Because life insurance is such a vital purchase, you want to ensure that you’re making the best decision for you and your family. There are several different types of life insurance that you have to choose from, but the most popular option is term life insurance. Buying life insurance doesn’t have to be a long and painful process, we can make it quick and easy.

If you’re shopping for term life insurance, the two most important factors to your policy are how much coverage you need and how long your term should be. In this article, we’ll go in-depth on how long you should buy term life insurance coverage.

While most consumers focus all their time on the amount of coverage, the length of the policy is also an incredibly important factor most consumers don’t put much thought into.

Since term life insurance doesn’t last forever, the premiums are much, much cheaper. Term policies are the best option if you’re looking for affordable life insurance coverage for your loved ones. However, how long should you have term life insurance?

Table of Contents

Good question! It depends on your situation. Probably not the answer you’re looking for, but we’ll guide you through the thought process below.

The Thought Process for My Term Life Insurance Policy

Let’s start with my thought process when I purchased a term life insurance policy.

Last year, my wife and I purchased 20-year term policies when we had our first child. The logic was that we wouldn’t need life insurance once the kids were grown, out of college, and could fend for themselves if something happened to us.

We both already had 30-year term insurance for income protection which would get us near retirement. This new 20-year term policy was “earmarked” to take care of the kids and make sure either of us would have to work and could give our children an opportunity they wanted.

The point of our example is that determining how long of a term to sign up for can be just as difficult as determining how much coverage you need. We’ll add and possibly replace coverage as our needs change.

That’s the thing. Your life insurance program should be reviewed every few years or when big changes happen in your life. So when you purchase that cheap term life insurance policy, remember that it will probably be different in the future.

Two Tips for Determining How Long to Buy Term Life Insurance

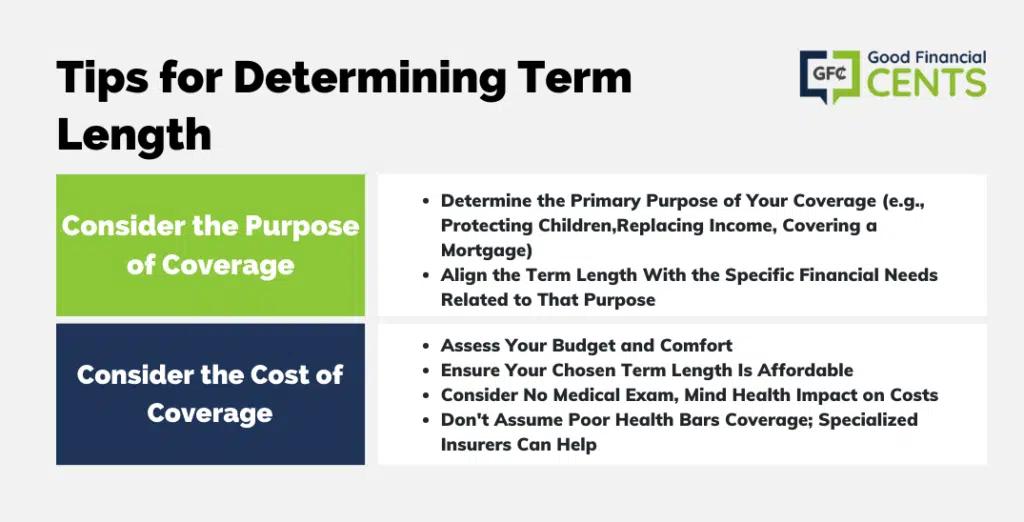

So here are the 2 biggest things to consider when deciding how long your term life insurance coverage should last:

Consider the Purpose of the Coverage

My #1 tip is to consider WHY you’re buying this coverage to determine how long you should buy your life insurance.

If you’re considering coverage for your family to protect your income, you’ll want to buy coverage until you hit retirement age, or at least near retirement age. That doesn’t mean that once you’ve reached retirement you’ll no longer need life insurance. You will still have to evaluate your specific situation and determine your life insurance needs from there.

If you’re buying coverage to cover your mortgage, choose a term length that equals the amount of time left on your note. This is one of the most important factors to consider. If you were to pass away, your family would be left paying for the mortgage, which can put serious financial strain on a grieving family. Having the proper length of life insurance will prevent this and give them the money they need to pay off those expenses.

The purpose of coverage should always lead to your desired term length.

Consider the Cost of Coverage

Once you determine how long you need the coverage, make sure you’re comfortable with the premiums. The longer the term length, the more expensive your premiums will be. The best way to determine cost is by utilizing instant life insurance quotes on this site. You can ballpark the cost of term life insurance at different term lengths. In most cases, term life insurance is much more affordable than most applicants think. It’s a great way to get your family the life insurance protection they deserve without breaking the bank.

Also, as attractive as no medical exam life insurance can be, make sure you can afford it. Bypassing the medical exam can make life insurance more expensive. If you can afford it, it’s a quick and easy way to purchase coverage and we highly recommend it. If you can’t, opt for the medical exam.

Any health issues you have can increase your premiums and will force you to rethink the term length you’re considering. If this is the case, opt for a shorter term length and re-visit purchasing a longer term length in the future when you’re health issues are under control.

If you do have poor health, or any serious health complications, don’t automatically assume that you don’t qualify for a term life insurance plan, or that the premiums will be too expensive. There are dozens of insurance companies that specialize in insuring high-risk patients with health problems. Our agents can help connect you with the perfect insurance company that is going to view your application favorably, which can be the difference between being denied coverage or finding an affordable policy.

Bottom Line

Working through the purpose of coverage, factoring in your term life insurance rates and the best life insurance companies in order to meet your needs, should make you confident in your decision of how long you should buy your term life insurance policy.

Remember that your life insurance needs will be changing throughout the years. It’s not uncommon to own multiple policies to meet your needs as they change. Everyone goes through major life changes that impact their life insurance needs.

You should always review your policies every few years, or when you have major events to see if your policy is still giving you the protection you need. Since the earlier you buy coverage, the less expensive it is – you usually keep your policies when you buy more coverage down the road.

If you’d like to discuss how long you should buy term life insurance, please don’t hesitate to contact us. We can answer any questions you have about term life insurance and ensure that you and your loved ones are getting the best possible plan.

Our agents at Life Insurance by Jeff are independent agents, which means that we don’t represent one single company. Instead, we represent dozens of highly rated companies from across the United States.

Working with one of our agents during the life insurance process can help you save both time and money on your policy. We can give you quotes from best-rated policies from dozens of companies, no calling and answering the same questions.

You never know what’s going to happen to you tomorrow. You can’t predict the future, but you can always protect your loved ones against the worst. Don’t wait any longer to purchase a life insurance policy that will provide for your family, regardless of what happens to you.