Creating an estate plan, writing down your last will and testaments, and identifying a healthcare proxy doesn’t seem like a fun way to spend a weekend.

However, organizing your end-of-life paperwork and making sure you have a plan for your finances are some of the most important tasks you can complete as an adult. After all, you don’t want your family to make difficult decisions in their grief or struggle to pay for your care.

By preparing your end-of-life documentation now, you are making a selfless decision to prevent your family from lengthy court proceedings and stress both before and after you pass away.

Table of Contents

Your Last Will And Testament: 5 Reasons It’s A MUST Have

You can prepare your finances by ensuring you have the proper levels of insurance, saving throughout your life, and investing wisely. By doing this, your estate will potentially have some value, and thus, it will be helpful to your family to have a thorough estate plan in place.

Learn more about the five main reasons you need to prepare your end-of-life finances below.

Reason #1: Most People Don’t

You should prepare your end-of-life paperwork because, well, most people don’t.

In fact, according to a Gallup poll, only 44% of adults write down their last will and testaments. Maybe it’s because it’s not a pleasant topic. People don’t like to think about their own mortality.

Or, maybe they think creating these legal documents will be too expensive. Spoiler alert: It’s not.

If you have a relatively straightforward estate, you can actually create your will yourself online, which will run you somewhere between $20-$100, which is far less than the cost of an estate planning attorney.

REMEMBER:

However, if you have an estate worth millions of dollars, it would be wise to speak with an estate planning attorney.

Even though their advice might be expensive, they could potentially save your family money if they have an exceptional understanding of the laws and rules regarding estate planning laws and estate taxes.

Again, even though this type of paperwork isn’t fun to complete, it’s necessary for your family’s well-being.

Additionally, please keep in mind that creating your last will and testaments isn’t just for the elderly. All adults should take the time to complete this paperwork, even if they don’t currently have a spouse or dependents.

Reason #2: It Puts You In Control

You might be wondering why someone who doesn’t have a spouse or dependents should plan their end of life paperwork and finances, but it’s pretty simple, really.

Things like:

- You get to write down what your hopes are for whatever you leave behind.

- You get to say whether or not you want to be resuscitated if you get too sick and stop breathing.

- You get to say who gets your gold watch and which charity will benefit from a portion of your investments.

Instead of leaving things to chance or hoping that someone remembers your wishes, write them down. Remember, just because you prepare your last will and testaments today doesn’t mean that you can’t change them.

In fact, any time you have a big life event (like having children, for example), you should go back and re-examine your will. If you do have children, buying term life insurance is a must if they’re young so you can ensure they have the same quality of life, even if you’re not there.

When it comes to your last will and testaments, you can include things like who you want to raise your children should something happen to you, where you want them to go to school, and even what traditions you want them to have.

Really, it’s so much more than legal documents; it’s a comprehensive list of how you want your family’s life to be in your absence.

This will not only give your family clear directives, but it will also give you peace of mind. You will be able to rest easy knowing that you clearly wrote down your expectations for your family, especially when it comes to the things in life most important to you, like your children.

Of course, once your children are older, you can adjust your will since you won’t have to assign a caregiver to them. You can also add grandchildren to your will as they come!

Reason #3: Your Family Won’t Have to Skimp on Your Medical Care

When you take the time to plan for your end-of-life care both from a medical and a financial perspective, you are more likely to get the type of care you want.

Additionally, your family members won’t have to make difficult decisions about your care if they have clear directives and funds to pay for it.

There have been numerous cases in the news lately of families struggling with decisions over life support and other serious medical considerations.

Don’t put your family in a bind. Tell them what you want to happen should you get sick and can’t speak for yourself.

Some examples of things to think about include where you’d like to spend your final days.

- Would you rather be at home with a skilled nurse taking care of you?

- Would you rather be in a nursing home or some other type of assisted living facility?

- Do you know whether or not you want to be resuscitated should you get ill and stop breathing?

These are things that can be included in your last will and testaments or even a living will, which is a document that states your preferences for medical care while you’re still alive.

Again, although these topics aren’t pleasant, they’re incredibly important to think about so you can create a plan. We tend to think we will live a long time, but medical directives are important to write down even if you’re young.

You never know what’s going to happen or if you will be in a serious or unexpected accident in the future.

Do your family a favor and think through these decisions now while you’re well.

REMEMBER:

Reason #4: You Can Prevent Any Financial Uncertainty

You’ve spent your life working, saving, and accumulating wealth. What are your hopes for your financial legacy? Do you want to pass your wealth down to your children, set up trusts for your grandchildren, or donate funds to charity?

You can put all of these wishes and plans in your last will and testaments. By writing down exactly what you want to happen to your investments as well as your personal belongings, your family will have clear instructions on what to do.

By getting the proper levels of insurance, your family won’t have to stress about paying for a funeral or paying for your final hospital bills.

Even basic levels of insurance are relatively affordable for someone with a low income, so take the time to research your options and get quotes now.

The younger and healthier you are, the more affordable insurance like term life insurance is. Again, by completing these tasks ahead of time while you’re of sound mind, you’ll take the stress and worry away from your family later in life.

Reason #5: Your Children Won’t Be Burdened

This is perhaps the most important reason for preparing your end of life documents. You might not realize this but if you don’t create a last will and testaments, your children won’t get to decide what to do with your estate.

Rather, according to the AARP, your estate will be settled in court.

A judge chooses someone called an administrator to manage your belongings, finances, and more. It will be up to them, and they “will most likely be a stranger to you and your family.”

This isn’t exactly a comforting thought to a spouse or children who are grieving.

Also, this court process could take an extended amount of time, delaying your children from receiving any financial benefits from your estate. By creating a last will and testaments, you are saving your children from the burden of going through court proceedings while they are grieving your death.

Because you put everything you wanted in writing, you are saving them hours and hours of time, a time they’d probably rather spend remembering you.

Ultimately, preparing for your end of life finances and completing all necessary documentation for the end of your life is an incredibly important process to complete.

It might take a few days or weeks to get all of your paperwork and insurance coverage in place, but you won’t regret it and your family will be incredibly grateful you thought ahead.

When Should You Use a Living Trust?

First off, not everybody needs a trust.

Typically, they are most appropriate for folks who have sizable estates.

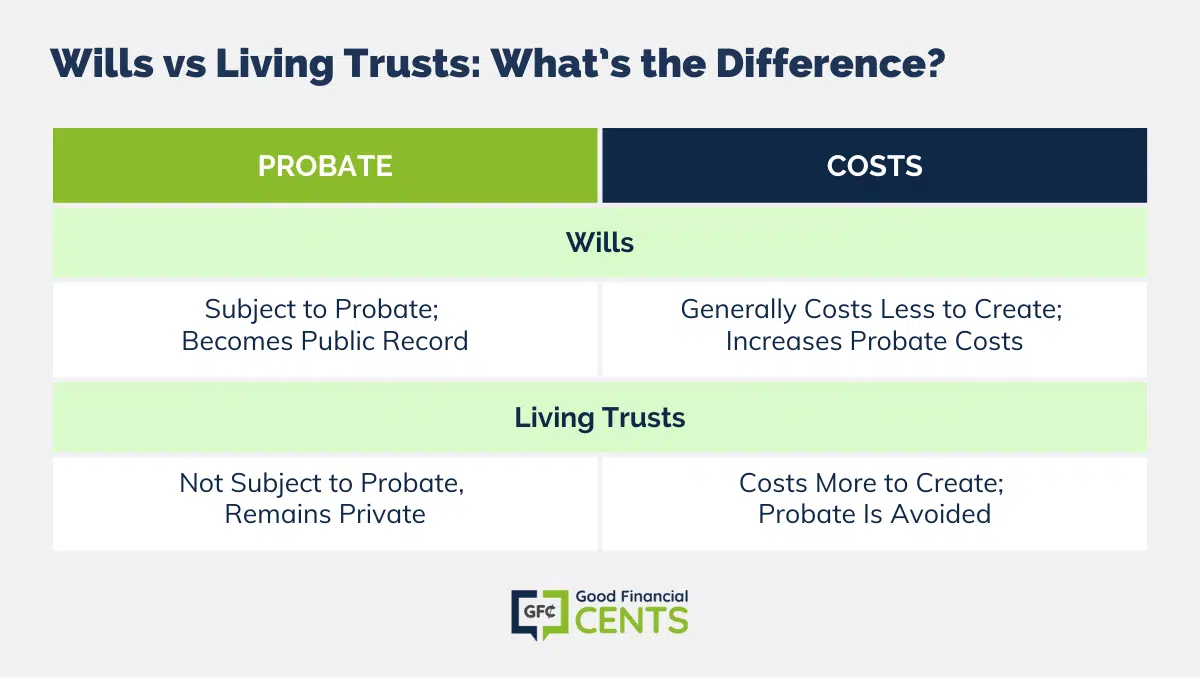

For example, people with who likely need trusts will have approximately have an estate of $1 million or more. When you have an estate of this size and you do go through probate, you can expect that court and legal fees will cost around 2-4% of the total estate.

This is where setting up a trust will usually pay for itself.

How to Name Your Trustee

Most people will name themselves as the trustee as the trustee’s role is to manage the trust’s assets.

A husband and wife will usually serve as the primary trustee and then carefully select a successor trustee they feel will manage the trust the most appropriately.

The successor trustee can be an individual (you better choose wisely) or a financial institution (bank or corporate trustee). A corporate trustee will be much more expensive, but you take the human element out.

Remember, you can always change your successor trustees at any time.

REMEMBER:

What Can You Put in a Living Trust

Almost any type of asset can be placed in a trust:

- savings accounts

- stocks

- bonds

- real estate

- life insurance

- business interests

- personal property

To fund a trust, one simply changes the name or title of one’s assets to the name of the trust.

Spouses and Domestic Partners

Since a living trust can hold both separate and community property, it may be a convenient estate planning vehicle for spouses and registered domestic partners to plan for the management and ultimate distribution of their assets in one document.

What Happens When You Die Without A Will or Trust?

This is one of the most common questions asked around the idea of wills.

First, let’s understand what it means to die without a will.

To die without a will, the legal term refers to dying “intestate”, which means you didn’t have a will drafted before you died, or your will doesn’t meet the requirements of the state law that you’re residing.

When dying without a will, almost everything is subject to probate. Previously, I had interviewed a local estate attorney, Carey Gill, and these were her remarks regarding what really happens when you die without a will:

While probate is usually the standard, you may also pass $100,000 with a small estate affidavit with or without a will.

Probate allows for clean titling of your assets to go directly to your next of kin.

One potential downside of probate is your matters are made public and anybody is allowed to make a claim against your property.

Another way of looking at probate is basically everything you have left over, you are leaving subject to your state government’s laws and regulations to determine how you wanted your property distributed.

So, if you are comfortable having the state determine how your assets get split up, then probate might be okay for you. That still doesn’t mean you shouldn’t have a will.

What Does a Will Really Do?

Many people don’t seek out getting a will drafted because they don’t understand what it really does or they think it’s only necessary for people with tons of money – not the case!

Here are the 3 main functions that a will allows you to do:

- It allows you to give away the property you own in your name the way you want to.

- It allows you to nominate an executor to take care of all of your last affairs as far as paying bills, etc.

- It allows you to nominate a guardian for your minor children.

Of course, if you do not have a will, then none of these will be accomplished in the way that you will see fit and will be subject to your state laws and regulations.

Are There Repercussions of Dying Intestate Between States?

Between different states, there are different rules, although many stick to a loose sense of how money should be distributed.

Additionally, your marital status, and whether you have children or not (also how many children you have) affect where your belongings go.

If you’re married and have children, often the money is split up into half between your spouse and children. Often the spouse will get one third to one half of the total sum, and the rest is split among the children. This is usually done regardless of the age of the children.

If you have a child who is 15 and another who is 30, they’re probably going to end up with the same amount.

If you’re married but you don’t have children, your spouse gets about the same amount as if you did have children (one third to one half).

The difference is the remainder often goes to the parents of the deceased. If the deceased has no remaining parents, the siblings of the deceased share the money equally among them.

It’s interesting to note, even half-siblings receive a share, no different than siblings who come from the same set of parents.

If you’re single but have children, the law tends to be very clear.

The entirety of the sum often goes to the children, who split it evenly.

Usually, there’s no provision for the other parent of the deceased’s children. This is one of the more frustrating aspects of the law for people who have been in long-term relationships, yet remain unmarried.

No matter whether they have had children or not, the state almost always regards them as single entities.

If you’re single and have no children, your possessions usually go to your parents. If they are deceased, the property is typically split evenly among any siblings you have. The same rule of half-siblings being treated the same as full-siblings tends to apply.

What About Other Circumstances

Family circumstances can be extremely complex, and the explanations above are not meant to cover every person in every state (or country). There are frequently extenuating circumstances that make each probate case a little more finicky.

For cases outside the above-stated circumstances, there are clauses that suggest money should go to grandparents, aunts and uncles, children of a deceased spouse, relatives of a deceased spouse, and finally to the state you were considered a legal resident of.

Final Thoughts on Your Last Will and Testament

Crafting a last will and testament might not be an enjoyable task, but its significance cannot be overstated.

This crucial act provides you control over your legacy, safeguards your family from legal complexities, and guarantees your wishes for finances, medical care, and asset distribution are honored.

Despite discomfort or misconceptions, all adults should create a will, regardless of their life stage. Updating it periodically is wise, especially after major life changes.

Without a will, dying intestate can result in probate, potentially leading to costly and unintended asset distribution. Taking the time now ensures peace of mind and a well-prepared future for your loved ones.

Recently remarried. Husband is a widower with 2 adult children. Had a will made after his wife died. Kids get everything. What should I do. I also have 2 children from a previous marriage.

Hi Christine – I’d recommend discussing it with your husband before you do anything else. Maybe he doesn’t know it bothers you. Otherwise you may want to consult with an attorney.

Could I get all of this information in Canada?

Hi Hector – I don’t know how much applies in Canada, but you can see if there are any online sources for the same information there.