They didn’t fit the typical millionaire profile.

They lived in a modest 1,800-square-foot home. They both drove Buick’s that were both completely paid off.

He retired from a manufacturing plant, and she, in grade school was an English teacher.

Despite their simple ways, they were both millionaires and were one of the first clients I landed as a financial advisor.

So what was the secret sauce? Did he buy Apple stock a few decades ago? Was it some crazy pension buyout? A salty family inheritance?

How about none of the above.

When I asked the husband what their secret was he shared the story about how every time he received his paycheck he would ALWAYS take a portion and purchase savings bonds (Remember: this was long before 401k plans).

That simple routine, which became a good flippin’ amazing financial habit, was the catalyst for them becoming millionaires.

It doesn’t matter if your goal is to become debt-free, increase your savings, or become a millionaire; all of them require you to have good financial habits.

Everybody wants to be financially stable, but unless you have a plan to get you there, it’s not going to happen.

Here are 27 that will enable you to set (and reach) your financial goals.

1. Live Within Your Means

Table of Contents

- 1. Live Within Your Means

- 2. Pay Yourself, You Deserve It

- 3. Give Yourself a Consistent Raise

- 4. Buy Value

- 5. If You Have to Borrow, You Can’t Afford It

- 6. Pay Your Bills Ahead of Time

- 7. Read One Financial Book Each Year

- 8. Track Your Spending

- 9. Spend Less Time Watching TV

- 10. Balance Your Checkbook Regularly

- 11. Shop Without Your Credit Cards

- 12. Pay More Than the Minimum on Your Credit Cards

- 13. Dust Off That Business Idea You’ve Been Putting Off

- 14. Learn to Say “No” to Yourself

- 15. Learn to Say “No” to Your Kids

- 16. Buy Term and Invest the Difference

- 17. Start a Retirement Savings Plan

- 18. Refresh Your Emergency Fund on a Regular Basis

- 19. Save for Specific Goals

- 20. Know What You’re Paying

- 21. Give to Others

- 22. Become the Go-to Guy/Girl at Work

- 23. Get to Work 15 Minutes Early Each Day

- 24. Cut Down on Your Spending Allowance

- 25. Cut Down on Restaurant Meals

- 26. Drive Your Car a Few Years Longer

- 27. Learn to Love the House You Live In

This strategy is the foundation of all good financial habits. In fact, I’m not exaggerating when I say there will be no point in setting good financial goals until and unless you come to the point where you can live beneath your means.

Seriously.

There’s nothing complicated or strategic about this habit. If you take home $5,000 each month, you live on $4,500 – and bank the rest. As your savings and investments grow, your financial situation will improve dramatically.

2. Pay Yourself, You Deserve It

If you’re having trouble with the whole concept of living beneath your means, it’s time to pay yourself first. If you have a 401k (or some other employer retirement account) this is a simple way to automate the process of saving money. Allocate a certain percentage, or even a certain dollar amount, to come out of your pay each pay period, before you even see it.

Without you even noticing it, the money is transferred to savings and investment accounts and turns into real money as the years pass. If you don’t have an employer-sponsored plan like a 401(k), see #17.

3. Give Yourself a Consistent Raise

Good financial goals are more easily achieved if you can build progress into your savings and investment funding. You can do this gradually by increasing your payroll savings once each year.

You can do this almost painlessly by increasing the savings payroll deduction – whether it is for retirement or some other savings or investment account – by increasing your deduction by one percentage point per year.

While this is a great start, the reality is you need to save at least 20% of your income if you have any hope of retiring early (or at all). If you want to get super ambitious and retire at 30, you can take a page out of this guy’s playbook and save over 50%.

When I encounter someone only saving around 5%, I challenge them to increase it by 1% each quarter until they reach at least 10%. From there, I have them adjust accordingly so they barely feel the extra amount deducted from their paycheck.

4. Buy Value

By “buy value,” I mean you neither buy the cheapest goods nor the most expensive. Instead, you look to buy the best value for the money. Sometimes it’s worth it to cough up a little extra dough for a product you know will last, rather than paying bottom dollar for shoddy merchandise you’ll have to constantly replace.

On the flip side, keep in mind not all products are better simply because they’re more expensive – often they’re just more expensive because of perception. Read reviews and shop around.

5. If You Have to Borrow, You Can’t Afford It

Credit is an awesome thing when you’re buying something big, like a house or a car. Very few people have $150K sitting around in cash to buy a home, so for those things, borrowing makes sense. However, adopting good financial habits means avoiding schemes to stretch your paycheck. Credit cards are probably the most common way to do this.

6. Pay Your Bills Ahead of Time

Paying bills late is another strategy to stretch the paycheck. But it’s also kind of like robbing Peter to pay Paul. All it does is give you a false sense of how much money you have and then put you under tremendous pressure to cover the difference later. By paying your bills ahead of time, you will gain more control over your finances, and that will make it easier to adopt good financial habits.

My wife is the queen at this! Instead of waiting until she receives our credit card bill, she logs into our accounts and pays it off in the middle of the month. There’s no way she’s allowing any interest to accrue!

7. Read One Financial Book Each Year

If you want to become financially stable, you’ll have to seek advice from the financial masters. Easy to do, since nearly every one of them has at least one book available.

Take advantage of that knowledge. If you only get three or four bankable ideas from reading a single book, think about how many you’ll get from reading a dozen or more.

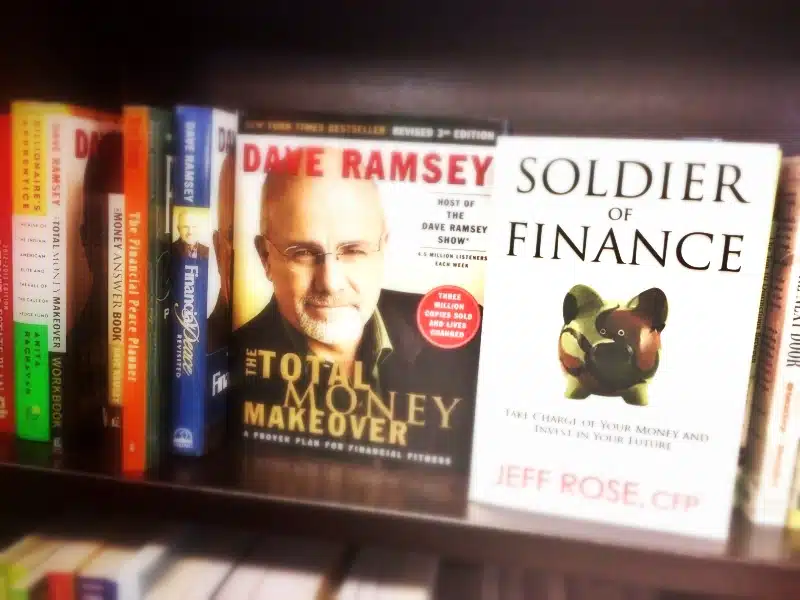

Some of the personal finance books that I’ve enjoyed over the years include Dave Ramsey’s Total Money Makeover, David Bach’s Smart The Automatic Millionaire, Ramit Sethi’s I Will Teach You to Be Rich. And…well there is of course the book on the left:

Shameless plug: My book, Soldier of Finance, can be purchased here.

8. Track Your Spending

If you don’t have a budget, then you probably don’t have even a remote idea where all of your money is going. This is one of those good financial habits you absolutely must adopt you if want to get control of your finances.

By tracking your spending, you will be able to identify the areas of excess. Eating out for 50% of your meals? Cut that back to even 25% and cook or brown bag the rest, and you’ll have a nice chunk of change to contribute to paying down debt or building up your savings.

Start tracking your spending now – you may be surprised to find where your money is actually going.

9. Spend Less Time Watching TV

Don’t think watching TV has anything to do with becoming financially stable? Guess what? TV is nothing but a giant advertising venue, and I’m not just talking about the commercials. Even TV shows advertise certain wares through a little thing called product placement.

It’s a place where “sponsors” come to peddle their wares, and often, to make you feel insecure because you’re not buying what they’re selling.

Much of our spending, especially impulse spending, is driven by time spent in front of the TV. The less time you spend watching it – and the ads it bombards you with – the less money you’ll feel compelled to spend on things you don’t need.

Plus, by watching less TV you can read more books!

10. Balance Your Checkbook Regularly

With online banking, it’s easy to ignore this step. After all, the balance is available to be checked every day. However, the balance does not reflect upcoming charges or outstanding checks. If you aren’t fully aware of these, it could lead to an undersized balance, or even bounced check fees. No bueno.

Balancing your checkbook helps you to avoid these pitfalls, so you know exactly how much cash you have at all times.

11. Shop Without Your Credit Cards

Not only will this keep you from running up your credit card balances, but if you have to use cash or your debit card to make your purchases, there’s a very good chance you will spend less money than you would if you were shopping with a credit card because you can’t just pay it off later.

It’s real money, being used right now, which helps you make a wiser decision in the checkout line.

12. Pay More Than the Minimum on Your Credit Cards

And speaking of credit cards, if you want to become financially stable, you will need to get rid of those balances. If you haven’t been successful in paying off your credit cards in the past, then you should commit to paying more than the minimum payment due.

On top of paying more than a minimum, you should consider consolidating your credit card debt under a single 0% balance transfer card. Once you do this, all those high-interest cards will be under zero since zero-interest cards save you money.

This will speed up the payoff of your credit cards without having to come up with huge sums of money to do it. You will simply be accelerating the payoff, and if you pay enough, it will happen more quickly than you think.

Pay attention to your credit card statements. They will often tell you how long it will take to pay off your balance if you only pay the minimum payment, and how long it will take if you pay a fixed amount slightly higher than the minimum payment. Most of the time, there’s a difference of several years.

13. Dust Off That Business Idea You’ve Been Putting Off

Do you have a business idea you have been putting off for quite a while? You may want to give it a serious try. The internet has made starting and running a business easier and less expensive than ever. A case in point example is my buddy, Steve Chou, who was able to replace his wife’s $100k income by launching an online store.

Another example closer to home is my wife’s blog. She was able to replace her full-time income from her corporate job after starting her blog about a year ago.

Best of all, you can run a side business for as long as you like, and that can provide you with an extra source of income. It’s important to set good financial goals, but you also have to carry them through. Starting a business is one way to do that – even if you only do it on a part-time basis

14. Learn to Say “No” to Yourself

This is important when you are shopping, or just out and about. This is really about getting control of impulse buying. You’re out somewhere, and you see some item you like, and you buy it because it doesn’t cost that much. Even worse is the ability to purchase things online nowadays and have them delivered to your doorstep in just a few days. If you do that several times a week, the spending can really add up.

Making just 20 impulse purchases (or fancy coffees) per month at an average of “only” $5 adds up to $100 spent on stuff you really don’t need. That’s $100 which isn’t going into savings or investments, or to paying down debt.

One trick is to enforce a “72 Hour Rule” on any purchases, especially online items. If you really think you need to buy <fill in the blank>, after you add it to your cart make yourself wait 72 hours before you purchase it. After 3 days you should get a good feel for whether you really need the item or if you just want it (and don’t need it at all).

15. Learn to Say “No” to Your Kids

If you have children, learning to say “no” to them is doubly important. First, kids are kids, they always want something. And that something tends to get more expensive as they get older. You can save a lot of money by learning to say “no” to the random things they see and decide they can’t live without.

Keep in mind, I’m not telling you not to give your kids birthday or Christmas gifts, or things they truly need. Rather, it’s about their own impulse buying – seeing something and wanting it – but instead, they’re using your money. Telling them “no” will keep more money in your pocket.

But the second issue is even more important.

How you spend money, and particularly how you spend it on your children, has important implications for the attitude they will have toward money when they grow up. Though saying “no” isn’t always easy, it’s a way of teaching an important financial lesson. It teaches your kids they can’t have all the candy in the store, and that’s something they need to grasp in preparation for adult life.

16. Buy Term and Invest the Difference

Everyone needs life insurance, but everyone complains about how expensive it is to buy it.

There is a better way.

Buy term life insurance. Because it costs only a fraction of what your whole life costs, you not only save money on the premiums, but you can buy more coverage. And that money you save on the premiums can be invested to build a large investment for the future, which by itself is its own form of insurance.

17. Start a Retirement Savings Plan

Good financial habits can be elusive if you don’t have a retirement savings plan of any kind. But if you don’t have a plan through your employer, there are plenty of options. You can open up a self-directed traditional IRA or a Roth IRA through tons of different platforms. Either will provide the type of income tax deferral that is essential to building a healthy nest egg for retirement.

If you don’t have a retirement savings plan, what are you waiting for? Set one up today, and start funding it with any money you have available.

Seriously. It’s better to start contributing a little bit now than to wait until you can contribute a lot. You can even fund it through payroll savings deductions through your employer. Our top choice is Ally Invest, with the rest of the best options for IRAs here.

18. Refresh Your Emergency Fund on a Regular Basis

There’s a lot of talk on the web about building an emergency fund, but far less in regard to replenishing it once you’ve taken money out of it. And if your living expenses increase over the years, you can even find your emergency fund is no longer adequate.

Take a look at your emergency fund at least once each year, and determine if it is sufficient to cover at least 3 to 6 months of living expenses, based on your current expense level. If it isn’t, set up a plan to refresh it as needed. It’s hard to remain financially stable without a well-stocked emergency fund.

19. Save for Specific Goals

A lot of people understand the importance of saving money in an emergency fund and for retirement. But less well understood is saving for specific goals. Those goals could include saving money for your children’s college education, saving money to replace your car without having to take a loan, or saving money to make major repairs on your home.

This isn’t just about saving money – it’s also about becoming self-funding. That means you pay cash for the kinds of major things other people borrow money for.

I’m a huge believer in revisiting your goals every 90 days. I started this over 4 years ago, and I’ve seen my revenue nearly triple while taking more days off than I ever have. So yes, I’m a HUGE advocate of goal setting. Here’s a quick peek at my last quarter’s goals as well as my goals for 2015.

20. Know What You’re Paying

A lot of people are not terribly concerned with investment fees, so long as their portfolios are growing in value. But there’s more going on with investment fees than people normally think. A difference of just 1% in investment fees can make a substantial difference over time.

For example, let’s say you have a $20,000 investment account earning 10% per year. If you pay 2% in investment fees, that will give you a net return of 8%. Over a ten-year period, the investment will grow to $43,179.

But let’s say you have the same investment, but you pay only 1% in investment fees. That will give you a net annual return of 9%. After ten years, the investment will grow to $47,347.

That’s a difference of well over $4,000 over ten years. The difference is even more dramatic over 20, 30, or 40 years.

It’s also important to understand the type of investment you own and the fees associated with it. Recently, I had a new prospective client that owned a variable annuity. She didn’t understand how it worked or what she was paying per year to own it. She actually thought she was only paying $50 per year to own it when, in fact, she was paying over $3,500!

21. Give to Others

This could be donating your time to a charity or cause, tithing, or cooking a meal for a friend in need. The point is to put others’ needs before yours.

It’s easy to put our own worries and concerns at the forefront but when you start focusing on others, the payback is unmeasurable.

22. Become the Go-to Guy/Girl at Work

Everybody wants a raise at work, but not everyone wants to do what it takes to get one – especially in a tight job market. The same is true for promotions.

But if you want to fast-track your career, work to become the go-to guy or gal in your office. That means taking on meatier work assignments and stepping up to help management and coworkers when needed. It’s not easy, and it’s not an immediate fix, but it can really pay off in the long run.

23. Get to Work 15 Minutes Early Each Day

By getting to work 15 minutes early each day, you can dramatically improve your work performance, and even reduce your stress levels. Just taking the extra time to organize your day, such as creating a to-do list that makes sure you get the most important tasks completed first, can give you a jump on the competition – your coworkers.

That can be an important part of improving both your productivity and your visibility at work. And that can eventually lead to a bigger paycheck.

24. Cut Down on Your Spending Allowance

Even people who budget can sometimes be lax when it comes to their personal spending allowance. That’s the money you use for entertainment, for casual spending, and for that latte at Starbucks.

Everyone needs a certain amount of free spending built into their budget, but it’s equally important to make sure it doesn’t get out of control. Since it tends to be spent in small amounts over long periods of time, it’s easy to get carried away with spending on this front.

Start by giving yourself a fixed allowance for free spending each month. Then gradually begin cutting it down to a more manageable number.

25. Cut Down on Restaurant Meals

Eating in restaurants has become so common these days that we hardly notice it. But if you find yourself eating out three, four or more times per week, your restaurant habit has become a major expense without you even realizing it.

Track the number of times you eat out each week, and begin reducing it. This is an excellent way to save money painlessly. And it may force you to sharpen your cooking skills. The Food Network is there to help you with that, should you need it.

26. Drive Your Car a Few Years Longer

If you are accustomed to taking out five-year loans on your cars, and then replacing them as soon as the loan is paid off, you need to realize that’s a very expensive way to drive. The longer you drive it after the loan is paid off, the less expensive your auto expenses will be. That’s another of those good financial habits that will point you in the right direction, and bring you to financial stability more quickly.

The average age of a car in the US is now 11.4 years. That isn’t to say you have to drive your car until it dies, but you should be able to drive it for as long as 10 years. And for the love of man, repeat after me:

Reliable transportation does NOT mean you have to buy a brand-new car.

If you are paying $500 a month for a car payment, and you can keep the car an extra five years after, that will be an extra $30,000 in your bank account ($500 X 60 months). You’ll lose some of that to repair bills, but nothing close to $30,000.

27. Learn to Love the House You Live In

Some people make it a practice to trade up on their home every time they get a promotion or a new job. If you want to become financially stable, it’s critical you learn to live beneath your means – which was the first strategy on this list.

If you can keep your house payment stable while your income rises, you can redirect the additional income into savings, investments, and non-housing debt. That will improve your financial situation a lot more quickly and efficiently than buying a larger and more expensive home every few years.

So there you go – 27 good financial habits that you need to not go broke – and to become financially stable. Pick just a few of them, and watch your finances get better.

It can take years of experience to develop good financial habits, but the benefits of being responsible with your spending are well worth any effort it takes to develop good practices. When people run into financial problems, it is usually the result of several bad decisions that pile up to create ongoing issues. To protect your financial future, you need to be able to identify bad financial habits and understand the ways in which you can avoid making those types of mistakes on a regular basis. It is okay to make financial mistakes. What is not acceptable is allowing those mistakes to turn into ongoing bad habits.

I couldn’t have said it better Rishika!

In regards to “if you have to borrow it, you can’t afford it” I generally agree. However, in addition to a mortgage or car, I would add student loans (if it’s a reasonable amount and for a degree that will pay for itself).

I think it’s great if your parents saved for your college education or if you worked/earned scholarships, but many people still need to take out some loans to get a college/master’s degree.

I was fortunate to only have to take out $10,000 for a $200,000 degree (and received scholarships for the rest), and I was easily able to pay it back. On the other hand, a co-worker took out $100,000 for a master’s degree that doesn’t lead to a high income career. That I would advise against.

“If You Have to Borrow, You Can’t Afford It.” –> YES. This is what I live, yet it’s increasingly difficult for people to understand my choices. They think because I make a good salary means that I can “afford” to do more. I live strictly on cash (debit) and no credit card. I think if more people did this, then they would keep themselves out of financial trouble.