- — Bestow specializes in term life insurance coverage for adults ages 18 to 60.

- — Policies from Bestow are underwritten by an A+ rated carrier.

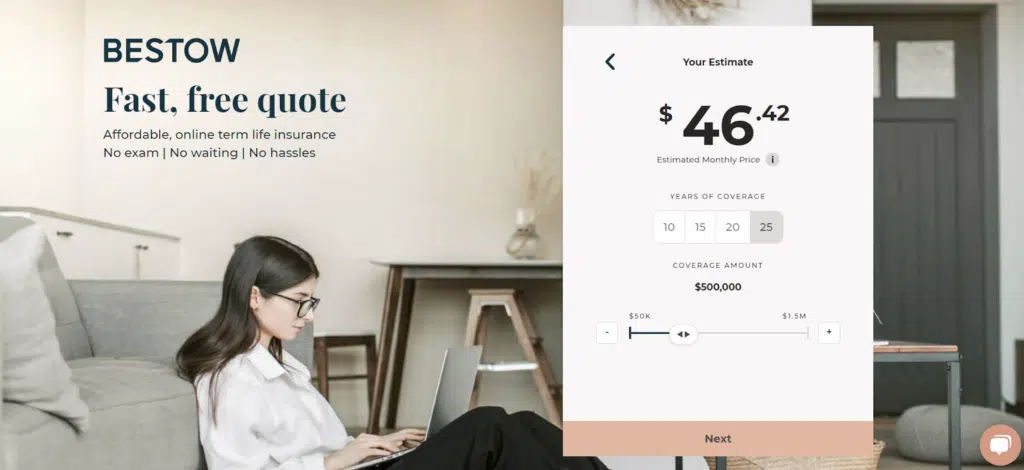

- — Premiums for term life insurance from Bestow can cost as little as $10 per month, and coverage amounts range from $50,000 to $1.5 million.

- — Terms are available from 10 to 30 years, and you can get an accurate, online quote in minutes.

Term life insurance is a popular option for working families, and it’s easy to see why so many people invest in this type of coverage.

Customers can tailor a term life insurance policy to their needs by choosing the policy amount and how long it lasts. Term life insurance is also much more affordable than permanent coverage, and you can often get approved without a medical exam.

If you’re in the market for term life insurance, Bestow is a top provider to consider. This company lets you purchase term life insurance online in a matter of minutes, and you won’t have to endure time spent on a medical exam.

Premiums can also be incredibly affordable and you can secure up to $1.5 million in term life insurance that lasts for 10 to 30 years.

Life insurance is a crucial component of any financial plan, so it’s smart to study the best life insurance companies and all they have to offer. This comprehensive review explains Bestow’s policy offerings, how this company works, and who it’s best for.

Table of Contents

About the Company

Founded in 2016, Bestow is one of the top providers of term life insurance without a medical exam. As a specialized term life insurance provider, Bestow doesn’t sell other types of life insurance to consumers.

Its policies are underwritten by North American Company for Life and Health Insurance® which has an A+ rating. It’s also reinsured by highly-rated Munich Re. This offers customers the security of knowing that if they ever have to file a claim with the insurer, Bestow can follow through.

Bestow operates entirely online for added convenience, and consumers can get an online quote in a few minutes without the pressure of working with a life insurance salesperson.

Bestow Products and Services

Bestow is a specialized life insurance company that only offers one kind of coverage. It’s not for everyone, but it does offer a life insurance product that’s easy for consumers to purchase and understand.

Term Life Insurance

Term life insurance from Bestow can last for anywhere from 10 to 30 years, and coverage amounts are available from $50,000 to $1.5 million. Potential customers can tailor their coverage to their unique needs, buying only the amount of coverage they want.

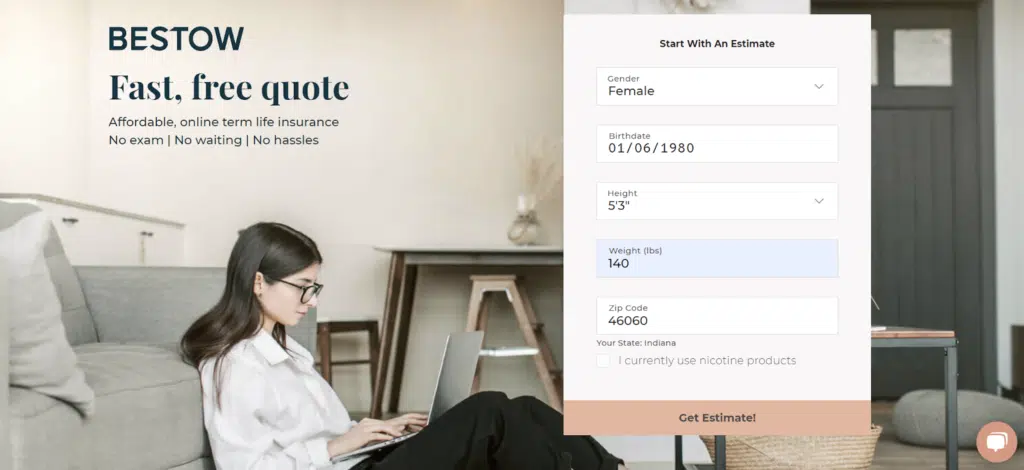

When requesting a quote, customers don’t even have to provide many personal details. Simply get started by clicking on “get a quote” and entering simple information like your gender, birthdate, height, weight, and zip code.

Once you enter these basic details, you will receive an instant quote for term life insurance coverage. However, you get the chance to tailor your policy from there, either by increasing or decreasing the coverage amount or switching the length of your policy.

If you’re happy with your term life insurance quote, click “Next” to fill out a full life insurance application. If approved, your term policy will begin without a requirement for a medical exam.

Unique Features

Since Bestow only offers term life insurance coverage, its policy offerings aren’t complicated at all.

Here are some important features to know:

- Bestow offers a referral program for current policyholders. This program lets you earn a gift card for each friend you refer who purchases a life insurance policy. Bestow customers can refer up to 10 people in total.

- Bestow offers accelerated underwriting. Its online, hassle-free life insurance doesn’t require a medical exam of any kind. Instead of medical exams, it approves you for a policy based on advanced algorithms and proprietary data.

- Bestow offers a 30-day money-back guarantee. If you’re unhappy with your policy and you cancel within 30 days, you’ll receive a refund of the premiums paid.

Who Bestow Is Best For

Bestow is an excellent choice for consumers who want to buy term life insurance coverage with minimal hassle. Since you can enter some basic information and get coverage without spending the time undergoing a medical exam, Bestow’s offerings are ideal for busy, working people.

Note that Bestow policies are only available to individuals who are ages 18 to 60, and people with a felony conviction aren’t eligible for coverage.

Also, Bestow’s doesn’t offer the option for riders, so you consider other options if you want to tailor your policy with riders for accidental death, an accelerated death benefit, or anything else.

Bestow Is Best For

- Consumers ages 18 to 60 who are eager to buy life insurance with minimal hassle and stress.

- People who want term life insurance coverage that lasts for a specific timeline, such as their working years.

- Anyone who wants to buy life insurance without dealing with a life insurance agent.

- Consumers who are comfortable handling important aspects of their finances online.

Bestow vs. Other Online Life Insurance Companies

Although Bestow is unique in that it offers online-only term life insurance coverage, it’s not the only provider in this space. Quite a few other startups offer similar coverage options with the same hassle-free online quoting system.

If you’re definitely in the market for term life insurance coverage, but want the best premiums, make sure to get a life insurance quote from at least two to three different companies.

| Bestow | Haven Life | Ethos | |

|---|---|---|---|

| Available Policies | Term Life Insurance, 10 to 30 year terms | Term Life Insurance, 10 to 30 years | Term Life Insurance, 10 to 30 years Guaranteed Issue Whole Life Insurance |

| Coverage Amounts | $50,000 to $1.5 million | $100,000 to $3 million | $100,000 to $1.5 million Guaranteed Issue Whole Life Insurance up to $25,000 |

| Medical Exam Required | No | Not always | Not always |

| Money-Back Guarantee | Yes | No | Yes |

What To Know About Term Life Insurance

Before purchasing term life insurance from Bestow or any other company, it helps to know about the other types of life insurance out there, and who they’re best for.

Although it’s not for everyone, permanent life insurance has certain benefits, including lifetime policies and their ability to build cash value.

Ultimately, you might want to dive into the whole life insurance vs. term life insurance debate before investing in a policy.

Not having to speak to a Bestow agent before purchasing a life insurance policy is a major perk. But this also means you’ll have to figure out a few details on your own, like how much life insurance coverage you need.

Fortunately, a good life insurance calculator can help you determine the ideal amount of coverage for your lifestyle by evaluating factors like your income, dependents, and your existing debt.

The Bottom Line

At the end of the day, Bestow is an excellent company to work with if you want term life insurance without a medical exam. Just remember that coverage is only available if you’re ages 18 to 60, and that the entire application process takes place on the Bestow website.

Always compare premiums from at least two or three other companies before making a final decision. Since term life insurance is such a cut-and-dry financial product, with a fixed payout when you need it, your main goal should be securing the lowest monthly premiums.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback.

By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Bestow Product Description: Bestow is a modern life insurance company that offers hassle-free, online life insurance solutions. It provides term life insurance policies designed to be easy to understand and obtain, with no medical exams for most applicants. Bestow aims to simplify the life insurance process and make coverage accessible to a wide range of individuals. Summary of Bestow Bestow has disrupted the traditional life insurance industry by leveraging technology to streamline the application and underwriting process. The company specializes in providing term life insurance policies, which offer straightforward coverage for a specified period, such as 10, 15, 20, or 30 years. What sets Bestow apart is its user-friendly online platform, where customers can apply for life insurance in a matter of minutes, often without the need for a medical exam. This convenience makes life insurance accessible to individuals who may have previously found the process daunting or time-consuming. Pros Simplicity and Speed: Bestow’s online application process is quick and straightforward, making it easy for customers to obtain life insurance coverage without the hassle of lengthy paperwork or medical exams. Accessibility: Bestow’s approach opens up life insurance to a broader audience, including those with busy schedules or health concerns that might have made obtaining coverage through traditional means more difficult. Competitive Pricing: Bestow offers competitive rates on term life insurance policies, providing affordable options for customers seeking financial protection for their loved ones. Customizable Coverage: Customers can choose from a range of policy term lengths to align with their specific needs and financial goals. Cons Limited Policy Options: Bestow exclusively offers term life insurance, so customers seeking other types of life insurance, such as whole or universal life, will need to explore alternative providers. Health Restrictions: While Bestow aims to provide coverage without a medical exam for most applicants, not everyone may qualify for this streamlined process. Some individuals with complex medical histories or specific risk factors may still require a medical exam or be ineligible for coverage.

Bestow Review

Overall