SoFi – short for Social Finance, Inc. – started out doing refinances for student loan debts, but has expanded into mortgages and personal loans. And beyond lending, they now offer wealth management and life insurance.

Based in Healdsburg, California, and founded in 2011, SoFi has funded more than $25 billion in loans to over 425,000 members. They claim their student loan refinances have saved their members well over $2 billion in interest charges.

What’s more, SoFi functions as a community for its members. They have a Career Advisory Group, Community Events, and an Entrepreneur Program. The platform also offers several calculators to help members make important financial decisions.

In just a few years, SoFi has transformed into a platform that provides an expanding range of financial services. We’ll describe each service below.

Table of Contents

SoFi Student Loan Refinancing

This is the financial service SoFi is best known for.

They have become one of the go-to sources for student loan refinancing. In fact, SoFi claims they have “refinanced the most student debt in the US”. They also report members who refinance their student loans through the platform save an average of $288 per month and $22,359 over the life of an average loan.

Signing up for a SoFi student loan refinance is a process similar to other P2P lending platforms.

You start by obtaining an online pre-approval before completing a full application. SoFi will do a credit “soft pull”, which will not affect your credit score. Loan plans will be presented to you with specific payments, rates, and terms.

Once you select a loan, you can complete the full application. You can then upload and sign documents using screenshots or smartphone photos.

Documents can be signed electronically.

Types of student loans refinanced. Federal and private loans.

Rates & Fees. There are no prepayment penalties and no origination fees in most states. Interest rates range from 5.799% APR to 9.99% APR on variable-rate loans and between 4.99% APR and 9.99% APR on fixed-rate loans. (Your rate can be reduced by 0.25% if you add the AutoPay feature, which is already reflected in the above rates.)

Minimum loan amount. $5,000.

Maximum loan amount. The full balance of your qualified education loans.

Loan deferment. You can request a deferment on an existing loan if you return to graduate school on a half-time or full-time basis, undergo disability rehabilitation, or serve on active military duty.

Income tax consideration. SoFi loans are considered student loans for federal and state tax consideration.

SoFi Student Loan Refinance Eligibility Requirements

To be eligible you must be a U.S. citizen, a permanent resident alien, or a visa holder. You must also be at least 18 years of age. Loans are available in the District of Columbia and in all states.

You must also:

- Be employed, have sufficient income from other sources, or have an offer of employment to start within 90 days.

- Have graduated with an associate’s degree or higher from a Title IV school.

- The loans being refinanced must be educational debt. Bar loans and residency loans are not eligible for refinancing.

- Be in good standing on current student loans.

- Have a strong monthly cash flow.

- Maintain a responsible financial history.

Use of cosigners. Adding a cosigner may result in a lower interest rate. But you must still qualify based on your own financial profile. There is no provision for a cosigner release.

Unemployment Protection and the SoFi Career Advisory Group

If you become unemployed, SoFi will provide certain benefits to help you weather the loss of income.

Unemployment Protection. If you lose your job through no fault of your own you may be eligible for this program. If you’re approved, your loan will be put into forbearance. Your monthly payments will be suspended for up to three months at a time, and 12 months in total (you have to renew the protection every three months). The unpaid interest will be added to your principal balance, though you do have the option to make interest-only payments.

To qualify for Unemployment Protection, you must be a current SoFi member, certify the job loss was involuntary, and be eligible for unemployment benefits. You must also actively work with the SoFi Career Advisory Group to find a new job.

Career Advisory Group. A coaching team will evaluate your job search strategy, and provide a custom set of recommendations and resources to help you. You’ll complete regular check-ins to report on your progress. Assistance will be provided along the way. You’ll also have one-on-one time with a career coach.

SoFi’s Other Education Loan Products

In addition to student loan refinances SoFi also has special education-related niche loans.

Medical Resident and Fellow Student Refinancing

Residency is additional medical education and training which could add anywhere from two years to seven years to the education process, depending on the specialty. Fellowship adds more specific training for medical sub-specialties, such as neurosurgery. SoFi’s medical resident and fellow student refinancing program enables the graduate to refinance loans taken for those purposes.

SoFi offers fixed-rate refinances ranging from 8.99-25.81% APR (with all discounts), and variable-rate loans ranging from 5.99% APR to 9.99% APR. Refinances cover both federal and private student loans. Loan terms range from five years to 20 years.

The minimum loan amount is $10,000, and the maximum is the full balance of your qualified education loans. You can refinance your student loan debts before you become an attending physician.

When applying, you start by getting your pre-approval online before completing a full application. You then select the rate and term combination that works best for you. Only then do you complete the full application, submit documentation, and electronically sign the paperwork.

There is no grace period on this loan program. Residents are required to make a minimum monthly payment of $100 until the end of their residency or fellowship program – up to a maximum of 54 months. At that time the loan will convert to full amortization status, in which your payment will go up to a level that will enable the loan to be paid off within the specified loan term.

The $100 per month payment limit cannot exceed four years. If you have not completed your residency or fellowship within that time, payments will be increased to the full amortization level at the end of four years.

IMPORTANT:

Parent Loans

These are SoFi loans that enable parents to finance their children’s educations. SoFi reports borrowers can save an average of $3,637 over the lifetime of the loan, compared with a Federal Direct Parent PLUS Loan.

The minimum loan amount is $5,000, and the maximum is up to the cost of attendance. Proceeds can be used to cover tuition, books, orientation fees, room and board, healthcare, and other personal expenses.

The application process is similar to SoFi’s other student loan programs. You get your online pre-approval, select a loan, upload documents, and sign paperwork electronically. The loan will be in the name of the parent, and not the child/student.

Parent Loan Rates and Fees. Fixed-rate loans range between 4.99% APR and 9.99% APR. Variable rates are from 5.99% APR to 9.99% APR. There are no origination fees and no prepayment penalties.

There is no grace period on this loan. Payment of principal and interest must begin immediately.

Eligibility. You must be the parent or legal guardian of a full-time student at an eligible school. You must also be a US citizen or permanent resident alien, with a permanent address in one of the 49 states where SoFi is authorized to lend.

Parent Plus Refinancing

If you already have a Federal Parent Plus loan, you can use this program to refinance and consolidate those debts. The application process is identical to other SoFi student loans.

Parent Plus Refinancing Rates and Fees. Fixed-rate loans are available with rates from 3.250% APR to 6.780% APR. Variable rates are available with rates between 2.750% APR and 6.590% APR. There are no application or origination fees and no prepayment penalties.

Loan terms. Terms from five to 15 years. Once again, there is no grace period and repayment will begin immediately.

Eligibility. Same as for Parent Loans.

Other SoFi Loan Programs

In addition to student loan refinancing, SoFi also offers mortgages and personal loans.

SoFi Mortgages

This is one of SoFi’s more recent product offerings. They’re offering mortgages of up to $3 million with as little as 10% for a down payment (but refinances cannot exceed 80% of the property value).

Do you know how most lenders require private mortgage insurance (PMI) anytime you make a down payment of less than 20%? SoFi doesn’t have that requirement.

Dedicated Mortgage Loan Originator. There’s another major advantage to getting your mortgage through SoFi. Unlike some online mortgage lenders, you’ll have a dedicated mortgage loan originator to help you through the process. That adds a human touch to the online experience.

Fast Application Process. As is the case with other SoFi loans, you can get prequalified in a matter of minutes. You can then select the loan you want, complete a full application, upload your documentation, and sign your paperwork electronically.

From application to funding, the process is generally completed within 30 days.

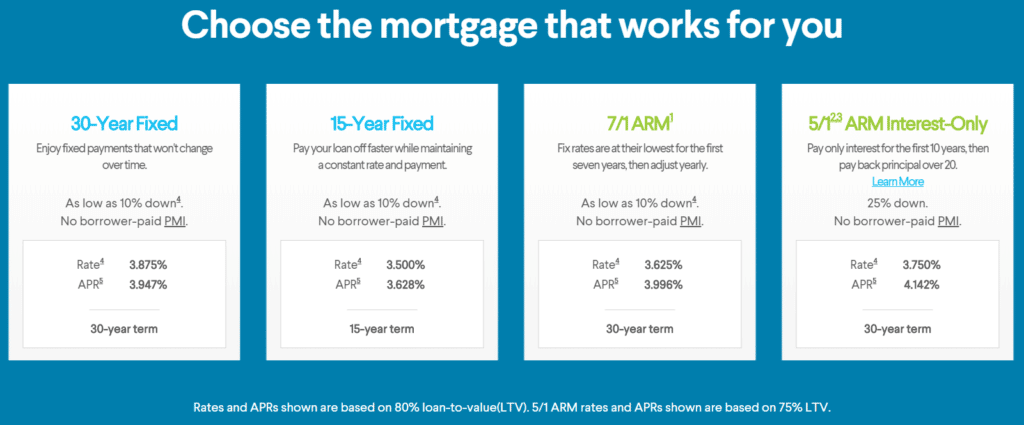

Loan programs include a 5/1 Interest-Only adjustable-rate mortgage (ARM), 30-year Fixed rate mortgage, 15-year Fixed and 7/1 ARM, with the following rates as of 2023:

They also provide a handy mortgage calculator. It will enable you to run different purchase and loan scenarios for your upcoming buy or refinance.

Loan fees. There are no origination fees and no prepayment penalties. 30-day rate locks are available. Standard third-party closing costs will be required

Loan Availability. SoFi mortgages are available in all states, except Massachusetts, Missouri, Ohio, South Carolina, and West Virginia.

Eligible Properties. Owner-occupied primary residences and second homes. This includes single-family homes, condominiums, two-unit homes, co-ops, and planned unit developments (PUDs). Investment properties are not eligible.

SoFi Personal Loans

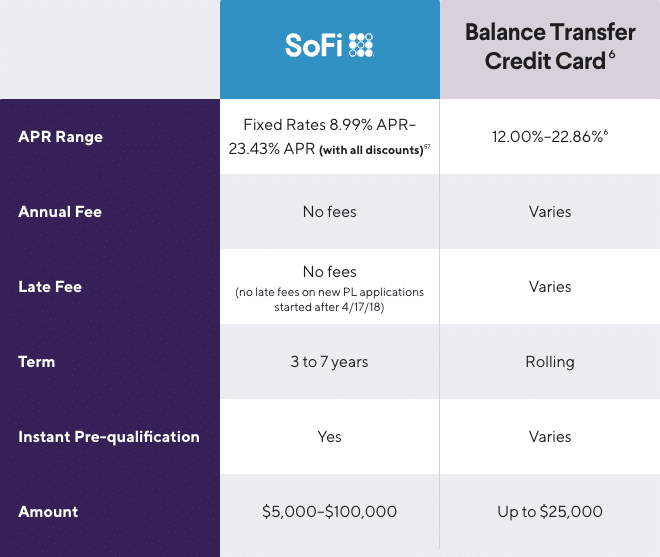

SoFi offers personal loans you can use for just about any purpose. All loans are fixed rate and are unsecured. Funding generally occurs within just a few days. Personal loans are available in all states except Mississippi.

Loan Purpose. Practically unlimited. Pay off credit cards, make home improvements, and pay for a vacation or other personal expenses.

Loan Amounts. From $5,000 to $100,000.

Loan Terms. Loan terms can be 3, 4, 5, 6, or 7 years, and all loans are fixed rates.

Personal Loan Eligibility. You must be a U.S. citizen, or permanent resident alien, at least 18 years old, in residing in an eligible state.

Interest Rates and Fees. *From 8.99 to 23.43% APR. There are no origination fees or prepayment penalties. (Most online personal loan services charge origination fees of between 1% and 6% of the amount borrowed.)

*Personal Loan Disclaimer: Fixed rates from 4.99% APR to 9.99% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of 06/1/23 and are subject to change without notice. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors.

Loan amounts range from $5,000– $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-6%, which will be deducted from any loan proceeds you receive. See Personal Loan eligibility details. Not all applicants qualify for the lowest rate. The lowest rates are reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed above and will depend on a variety of factors, including evaluation of your creditworthiness, income, and other factors. See APR examples and terms.

Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

Direct Deposit Discount: To be eligible to potentially receive an additional (0.25%) interest rate reduction for setting up direct deposit with a SoFi Checking and Savings account offered by SoFi Bank, N.A. or eligible cash management account offered by SoFi Securities, LLC (“Direct Deposit Account”), you must have an open Direct Deposit Account within 30 days of the funding of your Loan.

Once eligible, you will receive this discount during periods in which you have enabled payroll direct deposits of at least $1,000/month to a Direct Deposit Account in accordance with SoFi’s reasonable procedures and requirements to be determined at SoFi’s sole discretion.

This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to receive a Loan.

Application Process. Same as with other SoFi loans.

Unemployment Protection. If you lose your job, SoFi will temporarily pause your payments until you find a new job.

SoFi Non-lending Programs

In case you’re thinking SoFi is just about loans, think again. SoFi is gradually incorporating the entire financial universe into its platform. Here are some of the non-lending programs they offer.

Entrepreneur Program

This might be the most interesting program offered by SoFi. The program motto:

“We help members with big ideas access the tools, intelligence and capital to get ahead.”

The SoFi Entrepreneur Program provides the following:

- SoFi will invest seed capital into your company.

- You will be given access to SoFi members to test and share your company.

- You’ll have access to the tools you need to build your company.

- SoFi will pitch top-tier venture capitalists and Angels for your business at SoFi Demo Day.

To qualify for the program, you must be a SoFi Member (you must have a SoFi loan), be the founder or co-founder of your company, and work in your business full or part-time. You must also be building an innovative and scalable tech-enabled business. Your business must be either a C-Corporation or an LLC.

10 entrepreneurs were to be admitted to the program for 2018.

SoFi operates a virtual acceleration program, which can work with your business no matter where it’s located. Once you join the program, you’re part of the network indefinitely.

The core benefits of the program, which include resources and mentorship, will last from January to October (9 months).

The program could be just the Kickstarter needed for a promising new business enterprise.

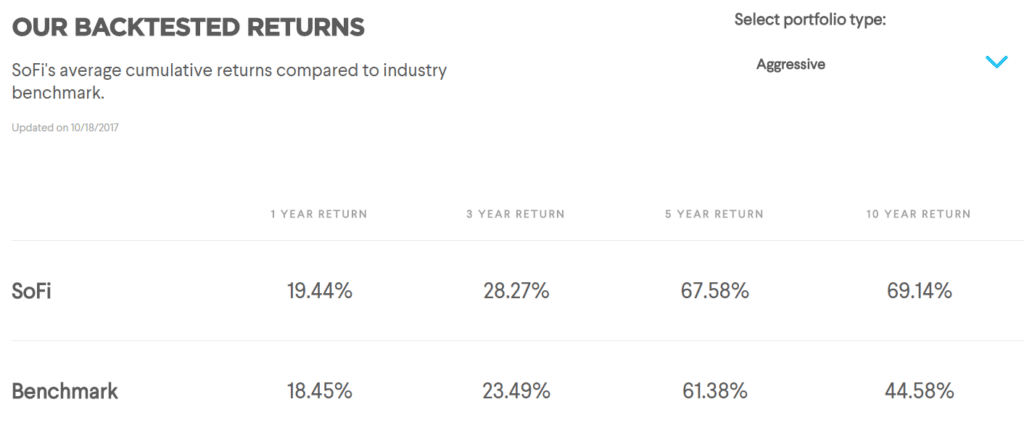

SoFi Wealth Management

This is SoFi’s robo-advisor. A robo-advisor is a low-cost, online investment management platform. By using algorithms based on Modern Portfolio Theory (MPT) SoFi Wealth Management creates and manages a diversified portfolio for small investors. They even handle periodic rebalancing of your investments, to make sure that your portfolio remains consistent with the designated asset allocations.

SoFi rolled this platform out in May of ’17.

Your portfolio will be comprised of diversified index-based exchange-traded funds (ETFs). They will be invested in a mix of stocks, bonds, real estate, and high-yield bonds. The use of ETFs will spread your portfolio across thousands of individual securities through the use of just a few funds.

SoFi Wealth Management is designed specifically for small investors. You can open an account with as little as $500. You can even open an account with zero, by adding automatic transfers of at least $100 per month.

Completing a brief questionnaire that determines your risk tolerance. Your portfolio will then be constructed based on that risk tolerance, as well as your age, income in the amount of investable assets you have.

SoFi Wealth Management Fees. The first $10,000 in your account is managed for free. Afterward, there is a fee of 0.25% per year charged on balances in excess of $10,000. This means you can have a $20,000 investment portfolio professionally managed for just $25 per year. And if that’s not enough, the annual fee is waived entirely if you currently have a SoFi loan!

One caveat to be aware of is the platform will be 100% in stocks if you are determined to be an aggressive investor, and 100% in bonds if you’re conservative. Either extreme lacks diversification. You will do well to avoid being classified at either risk level.

SoFi Life Insurance

SoFi offers term life insurance policies. Policies are offered through Protective Life. SoFi reports you can get a policy online in less than 20 minutes.

Protective has been in business since 1907 and provides life insurance coverage in all 50 states.

Coverage for up to $1 million without a medical exam is available to applicants up to 40 years old who meet certain risk and eligibility requirements. But you can get a policy for up to $5 million with a medical exam.

The platform offers you the ability to get a personalized life insurance quote online in about two minutes. It then takes about 20 minutes to complete the full application. You can then receive and sign your life insurance policy from your inbox in as little as one business day.

SoFi’s Comprehensive Financial Portfolio: Education Loans, Mortgages, and Beyond

| Loan Program | Details |

|---|---|

| Medical Resident and Fellow Refi | • Refinance Medical Education Loans During Residency or Fellowship • Fixed: 8.99-25.81% APR, Variable: 5.99-9.99% APR • Terms: 5-20 Years |

| Parent Loans | • Enables Parents to Finance Children’s Education • Fixed: 4.99-9.99% APR, Variable: 5.99-9.99% APR • Loan Amount: $5,000 to Cost of Attendance |

| Parent Plus Refinancing | • Refinance Federal Parent Plus Loans • Fixed: 3.25-6.78% APR, Variable: 2.75-6.59% APR • Terms: 5-15 Years, Immediate Repayment |

| SoFi Mortgages | • Up to $3 Million, 10% Down Payment, No PMI • Types: 5/1 ARM, 30-Year Fixed, 15-Year Fixed • No Origination Fees, 30-Day Rate Locks |

| SoFi Personal Loans | • Fixed-Rate Unsecured Loans for Various Purposes • Amounts: $5,000-$100,000, Terms: 3-7 Years • Rates: 8.99-23.43% APR, No Origination Fees |

| Entrepreneur Program | • Seed Capital, Member Access, Tools, Mentorship • For SoFi Loan Members Building Innovative Businesses |

| SoFi Wealth Management | • Robo-Advisor for Diversified Portfolios • Minimum Investment: $500, No Fees Up to $10,000 • Fee: 0.25% per Year After $10,000, Waived With a Loan |

| SoFi Life Insurance | • Term Life Policies Through Protective Life • Policies Up to $1 Million Without a Medical Exam • Online Application in 20 Minutes |

Is SoFi the Right Financial Platform for You?

There are many different online platforms that do what SoFi does, but virtually none do all that SoFi can do. This is one of the most comprehensive financial platforms available. There’s no need to use separate services for each function.

One of the big advantages SoFi offers is the platform can grow as your own life expands. For example, as a recent college graduate, your most immediate financial need may be to refinance a collection of student loans. Your next need might be to start investing. You may open a traditional or Roth IRA.

A few years later, you may need to purchase a home. When you have a family, you’ll be purchasing life insurance.

SoFi can do it all.

As you move into each phase of your life, and your need for financial services expands, SoFi can be the source. If you have an innovative business idea, they may even be able to help you obtain seed money, venture capital, or an angel investor.

And, SoFi is adding new financial products all the time. And each one incorporates peer support with Internet technology. Each financial service is easier to obtain, and less expensive than what you will find in the world of bricks-and-mortar.

They offer some of the lowest interest rates available on student loan refinances and personal loans. If you have a SoFi loan, you get free professional investment management through SoFi Wealth Management. Imagine having a $100,000 IRA account managed free of charge.

SoFi is worth using for this alone.

If you’d like more information, or if you’d like to sign up for one of SoFi’s financial products, visit the Sofi website

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

SoFi Review

Product Name: SoFi

Product Description: SoFi, short for Social Finance, is a personal finance company that offers a wide range of products including student loan refinancing, personal loans, mortgages, investment accounts, and insurance. Known for its innovative financial solutions, SoFi aims to provide a one-stop-shop for modern financial needs. Its platform combines technology with advisory services to assist members in achieving financial independence.

Summary of SoFi

SoFi emerged as a leader in the student loan refinancing space and quickly expanded its offerings to cater to other financial needs of its growing user base. With a focus on providing value to its members, SoFi integrates a suite of financial products with educational resources and community events. Beyond lending, their platform includes SoFi Money, a cash management account, and SoFi Invest, a platform for both active investing and automated robo-advisory services. What sets SoFi apart is its emphasis on community engagement and member benefits like career counseling, financial planning sessions, and networking events. This holistic approach underscores their mission to help members realize their financial ambitions in multiple facets of life.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- This is fast evolving into an everything financial web platform. You can borrow money to refinance student loan debt, buy or refinance a home, take a personal loan, invest for the future or for retirement, or purchase a term life insurance policy.

- Loan preapprovals can be done online in a matter of minutes.

- SoFi does a “soft pull” on your credit so your credit score will not be affected.

- 10% down payment with no PMI on very large mortgage loans.

- Personal loan amounts are as high as $100,000. This is much higher than the typical limit of $35,000 or $40,000 offered by other P2P lenders.

- Personal loan interest rates that are well below those of Lending Club and Prosper. SoFi has NO origination fees. The typical P2P personal lender charges 1% to 6% for origination.

- Unemployment protection. SoFi loans come with various payment suspension options should you lose your job involuntarily.

- SoFi Wealth Management offers professional investment portfolio management, for accounts with as little as $500, and at an annual fee of 0.25% per year. And the first $10,000 is managed for free. But if you currently have a SoFi loan, the fee is waived completely.

Cons

- SoFi offers student loan refinances, but not new loans to students. (The exception is the Parent Loan.)

- Refinancing a federal student loan with SoFi can forfeit important benefits that are unique to federal loans.

- SoFi Wealth Management doesn’t offer tax-loss harvesting, which is a popular feature of most robo-advisors.