While robo-advisors for beginners and seasoned investors, this online firm has chosen to dive into the banking industry in recent years. Betterment originally started out with an online savings account that is now known as the Betterment Cash Reserve account, yet recently, Betterment also rolled out a new checking account product to the general public. With this mobile-first checking account, you get a debit card, an account with no fees, and ATM and foreign fees reimbursed.

If you’re looking for a checking account and plan to do most of your banking online, Betterment’s new checking account is worth considering. Just remember that, like all banking products, there are plenty of pros and cons to consider.

Get Started With Betterment Checking

Table of Contents

About the Company

Betterment was founded in 2008, although it didn’t officially launch to the public until 2010. This company offers the help of a financial advisor without having to visit a stuffy sales office or deal with sales pitches or ridiculous fees. When it comes to investing with Betterment, you’ll pay a flat fee of .25% to 40% for account management and personalized financial advice. (See also: Betterment Investing Review)

Betterment Checking is appealing based on the fact there are no fees or “gotchas” to be aware of. ATM fees and foreign transaction fees are also reimbursed worldwide, so you can take this card with you no matter where you go.

Like Betterment’s other services, Betterment Checking benefits from a helpful mobile app. You can use the Betterment app to track your spending and manage the money kept in your Betterment Checking account.

Betterment Checking accounts are FDIC-insured for up to $250,000. This is the industry standard, and it’s important to make sure any account you sign up for offers this protection.

Betterment Checking: Detailed Review of Features

Betterment Checking is a new type of account that lets you take advantage of digital checking with the use of a mobile app and a connected debit card. Major benefits include:

- Getting ATM and foreign transaction fees reimbursed worldwide

- Paying no monthly transaction fees, maintenance fees, overdraft fees, or hidden fees

- Having your deposits insured for up to $250,000

Important features you can look forward to with a Betterment Checking account include:

Seamless Transfers

Move money between Betterment accounts you have with ease, including any funds you have in a Betterment Cash Reserve account. You can also automate transfers to a Cash Reserve account, which you can then funnel into a Betterment investment account. Best of all, you can do this all in one place and for free.

Mobile-First Experience

You don’t have to use a mobile device to manage your Betterment Checking account, but you have that option thanks to the user-friendly mobile app. You can also manage your Betterment Checking account using a desktop computer, making it easier than ever to manage your money whether you’re at home or on the go.

Debit Card

Betterment Checking comes with a debit card that lets you pay bills or make purchases with a tap-to-pay feature. There are no extra fees involved in acquiring or using your debit card for purchases.

Betterment Security Features

It’s crucial to keep your money safe, and Betterment focuses on security as an integral part of its core business plans. Important security features include aggregated app passwords, two-factor authentication, and protected account log-ins for mobile.

Other Betterment Checking features that will soon be on the way include mobile check deposits, physical checkbooks and checks, joint checking accounts, effortless direct deposits, and more.

Betterment Checking vs. The Competitors

Several other online banks and robo-advisors have rolled out their own online checking accounts with success over the last few years. This comparison chart can help you see where the options differ and the features each one offers.

| Betterment Checking | SoFi Money | Citi High-Yield Checking Account | |

|---|---|---|---|

| Fees | None | None | $15 monthly service fee for balances of $5,000 or less |

| Minimum to open | $0 | $0 | $0 |

| Reimbursed ATM fees worldwide | Yes | Yes | Yes |

| Mobile app available | Yes | Yes | Yes |

| FDIC-insured | Yes | Yes | Yes |

Another thing to consider is that some banks offer bonuses upon signing up for an account. Check out our list of the best bank bonuses available to aid in your decision-making.

How to Open a Betterment Checking Account

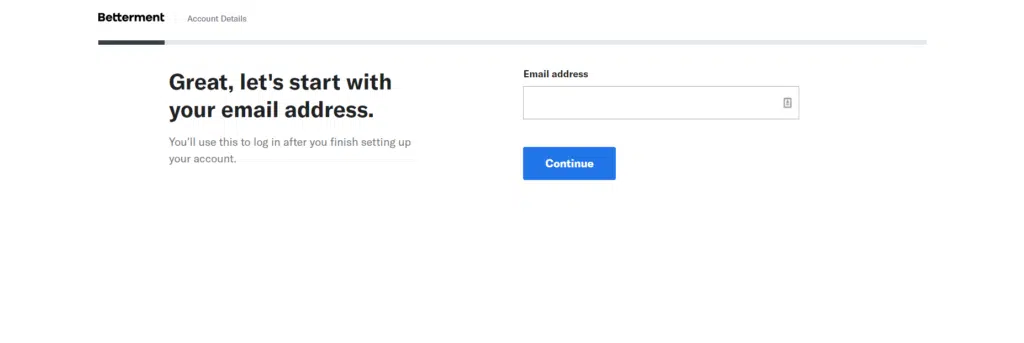

Opening a Betterment Checking account is a breeze. All you have to do is head to the Betterment Checking account page by clicking the button below and clicking on the button that says “Get Checking.”

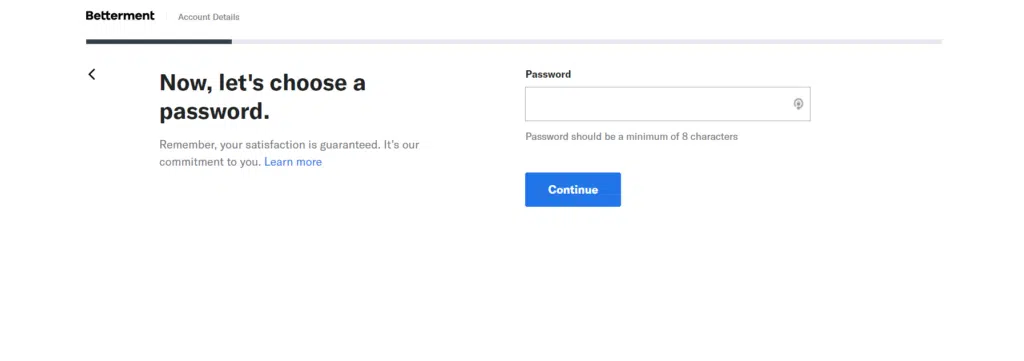

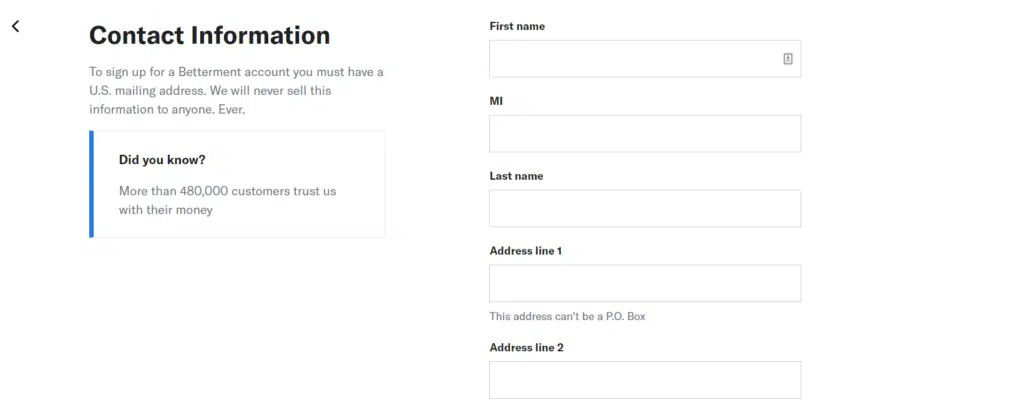

From there, you’ll follow the instructions, including these steps:

Step 1: Provide Betterment With Your Email Address

Step 2: Create a Password

Step 3: Provide Your Contact Information

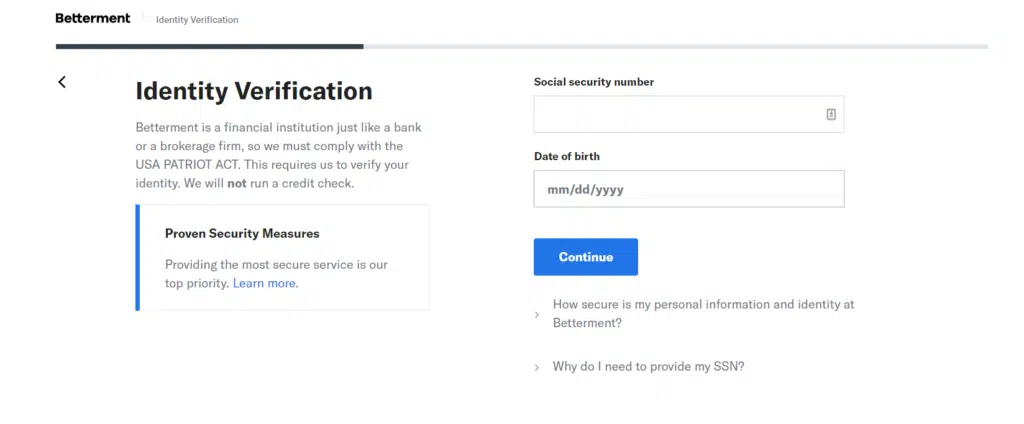

Step 4: Verify Your Identity

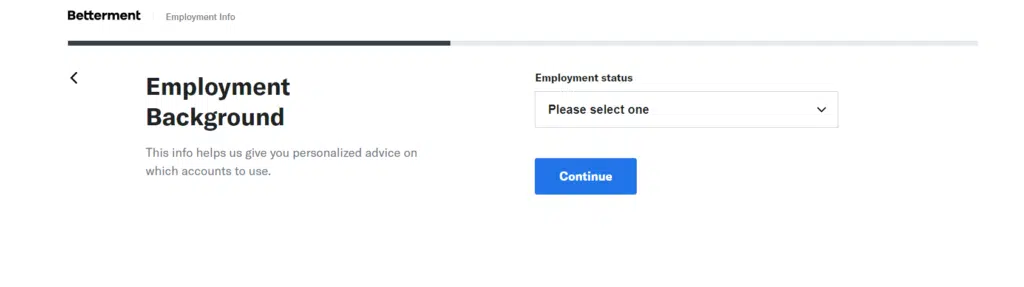

Step 5: Share Your Employment Status

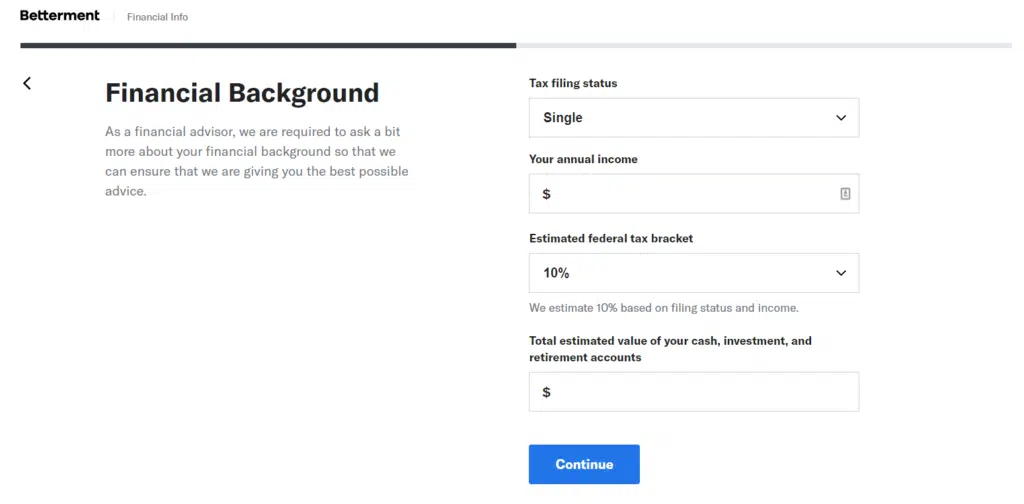

Step 6: Share Basic Financial Information

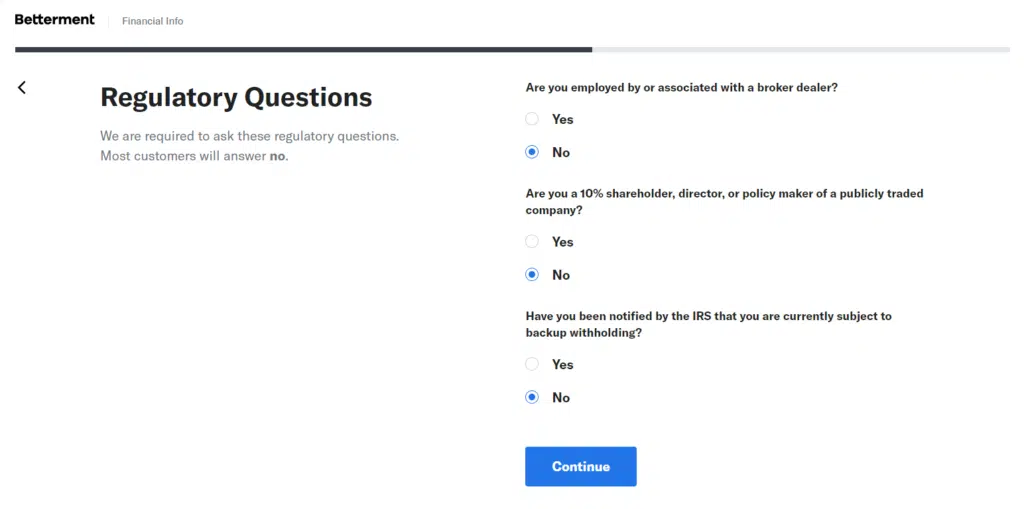

Step 7: Answer Regulatory Questions

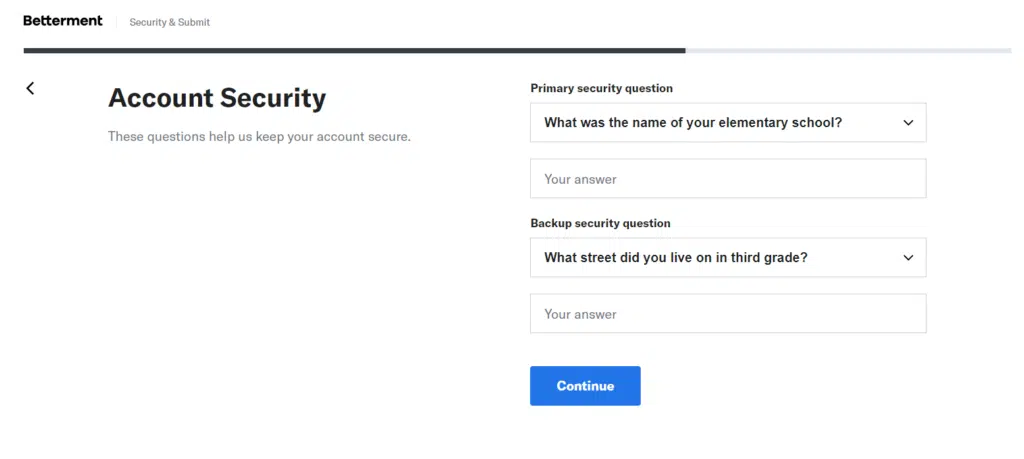

Step 8: Answer Security Questions

At this point in the process, you can accept the terms and conditions and open your account. From there, you can connect to another bank account for funding, as well as confirm all the information in your account is correct.

While this may seem like a lot of steps, the entire process of opening a Betterment Checking account only takes five minutes.

When to Use Betterment Checking

Considering Betterment Checking doesn’t charge any account maintenance fees or hidden fees, this account could work for anyone who wants access to checking features and a connected debit card account. However, there are definitely some types of consumers who could benefit the most.

Consider signing up for Betterment Checking if you can relate to any of these scenarios:

- You travel outside the United States often and you hate trying to guess how much you’ll be charged to use a foreign ATM. With reimbursed foreign ATM fees worldwide, you’ll never have to wonder again.

- You travel within the U.S. often and hate spending your time looking for an ATM in your network. Use any of the 2.8 million ATMs where Visa is accepted worldwide, and you won’t have to worry about fees.

- You like monitoring your checking account on the go, so you want to be able to use a mobile app. The Betterment app lets you manage your money and bills using your favorite mobile device.

- You’re a Betterment Cash Reserve or investing customer already, and you want to be able to move money freely between accounts. You can transfer money seamlessly from Betterment Checking to a high-yield Betterment Cash Reserve account, and then to your investment accounts.

What You Need to Know About Online Banking

Due to technology and the Internet, the banking industry has changed dramatically over the years. Where people once did all their banking with a big-name bank within their community, many people now turn to online banking for better perks and performance, including higher interest rates on deposits.

A recent report from Allied Market Research shows that the online banking market may increase to $29,976 million in 2023, whereas the market was only 7,305 million in 2016. In the meantime, traditional brick-and-mortar banks will continue serving customers, but there is no way that traditional banks could possibly keep up with or compete with rising online banks.

According to their research, online banking continues to grow based on customer convenience and the ability of online banks to keep costs down. “Less bank staff, no cost of significant infrastructure, and overhead costs allow online banking portals to pay higher interest rates on savings and charge lower mortgage and loan rates,” writes the firm.

With all of this in mind, it’s expected that we’ll have more options when it comes to banking and investing in the future thanks to technology. And with more mobile-friendly and digital banking available, costs should go down while interest rates and customer benefits continue to increase.

Betterment Checking is just one component of the growing online banking world. Robo-advisors like Betterment have also disrupted the financial planning industry, and an array of online banks and lenders have rolled out other products like online personal loans and digital high-yield savings accounts galore.

Summary: Betterment Checking Overview

If you need a checking account and you don’t want to pay any account maintenance fees or hidden fees, Betterment Checking is hard to beat. You can open your account online in a matter of minutes without a minimum opening deposit, and you’ll get a free debit card to use. Not only that, but you’ll have all your ATM fees reimbursed worldwide, and you can manage your entire account, your spending, and your bills from your mobile device.

Since Betterment Checking is free to use, you have nothing to lose by giving it a try. Consider opening an account today, and see where Betterment Checking can take you.

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Betterment Checking Review

Product Name: Betterment Checking

Product Description: Betterment Checking is a no-fee mobile-first checking account provided by Betterment Financial. Integrated into the Betterment ecosystem, it offers users seamless digital banking, automatic savings tools, and globally accepted Visa debit cards.

Summary of Betterment Checking

Betterment Checking, an extension of Betterment’s robo-advisory platform, provides users with a modern, digital-first banking experience. As a member of the Betterment suite, Checking benefits from advanced financial tools designed to enhance savings and spending habits. The account boasts features such as no minimum balances, no monthly fees, and worldwide ATM fee reimbursements. Additionally, its integration with the Betterment app allows users to view and manage their finances in one unified space, making it easier to align everyday spending with long-term financial goals.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- No Hidden Fees: Betterment Checking stands out with its transparent fee structure, having no monthly fees and offering reimbursement for ATM fees globally.

- Integrated Financial Tools: Users benefit from Betterment’s suite of tools, facilitating better financial habits and holistic money management.

- Seamless Digital Experience: The mobile-first approach ensures a user-friendly interface and easy access to banking functions on the go.

- FDIC Insured: Funds in Betterment Checking are FDIC-insured, offering peace of mind to account holders.

Cons

- Lack of Physical Branches: Being a digital-first platform, users cannot visit a physical branch for in-person services.

- Limited Banking Services: Unlike traditional banks, Betterment Checking may not offer the full spectrum of banking services or products.

- Dependency on App: Most functionalities are tailored for the app, which may not appeal to those preferring desktop or in-person banking.

- Newer Player: As a relatively newer entrant in the banking space, some potential users might be hesitant, favoring more established banking names.