The American dream for many people may be to become a homeowner, but it doesn’t always make sense to buy. There are times when it makes more sense to rent.

After graduating college, I was still single (but dating my future wife-to-be) and I had the opportunity to buy a house with some buddies of mine. Having the mentality that it’s always better to buy than rent I almost nearly pulled the trigger.

Luckily, “sense” kicked in (or should I say my future wife 🙂 and I opted to not buy it. Primarily, because we had no idea what the future held and it made more sense to just rent and leave our options open.

In our case, it didn’t make sense to buy, but that could be different for your situation. If you’re thinking about buying a house, here are some tips to know when renting makes more sense:

Table of Contents

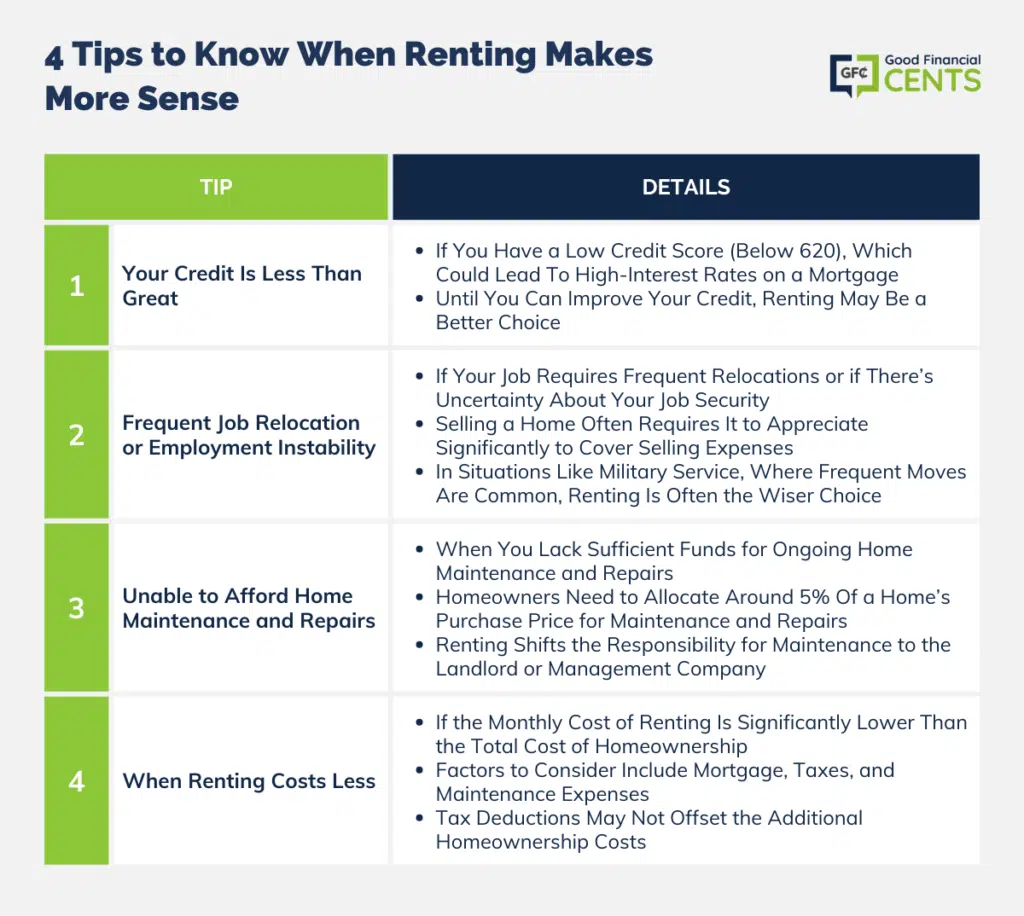

Your Credit Is Less Than Great

While it’s often possible to obtain a mortgage with a less-than-perfect credit score, the lower your credit score the higher your interest rate will be. A FICO score that’s below 620 will pretty much guarantee the only mortgage lender you qualify for will be a “predatory lender”.

Until you’re able to improve your credit score, people with low credit scores might want to consider renting instead of buying a home.

Although young, this did not affect us. We had excellent credit scores at the time and that proved to be vital when it was time to buy our first home.

Frequent Job Relocation or Employment Instability

Does your job require you to relocate often, or is there a chance you will have to relocate sometime within the next few years? If you have to sell a home, it needs to appreciate a minimum of 10% in order to cover the expenses associated with selling.

If your home doesn’t have time to appreciate in value, you’ll lose money when you sell it. One common example is if you are in the military where you’re always on the move. Unless you are quite certain you aren’t relocating any time soon, renting is probably a better solution.

While there is no such thing as job security, you probably have a reasonable idea whether or not you have a chance of being laid off or fired.

Keep in mind that compensation during unemployment is rarely (if ever) enough to replace your lost income, and during tough economic times, you can’t assume you’d be able to run out tomorrow and find a new job.

If there is a good possibility you could be laid off or fired, renting makes more sense. When you rent a home, you may have to downgrade to a lower-rent apartment; but if you own a home and can’t keep up with the mortgage payments, you’ll go into foreclosure and damage your credit.

Unable to Afford Home Maintenance and Repairs

When you buy a home, you need to consider more than just the mortgage and taxes associated with the home.

Experts predict that homeowners need about 5% of the home’s purchase price available to maintain the home or make repairs. I know that I’m no “Jack Handy”, so if something breaks; I’m calling the repair man to fix it.

After paying the routine expenses of owning a home, will you have additional funds available for maintaining and repairing it? If not, renting is a better option since the landlord or management company is responsible for the maintenance and repairs of the property.

When Renting Costs Less

Finally, one of the most obvious reasons for choosing to rent instead of buying a home is when renting simply costs less. If you can rent a property for $2,000 a month and it would cost you $6,000 a month to own a similar property – does becoming a homeowner make financial sense?

Some people argue that the tax deductions available for homeowners actually make home ownership more attractive than renting, but the deductibles rarely add up to the additional expenses paid.

If you’re still not sure that’s why it always makes sense to talk with a qualified financial planner or tax professional to help analyze your situation.

I’ve seen too many cases where young people were so eager to “live the American Dream” and get their first home that they didn’t realize all the little things that come along with being a homeowner.

Slow down and do your homework before you take the plunge. Remember the friends that ended up buying the house we were living in? They still own it and have been trying to sell it for over two years.

Bottom Line: Renting vs. Owning

Owning a home is a significant component of the American dream, but it’s essential to evaluate if it’s right for your current situation. Consider factors like credit score, potential for job relocation, ability to handle maintenance costs, and the comparative expense of renting versus buying.

While the allure of homeownership is strong, sometimes renting offers greater flexibility and financial prudence. It’s crucial to consult professionals, consider all expenses, and make an informed decision.