Mutual of Omaha has been in the business of offering insurance and financial products for over 100 years. Our Mutual of Omaha review shows that the company is financially strong, and it deems itself as being family-oriented with a solid set of “unflinching values.”

The company prides itself on backing its products with both fair and timely service to its customers – and it continues to pursue excellence at all levels. Mutual of Omaha strives to maintain a Code of Ethics and Business Conduct for legal, ethical, and responsible practices to follow. The company also prides itself on encouraging new ideas, trying new things, and not being afraid to fail and learn from their mistakes in order to grow the business.

Mutual of Omaha currently has approximately $31 billion in total assets under management – and due to the company’s Midwest values, it is one of the most respected insurance companies in the industry today.

Table of Contents

The History of Mutual of Omaha

Mutual of Omaha actually began as Mutual Benefit Health & Accident Association back in 1909. The company started in Omaha, Nebraska, with its first president, Harry S. Weller, who served as its leader until 1932.

By 1920, the company was licensed to offer insurance in 15 states. That same year, premiums went over $1 million, and less than 20 years after that, the firm was licensed to sell insurance in 48 states and two territories.

By 1958, Mutual of Omaha surpassed the $1 billion mark in terms of benefits paid out to its policyholders. But it was in 1963 that the company became famous for its wildlife and reality programming – the “Mutual of Omaha’s Wild Kingdom” show that featured Marlin Perkins.

Today, the company continues to make great strides in the insurance industry – as it is one of the very few insurance companies that offers an online application for Medicare Supplement insurance policies.

Products Offered

Mutual of Omaha offers a wide variety of insurance and financial products for both consumers and business customers. These include Medicare Supplement, life insurance, long-term care, disability insurance, critical illness coverage, annuities, structured settlements, cancer, heart attack and stroke insurance, small business solutions, and investments.

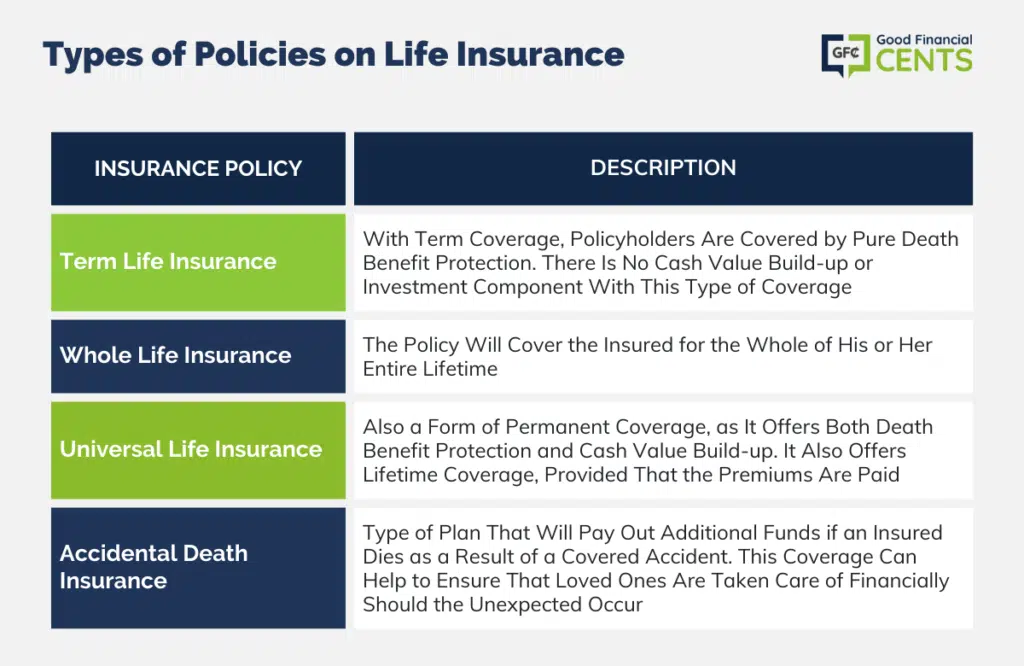

On the life insurance side, the company focuses on the following types of policies:

- Term Life Insurance – With term coverage, policyholders are covered by pure death benefit protection. There is no cash value build-up or investment component with this type of coverage. This is why term life is so affordable for most people. The term is also considered to be “temporary” coverage.

This is because policies are purchased for a set period of time, such as for 10 years, 15 years, 20 years, or 30 years. Should the insured pass away while the policy is in force, the named beneficiary will receive the set amount of death benefit protection.

- Whole Life Insurance – Whole life policies are considered to be “permanent” protection. This is because – provided that the premiums are paid – the policy will cover the insured for the whole of his or her entire lifetime. Although the premiums are typically higher than for a similar amount of coverage, whole life insurance will also provide both death benefit protection, as well as cash value.

The cash value in a whole life insurance policy is guaranteed to grow at a set interest rate. And, the cash is allowed to grow on a tax-deferred basis. This means that no tax is due until the time of withdrawal. This can allow the cash to grow and compound exponentially over time.

- Universal Life Insurance – Universal life insurance is also a form of permanent coverage, as it offers both death benefit protection and cash value build-up. It also offers lifetime coverage, provided that the premiums are paid. This coverage, however, is more flexible than whole life in that the policyholder has more freedom in terms of when they can pay the premium, as well as with how much of the premium they allocate to the death benefit and how much they allocate to the cash component of the plan.

- Accidental Death Insurance – Accidental death coverage is a type of plan that will pay out additional funds if an insured dies as a result of a covered accident. This coverage can help to ensure that loved ones are taken care of financially should the unexpected occur. (It is important to note that this coverage will not pay out if the insured dies due to sickness or other natural causes).

Disability Insurance

Mutual of Omaha sells a lot of different products, including disability coverage.

If you don’t understand disability insurance, you need to do your homework. It’s one of the wisest investments you can make.

If you find yourself unable to work because of an illness or injury, you won’t have that precious paycheck you need. If you have a disability insurance plan, you will be able to soften the blow.

Mutual of Omaha sells two kinds of disability insurance. Both of them can help protect your paycheck.

The first one we will look at is the Disability Income Choice Portfolio. One of the nice things about this option is the customizable options. You can get long-term coverage, short-term, and accident-only protection.

If you purchase their Disability Income Choice Portfolio, you can get a monthly benefit of up to $12,000 for 10 years of benefits. The premiums are going to stay the same until you are 67. You can keep the coverage until 75, but the premiums are going to go up.

This plan also has some benefits included in the plan. Mutual of Omaha has a total disability income benefit and proportionate disability benefit in the plan.

They also include a waiver of premium rider and terminal illness rider, and the plan is guaranteed renewable.

On top of these built-in benefits, you can also buy some additional riders to beef up the protection:

- Hospital Confinement Indemnity Benefits

- Critical Illness Benefits

- Cost-f-living Adjustment Rider

- Future Insurability

- And more

The more riders you add, the more you’re going to pay in premiums.

The other option they sell is the Priority Income Protection plan. This policy is their simplified version of disability insurance coverage.

This policy will still give you disability coverage, but it’s much easier to apply for and be accepted for protection. You can get monthly benefits up to $4,000 (or up to 70% of your income) and you can receive benefits anywhere from 12 months to 36 months.

What makes this policy so special is the ability to skip the medical exam and get protection in a matter of days. Just like with their other policy, you can still purchase additional riders to increase your coverage.

Click here if you want to compare other disability companies.

Financial Ratings

From a financial standpoint, Mutual of Omaha is considered to be extremely strong – which is why the company has earned top ratings from the insurance company ratings agencies. This means that policyholders can know that the company will be there when they need them to pay on when they have a claim. Mutual of Omaha’s ratings include:

- A+ (Superior – For overall financial strength and ability to meet ongoing obligations to policyholders) from A.M. Best Company, Inc.

- A1 (Good – for current financial strength and ability to withstand financial stress in the future) from Moody’s Investors Service

- A+ (Strong – for financial strength to meet obligations to policyholders) from Standard & Poor’s

Advantages and Considerations Regarding Mutual of Omaha

There are a number of nice advantages associated with Mutual of Omaha – starting with the fact that it is a Fortune 500 company. The firm has a great deal of both history and stability, and it has great ratings from the insurer rating agencies. Due in large part to its long-running Wild Kingdom programming, the company has a great deal of name and brand recognition.

The company’s website allows its visitors to easily obtain quotes for both whole-life and term insurance coverage. And, the prices for all lines of the company’s life insurance are quite competitive.

In addition, the Better Business Bureau (BBB) has also given Mutual of Omaha an A+ rating, as the company strives to honor the promises it makes to its policyholders via its business practices and customer service. Mutual of Omaha has been accredited with the BBB since February 1940.

Yet, even with all of the advantages of Mutual of Omaha, there are still some factors to consider before moving forward with the purchase of a policy. First and foremost is the fact that by obtaining quotes from only one insurer, you can essentially lock yourself into just one premium price.

Imagine going to just one auto insurance company or just one appliance website before purchasing these products – without so much as checking into other companies’ prices. On such an important decision, it is highly recommended that you do some comparison shopping and see what else is available. You may find that Mutual of Omaha is the best deal out there – yet, there may be something else better.

For those who may have an adverse health issue, it is especially important to do some comparison shopping. This is because there is the possibility of being either “rated” or declined for coverage altogether. However, by working with an agency or company that has access to more than just one insurance carrier, you can directly shop your application to numerous insurance companies at one time.

This can save you countless hours of time and frustration during the insurance shopping and application process. There is also the option out there for a no-medical exam life insurance policy that may work best for you. Whether you need life insurance, or burial insurance or need to know what different companies are out there, we can help!

How to Obtain the Best Life Insurance Policy

Regardless of needs, goals, and/or current health condition, it is always important that when seeking out life insurance coverage, you should compare the policies and the premium quotes that are available to you.

Any time that you shop for important products or services, you will typically seek out the very best deal – so, when looking for the financial security of those that you love, wouldn’t it only make sense to do the same?

If you’re ready to locate the insurance policy and company that will best serve your needs, simply use the form on this page. I have partnered with Root Financial to provide you with unbiased life insurance quotes. They work with the top life insurers in the industry today and can help to get you all of the pertinent information that you require quickly and easily – directly from your computer.

I know that the purchase of any type of insurance, such as life or health, is a big decision – so it is essential to review the companies that you may be choosing and make sure you are getting the right policy. That is why I partnered with a trusted independent agent to help answer all your questions and provide you with the information you need to make the best decision.

Since Root Financial is an independent agent they work for you not for the insurance companies and will help you get the best rates. So instead of just getting quotes from Banner or MetLife, you will get quotes from all the top companies that offer coverage in your area. The time is now to get started on solidifying your family’s financial future.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Mutual of Omaha Review

Product Name: Mutual of Omaha

Product Description: Mutual of Omaha provides a robust suite of life insurance products aimed at ensuring financial security for individuals and families. Their offerings range from term to permanent life insurance policies, combined with a reputation built over a century of dedicated service.

Summary of Mutual of Omaha

Mutual of Omaha has cemented its legacy as a reliable life insurance provider with over a hundred years of industry experience. They cater to a diverse clientele, offering an array of products including term, whole, and universal life insurance. Understanding the evolving needs of modern families, they have developed policies that provide flexibility, security, and peace of mind. Beyond life insurance, Mutual of Omaha Life also offers additional financial services such as disability insurance, critical illness coverage, and annuities, showcasing their holistic approach to financial well-being.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Established Reputation: With a history spanning over a century, Mutual of Omaha is a trusted name in the life insurance sector.

- Comprehensive Offerings: They provide a wide array of insurance products, ensuring a fit for various customer needs.

- Customer Service Excellence: Their long-standing commitment to client satisfaction is reflected in their responsive and helpful customer service.

- Additional Financial Products: Beyond life insurance, they offer a suite of financial solutions, making it convenient for clients to manage multiple aspects of their financial lives in one place.

Cons

- Costs: Some customers might find their premium rates to be higher compared to other insurance providers.

- Policy Limitations: Depending on the region or specific circumstances, some policy options may not be available to all consumers.

- Online User Experience: Some users might find their online platforms or digital tools less intuitive compared to newer, tech-centric providers.

To who it may concern,

I will like to receive information about quotes for long term disability please

I’m looking for short or long term disability for myself I’m 63 yrs old I’m still currently working my plan is to retire at 67 yrs do have a plan for me at good cost?

I would like more information on purchasing disability insurance on myself and my husband…

Hi Regina – We don’t actually sell disability insurance.

I’m in conparison shopping for life insurance… maybe you can help

Sure! You can use our online life insurance quoter to compare offers.