Do you really need to get life insurance quotes from lots of companies?

I have seen so many clients who ask this question. If you want to save money, then my answer is a definitive yes!

Not all life insurance policies are the same (nor are the companies that offer them). For this reason, you should absolutely get a lot of quotes all at once to see what is actually going to be the best decision.

Did you know there are hundreds of life insurance companies that offer coverage, and each of them has their own pricing model?

Below, learn how you can get free life insurance quotes and secure the best coverage for your family’s needs.

Table of Contents

Reasons to Buy Life Insurance

Here are the most common reasons people buy life insurance:

- Replace Income

- Protect Key People in Business

- Cover Debts

- Funeral Expenses

Some people buy whole-life policies as an investment strategy. Others, like small business owners, might even purchase life insurance to secure a loan. With such a policy, you could pursue collateral assignment of the life insurance policy’s proceeds.

The possibilities are endless. Regardless of the reason for obtaining life insurance, you need to consider how much coverage to buy.

Who Needs Life Insurance

If you read my blog regularly, you know I took out a $2.5 million policy on myself so if anything happens to me, my wife (who is my life insurance beneficiary) will be able to spend her time mourning and keeping the kids’ lives in order as much as possible.

She will not have to think about how the mortgage gets paid or how to make ends meet. Designating a beneficiary ensures they’ll be taken care of financially in the event of your death.

You can even establish a contingent beneficiary in case your primary beneficiary is unable to claim your benefits.

A lot of people buy life insurance for their children to provide additional protection. Whether you are purchasing a policy for yourself or want to get life insurance for someone else in your family, the protection of a life policy can be invaluable.

If you don’t have someone who is directly dependent on your income then you will want a small policy that will make it easy to take care of any financial obligations you may have. This will make it easier for the executor of your estate to clear up any final expenses.

Do You Need Life Insurance?

It depends. If you’re wondering about life insurance for millennials, and you have zero debt or dependents, you may be safe without a policy. But if you have transferrable debt or loved ones depending on you, you could benefit from life insurance.

How Much Life Insurance Do You Need?

All the time, I get questions about life insurance, but especially this one and the answer is always, “It depends.”

It depends on how much you are making, what your financial obligations are, and how much debt you have (among other things).

This will typically leave enough money for a spouse to get the finances straightened out and still have plenty left over to replace your income. There is a wide range of options for life insurance for married couples tailor-made to meet your goals.

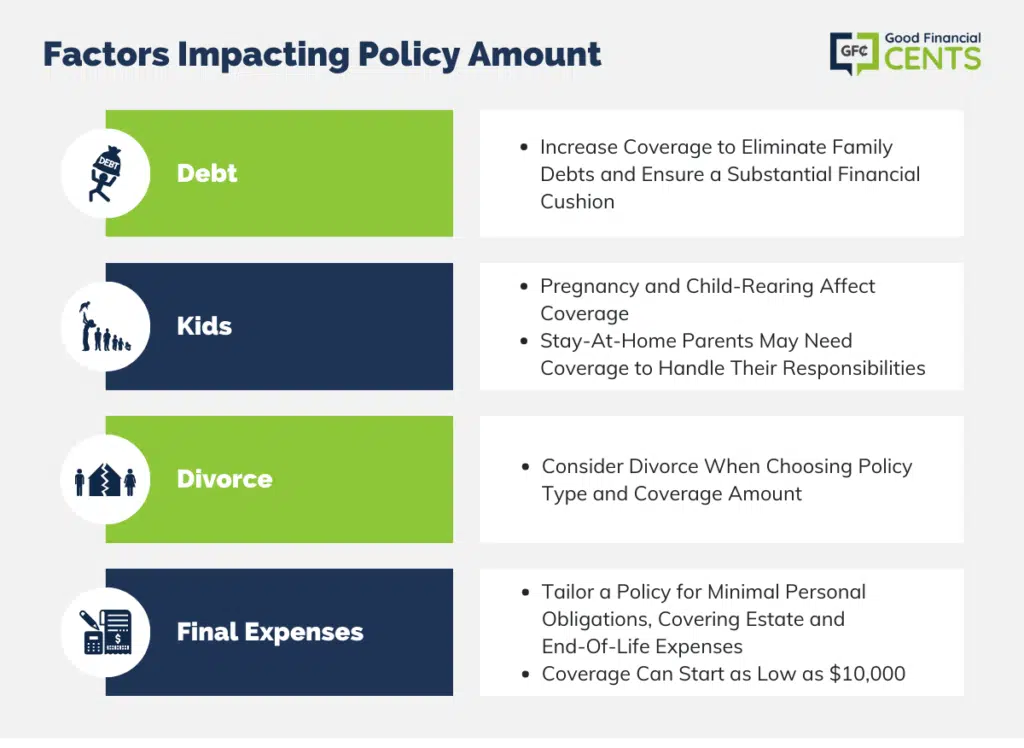

Factors That Might Impact Your Policy Amount

- Debt: If you have large amounts of debt, you may want to increase the number to make sure you wipe out all the debt your family has and still have a sizable nest egg for your family.

- Kids: Pregnancy affects life insurance and the amount of it you need, as does raising children. If one person in your family is a stay at home parent, you will need a decent size policy on them just to cover the cost of all the duties they take care of.

If you’re looking for cheap life insurance for moms, you can rest assured that there are plenty of options out there for you. I frequently see families get between $250,000 and $500,000 of coverage on a non-income producing spouse.

- Divorce: If you’re facing a divorce, you should also take that into consideration as you choose which type of policy and what amount to purchase.

- Final expenses: Finally, if your personal obligations are small and you just need to make sure your estate and final expenses are taken care of, you can look at a policy that is tailored to just your needs. I have seen people purchase as low as $10,000 worth of coverage just to tie up any loose ends.

Whether you buy a life insurance policy through your employer or with a life insurance agent, knowing your policy options is a crucial first step. You can listen to my podcast about life insurance through your employer for my thoughts on work policies.

What Types of Policies Are Available?

Overall, there are still two primary types of life insurance which are available in the marketplace today: Term and Permanent.

There are actually several other types within each of these two types, but we’ll get to that in a minute.

Term Life Insurance

These particular policies do not contain any type of cash value or investment component. This is why term life is considered to be the most basic form of life insurance there is.

It is also typically the most affordable – especially for those who are young and in good health.

In fact, for individuals who wish to obtain a large amount of death benefit for a low premium cost, term policies can be a very good option.

As the name suggests, the term life is sold for specific time periods, or “terms.”

Term Lengths

These are usually:

- 10 years

Although there are some term life plans which are sold for as short as 1-5 years, and for as long as 40.

Term Considerations

When a term policy expires – provided the insured has held the policy throughout its entire length – and if the insured still wants coverage, he or she will need to re-qualify for another policy at their then-current age and health condition.

Because they will be older – and they may also possibly have an adverse health condition – the new policy’s premium will likely be higher. If the individual has been diagnosed with various health conditions, they may be deemed as uninsurable and may not be able to obtain future coverage.

Because a term policy is considered to be “temporary” coverage, it is oftentimes thought to be a good way to cover temporary needs.

As an example, this type of insurance may be a good way to cover the cost of a child’s future college education if a parent or grandparent were to pass away before the child turns age 18.

Likewise, term life insurance can also be a good way to ensure a 15 or 30-year home mortgage will be paid off if a breadwinner passes away while there is still a balance to be paid off.

Term Life Insurance Quotes

The premiums for term life insurance plans are typically lower than those for whole life insurance – especially for applicants who are young and in good health. These policies can provide a great way to purchase a high amount of death benefit coverage for a very low price.

In fact, if you’re looking for the cheapest life insurance you can buy, it better be a term policy.

In some cases, term policies may include a conversion rider which will allow the policy to convert over into a permanent policy after a certain period of time.

When looking at your first set of term life insurance quotes the premiums may vary greatly.

Some policies are medically underwritten, requiring an attending physician statement from your doctor, while others are true no exam policies. Whichever option you choose will have an impact on the premiums you pay.

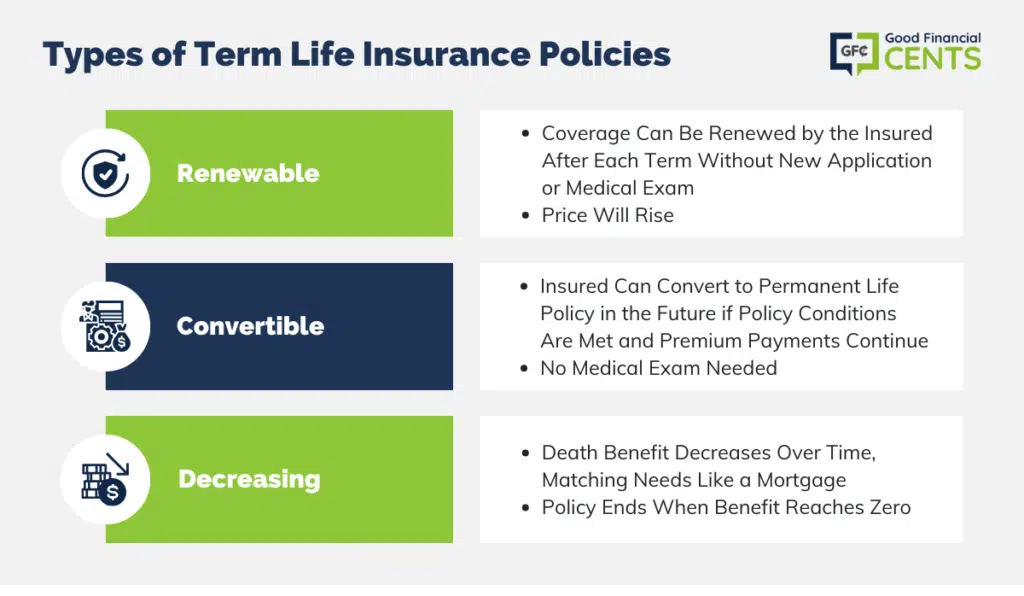

Types of Term Life Insurance Policies

There are several different types of term policies which are available in the marketplace today:

- Renewable – This type of term coverage is able to be renewed by the insured after each time period – or “term” – has elapsed. This is allowed without the need to complete a new application for coverage or to pass a new medical examination. Just understand, the price will rise.

- Convertible – With convertible policies, the insured is able to convert from a term policy over to a permanent life insurance policy in the future.

Provided the conditions of the policy have been met and the premium payments have continued to be made, there will be no medical exam required in order to do so.

- Decreasing – With a decreasing term policy, the amount of the death benefit will decrease over time, until it gets to zero. At that time, the policy ends. These tend to be matched to something like a mortgage, for example, and match the decreasing amortization table.

Because there are so many different types of term life insurance on the market today, applicants can pick and choose which will work best, based on their specific coverage needs and goals, essentially allowing them to “customize” their coverage.

Permanent Life Insurance

This type of life insurance will include both a death benefit and a cash value component. The cash value in a permanent policy is allowed to grow on a tax-deferred basis.

This means there are no taxes which are due on the gain until the time the money is withdrawn. This can essentially allow the cash to grow and compound on an exponential basis.

Those who purchase permanent coverage will typically plan to keep their coverage for the “whole” of their lives. These plans are usually intended to cover longer-term needs, as well, and they are oftentimes used in estate planning.

Permanent life is also often purchased on younger individuals and then kept for many years. This way, the person has life insurance coverage, along with a savings vehicle that grows tax-deferred over time.

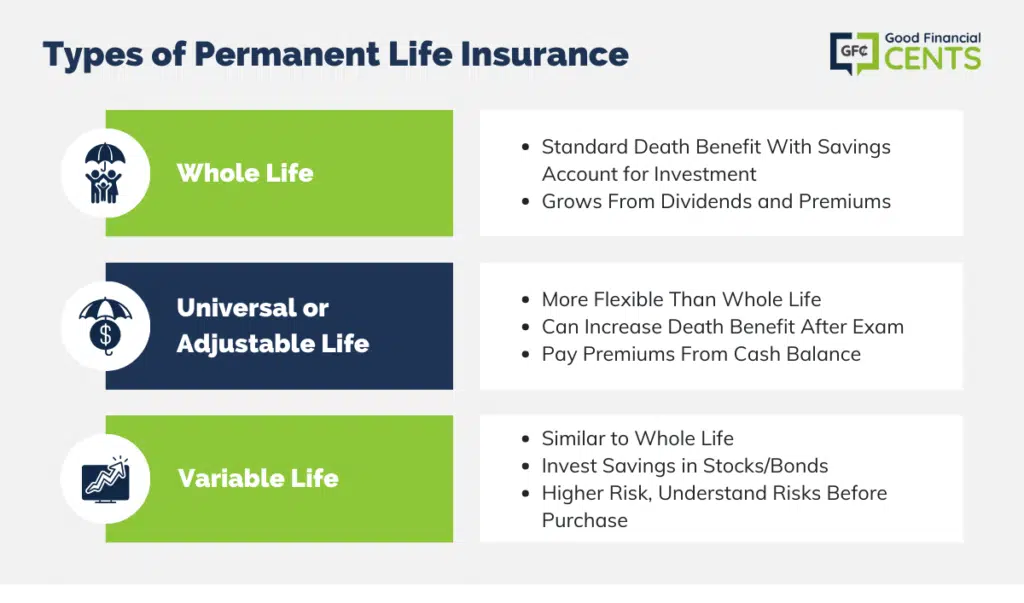

Types of Permanent Life Insurance

There are three main types of permanent life insurance:

- Whole Life – the most common permanent policy. It has the standard death benefit and uses a savings account as its investment piece. Along with deposits from your regular premiums, the savings account grows from dividends the insurance company pays into the account.

To help you get a better understanding we did an entire write up on whole life insurance.

- Universal or Adjustable Life – These policies offer a greater amount of flexibility than standard whole life policies. Many offer you the opportunity to increase your death benefit after passing a new medical examination.

These policies will also let you pay your premiums from your cash balance. This can be a useful feature in times when your personal finances are stretched. Get a better understanding of our article on universal life insurance policies.

- Variable Life – Similar to whole life except you can take the money in your savings account and invest it in stocks, bonds, mutual funds, and money market accounts.

This comes with more risk so make sure you have a good grasp on those risks before purchasing a variable life insurance policy.

Permanent Life Insurance Quotes

Permanent life insurance quotes will be higher than term life quotes for a comparable amount of death benefit coverage on an individual.

However, this is typical because, with permanent coverage, the policyholder is not just purchasing death benefit coverage, but also the cash value component within the policy.

In addition, unlike term life insurance, a permanent policy will not expire after a certain number of years. Rather, provided the premium continues being paid, the permanent policy will continue indefinitely.

How Do You Know You Are Using a Good Company?

All the life insurance quotes on this site are from top rated carriers, meaning they pass standards for financial stability and for fulfilling the claims necessary.

There are four nationally recognized rating agencies in the country: A.M. Best, Standard & Poor’s, Fitch, and Moody’s

They assign ratings to insurance companies based on a wide spectrum of data points, both looking forward and looking back. These ratings are based on factors such as the financial strength of the company, claims payout, and reputation in the industry.

In most cases, these ratings are letter grades similar to those on a report card. It is important to stick with insurance carriers who have high grades in the “A” range.

For most people, it is hard to understand what it actually means to be secure, so I also put together a list of who I consider to be the 10 best life insurance companies.

Keep in mind the life insurance quotes you get here may include some other more localized companies when you get your own quotes, so your results might vary.

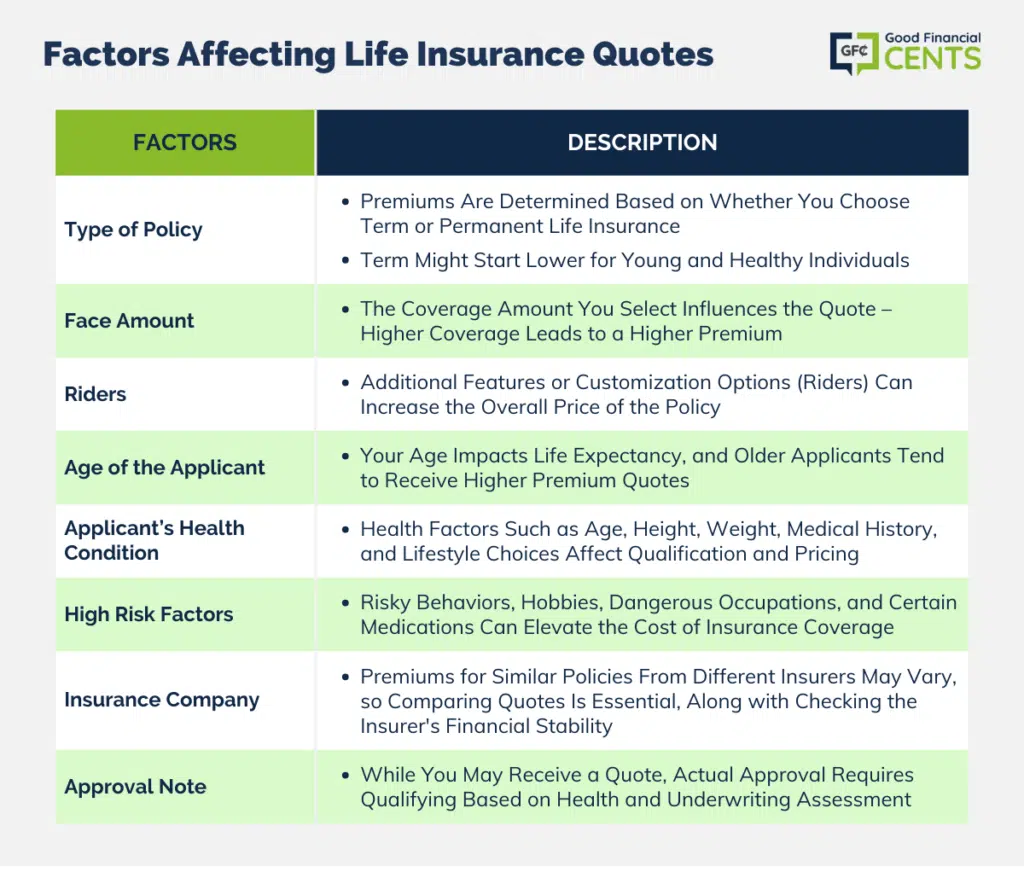

How Are Life Insurance Quotes Determined?

When determining the price of a life insurance policy, there are several key criteria that go into coming up with the final quote.

1. Type of Policy

One of the biggest factors in coming up with the premiums is what type of coverage you are purchasing.

For example, will the coverage be term or permanent? In most cases, especially if an applicant is young and in good health, a term quote will be lower – at least initially. However, over time, as an applicant gets into the older ages, whole life insurance can become more competitive.

2. Face Amount

The face amount refers to the amount of death benefit coverage you are purchasing.

This, too, will be a primary factor in the amount you will be quoted for life insurance. As with most other types of goods or services, the higher the amount of coverage you are purchasing, the higher the quote will be.

3. Riders

There are many different riders that may be included on a policy to help in customizing it more toward the insured’s needs and goals.

These “add-ons” can add to the overall price of the policy.

4. Age of the Applicant

The applicant’s age is another key criterion in how much the insurance quote will be. A big part of the cost of life insurance is based on a person’s life expectancy.

Therefore, your age at the time you apply will certainly factor into the price of your coverage.

5. Applicant’s Health Condition

Life insurance underwriters consider many different factors when pricing coverage – as well as deciding whether or not an applicant will even qualify for coverage at all.

Some of the main components regarding a person’s overall health and body which are considered include his or her age, height and weight, overall health history, and family health history. Also considered is whether the person smokes and/or drinks alcohol (and if so, how often).

6. High Risk Factors

Many companies will require a urine analysis as part of the application process.

In addition, other criteria will also be examined such as whether the applicant participates in any type of dangerous or “risky” hobbies or occupations, takes prescriptions, or has financial issues.

All of these criteria will be considered in order to determine the person’s overall risk to the insurance company.

7. Insurance Company

When comparing insurance rates, individuals will find policies have very similar – or even the same – benefits, yet will have drastically different premium quotes.

When reviewing an insurance company, it is always important to take a look at the financial strength of the insurer. This is because you will want the company to be there in the future when it is time for the claim to be paid out.

NOTE:

Get A Quote Now

With the information from this post in hand, you can confidently shop for rates and get excellent life insurance for you and your family.

Life insurance is one of the most foundational pieces to your financial plan you can put into place and a key part of any insurance portfolio. Don’t wait another day to secure protection for your loved ones.

Final Thoughts – Life Insurance Quotes In (Literally) Seconds

The importance of obtaining diverse life insurance quotes becomes evident when considering the varying policies offered by numerous companies.

Tailoring coverage to individual needs and goals is vital, as life insurance serves purposes like replacing income, covering debts, and funding funeral expenses. Those with dependents or debts should prioritize life insurance.

Coverage selection depends on factors like income, financial obligations, and family roles. By comparing term and permanent life insurance options, individuals can secure suitable protection and plan for their financial future.

Selecting a reliable insurance company with high ratings ensures that claims will be fulfilled when needed most.

A GOOD LIFE INSURANCE

I was about to pull the trigger and purchase the Haven term policy. I read through the details but it states that it’s not available in California or Montana as of yet. Well thats 20 minutes of my life I won’t be getting back. Maybe a disclaimer would be in order?

What is your opinion on Cashflow banking?

1.Do you sell car insurance?

2. How do you do the blood test? Do I have to pay for or will be included in my policy?

3. I interested in a Universal Life Policy. What are the requirements? Minimum Premium?

Not directly Daniel.