Recently, a younger business owner client of mine was inquiring about purchasing a term life insurance policy.

A term life policy makes total sense for his situation, but he also wanted to give it a twist. In addition to a 30-year term life policy, he wanted to add what’s called a return of premium rider.

For those who are not familiar, the return of premium rider allows the policyholder to get a full refund of all the premiums paid at the end of the contract.

At first, it sounds like a pretty good deal. The most common complaint that consumers have with life insurance is that if you don’t die, all the money goes directly to the life insurance company. If this is the case, then purchasing the return of a premium rider seems totally worth it.

Table of Contents

Cost of Return of Premium Rider

At first glance, the return of premium riders seems like a no-brainer. One piece of information that you need to know is that the rider comes with a price. The ROP rider on average will run 20%-40% higher than purchasing a policy without it.

In addition, you have to keep the policy for the entire contract period to get a full refund of your premium. So then the question remains, does it make sense to pay more for the rider since you know you’re getting all your premiums back? Let’s take a closer look…

ROP Rider vs. Regular Term Insurance

To illustrate the cost difference between purchasing regular term insurance vs. one with the ROP ride, here are some life insurance quotes that I ran.

In our scenario, I am using a 30-year-old male, assuming he is in excellent health. We are going to get a quote on a 30-year term life policy with a $1,000,000 face value.

Without the ROP rider, the annual premium will cost approximately, $720 per year for a total of $21,6000 premiums paid over the 30-year period.

By adding the ROP rider, the premium jumps to $1,180 per year, for a total outlay of $35,400. That’s a total difference of $13,800 in premiums paid ($460 per year) or a 63.88% increase.

Invest the Difference

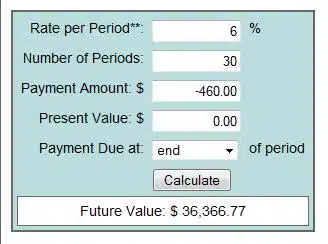

Since I’m a firm believer of long-term investing, my initial argument would be, to go without the ROP rider and invest the difference. Let’s see how my theory holds up. If we take the difference of $460 per year and invest it and average 6% over the 30-year period, it looks something like this:

By averaging a 6% return, you will have accumulated $36,366 over the 30-year period. Subtract the $21,600 you paid in premiums over that period and your net amount is $14,766.

As you can see in this example, purchasing the ROP rider seems to make sense. Hmmm…..Gets you thinking, right? Now let’s see if we average 8% return:

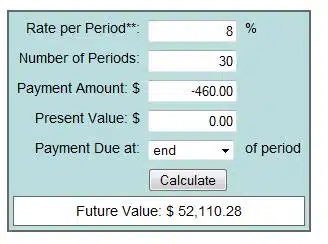

If we are able to average an 8% return over that same period, we accumulate a total of $52,110, and after subtracting the premiums are left with $30,500.

Compare that to the $35,400 we would get back with the ROP rider, and we’re still in the red. If we can average closer to a 10% return, then we have a greater chance for the normal policy to be more economically viable.

One Major Thing to Consider:

Few More Considerations

I have to admit that the outcome of the scenarios I ran was different than what I predicted. What we have to keep in mind is that when I analyzed the cost differential, we are relying on a few big assumptions:

1. That the person can afford to pay the higher premium.

2. The person will keep the policy for the entire 30-year period.

3. The cost of insurance won’t decrease.

This and other variables would have a dramatic impact on the long-term results of this scenario.

When Does Purchasing ROP Rider Make Sense?

Typically, you wouldn’t purchase ROP on such a long-term policy. Where it is more common is term policies 10 to 15 years in length.

You usually see this being used in buy/sell agreements between business partners where each partner buys insurance on the other’s life. With such a shorter time horizon, the ROP makes more economic sense.

Disclaimer:

What about you? Have you purchased a term life policy with a ROP rider?

For more information, check out other types of life insurance.

Analyzing the Return of Premium Rider: Costs, Comparisons, and Considerations

| Topic | Description |

|---|---|

| Cost of Return of Premium Rider | ROP Rider Costs 20%-40% More; Requires Full Policy Term for Premium Refund |

| ROP Rider vs. Regular Term Insurance | Compares Costs for a $1M, 30-Year Policy Without ROP: $720/Year; With ROP: $1,180/Year; $13,800 More in Premiums (63.88% Increase). |

| Invest the Difference | Suggests Investing ROP Cost Difference At 6% Return: $14,766 After 30 Years; At 8% Return: $30,500 (Less Than ROP Cost) |

| One Major Thing to Consider | ROP Funds Not Adjusted for Inflation; May Reduce Future Purchasing Power |

| Few More Considerations | Emphasizes Affordability, Policy Duration, and Potential Insurance Cost Changes When Evaluating ROP Rider |

| When Does Purchasing ROP Rider Make Sense? | ROP Common in 10-15 Year Policies or Business Buy/Sell Agreements for Economic Viability |

Bottom Line: Should You Invest in Return on Premium Life Insurance?

The Return of Premium (ROP) rider in term life insurance offers a refund of all premiums paid at the end of the contract, seemingly addressing the common complaint that if one doesn’t die, premiums are lost to insurance companies.

However, the ROP rider can cost 20%-40% more. Investing the difference between standard premiums and ROP-inflated premiums can yield better returns, especially over longer terms.

Additionally, the returned ROP amount doesn’t account for inflation. While ROP might make sense for shorter-term policies or specific business arrangements, its economic viability depends on multiple factors, and traditional investing could offer better returns.

I really found your article helpful, BUT do you recommend any insurance for people with no relatives to worry about?

It seems from the business standpoint, the only way to go would would be ROP for 10-15 years while paying off the lease?

I heard this in 80’s “buy term, invest the difference”. Most people didn’t invest

the difference, they lived pass the term and wound up with nothing. I like the

ROP. It is a no risk way to gain the money, and if you don’t die you get a payday!

Right now my bank pays 2% per year on CD’s. Where can you get 8% with no

risk, I would like a piece of the pie.

Hi Ronald – That’s an outstanding counter point on “buy term and invest the difference”. I don’t know where you can get 8% completely safe, but if you find a place, please send me an email 🙂

In your invest the difference example, how come you subtract the premiums paid from your investment balance? Since your annual investment excludes cost of insurance ($460 is net of premiums), aren’t you double penalizing?

Hi Andy – No because we’re making the assumption that the $460 is not paid without the ROP provision.

You need to subtract the premium in both cases. You cannot compare if you only subtract one premium. So, Term w/investment at 6% = premium – Investment amount at 30 years (the amount you have at 30 years. That equals $14766.

Term w/ROP = premium – the amount you have at 30 years. which equals $35400 – $35400 or zero dollars ahead at 30 years. Term with investment is the best option. Unless the Term w/ROP returns some interest or gains through some sort of investment strategy.

I know this thread is a bit old, but the info is good. MY QUESTION IS:

I am 44 years old

Diabetic, but in good care with no side effects.

I am trying to figure out what the best policy is for me to protect my family?

Should I go 30 year fixed without ROP?

Any sound advice or company names will be appreciated!

I think the 30 year term is a good policy in your situation. As to the ROP, remember the cost factor – it’s more than a small bump up in the premium. And also, you have to keep the policy for the full 30 years. If you drop it after just 10, you’ll have paid the extra premium, but not be entitled to the refund of premium. I don’t want to tell you what to do, since I don’t know you, but if you were my client, I’d tell you to take the policy without the ROP, and invest the difference, that way you’ll have the money with accumulated investment earnings. The ROP is a return of the premiums alone, not interest earned on those premiums.

What was stated about having to go the whole 30 year term or whichever to get your premiums back is false. For some companies this is true but for others it is not. With some companies, if you are in a 20 year term policy with ROP and at the 16th year you decide you’re done, then you get your premiums back.

Should a little more fact checking before posting something like that.

Also, do not forget that you get pay taxes on all the money earned while investing the difference scenario. You could play it safe and continue to keep your money in a tax free shelter like a life insurance policy. I know of a handful of index policies that have 30 year averages of 8%. And have ceilings of 14% and floors of 3%. Not saying it’s the only way to go but if you need a death benefit driven product might as well get one that also participated in all market gains and no losses. ( needs to be properly funded mind you )

People Please stop being greedy , there is no free lunch right . what’s about car insurance did you get any money back?. i think ROP is awesome product out there. I’m Retail business owner but i do like it . If 30 years later money inflate i will move to where has low cost living for my retirement simple as that. My question is would you go to work for free?. then the Insurance has the right to earn that money period. Let put this way i just lend the money to my family member for 30 years they will paid me back guaranteed and if i dies couple years later will they give 300k to take care my family? No way Jose .

Its really simple. Buy ROP=lend money to insurance company, They use your principal(premium payments) to reinvest and make interest for their own corporate directives and investors. Then 20 or 30 years later the insurance company returns your principle you loaned them with no interest and says thanks for the loan. Your money is worth less due to inflation. However what you gained was a potential death benefit for 30 years, with a promise of a return of your principle with no investment gains or interest. The only time you want to do ROP policy is if you are absolutely awful with saving money and investing and you need some kind of forced ludicrous savings plan that pays you no interest on your money like the mattress. Perhaps if inflation was kept at 0 for 30 years it would be more attractive to some

Hello, this is probably a simply question but I am confused. If the insurance company itself makes money from the premiums of the policies it has enforced, then how does it make a profit if it returns the premium at the end of the term?

There is no “profit”. Only your money returned, if you keep your policy in force to the anniversary date of the policy, usually 20 sometimes 30 years. The advantage, when compared to “regular” term insurance is the fact that you get all your premium back at that time. Unless your dead, obviously. Rates are definitely more expensive, many times double. But you get it all back. Most return of premiums plans are based on paying back annual premiums so, unless you pay annually, you won’t get back the entire amount you paid in, when compared to paying other modes. Monthly, Qty, S/A premiums can be more expensive when compared to annual. It is a choice, nothing more, nothing less. If you can budget the extra premiums each month and you can follow through and keep that policy in force, ROP is a great option, if not, well ….. there you go.

Because THEY invest your money instead of you and THEY make the profits from it. You just break even. They are rip off policies, especially to young people. At the end of your term you have to surrender your policy to collect premiums. Then, when you purchase a new policy you are rated at the age you are currently at, which if you take the advise of some comments and only purchase a 15 or 20 year term, chances are you still have mortgage payments, kids in school, other debts etc. So you will still have the need for life insurance. The only use for a policy like this is possibly a buy sell agreement between business owners. Other than that, buy term and invest the difference

I purchased a ROP life insurance policy at 30years of age. My policy cost 79.26 for 450,000 of coverage with a spouse rider. I have had it for 9 years. In 11 years I get back 19022.40 if I’m not dead. With the stock market plummeting in 2008 I think I made the right decision on return of premium. If I had invested the difference I would not get that money unless I invested in Apple Inc. If your 39 or younger I would always do a ROP life insurance policy, but I would not do it for longer than 20 years.

Wow. What company wrote you that much death benefit for that small amount of premium? Are you sure he or she, included ROP? That would be an amazing deal. Actually, unbelievable! In fact, no offense but, I would have to see the policy to believe it. Please send me info on this Company!!

The company name was Life Investors. They were bought by Transamerica. I don’t know if Transamerica write Return Of Premium policies. I think they go. I also have one with Prudential for 129.00. I just purchased this one at age 39.

Great! Thanks for the info. I have been doing some checking regarding these ROP plans. They are fully underwritten plans requiring paramed exams etc. my product is simplified issue. Cost a little more but are far easier to get. No parameds, no physicals, answer a few simple health questions, approval over the phone. Policy in the clients hands in 1 week. However, if a person is in good health and doesn’t mind being poked and jabbed by complete strangers and can jump all the hurdles then I can definitely see the advantages of the fully underwritten plan. Personally, I like simple. Thanks again for the info. American General also has some good rates for fully underwritten ROP insurance.

Wow! I see how edumacated people can sure stir up a bunch of BS. This is so simple my 9 year old grandson can figure it out. When ever you two eggspirts get time, send me an email. I will show you how I have averaged over 500 term sales with ROP each year for the past 7 years! Yes that is correct! My average monthly premium collected was $129.00 per month. My retention for 7 years. 92%!!! Now, do that math!!!

Greg,

Greg – I am a Life Insurance Agent very interested in writing more ROP. Are you at Liberty to pass on the name of your Non Med /Carrier?

You could always send me an a E Mail at [email protected]

if you need to keep it confidential.

Thanks for the great comments and congratulations on your production.

Thanks for the comments Greg; please let me know if ROP Term policy differs from this proven fact. 97% of all family’s with term insurance never get paid due to increased premiums, unpaid policies etc. – since ROP is term, how is your retention at the 20-30 year mark?

There is a big hole in your argument. Few Points

1) If you are investing by your self there is no way you can get 8% forget about 10%.

2) Also you need safe investment such as CD where you will not loose your money

3) Even if you invest in any index fund, you need to buy every month where you need to take into consideration of commision when you buy through Vanguard or fidelity

4) When you buy return on premium if you choose mothly this is like investing monthly without any comission or taxes.

5)Lets say for ROP you chose monthly option

M => Monhtly Premium

I => Additional amount they charge for ROP

Total Amount you spent without ROP is 30 *12 * M

There is no investment instrument available where you can invest I every month for 30 years without any comission or tax consequences which will generate your 30 *12 * M

6) To really advice correctly you need to factor those points.

If you can find any investment where I will get my return let me know.

I am in market to buy term and discussing with lots of advisors , but what Here is what I got

2.5m term 30 yrs :$ 2015/yr

2.5m term 30yrs/with ROP rider:4300/yr.

Difference 2285/yr.

I am in 28% bracket +7% state tax( NJ)

Now as per your calculations on down side 6% , which I found that in market I am not getting it tax free , the best I got is around 4.5% ( A grade only:munibonds, but nothing close to 5 or 6% ( todays market)

considering the senario and putting calculations @ 3.75% , I will loose

apporx $ 58,000 -60000 in interest ..which is equal to term life.

Now ofcourse I am not even getting 3.75% rate….tax free without risk involved.

Looking at current scenario(2012 and moving forward) do you think ROP makes better sense ?

Putting that into figure…lets say @3.75%

@ Sam Before we do some calculations let’s first verify that you have the right amount of the cost of your life insurance. Did you get the quotes from the quote engine on my site?

Jeff

That was quick response, Thank you.

No I got got quote from selectquote.com and other local agent , ( both were exact same from prudential( for ROP

): preferred best ( Male age 36 ,with no health risk history, and 1 ticket( traffic) in 3 rs.

I saw an article you had written, and I had a question. I have part of the article so you can see what I am talking about.

You said: To illustrate the cost difference between purchasing regular term insurance vs. one with the ROP ride, here are some quotes that I ran. In our scenario, I am using a 30 year old male, assuming he is in excellent health. We are going to get a quote on a 30 year term life policy with a $1,000,000 face value. Without the ROP rider, the annual premium will cost approximately, $720 per year for a total of $21,6000 premiums paid over the 30 year period. By adding the ROP rider, the premium jumps to $1,180 per year, for a total outlay of $35,400. That’s a total difference of $13,800 premiums paid ($460 per year) or a 63.88% increase.

If we are able to average 8% return over that same period, we accumulate a total of $52,110 and after subtracting the premiums were left with $30,500. Compare that to the $35,400 we would get back with the ROP rider, and we’re still in the red. If we can average closer to 10% return, then we have a greater chance for the normal policy to be more economically viable.

I am saying: I quickly read your article, and maybe I am missing something, but it seems to me that in the 8% scenario, the normal policy is already more economically viable, and your NOT in the red. If you had the ROP and had a total outlay of $35,400, over 30 years, then $35,400 is ALL you would get back at the end of 30 years. In the 8% scenario, you have $52,110 (all from your investment and got nothing back from the premiums) at the end of 30 years. So actually, you have $52,110 at the end of 30 years, which is over $16,000 more than what you would have gotten back if you had ROP. For this example, I do not see the need to subtract the $21,600 from the $52,110. It seems that at the end of 3o years, with ROP, you get back $35,400, and WITHOUT ROP, and investing the difference in premiums, you had $52,110, even though you got non of your premiums back. Please let me know if I missed something.

@ Jason.

Thanks for the comment. At first glance what you say makes sense, that the $52,110 you get from investing the difference on the ROP is more than the $35,400 you would get back with the ROP.

I think where our views differ is that with the ROP, at the end of 30 years, your expenses are $0 because you get it all back with the ROP. In the other case, sure you made $52,110 off of the difference, but you had expenses over the 30 year period of $21,600 for the insurance.

Does that make sense?

Jeff,

If you are investing the difference, then there’s no need to subtract any expenses at the end. They’ve already be accounted for out since you are investing the DIFFERENCE.

Another way to look at it is like this:

You have a budget of $1180/yr to spend on SOME combination of services. You are interested in term life and a return on investment for the remainder of your budget. You can invest the difference yourself or let the insurance company do it for you.

The ROP policy in your scenario is equivalent to purchasing the term policy and investing the difference with an annual return of 5.x% (something really close to 6%).

To beat that offer/proposal, all you need to do is invest the difference and earn an average annual rate of return HIGHER than that 5.x%.

ALL of your scenarios beat the ROP offered by the insurance company. I think you did the right move by purchasing three term life policies and skipping the ROP route. I’m about to do the same myself. I think your gut instincts were correct the whole time.