Peer-to-peer lending has come on strong since the financial meltdown – and not by coincidence. That was about the time that banks decided they weren’t lending to anybody. The decision opened up an opportunity for the free market to provide another way for people to borrow money. And that’s when the peer-to-peer phenomenon started getting popular.

There are a lot of reasons why P2P lending has grown so quickly. But is it a good loan source for you? Learn more here about getting a loan as part of your decision-making process.

The Complete Guide on Peer-To-Peer Lending

Table of Contents

What Is Peer-To-Peer Lending?

Peer-to-peer lending can loosely be thought of as non-bank banking. That is, it’s a process of lending and borrowing that takes place without the use of traditional banks. And for that reason, it looks a whole lot different than conventional banking.

Peer-to-peer lending is mostly an online activity. Borrowers come to the various peer-to-peer lending websites looking for loans – and better terms than what they can get through their local bank – while investors come looking to lend money at much higher rates of return than what they can get at a bank.

On the surface, it may seem as if the higher rates paid to peer-to-peer lending investors would result in higher loan rates for borrowers, but that’s not generally the case.

Commonly known as “P2P”, It’s an arrangement that “cuts out the middleman”, more commonly known as the banker.

Peer-to-peer lending brings borrowers and investors together on the same websites. Commonly known as “P2P”, it’s an arrangement that “cuts out the middleman”, more commonly known as the banker.

Here’s the thing, it costs money to operate a bank. You need a physical bank branch that has to be purchased and maintained. You also have to staff the operation with employees, and that requires paying multiple salaries, as well as related employee benefits. Then there’s the acquisition and maintenance of costly equipment, such as in-house computer systems and software, as well as sophisticated security equipment.

Now multiply the costs of that single bank branch by multiple branches, and you start to get an idea why you might pay 15% for a loan at the same bank where you will earn less than a 1% return on funds held on deposit there. It’s not exactly an equitable – or democratic – financial arrangement.

P2P lending doesn’t have all that bank branch real estate, hundreds or thousands of employees, or expensive equipment. And for that reason, you might see an arrangement that looks more like 10% loan rates, and 8% returns on your investment money.

Lending Sites in the U.S.

Though the entire concept of peer-to-peer lending started in the Third World decades ago, there are now dozens of P2P platforms operating in the US. Most people have heard of Prosper and Lending Club (which no longer offers P2P lending), but there are several other lenders in the U.S. Market.

Although Lending Club no longer offers peer-to-peer lending, it definitely became one of the biggest names in this field. Starting in 2007, Lending Club has since grown to become the largest peer-to-peer lending platform on the web. By the end of 2015, the site funded nearly $16 billion worth of loans, including more than $2.5 billion in the last quarter of the year.

Obviously, Lending Club was doing a bunch of things right. With the acquisition of Radius Bank, they announced that they would be retiring their P2P lending service in place of a more traditional banking model. Either way, there were lessons learned along the way that I share in My Lending Club Investment Review that you might find useful.

Other Peer-To-Peer Lending Platforms

Sofi: Student Loans and Refinances

SoFi, which is short for Social Finance, has become one of the leading sources for student loan refinances available anywhere. This site is virtually synonymous with student loans, though they also provide mortgages and personal loans.

The platform was founded by people who are close to the college scene and well-acquainted with the nuances of student loan refinances. That is an area of finance that is not adequately served by the banking industry. There are just a few major lenders who will provide student loan refinances, and SoFi is one of them.

SoFi is a lending platform where student loan refinances are granted largely on the basis of non-traditional criteria, such as type of occupation, the college or university you graduated from, your GPA, and your major – as well as your income and credit profile. But this means that loan approval is not strictly based on income or credit. The education-related criteria weigh heavily in the decision.

This is important because while student loans are granted on a virtually automatic basis, student loan refinances require that you qualify based on your ability to repay. SoFi considers your educational background as part of the evidence that you can repay.

Also, SoFi is available seven days a week, and you can complete the entire application process online.

The site claims that the typical member can save an average of $14,000 as a result of refinancing a student loan with them.

SoFi currently has rates on student loan refinances that range from 5.24% to 9.99% APR on fixed-rate loans and between 6.24% to 9.99% APR on variable-rate loans. You can also refinance the entire amount of student loan debt that you currently have, as the platform does not indicate any maximum loan amount.

You can refinance both private student loans and federal student loans, though the site recommends that you be careful in refinancing federal loans. This is because federal loans come with certain protections that are not available with private source loans, nor with a SoFi refinance. You have to appreciate that kind of openness and honesty in a lender of any stripe!

These are just a handful of the growing number of peer-to-peer companies in the United States.

Prosper: First p2p Lending Platform

- More than 2 million members

Founded in 2005, Prosper is the first among the popular peer-to-peer lending sites. The site has more than 1.4 million members and has funded more than $23 billion in loans to date. The platform works in a fashion similar to Lending Club, but not identical.

Prosper brings individual investors and borrowers together on the same website. Some of those investors are large concerns, such as Sequoia Capital, BlackRock, Institutional Venture Partners, and Credit Suisse NEXT Fund. This institutional participation is important in itself; as peer-to-peer lending is rapidly growing, large, institutional investors are becoming more actively involved in the funding side.

Prosper makes personal loans for amounts of between $2,000 and $50,000. Proceeds of the loan can be used for just about any purpose, including debt consolidation, home improvement, business purposes, auto loans, and short-term and bridge loans.

You can also borrow money to adopt a child, purchase an engagement ring, or take out “green loans”, which enable you to finance systems that are based on renewable energy.

Loan terms range from 24 months to 60 months, with interest rates between 6.99% APR and 35.99% APR. Your loan rate is calculated on the basis of your Prosper Rating and is based on your credit score and credit profile, loan term, and loan amount.

Loans are fixed-rate installment loans, which means that the debt will be fully paid by the end of the loan term. There are no prepayment penalties, and no hidden fees, though Prosper does charge origination fees.

Once again, the entire process takes place online where you can complete an application in minutes, and get your Prosper Rating. From that point, your interest rate will be determined, and your loan profile will be made available to prospective investors who will decide to fund the loan. Since funding is done in small increments from multiple investors, the loan will not be fully funded until there is sufficient interest from enough investors. But that process could happen in as little as one or two days.

Learn more about the oldest of the P2P companies in the United States in our full Prosper review.

Peerstreet: Real Estate Loans

PeerStreet is taking what Lending Club and Prosper did for personal loans and applying it to real estate. Founded in 2013, Peerstreet has expanded rapidly and its private marketplace is very easy to use.

Unlike other companies that are funneling their investors into REITs, PeerStreet allows investors to invest directly in real estate loans. The loans are not your typical 30-year mortgages but short-term loans (6-24 months). The loans are for special situations like the rehabilitation of a property that a landlord wishes to rent out.

The annual returns for the average investor work out to be between 7-12% and you can get started investing with as little as $1,000.

PeerStreet also does all their own underwriting on the properties and evaluates all their loan originators.

The one downside to PeerStreet is that you must be an accredited investor to participate in their marketplace. This pretty much eliminates most small investors from having a shot at this unique P2P lender.

Fundrise: Property Investment

Another crowdfunding source that only deals in real estate is Fundrise. If you’re looking for a way to invest in properties without having to do the day-to-day duties of a landlord, investing with Fundrise can be an excellent way to get your foot in the door.

One of the advantages of investing with Fundrise is you can start with as little as $1,000. Fundrise uses all of the smaller contributions to invest in larger loans. Fundrise is basically a REIT, which is a company that owns income-producing real estate.

According to Fundrise’s website performance page, they had a return of 8.4% as to date.

When you’re looking at fees, Fundrise has a 1.0% annual fee. This includes all of the advisor fees and asset management. While 1.0% might sound like a lot compared to some other investment routes, Fundrise has lower fees than other REITs.

There are several benefits to choosing Fundrise. If their returns stay on course, you might make more than you would with a traditional REIT or with other P2P sites. On the other hand, these investments are going to be a little riskier than other options.

Getting started and investing with Fundrise is easy. You can create an account and start investing in no time. Even if you don’t have any experience with investing in real estate, Fundrise makes it incredibly easy. In fact, they now have Fundrise 2.0, which will handle all of the investing for you. Fundrise 2.0 will select the eFunds and eREITS and diversify your investments based on your goals.

To learn more, check out my complete Fundrise review.

Funding Circle: Business Loans

Funding Circle is a peer-to-peer lending site for people who are looking for a business loan. This is important because the small business market is completely underserved by the banking industry.

Not only do banks typically have extensive requirements before they will make a loan to a small business, but they also have a preference for lending to larger businesses that are better established. The small, one-man or woman shop is often left out in the cold when it comes to getting business financing.

The platform has made more than $2 billion in loans to more than 12,000 small businesses around the world.

With Funding Circle, you can borrow as little as $25,000, to as much as $500,000 on a business loan at rates that start as low as 5.49% (the range is between 5.49% and 20.99%). Loan terms are fixed-rate and range from one year to five years. And of course, Funding Circle also has an origination fee, which is typically 4.99% of the loan amount you are borrowing.

You can borrow money for a variety of business purposes, including refinancing existing debt, buying inventory or equipment, moving or expanding your operating space, or even hiring more employees.

One of the best features of Funding Circle is that you only need to be in business for as little as six months to three years. The application process takes as little as 10 minutes, and you can receive funding within 10 days.

The entire process takes place online, and you will be assigned your own account manager to help guide you through the process. Learn more about their small business loans and investing in our Funding Circle reviews.

Upstart: The Non-traditional Newcomer

A recent newcomer to the list of peer-to-peer sites, Upstart began operations in 2014 but has already funded more than $300 million in loans. Among the major peer-to-peer lenders, Upstart has the most in common with SoFi. Like SoFi, Upstart takes a closer look at non-traditional underwriting criteria, preferring to look at a borrower’s potential, which includes consideration of the school you attended, the area of study, your academic performance, and your work history.

They do take more traditional lending criteria like credit and income into consideration. The primary focus is on looking to identify what they refer to as “future prime” borrowers. Those are borrowers who are early in life but are showing signs of having strong future potential. For this reason, the platform carefully evaluates factors that contribute to future financial stability and makes loans accordingly.

Loan amounts range from $1,000 to $50,000, with terms of from three years to five years, and have no prepayment penalty. All personal loans through Upstart offer a fixed interest rate and range between 5.2% – 35.99%. Like the other peer-to-peer lenders, Upstart also charges an origination fee, which can range between 0% to 12% of the loan. See the full details in our Upstart Loans Review.

Why Would Anyone Invest Through a P2P Platform?

Higher returns on investment are a powerful motivator. This is especially true since interest rates on completely safe, short-term instruments like money market funds and certificates of deposit are commonly paying less than 1-5% per year. And even if you want to invest in longer-term securities to get higher returns, they’re not there either. For example, the 10-year US Treasury note currently pays only 3.72% per year. That’s an incredibly low return considering that you will have to tie your money up for a full decade just to get it.

Your choices are:

1. tie up your money with a low return or

2. lend your money with more risk and more reward

By contrast, an investor can easily get a return in the neighborhood of 10% per year on a portfolio of five-year loan notes, with blended credit profiles, by investing his or her money through a peer-to-peer platform.

Yes, there’s more risk involved in investing/lending through a P2P platform – after all, there’s no FDIC insurance on your money. However, the rate is much higher than what it is on conventional fixed-income instruments, as well as the fact that a P2P investor can create his own portfolio to match his own risk tolerance.

For this reason, peer-to-peer lending platforms tend to have plenty of investor money to lend out. And if you’re a borrower, that’s a win for you.

Why Would a Borrower Use P2P?

If investing through peer-to-peer sites makes good sense for investors, there are probably even more reasons why a borrower would want to get a loan from one.

- Lower Interest rates – Depending on the type of loan taken, rates are often lower on P2P sites than what you can get through a bank. This is especially true when you compare P2P rates with those that you will pay for credit cards and business loans. It gets back to P2P platforms having a lower cost of doing business than the banks. They’re not lower in all cases, but they’re always worth a try on just about any loan type you want to take.

- Bad credit, no problem – P2P platforms are not subprime lenders, but they will often make loans that banks won’t. You’ll be charged higher interest if you have credit blemishes, but that may be preferable to not being able to get a loan at all.

- Less restrictive – P2P platforms are a lot less restrictive when it comes to the purpose of your loan. One example is business loans. A P2P lender might make you a personal loan for business purposes, while a bank may not want to make a business loan at all, under any guise.

- Ease of application – The entire loan process is handled online, so you never have to leave your house. Even third-party verification and document signing can usually be done online. All you need to do is scan them, then either email them or download them to a portal on the P2P site.

- Speed – You can often handle the entire loan process, from application to receipt of funds, in as little as two or three days. By contrast, certain bank loans can take weeks or even months to drag out.

- No face-to-face meetings – Some people feel uncomfortable when applying for a loan requires a face-to-face meeting, particularly at a bank. Such meetings can often have the feel of a physical exam and include requests by bank personnel for information and documents that make you feel uncomfortable. There are no face-to-face meetings when you apply for a loan through a peer-to-peer website.

- Anonymous processing – Investors will see your loan request, but you won’t be personally identified in the process. There’s little danger that a neighbor who works at a bank will have access to your loan information since a P2P is not a bank.

How It Works

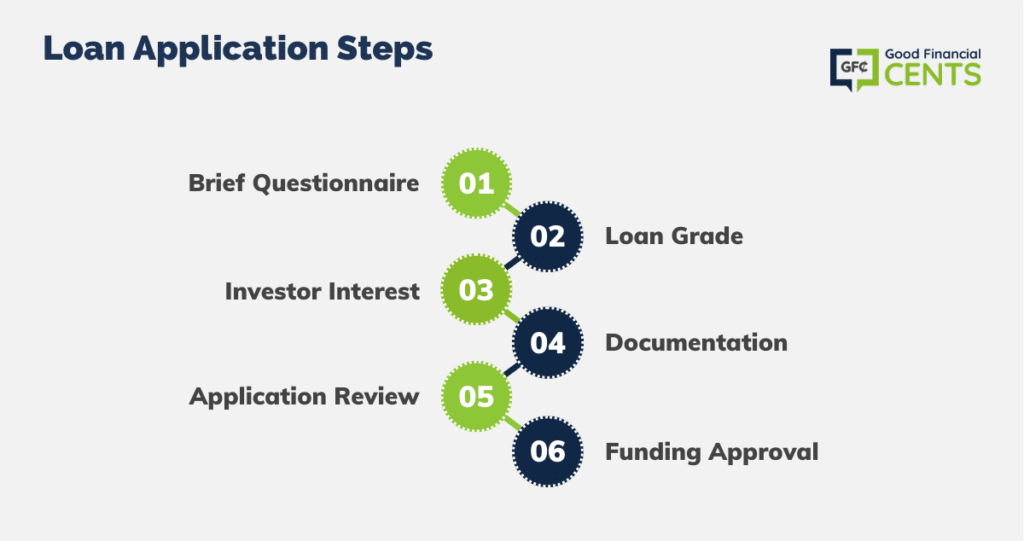

Each peer-to-peer lender works a little bit differently from the others, but there are some common steps to the loan application process.

Loan Application Steps

- Brief questionnaire: The platform does a “soft credit pull”, and you’re assigned a loan grade (we’ll get deeper into these with individual P2P reviews).

- Loan grade: Your loan inquiry will be made available to investors, who will review the loan request and determine if they want to invest at the assigned loan rate (which is based on the loan grade).

- Investor Interest: When enough investor interest is shown in your loan, your loan will then be eligible to be funded.

- Documentation: Provide proof of income and employment, and a list of existing debts that you intend to repay with the new loan (refinances and debt consolidation loans are very common with P2P platforms).

- Application Review: The loan is then underwritten to make sure that the documentation supports your claims in the initial questionnaire; the package will either be approved for funding or there will be a request for additional documentation.

- Funding Approval: the loan documents will be prepared, and sent to you for signature. Funds are typically wired to your bank account within 24 to 48 hours of the receipt of your signed documents by the peer-to-peer platform.

Though the process may seem as if it takes several weeks, it will actually proceed very quickly if you are prepared to immediately furnish any and all required documentation. Since you can usually scan and email information, the entire application process can be compacted down to just a few days.

Loan Characteristics

Loan amounts granted are typically anywhere between $1,000 and $50,000, though many platforms will lend higher amounts for various purposes – all the way up to well over $100,000 depending on the loan purpose. You will usually be required to have a credit score in the mid-600s or higher in order to qualify, though loans for those with impaired credit are becoming more common. Loans typically run between three years and five years, but once again there is significant flexibility for different loan types and from different lending platforms.

P2P platforms usually don’t charge application fees or any of the various fees that are generally charged by banks in connection with loans. But one fee with peer-to-peer loans that you will need to be aware of is that they generally charge origination fees. They can represent anywhere from 1% to 5% of the loan amount provided and are usually deducted from the loan proceeds. So if you are approved for a $10,000 loan with a 2% origination fee, $200 will be deducted from the amount of the loan proceeds that you will receive.

The actual amount of the origination fee is closely tied to your loan grade, which is largely (but not entirely) determined by your credit profile. Other factors include the term of the loan, the purpose, the loan amount, and your income or employment.

Types of Peer-To-Peer Loans

As the number of peer-to-peer lenders has expanded, so have the types of loans that are available through them.

Common Loan Types Available Include

- Personal Loans

- Auto Loans

- Business Loans

- Mortgages

- Student Loans (including student loan refinances)

- Bad Debt Loans

- Medical Loans (for uncovered medical expenses)

Not all peer-to-peer lenders do all of these loans, in fact, a single platform typically specializes in just one or two loan types. But never assume that a certain kind of loan is not available through a peer-to-peer platform somewhere; new sites are coming up all the time, and some are moving into previously unexplored territory.

Investing Software Services

As interest in investing through peer-to-peer sites becomes more popular, there is a growing demand for software services that can help investors select specific loans – or notes – that they want to invest in. These software services help with the construction, management, custody, and reporting requirements for a portfolio of peer-to-peer loans.

These software services help with the construction, management, custody, and reporting requirements for a portfolio of peer-to-peer loans.

An example of such a provider is NSR Invest, which entered the P2P investing software services market in 2015.

NSR Invest is hardly alone, even though the industry is new. Some of the more prominent peer-to-peer investing software services include:

- BlueVestment

- Peer Trader

- PeerCube

Each of these firms is actively working to improve the investment experience on P2P platforms. And as they do, the lending process itself will become increasingly streamlined and more efficient.

Despite the fact that peer-to-peer lending has been happening in the US for only a few years, the practice is growing rapidly. As general participation increases, along with the various loan types the industry will serve, peer-to-peer lenders will provide serious competition for banks when it comes to lending.

But the future is already here since hundreds of thousands of people have already taken loans through the many peer-to-peer lending platforms that are up and running. Have you tried to use one yet, either as an investor or a borrower?

The Bottom Line

Peer-to-peer (P2P) lending has revolutionized the loan market, providing an alternative to traditional banking systems, especially since the financial crisis. Operating predominantly online, P2P platforms connect borrowers with individual lenders, offering potentially better terms and higher returns on investments. Despite its rapid growth and the advantages of lower operational costs, it is crucial for potential borrowers and investors to carefully evaluate and understand P2P lending.

The market has a range of platforms, each catering to specific needs, from personal loans and business financing to student loan refinances and real estate investments. The entrance of large institutional investors and the variety of platforms have validated P2P lending’s place in the financial world, but users must navigate carefully, weighing the potential risks and returns.

Hi I want to start investing in the p2p lending,, how do I start

I got the TV Broadcasting Stations licence.

Now I need to borrow some working capital to start my business.

Hi Jeff,

I’m just beginning on this road of building passive income and your comprehensive articles come in very useful. Thank you!

First thing I bumped into though, is that Lending Club is an available option only for US citizens. Would you be able to reccomend some reliable platform that can be used by members of the European Union, for example? 🙂

Thanks!

Hi Natalija – You should do a google search of P2P lenders in your own country. I don’t know of any, and wouldn’t know the specifics. You’ll have to do some deep research on it. It does seem to be mostly a US based industry, at least for now.

Hello I wanna get some information about the program, what does my credit score have to be.

Hi Monique – You’ll have to check with the credit score requirements on what ever P2P site you want to apply to. The minimum is generally between 600 and 640, but it varies by platform.

Thanks for the analysis of P2P lending. I’ve been seriously considering giving Lending Club a try. I actually created an account but haven’t transferred any money yet. What do you think of the automated feature of lending club. It requires a minimum of $2500, but it selects the loans for you based on the criteria you set up.

Thanks again for the great information in this article.