Purchasing a life insurance policy is one of the most important decisions an individual can make. The problem is that there a so many life insurance companies, that choosing the right one can be an intimidating task. You should certainly do your due diligence before choosing. And, there are many factors you should consider before making your choice.

One factor to consider is the rating and stability of the company. One of the worst things that could happen after purchasing life insurance is that the company you purchased it from goes belly up. Now, while you can’t predict the future, there are some tools you can use to judge the stability of a company.

One of those tools is the Fitch insurance company rating system.

Table of Contents

History of Fitch

The Fitch rating system goes back 100 years, all the way back to 1913.

John Knowles Fitch created the Fitch Publishing Company. He published “The Fitch Stock and Bond Manual,” in which he provided statistics for use in the investment industry.

Fitch published the statistics in “The Fitch Stock and Bond Manual” and “The Fitch Bond Book.” In 1923, he decided to add a detailed rating system, the AAA through D, which is still used today.

In 1990, Fitch combined with IBCA of London, which is a subsidiary of a French holding company.

They also brought in a few competitors, Thomas Bankwatch and Duff & Phelps Credit Ratings Co. Through the years, they have drastically grown, and have become one of the largest third-party rating companies on the market.

What Is the Fitch Rating System?

The original purpose of these rating systems was for investors.

The goal of the Fitch ratings was to give investors an idea of financial stability and give them an idea of how risky an investment would be. These ratings are not only good for investors, but they can also be handy for customers looking for a solid insurance company.

A lot of things could change in 70 years. What would happen if the insurance company went bankrupt after 50 years? The worst possible outcome is for your loved ones to try and claim the life insurance policy, only for the company to not have the funds to pay out.

When evaluating a company, The Fitch Rating Group uses some criteria which include several different factors when determining the grade. Some of those factors are financial assets, management style, historical performance, and much more. They will use data from insurance companies, financial reports, and medical underwriters.

The ratings essentially show the company’s credit quality and ability to pay its debts.

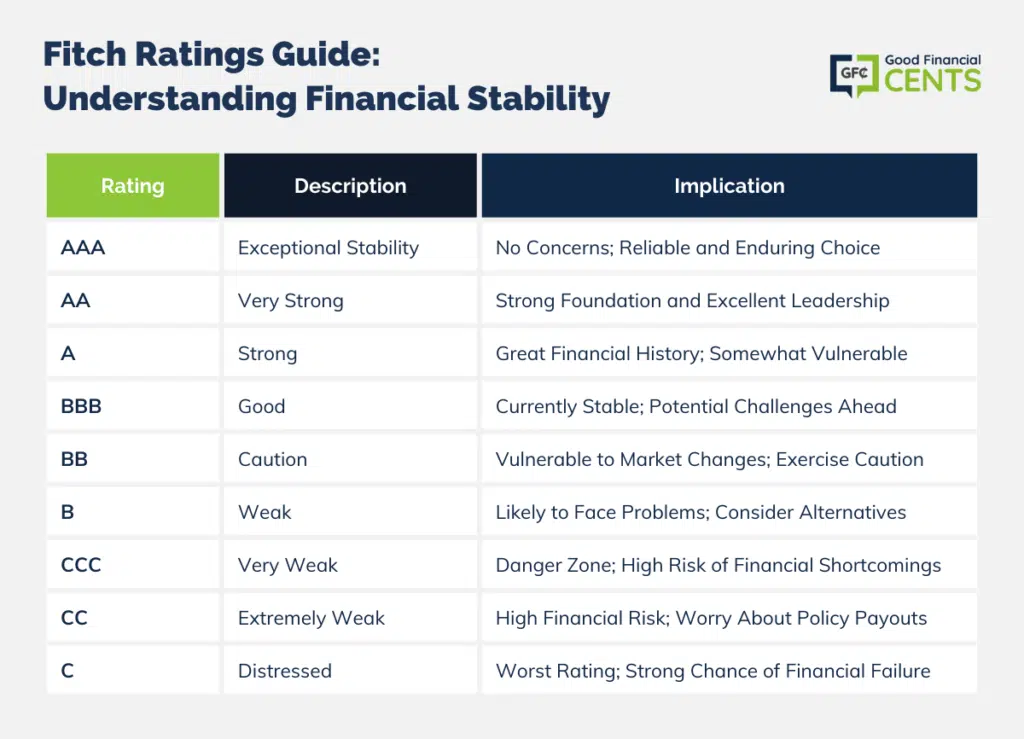

What Do the Fitch Ratings Mean?

When you’re comparing companies, it’s important you look at the financial ratings. Fitch is one of the largest and most well-trusted. Fitch makes it easy to find the rating for nearly all insurance companies. But, it’s important to know what the ratings mean.

The Fitch ratings are broken into two separate categories, short-term ratings, and long-term ratings.

As you can probably guess from the name, the Fitch ratings are used for investors or customers looking to make longer or shorter investments. Additionally, there could be an insurance company you find that is “not rated,” that doesn’t mean the company is unstable, it only means Fitch was not able to complete an evaluation.

AAA: This is the highest rating handed out by Fitch. Companies that have received this honor have shown to be the most stable. If you’re considering a company with an AAA rating, you don’t have to be concerned about the financial security of this company. More than likely, an AAA company will be open for many years to come.

AA: While not the highest rating out there, companies with an AA rating have shown a strong financial foundation and excellent leadership management. These companies are shown to be “very strong.”

A: An A rating is a “strong” rating, and they have shown great financial history and have performed well in the past. Companies with an A rating are financially stable, but they would be more vulnerable to economic downturns.

BBB: This is when companies are currently doing well but could experience problems in the future if the economy tanked. BBB is considered a “good” rating, and they are meeting all of their financial obligations. You shouldn’t necessarily avoid any BBB-rated companies, but be aware of the possible outcome.

BB: This is the point where you should start being wary of any companies with BB ratings or below. These companies are extremely vulnerable to any changes in the market, which could make them struggle to meet their obligations. Unless they make serious changes, it’s better to find a company with stronger ratings.

B: B is a “weak” rating. Based on the Fitch criteria, these companies are likely to have problems meeting financial obligations and paying out the policies.

CCC: This is the start of the danger zone. CCC is the “very weak” category. Anyone with these rates faces a strong chance of falling short in their finances.

CC: “Extremely weak” is the second to worst possible rating a company could receive. Applicants should be worried about not receiving payouts from policies from these companies.

C: This is the worst possible rating a company could receive from Fitch. Anyone in this category has reached the “distressed” level. The rating says it all. They have a strong chance of not being able to make ends meet and have a low likelihood of making a recovery.

How Fitch Ratings Compare With Others

Fitch Ratings is undoubtedly one of the prominent names in the credit rating world, but it’s not the only player in the field. Other major agencies, like Moody’s and Standard & Poor’s (S&P), also offer their perspectives on the creditworthiness of companies. Each agency has its methodology, and while they often arrive at similar conclusions, there can be discrepancies.

Moody’s, for instance, uses a rating scale that starts with Aaa for the most creditworthy entities and goes down to C for the least. On the other hand, S&P’s scale ranges from AAA to D. While the letters might appear similar, subtle differences in their methodologies can result in different ratings for the same entity.

Investors and policyholders often consider multiple ratings to get a comprehensive view. This approach is akin to seeking a second opinion in medical scenarios. While Fitch might rate a company as AAA, indicating top-notch creditworthiness, Moody’s might rate the same entity as Aa, a slight step below their highest rating. Such differences could arise due to the weightage given to various factors by the agencies or due to their assessment of industry trends and risks.

While Fitch Ratings provides valuable insights into a company’s financial health, it’s beneficial to juxtapose it with ratings from other agencies to get a well-rounded perspective. This multi-pronged approach ensures that investors and customers make informed decisions backed by multiple expert opinions.

Using These Ratings

The Fitch Rating shouldn’t be your end-all-be-all for finding the best company. There are dozens of other factors you’ll need to add to your search, but it’s important you look at their credit rating when trying to decide which company is best for you.

Alongside Fitch Ratings, consider other multifaceted factors such as customer service, policy options, and company reputation to ensure a comprehensive evaluation. This well-rounded approach allows for a more informed and confident choice in selecting the insurance company that aligns best with your needs and expectations.