Working a few extra years can significantly boost your retirement savings and reduce the number of years you need to fund.

- Lifestyle Adjustments: Be willing to adjust your retirement lifestyle expectations based on your savings. This might include downsizing your home, relocating to an area with a lower cost of living, or finding part-time work during retirement.

A dynamic retirement savings plan is not a “set it and forget it” plan; it requires ongoing attention and adjustment.

By setting clear goals, staying adaptable, and revisiting your plan regularly, you can help ensure that your retirement savings align with your changing needs and the realities of your financial landscape.

The Bottom Line – Saving for Retirement – When Is “Late,” Too Late?

Embracing a late start in retirement savings demands a proactive, decisive mindset and an adaptable financial strategy. The journey may be challenging, but many avenues for catching up—from maximizing tax-deferred accounts to smart investing—provide a roadmap for securing a comfortable retirement.

Incorporating HSAs, understanding the intricacies of Social Security benefits, and reassessing spending habits are practical steps toward building a retirement fund. Crafting a realistic savings plan with clear goals and milestones allows for progress tracking and plan adjustments as necessary.

Ultimately, a dynamic approach to saving, even later in life, can yield a retirement period rich with deserved rest and fulfillment. With the right adjustments and a commitment to financial discipline, the golden years can still shine brightly, offering peace of mind and stability after a lifetime of hard work.

Just turned 60( yikes hard to say). Didn’t start saving until age 47 when ING offered me 40.00 to open a account. And yes l still take advantage of bank offers to pay me but it goes to savings. I m self employed and no 401k but l did make 800.00 from stocks now in savings. I save 20.00 each day of work Mon thru Thurs that l work and 5.00 on Friday. No matter how much l make. All my Saturday earnings goes to savings. I have opened many CDs at even 5 per cent rate all savings. I put any unexpected money such as gifts tax returns refunds on mortage class action checks to savings. I have coin bucket that l cash in twice a year. I have put 5O.O0 per month in a account. I have almost all credit cards paid and hope to keep it that way. I keep expenses low and look for deals. I even donate plasma but that has been for car and home repairs. I plan to wait to age 70 for social security. By doing all this l now have $102,000. It has taken me 12 years and 10 more before targeted retirement date. I hope to stay in good shape so l can work some for awhile post retirement age 70. I agree with young wise person who says start with a dollar. I did with 40.00 you get creative as you go along.

Jeff, all good points you make here. I see my kids struggle in this poor economy but I have to think to myself, as you say, the latest iphone is not a necessity. Saving more to catch up IS a necessity. Thank you, Glenis

Let me comment on this, having been retired now for a whole 7 months.

1. It is retirement, not working life. Your expenses are a whole lot less. Fewer clothes, no commute. I hope you have several hobbies.

2. Savings ain’t worth a crap, an investment that returns you decent CASH is wonderful! Forget the CD’s & Bonds for now.

A portfolio of decent dividend paying stocks, and mREITS helps beat the 2% blues. Start early buying those BIG blue chips.

A DRIP savings idea works very well.

3. The company 401K is only worth a dam if there is a match (free money).

4. If no 401K start a ROTH plan to accumulate the cash. The government doesn’t help us much, and in fact may be your enemy, or enema. Start early, and keep it away from your uncle in Washington. That SOB will take it away, or corrupt it through his minions if he is able.

5. As for the number, do as much as you can. Whoever heard of a retiree with TOO MUCH money. I’ve never met one.

Start the earliest you can, especially when you “can’t afford it.” Truth is, you will NEVER be able to afford it. Just do it anyway.

The trick question is how long will you live? Unknown, but you D?O control when you might end it. Few do, but you do have that option.

Living Comfortable thus far in WI. PS send rain, we need that more than anything else right now!!

I agree. It is never too late. It really just takes making a game-plan and having the will to see it through!

This is Saving for Retirement in Plain English. … learned early in life that saving a little bit of money over a long time can make sure they retire comfortably.

Great Article. I hope more people understand how much easier it is when you start young!

Good info Jeff. One of the things I always remind clients is that one of the biggest returns they can get if they are “late to the game” is working longer. It benefits you three-fold: (1) more years of working gives you more years to save, (2) you now have fewer years you need to finance a retirement for, and (3) you can put off filing for Social Security benefits until you are older, and your benefits have risen significantly.

Great Article! Words like these keep me motivated. Thanks!

I am glad I am saving now in my twenties but I agree it is never too late. Also, no amount is too small to start. Saving just one dollar is a better start than spending it because everyone has to start somewhere.