It’s probably not unusual for people with high net worth to assume they don’t need life insurance.

After all, when you have a certain amount of money, you might consider yourself essentially self-insured.

But self-insurance is no insurance.

That can be true even for high-net-worth individuals.

People with high net worth usually also have high living expenses and high debts.

Even a large estate can be drained in surprisingly little time in the absence of a family’s primary income earner.

Table of Contents

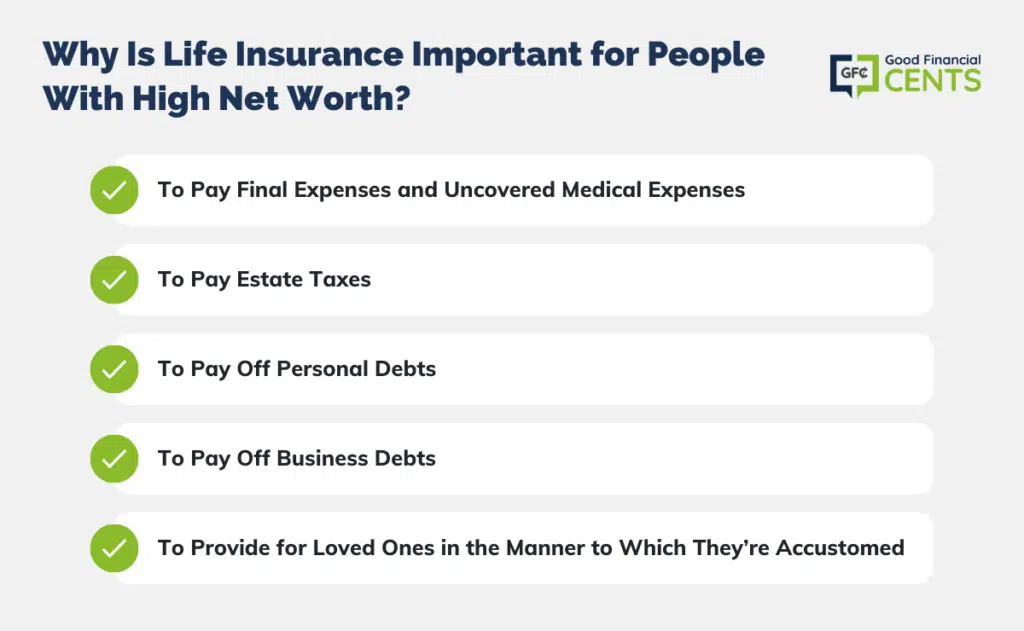

Why Is Life Insurance Important for People With High Net Worth?

That’s why life insurance for people with high net worth is much more important than commonly assumed.

What are some of the reasons?

To Pay Final Expenses and Uncovered Medical Expenses

The average funeral cost is more than $8,700.

But, for high-net-worth individuals, that figure could be several times higher.

That may be fairly easy to manage if you leave an estate with $1 million or more in financial assets.

But medical costs may be a different story.

Sure, health insurance policies have fixed deductibles and out-of-pocket maximums.

But a situation involving a prolonged terminal illness, one that goes on for a year or more, could result in much higher direct costs.

It’s not uncommon for experimental procedures and treatments to be administered to a terminal patient.

Then there’s the matter of extended nursing care.

Did you know the current cost of a nursing home exceeds $100,000, or over $8,000 per month?

With certain types of terminal illness, you could be in a nursing facility for a year or more.

That will result in a six-figure outlay that may be no better than partially covered by medical insurance.

Even with good health insurance or a long-term care insurance plan, you can still end up with six figures in uncovered medical expenses, plus funeral costs.

If your financial assets are between $500,000 and, say, $2 million, that could leave your loved ones with substantially less money.

A life insurance policy would cover these costs, leaving your entire estate to your family.

To Pay Estate Taxes

Historically, estate taxes are one of the primary reasons high-net-worth people have life insurance.

Estate taxes can take a big chunk out of your assets, which would leave less to your heirs.

The federal estate tax threshold is high at $12.92 million for 2023, up from $12.06 million in 2022. That’s a fairly substantial increase.

But just as the federal threshold can increase, it can also decrease.

That decrease can happen if the government is looking to increase tax revenues to plug a hole in future budget deficits.

It’s generally more politically popular – and less risky – to raise taxes on the rich than to enact increases that will affect the general population.

The federal estate tax isn’t the only one you have to be concerned with.

At least a dozen states have estate tax thresholds that are well below the federal limit.

For example, both Massachusetts and Oregon impose estate taxes on estates valued at more than $1 million.

There’s another catch when it comes to the estate tax, and it applies to both federal and state taxes.

For estate tax purposes, your estate is your entire asset base, not just financial assets like certificates of deposit, stocks, and brokerage accounts.

Other assets included in your estate are:

- Retirement savings

- Life insurance proceeds

- Personal residence

- Second homes and timeshares

- Investment property

- Business interests

- Intangible assets (patents, copyrights, etc.)

- Personal property, like furniture, entertainment equipment, jewelry, artwork, and antiques

These assets still may not push you into the range of the federal estate tax.

But millions of people are worth more than the $1 million or $2 million it will take to trigger the tax at the state level.

To Pay Off Personal Debts

It’s not uncommon, even for high-net-worth individuals, to underestimate the amount of debt they have.

For example, if your gross estate value is $3 million but you owe $1.5 million in various loans, your loved ones could be forced to liquidate much of your estate to settle those debts.

The problem is once you’re gone, your estate may remain, but your income will go with you.

Though you may be able to comfortably afford your current debts, your family might not be able to do the same without your income.

What’s more, the inability to service those debts could result in your family liquidating assets at less than fair market value.

It’s the kind of thing that happens when bills are piling up, and money is short.

Still, another possibility is your family attempting to retain the assets securing those debts.

In an effort to do so, they may drain down liquid and financial assets.

As they do, their ability to sustain themselves, as well as to draw income from those assets, will gradually decline.

Eventually, they could be left broke – while still owning indebted physical assets they will no longer be able to carry.

This is often how even very large estates are lost forever.

To Pay Off Business Debts

A lot of high-net-worth individuals have substantial business interests.

But along with business interests come business debts.

Once again, those debts might be easily serviced while you’re alive and running your business.

But your death may result in a decline in gross business income, which will leave less cash flow to pay debts.

And, of course, just because you’re gone doesn’t mean the debts will go away.

One of the primary reasons why high-net-worth individuals have life insurance at all is because of business debt.

Often, the family isn’t connected with the business and won’t be able to maintain it after your death.

The debts will still be there, needing to be either serviced or paid off completely.

Enter life insurance, which can provide the coverage your family needs.

Still, another consideration is the possibility (or even the likelihood) that your business debts carry your personal guarantee.

That being the case, your business debts will extend to your personal estate.

Life insurance for the purpose of paying business debts may not enable your family to continue operating the business indefinitely.

But it will buy them time to sell the business or shut it down, absent the need to pay off business-related debt.

To Provide for Loved Ones in the Manner to Which They’re Accustomed

If you live to a ripe old age, when it’s just you and your spouse living off retirement income and the investment income from your financial assets, life insurance may not be that important.

Much or most of the income will continue flowing to your spouse even after your death.

But it’s different if you have a dependent family, particularly children, and a nonworking spouse.

Since you’re a high-net-worth individual, you probably also have a high income.

That money will certainly disappear upon your death.

But your family’s living expenses won’t.

For example, let’s say you currently earn $500,000 per year.

Now, you may be a committed saver, saving $200,000 out of that salary each year.

But that means your family is living on $300,000 per year.

If that income disappears, they may have to live on a lot less.

Since that’s a less-than-desirable outcome, you’ll need a large amount of life insurance to support them.

College is an especially significant family expense.

It can cost several hundred thousand dollars to send a child to a high-quality school.

If you have several children, or if any one of them wants to pursue a career that requires an extended education, the total cost is even higher.

A large life insurance policy, even just for education, can make that happen after your death.

What’s the Best Type of Policy for People With High Net Worth?

Even if you’re a high-net-worth individual, you don’t want to pay too much for life insurance or have more of it than you need.

You can match coverage with specific needs.

In most cases, term life insurance will be the most cost-effective.

It’s much less expensive than whole life insurance and other investment-type policies.

That not only keeps premium costs low but it also allows you to buy more coverage.

In addition, it tends to match up better against specific expenses.

For example, let’s say your estate has a gross worth of $4 million, but you also have $2 million in debt.

If you expect all the debt to be fully paid within 20 years, you can take a 20-year term policy for $2 million to cover them in the meantime.

Once they’re fully paid, there will be no need for coverage, and you can then let the policy expire.

The situation is similar to providing a college education for your children.

You may only need a policy until they complete their education.

In each of the above situations, term life insurance is the best choice.

But you may need to look at some form of permanent insurance if you want to leave additional funds for your spouse.

Term policies eventually expire, and you won’t be able to replace them beyond a certain age.

On the other hand, a whole life policy will literally last until the end of your life.

Of course, that means it will cost more in annual premiums.

But if you’re a high-net-worth individual, it will be well worth your time to consider the best combination of coverage and cost.

Bottom Line

As you shop for life insurance, take a look at my review of the top ten life insurance providers in the United States to ensure you get the best price and policy for your needs.

It’s the best way to ensure your loved ones will get the benefit of your entire estate upon your death.