Most people are aware that your profession can impact your access to affordable life insurance, but not everyone knows that hobbies can do the same.

If you’re a stamp collector or painter, chances are you’re safe.

On the other hand, if your hobbies take you to the edges of cliffs, the depths of the sea, or the open skies, your life insurance will likely be affected.

Table of Contents

Read on to understand how high-risk hobbies play into your life insurance and which adrenaline-pumping extracurriculars have the biggest effect.

How High-Risk Activities Influence Life Insurance Rates

Life insurance companies have one concern when it comes to insuring you: risk.

As a life insurance company decides whether or not to grant you coverage and at what cost, they’re assessing the risk of having to pay out your policy.

This process, known as underwriting, involves the life insurance company taking an in-depth look at factors such as:

- Age

- Health

- Weight

- Family Health History

- Career

- Hobbies

They then use that information to place you in a rating class which determines the price you pay in premiums.

When you participate in hobbies that make you more susceptible to the dangerous forces of nature, your odds of dying by unnatural causes increase.

Without further ado, let’s dive into some of the most dangerous hobbies that impact life insurance.

Riskiest Activities for Life Insurance

Skydiving

Aviation sports like paragliding, base jumping, and skydiving rank pretty highly among hobbies life insurance companies dislike.

When you jump out of a plane, you run the risk of an airplane malfunction, parachute failure, collisions, and botched landings.

The rates and coverage available to you will depend on several factors:

- Experience Level;

- How Often You Make Jumps;

- Whether or Not You Skydive Professionally;

- Areas Where You Make Jumps; and

- Safety Level of Your Jumps.

Aviation

Jumping out of planes isn’t the only airborne hobby life insurance companies are generally concerned about. Professional pilots are at risk of higher life insurance rates, but also pilots who fly for fun.

The good news is that not all pilots are treated equally by underwriters.

When you apply for life insurance, you’ll complete an avocation questionnaire, which will ask questions about:

- The Type of Aircraft You Fly;

- The Conditions of Your Flights; and

- Your Certification.

You may also have a hard time finding coverage if you hang glide or frequent the skies in a hot air balloon. Basically, if your hobby takes you to the open skies, you can expect it to be considered high-risk by the insurance company.

Scuba Diving

While scuba diving may seem less deadly than skydiving, it still comes with its own set of risks.

Equipment malfunctions, drowning, and decompression sickness all contribute to heightening the risk of this hobby.

Whereas more frequent dives imply that pilots or skydivers are more experienced, they make you a riskier client with scuba diving.

So if you decide to do a dive as an excursion on your family’s vacation cruise, you can relax.

If, however, you do deep sea diving frequently, you go alone, or you haven’t attended proper lessons, you could pay higher rates or get denied altogether.

Water Sports

If you love the following water sports, your life insurance provider probably won’t cover you due to these hazardous activities:

- Racing Boats;

- Extreme White Water Rafting Trips; and

- Surfing

These activities increase the likelihood of drowning. The more frequently you engage in these activities and the more dangerous the circumstances, the likelier they are to impact your access to premium life insurance.

Mountain Climbing

If your enthusiasm for rock climbing takes you to your local indoor climbing wall, your life insurance is unlikely to be affected.

When your climbing hobby takes you to rough terrains and puts you at an increased risk of falling off the side of a mountain, insurers get concerned.

Much like the other hobbies in this list, you’ll be asked a series of questions to gauge just how risky your climbing is:

- Experience Level;

- Frequency of Climbing;

- Safety Measures;

- Areas in Which You Climb;

- YDS grade; and

- Length of Rope You Use

Backcountry Skiing

Much like scuba diving, taking a family vacation to a ski resort or hitting the slopes on a marked trail with your friends won’t hurt your access to life insurance.

Backcountry and heli-skiing will, though.

If you participate in these particularly dangerous forms of skiing more than 7 days out of the year, you can expect to pay more for life insurance.

Life insurance companies also take precautions into account. If you go with a trained professional, you’re far more likely to be accepted for coverage.

Racing

Racing is another high-risk hobby that life insurance companies frown upon.

While racing cars may not be the most dangerous hobby on the list with ever-increasing safety measures, they can still pose a threat to your safety. Even more dangerous is motorcycle racing.

Companies will look at several different factors including:

- Your Age;

- Level of Experience;

- Frequency of Racing;

- Driving Record;

- Car’s Top Speed;

- Car’s Structure; and

- Engine Capacity

If you participate in an activity like stock car racing from time to time, you may not even see an effect on your rates.

If you actively participate in any of the high-risk hobbies above, read on for a few tips on getting coverage.

Tips for Life Insurance With High-Risk Hobbies

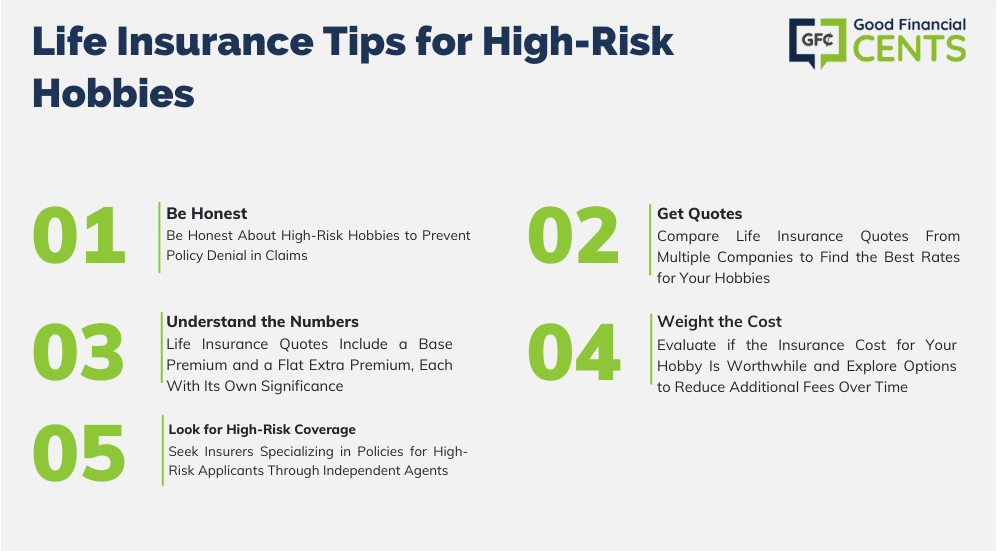

- Be honest: Tell the truth about your hobbies in your application. If you fail to disclose your hobby and die doing that activity, the life insurance company likely will not pay out on your policy.

- Get quotes: Each company favors your hobbies and other risk factors differently. Just because one company quotes you high premiums or denies coverage doesn’t mean every company will. Shopping for multiple quotes is the best way to ensure you get the best rates.

- Understand the numbers: The life insurance company’s quote consists of two parts: the base premium and the flat extra premium. The base premium is strictly the amount that corresponds to your rating class. The flat extra is a fee, usually per thousand dollars of coverage, added to your base.

- Weigh the cost: If your hobby seriously limits your access to affordable life insurance, you might want to consider whether or not it’s worth it. If you’re ready to hang up your snorkel and retire your rock climbing gear, you may be able to eliminate the flat extra fee from your policy after a certain amount of time.

- Look for high-risk coverage: A number of life insurance companies specialize in offering policies to high-risk applicants. If you work with an independent agent, you can find companies that are more likely to offer you an affordable life insurance policy.

Bottom Line

Life insurance is a critical component of protecting your family financially. While you may be fond of taking risks in your hobbies, you shouldn’t risk leaving your family in financial distress after you pass away.

By shopping for life insurance quotes from multiple companies, being honest on your application, and reevaluating the safety precautions you take when you engage in your hobbies, you have the best chance of getting the life insurance you need.

Don’t assume you won’t qualify for life insurance just because you participate in one of the hobbies on the list. Start shopping for life insurance today.