Assurity Life Insurance Company has been in the business of offering coverage and protection to its policyholders for well over 100 years. This company’s heritage dates back to the year 1890.

Throughout the years, the company has grown and expanded.

According to a recent Gallup Poll, Assurity Life Insurance Company has also been ranked in the 91% of all life insurance companies in the Gallup survey when it comes to employee engagement.

Table of Contents

Assurity Life Insurance Company Review

Assurity Life Insurance Company has a strong set of financials. As of year-end 2022, the company had nearly $454 million in surplus – which is $9.8 million more than what the company had for the year 2021. It also had approximately $2.6 billion in total assets.

For this same time frame, the company had more than $282 million in insurance premiums and deposits, as well as more than $38 million in operating income. In addition, as of the end of the year 2015, Assurity Life Insurance Company had paid out nearly $142.8 million in benefits to its policyholders.

The company also declared nearly $9.8 million in policyholder dividends. While dividends are not guaranteed, they can be a nice benefit for policyholders, as they can be taken in the form of cash, or alternatively, they may be used for purchasing additional amounts of insurance or for adding to the cash value of a permanent life insurance policy. This can help the cash in the cash value component of a permanent life insurance policy to grow and expand even further – without being taxed at the time of receipt.

Assurity is also known for being involved in the communities that it serves. This includes assisting people through difficult times – by not just serving the company’s customers but also via a meaningful commitment to strengthening the community overall.

The associates of Assurity Life Insurance Company spend countless hours helping and serving, as well as volunteering. Some of the events that are taken on include blood drives, collections for the Food Bank, Habitat for Humanity, the holiday giving tree, the Special Olympics, and Junior Achievement.

In addition, the company is also known for being high-tech – which includes combining the most sophisticated equipment and processes with the flexibility to anticipate future advances in technology. This includes ensuring the ultimate safety of the company’s customer information.

Ratings and Better Business Bureau Grade

- A.M. Best Rating: A- (Excellent)

- BBB Rating: A+

Life Insurance Offered via Assurity Life Insurance Company

Assurity Life Insurance Company offers a variety of different life insurance options. This can help policyholders to better customize their life insurance coverage to meet their specific needs.

Life Insurance Options Available

Term life insurance provides pure death benefit protection only. In fact, term life is considered to be the most basic form of life insurance that is available in the marketplace. Making the premium that is charged for term life insurance can oftentimes be very affordable – even for a large amount of death benefit – if a person is young and in good health at the time that they apply for the coverage.

With term life insurance, a policy is purchased for a certain period of time, such as 10, 15, 20, 25, or even 30 years. In many cases, the amount of the premium will remain level throughout the term of coverage.

A term life insurance policy can be a good solution for someone who is seeking to cover “temporary ” needs, like the payoff of a mortgage balance or the funding of a child’s or a grandchild’s college education. This type of coverage can also provide the protection that may be needed during various events in one’s life, whether it be marriage, buying a new home or business, and/or the birth or adoption of a child.

Whole life insurance is a type of permanent life insurance protection. This type of life insurance is intended to last for the entire lifetime of the insured.

It offers a guaranteed death benefit and a cash value component where the funds grow on a tax-deferred basis. This means no tax will be due on the growth of the funds unless they are withdrawn.

This cash may be withdrawn by the policyholder for any purpose. While the cash does not have to be paid back, it is important to know that the amount of unpaid cash balance at the time of the insured death is counted against any amount that will be paid out to the named beneficiary.

Another type of permanent life insurance is universal life. This form of life insurance also has a death benefit and a cash value portion.

However, universal life is considered to be somewhat more flexible than a whole life insurance plan since the policyholder can decide how much of the premium will go towards the death benefit and how much toward the cash value. Also, the policyholder may be allowed to change the due date of the premium.

Other Products Offered Through Assurity Life Insurance Company

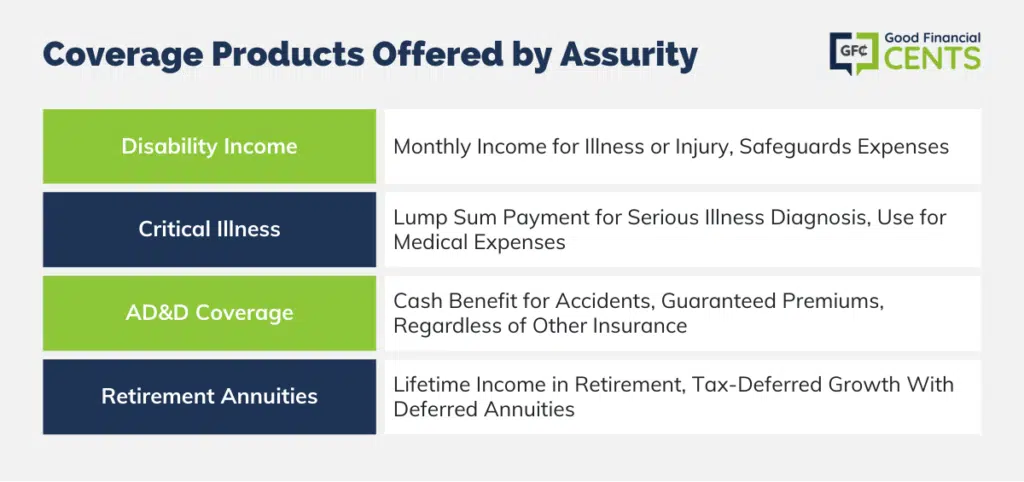

In addition to life insurance protection, Assurity Life Insurance Company also offers a number of other coverage products, including:

- Disability Income – With a disability income policy, you can obtain a monthly income if you are sick or injured and you are unable to work. Having a disability income plan can help you to better ensure that your living expenses can be paid – without you having to dip into your savings, retirement plan, or other financial assets.

- Critical Illness Insurance – When you have a critical illness insurance policy, if you are diagnosed with a covered serious illness, you will be able to obtain a lump sum payment. These funds can be used for paying your medical expenses or any other need that you see fit.

- Accidental Death and Dismemberment (AD&D) Coverage – AD&D coverage will provide a cash benefit if a loss of covered life is caused by an accident, as opposed to illness or other types of natural causes. The premiums on the Assurity Life Insurance Company AD&D coverage are guaranteed – and the benefit will be paid out, regardless of what other types of insurance you may hold.

- Retirement Annuities – Today, due in large part to longer life expectancy, many people are worried about outliving their income in retirement. But, by having an annuity, income can be paid out for the remainder of your lifetime – regardless of how long that may be. With a deferred annuity, the funds that are accumulated are allowed to grow on a tax-deferred basis. This means that there will be no tax due on the growth of these funds until the time they are withdrawn.

Assurity Life Insurance Company offers a number of different plans that are available via the worksite. These could be offered as a part of an overall employee benefits plan. In many cases, the premium can be paid via paycheck withholding.

The Bottom Line – Assurity Life Insurance Company Review

Assurity Life Insurance Company stands as a beacon of trust and commitment in the insurance sector. With its rich history spanning over a century, robust financial performance, and diverse product offerings, it has firmly established itself as a reliable choice for potential policyholders.

Furthermore, Assurity’s strong emphasis on social responsibility, community engagement, and technological advancement underscores its holistic approach to business. When considering life insurance and other coverage needs, Assurity offers not only financial protection but also a partnership built on integrity and a genuine desire to serve the community at large.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Assurity Life Insurance Company Product Description: Assurity Life Insurance Company offers comprehensive life insurance solutions tailored to meet diverse needs. With its rich legacy spanning over a century, the company emphasizes both financial protection and social responsibility. Summary Assurity Life Insurance Company, rooted in a history dating back to 1890, has consistently provided robust insurance products designed to safeguard policyholders’ financial futures. Their offerings range from term whole to universal life insurance, catering to varied coverage requirements. Apart from its traditional insurance portfolio, Assurity also stands out for its commitment to community service, employee engagement, and technological innovations, ensuring it remains a relevant and trusted choice in today’s dynamic market. Pros Cons

Assurity Life Insurance Company Review

Overall