I’m on a quest. Much like Indiana Jones and his quest for the coveted Holy Grail. Only, my quest is not nearly as dangerous, but it does lead you down many dark tunnels and great quests filled with mystery and suspense.

I’m on a quest to find my real FICO credit score (cue Indiana Jones theme music….).

Okay, so this quest isn’t that exciting. For me, it was a quest because it took several days to get the answer I was seeking.

You’re probably wondering: why the obsession with my credit score? I already knew I had a decent score. (I found that out when we recently built our dream home and then again after we refinanced).

So why am I now really obsessed?

A large part is attributed to my book, Soldier of Finance, that I’m working on. A good chunk of the book is dedicated to learning your credit score and various ways to improve or raise your credit score if you need it.

What I realized was that the more I wrote about credit scores the more I learned I didn’t know about them. In fact, I feel like instead of majoring in Finance I should have majored in “Credit Scores” because the whole system is confusing.

Why The Fuss? Some financial experts like Dave Ramsey say to not worry about your credit score. Personally, I disagree. Your credit score is the heart rate of your financial health.

You don’t want to obsess over it, but you do want to check it every once in a while to make sure your pulse (score) is still good.

Table of Contents

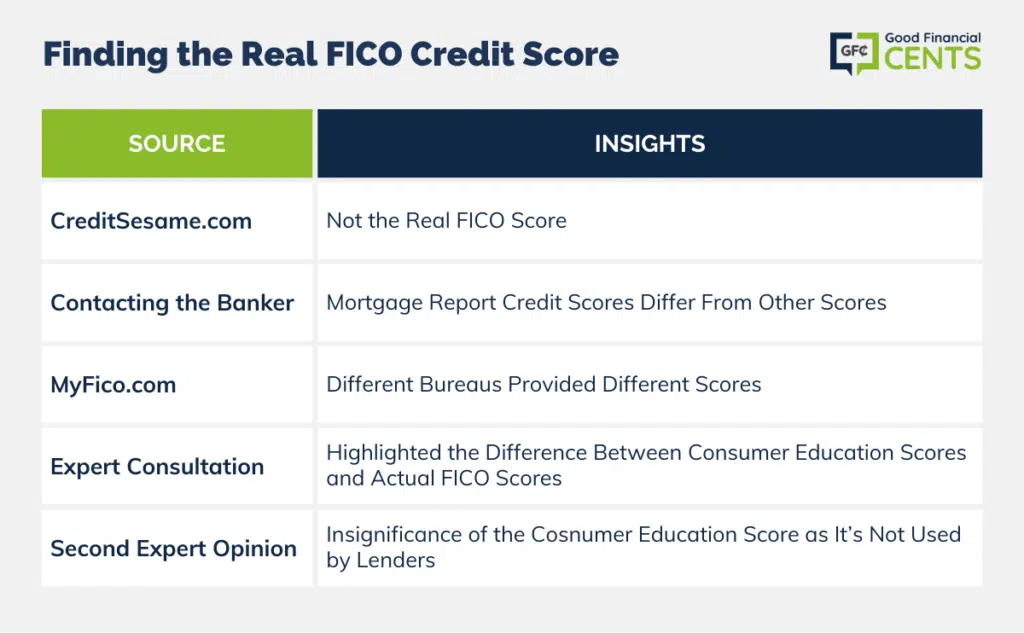

First Stop: CreditSesame.com

One of the first sites that I visited to get my “free credit score” was CreditSesame.com. After retrieving my score here, which was 758, I realized that technically it wasn’t my real FICO credit score.

What? Not my real credit score? Doh! (I’ll explain this more in a bit.)

So if that’s not my real FICO score, what is?

Second Stop: My Banker

We just completed the building of our dream home earlier this year and refinanced when rates dropped a few months back, so I knew that my bank would have our most recent credit scores. I contacted my banker to see what scores they had on me.

This is what I got from them:

“776 / 765 / 773 These are from all three credit bureaus. Also, these are mortgage report credit scores which will be lower than credit scores that you would pull.”

Did you catch that? Look again:

“….these are mortgage report credit scores…..”

Mortgage report credit scores….what the heck is that? (This is the classic phrase that my Filipino mother says all the time. Love you, mom!) Now thoroughly perplexed, I emailed my banker to see exactly what that meant. His second response: (I’m sure he’s loving me by the way)

“I found out about a year ago, that Freddie & Fannie had been working with the three credit bureaus to set up a scoring model for the purpose of mortgage loan requests. The mortgage scoring is tougher than the normal consumer scoring.

Both are FICO scores utilizing the same system, but as one example, consumer models don’t give a lot of weight to collection items, whereas the mortgage scoring system does.

People who have collection items on their credit will score lower with the mortgage scoring system than with the traditional consumer scoring system. That’s one of the examples, but since FICO is a proprietary system, the public knows very little about the full details that go into your score.”

After I read the email, this was my response: Huh?

I knew at this time I was in way over my head.

Just like a typical male who won’t stop to ask directions when he’s completely lost, I trudged on hoping to find my answer to what my real credit score is. Next stop MyFico.com.

After going through this process, I have also learned that CreditKarma.com is also another option in retrieving your free credit score. They pull your credit score from TransUnion.

Third Stop: Credit Scores at MyFico.com

Still curious I decided to actually purchase my credit score through MyFico.com. It cost me $25 bucks, but I didn’t care. I was on a mission.

Note:

Thinking there would only be one true credit score, it gave me two. One from TransUnion and the other from Equifax, which were 779 and 770 respectively.

Really? Two Credit Scores?!

So here’s what I’m looking at so far: 758, 776, 765, 773, 779, and 770. At this point, I have no clue which one is the real deal. No more messing around. It was time to break out the big guns.

Fourth Stop: Contact the Expert (About Freakin’ Time)

Looking to sort through the credit score maze, I contacted the personal finance guru and author of Your Credit Score, Your Money, and What’s at Stake, Liz Weston, and explained my situation to her.

First, Liz explained to me my Credit Sesame score.

“It is true that the scores many consumers get aren’t FICOs, and these ‘consumer education’ scores can be 30 to 100 points higher than your FICOs.”

Okay, great! Consumer education scores. That helps a ton! I quickly began to realize there are several different types of credit scores. So in fact, Credit Sesame’s credit score gives you a general range of where your credit score is at.

My score there wasn’t too far off, so at least it gave me a good starting point. Now, what about the “mortgage report credit scores”

Liz had an idea but verified with a contact at FICO – nothing like going straight to the source! She states,

“It was my understanding that most mortgage lenders use the classic FICO score, which is what you get at MyFico.com. The scores will be different day-to-day (and even sometimes intraday) because the information in your credit files is constantly changing.

I’m not sure what your banker means when he says Fannie and Freddie worked with the bureaus to change the FICO formulas since they (none of them, the agencies, or the bureaus) would not be able to do that. That’s FICO’s (Fair Isaac’s) purview.

But this wouldn’t be the first time a banker or mortgage lender gave bad info. There’s a whole chapter in my credit scoring book devoted to myths perpetrated by those who should know better.”

She later confirmed that the banker was off in his statement. In my banker’s defense, this stuff is really confusing – obviously. Liz adds,

“Fannie and Freddie don’t do anything in concert when it comes to risk-evaluation tools, and neither do the bureaus, other than creating VantageScore as a would-be competitor to FICO (not that VS made much headway).

Fannie and Freddie are evaluating a version of the FICO called the FICO 8 Mortgage Score, but they have yet to tell the mortgage industry that they will accept that score instead of a classic FICO.

The FICO 8 Mortgage Score was introduced to lenders from Equifax in March but just became available to lenders from TransUnion and Experian last month, so your lender couldn’t have been using it to generate scores from all three bureaus earlier this year.

The FICO 8 Mortgage Score does give more weight to a person’s mortgage history, but not to collections. This is in line with other versions of the FICO, such as the one for the auto lending industry that gives more emphasis to a person’s auto loan history.”

There you have it. This is probably more information than you ever wanted to know about your credit score, but at least now I have a better understanding.

If you have a question for Liz, check out her site Ask Liz Weston.

This lady knows her stuff. Thanks, Liz for helping out!

Fifth Stop: Getting a Second Expert Opinion

Then I checked with Philip Tirone, a mortgage broker and the author of 7 Steps to a 720 Credit Score, from 720CreditScore.com. Philip echoed what Liz said, and then he added this:

“The consumer education score is worthless because no lender will ever use it. And because it is almost always higher than a FICO score, the consumer score gives a person an artificial sense of security about their credit score. They would be much better off getting the scores directly from FICO and ignoring the consumer scores entirely.”

Philip added that 100 percent of the credit scores that he reviews in his capacity as a mortgage broker have been based on the FICO score.

Okay, but I’m still confused. Where do TransUnion and Experian come into play?

Philip explained,

“There are three primary credit-reporting bureaus—TransUnion, Experian, and Equifax—who are responsible for collecting your credit information and applying a formula to the information: TransUnion, Experian, and Equifax.

So you have a TransUnion FICO score and a TransUnion consumer score, and so on and so forth. When a lender pulls your credit score (and as I’ve noticed, this will always be your FICO score), the lender actually gets three scores, one from each of the three bureaus.

The lender ignores the high score and the low score, looking at the one that falls in the middle, and assigning interest rates only.”

Philip went on to explain that only TransUnion and Equifax sell both FICO and consumer scores to the public. If you buy a score from Experian, it will always be the consumer score.

Get Your Free Experian Credit Report >>>

Assuming what I’ve written is true, I also suggest inserting this after: “It was my understanding that most mortgage lenders use the classic FICO score, which is what you get at MyFico.com.

The scores will be different day-to-day (and even sometimes intraday) because the information in your credit files is constantly changing.”

This explains why the scores I got from MyFICO were different from the scores I got from the lender—they were pulled on different days. You can read more about how Experian pulled the plug from allowing consumers to purchase their credit score at Credit Cards.com.

Credit Score Takeaways

The biggest thing I got out of this is that you have several different scores and they constantly change. I don’t want you to become obsessed over your credit score like I did, but it is important for you to know.

As I went through this process, my intern was intrigued so he looked up his credit score and found it he was in the low 600’s. Ouch! What was the primary culprit? He didn’t have any credit cards or any credit history.

His parents had warned him of getting into credit card debt, so he avoided them. Getting his credit score was an eye-opening experience since he’ll be soon graduating and joining the real world.

Have you had any credit score surprises? What did you do about it?

Appreciate the information but there are many inaccuracies…

CreditKarma pulls from BOTH Transunion and Equifax, not just TransUnion as you stated above (blue text, large font).

Secondly, Experian shows you your FICO score for free; if you log in right now, it will show you that it is a FICO 8 score (small text below your score that generates), while CreditKarma uses your VantageScore like most of these free sites. Meaning it’s not just your “consumer educational score” but actually off of an entirely different system as Lisa stated.

Additionally, Experian allows you to buy scores from all 3 bureaus for a monthly membership of $14.95/mo. (after a 7-day free trial). Again, Experian tells you directly on their site that this is a FICO 8 score, not just a “consumer education score” as Philip stated.

___________________________________________________

Lastly, it seems that your banker may have been referring to the fact that Fannie & Freddie were given approval by the FHFA in November 2020 (a little over a year ago) to continue using the classic FICO models compared to the new FICO9 model, which is less harsh on certain collections like medical bills than its predecessors, and Fannie & Freddie made their own determination to continue judging creditworthiness on the previous models standard.

Please update this or embed a YouTube video so the people that run across this (especially in the comments) can stop running with false information. Thanks, Jeff! I’ve been watching your videos for several years, and look forward to your future content.

Have you found any lenders that will use the FICO 8 score now?

Experian does; they do it directly on their website, and also allow you to monitor your TransUnion & Equifax ones as well, for a membership of $14.95/month after a 7-day free trial.

The “consumer educational report” from CreditKarma and similar free sites come from your VantageScore usually so that’s the discrepancy.

I would like to receive my free once a year true credit report with my real FICO score

Thank You so much for doing the homework to give some of us an idea of how to understand credit. I am in the process of rebuilding my credit after getting out of the military. my scores are not great at all but i understand it was my fault for being careless. i paid for the myfico.com which i think is amazing by the way. my scores are 584eq 614trans and 584exp. But my mortgage scores are the ones i am more concerned with. they are 525eq, 561trans and 577exp. i thought that was very interesting that my transunion score on myfico is the highest but on the mortgage scores it’s lower and experian is higher. Do you have any idea why that could be? also, do you have any suggestions that could possibly help me get my scores up for mortgage? I don’t have a large debt but my credit history is extremely new not even a year. anything you can suggest would be helpful.

Hi Ayishah – Each credit bureau will have a different score, especially if there’s a difference in what’s been reported between the three. Not all creditors report to all bureaus. That can lead to some wide differences. I’m not sure what you mean by mortgage score, though I do know there are different scoring models for mortgage lenders, so if you pull a residential mortgage credit report (called an RMCR) the scores will also be different. But RMCRs are usually pulled by mortgage companies, and not available to individuals, so I’m curious.

Hello,

I enjoyed your article. If I may say, I am so very frustrated. I finally paid all of the negative debt in February 2017, but my scores are barely moving. I have a secured card that I keep under 30% usage but it is agonizing waiting for my scores to go up..do have any advice for me? Thanks!!

So after reading all the comments….my question is…..So where do you get your FICO score?

Hi Jin – You can contact each of the three credit bureaus to get them, or you can order them from Annual Credit Report.com, which is a company that is authorized to provide them, and the only one at that. Just keep in mind that it will represent your credit score as it is right now. 30 days from now it will be different. Credit scores are a moving target!

No Jeff as far as I can see you can’t request just your score at least if you can can you please show us the link to where you can because every single thing that I tried to get that simple credit score FICO score it wants you to join an expensive monitoring service to get it how do I get just the score and only the score the FICO score?

Hi Brad – You can usually get your FICO free from your bank. Many offer it as a free service.

Hi Jeff!

Late viewer here but I really enjoyed your quest!

I personally like the “educational” scores I get for free. It’s just a guide that I use to see where I’m at. When my credit usage goes up, the scores come down, when I bring the usage down the scores go up. It give me an idea of what’s happening when I do certain things. I know it’s not real FICO scores, they tell you that up front. It is educational, as long as you don’t fall for the “sign up for this or sign up for that” sort of thing.

To be honest, I started with terrible credit due to my divorce. All the free credit score sites you mentioned helped me get back on my feet, and gave me confidence to move forward. Two years ago I had a 588 score from Credit Karma to start with. My credit card CL’s were $500 and $750. Today I have a 689 FICO score, yes not the best but I have a care loan that has no missed payments and my CL’s total $28,950! If not for Credit Karma and MyFICO, I’d be lost.

Everyone will have their own experience. I for one believe those “free” sites have their place is taken with a grain of salt and used for “educational” purposes.

Again, sorry for being late to writing, I’ve been busy working on my self but again, I really enjoyed all that you provided! I also appreciated everyone’s comments below.

Have a Very Happy New Year and let’s everyone look forward to a prosperous 2017 New Year!!!

Hi Scott – I completely agree with what you wrote about educational scores having their place. Know as “FAKO scores”, they’re not your actual FICO scores, but they’re calculated as parallel scores. That means that they can show you the relative level of your score, and just as important, what direction it’s taking. That’s important, even if it isn’t “official”.

Along the same line, each lender uses its own version of your FICO score, so a ballpark is really the best you can do. Since you can also order a copy of your credit report from each of the three credit bureaus for free once each year, the educational score can help.

What you have proved to me is the system is faulty and needs to be changed. It also is a huge system of corruption and deception on deceiving the public and stripping away a persons pride and moral. Why do you suppose so many homeless are on corners across this country. Lies and deception. If your really going to help us, then take your knowledge to the Senate and Congress to have the system uniform across the board and allow us to see our Fico at the car dealer etc. No more scores for this and scores for that. No more Oh well , that is the way it is. Write, call and complain to the law makers to change things. We are not sheep.

Hi Charles – I don’t know if it’s as deceptive as it is complicated! But you may have a point that greater standardization and transparency are needed. Maybe your comment will motivate a few readers to act. Thanks for weighing in.

YES!!!!! credit karma and credit wise just dropped me 100 points on transunion although I just had my last derog removed and 6 inquires dropped off. everything else says ‘excellent’ on credit karma except inquires and age of credit. ???????????????????????????????????????????

Because of all the corruption with the government and just peer arrogance with the ruling class i’m convinced that nothing with these folks is honest and true–I didn’t always feel this way, I once had confidence concerning government–that is Freddie ma and Mac and the way the credit system was governed but not anymore. They are corrupt and have established a system to captivate those uninformed. I too have run into the maze of credit deception and due to the lack of transparency I’ve had to jump through many unnecessary hoops. Call Experian. Ask for help and see what a maze they send you through they are not helpful. And far from honest. Better yet look at Yelp and consumer replies you will be shocked.

Sorry Mr Rose but I agree with Mr Carson, the credit system is deceptive and corrupt. There is a difference between something being difficult or confusing, the credit bureaus practice misinformation.

I have done condiderable research since Trans union, experian, & equifax collaborated to invent the ever so useless advantage “educational score”. This is what credit karma, credit sesame, Quizzle & capital one credit wise use. The month before they implemented the advantage score trans Union sent me an email stating the release of the advantage score & to expect a change in what my “free score” had been.

I knew my true fico @ the time through myfico .com membership & a free month trial @ equifax. All scores were in line in a range from 638-663.

When advantage was first released in July 2016 my “free entertainment scores” offered via sites like credit karma, sesame, Quizzle, & credit wise thru cap one all dropped to 551!!!! I was shocked! Myfico.com & trial experian stayed in the mid 600 ranges I stated above.

In August the second month of advantage free entertainment scores I mentioned credit karma, sesame, Quizzle, & cap 1 credit wise use dropped AGAIN TO 501!

I was in more shock! What’s even more shocking is that in July & August my categories on karma & sesame all improved! I lowered debt by 3k, had two inquiries fall off, had a collection removed, & my score still dropped in this new advantage formula!

With the changes I mentioned to my credit, myfico.com & experian free trial, my CScores all went up by a minimum of 29 points @ all 3 bureaus.

I am following this closely & relaying my credit story as I am saving for a rural Usda home loan which requires only a 640 CS. With mine so close this summer, I wanted my August 11 2016, application online with my credit union for the home I wanted to go smoothly. I got approved instantly last Thursday & went to the credit union the next day to start paperwork.

My credit union rep. Was aware of the new advantage score & said its being denied by all real estate lenders & they will continue with a TRUE fico 8 real estate model to lend $.

She also said the advantage score is geared to make $ for the free sites so you follow their recommendations on credit cards, home refi’s, personal loan offers they suggest.

I had her pull up my karma score & she laughed @ how much they dropped my score in 2 months & we looked back 4 months to where my score was the old model & I had recommendations on 4 credit cards for 3 straight months I didn’t take & when advantage score was released & my score dropped, my only recommendations were for Lexington law credit repair!!!!!

It’s all about $$$$

Wow, that’s complicated Timmy. And I don’t doubt what you’re reporting. Anyone else out there have an experience similar to Timmy?

Yes, almost exact experience. So frustrating.

Credit Karma always gives me scores lower than what they truly are. We are talking 50 to 100 points lower on each of the three bureau scores. In the midst of applying for pre-qualification for a mortgage and was relieved to find out my three scores were actually much higher. It makes sense now that I read they are trying to market cards and other products to you.

Yep My FICO is 653 and FAKO is 335 and 541. FAKO’s got worse as I gained credit, FIOC wen up fast as i was approved for 3 different cards. makes no sense

I apologize for my typos 🙁

my confusion is that just about everyone on everything you read says that creditkarma.com and the like are going to give you score that are way higher that your FICO scores are going to show. In my experience with every authentic FICO trial including my $4.95 purchase at Experian for my FICO Score 8 have shown me way higher scores that the free “estimated scores” I have received from credit sesame, credit karma, my own credit unions “savvy money” score, etc…. So why am I getting the complete opposite results as everybody else??? I am SO LOST!!

Hi Tabitha – Be happy that your real score is higher! I wouldn’t go so far as to say that free scores are always higher than the real ones, but they are often very different, since they aren’t the real scores used. The good thing about the real scores is that they’re the ones that count, so you’re in a good position.

I’m not sure what site to believe. My credit karma scores are exactly a point apart. My credit.com score is higher than credit karma, and my quizzle is lower than credit karma.

Each is using a proprietary scoring model so each will be a bit different. And those will be different from what a bank or other lender will pull! You should be mostly concerned with your score range, not a specific score. If they’re all close it’s OK. Also remember that your scores can change day by day.

My Fico is 100 points higher than the “education scores” you are not the only one

I will try to clarify some things from this old post. First, “real score” is a problem. The 3 bureaus collect the information. The scoring is a formula that can be used to determine the credit worthiness of a potential borrower. There are many many scoring methods. Most of them are proprietary and cost money to use. When you go to transunion for a score, you are getting a “real” transunion score.

It’s not fake, it’s just not the same one a mortgage lender would use because transunion doesn’t want to pay the fee for a FICO score from FICO. The FICO 8 is the one I monitor after all my research and yes I have to pay for it.

Second, “the ever changing score”. There can be zero changes in your credit history and your score can change. That’s because the scoring formulas use “buckets”. A bucket is where they group people with similar credit history and then rank you in that bucket. The reason yours changes is because the people around you change which changed your ranking in the bucket or moved you to a different bucket.

I personally thing the bucket thing is stupid. Keep in mind that Verizon cares about different things in your past when deciding if it wants to sell you a $600 phone over 24 month vs a mortgage bank lending you $200k over 30 years.

Being in collections for $30 is more serious to Verizon because it tells them you won’t take care of the small bills but your mortgage lender will be more concerned about a 30 day late payment on your house 2 years ago. To defend Dave Ramsey, his approach is to not barrow the money in the first place so your score doesn’t matter. If you save and pay cash then what does your score matter? I fall somewhere in the middle. I advised my teenage kids to get a secured VISA from our bank so they could build credit without building debt.

We are starting the process of building a house. Two months ago we had a mortgage broker pull our credit. Myfico.com was showing around a 620 at that time. When the mortgage broker pulled my credit my scores were 567/567/587 he said it is because it is a different scoring model mortgage companies use than even banks. Which is highly irritating because I just refinanced my car based on the 620 that my local credit union had pulled. We have to have a 620 for a VA loan and we have about 10 months before we will close. Today myfico.com shows 642/638/649. My question is why was the mortgage brokers credit report so different than the Equifax pulled from my bank? Could he have a system that was not live vs live? Would we be better off going through a regional bank mortgage that may use “bank” scores or will they pull the same scores?

I monitor my credit on credit karma which gives my scores as TU 664 EQ 680 which I calculate to be about 50 points less. I paid $1 for 10 day trial on Experian and EX says my score is 633, so I applied for a cc which I was denied for due to insufficient credit history but they gave me my score as a courtesy which was 729. So my question, which score is correct? I’m more inclined to go with the 729 as that’s coming from the credit card company.

I recently applied for a refinance of my home. lender pulled scores and all 3 wee dead on with my fico.com

the last thing we need is government getting involved

I don’t like the govt. stepping in at the drop of a hat and I’m all for capitalism but I’ve always been of the opinion that because our “entire country” runs on credit scores that there should be a govt. agency setting guidelines and rules for credit. Credit scores will continue to get more confusing and consumers will continue to be taken advantage of until a major change is made..

The FCRA (Federal Credit Reporting Act) was written by the agencies and approved by the agencies.

Ever use a fox to guard a henhouse? Growl.

Someone please help me…my scores from Credit Karma are 727(trans union) and 744(Experian). After applying for a credit card they recommended (based on my credit)I was declined and the letter stated my FICO score from trans Union was 590?!?! I understand CK scores will be a little higher but that is crazy! I paid off a big collection a couple weeks ago, could it be that it’s not updated yet?

This was a very interesting article, however I also read in “Consumer Reports” that myfico.com is not recommended… and a “waste of money”… gosh, who am I to believe??

I monitor my credit on credit karma which gives my scores as TU 664 EQ 680 which I calculate to be about 50 points less. I paid $1 for 10 day trial on Experian and EX says my score is 633, so I applied for a cc which I was denied for due to insufficient credit history but they gave me my score as a courtesy which was 729. So my question, which score is correct? I’m more inclined to go with the 729 as that’s coming from the credit card company.

The same information is in all three of my credit reporting agency’s. Transunion 657 , Equifax 677and Experian 678. But Trans union score is a lot lower. They are even reporting I have bad credit history. But the same (Identical )history is in the other two. Why is TranUnion so different?

@David, that’s why it’s important to pull all reports, so you can see discrepancies! Now you need to dispute things on your TransUnion report that are outdated, or wrong. Don’t pay someone to do it for you, you can do it yourself! https://dispute.transunion.com/

i see you keep promoting myfico.com but why are we forced to keep for 3 months??? seems like this page is more like a advertisement page ! just like all the others!

@ Raul Because MyFico.com is the only place to get your real credit score.

You can also go to each website and get the 3 individual from them

Do you have any clue how much will my credit score change with newly acquired credit cards? And when will it change?

I’ve been watching MyFico.com for a year now and have got my FICO score to about 660. (Was 550). I’m also paying a company to remove really old and bogos claims on my credit reports. This is going on for 2 months now and they have removed about 5 things on each credit company. Today I went and paid for the freecreditreport.com to see how it looks. 550 is my score WTH!!!! how is it MUCH lower than my Fico. I mean I have almost perfect credit for over 8 years now with many credits paid off including vehicles. Can someone please explain? Thanks, Jeff

@ Jeff That’s a tough one. Is your score with MyFico.com currently 660?

This was a great article, but I’m not sure we ever got an answer. HOW DO WE GET OUR REAL FICO SCORE?!??!?!?!?

@ Jared I think MyFico.com is the only place to get your real FICO score. Keep in mind that it changes constantly.

Not true. The whole site and forums contradict themselves too much. This is the reason for mass confusion Pole 100 points lower 35 lower. I got 1 point difference on one score and 60 points on another. They give you FICO8 but logs say mortgage lenders use FICO 4 or 98. The whole credit part is a scam to suck the lifeblood of people just wanting to buy a house. It s no wonder the American Citizen is one of the most medicated cultures of the world. I am no better off reading as much as I have, then when I was told years ago to keep one credit card to be used for emergencies. I have used disputes to knock off double jeopardies form one company that received my payments to have another add to it with know knowledge of who there are. List as original owner when original owner was a medical company. Disputes fall to way side because they already handled it once and unless new information (documents) can be provided, it remains. Scores drop when a collection is posted that is not supposed to go to you. Takes months to repair and yet the score climbs at a fraction the speed it drops. For someone else’s mistake. The whole thing a clustered joke where it appears bankers laugh and companies like MyFico offer the true FICO to find out it is not the ones lenders are using for the scores. FCRA really needs to hammer home. Even as much as I dislike the government in my business. This whole FICO/FACKO and F**KO needs a makeover.

Yes misspellings in here, so back away Grammar Nazis. The frustration of make things right to buy a house when information is so skewed by what I have witnessed and read. But then again, its the internet, Bonjour!

MyFico has several different scores. Mortgage scores are pulled from the 3 bureaus but they still don’t use what lenders use. For example, MyFico uses TransUnion 98 to pull — mortgage lenders use Trans Union Classic 04.

My Fico used to use Equifax Beacon and now I hear they’re using something else.

I’m no expert but it’s discussed on the forums.

But you said it is the CONSUMER ‘REAL’ FICO score from them, not the ‘MORTGAGE LENDER’ FICO score rate.

Would you like some artificial milk, real cream Ice milk with that order? Absoloutly ZERO transfats except where the government says that less than 2% TRANSFATS can be counted as ZERO.. It’s a crazy, lying cheating world we live in.

Seems myfico.com is an unfair monopoly. I have been using them for years and other than a lender or your credit cards that give a TRUE fico each month ( usually transunion ) there is no other way to get them. Several sites for idenit guard will let you sign up and get true Fico the remainder of the time you get FAKO or educational scores you talk of. Some FAKO scores can be higher some lower than your true FICO. This past month my FAKO scores were lower as they showed me in high 700 range when really 2 of Mt FICO scores had tipped into 800 range. You will never have a good range of fico scores without credit cards you use and payoff giving you payment history. Also I have learned after the mortgage meltdown that no matter what your true fico is if you income is not there to back up a car or mainly a mortgage payment even at 850 the top end of the fico scoring model you are not going to get that loan. After a 720 – 740 Fico now they look at debt to income more than anything. A mix of credit is good to as an installment loan and credit cards you use and pay on. Never pay your credit card balance on all cards to zero instead leave a small less that 3% balance of the cards Credit Limit on the card. A zero balance on all cards will take about 7 points off your scores for the month. I have studied, tried and worked on my scores for 8 years and came from a low 500 range to now tipping into 800s. Remember your FICO range is 300-850 850 being perfect. Once you get over 800 it moves you credit risk level from very good to exceptional giving you a less that 2% of default rate. Lots to learn out there and I have checked out an out every book at library on fico scoring and read as much as I can find daily on fico scoring. This is how I ran across this article. If I can learn one new thing it was worth reading. Let’s of good information on myfico.com and as most of you and Jeff feel Dave Ramsey is totally wrong on this. Your Fico score is a snapshot of your finacial life and finacial health just as your colestatrol score gives your Dr. an indication of your physical health. I am currently writing a book to help others sort through all this and the different algorithms used for FICO scoring. Good luck and work hard on your fico because it is you in the finacial sector of life.

Hi Steven – You’re right that the game changed after the financial meltdown. Before that happened, lenders were looking to reduce the lending decision to a math equation, and it was thought that FICO scores were THE barometer. But as you say, income proved to be the X factor, and lenders quickly began to realize that it does matter. That’s when the no-income/liar loans disappeared.

One of the problems with trying to stay on top of your FICO is that the whole set up is incredibly complicated, which is a point I made in the article. Then they periodically tweak it, so what works now, may not apply a year from now.

Credit scores matter but we can’t obsess on them either. We don’t have complete control over our scores, since there’s definitely a “black box” component to it. The most we can do is pay our bills on time, and keep debt levels to a minimum.

So is my FICO SCORE>COM a trusted and true sight.

I would go to myfico.com.

THANK YOU SO SO MUCH for explaining this fairly convoluted credit score maze in way that was both an easy to understand and actually interesting. Your article was very helpful, and now, a whole lot of things i’d been confused about, suddenly all make sense.

One part i did not truly grasp, though, was how a FICA score could change much in a single day. Well, of course, if that day you were late on a payment, or took out a big loan, sure, the score would change,

but, otherwise, i didn’t quite get how the FICA score could change much on a day where not a lot happened financially to a person.

still, thank you again. I wish more people could take boring and complicated topics and inform us about them in such an entertaining and informative way as this author, Jeff Rose does.

[Jeff, since you are adept at explaining complex, multi-faceted things, can you now explain to me how to save my computer’s Firefox bookmarks prior to installing the new windows8 OS? ha.]

PS—Oddly, in the smaller print, on something on the FICA site called “score watch” feature————-it called my fica an

“Equarian FICA score” yet it was from the actual MyFICA.com,

??????

and it said, my FICA score was 728 “based on my FICA score and my equarian credit report”

which confused me. I thought it would just be ‘plain’ FICA score, and was surprised the other 2 major credit reporting agencies were Not mentioned…?????????

i used the “free 10 day trial thing, if that made a difference…? hope i remember to cancel it now before 10 days goes by…

Excellent Article. My experience has been wasted money purchasing scores that are varying 100 point spread. In the process of credit repair this is quite upsetting….why can’t there be one score?????—then we would all know what we are getting. Thank you again.

OMG!! I applied for a mortgage recently because I got my three “scores” and thought I was okay. And the lender showed I was about 100 points less than what I thought. Boy was I mad. I thought I was the only one who didn’t have a clue. This article is an eye-opener. I do have a question. If there were late payments in the past, how long before they don’t hurt so much in the rear? I know they will be there for at least 7 years. Everything was paid off in full and all have been paid on time for two years. I was just wondering…..

@ Paulette Everything I’m reading shows 7 years, too. Check out this thread in the MyFico forums that might help: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/How-long-do-late-payments-stay-on-credit-report/td-p/188889

Your payment history only goes back 2 years, so if you’ve been on time for 2 years then it won’t show any of your late payments, and payment history is about 30% of your credit scoring. An actual creditor, good or bad stays on your report for 7 years. Inquiries are on for 2 years. Bankruptcy can be 7 or 10 years depending on which kind of bankruptcy you file. Pull your credit report, not just your scores. You’ll see your payment history!

Not true. Late payments show up for 7 years. About 5 years ago I was laid off and got behind on student loans. I have been on time now for over 4 years and they still show up in the “30-day, 60-day, 90-day late” category. Fortunately they are so far behind that they have less impact as they used to .

mike dobbs is absolutely correct. what good is it to buy their product when it is completely worthless??? give me my money back.

I would like to propose a class action lawsuit against Transunion. I PAID for a credit report and score from Transunion. The score was 756. I felt fairly safe I could get a decent interest rate. My mortgage broker pulled my credit and score less than 24 hours later and it was 100 points, yes 100 points less.

I contacted Transunion and they said the score given depended upon the model they used to provide the score and that the number I got is always going to be higher than the number given to a potential creditor.

Why pay for a score if it/s meaningless. Transunion should state that in their advertisements that the score given is not the real score given to creditors. They don’t, why–no one would pay them for the score.

I would love to find an attorney brave enough to take on Transunion who is taking our money and providing no benefit. In my opinion. It’s fraud.

I am having the exact same problem. I’ve been paying Transunion/ TrueCredit for years to be able to keep up with my credit scores which is 748-674-696. I contacted My Fico.com and found out they had my Equifax report showing 100 points (596) below what True Credit had shown on my report. I also feel they should repay me all the money they have taken from me. I also feel that 596 is much to low as my credit report is not that bad and I do not owe much money. I am so perplexed I just don’t know who to believe.

i just check my chedit score through the internet they were 681 683 and 687, I bought a new vehicle and they told me my credit score was 591, did they use the fico score

To my understanding there is a different score model that lenders use for auto loans. Having previous auto loan history is a must for getting a good rate. .

Hi Chris – That’s true. And there are also scores for mortgages, credit cards and other loan types and industries. Each tries to create a model that’s industry specific. An auto score will give heavier weight to your past auto loan history. Mortgage scores will emphasize mortgage history. It’s all more complicated than it seems on the surface.

Thanks for the information. Working on an article right now about how the FICO 8 will effect consumers, but your article reminded me that many consumers have no idea about even the basics when it comes to credit scores.

Great post! Thanks for doing this research and sharing it. I’ve been going crazy trying to understand why MyFico (yep, I paid for it, too!) gave me different credit scores than a mortgage lender who recently ran my scores. I disagree with Dave Ramsey as well. Credit scores ARE important because lenders use it to determine (along with other factors) what kind of interest rate you can get on a loan.

I checked my scores at creditkarma.com and myfico.com. My credit score at creditkarma was 765 and my fico.com from Equifax was 802. So, if I read everything correctly, my creditkarma score should have been higher because it is a ”consumer education” score. Might be another one of those credit score mysteries…..

Thanks for doing all the detective work for us Jeff!

I suspect the credit score puzzle will only get more complex as the credit bureaus keep adding in additional scoring criteria to help get a more comprehensive view on a borrower’s ability to pay back a loan.