Regular followers on this blog and my YouTube videos know that I’m a pretty positive guy. So why would I take on a topic like how to prepare for the next recession? And why would I even speculate that it may happen as early as this year?

Because it’s going to hit – sooner or later. That’s not a crystal ball prediction, either. There have been a dozen recessions since 1945, and the last two were pretty ugly.

Given that reality, the most positive and proactive approach is to be well-prepared in advance of trouble, even if you don’t know when it will come or exactly how it will play out. As a financial advisor, I owe my clients and readers nothing less.

Table of Contents

When Could We Get The Next Recession?

The current economic expansion officially became the longest on record on July 1, 2019, when it reached 121 months. Six months later, it’s still going. In other words, this expansion is well into its 11th year.

To put that in perspective, a Federal Reserve publication confirmed the average length of an economic expansion to be just 57 months. That’s just under five years, which means the current expansion is more than twice as long, at 127 months as of January 1.

At least statistically speaking, we’re overdue for a downturn. I’m not calling a date here, nor am I attempting to project the details it’ll involve. But I am saying it’s coming. And as financially responsible people, we owe it to ourselves and our loved ones to be prepared.

How to Prepare for the Next Recession

Because the specific events of each recession are different from the ones before it, we can’t know how the next recession will go. For example, the Dot.com recession of the early 2000s was caused by a collapse in the tech sector.

The Financial Meltdown a dozen years ago started in the housing sector and then spread to banking and the rest of the economy.

The specific cause of the next recession can’t be known. But we do know how it affects people on a personal level. Jobs become unstable or are lost.

That’s the part we can know – and prepare for.

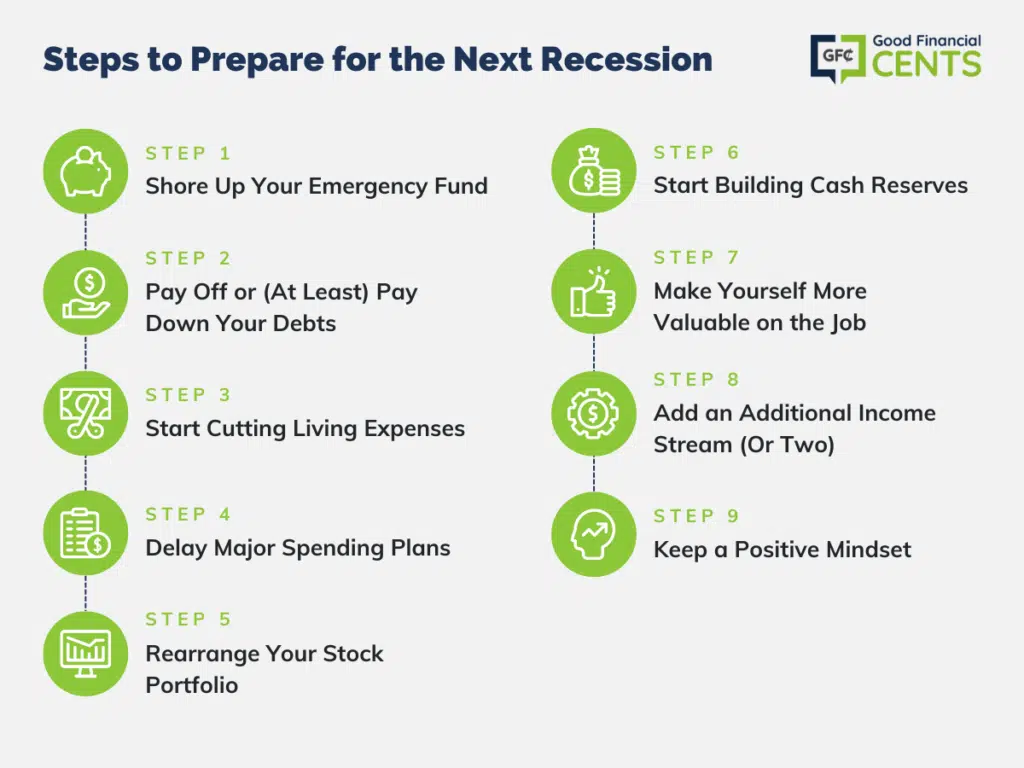

With that in mind, how to prepare for the next recession can be accomplished with the following nine strategies:

1. Shore Up Your Emergency Fund

Emergency financial needs can crop up at any time, but they can be more frequent during recessions. But apart from having funds set aside for emergencies, it can be liberating to have cash in the bank to cover you in case you lose your job.

While you don’t want to get too carried away putting money into savings, you may want to increase your emergency fund from three month’s living expenses to six months or more. Just having that kind of money in reserve can reduce the fear of losing your job.

By moving your savings over to one of the best online savings accounts, you’ll earn many times more than your local bank is probably paying you.

When a crisis hits, nothing feels quite as good as money in the bank. Now is the time to stock up on it.

2. Pay Off or (At Least) Pay Down Your Debts

An oncoming recession may not be the best time to take on a long-term project like paying down your mortgage early. But it’s an excellent time to pay down or pay off other debts.

Topping the list are credit cards. Since interest rates typically range between 15% and 25%, paying them off is an excellent strategy to improve your cash flow. Another good strategy is to transfer your high-interest credit cards to a 0% balance transfer card.

That can eliminate interest payments for 12 to 24 months, so more of your payment will go toward your principal. And as it does, you’ll be able to pay off your credit cards faster.

Next in line would be auto loans or other types of installment financing. Though interest rates on these may be low, high fixed monthly payments may be something you can’t afford after a potential job loss.

Just getting a payment off your plate can be a major stress reliever.

And while you may not be able to pay off your mortgage, you may be able to lower the payment by refinancing into a lower-interest loan. That’ll be an especially smart strategy for interest rates to rise before or during the recession.

Paying off student loans – there’s no easy answer here. If it’s a relatively small amount, it may be worth paying off just to get rid of the payment (or to avoid the possibility of default). But a large amount is much like a mortgage.

Paying it off requires a long-term commitment. You may be better off keeping the funds liquid for emergencies than trying to tackle a large loan balance on short notice. Crunch the numbers and use your best judgment.

There are strategies to pay off student loans more quickly, but you’ll need to be prepared to fully commit to the effort. Investigate strategies and see which one will work best for you.

If paying off your student loans doesn’t seem doable, refinancing is another option. By choosing one of the best student loan refinance sources, you may be able to get both a lower interest rate and a smaller monthly payment.

That will make your student loan payment go away, but it can make it a lot more manageable.

3. Start Cutting Living Expenses

This is where you can release your inner penny pincher. If you have any expenses that aren’t absolutely necessary, now is an excellent time to reduce or eliminate them.

Paying off or paying down debts is one of the single best ways to cut living expenses. Once you pay off a debt, it’s no longer an expense.

But apart from debt, review all your expenses. If you have a Hulu or Netflix subscription you hardly use, get rid of it.

Have you been thinking about cutting your cable? Now may be the time. If you have a gym membership but you never go to the gym, that’s another target. Just make sure you have alternative methods for keeping fit.

Insurance. Now is an excellent time to do a complete re-evaluation of your insurance policies.

Insurance has become a major expense in most households, and premiums can often be reduced with periodic reviews. Committed to finding the best insurance in each category – life, health, disability, business, and even pet policies.

Food is another cost that’s a potentially rich target for cutting expenses. Start with restaurant meals. If you eat out twice a week, cut it down to once. Eat at lower-priced restaurants and take advantage of coupons and specials.

With grocery shopping, look into wholesale clubs. You’ll have to become a member, but you’ll probably get back the cost of the membership on your first shopping trip.

If you have one in the area, check out ALDI. It’s unconventional for a food store, but you can seriously cut your grocery bill shopping there.

Finally, if you’ve never had one before, get serious about implementing a budget. There are free budgeting apps you can use to organize your finances. Sometimes, just having your income and expenses recorded on one platform makes a budget more doable.

4. Delay Major Spending Plans

If you’ve been thinking about trading up to a new home or buying a new car, consider delaying the purchase for a couple of years.

One of the situations that gets people into financial trouble during a recession is making a major purchase – and taking on a bigger monthly obligation – just before the downturn hits.

This is especially true of buying a new house. House prices are at all-time highs, reaching levels even higher than they were before the last housing meltdown. That should be a red flag.

It isn’t just the basic cost of the house either. When you transition from one home to a more expensive one, other expenses often increase as well.

That can mean higher utility costs and property maintenance, as well as the expenses that inevitably come whenever you move into a new home.

A little bit of caution now can save you major financial trouble later.

5. Rearrange Your Stock Portfolio

This doesn’t mean it’s time to dump your stock holdings. But it may be an excellent time to begin redirecting your portfolio to safer alternatives.

Try these:

High dividend stocks. If the stock market goes down with the economy, there will be a shift in investor focus. Income becomes more important when growth is less certain. You may want to favor high-dividend stocks over growth stocks.

Consider moving some funds into a category of stocks known as dividend aristocrats. Those are stocks of large, well-known companies that have been increasing their dividends for at least the past 25 years.

If you’re going to be making changes in your portfolio allocations, now may be an excellent time to consider changing brokers.

A lot of changes have taken place in the brokerage world, including the implementation of zero-commission trades in the past few months. Investigate the best online brokers for you, and make the changes while the markets are still behaving.

Real estate investment trusts (REITs). They’re something like mutual funds that invest in commercial property.

For example, a REIT may hold a portfolio of retail properties, office buildings, or large apartment complexes. It’s a way to diversify a small amount of money across many different properties and even geographic locations.

REITs pay regular dividends, offer capital appreciation, and even have certain tax advantages.

And their performance has historically been equal to or better than stocks. Equity REITs have outperformed stocks with an annualized return of 18.8% from 1994 to 2021.

REITs are a good way to diversify your equity allocation away from an all-stock portfolio. They may continue to produce positive returns even if stocks decline.

Pare down company stock. If you have a lot of company stock in your employer-sponsored retirement plan, you may want to consider reducing your exposure.

Financial problems with your employer will not only impact your job, but it can cause the value of your stock to decline. Having too much stock in the company you work for can be a double jeopardy situation in a recession.

6. Start Building Cash Reserves

This doesn’t mean selling investments to raise cash. Instead, hold your new investment contributions in cash and cash equivalents.

This will accomplish three important objectives:

- Any funds held in cash will be safe from market declines.

- The higher cash position will reduce the volatility in your portfolio.

- When the bear market ends, you’ll have cash reserves available to buy stocks and funds at much lower price levels.

There’s one more point – when the financial markets come unglued, cash is the only truly safe investment. By building up your cash reserves, you’ll be creating a truly safe corner of your investment portfolio.

7. Make Yourself More Valuable on the Job

Recessions mean staff reductions. In the last recession, the unemployment rate topped out at around 10%. But the good news is that 90% of workers didn’t lose their jobs.

That’s the group you’ll want to be part of when the next recession hits. Promise yourself you will.

The best way to ensure that is to up your professional game. Get any certifications, professional training, or skill sets now that will make you more valuable to your employer. Yes, people lose their jobs during recessions.

But the most valuable employees keep theirs. By becoming better at your job, you’ll have a much better chance of counting yourself among the survivors.

But there’s a secondary benefit to improving your skills and qualifications. If you do lose your job, you’ll be better qualified for the job search that will follow.

It’s better to implement these strategies now, while you’re still in control of the situation, than to wait until your job becomes a problem.

8. Add an Additional Income Stream (Or Two)

This strategy has at least three major advantages:

- It can provide the extra income needed to implement the other strategies on this list.

- A second income will give you greater strength in a downturn.

- The second income may form the foundation of your next primary income-generating activity if you lose your job.

One of the best ways to develop additional income streams or at least a second income is by creating a side hustle. Essentially, that means becoming self-employed. But doing that with a side hustle makes the entire process easier and less risky.

Think about any skills you have, particularly if you use them in your current job or in previous positions.

But you can also consider the skills you use in your personal life. Any one or a combination of those skills can potentially be monetized and converted into a profitable side hustle.

It’ll take some time to get a side hustle out of the starting gate and up to the point of generating a regular cash flow. And that’s exactly why you should get started on this venture now.

9. Keep a Positive Mindset!

There’s no denying that worrying about your job at the same time your stock portfolio is falling is unnerving.

But a critical strategy when facing any crisis is not to panic. The best way to do that is by being intentional about implementing and maintaining a positive mindset.

There’s plenty to be positive about in what might otherwise be considered a gloomy situation:

- The downturn can help you build motivation to develop new job skills that may ultimately propel your career to greater heights.

- By rearranging your investments and building up cash, you may be positioning yourself for the next major advance in the financial markets.

- It may motivate you to get out of debt.

- You may finally have the incentive to implement that budget you’ve been putting off during the prolonged expansion.

- By creating a side venture, you may be creating an exciting new way to earn additional money. Or you might just be building the foundation for your next occupation.

Concentrate on the positives of a recession, and leave the gloom to others!

Final Thoughts on Being Prepared

All this preparation is – more than anything else – taking greater control of your finances. If you’ve been doing that during the expansion of the past 11 years, you should be even more motivated before and during the next recession.

And in what may be the ultimate way to put a positive spin on the potentially negative situation, remember that all recessions are temporary. There may be some turbulence along the way, but you’ll survive it and go on to thrive.

This was extremely useful and I will be passing the details of your website to family and friends given the current economic situation.