Life insurance is an important part of nearly everyone’s overall financial plan. This is because it is an essential tool that can help to ensure that all of a person’s other financial assets can remain in place for their originally intended purpose if the unexpected were to occur.

When applying for a life insurance policy, there are several key criteria that you need to keep in the forefront of your mind. These will certainly include the type and the amount of coverage that you are purchasing. This is because you will not want your coverage to expire. You will also want to be sure that you have enough financial protection for the needs you are insuring.

Another primary factor that many people may not realize is extremely important is the insurance company from which you buy your life insurance policy. But this, too, can be a top concern. This is because you will want to be sure that the insurer will be there to make good on the promise of paying out the claim should your loved ones, or other beneficiaries need to file.

One life insurer that has been in the business for more than 100 years, and that has kept its promise to pay out to its claimants is American National Life Insurance – also referred to as ANICO.

Table of Contents

American National Life Insurance Company History in the Industry

ANICO has been in the business of providing life insurance coverage to its policyholders since the year 1905. Headquartered in Texas, the company also has offices located in other areas of the U.S., including Missouri and New York. They specialize in the high-risk life insurance market and are a leader in that area.

American National Life Insurance Company has a key mission of providing insurance and financial products, and in so doing, to also continue to maintain financial strength and stability. In addition to American National Insurance Company, the company is segmented into several insurance area components, including:

- American National Life Insurance Company of Texas

- Garden State Life Insurance Company

- Standard Life and Accident Insurance Company

- Farm Family Companies

- American National Life Insurance Company of New York

- American National Property and Casualty Company

A Review of American National Life Insurance Company

Because American National has some different divisions, the company also has several different marketing components. This helps to keep its marketing segmented towards the proper consumers that it is targeted to. For example, each marketing area promotes certain consumers, based on the particular line of insurance that it is focused on.

The company’s Independent Marketing Group provides life insurance, pension products, and annuity products to both small business owners, as well as to individual consumers. This marketing group has some different distribution channels that it uses such as broker-dealers, independent insurance brokers, financial institutions, agents, and employee benefit companies.

ANICO Direct, another of the company’s marketing groups, offers insurance coverage directly to consumers via a variety of different media outlets, while the firm’s Health Insurance division provides a specialized portfolio of coverage like stop-loss reinsurance and association group coverage to both associations and employee groups.

In ANICO’s Career Sales and Service Divisions, there are also a variety of different products that are offered. These include life insurance and annuities, as well as certain types of health insurance. These products are sold to households in the United States via career agents, usually directly in the individuals’ homes.

There is also a Multiple Line marketing segment. This division offers life insurance, along with property/casualty, agricultural, and commercial insurance products. These coverages are offered in the United States, as well as in Puerto Rico.

The Senior Age Marketing segment of ANICO offers individual life and health insurance – mainly Medicare Supplement policies – as well as retirement annuities, while the Credit Insurance segment offers insurance products that can provide repayment of loans in case a person dies or becomes disabled, or becomes unexpectedly unemployed. Make sure to compare medicare supplement plans to ensure you are getting the best deal.

Because of its strong financial stance and excellent reputation for paying out its policyholder claims, ANICO is a highly-rated insurance carrier. The insurer has been provided with a rating of A from Standard & Poor’s.

In addition, although American National Life Insurance Company is not an accredited company via the Better Business Bureau, it has been given a grade of A+ by the BBB. This is on a grade scale of between A+ and F.

Over the past three years, the company has closed a total of 28 complaints through the BBB, and a total of 7 of these complaints have been closed within the past 12 months. Of these 28 complaints, the majority have been concerning issues with the insurance company’s products and/ or services.

American National offers a lot of good information regarding its products on its company website. This can be helpful for those who are considering the purchase of life insurance – or any of the other coverage products that are offered by the insurer.

There are also several ways in which customers may reach the company’s customer support team in case of a question or a concern regarding their policy. These methods include toll-free telephone support, as well as email. ANICO is consistently considered one of the best U.S.-based life insurance companies when it comes to customer service.

Life Insurance Products Offered Through ANICO

ANICO provides numerous insurance and financial products for its customers so that they can save for the future, and protect that wealth. Some of these products include life insurance, annuities, property and casualty coverage, and personal lines insurance.

These products are sold via career agents, as well as through direct distribution channels, and through some different IMOs (independent marketing organizations) around the United States.

Concerning life insurance coverage, American National Life offers the following coverage options:

Term Life Insurance Coverage

With term life insurance coverage, the insured is covered with pure death benefit protection only. For this reason, term life insurance is considered to be the most “basic” of all forms of life insurance. It is also typically the most affordable. This is especially true if the insured is young and in good health at the time he or she applies for the coverage.

Term life insurance is purchased for a certain period such as 10, 15, 20, or even 30 years. There is also a 1-year annual renewable term life insurance option that is offered. Term life insurance will expire at the end of its period. In some cases, term life insurance will be convertible over to permanent life insurance coverage.

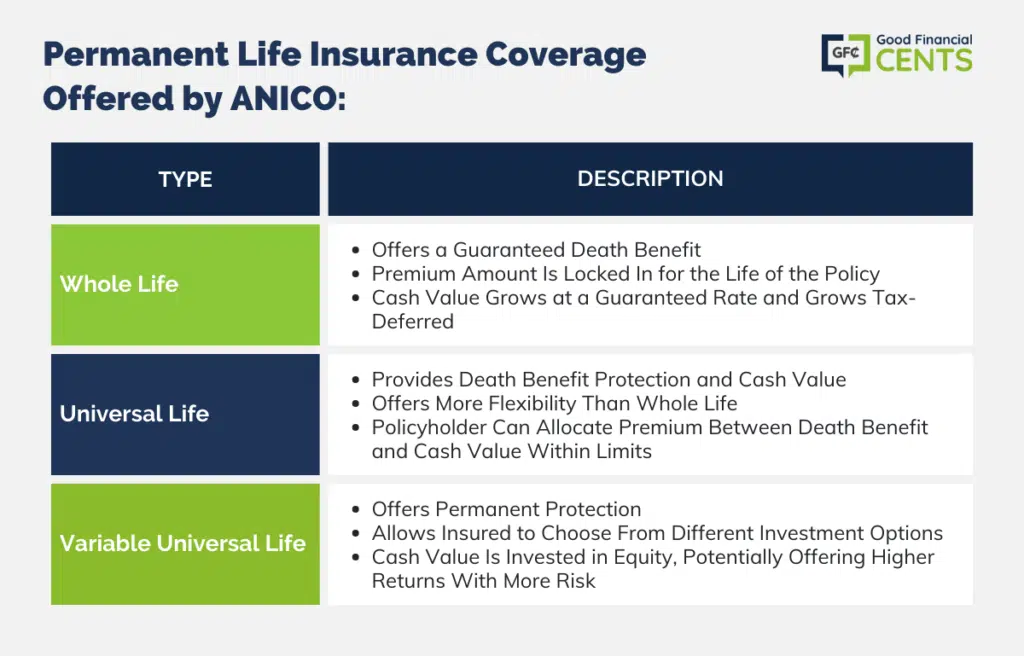

Permanent Life Insurance Coverage

Permanent life insurance offers both death benefit protection, along cash value build-up. As long as the insured pays the premium, the permanent coverage will typically remain in force. ANICO offers several types of permanent life insurance coverage, including:

- Whole Life – Whole life insurance is the simplest form of permanent life insurance. It offers a guaranteed death benefit, and the premium amount will be locked in for the life of the policy. The cash value will grow at a guaranteed rate, and the funds grow tax-deferred.

- Universal Life – Universal life insurance also provides death benefit protection and cash value. However, this type of permanent protection is more flexible than whole life, primarily because the policyholder can – within certain limits – choose how much of the premium will go towards the death benefit, and how much will go towards the cash portion of the policy.

- Variable Universal Life – Variable universal life insurance is also considered to be permanent protection. With this type of coverage, the insured can choose from different investment options. Because the cash value is invested in equity, it has the opportunity to grow more than the funds that are in a whole or universal life insurance policy. There can also be more risk involved, too.

Where to Find the Best Quotes on Life Insurance Coverage

When seeking the best quotes on life insurance coverage, or getting renters insurance quotes from ANICO (American National Life Insurance Company), or from any life insurance carrier for that matter, the best course of action is to work with either a company or an agency that works with multiple insurers. That way, you will be able to more directly compare the policies, the benefits, and the premium quotes. This is true not only for life insurance but for other forms as well such as health and auto insurance coverage as well.

If you are ready to move forward with the purchase of life insurance, we can help. We work with many of the top life insurers in the industry today, and we can assist you with obtaining the information that you need. When you are ready to proceed, all you need to do is use the quote form on this page.

We know that purchasing life insurance can seem a bit confusing. There are a lot of carriers to choose from, and you want to make sure you have the right type and amount of coverage. So, contact us today – we’re here to help.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

American National Review

Product Name: American National

Product Description: American National Insurance Company offers a diverse range of insurance and financial products, from life insurance to retirement solutions. Serving customers for over a century, they emphasize personalized service and robust financial strategies.

Summary of American National

Established in 1905, American National Insurance Company has grown to become one of the leading insurance providers in the United States, covering a variety of sectors like life insurance, health, property, and casualty insurance. Their products are tailored to meet the evolving needs of individual and business clients, emphasizing long-term financial planning. With a commitment to reliability, they have garnered a reputation for their dedication to policyholders and financial strength.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Diverse Product Line: Whether it’s life insurance, annuities, or property and casualty insurance, they offer a comprehensive range of products for different needs.

- Longstanding Reputation: Being in business for over a century, they have a track record of stability and dedication.

- Personalized Service: American National prides itself on delivering tailored solutions for its customers, rather than one-size-fits-all products.

- Financial Strength: The company boasts strong financial ratings, showcasing its ability to meet long-term obligations to policyholders.

Cons

- Limited Online Capabilities: Some users have reported that their online platforms could be more user-friendly, lacking in certain digital amenities that newer companies offer.

- Pricing: In some sectors, their products might be priced higher than competitors, which could deter cost-conscious consumers.

- Availability: While they offer a wide range of products, not all of them are available in every state.

- Limited Innovation: With a longstanding history, sometimes they might appear slower in adopting newer industry trends or technological advances compared to newer entrants.