Knowing that you have life insurance protection can provide you and those you love peace of mind. While nobody wants to dwell on the unimaginable, life insurance can help to ensure that your dependents will have additional funds that they may require for paying off debts and/or continuing to pay their ongoing living expenses.

When you are searching for the best life insurance policy, it is important that you obtain the proper type and amount of coverage. That way, your loved ones won’t be left with too little to serve their needs.

It is also key to make sure that the insurance carrier that you purchase your life insurance coverage through is strong and stable financially – and that it has a good, positive reputation for paying out its policy holders’ claims. One company that meets these criteria is Phoenix Life Insurance Company.

The History of Phoenix Life Insurance Company

Phoenix Life Insurance Company has more than a century and a half in the business of providing coverage to its customers. Initially founded in 1851 as the Phoenix Companies, Inc., the company has grown and expanded throughout the years.

This insurer has a primary focus on helping those who are considered to be in the middle income market, as well as those who are more affluent, with securing the property life insurance protection for their needs.

Nassau Re completed its acquisition of Phoenix in 2016 and has since been actively investing and working towards the seamless integration of their operations to create a more robust company poised for future growth. These strategic initiatives position them well to expedite their expansion plans as they move into 2019 and beyond.

In recent months, they have initiated the process of rebranding their insurance operations under the Nassau Re umbrella. As part of this transformation, they have officially renamed two of their insurance subsidiaries:

- Phoenix Life Insurance Company is now recognized as Nassau Life Insurance Company.

- Phoenix Life and Annuity Company has undergone a name change to become Nassau Life and Annuity Company.

Phoenix Life Insurance Company Review

Phoenix Life focuses on offering a variety of life insurance plans, as well as retirement annuities. These are offered via financial advisors throughout the U.S. The company also has a distribution subsidiary, Saybrus Partners, which provides insurance coverage to clients.

While Phoenix Life Insurance Company is considered by many to be a somewhat small insurance carrier – with roughly 600 home office employees – its products and services rate among the best. Phoenix Life is headquartered in Hartford, Connecticut.

Insurer Ratings and Better Business Bureau (BBB) Grade

Due in part to recent financial issues, Phoenix Life Insurance Company’s ratings are not currently among the best from the insurer ratings agencies. These ratings include a B+ (Credit Watch) from Standard and Poor’s (which is a rating of 14 out of 21 possible ratings), and a B (Stable) from A.M. Best Company (which is seventh out of a possible sixteen total ratings.

Even though the company’s ratings are not on par with where they could ideally be, Phoenix Life Insurance Company has been satisfying the financial obligations that it has to its current policy holders.

While Phoenix Life is not an accredited company through the Better Business Bureau (BBB), it has still been provided with a grade of A+, which is on an overall grading scale by the BBB of A+ through F). Over the past three years, Phoenix Life Insurance Company / The Phoenix Companies, Inc. has not had to close out any customer complaints through the Better Business Bureau.

Life Insurance Products Offered by Phoenix Life Insurance Company

With its key focus on life insurance and annuities, Phoenix Life Insurance Company provides a wide range of products for customers to choose from. This can be quite beneficial, as coverage can change along with the client, as his or her needs change over time.

The company provides several types of permanent life insurance, along with final expense coverage. With permanent life insurance, there is both a death benefit component, and a cash value component. Typically, once an insured has been approved for coverage, the amount of the death benefit protection is locked in, as is the premium amount – which means that the premium that is charged will not go up, even as the insured’s age increases, and if he or she contracts an adverse health condition.

The cash that is inside of the cash value component is allowed to grow and compound over time on a tax-deferred basis. This means that there are no taxes due on the growth of these funds unless or until they are withdrawn.

Policyholders who have permanent life insurance protection are allowed to withdraw or borrow cash from the policy’s cash component for any need that they see fit – including to pay off debts, to supplement retirement income later in life, or even to take a nice vacation.

One type of permanent life insurance coverage that is offered through Phoenix Life Insurance Company is whole life. The Phoenix Remembrance Life policy is a simplified issue whole life insurance policy, which also offers supplemental benefits that are designed for protecting the insured’s loved ones and for leaving a legacy.

Because the Remembrance Life plan is a simplified issue policy, it will not require the applicant for insurance to undergo a medical examination, or to answer a long list of medical-related questions. Because of this, these policies will oftentimes be approved within just days – or sometimes even sooner. So, if an individual is in need of life insurance protection quickly, this could be a viable option.

Another form of permanent life insurance coverage that is offered by Phoenix Life Insurance Company is universal life. With a universal life insurance policy, there are some similarities to whole life in that there is death benefit protection, along with a cash value component. However, in many ways, universal life insurance is considered to be much more flexible than whole life, as the policyholder is allowed – within certain guidelines – to change the due date of the premium, as well as to allocate how much of his or her premium will go towards the death benefit, and how much will go into the cash component.

Phoenix Life offers the Phoenix Accumulator UL universal life insurance policy. With this plan, policy holders may obtain a higher cash value crediting rate than they can with whole life insurance. There is also an interest bonus feature with this policy.

For those who are seeking both death benefit protection, along with a potentially higher amount of cash value build up over time (in a tax-advantaged manner), the Phoenix Accumulator UL policy may be a good fit.

Another type of universal life insurance that is offered through Phoenix Life Insurance Company is indexed universal life. Here, there is also a death benefit and a cash value component within the policy. However, instead of having the cash grow based on a certain rate of interest, the growth is based on the performance of an underlying market index (or indexes) such as the S&P 500.

With an indexed universal life insurance policy (IUL), if the underlying index or indexes perform well within a certain time period, then the cash value will be credited positively – typically up to a certain “cap.” If, however, the underlying index performs poorly – or even in extreme negative territory – then the cash value will not lose value. Rather, it will just simply be credited with a 0 percent for that time period.

Because of this, indexed universal life insurance is used by many policyholders who are seeking higher potential growth (than that of whole life, or even CDs and money markets), yet with the protection of principal.

Phoenix Life Insurance Company offers the Phoenix Simplicity Index Life policy. With this plan, the policy holder may choose from several different cash value accumulation options. There is also a death benefit included in the policy, with the option to allocate policy value in a fixed account and / or to two indexed accounts.

As with the whole life insurance policy that is offered via Phoenix Life, this indexed universal life product will not require a medical examination by the applicant for coverage. There is also no need to fill out a large amount of paperwork. Therefore, those who may have certain health issues could still qualify for this policy – and it could be a viable option if someone is looking for guaranteed death benefit protection, along with protection of cash value and possible higher growth.

Other Products and Services

While Phoenix Life Insurance Company is known for its offerings of life insurance coverage, the company also offers some options for retirement annuities. Today, because many baby boomers are reaching retirement age, there is worry about whether or not retirement income will be able to last through the remainder of their lifetimes. This is particularly the case as life expectancy has increased.

With an annuity, a guaranteed, set income can be received – and, if the annuity holder opts for the lifetime income option, they can literally receive an income stream that will last for the remainder of their lifetime, regardless of how long that may be. Do your research and make sure you’re getting the best annuity rates.

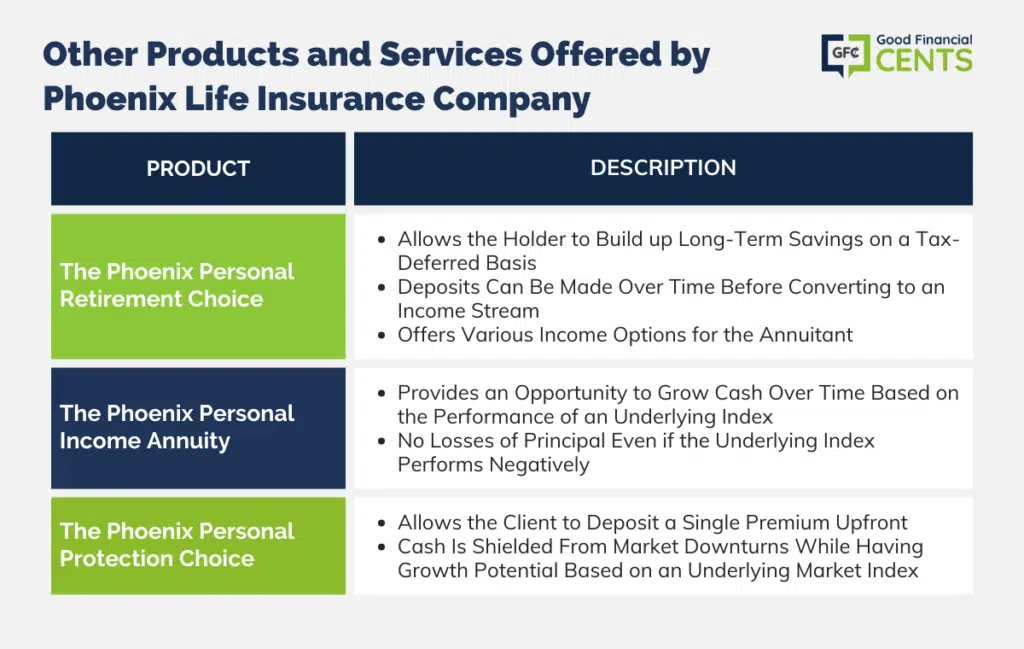

All of the annuity products that are offered via Phoenix Life Insurance Company are designed for flexibility – depending on what it is that a client needs. These annuity products include the following:

- The Phoenix Personal Retirement Choice: The Phoenix Personal Retirement Choice is a deferred annuity that provides its holder with the ability to build up long-term savings over time on a tax deferred basis. Deposits can be made into the annuity over time, prior to converting the annuity to an income stream. This annuity has several different income options to choose from as well.

- The Phoenix Personal Income Annuity: The Phoenix Personal Income Annuity is a fixed indexed annuity, so it allows the opportunity to grow cash over time, based on the performance of an underlying index – but if the index should perform negatively in a given time period, there are no losses of principal.

- The Phoenix Personal Protection Choice: With the Phoenix Personal Protection Choice annuity, the client can deposit a single premium up front. Because this annuity is a fixed indexed annuity, the cash will be protected from market downturns, while at the same time having the opportunity to grow, based on an underlying market index.

How to Get the Best Premium Rates on Life Insurance Coverage

If you are looking for the best premium rates on life insurance coverage on plans from Phoenix Life Insurance Company – or from any life insurance carrier – then it is typically recommended that you work in conjunction with an independent life insurance brokerage or agency.

In doing so, you will be much better able to shop and compare – in an unbiased manner – from numerous life insurance policies and carriers, and from there, you can choose the plan and premium quote that works the best for you and your specific needs.

If you are ready to take a look at the life insurance coverage that may be available to you, we can help. We are an independent life insurance brokerage, and we work with many of the top insurance carriers in the marketplace today. We can get you the details that you need quickly, easily, and conveniently – all from your own computer – and without you having to meet in person with an insurance agent. Whenever you are ready to begin the process, all you need to do is just simply take a moment to fill out the quote form on this page.

We understand that the purchase of life insurance coverage is a big decision. There are many different variables that you need to be aware of – and you want to be sure that you are obtaining the property type and amount of protection for your needs. The good news is that this process can be made so much easier when you have an ally on your side. So, contact us today – we’re here to help.

Final Thoughts on Phoenix Life Insurance Company Review

Phoenix Life Insurance Company, with its long-standing history and focus on middle-income and affluent markets, offers a range of life insurance and annuity products. While its financial ratings may not be the highest, it has maintained its commitments to policyholders. Their simplified issue policies are convenient for those seeking quick coverage. The variety of permanent life insurance options, including indexed universal life, allows clients to tailor their policies to their specific needs. Phoenix Life’s annuity offerings provide flexibility and financial security for those planning for retirement. To secure the best premium rates, working with an independent brokerage can simplify the process.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Phoenix Life Insurance Company Review

Product Name: Phoenix Life Insurance Company

Product Description: Phoenix Life Insurance Company offers a range of life insurance and annuity products designed to meet the financial needs of middle-income and affluent clients. Their portfolio includes permanent life insurance options, such as whole life and indexed universal life, as well as annuities for retirement planning.

Summary of Phoenix Life Insurance Company

Since its acquisition by Nassau Re in 2016, Phoenix Life Insurance Company has undergone significant transformations and investments. These efforts are geared towards streamlining operations and fostering a stronger, more prosperous company for the future, with accelerated growth plans for 2019 and beyond. They are currently in the process of rebranding their insurance business under the Nassau Re name, which includes renaming subsidiaries such as Phoenix Life Insurance Company to Nassau Life Insurance Company and Phoenix Life and Annuity Company to Nassau Life and Annuity Company.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- A long-established company with over 150 years of history.

- Offers simplified issue life insurance for quick coverage.

- Diverse range of permanent life insurance and annuity products.

Cons

- Financial ratings are not the highest, which may concern some potential clients.

- Limited online presence and customer service options.

- May not be the best option for those seeking the highest possible cash value growth.