Note from the editor:

| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

Lending Club no longer offers its notes platform as an investment but they are still very much a thriving company primarily functioning as a neo-bank. They still offer personal loans for consumers as well as commercial financing.

I was a big fan of Lending Club as an alternative to investing in the stock market. Because of that, I began searching for other investment platforms that could replace my allocation to peer-to-peer lending. Here are a few you can consider:

Table of Contents

Lending Club Alternatives

Here are the closest alternatives to Lending Club that I could find. Please note that this is not an apple-to-apple replacement. Peer-to-peer lending seems to dying, at least in the way that Lending Club initially envisioned it would replace traditional banking.

1. Fundrise – A online real estate and private asset platform that allows investors to pool their money into diversified real estate investments. You can see how my Fundrise portfolio has performed here.

2. YieldStreet – This is truly an “alternative investment” platform that offers investment opportunities that were typically only available to the super-wealthy and institutions. Investments could include private equity, structured notes, real estate and art equity.

3. Masterworks – speaking of art equity, another alternative investment platform is Masterworks. They allow you to buy fractional shares of investor quality fine art.

These are the 3 that came as close to Lending Club when I began looking for replacements. The other option I didn’t mention here is crypto, primarily because of how volatile it is. If you’re into crypto, you can see how I’m currently making money from cryptocurrency.

Lending Club Review (cont)

Lending Club was an online peer-to-peer (P2P) lending platform that took the banker out of banking. Investors would lend money directly to borrowers through the website, enabling both to benefit from the rate of interest established for each loan.

Lending Club is no longer offering this peer-to-peer lending service, however. This review was originally made at a time when Lending Club was one of the top names in the p2p space. There are still lessons to be learned about P2P in general, so feel free to read ahead but please remember that Lending Club no longer offers this service.

And just as important, the entire transaction happens online, eliminating the need for sometimes embarrassing face-to-face meetings common with bank loans. It’s a win-win as both the investor and the borrower benefit from the Lending Club process. Read more information here on getting a loan!

Lending Club is legit for both investors and borrowers. This Lending Club review, unlike some others, will review the service from both sides of the deal. Make sure to read about my experience below before you invest or borrow with Lending Club. Check out other great ways to invest by reading our M1 Finance Investing Review as well.

Table of Contents

Lending Club at a Glance

- Lending Club is no longer offering P2P Lending (2021)

- $1,000 minimum investment

- Average returns between 5.06% and 8.74%

- Personal loans up to $40,000; Business loans up to $300,000; Medical loans up to $50,000

- Best suited for good-credit borrowers and higher income investors

Is Lending Club Right for You?

Are you an investor looking to earn more than the going rate?

Are you a borrower wanting to pay less than what the banks are charging?

Lending Club had been transforming the banking system because of their peer-to-peer lending model that made those exact promises. And after I got my first taste of P2P investing, I realized I had to do a Lending Club review. It was a service suitable for those looking to invest as little as $1,000 or as much as $20,000. And they offered a multitude of loan products, from personal to medical to business — many collateral-free.

That said, there are some downsides, or at least things to be aware of.

I’ll cover the ins and outs of peer-to-peer lending through Lending Club from 3 different perspectives:

- The investor

- The borrower

- My personal experience

Lending Club Review for Investors

With interest rates on safe, fixed-income investments sitting generally at below 1%, Lending Club offers a real opportunity to get dramatically higher returns. In fact, you can get average returns of between 5.06% and 8.74% (do I have your attention now?).

Those are attractive rates, but just so we’re clear, there are more risks with Lending Club investments than there are with bank certificates of deposit. Plus, there are certain requirements you have to meet as an investor. Remember, the higher the potential reward, the higher the risk.

Investor Requirements

Notes are not available in all states. To invest in Notes through the LendingClub platform, you must reside in one of the following states or the District of Columbia: Alabama, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Jersey, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

If your state is not listed above, you may be eligible to trade Notes via the secondary market. At this time, Ohio residents are not able to invest in Notes.

Depending on which state you live in, there are income requirements to invest in Lending Club. In most states, it’s a minimum of $70,000 per year, though it may be higher in some states. Generally, the income requirement does not apply if you have a minimum net worth of $250,000. The platform also requires you to invest no more than 10% of your net worth in Lending Club notes.

The minimum opening account with Lending Club is $1,000 and $25 is the minimum requirement to invest in any single note. For retirement accounts, the minimum to open is $5,500.

Lending Club IRA

You can also hold Lending Club investments as part of an individual retirement account (IRA). You can do this through a Lending Club self-directed IRA. Lending Club IRA requires an initial deposit of $5,500. That amount allows you to start investing at a higher level and negates the need for monthly management fees.

Lending Club IRAs come in two flavors, Traditional IRA or Roth IRA. As you know, I’m a big fan of the Roth IRA. This is just one more way you can invest in your future. But, I wouldn’t keep all of your retirement money there. Roth IRAs aren’t for everyone, so be sure to speak with a financial adviser before you sign up for this specific type of investment. Learn more about Roth IRA contribution limits here.

Choosing Notes to Invest In

There are two ways to invest with Lending Club. Manual investing is where you browse available loans and choose which ones you’ll invest in one at a time. But you can also use automated investing in which you set investment criteria, and notes are selected automatically based on those criteria.

While you can invest in individual loans, it’s generally best to buy them in fractions (which are referred to as notes). You can purchase notes in increments of $25. At the very least, you can purchase a fractional interest in 200 loans with a total investment of $5,000. This will enable you to minimize the risk involved in investing in any single loan.

Collecting Investment Returns

It’s important to understand the notes you’re investing in are not like certificates of deposit. Each note represents a loan that will be repaid to you over the term of the loan. These payments will include both interest and principal.

That means at the end of the loan term, the loan will be completely extinguished (including 100% of your original principal invested). For this reason, you will need to reinvest payments received on a continuous basis as you receive payments.

Lending Club Loan Types and Loan Grading

Loan terms are either 36 months or 60 months and are fixed-rate. More than 80% of the Lending Club loans are taken to refinance existing loans and credit card balances. Similar to other peer-to-peer loans, borrowers are evaluated – and loans are priced – based on credit and credit scores, debt-to-income ratios (DTI), the length of your credit history, and your recent credit activity.

Each loan is assigned a loan grade, ranging from “A” (the highest) to “G” (the lowest). The higher the grade, the lower the rate.

Within each letter grade, the Lending Club also assigns a numerical rank between 1 and 5 (A1, A2, A3, A4, A5). These numeric sub-grades adjust for other factors, such as loan size and loan term. For example, a loan amount of $5,000 would be seen as low risk, and actually result in an improvement in the sub-grade. By contrast, the maximum loan of $35,000 is a higher risk and could turn a B1 grade into a B4 or B5 grade, resulting in a slightly higher interest rate.

Buying and Selling Notes Before They Mature

Lending Club offers its Note Trading Platform through Folio Investing where you can sell the remaining portion of a note under certain circumstances. This is a marketplace where investors can buy and sell Lending Club notes to one another.

In order to participate in this marketplace, you must also open a Folio Investing trading account through Lending Club. There are no fees if you buy notes on the trading platform, but there is a 1% fee charged if you sell a note.

Risks With Lending and How to Minimize Them

It’s important to realize investments held through Lending Clubs are not bank assets, and as such they are not insured by the FDIC. Individual loans can go into default, and if they do, you will lose that portion of your investment.

In addition, a missed payment by a borrower means you will not get the payment on that loan in that particular month. Lending Club does use “best practices” to collect payments from delinquent borrowers, but some will default nonetheless.

When a payment is past due, you as an investor will pay a collection fee of 18% if the loan is at least 16 days past due but no litigation is involved. If litigation is required, you will be required to pay 30% of an attorney’s hourly fees, plus attorney costs.

If collection efforts fail, and it is apparent the borrower cannot repay the loan, the loan will be charged off once it is 150 days past due. When that happens, the remaining principal balance of the note will be deducted from the investor’s account balance.

Just as is the case when you’re investing in a portfolio of stocks and bonds, there are ways you can invest in Lending Club that will reduce your overall risk. The most obvious strategy, of course, is to spread your investment over many different loans – hundreds if you’re in a position to do so.

You can minimize your risk by setting certain loan requirements. For example, you may decide to set a credit score that is some number higher than what is required by Lending Club (currently 660). You can also emphasize loans in which borrowers are refinancing existing debt, rather than taking on new debt. Employment stability is also a factor. A person who has been employed in their field for a number of years is likely to be more employable than one who is just starting out.

A low DTI is also a positive factor. For example, you can make sure the borrowers whose loans you invest in have a DTI of less than, say, 30%. This means their fixed monthly expenses, including their housing expense, the new loan payment, and any other fixed payments do not exceed 30% of their total gross monthly income.

Investor Fees

There are fees charged to investors with Lending Club. However, the fees are collected only when you receive a payment from a borrower. For example, there is a 1% service fee collected on each payment received.

Investing through Lending Club can provide you with excellent high-income diversification in a fixed-income portfolio. Just investing a portion of your fixed-income allocation in Lending Club notes can increase the overall yield on your fixed-income investments.

Navigating Lending Club: A Comprehensive Guide for Investors

| Key Points | Description |

|---|---|

| Returns Potential | Average returns between 5.06% and 8.74%, Offering a Higher Yield Compared to Traditional Fixed-Income Investments |

| Investor Requirements | Limited to Specific States, Income Requirements (Minimum $70,000 in Most States), and a Maximum Investment of 10% of Net Worth |

| Account Minimums | Minimum Opening Account of $1,000, $25 Minimum Investment per Note, $5,500 Minimum for Retirement Accounts |

| IRA Option | Lending Club IRA Available With a $5,500 Initial Deposit, Offering Potential for Tax-Advantaged Investing |

| Investment Choices | Manual or Automated Investing in Fractions (Notes), Allowing Diversification With Increments as Low as $25 |

| Loan Types and Grading | Fixed-Rate Loans with Terms of 36 or 60 Months, Graded from “A” (Low Risk) to “G” (Higher Risk) Based on Credit Factors |

| Note Trading Platform | Ability to Buy/Sell Notes Through Folio Investing, With a 1% Fee on Note Sales |

| Risks and Mitigation | Uninsured Investments, Potential Defaults, and Collection Fees; Risk Mitigation through Diversification and Setting Stringent Loan Criteria |

| Fees | 1% Service Fee on Received Payments, Potential 1% Fee on Note Sales |

Lending Club Review: For Borrowers

Not only can you invest with Lending Club, but you can also borrow with Lending Club as well! Truly, whatever your needs are, you can get a fantastic deal through Lending Club.

You can typically get lower interest rates on loans through Lending Club than you can at a bank. You can also apply for a loan without ever leaving your home. Everything is done online through the website, virtually eliminating the need for an uncomfortable face-to-face meeting at the bank offices. And if your loan is approved, your funds will arrive within a few days.

How the Lending Club Loan Process Works

This is a simple multi-step process that looks something like this:

1. Complete an application on LendingClub.com.

2. Your application is evaluated and your credit score is pulled (this is a “soft inquiry” that will not have a negative impact on your credit score).

3. As described in the preceding section, you are assigned a risk grade of somewhere between A1 (highest grade, lowest rate) and G5 (lowest grade, highest rate). Once again, this grade is based on a combination of your credit score and credit history, employment, income, and debt-to-income ratio (DTI).

4. Your loan is given an interest rate based on your risk grade.

5. You are presented with a variety of loan offers.

6. Investors will review your criteria and loan grade and decide if they want to invest in it.

7. Once all parties agree to the transaction, the loan goes through and your funds are available within a few short days.

If you’re concerned about privacy during the application process, you don’t need to be. Lending Club investors will never know your identity so you’ll be able to borrow on a completely anonymous basis. The site also promises it will never sell, rent, or distribute your information to third-party websites for marketing purposes.

Profile of Lending Club Borrowers

The Lending Club screens borrowers and businesses with their credit screening process.

You will be required to have a minimum of a 600 credit score to even be considered. You will not find this information posted anywhere on LendingClub.com because they do not openly share their lending criteria. You can be assured that if you have a decent credit score, a credit history of several years, and a debt-to-income ratio that is reasonable you will get approved for a loan.

Per the most recent data available the average borrower with Lending Club had:

- Credit Score – 699

- Income – $74,414

- Credit History – 16.2 Years

- Non-Mortgage Debt to Income Ratio – 17.9%

Remember that there are a lot of small business owners borrowing through Lending Club, so if you don’t meet these averages it should not dissuade you from applying.

What Types of Loans Are Available?

Most P2P lending sites make either personal loans or business loans, but very few make both. Lending Club has both business and personal loans, and they also make specially designed medical loans too.

Here is a rundown of the types of loans that are offered through Lending Club.

Personal Loans

Lending Club’s personal loans can be used for just about any purpose. This includes credit card refinancing, debt consolidation, home improvement, major purchases, home buying, car financing, green loans, loans for business purposes, vacations, and moving and relocation. You can even take a personal loan to have a swimming pool installed in your backyard.

Credit card refinancing is perhaps the most interesting of the personal loan offerings. When you consolidate several credit card balances into a single personal loan, it usually results in an increase in your credit score. This is because the payoff of the credit card balances results in both a lower credit utilization ratio and a smaller number of debts with open account balances. Both outcomes have a positive impact on how credit bureaus calculate your credit scores.

Most other P2P lending sites cap their personal loan amounts at $35,000; Lending Club recently increased their limit to $40,000. What’s more, all personal loans made through Lending Club require no collateral. That even includes personal loans used to purchase automobiles.

All loans made through the platform are installment loans, that are fixed rates with fixed payments, and fully paid by the end of the loan term. Those terms can be two years, three years, or five years.

Business Loans

Many P2P lenders offer business loans, but what they really are is personal loans that can be used for business purposes. Lending Club has an actual business loan program. In fact, it’s not just business loans, but also business lines of credit.

Business loans are fixed-rate, fixed monthly payment loans with terms of between one year and five years. The business line of credit works similarly to a credit card or a home equity line of credit, and you are granted a line of credit that you can access as needed. Interest is charged only on the amount of the outstanding balance. And as you pay down the balance, you free up the line for future borrowing purposes.

These loans and lines are available in amounts up to $300,000. Lending Club does not ask for business plans or projections, or for appraisals and title insurance. If you have ever taken a business loan from a bank, you know that those requirements are virtually industry standards.

What’s more, for loans and lines are taken for less than $100,000, no collateral is required. For higher loan amounts, collateral is usually provided by a general lien on the business, as well as personal guarantees from the owners of the business.

The purpose of loans and lines is almost unlimited. You can use them for debt consolidation, to refinance existing debt, purchase inventory, acquire equipment, set up a new business location, remodel your business, or pay for marketing expenses.

Medical Loans

This is a loan type whose time has truly come!

Given that health insurance deductibles and co-insurance provisions are increasing, Lending Club Personal Solutions gives you the option to finance uncovered medical expenses. And here’s something even more interesting: the loan can even be used for procedures such as hair restoration, weight loss surgery, fertility, and dental – procedures that are typically excluded under most health insurance plans.

Lending Club offers three types of loans for this purpose:

- Fixed-Rate Plan

- Promotional No-Interest Plan

- Promotional Rate Plan

Lending Club works with thousands of healthcare providers who accept financing arrangements through the platform. It’s always important to be sure that a provider is one of those participants before having any procedures.

Auto Refinancing

According to Lending Club, “auto refinancing is when you pay off your existing car loan and replace it with a new one, usually from a different lender. Refinancing your auto loan can help you save money by scoring a lower interest rate. Or you can reduce your monthly payments by adjusting the length of your loan term, freeing up cash for other financial responsibilities.”

On average, customers who choose to refinance their auto loans with Lending Club save $80 per month.

To qualify for auto refinancing, your car must be:

- 10 years old or newer

- Under 120,000 miles

- An automobile that is used for personal use.

Additionally, your current auto loan must have:

- An outstanding balance of $5,000-$55,000

- Been initiated at least 1 month ago

- At least 24 months of remaining payments

Loan Terms and Pricing

You can borrow any amount up to $40,000, and while the loans are typically used for refinancing debt or debt consolidation, you can also borrow for other purposes, such as unsecured home improvement loans. Current terms are fixed-rate loans of either 36 months or 60 months.

Exactly how much you will pay in interest rates and fees depends upon the type of loan that you are looking for, as well as your loan grade.

Personal Loans

As noted above, your interest rate will be based on your credit grade, which can run between a high of A1 and a low of G5. A1 has a minimum APR of 10.86% APR. The highest interest rate currently possible is 35.89%.

Lending Club does not have an application fee, but it does have an origination fee, which is typical for P2P lenders. Lending Club’s origination fee ranges, so review the current terms to see if it’s right for you. The fee is deducted from the loan proceeds, therefore it will only be charged if you actually take the loan.

Lending Club does not charge a prepayment penalty on any of its loans.

Business Loans

These loans carry an entirely different pricing structure. Depending upon your credit grade and the financial strength of your business, interest rates on business loans range between 9.77% APR and 35.89% APR.

Business loans and lines of credit also require an origination fee. This ranges between 3.49% and 7.99% of the loan amount. And once again, there are no prepayment penalties on business loans and lines of credit.

Patient Solutions Loans

Since there are three types of loans available under Patient Solutions, there are also three types of pricing.

- Fixed-Rate Plans – This plan offers 4.99%-24.99% APR based on the amount financed and the applicant’s credit history for terms of 24, 36, 48, 60, 72, or 84 months. Rates start as low as $105 per month for a $5,000 case at 8.99% APR over 60 months.

- Promotional No-Interest Plans – This loan program offers 0% APR for terms of 6-, 12-, 18-, or 24-months, and for loan amounts ranging from as little as $499 up to $32,000. After the no-interest term expires, a variable rate of 26.99% APR applies on the remaining balance (this arrangement is similar to the one offered by CareCredit, but at a lower rate of interest after the initial 0% interest period). And if you can pay off the loan within the 0% interest term, you can get funds for medical procedures without having to add interest to the cost of an already expensive operation.

- Promotional Rate Plans– This plan offers 17.90% APR for 24, 36, 48, or 60 months for loan amounts ranging from $1,000-$32,000. After that, purchase an APR of 26.99%. The minimum purchase of $1,000 for 24, 36, and 48 months, and $2,500 for 60 months. Payments start as low as $127 per month for a $5,000 treatment in 60 months, the total cost is $7,620.

Best of all, there are no prepayment penalties should you decide to pay off your loan early.

The Lending Club Loan Application Process

You start the loan application process by checking your rate. This requires providing just general information and should take no more than a few minutes. This step will have no impact on your credit score.

If you meet the loan criteria, you will be presented with multiple loan offers. You can then select the offer that best meets your needs.

You then submit your application, and your loan is then listed for review by investors. The investors are the ones who post the capital you use as your loan. Your personal identity is protected during this process. Your name and other personally identifying information do not appear on your listing.

Once set up, the verification process will take place (see below), the loan will undergo a final review, and then loan documents will be prepared.

The loan application process can take as little as three days, based on approximately 60% of borrowers who received offers through LendingClub, according to the most recent data. The time it will take to fund your loan may vary.

Verification Process

Lending Club will require documentation in order to verify your income and employment. Income documentation may require pay stubs, bank statements, W-2s, pension awards, 1099s for investment income, or income tax returns. In order to verify employment, Lending Club may contact your employer.

As is the case with most lenders, P2P or traditional, they will typically require copies of documents for identification purposes in order to comply with federal law.

All documentation can be provided by uploading it to the Lending Club platform.

Multiple Lending Club loans

Lending Club will allow you to have two active personal loans at the same time. You will have to have made 12 months of on-time payments on your existing Lending Club loan, and you must meet current credit criteria for the second loan.

Loan Repayment Methods

Lending Club sets up your payments to be automatically deducted from your bank account – you will receive a reminder a few days ahead of time by email. You can make your payments by paper check, but you’ll be charged a processing fee of $7 for each such payment.

Navigating Lending Club: A Comprehensive Guide for Borrowers

| Key Points | Description |

|---|---|

| Loan Process | Online Application, Soft Credit Check, Risk Grade Assignment, Interest Rate Determination, Multiple Loan Offers, Investor Review, and Fund Disbursement Within Days |

| Privacy Assurance | Borrowing Anonymously, No Sale of Personal Information to Third Parties |

| Borrower Profile | Minimum 600 Credit Score, Average Borrower With 699 Credit Score, $74,414 Income, and 16.2 Years of Credit History |

| Loan Types | Personal Loans for Various Purposes, Business Loans, Lines of Credit, Medical Loans, and Auto Refinancing |

| Loan Amounts | Personal Loans Up to $40,000, Business Loans and Lines Up to $300,000, Medical Loans With Various Plans |

| Loan Terms and Pricing | Fixed-Rate Personal Loans of 36 or 60 Months, Interest Rates Vary Based on Credit Grade. Business Loans and Lines Have Different Pricing Structures |

| Application Process | Rate Check With No Impact on Credit Score, Multiple Offers, Investor Review, Quick Application-to-Funding Process |

| Verification Process | Documentation Required for Income and Employment Verification, Identity Verification in Compliance With Federal Law |

| Repayment Methods | Automatic Bank Deductions or Paper Check With a Processing Fee |

| Multiple Loans | Option for Two Active Personal Loans Simultaneously After 12 Months of On-Time Payments and Meeting Credit Criteria |

How I’m Investing Using Lending Club

What I really want to do today is walk you through how I am investing with Lending Club. While we’ve already covered details on how to invest and borrow with Lending Club, I thought I’d show you a little bit of my personal experience with investing using the peer-to-peer lender.

I have been investing with Lending Club for a few years now. I don’t have a whole lot invested, and you’ll actually see that here in a minute because I really didn’t understand it and I wanted to test it out first. I wanted to test-drive it before 1) I put more money into it and 2) I recommended people take a look at it.

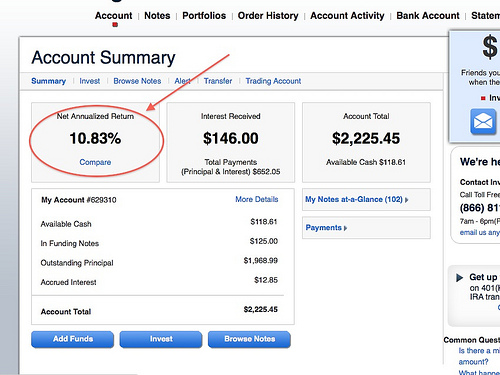

Below, you’ll see a screenshot of the website. I went ahead and logged in so you can see where I’m at right now. Right now, I have invested a total of $2,200, so not a big investment by any means.

My net annualized return is 10.83%, so right off the cuff, you can see I’m already making more than the average investor at Lending Club is making – almost a full percentage point more. That’s not because I am a uniquely great investor. I’m actually very passive in the way I choose my notes, which I’ll show you here in a minute.

I currently have $525 sitting in cash in my Lending Club account that I need to invest, and that’s exactly what I’m going to use today to show you how to invest.

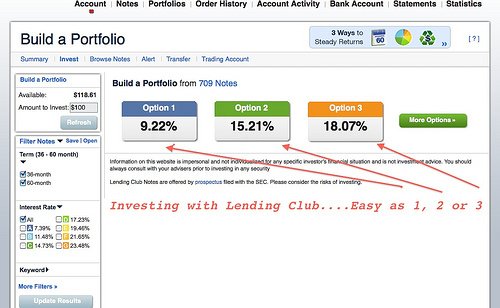

I love Lending Club because they keep things simple. For the people who don’t like to spend a lot of time doing research, they make it very, very simple in that you can choose option one, option two, or option three. Let’s just assume you have a high tolerance for risk and you are looking at the 17% figure. You look at that number. You’re drooling over it. You want it. That’s how much you want to make.

By quickly clicking that option, they will show you where you are investing your notes (the agreements you have with people you’re lending your money to). They’re ranked similarly to that of a report card or a bond.

Initially, you’ll notice by going the more aggressive direction you do not have any of the A- or B-type investors. These are your higher credit score people. They are less likely to default on their loan, so this is definitely more of a high-yield approach when it comes to peer-to-peer lending.

Of that $525 I have to invest, $100 is going into C notes, $200 is going to D notes, $150 going to E, and $75 going to F. Immediately, Lending Club breaks it down for you automatically. And I can’t tell you how much I love that! That’s actually my strategy. I don’t select the third option. I typically select option one, but immediately they break down the notes for you.

They also show you your average interest rate on that is 17.9% (in this example), but because some of those folks are going to default on their loans, they are estimating you’ll lose 4.42% based on default.

Then there is Lending Club’s charge of 0.52%, so your projected return after it’s all said and done is going to be approximately 12.25%. And that’s approximate. Maybe all of those people do pay you back where you’re all good and you actually make more, but that should just give you an idea.

Lending Club Notes

Let’s just go to the next step real quick. Here is another area where you can start seeing what some of these loans are used for. For example, you might see listed: credit cards, debt consolidation loans, small business loans, and more. You can actually see what these notes are.

Note: You should know I’m going through this process in real-time, so I can make sure to show you my thought process along the way and you get a real Lending Club review as I move from screen to screen.

The amount left is how much more that person needs to borrow to take care of the debt. If you want to take it one step further you now can see more about the individual, their gross income per month, if they’re a homeowner or not, their length of employment, their current employer, where they are located, their debt-to-income, and their credit score range. It just gives you a lot more details about the borrower.

Even more, if you want you can ask them questions if you’re not confident or just need some reassurance.

Lending Club actually gives you some direct questions to ask. They did change that a little bit over the past few years (I think because of a privacy act), but they give you a lot of the good basic questions to ask.

One thing I didn’t mention is that of the $525 I have to invest, typically only $25 of that is going toward each individual note, so that’s where the diversification comes into play where you’re not putting all your eggs in one basket.

I am going to try option one. I’m much more comfortable with that option. My projected rate of return is going to be lower, but as you can see I’m actually doing better than what was predicted. I think I might have done some high-risk investing in the beginning, but typically I have stuck with option one. You can see I have a lot more of the B borrowers and none on the F and G side. I’m not much on the high yield. I like to be a little bit more conservative with this aspect. Immediately they break it down and it looks like I’m doing some overlap of my last entry so let’s see if we can get that straightened out.

The other thing too is you could actually choose the term of the note. Lending Club initially just started out with a 36-month, three-year note. They now offer a 60-month note so that’s actually a little bit more of a return on that one, but you are locked into your own money. You can also sell these notes, so if you do not want to hold them for maturity you can find a buyer – just like selling stock on the open market.

Choosing Note Options

All right, let’s see if I can finally get this figured out. I just want to invest. I should’ve started with the option one, to begin with. Let’s start over. Sorry about that.

Let’s go with option one. I can actually go in there and select notes by themselves. I can add more money to one note, take some money away from another note, etc. You have that ability! You also have the ability to build your own portfolios from scratch, so if you want to go through all of the different available notes, you can do that as well.

I personally don’t have an interest in that so I don’t. So, with $525 I’m going to invest in 21 different notes and my average rate of return will be approximately 9.58%. A quick look at the notes and we are going to place the order.

You can then give your portfolio a name. I haven’t done a very good job of managing this so I’m just going to assign it to “Portfolio 10” and we can go from there. I will soon get a confirmation.

One notable thing is that I’ve just invested $525 into 21 individual notes. Most likely, not all of those notes will get the entire funding. In some cases, you won’t get the investment you initially were after. In that case, you would get a refund. From there, you can go out and find some new notes. It most likely will happen, just so you know.

That is it as far as how to invest with Lending Club. It’s so simple! As far as who I would recommend this to – this is not a savings account replacement. This is not a certificate of deposit replacement. Even though you can get a three-year or five-year note you might think of that as a three-year or five-year CD.

How Lending Club Fits in My Overall Portfolio

How do I view Lending Club in my overall investment portfolio? Well, we already have our emergency fund and we have our savings account – this is just something to complement what I’m doing in my stocks. Like I said, I only have a small investment now, but after doing my initial Lending Club review we are planning on shifting some more money there.

We were building a house, had some other improvements we were doing, and had a third child, so we wanted to have more in cash than we probably should, but we just felt more comfortable doing that. Now that we have some of those things out of the way I am definitely a lot more comfortable moving some more cash into Lending Club and start making some more interest.

I should also say I have never had any notes default on Lending Club up to this point. I’ve been doing it for just over two years, and I believe and have not had a default yet. I’m not saying I won’t, but I haven’t had one yet. If I do I will definitely report it.

If you have any more questions let me know. You’ll find an affiliate link, so if you do click and open an account I do earn a bit of money for you doing that. You can also go to LendingClub.com directly. I won’t get the commission and that’s fine by me as well.

If you have more questions on my Lending Club review or if you have any experiences, please share. I’d love to hear more about it as this becomes more of a mainstream investing approach for a lot of people.

How Does Lending Club Compare?

Whether you are an investor looking for an above-average rate of return, or a borrower looking for more affordable loan programs, you’ll find what you’re looking for at Lending Club. Here’s how Lending Club compares to a few competitors.

Remember, only you can make the determination of what’s right for you when it comes to peer-to-peer lending. I wouldn’t recommend putting all your eggs in the Lending Club basket, but it’s certainly an appropriate choice for well-established investors or borrowers needing some money.

For more information, you can read a full review of Prosper and Sofi.

The Bottom Line: Lending Club Reviews

Lending Club is really geared toward borrowers with good to great credit scores. Their loans are a real boon to small business owners and others who have been affected by the banks tightening all their lending criteria.

The size of the company and the several years of experience as a lending marketplace allow both borrowers and investors to know they are working with a solid entity. While the approval process takes a little longer than with some of the other P2P lenders, this is because they are dedicated to allowing individuals to pick the loans they want to invest in rather than keeping a large pool of money from investors.

Please note: This article contains affiliate links that may result in providing me with a commission for you signing up for the services listed. Still, my opinions are my own and I wouldn’t steer you wrong.

Disclaimer: All loans made by WebBank, Member FDIC. Your actual rate depends upon credit score, loan amount, loan term, and credit usage & history. The APR ranges from 6.95% to 35.89%*. The origination fee ranges from 1% to 6% of the original principal balance and is deducted from your loan proceeds.

For example, you could receive a loan of $6,000 with an interest rate of 7.99% and a 5.00% origination fee of $300 for an APR of 11.51%. In this example, you will receive $5,700 and will make 36 monthly payments of $187.99. The total amount repayable will be $6,767.64. Your APR will be determined based on your credit at the time of application.

The average origination fee is 5.49% as of Q1 2017. In Georgia, the minimum loan amount is $3,025. In Massachusetts, the minimum loan amount is $6,025 if your APR is greater than 12%. There is no down payment and there is never a prepayment penalty.

Closing of your loan is contingent upon your agreement to all the required agreements and disclosures on the www.lendingclub.com website. All loans via LendingClub have a minimum repayment term of 36 months.

Borrower must be a U.S. citizen, permanent resident or be in the United States on a valid long-term visa and at least 18 years old. A valid bank account and Social Security number are required. Equal Housing Lender. All loans are subject to credit approval. LendingClub’s physical address is LendingClub, 71 Stevenson Street, Suite 1000, San Francisco, CA 94105.

†Per reviews collected and authenticated by Bazaarvoice in compliance with the Bazaarvoice Authentication Requirements, supported by anti-fraud technology and human analysis. All reviews can be reviewed at lendingclub.com

How We Review Brokers and Investment Companies:

Good Financial Cents conducts a thorough review of U.S. brokers, focusing on assets under management and notable industry trends. Our primary objective is to offer a balanced and informative assessment, assisting individuals in making informed decisions about their investment choices. We believe in maintaining a transparent editorial process.

To achieve this, we gather data from providers through detailed questionnaires and take the time to observe provider demonstrations. This hands-on approach, combined with our independent research, forms the basis of our evaluation process. After considering various factors, we assign a star rating, ranging from one to five, to each broker.

For a deeper understanding of the criteria we use to rate brokers and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Lending Club Reviews

Product Name: Lending Club

Product Description: Lending Club is an online peer-to-peer lending platform that connects borrowers with individual investors willing to fund their loans. Catering to individuals and businesses alike, the platform offers personal, business, and auto loans among other financial products. It aims to provide a streamlined, transparent, and efficient alternative to traditional banking systems.

Summary of Lending Club

Lending Club has pioneered the peer-to-peer lending industry, offering an innovative platform where borrowers can secure loans without the intermediation of traditional financial institutions. By directly connecting borrowers to investors, Lending Club often provides competitive interest rates based on a graded risk system. This grading, determined by a borrower’s creditworthiness, ensures investors understand the risk associated with their investment. Moreover, the platform offers a range of financial solutions, from debt consolidation and credit card refinancing to medical and business loans. By leveraging technology, Lending Club endeavors to simplify and democratize the lending process.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Innovative Model: Peer-to-peer lending bypasses traditional bank intermediaries, often resulting in competitive rates for borrowers and decent returns for investors.

- Flexibility: Offers a variety of loan types and terms, catering to diverse financial needs.

- Transparency: Borrowers and investors have access to detailed information, ensuring clarity throughout the lending process.

- Fast Approval Process: The online-based system often results in quicker loan approvals compared to traditional banks.

Cons

- Origination Fees: Lending Club charges borrowers an origination fee, which might increase the cost of borrowing.

- Credit Requirements: Borrowers with lower credit scores might face higher interest rates or might not qualify for a loan.

- Limited Availability: Peer-to-peer lending is not available in all states due to regulatory constraints.

- Investment Risk: As with any investment, there’s a risk that borrowers may default, leading to potential losses for investors.

I invested as a ordinary person wanted to invest in a start up company gave them 275 dollars for 100 shares and 10 percent bonus on ally my investment ally i got was a page with my name and no investment sent several emails and they keep telling me i didn’t invest. They have a phone number, that directs you to email them. But you never speak to a live person. With the kind of money that is being given you would think they would have live support so these issues can be address the screwed me out of my money which I am still trying to recover, I was introduced to a recovery agent hack101 at tutanota d o t c o m .. And happy to say i got all my money back

Your review of LendingClub is far too positive. As the saying goes, “Past performance is not a guarantee of future results”. In a year or two I would suggest re-reviewing LC with your actual returns.

But here are the gaps that I see in your article.

One, notes you purchase are not easily sold for face value in the secondary market. If you want to sell a note you’re no longer interested in owning, you will have to sell it at a significant discount on the secondary market.

Two, some borrowers will straight roll you, meaning never even make a single payment. The worse part of this is that because your investment was less than 12 months, you can’t even deduct it as a capital loss, if you are investing in a taxable account. For IRAs, you’re just straight out of luck. And this doesn’t even discuss the fact that charged off notes will get sold off by LC and you’ll get pennies on the dollar (net of LC’s cut for the “recovery”)

Three, there are statistics pages on LC’s website that show the range of returns, and at present the vast majority of LC note investors are not getting anywhere near 10% return.

Four, if you decide to start an IRA account with LC, there is an administrative fee if your balance is too low. When it comes time for you to start taking minimum required distributions from your IRA, then you had better hope you are not forced to sell notes to avoid IRS mandated penalties (see point number one above).

Five, LC has been engaging with other financial institutions to buy up whole notes, never getting to the fractional market (retail lenders such as yourself) that got them started.

Six, this may have changed, but at least in past, if LC ever goes bankrupt your investment with the notes goes to nothing. You are actually not investing directly in the notes, you are investing with LC who then lends the money to the borrower based upon what notes you want to put money towards. So, make sure you know if LC is a going concern long enough for you to get your money back. And note that LC recently did a reverse stock split.

Seven, if you invest in a taxable account, net of taxes your returns will likely not be much better than U.S. Treasuries.

Eight, there are many long-time investors, on other forums, who are unwinding their LC investments. These are sophisticated people who’re using LC’s API to pull data down, score notes and make investments every four hours that LC makes notes available for sale.

Which brings up number Nine. If you’re investing notes, with the sophisticated operations that some investors have, you will be lucky to invest in the crumbs of notes that fall through the cracks.

And Ten, The previous two years and the current year-to-date, my charge-offs have exceeded my interest income. At first I had a real nice rate of return, and up until 2017 I was stable around 7%, thinking I had found a way to get good income, then 2017 happened, and 2018 and 2019 haven’t been better. Over the years of investing on LC, I’m looking at a net of taxes return of about 2% overall and that isn’t climbing when charge offs exceed interest income.

And just to go to Eleven, you might score a good note with high credit scores and high interest rates, but then another financial institution will come along and offer that same borrower another re-financing package with better terms and that borrower will pay your note back in full. So, don’t count your chickens until all your eggs are hatched.

And don’t even get me started on how much in fees LC takes from the loan payment as it relates to collections.

What is another place you suggest to use instead of LC?

Does Lending Club lend money to persons from other countries or only within United States

The authors comments are unrealistically skewed towards the positive. In reality, after 3.5 years, my initial investment of $5K has only made a 3.2% return with 18% of the loans written off. Oddly enough, the highest percentage of loan write offs have been A and B rated loans with my loan portfolio containing A, B, C and a few D rated loans. In my opinion, Lending Club is not aggressive enough in pursuing payment and they charge you for the lame collection attempt they make. I am currently make a higher return in certificates of deposit and I recommend that course of investment over an unpredictable return and poorly administered collections procedures. Another sad fact of the Lending Club is that they promote the ability of selling loans out of your portfolio which in practice does not work.

Very interesting article – thank you for your effort. A couple of questions which you might have covered in your article. When is interested credited to your account and can the interest be withdrawn say on a monthly basis leaving the principal in the account for further investment when after current loans mature. I would like to receive to receive the interest as part of my monthly income.

Thank you for your help.

Great article. Informative and easy to follow. Will definitely be checking out this form of investing further. Thanks!

Quistion: If you invest 1000 with a posible return on 3% what is 30 anual, but you divide all this 1000 in miltiples notes. With one single person that don’t pay you, you lose the whole posible return. Is that true or i am missing something???

Please explain

Hi Angel – Each note is $25. So if that loan defaults, you will lose part of your investment return. But if you’re earning 10%, that would be $100. A single loan default would drop your net return to 7.5%.

Jeff, good morning. Your article is dates 10/19/2018 but in your personal experience you only reference 2014 and 2015 data for the Lending Club. Did you start investing prior to those dates or only in the last 2 years? Do you plan to significantly increase the amount invested by influx of new funds or allow to grow through reinvestment of funds currently invested? What percentage of your total investment portfolio do you have invested in the Lending Club?

I’m curious about this.. I’m on retirement so I would need to invest only $25 per check.. I only get paid once a month.. what would you recommend (Bill Naquin)

Hi William – Once you’ve satisfied the minimum investment, you can set up a direct transfer of the $25 per month. I’m not aware of any minimum ongoing contribution.

In your article, you stated “…we put together an in-depth Prosper vs. Lending Club comparison.” However, I was unable to find a link to this comparison. Do you mind providing that link? I would be very interested in seeing the comparisons, and which you would recommend over the other. Thank you very much for your time.

Hi Rob – There is no link because we prepared the comparison.

I appreciate the information. However, since most people do not make 70k do you have any suggestions for investment the other 80% of people?

Hi John – If you make well below $70k, you might want to look at some safer investments, like bank CDs or online savings accounts – unless you have a large amount of money to invest.

I invested in a Lending Club IRA. It’s been a few years, and the return on the investment never topped 5%, so I’m currently trying to roll the money over into another retirement account. Lending Club, and Strata Trust, the company that manages the IRA, make this difficult and time consuming. It’s taken 5 phone calls and several emails. The transfer process will take at least three days. I’m only transferring about 25% of my money, because the rest will be tied up until the loans mature. So, I’ll have to go through this multiple times. From my perspective, Lending Club is a waste of time and money.

Thank you for the review. It sounds very interesting. Will you offer a bit more information on a paragraph that sounds scary: “When a payment is past due, you as an investor will pay a collection fee of 18% if the loan is at least 16 days past due but no litigation is involved. If litigation is required, you will be required to pay 30% of an attorney’s hourly fees, plus attorney costs”?

18% of what? 30% of what – total lawyer fees? That could sink a person.

Thank you!

Vanessa E.

Hi Vanessa – It’s 18% or 30% of the note experiencing the delinquency or non-payment. So if your investment is $25 in that note, it will be 18% or 30% of that amount. So you’re liability is limited.

Question: You said an investor will pay an 18% collection fee for late payments and 30% of attorneys’ fees in the event of litigation. Is that 18% and 30% of my investment in the note (e.g. $25 investment)? If it is not proportionate, those charges could be really high, especially litigation costs. It could wipe out my entire account.

Hi Susan – I believe the percentages are based on the amount of the note still outstanding.

I want to know if a nigerian is entitled to this loan

Hi Abelebara – It may be available if you’re a US resident with a taxpayer ID number. But I don’t believe it’s available if you live in Nigeria. Please do a web search and see if Lending Club has a Nigerian branch, or if there are any other P2P lenders there.

Question:

Should I get a loan through Lending Club, is there a penalty for paying the loan off early??

Hi Lucie – That’s a decision you’ll have to make for yourself. You might try applying and see what they come back with. And no, there is no prepayment penalty.

As a non resident,living in the Caribbean to be exact St. Maarten can i open an account and start investing as well?

thanks

I don’t think so Zen. To my knowledge it’s only available in the US. But you can contact Lending Club and ask if you can, or what they might suggest.

As an investor – large amount of defaulted loans ans write downs. There is no path to get out of Lending club notes except to sell them on secondary market – takes a long time unless you are willing to discount them – once you start your notes the yield be comes negative “(Adjusted Net Annualized Return -4.46%)” quickly. In hind sight – probably was not worth it

Since this article is more than a year old, do you have any updates to it?

I do not recommend Lending Club at all. I have been an investor with them for a very long time. And yes I did make money with them when I was actually reinvesting my money.

However, a better opportunity came my way and I wanted to take my lending Club money out to use it. I knew this would take time to do which I was ok with.

Since I was no longer reinvesting my money on new loans my rate of returns just keep falling and falling and falling. The reason for this is new loans is where you are making your returns. Over time way to make loans go default.

I do not like this system and would never invest with them again.

Hi Justin – It’s true, you do have to reinvest to make P2P lending work efficiently. But have you calculated the actual return on the declining balances? It may have been positive, but as the balance drops, it seems like you aren’t making any money, even though you may be.

There’s other direct lending programs out there. From my experience with L.C. where borrowers can default and just walk away – and leave you hanging as a lender with no recourse. There are programs that loan for ie fund commercial & residential real estate with the loan – a tangible asset for the lending company to have a lien against.

The risk reward isn’t worth it on the L.C. program.

Hi Todd – Yes, PeerStreet is an example. They make only secured real estate loans. But the returns aren’t as high as Lending Club, and even they admit to less than 100% recovery on defaulted loans, especially in states with judicial foreclosure laws. No platform is 100% perfect, but that doesn’t mean they aren’t worth investing in.

Great Program but there a few issues for having a lending account:

1. Default rate is way too high

2. No clear exit strategy except try to sell notes on secondary market or at a discount if you need money sooner.

3. Try to transfer money back to your IRA from L.C. – took 2+ months

they were less than helpful and refused to help or give any info to company receiving funds- they just rejected with no reason.

I’ve been selling notes since last June and still am not out completely

Hi Jeff,

Great article but I do beg to differ on just a few of the borrowers criteria you have listed. I just paid in full my lending club loan as of today and it was a last resort for us and ended up saving us the past few months from bankruptcy or credit counseling. It basically saved our credit scores and saved us over $200 a month by consolidating. We were turned down by everyone for months because our debt to income was almost 90% and our scores were 600 and 675. Combined we only make $108K and our debt was pushing $35k which by today’s average I know is not that high but for us it was drowning. Anyway in our situation I took a one last shot before we called credit counseling and lending club actually approved us. We originally got approved for $25k plus their $1,500 fee, which took the bulk away and still saved us a ton even at the 28% interest rate they approved us for. We made 3 payments on it and between that and our tax return we got our utilization down to 5%, our scores jumped hugely and we were able to refinance the loan through our credit union at a 7% interest rate saving us even more money. I thank lending club for being the ones who saved us from ruining any chance of bouncing back from this and making it possible. It’s tough to do but sometimes places take a chance and it pays off.

Thanks for sharing a success story Nicolle!

Thanks for the article! This is great information, and I am certainly interested in investing when I am able to save up a bit more money. My question is, what is the fee for withdrawing money once you have started to earn, if you’d rather withdraw a specific amount than to reinvest?

Hi Kelly – There shouldn’t be a fee for withdrawing money, but there might be for closing out the account.

After watching your video and just reading the beginning of this blog, I went to lendingclub and open an account. However, upon reading the rest of your blog, I would like to request to have my account be credit to you. Would that be possible?

Also, thank you very much for this! I think it’s wonderful how you complete the blog as you go through the site.

Hi Kammie – Thank you so much. You can see if they have a referral program then give them my name. That might work.

how are investors profits income taxwise

Hi Ed – They’re taxed the way any investment income is. The interest is taxable.

I honestly don’t believe lending clubs loan standards are very thorough or up to what banks require. For example I invested in 134 loans and 18 are in default, late or charged off. That is a 13% default rate. Quite a few of the defaults paid 1 or 2 payments and stopped paying. I am slowly withdrawing my cash monthly to recoup cash as it comes back but once my balance says 0 I will leave the website. I would not invest a single dollar. You would be better off investing in some dividend stocks or ETF. Ally Bank pays 1.0% interest. All better than lending club.

I put $10,000 in to Lending Club and had it set up to reinvest accrued interest. I have had the money in for close to 9 months. I have made $450 so far, 4 loans have been charged off, 2 defaults, and currently 9 that are 36-120 days late. I stopped the auto reinvestment and will be pulling my money out as it is paid. I am very disappointed in this investment. They need to come up with a better way to collect when borrowers default on loans. Most of the deadbeats only paid 2-3 payments and then quit. I could have placed the $10,000 in stocks and made at least $1,000 on my money by now. If you have money don’t waste your time on this, go with the market instead.

You do realize your comparing Lending Club against one of the most bullish markets in history, right?

Thank you for your review of Lending Club. You mention that you have to reinvest your earnings. Why do you have to reinvest? Can you get money out of the account as it is accrued? Or do you have to wait until the end of the note, which means the cash will be sitting there for years?

Thanks.

Hi Stephen – All loan notes held with LC are self-amortizing. That means that payments you receive are both interest and principal. At the end of three or five years, the money will have been completely withdrawn if you took it as income and spent it. That’s why you have to reinvest, to keep your investment growing by investing loan payments into new loans.

I applied for a loan on 9/13/17. As of today, funding has a green check mark next to it and my application says its in final review. I got an email stating everything looks fine and they are just waiting for investors to back the loan. However, I looked on the manual investing website but I dont see my loan on there. Do you know anything about this or how it works? Im trying to find out how much of my loan is currently funded. Thanks

Hi Ashley – If it’s not showing on your loan, you’ll need to call them and find out what’s happening.

This company is full of air …. I am 690 beacon ..job over 125000 a year … but somehow how got turned down .. then they send you to another company to shop u around and hurt your credit …. don’t believe the hype…I went to my credit union got a loan fast …these people are waste of your time …don’t let them use your credit and your name to shop around …. do not trust

I prefer Prosper, but Lending Club is a great place and alternative. Can’t deny these solid returns for Peer to Peer lending/investing. Great post!

Is there a limit to how much you can invest with Lending Club?

@Alvin I’m not familiar with any limits. The minimum to invest with Lending Club is $1,000.

That’s good to know. I ask because I read on another site that you must have at least $70,000 income to invest, and they do not let you invest more than 10% of your income. I just hoped that wasn’t true.

Alvin,

That is what is stated; you must have an income of $70K or more and you cannot invest more than 10% of your income; $7K in your case.

I reside in Canada, does Lending club operate in Canada. can someone in Canada Invest in Lending club?

Hi Obiora – I wasn’t able to find any reference to Canada on the Lending Club website, but a couple of review sites indicated that it’s not available there. But my guess is that they’ll get there eventually. P2P investing is new, and is spreading out fast.

I’m coming into $10,000 in a couple of weeks. I read your article about Lending Club and I’m thinking about investing $5,000 for a short term gain.

Do I sign up on this site or where do I go to invest?

Hi Michael – You can just click on one of the links in the post and it’ll get you right where you want to go.

Boo Hoo, as a PA resident, I am unable to participate in Lending Club investing. I can find no direct reason, except PA stinks!! To protect us? Hmm.

I just had some unexpected extra cash that I wanted to invest.

Anyhoo, your YouTube video and article were very good. Thanks anyway.

Isn’t kind of misleading to say that LC “…takes the banker out of banking.” since actual loans to the borrowers are originated by WEBBANK of Utah. Further no investor directly “funds” the loan but acquires an unsecured debt against LC. LC is very honest that they have NO legal obligation to pay a linked loan debt if the debtor ceases to pay.

Hi Scott – Not necessarily. Webank acts more in the administrative role in creating the loans. They don’t actually fund them, otherwise all the investors would be getting no more than 1% or 2% on their money. The act more as a temporary warehouse.

Same in Texas but I buy notes off of the secondary market or their Folio Platform. I am not sure if it is the same for your state but Texas allows you to buy loans from people that have invested in a loan and are reselling it

Thanks for the heads-up Peter!

One of the downsides to Lending Club is the hefty fee for taking money out. I tried to take $1000 out to invest elsewhere and was told the fee would be $100. On an IRA.

Can someone from outside the US invest?

Hi Peter – Technically yes. But Lending Club requires that you have a Social Security number, a US bank account and that you reside in a US state where they can legally operate, which means that you’d virtually have to be a US resident or citizen. Sorry there isn’t a better answer.

Hello Jeff,

thanks for the comments. I am currently living in USA but will be gone in two months back to my country. Still I need to keep an account here for some months and instead of letting the money do nothing, this is a good option. I currently have SSN, bank account and reside here. But in two months I am gone. Can I still use this service with my current information, go away and keep my account even if gone out of USA? both as investor and eventually borrower?

Thanks!

Hi Juan – You’ll have to find that out from Lending Club directly. They have rules in regard to opening an account, but I don’t know if they extend to your continued residency status.

Thanks for another great article Jeff. I had not heard of Lending Club until listening to your podcast, after doing some research it appears to be a great product. I have heard you mention portfolio diversification a few times. I understand the concept of using this instead of other investments options (e.g. stocks), but I have been trying to decide if this diversification mitigates any risks. As we know, the financial markets can be shaken at any news. The most recent news of Brexit has hurt the markets before any losses have taken place. Stock markets tend to be preemptive and news based, while products like Lending Club aren’t impacted until actual results take place. Actual results in this tense would be job loss. I look at market trends as indicators for future results on other investment tools like Lending Club. This results in Lending Club not having an impact yet, but a good sign of increased risk in the future.The markets may crash first, but if we enter an economic downturn this type of investment will also receive negative implications.

Long story short, what are your thoughts on the correlation between these investment options? Would you advise investors to stay away from Lending Club in a time where we predict a near economic recession? Or does Lending Club have underwriting requirements in place that can serve as a great alternative in unfavorable market conditions?

I believe the correct option is targeting high-quality credits (over 740 FICO). Your return won’t be as good, but your risk will be less. This appears to be a great alternative, yet it does tie your money up in a low rate environment for 36-72 months.

Any thoughts on using this for mitigating risk in other investment areas while still receiving a great return?

Hi Sean – That’s a complicated question, since the answer involves a large dose of predicting the future, which no one can do. But I get where you’re coming from. The history on P2P lending isn’t deep, since the industry was very young during the last recession. But it might help if you go to Lending Club’s Statistics page and it will show you the performance of the different credit grades at different time periods. You can go to the interactive chart on the page and plug in the numbers. I did it for the timeframe between 1Q 2007 and 4Q 2009 – roughly the period of the financial meltdown. What I found is that while the lowest credit grades performed poorly, the highest grade loans – A – turned in a gain of greater than 5% per year for all three years. When you consider that stocks were down more than 50% at one point in that timeframe, 5% per year looks really good.

What are your thoughts on the Lending Club scandal?

Hi Rebecca – I’m certainly disappointed, but I want to wait and see how this plays out. It may look very different a year from now. One good thing that comes out of situations like this is that companies often improve their processes in response. In the end, it could make Lending Club a more secure platform. We’ll have to wait and see.

I’m interested in peer to peer lending but not sure how it works if I want to sell my notes. How liquid are they?

@melanie

I definitely wouldn’t compare peer to peer lending to CD’s or a money market account. I would view it more like a 3-5 year investment.

That being said, peer to peer lenders will use a third party to sell the notes for you in what is considered a third-party marketplace. You have to list your notes there and wait for buyers to pick up your notes. Buyers may pay full price or you may have to sell at a discount to sell your notes. This whole process can take anywhere from a few days to two weeks (also considering the time it takes to ACH the money from your P2P account to your personal bank account.

How does Lending Club compare to traditional bank or credit union loans? Could you provide an idea of the difference in rates?

You can get double digit returns on Lending Club, but it will be hard to get anything better than 1% on banks and credit unions. I wouldn’t recommend abandoning traditional savings, but you might mix in some Lending Club investments to improve the overall return on your interest bearing holdings.

There’s always been a debate on whether a personal loan is the right move to use it to consolidate your debts. Think the consensus is that a personal loan will typically save you money vs paying minimum payments on credit cards, why is that? Is it because interest is calculated differently on personal loans than credit cards?

Hi Jeremy – It’s partly because you can often get lower interest rates on personal loans (but not always), but also because personal loans are term loans. You pay them off in three or five years, which saves you a lot of interest. As revolving debts, credit cards are like perpetual debts. You pay a fortune for them over a lifetime.

Mr Rose I must say of all the hogwash opportunities I’ve looked this is the most honest and understandable one. I want to try this only have little money 100 . great article by the way. I have a very short attention span and I read it all. If I do this youve got my vote. Thank you.It sounds like something I could learn and get better at.

Thanks for the review. I’ve never really gotten into investing in debt, but I’ve thought about it a lot. I’ve been more into ownership investments up until this point. Perhaps I’ll give it a shot and see how it goes.

Hi Jeff, I was just looking at the stock trends for Lending Club and it looks like they have steadily gone down since December 2014. Would you still recommend investing your money in this platform based on this information?

Laura

Hi Mr.Rose, Peace and blessings to you and yours this day. I have watched your videos and read up on the lending club. Presently I am in the process if setting up my own account with them as an investor.

I do wish to ask. In your opinion, is this a good vehicle to generate residual Income? As that is my primary intent in investing.

Second, if the results from.investing are residual, can I have them directly deposited to my bank accounts ?

Thanks in advance,

Jon

@ Joh With Lending Club (or any other P2P lender) they can accomplish what you are seeking: passive residual income.

I’m not sure about having it automatically deposited into your account. You would have to check with them. I do know you can have a direct line into your checking account and it’s easy to move funds between the two accounts.