Qualifying for life insurance protection can be harder when you have a serious health condition.

When you apply for coverage, underwriters determine the risk your life insurance policy would create for the insurance company.

Healthier people pose less of a risk. If you have a chronic or unmanaged health condition, your policy presents a greater risk, and underwriters might not approve it.

Or, if you can get approved for coverage, it may be too expensive.

Sneak Peak: Our Top 4 Companies

**Click here for our complete list below.

The same can happen when senior citizens seek coverage since underwriters evaluate risk based on life expectancy as well as health.

So, if you can’t get coverage, and you need it to protect the people who depend on you financially, what can you do?

One alternative is to apply for a no-medical exam life insurance policy.

Table of Contents

- What Is No Medical Exam Life Insurance?

- Types of Life Insurance With No Medical Exam

- How Does This Type of Life Insurance Work?

- How Much Coverage Can You Purchase?

- How Much Does a Policy Cost?

- Do I Need a No Exam Life Insurance Policy?

- Reasons (Other Than Health) To Get One

- Important Factors to Consider

- Medically Underwritten, No Exam Coverage With Haven Life

- Medically Underwritten, No Exam Coverage With Bestow

- Cheap No Exam Life Insurance Quotes

- Top 15 Best Non-Med Insurance Companies for 2024

- No Exam or Not, Your Coverage Should Fit Your Life

- The Bottom Line – No Medical Exam Life Insurance

What Is No Medical Exam Life Insurance?

A No Medical Exam Policy allows you to avoid the medical exam that is required by most types of life insurance. Skipping the health exam makes approval much easier and gets you the coverage you need more quickly.

Typically, life insurance applicants meet with a paramedical professional, also known as a paramed.

During this meeting, the paramed will:

- Ask Some In-Depth Health Questions

- Get the Applicant’s Weight and Height to Calculate Body Mass Index

- Get a Blood Pressure Reading and a Resting Heart Rate

- Take Blood and Urine Samples From the Applicant.

A lab then tests the samples for various health conditions that could make the applicant a riskier policyholder.

This process can prevent people with hard-to-manage health issues such as diabetes from getting medically underwritten life insurance.

Bypassing the health exam could make qualifying for coverage much easier. And, with no test results to wait for, underwriters can make a much quicker decision.

Naturally, there’s a catch. No exam insurance typically costs more and provides less coverage than a medically underwritten policy because underwriters don’t know as much about the risk your policy would create.

If you are in good health, you should be able to find better coverage at better rates by getting insurance that requires a health exam.

Types of Life Insurance With No Medical Exam

If, however, a medical exam would prevent you from getting covered or would make your coverage just as expensive as a no-exam policy, no-exam life insurance may help.

No exam policies fall into two main categories: guaranteed issue and simplified issue.

Guaranteed Issue Life Insurance

When you apply for a guaranteed issue life insurance policy, not only do you avoid the medical exam, but underwriters do not even see your medical records.

The insurance company knows almost nothing about the risk your policy would present, so a guaranteed issue (sometimes called a guaranteed acceptance) costs more than just about any other kind of life insurance.

When you apply, the company will ask a series of yes-or-no questions, such as:

- Are you currently residing in a hospital or long-term care facility?

- Do you have HIV or AIDS?

- Have you been declared terminally ill (defined here as having less than 24 months to live)?

Based on your answers, underwriters will decide whether to accept your application.

Getting approval doesn’t always mean you’ll have coverage right away because guaranteed issue policies for life insurance often come with a graded death benefit.

This means if the insured were to pass away in the first 2 or 3 years of owning the policy, the beneficiary would not receive the full life insurance coverage amount.

Instead, depending on how soon the policyholder died, the beneficiary may receive only a refund on the premiums paid so far, along with interest.

If the policyholder survives and continues to pay premiums for two to three years (this varies depending on the insurer and the details of the policy), the beneficiary would qualify for the full coverage amount.

You’re just about guaranteed to get coverage with this kind of policy, but you’ll also pay more and possibly not have coverage when your family needs it.

For these reasons, many people consider guaranteed issues a last resort for life insurance coverage.

Simplified Issue Life Insurance

With a simplified issue policy, you can bypass the medical exam, but underwriters will access your medical records and ask more thorough questions than you’d see on a guaranteed issue policy application.

If your health records or questionnaire answers reveal evidence of serious health issues, you may not get approved for coverage.

A simplified issue application will ask more complex questions, such as:

- Are you currently employed, and have you actively and continuously participated in the duties of your regular occupation on a full-time basis (at least 30 hours per week) for the past 6 months?

- If retired or currently unemployed, are you physically and mentally capable of being employed on an active full-time basis?

- Have you been disabled for 30 days or longer during the previous 12 months, and has said disability prevented you from performing your normal daily duties or activities, or are you currently receiving disability benefits?

- In the last five years, have you been diagnosed by a member of the medical profession as having, or have you been tested positive for or been treated by a member of the medical profession for any of the following: Acquired Immune Deficiency Syndrome (AIDS), AIDS Related Complex (ARC), HIV virus, or any other disease or disorder of the immune system?

- Within the past 24 months, have you used or are you currently using narcotics, amphetamines, or any controlled substance other than on the advice of a physician?

- Are you now receiving or, within the past 12 months, have you received chemo or radiation therapy for cancer, or have you ever been diagnosed as being terminally ill?

- Do you require any assistance with two or more of the following activities: bathing, dressing, toileting, indoor or outdoor mobility, or eating, or do you use oxygen for a medical condition?

These types of policies can be more specialized and have names like burial life insurance or final expense insurance.

In reality, they can cover much more than just your final expenses. Like just about any kind of life insurance, your beneficiary has the freedom to use the money as needed.

It’s usually not as expensive as a guaranteed issue, but simplified issue policies still cost more than a comparable medically underwritten policy.

How Does This Type of Life Insurance Work?

In many ways, a no-exam policy works like a traditional one:

- Once you’re approved for coverage, you pay your premium in exchange for the life insurance protection.

- If you die with the policy in force, your beneficiary will receive the coverage amount.

- Life insurance premiums are not tax-deductible, but the payout is tax-free.

So, other than the obvious — the ability to avoid a medical exam — how is this policy different?

- Coverage amounts tend to be lower. We’ll get more into these details below.

- As we’ve already mentioned, guaranteed issue policies sometimes have a graded death benefit, which means you may not have full coverage in the first 2 to 3 years of the policy.

- Since underwriters know less about your health, premiums will cost more than comparable coverage from a medically underwritten policy. More about this later, too.

- You can often get coverage more quickly since underwriters won’t be waiting on your lab results or considering more nuanced criteria.

How Much Coverage Can You Purchase?

No exam policies cost more, and they usually place a limit on the amount of coverage you can buy.

A traditional, medically underwritten term policy, such as a million-dollar term life insurance policy, can offer a lot of coverage at a low rate.

Many companies cap guaranteed issue policies at $25,000. Exceptions include Guaranteed Trust Life, which offers up to $100,000 in guaranteed issue coverage.

With simplified issues, it’s possible to get up to $350,000 in coverage from Assurity if you’re younger than 50. Most insurers cap coverage at $250,000, though you can find some exceptions.

If you’d like your life insurance coverage to replace several years of your income, pay off a mortgage, or protect your family’s savings, simplified or guaranteed issue policies likely won’t be big enough.

A positive medical exam unlocks your eligibility for a million-dollar or more in life insurance coverage, and depending on your age and health, this level of coverage may cost less than a lower amount of no-exam coverage, especially if you get a term policy.

To get around this shortfall, some people whose health prevents a medically underwritten policy buy two no-medical policies.

For example, someone could get $350,000 of coverage with Assurity and another $150,000 with Fidelity.

This approach can get you closer to the coverage amount a medically underwritten policy can provide.

But it will work only if you can afford to keep up the premiums for both policies.

How Much Does a Policy Cost?

We’ve talked a lot about the high cost of policies. But just how expensive are they?

If you watch much TV, you’ve probably seen ads offering cheap life insurance with no medical exam.

That’s not exactly the case, at least when you compare these policies to traditional, medically underwritten term policies.

Any time you bypass a medical exam, it’s going to cost more, and it makes sense: Without access to the information gathered from traditional underwriting, your insurance company risks more.

With insurance, more risk equals higher premiums. It’s that simple.

For example, a 30-year-old applying for $250,000 in no-exam life insurance from Assurity (Non-Med Term 350) could get the same coverage for about half the cost with a term policy that requires a medical exam.

| SEX | AGE | POLICY | ASSURITY | CHEAPEST COMP W/ EXAM |

|---|---|---|---|---|

| Male | 30 | $250,000 | $34.76/mo | $18.92/mo |

| Female | 30 | $250,000 | $28.38/mo | $15.66/mo |

If you’re reluctant to get a medical exam because it’s a hassle, you may want to give the situation a little more thought.

Yes, making an appointment and spending a couple of hours with a paramedic takes time and effort. But if you’re healthy, the medical exam can save you a lot of money over the life of the policy.

If it’s your fear of needles holding you back from a traditional policy, well, we can’t help much there. You’ll have to decide how much extra you’ll pay for a policy in order to avoid that needle.

Usually, the higher cost of coverage will be worthwhile only if you can’t get medically underwritten coverage.

Do I Need a No Exam Life Insurance Policy?

When you’re shopping for a life insurance policy, speed and convenience can be appealing. It takes a while to research coverage and check out company ratings.

Adding a medical appointment to the mix won’t speed things up.

Despite the temptation to speed things along, it’s usually worth the time if one or more of the following is true:

- You need coverage that would replace 5 to 10 years of your salary so your family wouldn’t have to worry about finances if you died.

- You’d like a policy to protect your mortgage so your loved ones wouldn’t have to consider selling the house if you died unexpectedly.

- You can wait four to six weeks to have coverage in place, and you don’t have serious health concerns.

- You’re not crazy about needles but can put up with that fear for a day.

- Your health isn’t perfect, but you don’t know about anything serious that’s going on.

- You have some health concerns but have successfully managed the symptoms for several years.

- You’re in excellent health.

- You have saved up the money you need to leave your loved ones.

Reasons (Other Than Health) To Get One

Your health may steer you toward guaranteed or simplified issue life insurance, but health isn’t the only reason that motivates people to go this route.

Other factors that make no exam life insurance attractive include:

- Speed: If you need coverage fast because it’s required for a divorce or a business deal, simplified issue life insurance can cut through the waiting time. Sometimes, you can have coverage the day you apply.

- White Coat Syndrome: Some people fear the medical profession so much they’ll pay higher premiums just to avoid the medical exam, not because they fear the results of the exam. These customers often point, specifically, to the needle used to draw the blood sample as the main reason to stay away.

- Dangerous Jobs and Hobbies: Along with age and health, traditional medical underwriting considers your hobbies and your occupation. If you’re a skydiving instructor or you drag race every weekend, you may get a better deal from a no-exam policy.

- Simple Convenience: Maybe you’re older and need coverage only to pay your final expenses and $25,000 in coverage will be enough.

If that’s you, a simplified or guaranteed issue policy will do the job without a lot of hassle. If you buy a guaranteed issue policy, be sure to pay attention to whether the payout will be graded.

Unless one or more of these reasons ring true (or unless, of course, you have a serious health condition) you’ll probably do better with traditional medical underwriting.

Important Factors to Consider

If you’re still reading, you’re probably serious about getting no exam coverage. So let’s be sure you’re getting a policy that meets your individualized needs.

Life insurance doesn’t come with a one-size-fits-all approach, so be sure to consider the following factors when you’re shopping for your no-exam coverage:

Death Benefits

When you apply for your coverage, make sure you know whether 100 percent of the benefit will be paid to your named beneficiary, regardless of when the insured passes away.

If not, find out for sure how the policy will be graded. Some guaranteed issue policies take three years to reach 100 percent of the payout.

In the earliest months of a policy, it may only refund premiums paid by the policyholder before death.

Premium Amount

Find out how much your premium will be, and whether it is due monthly, quarterly, or annually. If you can’t afford the premiums, there’s no reason to finalize the coverage.

Compared to medically underwritten life insurance policies, a no exam policy will typically cost more – sometimes three to four times more – because of the added risk the insurance carrier is taking on.

Depending on your situation, you may want to first apply for medically underwritten coverage. If you don’t qualify, move on to a no exam policy.

Even if one insurer turns you down for medically underwritten coverage, you may succeed with another company. Some of the best life insurance companies specialize in policies for people who have a specific kind of health condition.

Even if you are applying only for no physical exam policies, be sure to compare several different policies to find out which company offers the best premium.

To make this easier, you can work with an insurance agency that has access to multiple carriers instead of an agent who sells insurance from only one company.

Insurance Carrier

Any time you’re buying insurance, review the financial strength and the claims-paying reputation of the insurance carrier you’re considering.

This can help give you an idea of whether the company will be financially viable and able to pay your claim when your family needs it.

Checking the ratings that are provided by Standard & Poor’s, A.M. Best, Fitch, and/or Moody’s can help determine this. These rating agencies thoroughly investigate the health of insurance companies and give them grades.

Each agency has its own grading scale, but generally speaking, a company with an A rating should be stronger than a company with a B rating, and so on.

Checking with the Better Business Bureau can also show you whether your company has had many complaints from former or existing customers.

Type of Policy

With any kind of life insurance, decide whether you need a whole or a term policy. There’s a big difference between the two.

Term life insurance lasts for a specific period of time, usually ranging from 10 to 30 years.

When the term expires, so does your coverage. This has some advantages and disadvantages.

Advantages of Term Policies:

- Since it has an ending date, you can get a lower premium.

- Term life can offer flexibility. For example, if you need a lot of coverage now but won’t need as much in 20 years, you can save with a 20-year term policy.

- Term life is simpler. You pay a premium and get coverage.

Advantages of Whole Policies:

- Coverage lasts the rest of your life or until you cancel the policy.

- Whole life accrues additional cash value that can be useful later in life.

Not all insurers offer both kinds of policies within the umbrella of no exam life insurance.

So if you have a specific kind of policy in mind, check to make sure the insurance company you’re considering offers it before applying for coverage.

Medically Underwritten, No Exam Coverage With Haven Life

Traditionally, the answer to this question would be no because your medical exam gives underwriters the most complete and reliable view of your health.

Skipping the exam automatically makes it impossible to access the best rates out there.

However, at least one company now offers a best-of-both-worlds approach to term life. Haven Life, an online agency that sells MassMutual insurance, allows some applicants who are younger than 45 to skip the exam and still get medically underwritten coverage at a great rate.

This is all possible because the company’s underwriting department can analyze your medical records through online databases. If they find no evidence of health issues in your past, you may be able to avoid the exam.

So check out Haven Life’s HavenTerm program if you’re healthy, you really want to avoid a medical exam, and you’d like a larger coverage amount at a competitive rate.

Keep in mind that this coverage isn’t technically no medical exam coverage. You’re not avoiding the exam because you’re not healthy; you’re avoiding it because the company has concluded you’re in such great health you don’t even need an exam.

Medically Underwritten, No Exam Coverage With Bestow

Bestow Life Insurance offers another best-of-both-worlds approach. Young and healthy shoppers can get a large, affordable term life policy without a medical exam.

Like Haven Life, Bestow relies on data-driven underwriting to determine whether you’ll need a medical exam.

Applicants in their 20s, 30s, and early 40s who don’t need an exam could have quality, affordable term life coverage in place within minutes.

If you have a more complicated health history, or if you’re mid-40s or older, Bestow will require a medical exam. Bestow does not sell whole life policies or term policies longer than a 20-year term.

Cheap No Exam Life Insurance Quotes

Finding the lowest premiums on no exam coverage requires comparing multiple carriers.

You should approach insurance shopping the way you’d approach a new car purchase or a new home appliance. For example, you probably wouldn’t buy the first refrigerator you saw in the appliance store.

Instead, you’d read about the manufacturer. You’d compare prices and features, and you’d make sure the refrigerator would fit in your kitchen.

Give your life insurance coverage the same level of thought as you shop.

At the same time, with hundreds of life insurance companies to choose from, comparing each one could take months or longer.

Below are 13 of our favorite life insurance companies to work with on a no exam policy. If you’re not sure where to start your search, consider one of these.

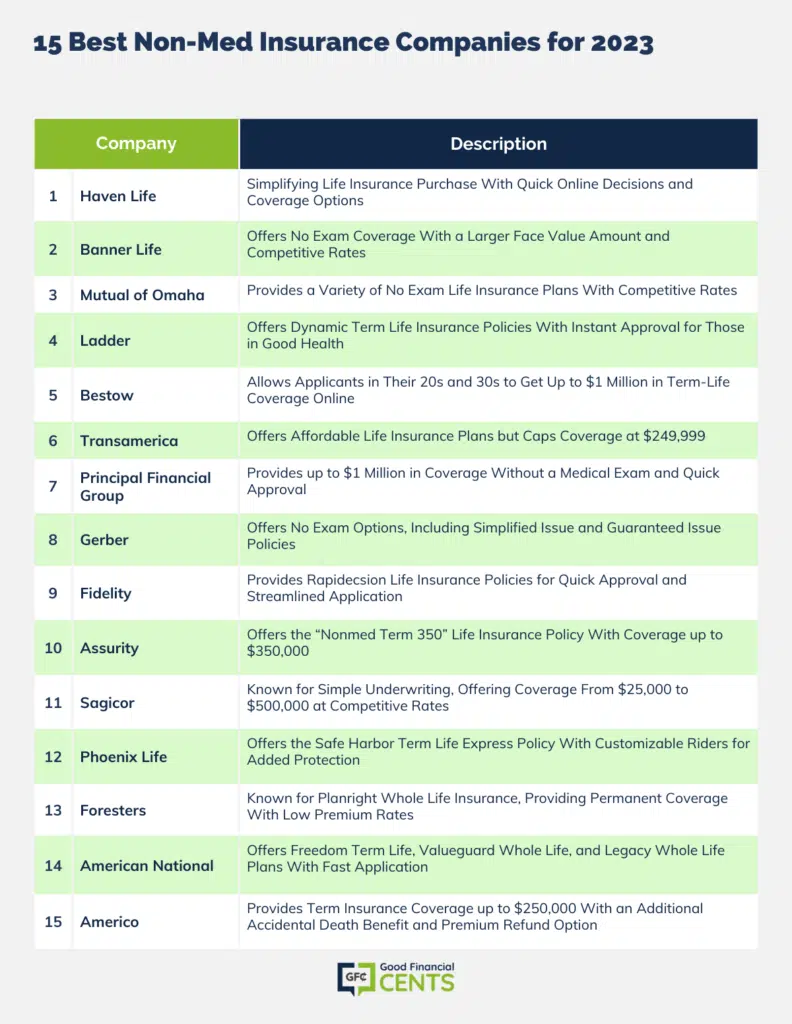

Top 15 Best Non-Med Insurance Companies for 2024

- Haven Life

- Banner Life

- Mutual of Omaha

- Ladder

- Bestow

- Transamerica

- Principal Financial Group

- Gerber

- Fidelity

- Assurity

- Sagicor

- Phoenix Life

- Foresters

- American National

- Americo

Haven Life

Haven Life, a subsidiary of MassMutual, is one of the youngest carriers on our list (kind of). While they might be one of the newest, they have already shown they are the best.

Haven Life is changing the way life insurance is being bought, with a goal to make it as simple as possible. Their algorithms allow certain people to get life insurance completely online and receive a decision in just a few days.

If you aren’t in good health, they might require you to take an exam, which is going to slow the process down.

As far as lengths go, Haven Life sells policies from 10 years to 30 years. The one stipulation is, if you want to buy a 30-year term, you have to be under 50 years old.

Haven allows you to get up to a million dollars in coverage online without a medical exam, depending on your age and health. If you need $2 million, then you’re going to have to jump through more hoops.

Haven Life also has two policy riders you can tack onto your plan:

- Waiver of Premium

- Accidental Death Benefit

Banner Life

Banner Life is one of the best in the business, with an A+ superior grade from A.M. Best and an AA- from Standard and Poor.

For no exam coverage, Banner offers a larger face value amount at $500,000, and it consistently provides some of the best rates out there.

However, Banner Life accepts applications only from people age 20 to 50.

If you’re the right age, Banner Life could be the best choice for you. For more information, read our review of Banner Life.

Mutual of Omaha

Mutual of Omaha provides a wider variety of no exam life insurance plans with rates that compare with other leading insurers.

Mutual of Omaha offers both term and whole life plans that you can buy without taking a medical exam. The company’s term plans offer coverage as high as $250,000.

With an A+ from A.M. Best and AA- from Standard and Poor’s, and an A1 from Moody’s, you can count on Mutual of Omaha to insure you.

Read our full Mutual of Omaha Review.

Ladder

Ladder’s dynamic term life insurance policies are affordable, expansive (with policies up to $ 8 million), and come with a streamlined application process.

After answering a few questions about your health, hobbies, and family history, you could get instant approval.

The key to accessing coverage with Ladder is being in good health. If you’re young and healthy and your medical records align with your answers, you’ll find cheap, quick, and comprehensive no exam coverage.

If, however, your health is declining and your age is extending, you may be asked to undergo an exam or be denied in some cases.

Keep Ladder on your shortlist for instant no exam coverage.

Bestow

Founded in 2016, Bestow Life Insurance is already changing the way younger shoppers buy life insurance.

With Bestow, applicants in their 20s and 30s can get up to $1 million in term-life coverage without a medical exam.

These are not simplified issue or guaranteed issue policies with low coverage amounts and high premiums. Bestow offers fully medically underwritten policies with no exam.

Database-driven underwriting makes this possible, and you’ll qualify only if Bestow’s algorithms say you don’t need the exam.

Typically, this won’t happen if you’re older than 45. Younger applicants who are in good health may not find a faster and more convenient way to get a $1 million, 20-year term policy.

Transamerica

Transamerica has decades of experience helping all kinds of applicants get quality life insurance at affordable rates. Another A+ rated company by A.M. Best, Transamerica is dependable.

All of the four ratings agencies like Transamerica, and so do many of its customers: the company has few customer complaints.

What are the downsides? Transamerica caps coverage at $249,999, so if you’re looking for a higher level of coverage, Transamerica may not be for you.

If you’re older, give Transamerica a close look. It has some of the best life insurance designed for seniors.

Principal Financial Group

Most companies cap no physical exam life insurance plans at $250,000 which won’t provide enough protection for many people.

If you need more than $250,000 but also need a no exam policy, check with Principal Financial Group.

Principals can offer up to $1 million in coverage even without a medical exam. Additionally, you can get approval as quickly as 48 hours.

While the plans will be more expensive than medically underwritten coverage, Principal offers competitive rates for no medical exam coverage.

Principal is rated A+ by A.M. Best, AA- by Fitch Ratings, and A1 by Moody’s.

Gerber

Gerber Life consistently earns high ratings from the third-party rating agencies. After a recent announcement of its sale to WSFG, Gerber has continued to receive positive ratings, with A.M. Best confident in its future stability.

The company offers several no exam options, including term and whole-life plans.

You can secure up to $150,000 in whole life, no exam simplified issue life insurance, but if you can’t get approval, Gerber also offers one of the simplest guaranteed issue policies on the market.

Anyone can get $25,000 in guaranteed issue coverage with no questions asked. Regardless of your health or any prior life insurance denials in your past, you should be able to get this coverage.

Fidelity

If you need coverage as quickly as possible, check with Fidelity Life. The company’s RAPIDecsion life insurance policies have streamlined the application process to make it as quick as possible.

Instead of having to wait several weeks to get approved for life insurance, you’ll be able to get insurance protection as quickly as 48 hours.

Fidelity’s RAPIDecision Express policy allows applicants to bypass the medical exam and offers coverage from $25,000 to $250,000 depending on your age.

Fidelity offers term lengths of 10, 15, 20, and 30 years. Fidelity is also highly ranked by the credit agencies, with A.M. Best upgrading the company to excellent at the conclusion of 2018.

Assurity

With more than 120 years of life insurance, Assurity is one of the oldest and most established companies on our list.

And it’s not all about age and experience. Assurity has earned A ratings from AM Best.

Assurity’s “NonMed Term 350” life insurance policy allows anyone aged 18 to 65 to get life insurance protection up to $350,000, which is $100,000 more than most companies can offer without a medical exam.

Sagicor

We can’t make a list of best no medical exam plans without including Sagicor. This company has proven itself one of the best places to get life insurance without a medical exam.

Sagicor has only three rated classes which keeps the underwriting processes simple and fast. You can buy coverage from $25,000 to $500,000 at competitive rates for no exam plans.

Along with simple underwriting comes a simple application process. Many applicants can complete the entire application in 30 minutes or less. Sagicor is a dependable company as well, confirmed with newly updated ratings from A.M. Best.

Phoenix Life

Applicants up to age 80 can get Phoenix Life’s Safe Harbor Term Life Express policy, and the company excels in its variety of riders which allows you to customize your plan.

When you’re buying no medical exam coverage, you can add riders such as:

- critical illness protection

- chronic illness protection

- an unemployment waiver of premium rider

- an option to convert the policy to another form of coverage.

These riders can help if you’re worried about how you’d deal with a long-term illness that keeps you from earning but doesn’t allow access to a life insurance death benefit.

Obviously, the more riders that you add, the more that you’re going to pay in monthly premiums.

Phoenix Life, too, is respected by the credit rating agencies, with an A+ from Fitch Rating.

Foresters

Name recognition carries a lot of weight with insurance, but you can’t always depend on it. Foresters, for example, offers quality insurance even though you may not have heard of it.

Foresters has an A rating from AM Best, which means it should be a reliable partner for your long-term life insurance needs.

The company’s most popular option is its PlanRight Whole Life Insurance policy. These plans are permanent coverage, which means you’d keep the coverage as long as you pay the premiums.

Foresters has one of the lowest premium rates schedules out there, but they do have some requirements that you’ll have to meet.

American National

American National Life Insurance Company has excellent ratings and several plans you can compare.

Their plans are:

- Freedom Term Life

- ValueGuard Whole Life

- Legacy Whole Life.

Each plan has various benefits and coverage limits that you can choose from. American National’s plans range from $25,000 to $250,000.

Additionally, the company has one of the fastest application processes you’ll find. You can complete the whole process and get coverage in as little as 15 minutes. American National has excellent ratings from the agencies, with an A from A.M. Best and Standard and Poor’s.

Americo

Last but not least on our list is Americo which offers term insurance coverage up to $250,000 for 20 to 30 years.

Americo’s strengths include its additional accidental death benefit. If you were to pass away from an accident, your family would get an extra 25 percent of your policy’s face value.

Americo also has a premium refund option. Like most return-of-premium riders, expect to pay more, and be sure to read the fine print. Most riders return premiums only at the end of the term and not if you stop paying premiums during the term.

The underwriting process is simple. It includes a short questionnaire. Americo also boasts high ratings from the credit agencies, with a stable outlook and high scores across the board.

No Exam or Not, Your Coverage Should Fit Your Life

You have your reasons for skipping a medical exam.

- Maybe you feel like you can’t qualify for medically underwritten coverage.

- Maybe you’re so afraid of needles that you’d rather pay a higher premium, and it’s not even worth debating.

- Maybe you’re in a hurry and just need coverage in place to satisfy a legal requirement.

Whatever the reason, we want you to know what you’re getting in to. Getting life insurance coverage should make life easier for your loved ones if you died unexpectedly and could no longer provide financially.

Daytime TV ads show no exam coverage as a cinch. Yes, it is easier to get approval with this type of policy, but things seldom work out as neatly in real life as they do in the ads.

Finding the right policy can take a little time because a variety of variables work together to create an insurance policy. When you have the right policy, these variables work together to your advantage.

So before jumping at a policy that looks good enough, check with an independent insurance agent near you, or contact us.

As consumer advocates, we are on your side. We work with a wide array of life insurance carriers, and we can help find the best no exam life insurance policy to best suit your life’s needs.

The Bottom Line – No Medical Exam Life Insurance

Obtaining a life insurance policy can be a daunting task especially for individuals with serious health conditions or senior citizens due to the rigorous medical examinations and the potential high costs involved.

However, no medical exam life insurance emerges as a viable solution, offering a crucial financial safeguard for loved ones.

By understanding the various options within no-exam insurance and how they operate, individuals can navigate through the insurance maze to find a suitable coverage, ensuring peace of mind and financial security for their dependents.

This option underscores a significant stride in making life insurance accessible to a broader spectrum of individuals, further cementing its importance in financial planning and protection.

I need information regarding term life insurance:

I bought a term life insurance for my husband for 29 years now. Premium paid automatically taken out of our checking account in advanced monthly. 6 days or 4 working days before he died I cancelled the policy by phone. I received the premium refund 4 days after his death I did not cashed the check.

Is it technically possible that he is still insured before he died?

Hi Emilie – Probably not, since you formally canceled the policy. But you can call them and see if your not cashing the refund check constitutes a continuation of the policy.

Super list of companies. Helpful highlights of each company too. Banner Life also offers between $100,000 to $500,000 of term life insurance to applicants between the ages of 20 to 50 without any medical examination. Banner Life offers an automated underwriting program is called Appcelerate. This is a form of “no exam life insurance” which offers simplified underwriting for people who are in relatively good health. Good luck in 2017!

I’ve seen people denied regular life insurance for having conditions that do not shorten their life span like glaucoma. Sometimes, you really DON’T have a choice and have to get the more expensive coverage.

Thanks Jeff. While there are a FEW reasons why no exam insurance is appropriate, it still makes my blood boil when I see the commercials and online ads. So expensive. As usual you’ve laid out the details perfectly 🙂

Life insurance is critical your web site has lots of fine information. Many thanks for expressing everything you know about life insurance with no exams.

If you’re in good health than you should strive to have coverage which likely would require an exam. Obviously if you get no-exam coverage, you’re going to get the lowest possible coverage based on the per dollar cost of what you’re contributing, but if you can prove your health via an exam, your risk will be lower and they’ll charge you less (or give you greater coverage for the dollar).