| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

I haven’t had a lot of success investing in real estate, at least not directly. That’s why I don’t talk about real estate investing more than I do.

But about five years ago I started investing in real estate and private asset platform through Fundrise, and I’m happy to say I’ve been making money at it.

I’d heard about all these different crowdfunding real estate platforms but hadn’t pulled the trigger yet. But as has become my way over the years, I decided to jump in and give it a try. For me, that’s the best way to learn.

That was five years ago, and I recently got a congratulatory notice from Fundrise on my “anniversary”. That made now seem like a good time to look back and see exactly how the investment has performed.

It’s not just a matter of looking at that performance either. I also want to know how that performance compares with the results from real estate in general, from competing real estate investments, and also from non-real estate investments.

I hope you don’t mind that we’ll be crunching a bunch of numbers here. But that’s the only way to know what’s really happening when it comes to investing.

Who Is Fundrise?

Table of Contents

- Who Is Fundrise?

- Private REITs

- The Fundrise Solution

- Other Real Estate Crowdfunding Platforms

- How Do You Get Started With Fundrise?

- Fundrise Plans & Portfolios

- My Fundrise Portfolio Returns

- My Specific Fundrise Portfolio Allocations

- How Do Fundrise Returns Compare with Other Investments?

- Fundrise Returns vs. Other Real Estate Investments

- My Thoughts on Fundrise Portfolio Returns

- Bottom Line – Is Fundrise Worth It?

- Frequently Asked Questions on Fundrise Returns

Fundrise got started in 2012, and they’ve since become one of the top platforms in the real estate space They may even be the top platform. Through 2023 they’ve originated over $4 billion in commercial real estate transactions across the U.S.

As of 12/31/2023, the total value of real estate investments is more than $7.1 billion, and the company has paid an incredible $361 million in dividends to over 385,000 investors.

Private REITs

Back when I was a financial planner I got involved in private real estate investment trusts (REITs). These are similar to Fundrise, so I am familiar with the concept.

As a financial planner, you love selling these investments. That’s because they paid commissions of between 7% and 10% of the investment made. If a client made an investment of $100,000, you could earn $7,000 or more in commission income. What financial planners like just as much is that when the investor sells their position, they usually aren’t aware of the commission they paid.

Some of the private REITs did quite well – that is, until the real estate crash in 2008. It was worse than just the declines in the value of the trusts. In the middle of the Great Recession, tenants were breaking their leases, cash flow dried up, and investors wanted their money back.

At that point, the problem was that the principals who were running these private REITs didn’t have any cash to pay back the investors. It was a liquidity crisis, which meant it was almost impossible to recover even part of your investment.

That’s not an impossible outcome with private REITs. Buried in the fine print is language advising investors there may be circumstances where they can lose some or all of their investment. But as you can imagine, few investors go into any type of investment with the idea that they’re going to lose money on their investment, let alone lose the whole amount.

It even happened to a friend of mine, or really a friend’s mother. She put $100,000 or $200,000 into a private REIT, then got the letter informing her it was all gone.

That’s not quite how Fundrise works, which is a big part of the reason I like them.

The Fundrise Solution

What you have with private REITs is a combination of high risk and a lack of transparency on the fees connected with the investment.

That’s exactly what Fundrise set out to remedy. Fundrise investments have lower fees and full transparency in disclosing those fees.

You can invest with a minimum of $10, which means almost anyone can participate. Even if you do take a loss on an investment that small, it’s probably not the kind that will wipe you out financially the way private REITs did to some investors in the last recession.

Fundrise does disclose the risks of commercial real estate investing. That includes the possibility you may not be able to liquidate your position.

Fundrise does a good job informing their clients making this point abundantly clear. The letters emphasized that if the market were to take a big dive, Fundrise might be forced to halt investment redemptions.

That’s just an inherent risk with commercial real estate investments, simply because real estate – and especially commercial real estate – is not a liquid investment.

Unlike a mutual fund, a private REIT can’t sell stock to raise cash to pay investors.

It’s also close to impossible to sell an office building or an apartment complex in a bad market where there are probably no buyers.

It’s unavoidable, but I give Fundrise credit for updating their investors about this possibility on a regular basis.

With Fundrise, there are no upfront fees, and you’ll know exactly what you’ll be getting into – including the fees you pay along the way.

Other Real Estate Crowdfunding Platforms

Fundrise isn’t the only real estate and private asset platform out there. There are others that provide similar opportunities, also offering low investments and transparent fee structures.

YieldStreet works similarly to Fundrise in that they offer investments in commercial real estate. But they also include alternative investments, like marine loans, artwork, and private business credit. It’s probably better suited to more sophisticated investors with a big appetite for risk.

Groundfloor also invests in commercial real estate, but not in the same way as Fundrise. Instead of offering equity investments, and an opportunity for long-term growth, they focus on investing in financing for commercial projects. You can invest with as little as $10, and the investments are short-term – generally less than one year.

DiversyFund is another real estate crowdfunding platform that invests in commercial real estate. However, they focus primarily on large apartment complexes, which they feel are better long-term investments. You can invest in their REIT with as little as $500.

I think RealtyMogul is probably the closest competitor to Fundrise. You can begin investing with as little as $1,000, but the deals they invest in are much more specialized. For example, you can invest in individual properties. But the one catch with RealtyMogul is that you must be an accredited investor, which means you must meet certain pretty strict financial criteria to qualify.

The fact that there are multiple real estate crowdfunding platforms in the market confirms strong demand for this type of investment. But just as important, the competition forces each platform to provide a better investment offer to their customers.

How Do You Get Started With Fundrise?

One of the big advantages of Fundrise is that they have their product on their website, and they even offer mobile access. This is unlike those private REITs I was talking about earlier, where information is hard to find, and often buried in the fine print. Fundrise puts it all out there, so you’ll know exactly what’s going on at all times.

You can sign up for an account directly on the Fundrise website. It’s free to open an account, and you can choose both the amount you want to invest and the specific plan that will work best for you.

Fundrise Plans & Portfolios

Fundrise Pro introduces an innovative approach for investors looking to actively manage and tailor their portfolios with precision. This premium membership service empowers investors by enabling them to concentrate their investments in specific funds and create custom investment plans that align with their individual preferences and financial goals.

The platform offers a unique blend of tools and resources, including access to proprietary data and curated content from leading financial publications, designed to enhance the decision-making process. This level of control and insight into one’s investment strategy is particularly appealing for those who wish to play a more hands-on role in their financial growth.

However, this comes with considerations. The service demands a more engaged and proactive investment approach, which may not suit everyone’s style or availability.

Additionally, there’s a financial commitment to access these advanced features, with Fundrise Pro priced at $10 per month or $99 per year after an initial 30-day free trial period. While this cost is relatively modest in the context of investment services, it’s an additional expense that potential users will need to evaluate against the value they expect to derive from the membership. For those ready to dive deeper into their investment journey, Fundrise Pro offers a compelling suite of features to explore.

Benefits of Fundrise Pro

| Feature | Description |

|---|---|

| Target Audience | Designed for investors who want an active role in managing their Fundrise portfolios. |

| Key Benefits | Allows investment concentration in specific funds, creation of custom investment plans. |

| Exclusive Tools | Access to Basis™ and curated articles from The Wall Street Journal, among others. |

| Customization | Enables investors to tailor their portfolio allocations according to personal preferences. |

| Investment Directness | Direct investment in specific funds is facilitated through the platform. |

| Data Access | Provides in-depth data and market research for informed decision-making. |

| Cost | $10/month or $99/year after a 30-day free trial. |

My Fundrise Portfolio Returns

I started my Fundrise investment in February 2018 with $1,000 in the Basic diversified portfolio plan. About a month later, Fundrise was offering an initial public offering (IPO), which is something that always grabs my attention.

But to take advantage of the IPO, I had to have at least $5,000 invested, and that meant moving up to the Core plan. That was as easy as adding an additional $4,000 to my original investment.

The current balance of my account is about $10,529.83. Of that, $8,055.99 is the growth of the original $5,000 investment. The remaining balance in the account is my portion of the Fundrise IPO.

Focusing only on the real estate side, my $5,000 investment has increased by $3,055.99 over just five years.

Here’s how that breaks down by annual percentage return:

| My Fundrise Returns | Year | % Return |

|---|---|---|

| 2018 | 7.4% | |

| 2019 | 9.2% | |

| 2020 | 7.6% | |

| 2021 | 23.9% | |

| 2022 | 6.4% | |

| 2023 | (10.7%) | |

| Average Annual Return | 6.9% |

I don’t have the full dollar breakdown for each year, but here’s what I do have, along with the split between dividends and capital appreciation:

| Year | Dividends | Capital Appreciation | Advisory Fees | Total Return |

|---|---|---|---|---|

| 2018 | $274 | $74 | -$5.75 | $348 |

| 2019 | $383 | $131 | -$7.97 | $506 |

| 2020 | $226 | $234 | -$8.40 | $452 |

| 2021 | $229 | $1,308.36 | -$9.26 | $1,528 |

| 2022 | $752.71 | (-$234.33) | -$11.59 | $506 |

| 2023 | $136.16 | ($1,014.74) | -$11.91 | ($890.49) |

| TOTAL | $2,471.06 |

This is what I really like! They break down exactly how much you earn, and also where you earn it. They also let you know when a property has been sold. All that information is available in the Fundrise dashboard.

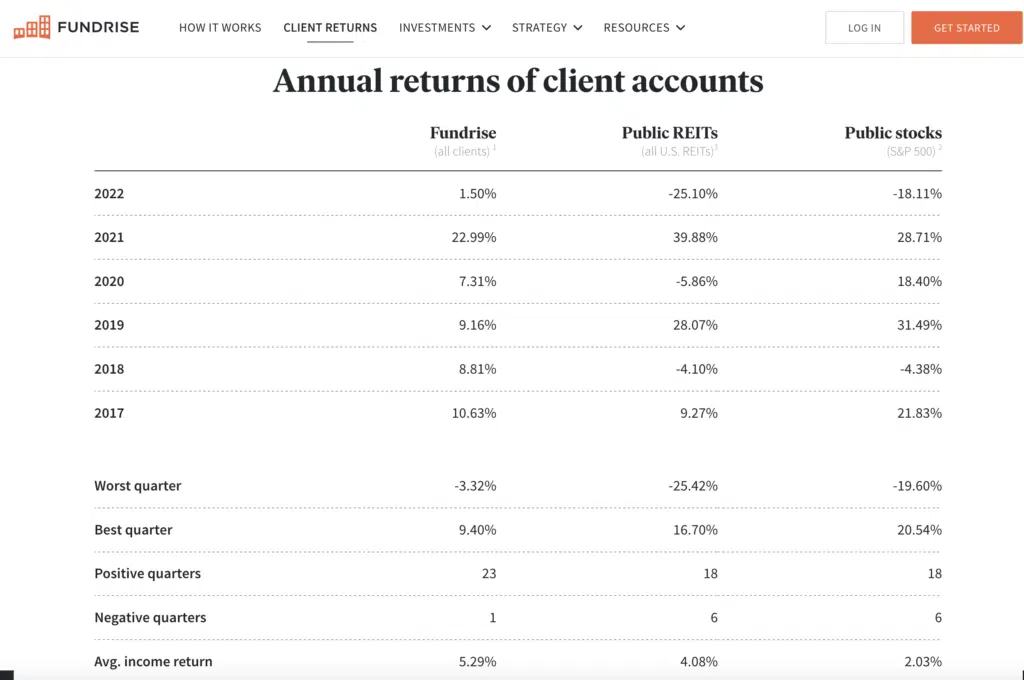

As a comparison of my returns here’s what Fundrise shares on their site:

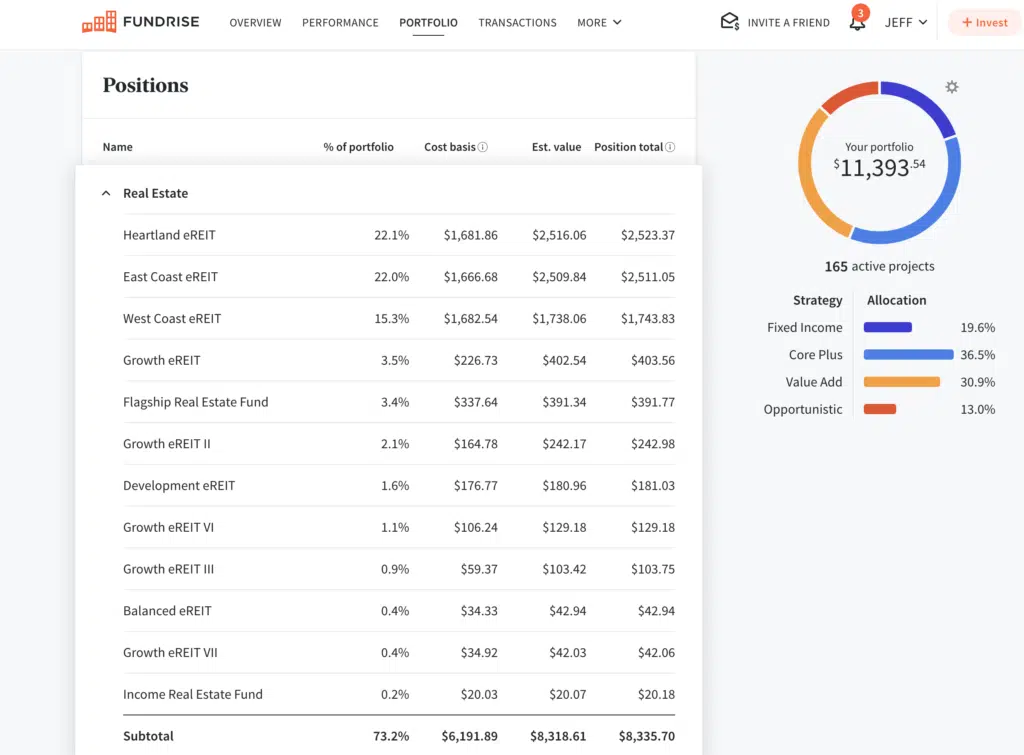

My Specific Fundrise Portfolio Allocations

I was most interested in long-term growth, so I invested in the Growth REIT. They also offer the East Coast, West Coast, and the Heartland (Midwest) REITs.

But in looking at the distribution on my pie chart, it says I have 36% invested in fixed income, 15% in Core Plus, 33% in Value Add (typically, renovation projects), and 15% in Opportunistic.

Not only do I always know what I’m investing in, but Fundrise even gives me pictures of what I’m invested in. For example, one holding is a $5.8 million construction project, Mosby University City. It’s a 300-unit apartment complex in Charlotte, North Carolina, and they’ve announced that it’s recently been completed.

Another example is the recent investment into a single-family rental development near Dallas, Texas. It gives you the strategy, which is Opportunistic, and a total value of $16.5 million. Others are projects in Atlanta, Los Angeles, and Austin, Texas. They even disclose some investments, located near where I live.

The point is, I know where my money is being invested at all times.

How Do Fundrise Returns Compare with Other Investments?

So I have an average annual return with my Fundrise investment of 13.3% in just over fiver years. But is that a good return?

It all centers on the basic question: “What if I had invested my money in something else?”

That can include other real estate investments, as well as stocks and crypto.

It really depends on what your investment goals are, and what you compare those returns with.

Fundrise Returns vs. Other Real Estate Investments

To recap, my five-year average return on my Fundrise investment was 6.9%, net of expenses.

I can’t do a valid comparison among other real estate and private asset platform since I’m only invested with Fundrise.

But we can look at the Fundrise returns against those provided by real estate exchange-traded funds (ETFs), which are widely available on market exchanges.

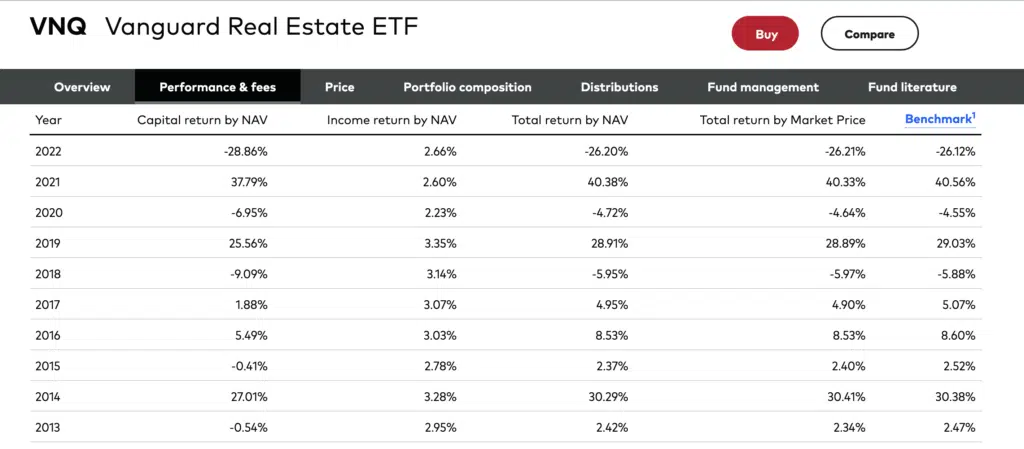

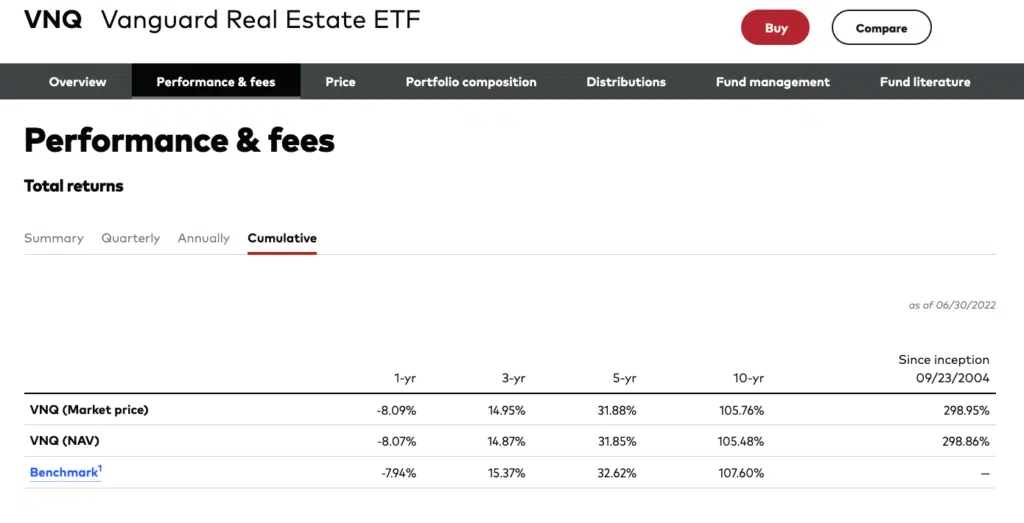

Fundrise vs. Vanguard Real Estate ETF (VNQ)

Probably the most popular is the Vanguard Real Estate ETF (VNQ). This isn’t a full apples-to-apples comparison, because I didn’t start my Fundrise investment until roughly the end of the first quarter of 2018.

Even still, in 2018 my net return with Fundrise was 7.4%. This compares with a -5.9% for the VNQ. That’s a more than 13% difference between the two investments, and I’d rather make money than lose it.

For 2019, my Fundrise return was 9.2%. VNQ had a return of 28.89%. Even though I made over 9%, it definitely hurt that VNQ made almost 29%. For 2019 at least, it was a 20-point swing against Fundrise.

What about 2020? Fundrise returned 7.6% for the year, while VNQ was down 4.64%. That’s a swing of more than 12% in my favor.

In 2021, both VNQ and Fundrise had stellar returns going for 40.38% and 23.9% respectively. Even with my Fundrise returning over 23% I was still 16% behind VNQ.

But in 2022 was a huge separator between the two with VNQ losing -26.20% and Fundrise returning 6.4% for a 32% swing in my favor.

The performances in 2018 and 2020 were no-brainers in favor of Fundrise. But if I had started investing in 2019, the investment with Vanguard would have produced a return three times greater than what I got with Fundrise for that year.

That’s a tough difference to swallow, and if it were happening on a consistent basis I certainly wouldn’t be happy with Fundrise.

Anytime an investment consistently underperforms the competition, it’s just about the best evidence you’re in the wrong investment.

But Fundrise demonstrated a major advantage over VNQ…

| Year | My Fundrise Returns | Vanguard Real Estate ETF (VNQ) Returns |

|---|---|---|

| 2018 | 7.4% | -9.09% |

| 2019 | 9.6% | 25.56% |

| 2020 | 7.2% | -6.95% |

| 2021 | 23.9% | 37.79% |

| 2022 | 6.4% | -28.86% |

| 2023 | -10.7% | 11.75% |

The Fundrise Consistency Factor

Even though VNQ made Fundrise look bad in 2019, it easily outperformed Vanguard in two out of three years.

When I did a three-year calculation of the average annual returns from Vanguard, it came to 6.093%. That was well below the 8.1% average with Fundrise.

But with that said, a quick look at the return on VNQ for 2021 shows a positive return of 40.38%. When compared with the 23.9% return from Fundrise, VNQ pulled ahead by a good 16%+ return. But looking at 2022 when VNQ lost a staggering -28.86% compared to my 6.4% return… that’s huge!

Even still, the fact that Fundrise has had three consecutive positive return years is also important. One of the primary challenges for any investor is to avoid losing money. That would be the case with a Fundrise investment over the past three years, while VNQ turned losses in two out of those years.

Consistency matters with investing.

Fundrise vs. the REET

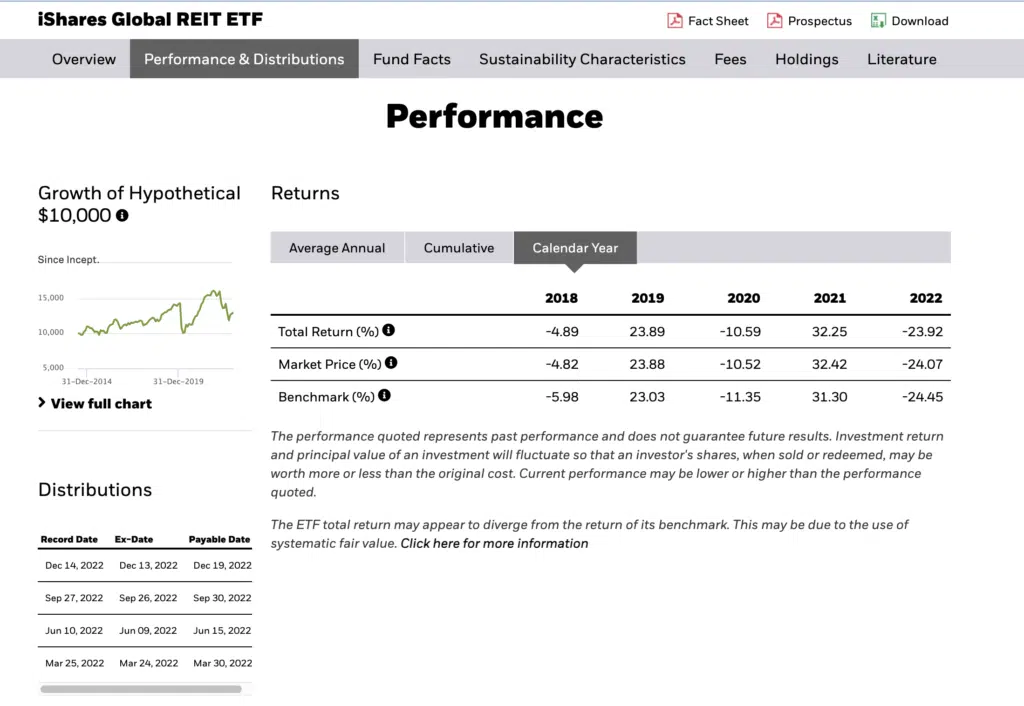

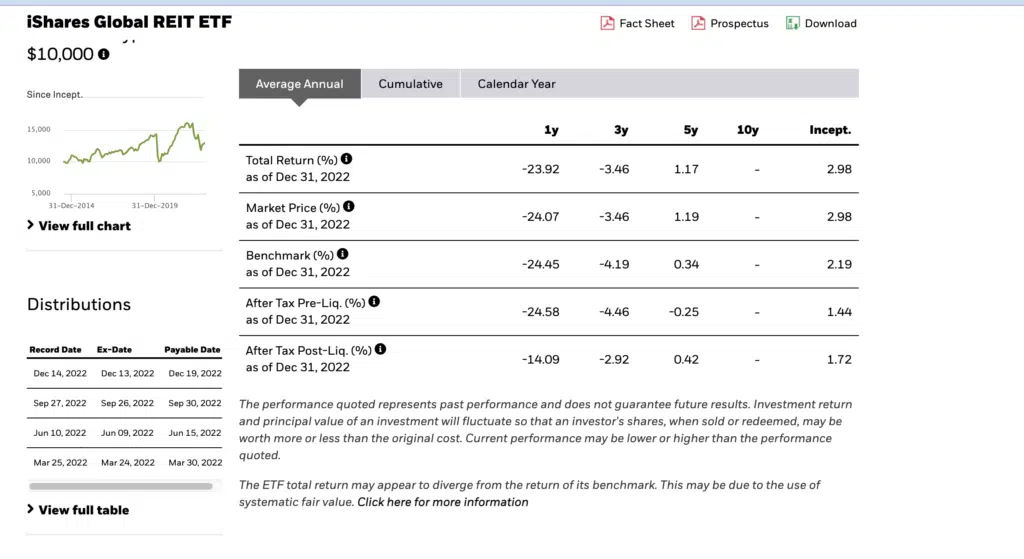

Let’s take a look at another example of the real estate front, iShares Global REIT ETF (REET).

This again is not exactly an apples-to-apples comparison. Where VNQ is a US-based ETF, REET takes in real estate investments from around the world.

Similar to the VNQ, REET was down in 2018 by 4.89%. In 2019 it was up by 23.89%, then down 10.59% in 2020, and back up 32.25% in 2021. I’m not going to break down the numbers with this one, because it’s pretty easy to see that REET underperformed both Vanguard and Fundrise on an average annual basis.

| Year | My Fundrise Returns | iShares Global REIT ETF |

|---|---|---|

| 2018 | 7.4% | -4.89% |

| 2019 | 9.2% | 23.89% |

| 2020 | 7.2% | -10.59% |

| 2021 | 23.9% | 32.25% |

| 2022 | 6.4% | -23.92% |

| 2023 | -10.7% | 10.43% |

In looking at these two potential real estate investments, I’m not having any buyer’s remorse over my decision to invest with Fundrise. It outperformed both alternatives over three years.

Fundrise Returns vs. The Stock Market

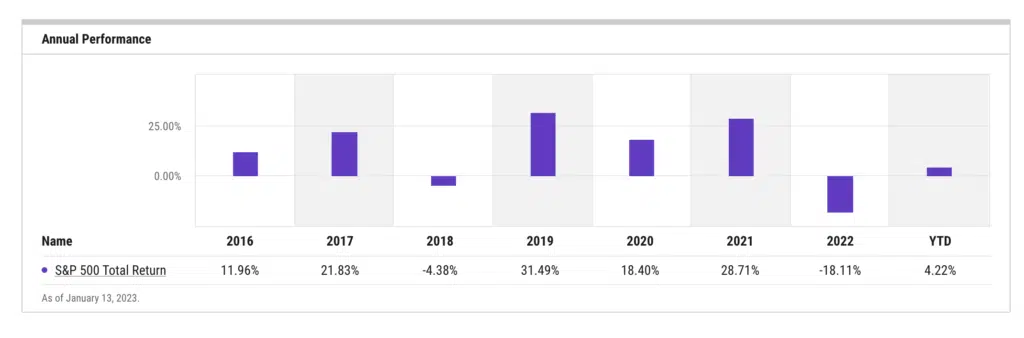

For 2019, the S&P 500 was up 28.88%; in 2020, up 16.26%; in 2021 it was up 28.71%; in 2022 finished down -18.11%, and 2023 finished strong up 24.24%.

Well, but those are crazy returns – especially in the middle of a global pandemic. And I don’t know that we’ll ever see returns like that again.

When I average out the returns on the S&P 500 index over the past three years and comes to 12.96% per year. That’s almost 5% per year more than my Fundrise investment paid.

(Source: YCharts)

| Year | My Fundrise Returns | S&P 500 Returns |

|---|---|---|

| 2018 | 7.4% | -4% |

| 2019 | 9.6% | 31.49% |

| 2020 | 7.2% | 18.40% |

| 2021 | 23.9% | 28.71% |

| 2022 | 6.4% | -18.11% |

| 2023 | -10.7% | 24.24% |

So clearly, if I had invested my $5,000 Fundrise investment in the S&P 500, I’d have come out ahead. That’s a definite investment opportunity cost.

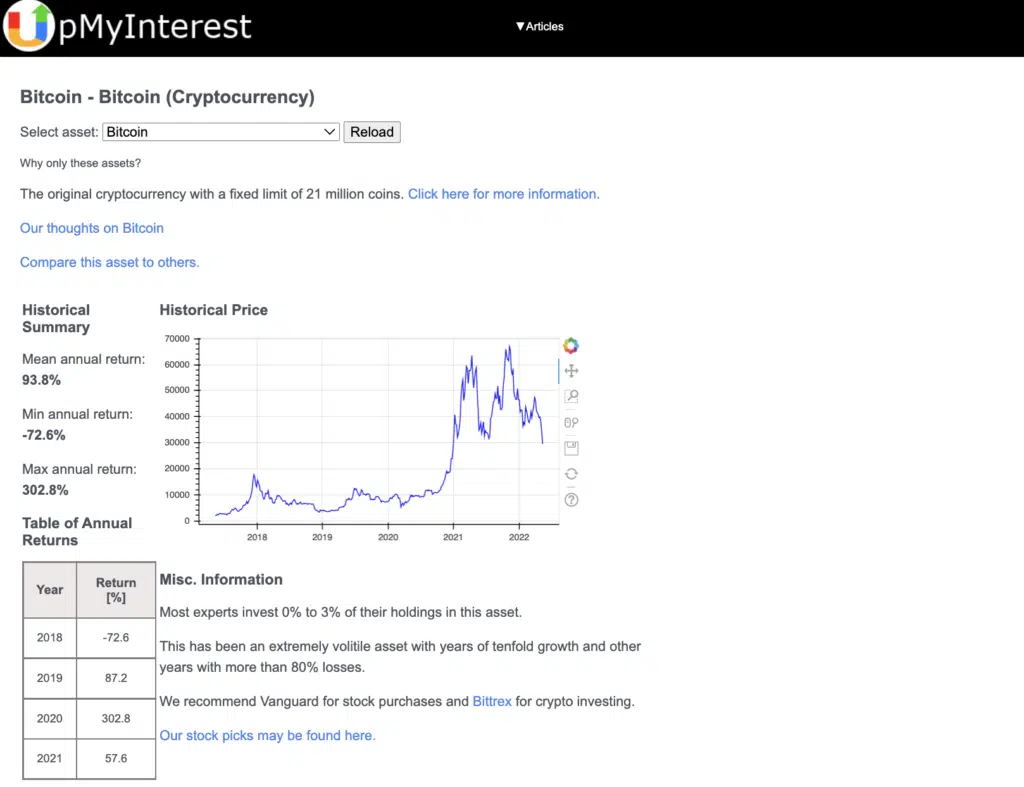

Fundrise vs. Bitcoin (Cryptocurrency)

Let’s go beyond stocks and other real estate investments and look at Fundrise compared with a true alternative investment: cryptocurrency.

This isn’t an arbitrary comparison either. I’ve been invested in crypto since 2018, along with my Fundrise investment.

We’re doing this just for fun because certainly comparing real estate crowdfunding with crypto is about as far away from an apples-to-apples comparison as you can possibly get. But let’s do it anyway!

We’ll compare Fundrise with Bitcoin. The total return for that crypto in 2021 was 57.6%, a massive gain in 2020 of 302.8%, and 87.2% for 2019 which followed a loss for 2018 of -72.6%. But that comes after 2017 when Bitcoin had a return of 1,318%. In 2022, Bitcoin plummeted to -81.02% only to rebound in 2023 to 156%

But the situation changes in the next two years. Bitcoin is up 87.2% in 2019, and 302.8% in 2020. What’s more, Bitcoin continued to power forward in the first few months of 2021 ending with a salty 57.6%.

Looking at the average annual return on Bitcoin for 2018, 2019, and 2020, it’s an unbelievable 105%.

Fortunately, I was invested in the stock market and crypto at the same time I was in Fundrise, so I didn’t miss out. But now you have a side-by-side comparison of how Fundrise performs compared to both commercial real estate and non-real estate investments, like stocks and crypto.

My Thoughts on Fundrise Portfolio Returns

We’ve crunched a lot of numbers in this analysis, but I need to point out that investing isn’t all about returns alone. More important is, what is your goal with your money? Or more specifically, what are you hoping to use the money for?

For example, if you’re looking to save money to make a down payment on a house, or to retire early, an investment in Bitcoin that drops more than 72% in the first year isn’t going to get the job done.

Something else I want to point out is that the returns in the market over the past few years have been phenomenal, but they’re not typical. A correction is going to happen at some point, and when it does investments in stocks and even crypto will take a big hit.

I’m not trying to spread doom and gloom and advise putting all your money into safe investments. But we all need to be ready for a correction. There are going to be losses, which we saw in both the Vanguard and iShares ETFs in 2018 and 2020.

Bottom Line – Is Fundrise Worth It?

For me, I want a diversification into real estate, but I’m not qualified to invest in individual properties. I’m not interested in buying, renting, managing, and selling property, but I want the diversification real estate provides.

I did put money into a private REIT in my self-directed IRA, but that’s primarily for long-term investing for my retirement. It’s a completely passive investment, which is exactly what Fundrise does for me outside my IRA.

I use the “barbell investment method”. That means I have a lot of money invested in safe investments and a small amount invested in high-risk/high-return investments. But I don’t have much in the middle, which is basically what Fundrise is.

So for me, returns aside, Fundrise has a definite place in my portfolio and is 100% worth it. It gives me exposure to the commercial real estate market, plus regular updates on what’s going on in my portfolio.

A big part of building wealth is being involved in various investments so that I can know what’s going on with different asset classes. That doesn’t happen unless I’m actually invested in those asset classes.

Frequently Asked Questions on Fundrise Returns

The average return investing differs from client to client based on their investing strategy. That being said, Fundrise publishes the returns of all its clients (over 446,000) on its website. From 2017-2021, they have averaged a return of 11.78%. YTD through 2022 they have returned 5.4%.

Yes, you can make money investing in Fundrise. In fact, over the past five years, Fundrise investors have earned a real-time return of over 60.4% from their original investment.

That’s significantly higher than what you would earn from the stock market or from a traditional savings account.

Yes, Fundrise investors can lose money if the company’s investments perform poorly. However, Fundrise offers a number of safeguards to protect investors, including a diversified portfolio and regular updates on the company’s progress. Additionally, Fundrise is backed by experienced investors and has a strong track record of success.

No, Fundrise pays its dividends quarterly. You can elect to receive the dividends in cash or reinvest them.

It can take up to three years to make money with Fundrise, but it depends on the amount of money you invest and the type of investment you choose. But since Fundrise pays dividends quarterly and has averaged double-digit returns since inception, it’s safe to say over the long term you can expect to make a decent return with them.

Yes, you can make passive income with Fundrise. Fundrise is a real estate investment platform that

allows you to invest in crowdfunded real estate projects. This means that you can invest in projects that other people have invested in, and you don’t have to be a real estate expert to do so.

Simply browse the available projects on the Fundrise website, and choose the ones that interest you. Then, invest your money, and sit back and relax while the money you’ve invested starts making passive income for you.

Investors in Fundrise are taxed as if they were investing in a regular, taxable investment fund. This means that investors will pay taxes on any profits or losses generated from their investment in the fund.

If you want commercial real estate in your portfolio, I recommend Fundrise. For me, it certainly passes the Legit Check ✅

Fundrise only requires a small investment, provides plenty of investment options, low and transparent fees, and you’ll always know what’s going on with your money.

While those will give you plenty of warm and fuzzy feelings, it’s important to remind everyone that Fundrise does have to file with the SEC as a legitimate real estate investment company. You can see all of their filings on the SEC.gov website here.

So yes, they are definitely legit! You can learn more in my in-depth Fundrise review.

Every fast-growing company will deal with some sort of headaches with personnel and/or business roadblocks. For the most part, Fundrise has avoided the most scrutiny from the media and investors.

The biggest negative headline that Fundrise has received was the ousting of their former CFO, Michael McCord, back in 2016. McCord claimed that Fundrise’s practices were fraudulent. Fundrise claimed their former CFO was attempting to exhort them for over $1 million plus company stock.

Both the SEC and the local police department conducted an extensive investigation into the allegations and were not able to find anything remotely close to what McCord was claiming. That was several years ago and Fundrise continues to grow and expand making their investors a good amount of money.

No, investments with Fundrise are not protected by the FDIC. The FDIC, or Federal Deposit Insurance Corporation, offers insurance for deposits at FDIC-member banks, safeguarding those funds up to certain limits should the bank fail. When you invest in Fundrise, you’re investing in real estate ventures, not depositing money in a traditional bank account.

Hence, the inherent risks associated with real estate investments aren’t mitigated by FDIC insurance. It’s pivotal for investors to differentiate between the safety provided by FDIC insurance for bank deposits and the risks related to other investment forms like those on Fundrise.

Fundrise Portfolio Returns Review

Product Name: Fundrise Portfolio Returns

Product Description: Fundrise is a real estate investment company that allows everyday people to invest in high-quality real estate. They have a variety of investment options, from buying individual properties to investing in a fund that contains many properties.

Summary of Fundrise Portfolio Returns

Fundrise is a technology-driven real estate investment platform that allows non-accredited investors to earn income from various types of real estate. They have a team of experts who identify high-quality, income-producing real estate investments and make them available to investors through their online platform. New investors can begin investing through them for as little as $10.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Fundrise offers investors a diversified portfolio of commercial real estate investments.

- Fundrise has a low minimum investment amount.

- Fundrise offers investors the ability to invest in different property types and risk levels.

- Fundrise has a strong history of returns, with an average annualized return of 8.7% since inception.

- Fundrise offers investors the ability to invest in real estate markets across the United States.

Cons

- Because of its unique business model, there is no guarantee that Fundrise will be successful in the long run.

- The fees associated with Fundrise investments are relatively high compared to other investment options.

- Fundrise investments are not as liquid as some other investment options – it can take up to 10 business days for a withdrawal to be processed.

- Fundrise is not FDIC insured

I invested as a ordinary person wanted to invest in a start up company gave them 275 dollars for 100 shares and 10 percent bonus on ally my investment ally i got was a page with my name and no investment sent several emails and they keep telling me i didn’t invest. They have a phone number, that directs you to email them. But you never speak to a live person. With the kind of money that is being given you would think they would have live support so these issues can be address the screwed me out of my money which I am still trying to recover, I was introduced to a recovery agent hack101 at tutanota d o t c o m .. And happy to say i got all my money back