DISCLAIMER

When I started this Motif review, I already knew that the best way to invest might also be the most boring way to invest.

Buy and hold. Buy and hold. Buy, and, yeah…hold!

Long-term investing is my recommendation for the masses, and unfortunately, that’s just not a very exciting way to invest.

Think about it. What’s exciting about throwing your money into a well-diversified portfolio and having it sit there for 20, 30, or 40 years? Not much. Well, that is, until you retire and realize you potentially have enough money to fill a swimming pool.

Personally, I get excited about investing, whether it be small amounts, like investing $1,000, or going bigger and finding the best way to invest $20,000! But I understand that for most people, it’s a chore they do because they understand the importance of investing in their future.

I’m always looking for ways to make investing exciting for people while warning them of the dangers of day trading. Thankfully, there are new companies cropping up that promise to add some spice back into investing.

One of those companies is Motif Investing.

Table of Contents

What’s a Motif Anyway?

Traditionally, if you wanted to invest a sum of money, you would probably meet face-to-face with a financial advisor who would select a portfolio of stocks and bonds to match your risk tolerance level.

This is still an excellent way to invest, but what if you’re the DIY type and want to learn a bit about the investment process yourself?

Well, you’d have a lot to learn.

How much should you invest in emerging markets? How are large-cap stocks doing? What’s an outrageous amount to pay in mutual fund fees?

What are the best places to open a brokerage account? These are just a small fraction of the number of questions you might have to answer in order to construct a solid portfolio.

If you don’t know much about that stuff, you’re not alone. It’s very, very difficult to create a comprehensive portfolio that’s tailored to your needs and risk tolerance level.

That’s where Motif saves the day. Motif Investing allows you to invest online in things you already know and care about.

For example, let’s say you study electric vehicles and think they are the way of the future. You can invest in a “Battery Charged” motif. Or, if you want to invest $5,000 into Apple, you can do that – you aren’t forced into buying a certain whole number of shares.

You see, motifs are groupings of stocks that are based on a single idea or value. You could invest in a “Robotic Revolution” motif or a “Medical Devices” motif.

Simply visit the Motif Investing website and search for what you want to invest in – you’re almost sure to find a motif related to your interests.

This is cool. Really cool.

Why? It gives the masses a way to invest in what they care about without having to understand the complexities of investing.

How Motifs Are Constructed

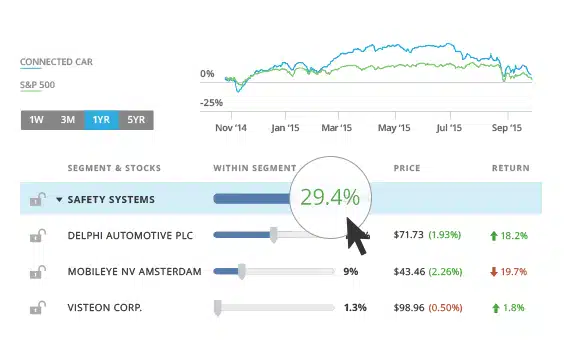

As stated earlier, motifs are a basket of stocks based on a single idea. When you select a motif, you can read the full details about the motif. The stocks are grouped together into segments.

For example, the “Robotic Revolution” motif is split into the following segments:

- Military & Defense

- Medical Applications

- Industrial Solutions

- Maritime Exploration

- Consumer Products

Next to each of the segments, there are percentages that indicate how much of the entire motif that segment represents. This is helpful, as it allows you to understand how each motif is weighted.

If you don’t agree with how the motif is weighted, you can always choose another, yet similar motif.

Under each segment are the stocks. You’ll know the exact companies you’re investing in and what percentage of the portfolio each stock represents.

Who Builds These Motifs?

There are more than 150 professionally built motifs.

That might be an overwhelming number to sort through, but Motif makes it easy to quickly find what you’re looking for by separating these professionally-built motifs into categories:

- Sectors

- Income Strategies

- Trading Strategies

- Global Opportunities

- Values-Based

- Asset Allocation

If you’re hungry for more, there are also 180,000+ motifs that were built or customized by the Motif community. That’s a lot, people.

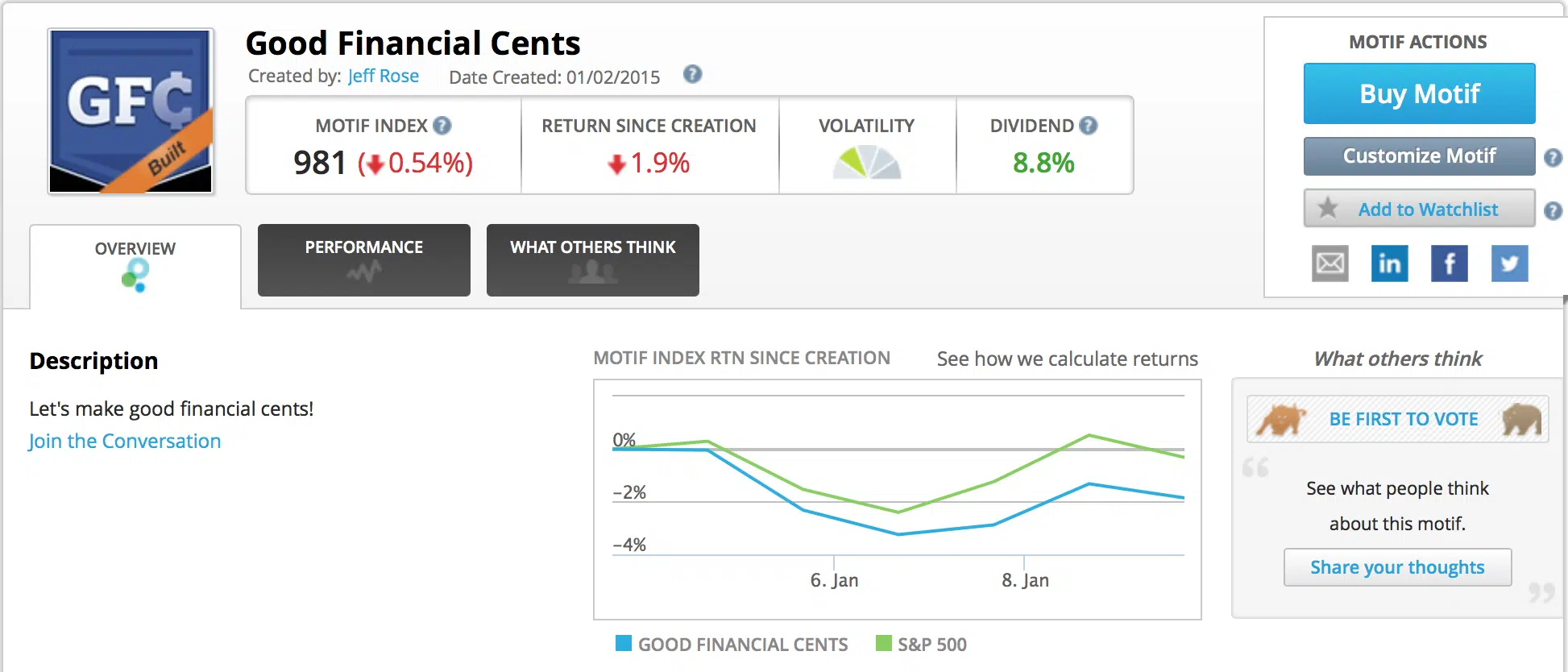

Yes, that means you can create your own motif and share it with your friends, family, or fans. In fact, that’s exactly what I did. I chose a few stocks and created the Good Financial Cents motif.

I have a whole bunch of goodies in this motif, including AT&T Inc. and Cincinnati Financial Corp., just to name a few.

How Much Does Motif Cost?

Most services charge a $5 to $10 trade commission for one particular stock. If you invest in a motif, however, you’re getting up to 30 stocks for just $9.95.

And yes, that $9.95 fee applies whether you buy a motif as it comes, customize how you want it, or if you build it from the ground up. That’s pretty straightforward.

You should know, however, that this pricing also applies when you sell motifs, buy additional entire motifs that you own, or if you rebalance positions in a motif. This isn’t surprising, and the pricing structure here still represents an excellent deal.

Additionally, keep in mind that the minimum investment amount is $250 for these buy and sell orders unless you do a “Sell All” order to sell an entire motif you own. Please note that on the FAQ page, it states that “you can start investing for as little as $300.”

This higher amount is listed so that you can pay the fee for buying or selling motifs. It’s a good suggestion anyway. If you’re going to invest in motifs, you’re probably going to want to put a bit of money into the motif to make it worth your fee.

While $9.95 is the fee for real-time trades, there is an even more affordable option. With Next Market Open Trades, your trades on Motif portfolios cost $0 and are executed on the trading day following your decision to purchase.

Oh, and by the way, you can also buy and sell individual stocks and ETFs outside of the motifs you own for the same price. Bonus!

There are some other fees with Motif Investing, but most of them you’ll probably never experience. Here’s a list of Motif Investing fees and additional pricing details.

Let’s Talk Returns

When you invest with Motif Investing, remember, that your portfolio is probably not going to be as diversified as a portfolio designed by a professional financial advisor.

Say, for example, you invest in a few different motifs. Yeah, you’re diversified, but those motifs probably don’t closely represent the market as a whole.

That’s why I feel you’ll find your returns to be more volatile than, say, investing in an index fund. That’s not necessarily a bad thing, but it’s something to know.

While Motif boasts a 16.3% average annualized return using their pre-built professional motifs, it’s important to remember that this figure is using data starting at their creation, which was not that long ago (from January 1, 2012, through July 31, 2015).

While they represent this fairly on their website, it’s important to note that you simply should not compare this figure with long-term historical returns of the stock market – it’s apples and oranges.

Is Motif Investing Right for You?

This, my friends, is the all-important question. Is Motif Investing right for you?

Like just about every investing service out there, Motif Investing isn’t right for everyone. However, it is right for quite a few people, so ask yourself which group you most align with:

Investing for retirement

Investing for retirement is probably the most important reason to invest. How does Motif Investing fit into retirement investing?

Well, the good news is that you can open a Roth IRA, Traditional IRA, or Rollover IRA with Motif Investing. Learn more about Roth IRA rules here. There are no fees for opening or maintaining such an account. However, there is a $95 account termination fee.

This obviously isn’t a big deal, however, if you’re going to be keeping your retirement account for a long time.

With these retirement account options and the low minimum investment, Motif Investing is positioned well to welcome a lot of clients who may not yet have the larger balance minimums that are often required by personal financial advisors.

On the other hand, I do have some concerns about people who might use Motif to invest in only a few segments; say, “Minimally Invasive Surgery” and “Modern Warfare.” Investing all of your retirement money so specifically isn’t the wisest thing to do.

I mean, sure, maybe World War breaks out and outpatient surgeries become exceedingly popular, but placing your bets on just a few motifs isn’t what I’d call “appropriate diversification.”

That said, Motif Investing is great for those who are just starting to invest for retirement and who have the self-control to diversify well. If that’s you, check out Motif Investing.

Investing for Short-Term Goals

Individual motifs probably have a higher likelihood of being volatile than a well-diversified portfolio. So if you’re looking for a short-term investment, Motif Investing probably isn’t right for you.

Instead, here are 11 of the best short-term investments for your money.

Investing for fun

I can see how Motif Investing would be great for people who already have a well-diversified portfolio for retirement, and simply want to invest more on the side – for fun.

With a variety of fun motifs to choose from, Motif Investing is great for those who want to “play” with some money to see what happens. Of course, this should still always be done in a serious manner.

For example, let’s say you’re a fan of planes, trucks, trains, and just about anything with an engine that moves things. If you also believe in the financial future of transportation, you might have some fun investing in the “Transporting America” motif.

If you’re already financially secure and want to have a little fun with some extra money, try out Motif Investing.

Is Motif Investing Right for Your Financial Goals?

| Investment Purpose | Motif Investing Suitability |

|---|---|

| Retirement | • Offers Roth, Traditional, and Rollover IRAs • No Account Fees, $95 Termination Fee • Suitable for New Investors with Low Minimums • Caution: Avoid Overconcentration in Specific Motifs |

| Short-Term Goals | • Not Recommended Due to Motif Volatility • Explore Alternative Short-Term Investments |

| Fun/Supplementary | • Ideal for Diversified Portfolios Seeking Fun Investments • Diverse Motif Options Available • Enjoy Thematic Investments (e.g., “Transporting America”) • Suitable for Those with Extra Funds. |

Final Thoughts: Expert Motif Investing Review

Motif Investing is a unique and easy way to invest in what interests you – at a very low price.

It’s unique because you can invest in companies you care about and invest in whole dollar amounts instead of having to invest in whole share amounts. This is what sets it apart from the competition.

Motif is also great because of its online interface, which is straightforward and comprehensive. You don’t have to understand the complexities of investments in order to make an informed decision about each motif.

The platform is on the cutting edge of investment software, recently announcing the 2019 launch of its crypto assets portfolio, making it the first in its field to offer crypto asset-based portfolios to individual investors.

That said, it’s not the right choice for every investor, which is why I advise you to check out all of your options:

I hope you enjoyed this Motif review. If it seems like a good fit for you and your investment goals, try it out and tell me what you think in the comments!

How We Review Brokers and Investment Companies:

Good Financial Cents conducts a thorough review of U.S. brokers, focusing on assets under management and notable industry trends.

Our primary objective is to offer a balanced and informative assessment, assisting individuals in making informed decisions about their investment choices. We believe in maintaining a transparent editorial process.

To achieve this, we gather data from providers through detailed questionnaires and take the time to observe provider demonstrations.

This hands-on approach, combined with our independent research, forms the basis of our evaluation process. After considering various factors, we assign a star rating, ranging from one to five, to each broker.

For a deeper understanding of the criteria we use to rate brokers and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Motif Investing Review

Product Name: Motif Investing

Product Description: Motif Investing is a unique online brokerage that allows investors to create and trade portfolios, called motifs, based on specific themes or investing ideas. These motifs can be comprised of up to 30 stocks or ETFs, empowering users to invest in concepts they believe in. The platform combines thematic investing with customization, allowing for a tailored investing experience.

Summary of Motif Investing

Motif Investing offers a fresh perspective on online investing by letting users craft and invest in portfolios centered around certain themes, sectors, or investing ideas. Instead of singular stock purchases, users can buy a motif, a pre-built or customized set of up to 30 stocks or ETFs, reflecting specific ideas like clean energy, tech innovation, or even social responsibility. This approach empowers investors to express their beliefs or predictions about market trends in their portfolios. Additionally, Motif offers real-time trading, insights on each motif, and the ability to adjust and personalize these motifs as one sees fit, merging traditional brokerage capabilities with thematic investing.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Thematic Investing: Motif’s unique platform allows investors to focus on broader themes or sectors, making it easier to align investments with personal beliefs or predictions.

- Customization: Users can design their motifs, selecting from various stocks and ETFs to build a portfolio that suits their preferences.

- Affordable: Trading motifs is typically more cost-effective than purchasing each stock or ETF individually.

- Educational Insights: The platform provides valuable insights and analyses for each motif, aiding investors in making informed decisions.

Cons

- Not for Day Traders: The platform’s focus on thematic investing may not appeal to day traders or those looking for quick stock turnovers.

- Overwhelming for Beginners: The plethora of options and the responsibility of selecting up to 30 stocks/ETFs might be daunting for novice investors.

- Limited Advanced Tools: Active traders might find the platform lacking in advanced charting tools and analytical features compared to traditional brokerages.

- Potential for Over-diversification: While diversification is generally good, there’s a risk that investors might spread their funds too thinly across motifs.

Motif is closing May 20th. I invested in some MLCDs with them which are supposed to be Buy and Hold to maturity. I can’t find a brokerage that I can transfer them, too. So I may have to sell them which at this time could be for a loss. So much for protecting my retirement assets while having a chance for a return.

Does anybody know of a brokerage that would accept these CDs? They were issued by Goldman Sachs Banks USA and are held by Pershing.

Thanks

Beware of borrowing from Lenders Club. There is a fraudulent company using their name. They are scamming people. Just make sure you are dealing with the authentic company!!!!

NO FOR EU CUSTOMERS

Avoid Motif! They have been nothing but a pain. They create new fees after you sign up, and you will not notice until it’s too late. For example, a $10 semi-annual inactivity fee. Also, their website is horrible and makes analyzing/researching your past activity very difficult. When problems are pointed out to Motif, they do nothing.

Go with a serious, well known company like Schwab, eTrade, etc.

I would like to invest my saving account but i dont know what the best way of investment is.

I have heard about Roth IRA but i am confused about it.

Hi Maryam – The Roth IRA is a retirement plan primarily. The contributions aren’t tax deductible, but the income can be taken tax-free when you’re 59.5 years old, and have been in the plan for at least five years. But the Roth IRA has one major advantage over other retirement plans, and that’s that you can always withdraw your contributions without having to pay tax on them. You can set up a Roth IRA with a robo-advisor like Motif.