I love making things automatic. Whether it is bill-paying, direct deposit, prescription renewals, or investing, making things automatic makes life easier, and that is where our Betterment investing review comes in.

When it comes to retirement planning, an overwhelming number of online tools and websites promise to help you create a dynamic and profitable portfolio while minimizing fees.

This growing list of services includes robo-advisors, a class of financial websites that offer to manage your portfolio with minimal in-person interaction and a heavy reliance on the latest investing tools and software.

One of the most popular robo-advisors by far is Betterment. Conceptualized by its founders in 2008, Betterment has since grown to help its customers invest billions of dollars of their hard-earned dollars. This is an investment platform that puts your investing on cruise control, and even allows you to make money watching TV! You can open an account with no money at all, and get the benefit of professional, low-cost investment management that enables you to invest in thousands of securities with as little as a few hundred dollars.

Table of Contents

It hasn’t been easy. With other competitors like Wealthfront and Empower always a few steps behind them, Betterment has struggled to find a way to stand out. Even with the competition, Betterment has emerged as one of the top online brokerage accounts and continues to grow its market share.

About Betterment

Betterment is an online, automated investment manager that uses advanced algorithms and software to find the perfect investment strategy for your portfolio and individual needs.

The main difference between investing your money with a traditional financial advisor and Betterment is that there is minimal human interaction. Unless you email or call in, your communication with an individual advisor will be very minimal.

But, there is some good news to counteract the lack of individual service. Because of lower operating costs, Betterment is able to charge lower fees than traditional financial advisors. This can be huge for individuals who want to take a hands-off approach to their retirement accounts, yet don’t want to pay top dollar for access to a top-tier financial advisor in their area.

Using complex investment software, Betterment allocates your investment portfolio based on your individual circumstances, investment time horizon, and thirst for risk.

In the meantime, they keep fees at a minimum by using ETFs (exchange-traded funds) that let you have a diversified portfolio, like mutual funds, but are tradeable much like stocks.

Since ETFs come with very low expense ratios, Betterment is able to pass those savings along to the consumer. Although the program already manages over $16 billion for its clients, they are still growing at a rapid pace.

Because the service is able and willing to deal with investors at all stages of wealth accumulation, it has become a go-to for both experienced and novice investors with various investing goals.

Further, Betterment’s portfolio strategy isn’t geared just toward retirement savings; the service can also improve your returns on dollars you invest for short-term and medium-term goals like saving for college, taking an annual vacation, or building up a cash reserve.

How Betterment Works

Like most other robo-advisors, Betterment provides complete, automated investment management of your portfolio. When you sign up for the service, you’ll complete a questionnaire that will determine your risk tolerance, investment goals, and time horizon. From that information, Betterment determines whether your portfolio will be designed as conservative, aggressive, or some level in between.

Over time, however, Betterment may adjust your portfolio to become gradually more conservative. For example, as you move closer to retirement, your asset allocation will be gradually shifted more heavily in favor of safe investments, like bonds.

Your portfolio will be constructed of Exchange Traded Funds (ETFs), which are low-cost investment funds designed to track the performance of an underlying index. In this way, Betterment attempts to match the performance of the underlying indexes, rather than to outperform them. For this reason, investing with Betterment – and most other robo-advisors – is considered to be passive investing. (Active investing involves frequent trading of stocks and other securities in an attempt to outperform the market.)

Betterment also uses allocations based on broad investment categories. There are three in total:

1. Safety Net – These are funds allocated for near-term needs, such as an emergency fund.

2. Retirement – This will naturally be your long-term investment account and held in tax-sheltered IRAs.

3. General Investing – This allocation is dedicated to intermediate goals, maybe saving for the down payment on a house or even for your children’s education.

Given that each of the three broad goals has a different time horizon, the specific portfolio allocation in each will be a little bit different. For example, the Safety Net will be invested in cash-type accounts for safety and liquidity.

The Betterment Investment Methodology

Like most other robo-advisors, Betterment manages your investment account using Modern Portfolio Theory, or MPT. The theory emphasizes proper allocations into various asset classes over individual security selection.

Your portfolio is divided between six stock asset allocations and eight bond asset allocations. Each allocation is represented by a single ETF that’s tied to an index specific to that asset class. The single ETF will provide exposure to scores or even hundreds of securities in each asset class. That means collectively your investment will be spread across thousands of securities in the US and internationally.

The six stock asset allocations are as follows:

- US Total Stock Market

- US Value Stocks – Large Cap

- US Value Stocks – Mid Cap

- US Value Stocks – Small Cap

- International Developed Market Stocks

- International Emerging Markets Stocks

The eight bond asset allocations are as follows:

- US High Quality Bonds

- US Municipal Bonds (will be held in taxable investment accounts only)

- US Inflation-Protected Bonds

- US High-Yield Corporate Bonds

- US Short-Term Treasury Bonds

- US Short-Term Investment Grade Bonds

- International Developed Market Bonds

- International Emerging Markets Bonds

Tax-loss Harvesting

Since Betterment offers tax-loss harvesting with taxable investment accounts, most asset classes will have two or three very similar ETFs. This will enable Betterment to sell a losing position in one ETF to reduce capital gains in winning asset classes. Alternative ETFs are then purchased to replace the sold funds to maintain the target asset allocations in your account.

Tax-loss harvesting is becoming an increasingly popular investment strategy because it effectively defers capital gains taxes into future years. It’s available only for taxable accounts since tax-sheltered accounts have no immediate tax consequences.

How Betterment Compares

Here’s how Betterment compares to the previously mentioned companies, Wealthfront and Empower.

| Betterment | Wealthfront | Empower | |

|---|---|---|---|

| Minimum Initial Investment | $0 | $500 | $100,000 |

| Advisor Fee | 0.25% on Digital; 0.40% on Premium (account balance over $100k) | 0.25% on all account balances | 0.89% on most account balances; reduced fee on balances > $1 million |

| Live Advice | On Premium Plan only | No | Yes |

| Tax-Loss Harvesting | Yes, on all taxable accounts | Yes, on all taxable accounts | Yes, on all taxable accounts |

| 401(k) Assistance | Yes, on Premium Plan only | No | Yes |

| Budgeting | No | No | Yes |

Betterment Accounts and Options

For the first few years of Betterment’s existence, they offered a single investment account serving as a one-size-fits-all plan. But that’s all changed. They still offer basic investment accounts, but they now give you a choice of multiple investment options.

Betterment Digital

This is Betterment’s basic investment plan. There is no minimum initial investment required, nor is there a minimum ongoing balance requirement. Betterment charges a single fee of 0.25% on all account balances.

Betterment Premium

Betterment Premium works similarly to the Digital plan, but it delivers a higher level of service. The plan provides external account synching, giving Betterment a high-altitude view of your entire financial situation. External investment accounts can help in enabling Betterment to better coordinate your portfolio allocations with assets held in outside accounts. They can also make recommendations to better manage those external accounts.

And perhaps the biggest advantage of the Premium plan is that it comes with unlimited access to Betterment’s certified financial planners. In this way, Betterment is competing more directly with traditional investment advisors, but doing it with a robo-advisor component.

You’ll need a minimum of $100,000 to invest in the Premium plan, and the annual advisory fee is 0.40%. That’s just a fraction of the usual 1% to 2% typically charged by traditional investment advisory services.

Betterment Cash Reserve

The account pays a variable interest rate, currently set at 0.30% APY. Betterment doesn’t actually hold these funds directly but rather invests them through participating program banks.

There’s no fee for this account, and you can move money as often as you want. For those with very high cash balances, the account is FDIC-insured for up to $1 million through the program banks.

Betterment Socially Responsible Investing (SRI)

SRI portfolios are becoming increasingly popular in the robo-advisor space. It involves investing in companies that meet certain standards for social, environmental, and governance guidelines. Betterment indicates that the ETFs they use in their SRI portfolio have produced a 42% increase in their social responsibility scores.

SRI portfolios work with both the Digital and Premium plans, using a similar investment methodology. But they make certain modifications, holding ETFs based on SRI in place of the ETFs used in non-SRI portfolios.

SRI portfolios do not require a minimum balance and charge no additional fees. And like their Digital and Premium plans, taxable SRI investment accounts take advantage of tax-loss harvesting.

Betterment Flexible Portfolios

The key word in the name is “flexible” because the main feature is adding personal options to your portfolio allocations.

This is done by adjusting the individual asset class weights in your portfolio. For example, if you have a 7% allocation in emerging markets, you may choose to increase it to 10% if you believe that sector is likely to outperform others. But you can also decrease the allocation if it makes you feel uncomfortable.

Betterment Tax-Coordinated Portfolio

This is less of a formal portfolio and more of an investment strategy. It must be used in combination with a taxable investment account and a tax-sheltered retirement account. Betterment will then allocate investments based on their tax impact.

For example, income-generating assets – that produce high dividends and interest income – are held in a tax-sheltered account. Investments likely to generate long-term capital gains are held in a taxable investment account since you will be able to take advantage of lower long-term capital gains tax rates.

Goldman Sachs Smart Beta

This option is for more sophisticated investors and requires a minimum account balance of $100,000. And since it is a high-risk/high-reward type of investing, it also requires a higher risk tolerance.

Betterment uses the same basic investment strategy as they do in other portfolios. But it’s an actively managed portfolio that will be adjusted in an attempt to outperform the general market. Securities will be bought and sold within the portfolio and can include either individual securities or Smart Beta ETFs.

The portfolio has many variations, including a wide range of allocations. Stocks are chosen based on four qualities: good value, strong momentum, high quality, and low volatility.

And like other portfolio variations Betterment offers, there is no additional fee for this option.

BlackRock Target Income Portfolio

Betterment recognizes that some investors are more interested in income than growth. This will particularly apply to retirees. The BlackRock Target Income Portfolio invests in portfolios based on your risk tolerance. This can mean low, moderate, high, or even aggressive.

Those categories may seem unusual for an income-generating portfolio. But while the portfolio attempts to minimize the risk of principal, it also recognizes that some investors are willing to add risk to their portfolio in exchange for higher returns.

A low-risk portfolio may have a higher allocation in US Treasury securities. An aggressive portfolio may center primarily on high-yield corporate bonds or even emerging-market bonds that have higher interest rates due to greater risk.

Betterment No-Fee Checking

Provided by Betterment Financial LLC in partnership with NBKC Bank, this is a true no-fee checking account. Not only are there no monthly maintenance fees, but there are also no overdrafts or other fees. They’ll even reimburse all ATM fees and foreign transaction fees you incur. And there’s not even a minimum balance requirement.

You’ll be provided with a Betterment Visa Debit Card with tap-to-pay technology, that you can use anywhere Visa is accepted. All account balances are FDIC-insured for up to $250,000. As you might expect from a company on the technological cutting edge, you can deposit checks into the account using your smartphone.

Check out our full Betterment checking review.

Betterment Account Options Overview

| Account/Option | Description |

|---|---|

| Betterment Digital | • Basic Investment Plan with 0.25% Fee, No Minimum Balance • Various Portfolios Available, Excluding Goldman Sachs Smart Beta ($100,000 Minimum) |

| Betterment Premium | • Similar to Digital With Extra Features • Requires $100,000 Minimum, 0.40% Advisory Fee • Access to Certified Financial Planners |

| Betterment Cash Reserve | • Variable 0.30% APY, No Fees, Unlimited Transfers • FDIC-Insured up to $1 Million Through Program Banks |

| Betterment SRI | • Invest in Socially Responsible Companies, No Minimum Balance, No Extra Fees • Compatible With Digital and Premium Plans, Includes Tax-Loss Harvesting |

| Betterment Flexible Portfolios | • Personalize Portfolio by Adjusting Asset Class Weights • Flexible Allocation Adjustments Based on Preferences |

| Betterment Tax-Coordinated Portfolio | • Investment Strategy for Taxable and Tax-Sheltered Accounts, Optimizing Tax Impact • Allocates Assets Based on Tax Efficiency |

| Goldman Sachs Smart Beta | • For Sophisticated Investors With $100,000 Minimum • Actively Managed, No Additional Fees • Diverse Allocations Based on Value, Momentum, Quality, and Volatility |

| BlackRock Target Income Portfolio | • Tailored for Income-Focused Investors, Adjusts Portfolio Based on Risk Preferences |

| Betterment No-Fee Checking | • True No-Fee Checking Account, FDIC-Insured up to $250,000 • Reimburses All ATM and Foreign Transaction Fees • Includes a Betterment Visa Debit Card and Mobile Check Deposit |

Betterment Key Features

Minimum initial investment: Betterment requires no funds to open an account. But you can begin funding your account with monthly deposits, like $100 per month. This method will make it easier to use dollar-cost averaging to gradually move into your portfolio positions.

Available account types: Joint and individual taxable investment accounts, as well as traditional, Roth, rollover, and SEP IRAs. Betterment can also accommodate trusts and nonprofit accounts.

Portfolio rebalancing: Comes with all account types. Your portfolio will be rebalanced when your asset allocations significantly depart from their targets.

Automatic dividend reinvestment: Betterment will reinvest dividends received in your portfolio according to your target asset allocations.

Betterment Mobile App: You can access your Betterment account on your smartphone. The app is available for both iOS and Android devices.

Customer contact: Available by phone and email, Monday through Friday, from 9:00 a.m. to 8:00 p.m., Eastern time.

Account protection: All Betterment accounts are protected by SIPC insurance for up to $500,000 in cash and securities, including up to $250,000 in cash. SIPC covers losses due to broker failure, not those caused by market value declines.

Financial Advice packages: Betterment offers one-hour phone conferences with live financial advisors on various personal financial topics. Five topics are covered:

1. Getting Started package: This package gives new users the professional vote of confidence they need as a professional will assess their account setup. $199

2. Financial Checkup package: This package takes it a step further, providing the customer with a professional opinion on their portfolio and financial circumstances. $299

3. College Planning package: As its name implies, this package helps parents who are investing with the goal of paying for their children’s college education in the next 5-18 years. $299

4. Marriage Planning package: Merging finances can be tricky, so Betterment created this plan to help engaged couples and newlyweds to succeed as they unite their lives and assets. $299

5. Retirement Planning package: Your investment goals and strategies change as you near retirement. This particular package helps keep you on target to meet them. $299

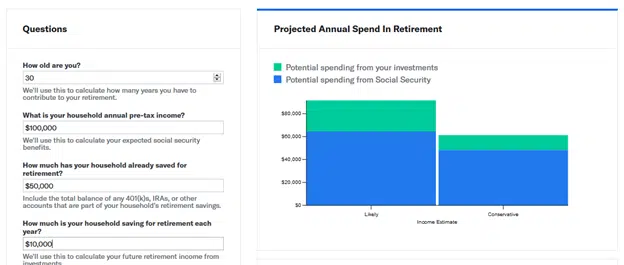

Retirement Savings Calculator: Robo-advisors are popular choices for retirement accounts. For this reason, Betterment offers the Calculator to help you project your retirement needs. By entering basic information in the calculator (it will sync external accounts if you have a Premium account – including employer-sponsored retirement plans) it will let you know if you are on track to meet your goals or if you need to make adjustments.

How to Sign Up for a Betterment Account

The Betterment sign-up process is one of the most user-friendly out there for any brokerage. It comes with easy-to-follow instructions and a streamlined registration process which users can navigate through in a matter of minutes.

First, get the process started by clicking the button below.

Sign up for a Betterment Account

After the initial sign-up process, users can expect a simple transaction as they transfer funds into the account, much like moving money from a checking to a savings account.

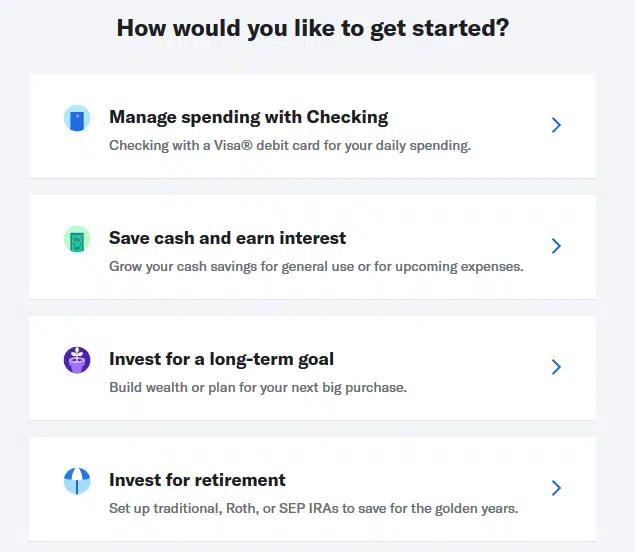

When you begin the sign-up process, you’ll be given a choice of four different investment goals:

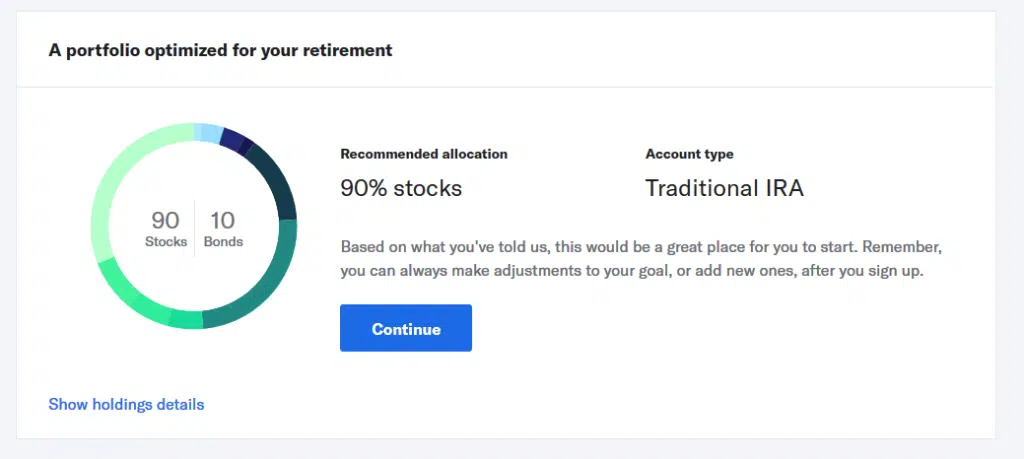

I chose “Invest for retirement”. It will ask your current age, and your annual income, then give you a choice of accounts to use. That includes a traditional, Roth, or SEP IRA, or even an individual taxable account. I selected a traditional IRA.

Based on a 30-year-old with a $100,000 income, Betterment returns the following recommendation:

You even have the option to have the specific asset allocations listed. After clicking “Continue”, you’ll be asked to provide your email address and create a password. You’ll then be taken to the application, which will ask for general information, including your name, address, phone number, and how you heard about Betterment.

Once your account has been set up, you can fund it immediately, by connecting your bank account, or by setting up recurring deposits.

You can also set up other accounts, such as “Manage to spend with Checking” or “Invest for a long-term goal”.

Why You Should Open An Account With Betterment

While nearly anyone who invests could benefit from online portfolio management and advising, this service is definitely geared to certain types of investors. In most cases, Betterment will work best for:

- Hands-off investors who have some investing knowledge – Since it takes care of the heavy lifting for you, it works best for investors who want to take a hands-off approach to their investment portfolio. Passive investors can let Betterment handle the logistics while using online account management to keep a close eye on their accounts.

- Novice investors who need help – Beginning investors who are just learning the ropes can turn to Betterment for online portfolio management with low fees. The many online tools and user-friendly interface make it easy for beginners to get a grasp on basic financial concepts and investing strategies.

Robo-advisors are growing in popularity and could easily replace in-person advisors in the near future. With lower fees and advanced software that can maximize results, online investing is certainly gaining an edge.

Whether Betterment is right for you depends on your individual needs and investing goals. If you’re a hands-off investor who wants to grow your retirement funds without paying a lot of fees, then Betterment might be ideal. Additionally, beginning investors can benefit handsomely from the online tools and investing education offered through the Betterment website.

If you think Betterment Investing might be exactly what your portfolio needs, sign up for a new account today.

However, if you determine that you would be better served by a more hands-on approach, check out the other online brokerage account options. Being a certified financial planner, I have had a chance to work with several of these platforms and have done the following reviews:

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Betterment Investing Review

Product Name: Betterment Investing

Product Description: Betterment is a robo-advisor platform offering automated investing services for individual investors. By using algorithms and streamlined investment strategies, the platform provides personalized financial planning solutions tailored to each user's goals. It simplifies the investment process, making it accessible for both novice and experienced investors.

Summary of Betterment Investing

Betterment stands at the forefront of robo-advisory, transforming the traditional investing landscape. Through its sophisticated algorithms, it curates diversified portfolios based on user’s risk tolerance and financial objectives, predominantly investing in low-cost exchange-traded funds (ETFs). With features like automatic rebalancing and tax-loss harvesting, Betterment optimizes investment returns while minimizing tax liabilities. The platform also integrates retirement planning and savings advice, ensuring a holistic financial planning experience. As a pioneer in the robo-advisory space, Betterment brings a blend of technology and financial expertise, democratizing investment management for all.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- There’s no minimum investment required.

- The low annual fee of 0.25% on the Digital plan can allow you to have a $20,000 account managed for just $50 per year, or a $100,000 account for just $250.

- Tax-loss harvesting is available at all taxable accounts.

- Betterment Premium provides unlimited access to certified financial planners, providing a service similar to traditional investment advisors, but at a fraction of the cost.

- The No-fee Checking and Cash Reserve give you cash management options to go with your investing activities.

- Betterment offers several portfolio options, including Smart Beta, Socially Responsible Investing, and the BlackRock Targeted Income Portfolio.

- The use of value funds also adds the potential for your investment accounts to outperform the general market, since value stocks tend to be underpriced relative to their competitors.

- Flexible Portfolio will give you some control over your investment allocations, which is a feature absent from most robo-advisors.

Cons

- Betterment’s annual advisory fee is on the low end of the robo-advisor range. But there are some robo-advisors charging no fees at all.

- Betterment doesn’t offer alternative investments. These include natural resources and real estate, which are offered by some of their competitors.

- External account syncing is available only with Betterment Premium.

How much can get monthly on $200,000 investment. Gross,net,taxes,inflation,etc. o.k.

I’m from Nigeria,l earned #30000 every month,please am interested to invest in betterment with the little l earned every month.

How do I go about it,

Thanks

Hi Muoneke – To my knowledge, Betterment isn’t available in Nigeria, so I don’t think it will be possible.

Hi Jeff

I watched your youtube videos about passive income and you mentioned about betterment. Now I am thinking about betterment over fundrise. I do not know which one to choose.

I would like to start investing now as I would like to see myself as having financial security and freedom. Hope you could guide me on this. Thanks.

Hi Leo – Without knowing your personal circumstances, I can’t make a recommendation either way. But one thing I can say is that Fundrise is a real estate investment platform, Betterment is diversified and may be the better choice if you don’t want to be limited to real estate only. Or you could put most of your money in Betterment, and a small amount in Fundrise. But please discuss this with a financial professional. Usually when someone doesn’t know how to invest their money they need direct help from someone close to their financial situation.

I am new to investment. I would like to have a practical example. If I were to invest 1000 can you please show me or gice an example of how much money I would earn after 2 years of investment.

Hi Wally Jean – No one can tell you what you’ll have in two years. Investing isn’t precise, unless you invest in fixed income assets that don’t fluctuate in value. Since Betterment involves investing in stocks and bonds, it’s not possible to say for certain what you’ll have in the future.

I wonder if the recent restructured fees and setup change your thoughts at all?

@Sarah We’ll be updating the post to reflect the recent changes. Even with the restructured fees I still Betterment is still a great option for those looking for a “robo-solution”.

I’ve heard a lot of good things about Betterment… but never quite sure about bias on the part of the writers. Were you compensated by Betterment to write this post? I see you have affiliate links for Betterment.

Hi Steve – We do receive compensation if someone signs up for Betterment, but I don’t endorse products I don’t believe in. I recommend Betterment because it will work for many types of investors, particularly those who are looking for professional investment management at low cost.

Hi. I enjoy your advice. Learned a lot. However I am free Canada. All the brokers such as betterment that u recommend are for USA citizens only. Are there any that would accept Canadians. Or a good Canadian company?