If there’s one thing that you don’t want to do twice, that would be retiring.

Imagine having to go back to work after you’ve called it quits. Yuck!!

I’ve heard horror stories of this happening, and the most common culprit is a lack of planning.

Planning your retirement is something you do not want to take lightly.

If you are approaching retirement, do you know if you are ready?

Do you have the funds saved that you will need?

Do you have all the other details in place and ready to go?

While retirement is an exciting time, it is also a time of big changes in your life.

Not only will you not be going to work every day but you will also have adjustments in your personal life and your finances will also be changing.

To make sure you are prepared for all the changes creating a retirement planning checklist is recommended.

Table of Contents

A Basic Retirement Checklist to Follow at Any Age

1. Develop Your Retirement Budget

Face it. You have to know how much you need per month to live on. “Guesstimating” is just setting yourself up for failure. Make sure that you factor in inflation which can be calculated at about 3%-5% per year.

The easiest way to start creating a retirement budget is to look at what you currently spend as a non-retiree. Grab your utility bills, bank statements, and credit card statements for the last 3 to 6 months and calculate how much you are spending in major categories like groceries, eating out, and car expenses. These categories may change significantly in retirement, but having an idea of what normal feels like before retirement is a good place to start.

Have trouble tracking down your statements and keeping your bills straight? I recommend using online software like Finovera because you can see all of your bills and statements in one place.

Try out Finovera. This free online software lets you connect all of your major bills to its system to track your due dates, keep statements archived, and be directed to that bill’s payment page easily.

2. Create a Retirement Plan

This might sound like common sense, but I’m amazed at how many people don’t do this.

Decide what age you plan to retire and determine how much you will need to save in order to live a comfortable lifestyle once you retire. This is something you will want to reevaluate throughout the years.

Many times as we age our living standards go up and you will want to make sure you are saving enough to continue your same lifestyle once you retire.

Many people don’t do this because they think it takes too long. Not true.

3. Determine Your Retirement Income

Look at what sources of income you will have during your retirement. This may include a pension, social security, and more.

You’ll have to plan for the unexpected. Sudden medical bills or a drop in the market can significantly affect your retirement income needs.

If you haven’t started drawing social security yet, you’ll want to review your options and verify you’ve selected the best option for you and your spouse. Not taking some time to do some research and contacting your local Social Security office could cost you thousands.

4. Look At Your Retirement Accounts Every Year

If it’s been over a year since you’ve opened your brokerage statements or logged into your 401(k) online account, you’re long overdue. Make sure you have saved enough during the past year and that you are on track to save enough before retirement. It is always a good idea to overestimate.

I highly recommend using software tools like Empower to see the big picture of all of the various retirement accounts and brokerage statements.

We did a full review of Empower that I encourage you to read, but here’s a snapshot.

A couple could easily have 5 or 6 different firms holding money for retirement which makes seeing your overall portfolio very difficult. Are you overexposed to emerging markets? Do you have enough bond or income investments? It can be hard to tell if you have to check multiple portfolios and start calculating everything by hand.

That’s where Empower comes in. The site gives you a really sharp and intuitive online dashboard where you can see all of your accounts — from checking to brokerage to retirement — in one place. They also state they have a critical two-word commitment to you: fiduciary duty (read our review to learn what this means and why it is so important).

If Personal Capital isn’t for you, we also offer something similar in our unique process, The Financial Success Blueprint.

5. Remember: It’s Never Too Late

If you start saving late, make sure you are saving every penny you can in order to make up for lost time. This may mean taking on an extra job, downsizing your home, and more. Keep in mind that it will be easier to sacrifice now compared to later.

6. Get Out of Debt for Good

Pay down all of your debts and aim to be debt-free by your retirement date or even sooner. Getting out of debt early in life will make retirement planning a much smoother process.

There’s nothing more terrifying than having a significant drop in income because of retirement and having a mountain of bills to pay. That’s why it’s important to know exactly how much debt you have and implement a plan of attack to get it paid off.

7. Keep On Keepin’ On

Continue to make retirement contributions to your retirement accounts. If at all possible make sure that you are maxing out your contributions every year.

Trust me when I say this: Financial planners love clients who retire with no debt and plenty of cash savings. It makes our job that much easier in helping you retire comfortably.

8. Don’t Become Complacent

After you retire, don’t go on cruise control with your investments. Continually evaluate them, making sure you always maintain a diversified portfolio. As you approach retirement age you may want to consider keeping the majority of your money in non-risky investments. Working with a Certified Financial Planner will help with this.

9. Determine Your Retirement Health Care Needs

For anyone retiring at age 65 or older, you will be eligible for Medicare. All the costs of Medicare are not fully covered by what you put in over your lifetime. To cover these costs you will want to head to medicare.gov and their resources to compare Medigap plans.

If you plan to retire before you are eligible for Medicare you will need to factor in the cost of healthcare into your retirement budget.

While you most likely will be able to get a COBRA package through your current employer, the cost can be high and the plan may not cover all of your needs.

Also, consider long-term care insurance to pay for things like nursing home costs. Long-term care insurance can be costly as well, but the earlier you get into a plan the lower your overall premium will be.

One of your best options is to get a health insurance plan that is custom fit to your specific situation. eHealthInsurance will generate several quotes for you from different insurance companies. Having multiple quotes in front of you makes doing comparisons a lot easier. I would try it out just to make sure I’m not missing a great affordable healthcare plan.

Once you are Medicare you should consider adding a Medicare supplement plan. These plans will complete your Medicare coverage and make sure that you do not get any nasty medical bills that are more than you budget can afford.

10. Know the Rules and Regulations of Your Retirement Accounts

Retirement accounts are all different and if you have saved in multiple accounts it may be confusing how retirement withdrawals will work. Many accounts require you to be a certain age before you can withdraw funds.

One costly mistake I’ve seen is rolling over your 401(k) to an IRA when you retire early and you’re under 59 1/2. 401(k)s allow you to withdraw money if you retire early and you won’t be on the hook for the 10% early withdrawal penalty. If you roll your 401(k) into an IRA, you basically give that up which could cost you if you needed access to your money.

Additionally, many require minimum withdrawals when you reach a certain age and more. Commonly known as “retirement minimum distributions” you’ll have to start taking out money from your retirement accounts at 73. Not doing so could cost you a tax penalty of 50%! Take the time to understand how your retirement funds will work best for you.

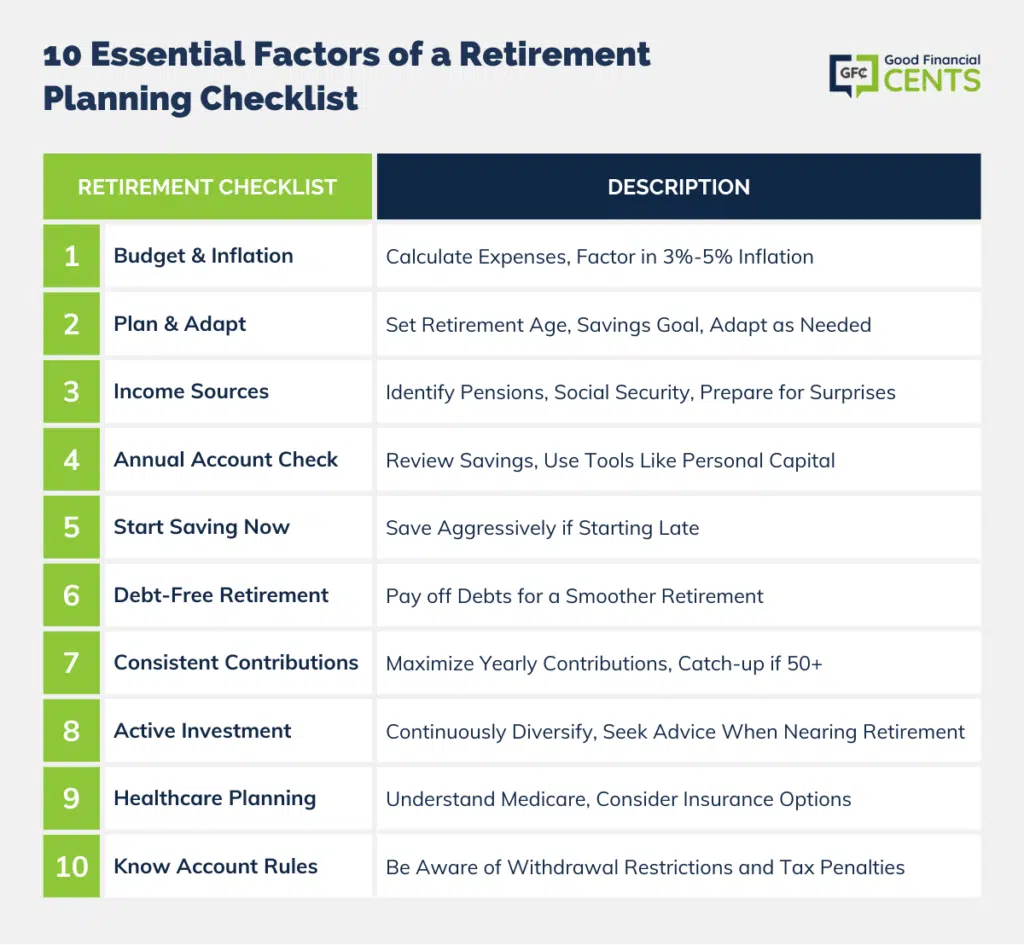

The Bottom Line – 10 Essential Factors of a Retirement Planning Checklist

Retirement is an exciting yet transformative phase in one’s life, characterized by significant shifts in personal, financial, and professional domains.

Properly planning for this transition is imperative, and there are pivotal steps one must take to ensure a smooth and enjoyable retirement. These include creating a comprehensive retirement budget, establishing a well-thought-out retirement plan, and determining your post-retirement income.

It’s crucial to review retirement accounts regularly, manage debts, and stay proactive with your investments.

Healthcare needs and understanding the intricacies of retirement account regulations are equally vital.

By diligently following these guidelines, one can confidently approach retirement, ready for the adventures and experiences the golden years offer.

Hey Jeff!!

Great points! I think the most important thing here is HAVE A PLAN!

Without a plan – you have NO CLUE if you’re on track or not.

Most people don’t even bother to think about this. We’re too busy planning our next vacation, planning for our kids education, planning to buy our next car. We’re too focused on the short term – that we forget about the long term.

It doesn’t take long at all – take an hour or two once a month, review where you’re at and where you want to be. If you do that, you’ll feel less overwhelmed than if you left it all until your age 55 – trying to retire by 65.

For the record, I am borderline obsessed with early retirement so it is safe to say that I think about retirement often. I’ve read many articles, stories and books on the subject. With that said, I found your checklist to be very good and useful to all. I think you’ve covered the topic well and have captured the essence of what one would find in several books about retirement.

Thanks for sharing…AFFJ

I never even considered #9 until about a year ago. After conducting some research I found a study done by Fidelity that said the average retirement couple spends approximately $300,000 on medical fees. That literally blew my mind and reshaped the way I thought about retirement.

I agree with your article. A comfortable retirement requires planning. Keeping track of your retirement portfolio is the most critical aspect in my opinion.