In some cases, a personal loan is desirable.

You may want to start a home business, borrow for a vacation, or have some other use for the money.

Whatever the reason is, getting a personal loan can give you the money you need. A personal loan — usually unsecured — can provide you with a little extra cash to help you meet your goals.

Actually securing that personal loan can be a bit difficult, though. Many people find the process scary, and they don’t know where to begin.

But I can help you navigate the process and offer a few ways to get your personal loan approved.

Table of Contents

And if that doesn’t work, we have some other options, too.

Easily Compare Loans

Credible

There are several places where you can get rates for personal loans. One of my favorite sites for comparing quotes is Credible. Their form is quick and easy to fill out, and you’ll be comparing loan rates in no time.

You only have to input what type of loan you want, the amount, your zip code, and a bit of other basic loan information, and then they provide multiple loan options for you.

Guide to Lenders

Guide to Lenders has been offering its free quoting services to customers in need for over 10 years, granting users access to quotes from more than 150 lenders. In just 5 minutes, you can see a wide array of options for your personal or home loan with Guide to Lenders.

Qualifying Through Your Bank or Credit Union

It’s becoming increasingly difficult to qualify for a personal loan through your bank or credit union, especially if you want a larger amount, but it is possible to get a reasonable loan if you meet the requirements.

Unsecured Personal Loans

Unsecured personal loans are great if you lack the collateral needed for a secured loan. Due to the enhanced risk the lender takes, unsecured loans come with higher interest rates and steeper credit score requirements. You can also expect to find short loan terms and smaller amounts of funding available.

Once again, LendingTree can unlock all of your options, presenting you with a comparison of your top options for unsecured personal loans. It will give you access to banks, but also online lending sources.

If you are a good customer and have good credit, you could get a “signature” loan for $3,000 to $5,000. These loans, also called “character loans,” are offered through banks. To give you an idea, you’ll probably need above 700 if you want to even be considered for an unsecured personal loan).

Not sure how your credit looks? Use services from Credit Sesame, Credit Karma, and Transunion to figure that out first.

Secured Bank Loans

Most personal loans are going to be unsecured; however, there are a number of unsecured loans available for personal financing needs. If you want a bigger loan, you’ll need a personal one, and you will need to jump through some hoops.

You will need to fill out a loan application and designate collateral. The collateral you offer for a personal loan might be your car or a savings account.

While secured loans typically come in the form of auto loans or mortgages, you can find a number of secured loans from banks, credit unions, and lending companies.

A secured loan will likely give you access to bigger loans and far better interest rates, and the credit score requirements might be less stringent.

Other Options for Personal Loans

If you have poor credit or don’t think you can receive an affordable loan from a bank or credit union, don’t worry. There are other options for personal loans, beyond your bank or credit union. Some of your other options include:

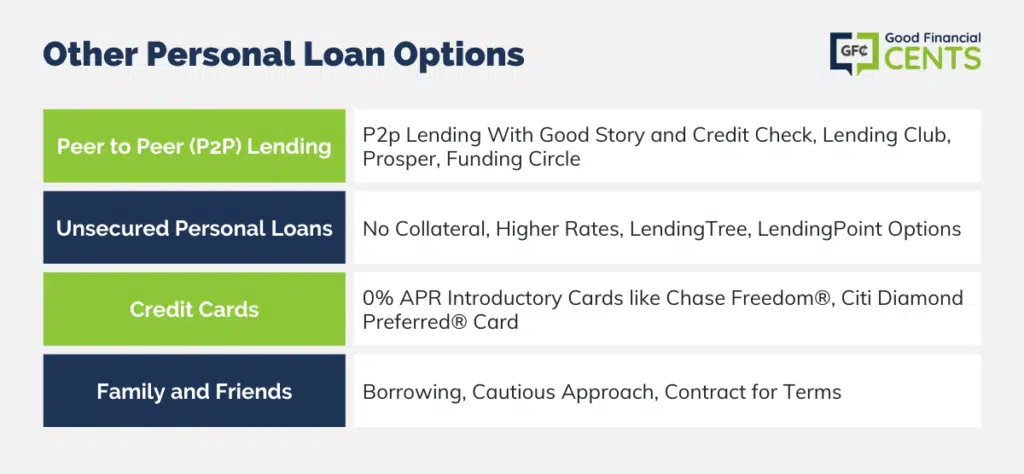

Peer to Peer (P2P) Lending

One increasingly popular option right now is P2P lending. Whether you are financing a business, paying for college, or trying to buy a motorcycle, P2P lending can help.

You will have to apply for the loan, and your credit will be checked. BUT, a good story and business plan can help get the funding you need — and at a competitive rate.

Interested in learning more? Check out:

These are leaders in the P2P lending space with solid processes for loan origination, repayment, and tracking.

My Lending Club review can help you get a better feel for how peer-to-peer lending works and whether it might be a good option for you.

Unsecured Personal Loans

Unsecured personal loans can provide a path toward your financing needs if you lack the collateral needed for a secured loan from a bank.

Since you aren’t putting up a savings account, CD, or purchase as collateral, you’ll find different terms with an unsecured loan.

Due to the enhanced risk the lender takes, unsecured loans come with higher interest rates and steeper credit score requirements. You can also expect to find short loan terms and smaller amounts of funding available.

If you have a solid credit score and only need a small amount for a short period of time and either lack the means to or prefer to hold off on putting up your possessions and investments as collateral, an unsecured personal loan could be a viable alternative to a secured one.

Once again, LendingTree can unlock all of your options, presenting you with a comparison of your top options for unsecured personal loans.

Another option to check out is LendingPoint.

Credit Cards

Many of us don’t think of credit cards as loans, but, in reality, your credit card constitutes a personal loan. If you have good credit, and you are hoping for a larger limit, you can apply for a new credit card. You can boost your available credit, and then draw on that for your personal use.

However, credit cards usually have relatively high interest rates, and if you carry a balance, you could wind up paying quite a bit. Try to get a new card with an introductory period, and you will have an interest-free personal loan.

Here are some of the best credit cards you can get with a 0% introductory rate for either purchases or balance transfers:

Chase Freedom®

- 0% APR on purchases and balance transfers for 15 months

- Earn 1x points on all purchases, plus 5x points on the first $1,500 spent in categories that rotate every quarter

- Earn a $150 signup bonus when you use your card for just $500 in purchases during the first 90 days

- No annual fee

Citi Diamond Preferred® Card

- 0% APR on purchases and balance transfers for the first 21 months

- No annual fee

- Access to Citi® Private Pass® travel program

- Worldwide Travel Accident Insurance

- Travel & Emergency Assistance

Family and Friends

If you have family members or friends who can help you out with the personal loan you need, you can often get the best loan terms.

However, you want to make sure that you are positive that you can repay the loan; you don’t want to risk your relationship. Have a contract so that you are accountable, and so that your friend or relative knows that you are serious. Be sure to include the loan term and the interest rate in the contract.

While I wouldn’t recommend using friends or family for a loan, sometimes it’s the best (or only) option.

Before Getting a Personal Loan: What to Know

We are going to be honest, getting a personal loan isn’t easy. There are a lot of things you need to consider before you apply for a personal loan.

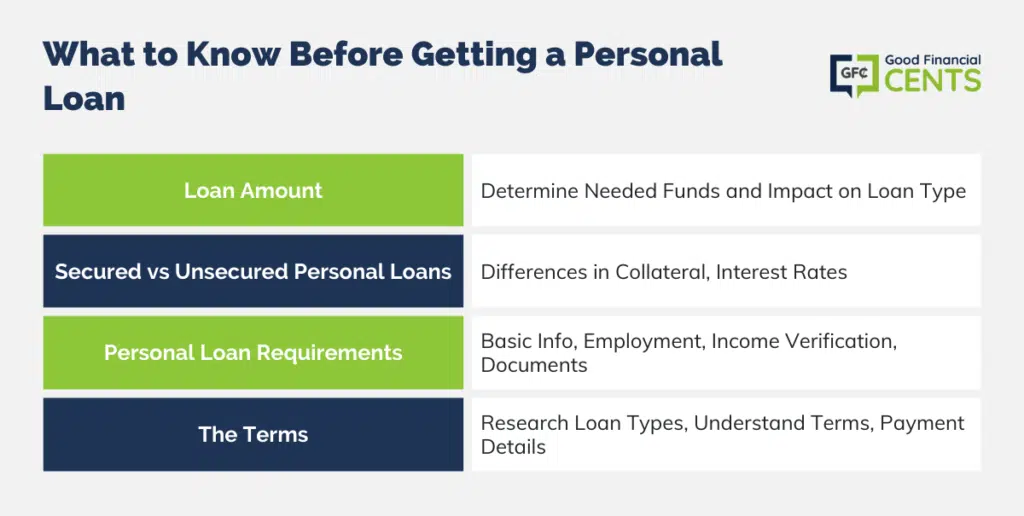

Loan Amount

The first, and most obvious, is to decide how large a loan you actually need. This might seem like a ridiculous tip to include, but it’s important enough to reiterate.

Before you apply for your loan, sit down and calculate how much money you will need. That amount will impact the type of loan you pursue.

Secured vs Unsecured Personal Loans

Understanding the differences between these two types of loans is critical as you decide your goals and shop for rates.

A secured loan will usually give you lower interest rates, but you have to put something up as collateral. If you don’t pay back the loan, they take your collateral. While unsecured loans don’t require any collateral, they will have higher interest rates.

Personal Loan Requirements

Just about every loan is going to require basic information like address, birthday, and social security number. You will also need employment information, like your work history and pay stubs to verify your income. You will need to provide other sources of income like alimony.

Depending on the loan type and amount, the lender may ask for other documents like a copy of your W-2 and tax information, as well as proof of address, bank statements, and mortgage or rent statements.

The Terms

Once you understand the basics, you should spend some time researching the different loan types, examining which might work best for you. There are several different ways to get a personal loan, and not every type will be a good fit for your situation.

Fully understand the type of loan you are getting, the loan period, the payment methods, payment amounts, and any other important information.

Final Thoughts on Personal Loans

If you are looking for a personal loan, there are a number of options.

From payday lenders (which you should avoid as much as you can), to credit cards, to friends and family, to random strangers via P2P lending, chances are that you can find a personal loan. But, depending on your situation, you might have to pay a lot for it.

Whichever path to a personal loan you select, make sure you track your finances well using a budgeting tool like Mint or Manilla. Both of these apps sync up with your financial accounts and are easy to use.

They can show you all of your bills in one place, making sure you don’t forget any debts. You don’t want to have to take a personal loan out during a pinch and end up paying thousands in interest and late fees from mismanaging your money.

Disclaimer

Our minimum annual income is $35,000 alimony, child support or separate maintenance income need not be revealed if you do not wish to have it considered as a basis for repaying the loan.

Offer Terms and Conditions:

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents. Applications submitted on this website may be funded by one of several lenders, including FinWise Bank, a Utah-chartered bank, member FDIC; LendingPoint, a licensed lender in certain states. Loan approval is not guaranteed. Actual loan offers and loan amounts, terms and annual percentage rates (“”APR””) may vary based upon LendingPoint’s proprietary scoring and underwriting system’s review of your credit, financial condition, other factors, and supporting documents or information you provide. Origination or other fees from 0% to 6% may apply depending upon your state of residence. Upon final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day. Loans are offered from $2,000 to $36,500, at rates ranging from 9.99% to 35.99% APR, with terms from 24 to 60 months. A $10,000 loan with an origination fee of 6% for a period of 24 months with an APR of 24.0980% may have a payment of $529.20 per month (actual terms and rate depend on credit history, income and other factors). The total amount due under the loan terms provided as an example in this disclaimer includes the origination fee financed in addition to loan amount, which is $12,700.80. Customers may have the option to deduct the origination fee from the disbursed loan amount if desired. The total amount due is the total amount of the loan you will have paid after you have made all payments as scheduled.

1. Alimony, child support, or separate maintenance income need not be revealed if you do not wish to have it considered as a basis for repaying this obligation.

2. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law concerning FinWise Bank is the FDIC Consumer Response Center, 1100 Walnut Street, Box #11, Kansas City, MO 64106. The federal agency that administers compliance with this law for LendingPoint is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC 20580.

Thanks for the information and posts 🙂

We give loan to interested borrowers

we are affiliated to banks of America and we work with the united states credit bureau we give out loans on a clear and understandable terms and conditions at an interest rate of 7% from as little as $1000 to $10,000,000.00 USD applicants can reach us via [[email protected]]

I have been doing this for 2 days. Got scammed. God all I wanted was 200 dollars. Now I’ll have to resort to crime. Drugs to sell buy

I need to take a little equity out of my apartment?

Hi Joanne – Unless you own your apartment, you can’t take out equity. Equity loans are strictly limited to assets you own.

I’ve been tryin to apply for a loan and all I’m getting is spam ppl call in me back and. I’m so sick of it

I’m from belize and we don’t have a zip code for our country.is it possible for me to still barrow a loan without it?

Hi Tanya – It has less to do with a zip code than with the country you live in. Most P2P lenders are US based and lend to US customers. You can check and see if any also operate in Belize. If not, do a web search to see if there are any in your country.

I’m trying to get a personal loan for $15,000 for credit card debt. My fifco score is a 688 and I have 99% on time payments and I had my fiancé co-sign because my income is only 16,000 a year and his is $43,000 and he is salary. My oldest credit card is 4 years and 5 months. The only thing on my credit that could be considered as bad is I co-signed on a car loan with him that was $30,000 and we still owe $21,000 on it and have had the loan for 2 years and he has missed one payment. What are my chances???

My credit score is 589. I’m really trying to get it higher. The problem is I have about 6 small personal loans from $300 to $900. I want to get one big loan like 6k to pay off all loans and just make one payment a month but no bank will approve me.

Hi Michelle – Work on paying off the loans one by one for now. Use the “debt snowball” method – payoff the smallest one first, then the next smallest one. After you get a couple of the loans paid, then reapply for a personal loan. Two paid off loans should improve your credit score enough to qualify. Lenders love paid loans, and so do the credit scoring models.

Loan Balance: $100,000.00

Adjusted Loan Balance: $100,000.00

Loan Interest Rate: 3.00%

Loan Fees: 0.00%

Loan Term: 10 years

Minimum Payment: $0.00

Monthly Loan Payment: $965.61

Number of Payments: 120

Cumulative Payments: $115,872.84

Total Interest Paid: $15,872.84

Note: The monthly loan payment was calculated at 119 payments of $965.61 plus a final payment of $965.25

My gross income is 63,000 with my spouse and my credit score is 595 via experian. I’m looking to get a $5,000 with One Main…what are the odds?

Hi Louis – You won’t know until you try. It is possible to get a personal loan with a 595 score, so if it doesn’t work with One Main, try another site.

Dear Jeff,

I’d like yoir opinion on my case please, if possible. I made a planned overdraft to rent my house in December 2015, of 5000£, in Lloyds bank. Once that I more or less have been having the same income, the overdraft is still in the same situation. My house deposit is 2200£, an amount saved though. I work full time but also a part-time university student. I wasn’t very worried with the situation because actually it raised my credit rating and I never missed a payment of anything in my life. But, probably as you might know, LLOYDS bank changed their overdraft rates since February amd who has big overdrafts like me, is terribly losing in this situation. Now I’m having a daily fee of more than 7£, which makes around 230£ fees/month. I tried to ask a personal loan to them, of the same amount, which I would have a monthly payment of 125£ and could pay it totally in 4 years. They do not accept because I have the overdraft which is ridiculous because if I can pay the 230£ monthly fees, obviously I can pay 125£ monthly for the loan right? … What I see here is the bank taking advantage of this kind of situation, they say people with small.overdrafts are actually winning with the rates changes, well is just a well played movement from the bank once that customers who use a big overdraft don’t get rid of the situation that easily. The only suggestion I had was to make a debt consolidation that would give me a bad credit rating which I really don’t deserve if I always meet my expenditures. Is rhere any way of of this situation because this way I’ll keep paying them this amount eternally and never actually pay the planned overdraft. ..thank you for any suggestion.

Hi Vanusa – Unfortunately I can’t answer your question. I’m not familiar with how banking works in the UK, nor the laws that govern it. My suggestion is to discuss it with a UK based expert or authority. Sorry!

Hi, I have tried every source but credit union and no one will lend us $30,000 that we need to pay off our lawyer or we may loose our home my husband has credit of 752 but won’t get accepted because he has little to no credit history. We don’t no what else to do.

Hi Angie – Have you talked to the attorney about a payment plan? Also, if your husband’s credit score is 752 how is it that you’re losing your home???

I’m in need of a personal loan of 12,000 to pay for my Mom’s surgery back in my country. My credit score is 757 but then I don’t have much credit history ( Just have one credit card for 3yrs with $1500 and recently got another with $10,000 – a month back). I’m not sure if my reason is good to get the personal loan. Please suggest.

Hi Vishal – If you apply for a loan on sites like Lending Club or Prosper, the reason for the loan isn’t usually an issue. You can list that as the reason, or something else. Basically, if you qualify, you’ll get the loan.

I just had a newborn and things are kind of tight. I need $3000-$5000 to put me in a space of financial freedom. I have steady income, credit score of 599, and will be going to open an account at a credit union this week. My question is with this type of situation what would be the most efficient way for me to get the money I need in a timely fashion. I make $13/hr fulltime. I applied for a personal loan through Onemain and it was a system decline. Plz help

Hi Derek – Your best bet may be to apply for the loan with the credit union. They may even give you a credit card for opening an account. No guarantees of course, but credit unions tend to be more forgiving with loans to members.

Im searching for a loan to purchase a home in the Dominican Republic. Would u advise applying with a bank in the country or one from mu credit union here in the US?

Hi Eliyah – It’s not likely that a credit union in the US will approve a loan on a property in another country, but you can look to take an unsecured personal loan and use the proceeds to buy the home. Otherwise you’ll need to get financing in the Dominican Republic.

I got myself in credit card trouble awhile back. I stopped using them and am now looking at trying to get a debt consolidation loan. I’m only paying interest on one of the credit cards, but I would rather pay some interest and get them all consolidated into one payment. I have never had a late payment, but because of inquiries and the amount of debt, my credit score is in the low 600s. The only ones I think I could get approved for are way too high of interest. I am thinking my best bet is to just keep paying towards all of them and try to get my debt down before trying to get a loan. Do you think this is my best bet or does anyone think I would have a chance for another option. I would need just under a 20k loan to get ALL my debt consolidated (including credit cards and two loans). Any ideas would be greatly appreciated!

Hi Aleece – You can try the peer-to-peer lenders. Some go as low as 600, but the rates are high. Failing that, you’re paydown idea is excellent.

I was wondering….with a credit score of 700 and 2 major credit cards, and a Kohls card, and no other debt…would I be able to get a credit union personal loan for $3500? My income us about 30k/year.

Thank you for your time.

Hi Crystal – With those numbers you should have no trouble getting a loan from a credit union. I don’t know about a personal loan, but they may offer you a credit line of $3,500 instead. Credit unions generally have better interest rates than other places too, so you’re making a good choice.

Hey Jeff,

Great info and advice! My situation is a little tough so I wanted to get your opinion? I am finalizing a 6 year divorce process, put through the “ringer” with support and obligations etc. Basically I was ordered to pay around $2800 per month in the beginning and eventually had it lowered to $800. My credit suffered tremendously, I did not get approved to refinance my home so it was lost in foreclosure. My ex did not help financially and I have 2 young children who I Love more than anything. I am self employed and looking to get a personal loan now since I am in between commissions and wanted to know any tips on applying to my credit union before going there? I am not looking for pity but wanted to be honest about my situation. Your thoughts??

Hi JM – You’re in a tough spot. But since you’re on commission (and “between commissions”) your income is unsteady. But lenders, including credit unions, get around this by averaging your income. Even if you have a month or two without an income, they will likely average your income over two or three years, so your annual income will be more important.

Try with your credit union, and see what they do. Then try P2P sites. It will depend on the level of your income as well as the actual state of your credit. The foreclosure will be a major factor if it’s within the past 3-4 years. If it’s older, it won’t be so damaging – so long as your credit since has been good. No guarantees here, I’m afraid.

Can I get a loan with a credit score of 573. I have monthly direct deposit and payments can automatically be drawn out.

Hi RM – Not from a bank, but very possibly from a P2P lender. The only way to know for sure is to make an application and see how it turns out. My guess is that you’ll get a loan, but your interest rate will be high with a 573 credit score. But give it a shot.

I’ve been with WellsFargo over 10yrs I applied for a unsecured personal loan & turned down. I checked my credit history my house shows paying on time over$855 for over $85000never late,paid off car 4yrs never late$353, credit card $650 balances & a unpaid hospital bill that went to collections!!!

My credit score is 813 !!!

I need $20000

Hi Christopher – With a credit score that high, you should be able to get a loan approved just about anywhere. I’m guessing the problem is income related, since your credit score is near the maximum. Try different banks, and failing that, check with a credit union. They tend to be more accommodating. If that doesn’t work, you may have to go the secured route, and maybe even get a second mortgage or home equity line against your house.

I think you made some good points in this post. Thanks for sharing this article. I have known very important things over here about how to get personal loan approval. Again thank you so much for this post.

Hi, I’m thinking about getting a personal line of credit from my credit union, California Credit Union. My Fico is 727 with 100% on time payments and my income is 83k. I have 17 years on the job, own a home, and my credit history goes back to 9 or 10 years. What else could help me guarantee my success in obtaining a personal line of credit? How much could I get with my income and no collateral? I’m looking for about 35k personal line of credit. Would that be asking for too much? I’m using it for small home improvements, pay off credit cards and misc things.

Hi Gina – With the numbers you’ve given, I don’t think you’ll have any trouble getting a personal loan anywhere. But it will all depend upon what the regulations are at your credit union. But I will tell you that peer-to-peer lenders, like Lending Club and Prosper, will lend up to $35,000 for just about any purpose. You should be in good shape to get the loan that you want somewhere.

Hey Jeff

I’m interested in applying for a loan for Debt Consolidation. My credit score is 700+, 100% on time payments, last Inquiry was a year ago. I have 4 years working for Tmobile with an Annual Income of 58,000+. My current Debt in total is 35,000(LendingClub loan & CreditCards). I want to apply for a 40k Loan with Citibank, was wondering if it’s a good idea or rather go to a different bank?

Hi Davey – If Citibank is a major lender in your area it’s certainly worth a try. Even more so if you bank with them already. I prefer not to give direct lender advice, because everyone’s experience with lenders is different. But give it a shot, then report back and let us all know how it worked out!

I’m applying for a loan to start a small business. The loan application at my bank asks for current employment information. Should I still include my current job, even if I plan on leaving to start another business if I get the loan? That feels dishonest to me but maybe it’s a normal situation to be in.

Hi Z – Honesty is the best policy, and I’d never advise anyone to commit fraud get a loan. Let the bank know what you’re planning to do and see what they advise. They may be aware that the business will be your new occupation (the whole reason for the business loan!), but are looking to see what you previous experience is.

I am trying to buy some land and build a house. The land I’m looking at is listed for 150K. With land loans some require up to 20% down payment. Is it possible to get a 30K loan for the down payment for the bigger loan? I have a few years of credit history, owned a credit card over a year, with a credit score around 720. What is the best option in order to get the money for the down payment?

Hi Andrew – That will all depend on the rules of the land loan lender. Some want you to have your own money in the deal. If you’re 20% down payment if from another unsecured loan then you technically have a 100% loan. From what I’ve seen with land loans, even a 20% down payment requirement is low (50% is more normal, due to the fact that land has no income stream).

It is hard for me to get a loan. My credit score doesn’t even exist. I’m trying to rebuild in my life. All my debts are through courts and fines. I have been trying to get a $15,000 loan. The last five years. If I could get a $15,000 loan Irritate me four point five years to pay it off At $300 a month. Being on a fixed income and kills everything. Theres anyway that you possibly help me out would be greatly helpful. or you can tx my cell 870613XXXX. Thank you may you have a blessed day.

Hi Jack – Without a credit score there isn’t much you can do, especially if you’ve got court fines to pay. You’ll have to build up your credit in order to get a loan. Start with credit builder loans at banks and credit unions. They’ll lend you $500 to $1,000, which will be deposited into a savings account, then used to pay the loan payments by automatic draft. The only cost you’ll have is the interest charge on the loan. Since it’s fully secured by the savings account you’re very likely to get approved. Once you’ve had a couple of these loans approved and paid, you’ll have a credit score and then you can go for the $15,000 loan. Good luck.

I have a 700 plus score and looking for a personal loan of 13,000 dollars to purchase an old mobile home which I plan to reside in. The home is located in a mobile home park and is fully furnished. Will they take the mobile home as caladrel even though it’s old? It does have a lot of upgrades.

Hi Gus – There are lenders who specialize in mobile home loans, and it will be up to them to determine if the home is good collateral. But you can also try for a personal loan, since they don’t require collateral at all.

Hello Jeff,

I am looking to apply for a personal loan to start a home business. My credit is an average of a 690, I recently purchased my home about a year ago. I have done extensive research and crunched numbers to request for a $15,000 personal loan. My question is what will be the best avenue to start in securing a loan for my start up?

I do not want to use my house for collateral. For what its worth I have one of my vehicles paid for, and the other I make payments.

Please give me your best scenario of any advice. I would like to have it up and running by summer.

Hi Valencia – You can try getting a credit line at a bank, such as a high limit credit card. Failing that you can try peer-to-peer lenders, like Betterment or Prosper. They can give you an unsecured loan, and you don’t even have to say it’s for a business. They don’t require collateral so your house will be safe. But get the loan before you quit your job. They’re unlikely to approve your loan based on income from a business start up, not the least of which because that income is very difficult to document.

Hi,

So I want to get a personal loan to pay off my motorcycle and pay off my credit card. I have some cash to pay so the mosh I would need is like 5000. I have good credit I’m just not sure where I should go to get the loan. Any ideas ?

I applied for a 10,000 loan with lending club and was denied because i dont have enough credit history, my oldest card is 3yrs old i have a total of 9 accounts, my fico is 726, how much years of credit history do i need before i can qualify for a loan? Thanks.

Hi Nick – I’m not disputing what you’re saying, but that doesn’t sound right. Have you contacted them to get more information? It might just come down to that they didn’t get enough investors willing to fund your request.

One question I always tried to find an answer but always mixed up. Which type of personal loan is better; payday lenders or credit cards ?

Hi Steven – It really depends. Generally speaking, a credit card is good for convenience and short-term needs. But if the need is longer term, or if you need to consolidate credit cards, personal loans are the way to go.

I have been trying to get a personal loan of $2,000. My credit was okay but when my granddaughter credited her car because ger credit was bad they put the car in my name. My granddaughter lost her job a few months ago and did not tell he she had missed payments or I would have helped her. She is now working again but because of the missed payments theft repossesses her car and it made my credit look bad. I need the loan so she can get back her car. I have direct deposit and the payments on the loan would be deducted from my account. I really want to help her cause now she has to take the bus and she has a son so she need her job. Can someone help me pkease.

Hi Linda – Unfortunately, the only way she can get the car back is to put up the money to get it back. If you aren’t able to get a loan, then the money will have to come from another source. This may be a do-over situation, where your granddaughter has to use public transportation or use Uber to get to and from work until she can save up enough cash to buy another car. Under the circumstances, she won’t be able to get a loan, and it looks like your credit has been damaged enough that you’re in the same situation. If you can’t get a personal loan, the only other alternatives are either loans from family or friends, or living on cash. Unfortunately Linda, you probably need to rebuild your credit.

I want to get a loan for about 5000 in order to buy a car and just sell it for more to get a profit. Is it possible to use the car I would buy as the collateral for the bank?

Or if anyone has any advice on this subject would be appreciated!

Hi Chris – You should be able to get a loan, but if you tell them it’s for a fix-and-flip they may not go along. Banks make money by having you pay interest over a the length of the loan, not opening the account and paying if off a few weeks or a couple of months later. Can you get a loan from a private source?

The best way to get your loan approved is to go for a company who offers loan checking your asset guarantees and not your credit.

Hi Ravi – There may be some banks who will make a personal loan if you have a checking account with them already, but most will still run a credit report. The checking account would certainly be an advantage if you have some credit issues, but it usually won’t cause a bank to not run a credit check. And of course, if you open up a checking account, they will usually do a credit check for that!

I have been trying to get a personal loan a lot of problems has been my credit history but seems like I get turned down I have been trying for years to clear my credit history and clearing what is current I have never had a personal loan I was told I needed a co sginer to get my foot in the door my personal family which they do not live in the same state as me I don’t even think it’s fair I have a fixed income that been used against me.

Why can’t I get a loan and the money be deposit in the the bank every month they can get the money back every month if I get a thousand dollar

Hi Latasha – I’m not sure I understand your question. What you’re describing is something like a reverse mortgage, where you sign up for the loan, then the lender provides you with a monthly income. I can’t think of another loan where anything like that would happen.

I loved your tip on using a personal loan budgeting tool. I have a hard time of keeping track of my money. I’m trying to get better at it, I think this tool could be my trick. Avoiding the mountains of interest is my main goal.

I think it’s interesting that if a loan isn’t backed by anything, then they usually have a higher interest rate. I have only needed to get a loan a few times, and I was never sure why my interest rates were the way they were. I will have to double check and see if they took collateral or not.

The problem with getting a loan with bad credit is that you’ve already shown you cannot repay the loan. There is a difference between wants and needs and usually those with bad credit have gotten into problems by having too many wants. Think about all of the bad money mistakes you’ve made. We’ve all done it that dinner out or that pair of jeans on sale. One transaction at a time has caused us to go over our credit limits and just one setback caused a late payment. Before you know it, you are taking loans to repay loans. The lenders know your personality type based on your credit score. What makes you or them think otherwise about your future if your past shows impulse? I don’t blame you for not wanting a cash advance but those are the kinds of companies willing to take risks because they charge such high interest. Your best bet is to increase income and/or reduce expenses. Do you NEED a loan or simply want one to bail out of mistakes you’ve already made? Think about a part time job, getting rid of some services you really don’t need, and developing and sticking to a financial plan that will give you the power to be a lender instead of a borrower. Don’t compound your bad credit with bad choices.

Not entirely true, Jeff. I work for a Credit Union and can tell you that we lend to people whose FICO scores are in the 600’s all the time. It is not limited to 700+. Sometimes special exceptions are made for emergencies (death in family, etc) and that is something that Big Banks will never do. Our rates depend on the score and our signature loans start at $300 and go up to thousands. Yes, we like to use vehicles (etc) as collateral with higher amounts, in order to minimize our risk, but that’s not always necessary. We offer amazing credit card rates with high limits for those who qualify (FICO over 640 and income over $30,000), but we pride ourselves on consumer education, and constantly refer members to our budgeting and debt management website to learn how to use their new tools wisely. Again, this is something that separates us from the Big Banks! 🙂

@ NayNay

Thanks for the helpful info. I’ve often heard that getting loans from credit unions can be more convenient.

Nay Nay

I’d like to know which credit union you are speaking of. Looking for a loan or credit card that would work for me. My credit score is 705, income 30000

Hi Julie – You should be able to get a loan at just about any credit union with that credit score. You can try Massachusetts based DCU Credit Union, the lend nationally even though they’re based in New England.