What Is a Home Equity Line of Credit?

The home equity line of credit (HELOC) differs from the home equity loan in that instead of one lump sum of cash being distributed to the homeowner, a line of credit is established from which they can borrow.

Whereas a home-equity loan has a beginning and end with set payments in between, the HELOC offers more flexibility in the amount you borrow and in turn how much your monthly payments will be.

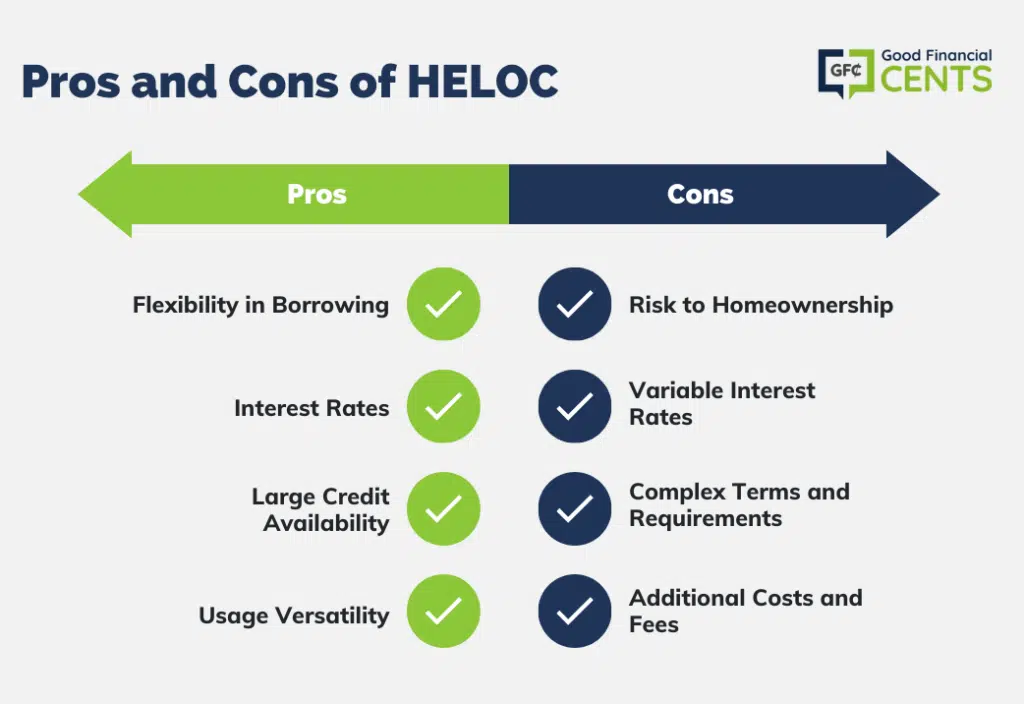

You can borrow from a HELOC on an ongoing basis and your payments reflect the amount of money you have borrowed. It is important for anyone considering a HELOC to understand the pros and cons of this type of loan.

With the pros and cons of a HELOC in mind, you can decide whether or not this lending option is right for you. If your other debts are minimal and your financial habits are strong, you could really benefit from a HELOC. Read on to see how you can apply for a HELOC and learn where to get the best one.

Table of Contents

Pros of a HELOC

Flexibility in Borrowing

One of the most significant advantages of a HELOC is its inherent flexibility. Unlike traditional loans where you receive a lump sum, a HELOC operates on a revolving credit structure. This means you have access to funds up to your credit limit, and you can borrow, repay, and borrow again.

Additionally, you only pay interest on the amount you draw, not the total available credit. This flexibility can be especially beneficial for homeowners who have ongoing expenses or aren’t sure of the exact amount they’ll need.

Interest Rates

In the world of lending, interest rates can make or break a deal. Luckily for those considering a HELOC, the interest rates are typically lower than those of credit cards and personal loans. This can translate to significant savings over the life of the loan. Furthermore, in some cases, the interest paid on a HELOC may be tax-deductible, providing an additional financial incentive—though it’s essential to consult with a tax professional to understand specific circumstances.

Large Credit Availability

A HELOC is determined by the equity in your home. For homeowners who’ve seen their property appreciate or have paid down a significant portion of their mortgage, this can mean access to a large pool of funds. This substantial credit availability can be particularly useful for significant expenses like home renovations or college tuition.

Usage Versatility

A HELOC is not restricted to home-related expenses. The funds can be used for virtually any purpose, making it an adaptable financial tool. Whether it’s for home improvements, debt consolidation, education expenses, or even as an emergency fund, a HELOC offers a range of possibilities.

Cons of a HELOC

Risk to Homeownership

While a HELOC offers many advantages, it also comes with notable risks. The most prominent is the potential risk to homeownership. Since a HELOC uses your home as collateral, failing to meet the repayment terms could lead to foreclosure. This makes it imperative for borrowers to have a clear understanding of their financial capabilities and a plan for repayment.

Variable Interest Rates

Unlike fixed-rate loans, many HELOCs come with variable interest rates. This means that the amount you pay in interest can fluctuate based on market conditions. For some, this can pose budgeting challenges, especially if interest rates rise significantly. Being prepared for possible rate increases and understanding how it impacts monthly payments is crucial.

Complex Terms and Requirements

Financial products often come with fine print, and a HELOC is no exception. The terms and conditions can vary widely among lenders, and some of these stipulations can be confusing. From potential penalties for not using the funds to minimum withdrawal requirements, it’s essential to understand the terms thoroughly.

Additional Costs and Fees

When considering a HELOC, it’s not just the interest rate that matters. There are often additional costs associated with setting up and maintaining the line of credit. These can include appraisal fees, closing costs, and ongoing fees like annual charges. It’s essential to factor in these costs when evaluating the total expense of a HELOC.

Should You Get a HELOC?

For a person that has credit card debt and other consumer loans, a HELOC is not the ideal lending option. You may have trouble getting approved altogether, finding good rates, and making payments.

If, however, you do have strong credit, plenty of equity in your home, and a solid financial plan to see you through in case of the unexpected, a HELOC could be a handy tool for you.

How to Get Approved for a HELOC

If you’re wondering what HELOC requirements are, you’ll have to look to your lender for specifics. Generally speaking, though, you can expect some of the following requirements across the board:

- Equity: You’ll likely be required to have an appraisal to determine that you have between 15 and 20% equity in the home.

- Good credit: Your lender will likely require a credit score of 620 or higher.

- Strong debt-to-income ratio: Your DTI will most likely need to fall between about 43 and 50%.

- Payment history: In addition to your overall credit score, the lender will take a close look at your history of making payments on time.

Evaluating a HELOC

Comparison With Home Equity Loans and Refinancing

A HELOC isn’t the only way to tap into your home’s equity. Home equity loans and refinancing are alternatives worth considering. While home equity loans also use your home’s value as collateral, they differ from a HELOC by providing a lump-sum amount with a fixed interest rate.

Refinancing, on the other hand, involves replacing your existing mortgage with a new one, potentially at a lower rate or better terms. Each option has its merits and drawbacks, and the best choice depends on individual financial situations and goals.

Assessing Personal Financial Stability

Before committing to a HELOC, it’s crucial to assess one’s personal financial stability. This not only involves ensuring a stable income but also considering the potential impact on your credit score. A HELOC application will result in a hard inquiry, which can temporarily lower your credit score. Additionally, depending on how you use the funds, a HELOC can either improve or further strain your financial situation.

Market Considerations

The housing market doesn’t remain static. As property values fluctuate, so too does the amount of equity available in your home. For potential HELOC borrowers, this means that timing can be a critical factor. If property values are on the rise, waiting could mean access to a larger credit line. Conversely, if the market is expected to decline, securing a HELOC sooner might be more advantageous.

Bottom Line: Pros and Cons of a HELOC

A HELOC is a powerful financial tool that offers flexibility and access to large sums of money. However, with this power comes a responsibility to understand the associated risks fully. While there are numerous benefits, such as favorable interest rates and usage versatility, there are also significant drawbacks, like potential risks to homeownership and fluctuating interest rates.

The decision to pursue a HELOC should be made after thorough research and consideration. By understanding both the pros and cons, homeowners can make an informed choice that aligns with their financial objectives and comfort level. As always, when in doubt, consulting with a financial advisor or lending specialist can provide tailored guidance.