Sell them what you want, not what they need.

Unfortunately, this happens A LOT in our industry.

Shady financial advisers will sell mutual funds, annuities, REITs, cash value life insurance — basically anything that might make more sense for them (in the form of making a commission) instead of the client.

This seems to be the case in almost every universal life insurance situation I’ve ever come across.

It’s often touted as a “great investment,” offering things like tax-free money just like a Roth IRA, a guarantee of principal, and on and on and on.

If you’ve been a reader of the blog, you’ll know I’m a firm believer that in the right situation, a financial product could work, but just like I see annuities being used inappropriately, the same applies to universal life insurance types.

A recent prospective client encounter illustrates that too perfectly.

Table of Contents

Universal Life Insurance Used Wrong

Both husband and wife are currently in their early 40s, and they don’t have a lot of savings.

The husband had a good government job, but was forced to resign, and is currently working part-time. They have little to nothing saved in retirement, and much of their past savings had been depleted helping out an ill family member.

Seven years prior, their insurance agent sold them a $1 million term policy (that I totally support), and a $100,000 universal life policy (that I totally do not support).

I asked the clients why they took out the universal life policy, to begin with, and their response was that the husband wanted something that would take care of his wife if something happened to him.

The term policy works perfectly for this. The universal life also does this but is MUCH more expensive.

He was paying $101 a month for the universal life policy and $88 a month for the 20-year term policy. If making sure that his wife was taken care of was his goal in taking out both policies, then in my opinion, the advisor fell short. The client could have purchased a much larger term policy and used the difference to start funding their retirement. The agent was trying to sell this policy as an investment for later.

Here’s where it gets even worse.

Diving into the numbers: the client took out the policy in October of 2007 and has been paying $101 ever since. At the end of last month, May 2014, the client had put in a total of $7,949 into the policy.

The total cash value accumulated was $6,000, with a surrender value of $5,900.

How’s that for an investment?

I’m not saying that universal life insurance is a horrible investment, but more times than none, it’s oversold to somebody who doesn’t need it. The husband and wife were not contributing to any retirement plans or IRAs when they took out the policy, which is something that should have been asked by the advisor.

Instead of putting money into an expensive universal life policy, they should have been funding a 401k or a Roth IRA.

If you’re considering buying a universal life insurance policy, here are the rules you need to follow:

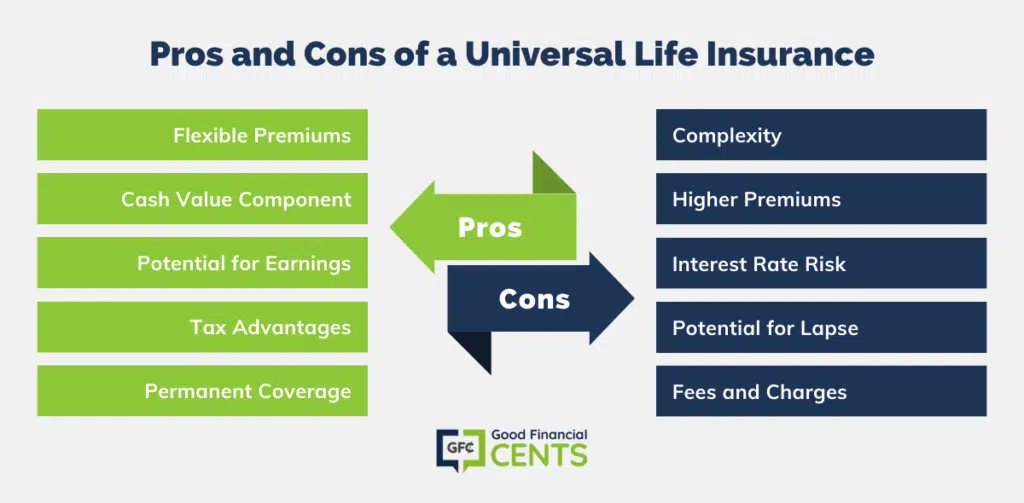

Pros and Cons of a Universal Life Insurance

Pros of Universal Life Insurance

1. Flexible Premiums: One of the standout features of universal life insurance is the flexibility it offers in terms of premium payments. Policyholders have the option to adjust their premiums and death benefits, which can be particularly beneficial if their financial situation changes over time.

2. Cash Value Component: Universal life insurance policies come with a cash value component that earns interest over time. The interest rate is usually pegged to the market rate, meaning it has the potential to grow significantly.

3. Potential for Earnings: The cash value of a universal life insurance policy can be invested, offering the potential for additional earnings. This investment component can help policyholders grow their wealth while also providing life insurance coverage.

4. Tax Advantages: The cash value component of a universal life insurance policy grows on a tax-deferred basis. Additionally, beneficiaries typically receive the death benefit free of income tax.

5. Permanent Coverage: As long as premiums are paid, universal life insurance provides permanent coverage, ensuring that beneficiaries are supported financially after the policyholder’s death.

Cons of Universal Life Insurance

1. Complexity: Universal life insurance policies can be complex and may be difficult for the average person to fully understand. The various features and options available require careful consideration and potentially the assistance of a financial advisor.

2. Higher Premiums: Compared to term life insurance, universal life insurance premiums are typically higher, especially in the early years of the policy. This can make it a less affordable option for some individuals.

3. Interest Rate Risk: The cash value component’s growth is subject to interest rate fluctuations. If the market performs poorly, the cash value may not grow as expected, potentially impacting the policy’s performance.

4. Potential for Lapse: If the cash value drops too low and is not sufficient to cover the cost of insurance, the policy could lapse, leaving the policyholder without coverage.

5. Fees and Charges: Universal life insurance policies often come with a range of fees and charges, including administrative fees, mortality charges, and surrender charges if the policy is canceled early. These costs can add up over time, reducing the policy’s value.

Rules for Universal Life Insurance

Have an Insurance Need

I once encountered a situation where a 26-year-old female, a 26-year-old single female, was sold a $1 million universal life policy. The insurance agent pitched it to her as a guaranteed savings account that was offering somewhere in the 6% to 7% range. She was told that she could never lose her principal and that she’d be making a great return on her money.

It turns out what she really had was a $1 million universal life insurance policy. She was paying a good chunk per month toward it, and when there happened to be a botch in how she was paying for her quarterly premium, it prompted her to investigate what exactly she had, because, in the short term that she’d had it, she hadn’t seen this 6% interest that the agent had spoken of.

After contacting the agent’s home office, she learned the truth. She had been sold a $1 million universal life insurance policy. When she learned that, her immediate question was, why does a 26-year-old woman who’s not married, with no kids, who has $100,000 of student loan debt, need a $1 million life insurance policy?

Of course, the back office couldn’t answer that question and deferred that to her agent. There’s no question that she did not have an insurance need, and therefore had no need for a universal life policy.

Have Term Insurance

It irks me to no end when an adviser or life insurance agent sells universal life insurance as an investment that also has protection. If they are leading in with that, and they haven’t even had the discussion of term life insurance, they are immediately added to my list of financial advisors I’d like to punch in the face. Term life insurance is dirt cheap, and that is where you need to start before purchasing any type of universal life policy.

To put things in comparison, I purchased a $2.5 million term life insurance policy for $2,500 per year as an annual premium. When I started inquiring about a universal life policy for myself, here is what I found.

Keep in mind in my own personal situation, I am unable to put into a Roth IRA because of the income limit. I was looking at a universal life policy as a long-term savings tool as well. (note: the policy I was reviewing was an indexed universal life policy).

If I structured the universal life policy to where I would pay $10,000 per year of premium and did so for 10 years, that would give me a death benefit of $285,743. The policy offers the ability to accumulate cash value, but the guaranteed rate is 3% before expenses.

By the time I was 60, I could pull a whopping $104,000.65 guaranteed. There are some ties to the market where the value could be much more. If I were to average 5.5%, that total would be $249,365, but as you can see, to have a $285,000 death benefit would take me putting in $10,000 a year for 10 years, which far exceeds the premium outlay for a term life insurance policy.

Roth IRA and/or 401(k) Is a Must

If the person pitching you universal life insurance policies uses the phrase “It’s an investment like a Roth IRA,” then why in the heck are they not suggesting you open a Roth IRA first? A Roth IRA should give you more bang for your buck, and won’t have the high cost of insurance attached to it. The same goes for a 401(k).

Preferably, I would love to see somebody maxing out both the 401(k) and a Roth IRA before they even explore any type of universal life policy. If the person is pitching you universal life insurance and they haven’t even inquired about whether you are putting money into your retirement account or not, you know they are sketchy. Move on quickly.

Compare the Cost of Multiple Carriers

In the original case above, where the individual is paying $101 per month for a $100,000 universal life policy, I was able to compare rates and see if they could even pay less than what they’re paying, in case they wanted to keep it.

It turns out I found multiple carriers that were far less than the $101 per month they were paying, from the top life insurance companies in the United States. The best option I found was actually $40 a month cheaper than what they were paying, for a total savings of just under $500 per year.

If you are fully committed to taking on a universal life policy, make sure the person selling it to you has the ability to work with multiple carriers. If they are working for a big box company that can only offer one solution, then you better at least get a quote from somebody else.

Smart Insurance Choices: Navigating Life Policies and Investments

| Topic | Description |

|---|---|

| Universal Life Insurance Pitfalls | Caution! A 26-Year-Old was Sold a $1 Million Universal Life Policy With False Promises. Verify Before Committing |

| Term Life Insurance First | Start with Term Life! It’s Cost-Effective Protection Without Unnecessary Complexities |

| Cost Comparison: Term vs. Universal | Crunch the Numbers! $2.5 Million Term Policy vs. $285,743 Universal After 10 Years |

| Roth IRA and 401(k) Priority | Secure Your Future! Max Out Roth IRA and 401(k) Before Considering Universal Life for Better Returns |

| Skepticism Alert: Check Multiple Carriers | Be Savvy! Compare Carriers; a $101/Month Policy Could be $40/Month Cheaper Elsewhere. Choose Wisely |

The Bottom Line

The short answer is no. Universal life insurance is not a ripoff, but it had better make sense for what you’re trying to accomplish. For example, I’ve seen these types of policies used for estate planning purposes to pass more on to the heirs of clients. In these cases, universal life insurance makes A LOT of sense.

For the couple that was sold a universal life policy above, I suggested they contact their agent and find out why exactly they were sold the policy in the first place.

Well, I have called every number on all your company pages. Doesn’t anybody work? Now I know why my stock is doing so poorly. All I want (without junk) a list of stock you purchased for me for the 37 years. My account is done so badly, all I am doing is paying your agents. Now if I could find an agent of yours to help me, I would be somewhat happy. I want this information and if I do not receive any action from all the phone calls and messages and trying to talk to your idiot customer service, maybe I should inform The Wall Street Journal, NYT, or the Washington Post about your shabby dealings with a small life insurance policy. You would think that after 37 years, I could speak to someone that has a brain. Again, all I want is a list of what your company bought for me (not anyone else) for the past 27 years, then I might be able to understand why my account is always on the brink of lapsing.

My wife and I have 403b with 250-300k in each. My investment guy wants us to withdraw $12,500 a year to pay for a universal life policy. I am 65, my wife is 61. This will go on 10 yrs and then no more payments. We’ll have 125000 in each with a death payout of 400k.

Who’s getting the deal, bad or good?

Hi Dave – I don’t know your personal financial situation, but this arrangement will definitely benefit the insurance agent, but not necessarily you and you wife. Please meet with a financial planner (one unrelated to the insurance agent) to discuss if this is really in your best interest. $12,500 is a lot of money to pay for a policy that will be worth no more than $125,000 in ten years.

I took out a Universal policy for 100000 costing 150 month 20 years ago. The premium has gone up each year and now it is so costly that we cannot afford it so I have been forced to drop it!

The Premium has jumped to over a thousand dollars WOW! I have paid so much money now as my age is much older we cannot paythe premiums!!!!! I hope i can find someone to help hoping class a class action law suite! who in there right mind would buy policy that has a increasing premium each year. HELP!!!

What about Universal Life for someone age 67 years with a four year old child? I want a plan for at least 25 years! No one EVER addresses this situation. I only live on social security.

Given the complexity of your situation, I suggest sitting down with an agent or representative and going over the options and limitations in some deep detail. I can’t address your situation in a web comment. Sorry!

So, I have a Universal policy, not sure if it si worth keeping or not, I have invest about 24K into it so far, it has grown nicely. It has a cap of 13% and a floor of 7%. The total payout is $750K and the total amount of cash that I would put in is $240K, so that seems like a good return on investment, I hate to say it that way, but in essence that is the case. I pay annually about $8K, which feels like a lot. I also do have term life insurance as well as you noted in the article. My initial reason for the policy was to have money for my kids education and I can withdraw a decent amount against the policy once my first child is 18 and ready for university. I am wondering if it is a good idea to just cut my losses and close the policy, then invest my money in a Roth IRA, or reduce the Universal Life policy, so my payments are drastically reduced, but I still have a gain above what I have put it? Thanks.

I am an agent and attend to agree with you Jeff on certain issues…. Unfortunately universal life policies have been structured by uneducated Agents for many years that has enviably ended bad for many folks… But if used as a correct financial tool they can be a good alternative to whole life policies, on the other hand same goes with Term insurance – because if you live long enough you can out live the policy , but not the need ! Companies make us go back through underwriting when we issue a new term on ourselves, 20 years down the line … so let me ask the question “is your health as good as it was 20 years ago”? With a universal policy you will pay more on cost of insurance up front versus a term, a universal policy will not ever make you as much as a financial product would( IRA ROTH 401 etc…) , but what if you make it 21 years and your health is bad and you haven’t saved as much as you would like? And now a company will not insure you due to health risk…. See we as consumers never think we are going to get sick or even worse die, and advocates of term policies always want to show the investment side of the products and never want to explain the fact that you may not be able to get insured again… I have a client that believed all he needed was term , until the day he was diagnosed with diabetes type 1 at the age of 34. ( his conversion time had elapsed as well)

so now you have a 34 year old with 4 kids all under the age of 9 with only a 401k as financial stability for his family….

We have to learn that just because the product works in one case does not mean it works in all cases, and truly never will

Well said Steve!

I believe TIAA Universal Life is a good alternative to Term Life. You do not lose any cash value to commissions, surrender charges etc. though there is a small premium tax that varies from state to state. You can pay the present value of your term policy’s premiums over its term as premium for your universal life policy. This amount will grow tax free and by definition it should pay your premiums for the life of the equivalent term life policy. In effect, you have paid for some of the premiums with the tax free returns on the cash value of your universal life policy.

I wouldn’t do this before exhausting all opportunities to invest tax free such as HSA, 401k, 403b, 457, SEP, solo 401k, and personal defined benefits plan. But if those opportunities have been availed off to the fullest extent, an universal life policy (for fixed income) or a variable universal life policy (for investing in equity markets) with TIAA is quite attractive relative to investing in your taxable portfolio, particularly if you are in the 39.6% tax bracket and live in a high tax state.

VG

I can’t get a straight answer to the following question: Why is it a need to know for Life Ins. Companies; to know if a person has Life Ins. with another company? If it was me, selling Life Insurance. I wouldn’t care less if you had one, or 100 Life Policy’s. But they all ask in writing; do you have an existing Life Policy?? The only logical answer I can think of. Is that companies can argue for the next 10 years back and forth of who is going to pay out, and how much. In hopes that you will either give up in trying to collect. Or you will kick the bucket. And neither company will loose any money in either case. Please answer. Thank You, Mr. Martin.(72 years young).

There are a couple of reasons Charles. One is that state law often prohibits the practice of insurance companies actively trying to replace life insurance policies with cheaper ones. It’s not that that’s entirely illegal, just that there is a specific process involved in doing that. The other is to determine if a person might be over-insured. For example, a person earning $50,000 per year buying $1 million in life insurance. It could indicate a potential fraud situation, or even a planned suicide. Those are just two of the reasons, each company could have more.

Steve — you’re right on target age wise… to sell your policy for serious bucks. A lot of boomers, seniors, are actually educating themselves online (not an easy thing for many older folks) and are indeed selling a life insurance policy to help pave the way for a much better retirement. They’re fed up getting over-charged every month by their life insurance company – after working hard all their life, winding down on expenses, down-sizing a bit… Convertible term and universal life policies can be sold for a lot of money. Motivated seniors, retirees, baby boomers – to escape their insurance company sending them a letter telling them uh-oh, too late to get anything for surrendering their life insurance policy. Possibly to pay for a nursing home or to add cash to a retirement nest egg. Oldsters frequently ask their financial advisor, “Can I sell my life insurance policy?” and “How do I sell my life insurance policy for cash?” or “How do you start the process for selling your life insurance policy for cash?” Selling a life insurance policy for cash is, for most seniors, a critically important move, at a crucial stage of their life, where they don’t have forever ahead, where one needs to make the most of one’s time…to make the most of every day, of every month, every year. You know what I mean? You’re not 23 any more, and time really counts. And wasted time you never get back, whether it’s an hour or a year… it doesn’t matter. It’s wasted time. And as we get older, in our late 70s and 80s and 90s, I hate to say it, but our options get more and more limited. For example, we don’t have the seemingly countless options and opportunities to make a lot of money – that we have when we’re in our 20s and 30s or even 40s, 50s and 60s. So we have to make the best of it at every turn. One option we do have is, for example, selling a universal life insurance policy, or a convertible term policy (if we’re over 70) – and after we figure out who are the companies that buy your life insurance policy… and learn about the advantages of selling your life insurance policy – we can go about selling a life insurance policy like that with an experienced life settlement company. Seniors these days are as Internet savvy as anyone, and tend to research high end online sources to get relevant data from websites like www.einsure.com, or www.insurancejournal.com, or AARP, or even an boutique life settlement company like www.harborlifesettlements.com. Clever boomers, retirees, seniors will call up a company like that and hit the bottom line right off the bat – they’ll ask, “How do I know how much my policy is worth!” or “Who purchases life insurance policies!” or “Who are companies that buy your life insurance policy! I need to know right now!” Solid research on the phone and online is, in my opinion, how you go about figuring out how to start the process of selling a life-insurance policy in a safe, smart manner… How to cash out a life insurance policy – to get as much money as possible from a life insurance cash out transaction, to finally stop wasting good money after bad on inflated premium prices that insurance companies are charging people in their 70s and 80s and 90s – without any conscience at all Don’t those life insurance VPs and CEOs, accountants and lawyers have aging mothers or fathers? Or grandfathers, or grandmothers? Seriously. How would they like some insurance company sharks to be squeezing their elderly relatives out of their life savings, basically forcing them to decide every single month whether they’re going to pay for horribly over-priced but critical medicine they must have… or to pay their life insurance premium! What a choice! Selling a life insurance policy, for many older people, is frequently a life-and-death matter. I think it makes sense to try to put a stop to that struggle – and, instead, sell your life insurance policy for cash now – and put some real money in the bank for a change! Hey, if you could get up to 40% of your universal life or convertible term life insurance policy in cash value, that is literally 4 to 10 times as much as the miniscule payment you get from the insurer if you surrender your policy to them – you’d be pretty dumb not to do it, wouldn’t you? And you’d get a happy answer to that classic question, “Can I sell my life insurance?” or “Can I sell my life insurance for cash now?” Plus a nice pile of cash in 2 or 3 weeks that could really change your life. For me, it’s a no-brainer.

Does everybody understand the life insurance industry and how it works ? I understand that many people here have ran across bad agents using and selling insurance the wrong way for a paycheck. I agree this happens often and its unfortunate but if you use deductive reasoning this argument can be used for any industry. Let me make with very easy because life insurance is a very very simple concept. ALL LIFE INSURANCE IS THE SAME JUST FINANCED DIFFERENTLY. You might ask why this is. Let me tell you. There is only one factor an insurance company is allowed to use to determine maximum insurance risk. By law all companies must use the mortality table. Term is low initial premium pay as you go up to 30 years. Whole life is fixed level premiums for life high in the beginning (cash value prepaid premiums) to subsidize later years costs. Universal life is just whole life with flexible premiums. Please dont play them against each other. And as far as it goes if all different financing options are created right whole life will always be most expensive because your paying in advance for your level premiums.

In 1993 as a 58 year old man about to retire, I purchased a Universal Life Insurance Policy in the amount of $100,000. to protect my wife. The premium at the time was $1,500.00 each year. Every year the premium has increased. This year the premium I paid was $6,400. I am now 80 years old and have paid more than $60,000.00 in premiums for this $100,000 policy since 1993. I don’t know if I will be able to continue paying these premiums until I am 95 years old as required. Yet I don’t want to lose all the money I have put into this policy. What can I do?

@john You have a few options. You can cash it out (if you’ve decided you don’t need the life insurance anymore). Or you can exchange the cash value of the policy to buy a permanent paid-up policy or maybe an annuity. Your age does have a factor in that. The benefit in both is that the cash value will be locked in and, in turn, a potential higher death benefit without having to make any more additional payments.

Thanks for the info. However there is nothing to cash out. There is no cash value. Any interest earned was put toward the cost of the premiums. The interest rates were very high in 1993. Now the guaranteed rate is only 4.50%. If I stop paying the premiums, I lose the entire policy. I have since been in touch with Great Southern Life Insurance Company. I am waiting for them to send me a projected premium changing the policy amount to $60,000, with a final payment at age 90. This should be interesting.

Hi Jeff, I’m a new listener and catching up on some old podcasts. I’m also an IAR and registered rep. I wanted to ask your thoughts on one type of UL not mentioned. I’ll preface it to say that I agreed with you 100% in the podcast. I generally hate UL policies and have had several clients whose assumed ROR’s were very overestimated and whose policies were set to lapse far earlier than they had been told. So they basically were purchasing really expensive term insurance since the policy ended up having a short life span. I don’t have a lot of experience with IUL’s as insurance isn’t my primary business anyway.

With all that said what are your thoughts on Guaranteed UL policies. In case you’re not familiar they are UL whose cash value disappears within the first 10 years typically, but the death benefit continues to age 90-121 depending on the policy. I definitely do not consider these to be an investment (obviously since the CV goes to 0). I view them more like a lifetime term. From a premium standpoint they are priced more closely to term than whole life. In fact if a company could offer a “lifetime term” I would think it would be very similarly priced. I only sale these when there is an insurance need and typically in face amounts of 50-100k and always suggest covering the additional life insurance need in 20-30 year term. The idea of course is to have final expenses coverage for life.

Would love your thoughts.

Would you recommend universal life insurance as a college tuition plan in place of 529 or along with a 529.

Mr. Rose As sergeant in the US Army and 50 years old. You look like your in your late 20’s or early 30’s. I talk from pure life experiences. In college, I had two roomates, one had to leave college because his dad got a 10k raise and he could not qualify for financial aid. My other roommate was present in the conversation, and he said, ” I am so glad that my grandfather, invested on a Life Insurance Policy; it has paid for my father’s and my college tuition. It will probably pay for my future son’s as well. So, Mr. Rose tell me any annuity or IRA that doesn’t force you to take the money out. As for the 401K, they have spoken for themselves as many American’s will have to work an extra 10years to regain their loses. I may have not gone to any 50k University and gratuated with a finance major. But one think I do listen to the people who faught and gave their lives to assure our freedom . Even for the individuals that have destroyed the moral statues of this country, due to their pure greed for money.

@ Mark As a Staff Sergeant that served in combat I, too, salute your service. I’m a HUGE proponent of life insurance. That’s why I have a $2.5 million policy on myself. What I’m not a huge proponent of is universal life insurance which I’ve seen misused and mis-sold on more than once occasion.

Any saying universal life insurance is a rip off hasn’t done their home work. Proper homework is done when you study the tax law as it relates to life insurance not ready blog posts that are slanted against it. My agent came to my husband and I several years ago as we where not getting the results in our 401k plan over the past 10-years.

Our agent explained using Indexed Universal Life as a tool instead of a 401k plan. After much reading of several box he recommended and of course pouring over some tax laws relating to these policies should be structured, we went all in. I put into my insurance (IUL) $950 per month and my husband puts in $1,125 in his, we where amazed on how this works for us.

With me as a 38 year young woman and my husband being 41, we are poised to garner much more income at retirement than our 401k plans would have ever churned out. NOT ONE of these agents who lobby against using life insurance as a retirement tool but push mutual funds, 401k’s, etc.. never take into consideration future taxation. Everyone knows taxes will increase, yet most agents seem to push clients into financial vehicles that expose them to possible losses. I believe I’m not a normal client as I’m considered a book worm and engineer type. In the end, using Life Insurance as a retirement tool is the most ideal plan over a 401k any day and year.

@ Cora

Possibly, but what investments were in your 401k? What kind of mutual funds did you have access too?

To say that life insurance is “the most ideal plan over a 401k any day and year” is just absolutely false.

Not to mention that you haven’t see the IUL policy play out yet. I’ve seen several clients that have been in cash value policies for 20+ years (that’s including universal life and whole policies) and they haven’t seen the projected growth that their insurance agent swore they would.

Either way, you should continue to fund your 401k to diversify your retirement income.

I think its really important for consumers to be skeptical whenever going into purchasing something. Its not that difficult to conduct your own research on such things, and it can ultimately help you to manage to avoid wasting money and time.

Universal Life Insurance is borderline rip-off, haha. In all seriousness, I believe term life is a much better deal for most people. Like you mentioned, there are situations where Universal Life insurance could work, but for most people term life is the better choice.

I didn’t know much about insurance and really educated myself when someone tried selling me universal. I was curious about “guaranteed investment.” The idea that I would get annuity payments excited me until I researched further and discovered that’s not what insurance is for. Term is a better way to achieve this to make sure our obligations are met.