For many, a 401(k) rollover to an IRA is the biggest monetary decision of their life. Imagine transferring the largest sum of money you’ve accumulated from one retirement account to the next.

Are there penalties you should be concerned about? What about taxes? Will you be paying higher fees or surrender penalties with the move?

Everybody out there is covering the ins and outs of Roth IRA rollovers and conversions, including me! They make a lot of sense to a lot of people. But we should never forget about the old reliable traditional IRA. So in this article, I want to cover the how, why, and when to do a 401(k) rollover to an IRA, as in a traditional IRA.

As beneficial as Roth IRA conversions are, there really are times when rolling an employer retirement plan into a traditional IRA will work better for you.

Why You Might Do a 401(k) Rollover to an IRA

Table of Contents

- Why You Might Do a 401(k) Rollover to an IRA

- What Are Your Rollover Options?

- Traditional vs Roth IRAs

- Direct vs Indirect 401(k) Rollover to an IRA

- Choosing Your IRA – Managed or Self-Directed?

- Best Places to Rollover Your 401(k)

- Let Your 401(k) Plan Administrator and Your IRA Trustee Do the Heavy Lifting

- Why You Might NOT Want to do a 401(k) Rollover to an IRA

- Summing Up a 401(k) Rollover to an IRA

Some 401(k) plans really are excellent. Others are no better than an afterthought – the company offers one, but it sits somewhere between mediocre and just plain lousy.

There are at least five reasons why you might want to do a 401(k) rollover into an IRA, and I’ll bet you can come up with a few more.

1. Direct Control Over Your Retirement Plan

If you prefer having direct control over your retirement plan, then you will want to do a 401(k) rollover into an IRA.

Since they are employer-sponsored plans managed by a plan administrator, it can often seem as if there’s an invisible wall around a 401(k). If you’d like easier access to your retirement funds and less bureaucracy in making decisions, an IRA is a better choice.

2. More Investment Options

Many 401(k) plans limit your investment options. They may offer a small number of mutual fund options – such as one index fund, one international fund, one emerging market fund, one aggressive growth fund, a bond fund, and a money market fund – plus company stock. If you want to spread your investments to other sectors or invest in individual stocks, you will do much better with an IRA account.

Many 401(k) plans limit your investing activities to stock and bond funds.

If you’d like to invest in other asset classes, like commodities or real estate investment trusts (REITs), they have no options. However, a self-directed IRA can enable you to invest and trade in virtually limitless investments.

3. You’re Unhappy With the Investment Performance of Your 401(k)

If you’ve been watching the market rise by 50% over the last five years, but your 401(k) has risen by only, say, 30%, you’re probably anxious to do a 401(k) rollover into an IRA.

Though there’s no guarantee you will be able to outperform the market in an IRA, you’ll at least have a chance to match the market. And if that’s better than what you’re 401(k) plan has been doing for the past few years, it may be time to make a move.

4. Escaping High Fees

401(k) plans can contain – and even hide – a large number of fees. There may be a fee paid to the plan administrator, as well as to the plan trustee, in addition to mutual fund load fees, trading commissions, and other charges. In a 401(k) plan, you have no control over the fees.

But by doing a 401(k) rollover into an IRA, you will have greater control. For starters, you will eliminate any fees associated with the plan administrator. But you can also choose to invest through a discount broker and trade only no-load mutual funds and exchange-traded funds (ETFs).

The seemingly small 1% or .50% reduction in fees with the IRA could make a huge difference in your long-term investment performance.

5. Consolidation of Accounts

If you have multiple retirement accounts, you’re paying multiple plan fees. But it can also be more difficult to create a comprehensive investment strategy while juggling several accounts. It may be more efficient and less expensive to simply consolidate your various accounts in just one super IRA. That will both lower the cost of retirement investing and simplify your life.

What Are Your Rollover Options?

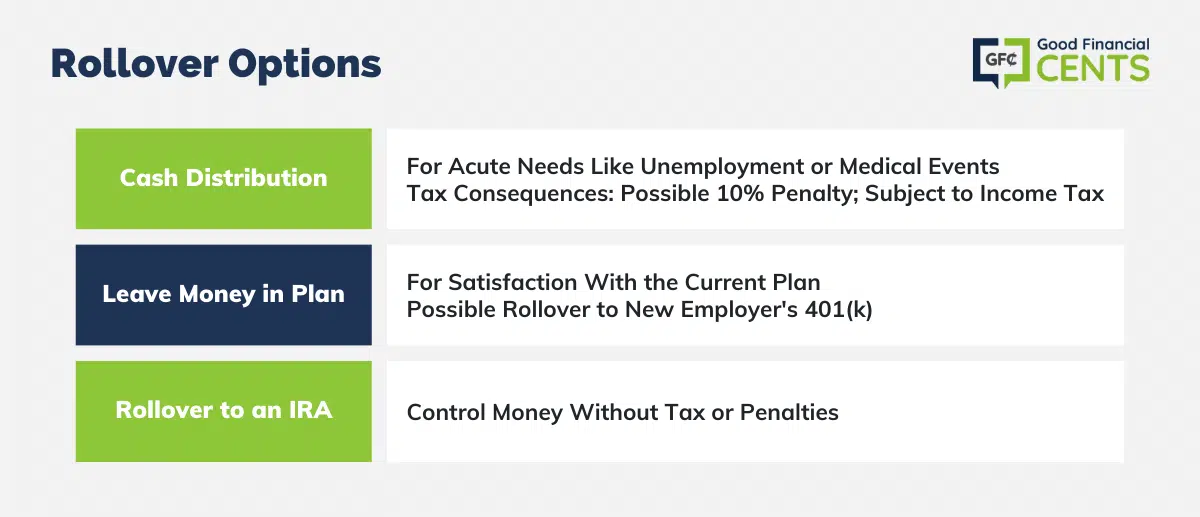

If you leave your employer, you have three basic options in regard to your 401(k) plan:

1. Take a Cash Distribution Now

This can make sense if you have an immediate acute need for cash. That can be caused by an extended period of unemployment or a major medical event.

But you should always avoid taking a cash distribution from any retirement plan for less than a true emergency situation.

Not only will you be depleting an account that was established for the long-term goal of retirement, but there will also be tax consequences. Though the IRS does provide a list of permitted hardship withdrawals, they will only enable you to avoid the 10% early withdrawal penalty. You’ll still have to pay ordinary income tax on the amount of the distribution.

2. Leave the Money in the Plan

If you’re satisfied with the plan overall, and particularly with the investment performance, this can make sense. It also has the advantage you may be able to roll it over into the 401(k) plan of a new or future employer.

3. Do a 401(k) Rollover to an IRA

You might do this for one, some, or all of the five reasons given in the last section. The advantage here is by doing a 401(k) rollover into an IRA, you can take control of the money but avoid having to pay either income tax or an early withdrawal penalty on the money.

And, of course, this option is the main topic of this article.

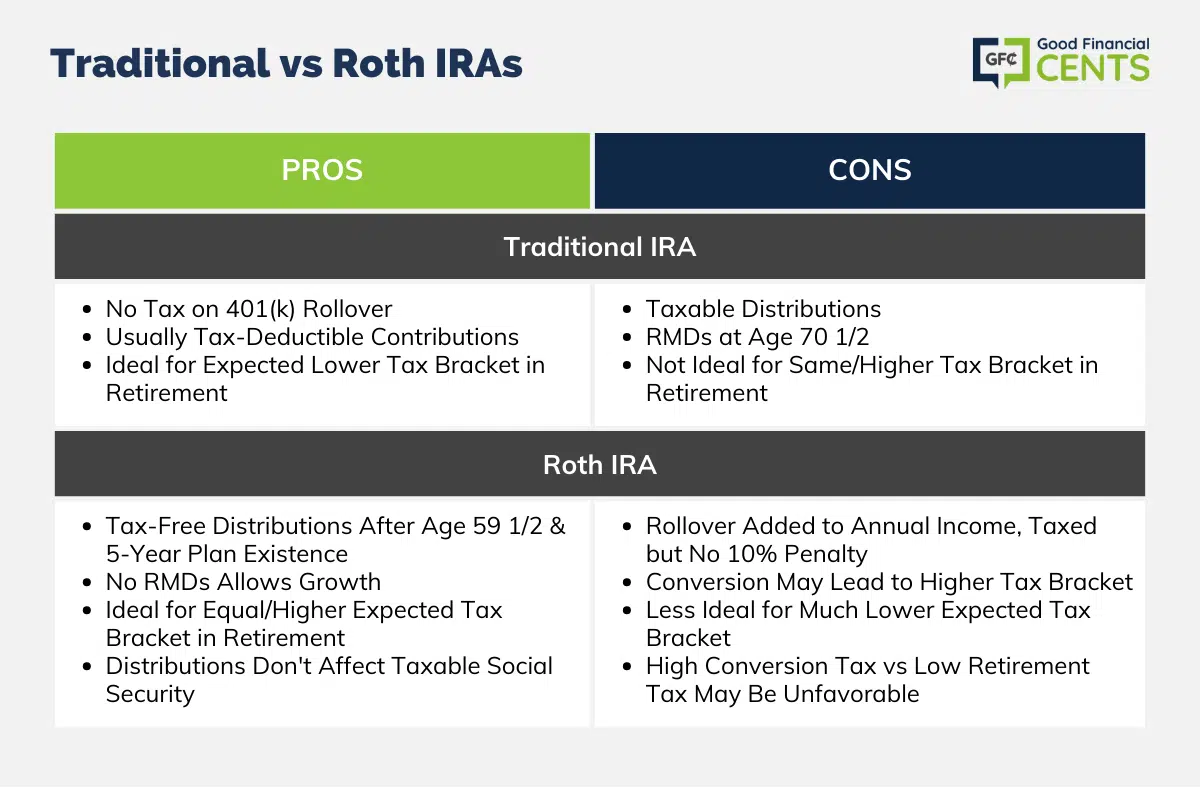

Traditional vs Roth IRAs

If you do decide to do a 401(k) rollover to an IRA, your next decision will be whether to do the rollover into a traditional IRA or a Roth IRA.

We’re just going to do a high-altitude review of this topic since I’ve already written about doing a 401(k) rollover to a Roth IRA.

We’ll review the basics of traditional vs. Roth IRAs here, but then we’ll get back to the main focus of this article, which is doing a 401(k) rollover into a traditional IRA.

Let’s keep it simple by looking at the pros and cons of doing a rollover into each type of IRA.

Traditional IRAs

Pros

- You can do a full 401(k) rollover to an IRA without any tax consequences

- Future contributions to a traditional IRA are generally tax-deductible

- This option makes greater sense if you fully expect to be in a lower tax bracket in retirement than you are in right now (defer high, withdraw low – tax rates, that is)

Cons

- Distributions from a traditional IRA are taxable upon withdrawal.

- Required minimum distributions (RMDs) must begin at age 73, forcing you to slowly liquidate the plan and incur tax liabilities as you do.

- This option will make little sense if you are in the same or higher tax bracket in retirement than you are right now.

Roth IRAs

Pros

- You can take tax-free distributions from a Roth IRA as long as you are at least 59 and 1/2, and the Roth plan has been in existence for at least five years.

- RMDs are not required on a Roth IRA; this is the only type of retirement plan that does not require them. This can enable you to continue growing your plan for the rest of your life and even reduce the possibility you will outlive your money.

- A Roth IRA is an excellent strategy if you expect your tax bracket in retirement to be equal to or higher than it is right now.

- Distributions from a Roth IRA will not increase the amount of your Social Security benefit that will be taxable.

Cons

- You will have to add the amount of your 401(k) rollover to a Roth IRA to your income in the year(s) of the conversion(s). The amount of the rollover will be subject to ordinary income tax, though not the 10% penalty for early withdrawal.

- The amount of the conversion could push you into a higher tax bracket, say from 15% up to 25% or even 33%.

- The conversion will make less sense if you expect a much lower tax bracket in retirement.

It may be a poor exchange if you pay 33% tax at conversion, in order to be exempt from a 15% tax rate in retirement!

Just know if you decide to do a 401(k) rollover to a Roth IRA, you will have to do a Roth IRA conversion. It’s a more complicated variety of the standard 401(k) rollover to an IRA, but it’s well worth the extra effort if you decide a Roth IRA will work better for you.

Direct vs Indirect 401(k) Rollover to an IRA

I like to think of this as a safety issue more than anything else. No kidding – get this wrong, and it can cost you thousands in taxes and penalties!

A direct rollover, also known as a trustee-to-trustee transfer, is where the balance of your 401(k) plan goes directly into your IRA. This is the simplest type of rollover since the money goes from one account to the other with no involvement or responsibility on your part.

What’s more, since the money is going from one retirement plan to another, there will be no tax withholding. 100% of the 401(k) balance will go directly into the IRA account.

An indirect rollover is where the distribution from the 401(k) plan goes to you first. From there, you move the money into an IRA account.

There are two problems with this type of rollover, and they are big:

- Withholding Taxes: Since the distribution from the 401(k) plan is going directly to you, the plan administrator is generally required to withhold an allowance for taxes. It’s either 10% or 20% of the amount of the distribution.

- You must complete the transfer of the 401(k) distribution funds to an IRA account within 60 days. Otherwise, the entire distribution will become subject to both income tax and, if you are under age 59 1/2, the 10% early withdrawal penalty.

I want to spend a few minutes on the first problem. If the 401(k) administrator withholds income taxes on your indirect rollover, the amount of cash you will have available to transfer to the IRA account will be less than the full amount of distribution. Got that?

If you do an indirect transfer of $100,000 from your 401(k) plan, with the intention you will move the money to an IRA within 60 days, the plan administrator will withhold 20% for income taxes. That means while you have taken a distribution of $100,000, you have only $80,000 to transfer over into the IRA.

This will leave you with one of two outcomes, and neither is any good:

- You will have to add $20,000 of non-retirement cash to the IRA transfer in order to make the full amount of the rollover, or

- You will rollover just $80,000, and the $20,000 that didn’t make it into the IRA because of the withholding taxes, will be subject to ordinary income tax and possibly a 10% early withdrawal penalty.

And if for some reason – whatever it is – none of the $100,000 from the indirect rollover makes it into the IRA, the entire amount will be subject to both ordinary income tax and, if you are under age 59 1/2, the 10% early withdrawal penalty.

No good can come from doing an indirect rollover, but a lot of bad stuff can happen.

My best advice: pretend the indirect rollover option doesn’t exist, and just do a direct 401(k) rollover to an IRA. That’ll make a mistake or miscalculation impossible.

Choosing Your IRA – Managed or Self-Directed?

If you have decided to do a 401(k) rollover to an IRA rather than a Roth IRA, and you’ve (wisely) chosen to do a direct rollover, the next step is to think about what type of IRA account you want as the destination for your retirement money.

Probably the first question you need to answer is whether or not you want a managed account or a self-directed account.

A managed account is where you turn the account over to an investment manager, who handles all of the details of investing for you. The manager or investment platform creates a portfolio, purchases the securities and funds that make it up, rebalances periodically, reinvests dividends, and buys and sells investment positions as needed. They handle everything for you while you take care of everything else in your life.

A self-directed account is just what the name implies. It generally works best with a discount broker, and you make all of your own investment decisions.

Which type of account should you choose?

A managed account makes sense under the following circumstances:

- If you have little or no investment experience

- Have a bad track record of managing your own investments

- Aren’t really interested in the mechanics of investing

- Have a busy life and no time for investing

- You’re comfortable having someone else manage your money for you

A self-directed account works better if…

- You’re an experienced investor

- You’re comfortable with your ability to invest successfully

- You have a deep interest in investing

- You have the time and temperament to manage your own investments

- You don’t trust anyone else can do a better job managing your investments

Think long and hard about which account type will work best for you. It takes many years to build up a large retirement nest egg, but only a few bad investment decisions to crush it.

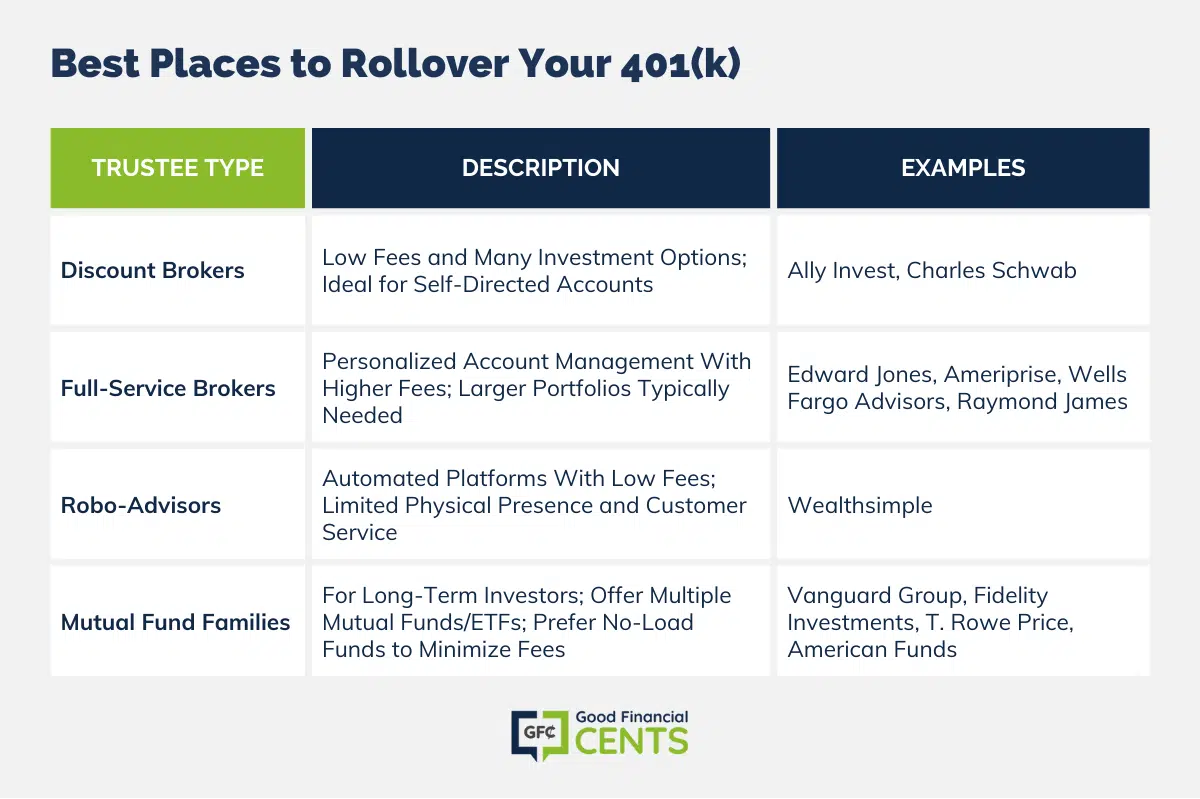

Best Places to Rollover Your 401(k)

Once you’ve decided whether you want a managed account or a self-directed account, you’ll be in a position to choose the type of trustee you want to set up your IRA with.

There are four basic options:

1. Discount Brokers

These will be the best option for you if you want a self-directed account. They have the lowest fees, including and especially trading commissions. This will be especially important if you plan to be an active trader. Discount brokerages also tend to provide the greatest number of investment options.

Most discount brokers DO provide a wide variety of trading tools, investment assistance, and educational resources!

Examples of discount brokers include Ally Invest and Charles Schwab.

2. Full-Service Brokers

These brokers are better for managed accounts. In fact, that’s the specialty of most brokers in this category. They will either offer direct personal management of your account or set you up in predetermined portfolios based on your risk tolerance and goals.

Full-service brokers are a perfect choice if you want to invest with a personal touch. You’ll be assigned a personal financial advisor who will manage your investments for you. This will provide you with hands-off investing, though your financial advisor may keep you in the loop with all investment decisions.

The downside of full-service brokers is they typically require a fairly large investment portfolio. For example, they may have a minimum managed account value of $50,000, $100,000, or even $500,000. The second negative is fees. You can generally expect to pay fees in excess of 1% of your total account value.

That means if your total rate of return on investment is 7%, your effective rate will be something less than 6%. That’s not a bad trade-off for professional investment management, but you’ll have to decide if that will work for you.

Examples of full-service brokers include Edward Jones, Ameriprise, Wells Fargo Advisors, and Raymond James.

3. Robo-Advisors

These are automated online investment platforms. Once you sign up for and fund a robo-advisor account, they will perform all of the investment functions of a human investment advisor, except the entire process is fully automated.

This means the portfolio and investment selection, reinvesting, and account rebalancing are handled by a computer algorithm. These accounts are perfect for hands-off investing.

They usually have very low or even nonexistent minimum account balance requirements and charge very low fees for their services. Those fees may be as low as 0.25%. The downside of robo-advisors is they lack physical locations, so you won’t be able to drop in to discuss your investments.

And since they’re automated, the customer service aspect is often limited. There are dozens of robo-advisor platforms, but two of the most prominent are Wealthsimple and Betterment. Both accommodate IRA accounts, as well as regular taxable investment accounts.

4. Mutual Fund Families

If you want hands-off investment management and you’re primarily a long-term, buy-and-hold type of investor, mutual fund families can work well for you too. These are investment companies that have an entire portfolio of mutual funds and/or ETFs. Since each fund is essentially a managed portfolio by itself, you just have to choose which funds you will invest in, and then you can sit back and relax.

If you use a fund family, you should favor no-load funds. These enable you to purchase positions in funds without having to pay the load fees that typically run from 1% to 3% of the value of the fund. However, since you’ll be unlikely to actively trade funds, fees will generally be less of an issue than they will be with other account types.

Examples of mutual fund families include the Vanguard Group, Fidelity Investments, T. Rowe Price, and American Funds. Each of those companies has dozens or hundreds of funds for you to choose from, including index funds and sector funds.

Let Your 401(k) Plan Administrator and Your IRA Trustee Do the Heavy Lifting

Most of us don’t do enough retirement plan rollovers to be experts. So if you decide you want to do a 401(k) rollover to an IRA, it’s best to turn the process over to both your current 401(k) plan administrator and your new IRA trustee. Since both are “in the business,” they’ll know exactly how to make it happen.

Your best friend in the rollover process is likely to be your new IRA trustee. It’s usually better to already have an IRA account in place, but opening up a new IRA isn’t at all difficult.

In a rollover situation, you simply need to tell the new IRA trustee you want to do a rollover. They will request certain information from you, including the contact information of your 401(k) plan administrator.

They will also have you sign certain documents that will enable them to make the transfer. From there, they will handle the transfer, including contacting your 401(k) plan administrator.

You should involve the 401(k) plan administrator in the process too, but they may provide only varying degrees of help. After all, you’ll be leaving their plan, so they may be less than enthusiastic about helping you.

And some plan administrators may be reluctant to help at all. The best strategy is to allow the IRA trustee to take the lead in the process and to involve the 401(k) plan administrator only where necessary! In the best of transactions, you will answer some questions and sign some forms at the very beginning, and then the transfer will be handled between the two plans.

Why You Might NOT Want to do a 401(k) Rollover to an IRA

In most cases, doing a 401(k) rollover to an IRA will be the right choice. But at the same time, no discussion of a 401(k) rollover to an IRA would be complete if we didn’t also spend some time on why you might not want to do this kind of rollover.

What are some reasons why you might choose to keep your 401(k) plan exactly where it is, even though you no longer work for the company?

- You’re perfectly happy with everything about the plan, including the performance, the investment selections, and the structure.

- The 401(k) plan you have is comparable in most or all respects to whatever type of IRA account you would roll over into.

- Your 401(k) plan is being professionally managed but without the professional investment management fee.

- Creditor/Lawsuit/Bankruptcy Protection: 401(k) plans are protected from all three under federal law, but IRAs may or may not be protected by state law. If the laws in your state don’t protect your IRA, you may be better off leaving the money in the 401(k) plan.

- 72(t) Distributions: If you lose your job or take early retirement at or after turning 55, you can take penalty-free distributions from a 401(k) plan but not from an IRA.

- You might be able to transfer your old 401(k) plan to the 401(k) plan of a new employer, which is generally not the case with IRA accounts.

- RMDs don’t apply to a 401(k) if you are still working after age 72. They will be required on IRA accounts.

There’s one other situation that’s highly specialized, though not uncommon. It applies when you have a large amount of employer company stock in your 401(k) plan. It’s the net unrealized appreciation rule or NUA.

It works like this: If you have a large amount of company stock in your 401(k) plan and you do a full rollover into an IRA, any distributions taken from the IRA will be subject to ordinary income tax rates. If you take the distributions before turning 59 1/2, you’ll also have to pay a 10% early withdrawal penalty.

If, on the other hand, you leave the company stock in your 401(k) plan, you’ll get a special benefit – the NUA.

When you take a distribution that includes the company stock, you will have to pay tax only on the amount you paid for the stock. Any gain on the stock will then be taxable at the more favorable capital gains tax rate, which can be as low as zero but no higher than 20%. If you have a large amount of company stock, and there is a substantial amount of appreciation on the stock, it’s best to keep the stock in the 401(k) plan and do a 401(k) rollover to an IRA only of the non-company stock assets in the 401(k) plan.

Summing Up a 401(k) Rollover to an IRA

Despite the long list of reasons not to do a 401(k) rollover to an IRA, or the solid reasons to do a conversion into a Roth IRA, there really are a lot of times when doing the rollover into a traditional IRA is the best strategy.

Evaluate your 401(k) plan, as well as your own preferences and investment objectives, and then compare these with the benefits a traditional IRA account provides. And don’t be afraid to discuss the rollover options in some detail with a trusted financial advisor.

You worked long and hard to build up your 401(k) plan, and one day will be one of the primary ways you’ll survive. You owe it to yourself to carefully consider which option will best accomplish that goal.

I recently did a rollover of my Arizona 403b into a traditional IRA. Only $13,400 of the account balance of $17,800 made it to the account. When I called, they said it’s because once you forfeit your membership they cut the interest rate you were earning from 8% to 2%. Is this a thing?? I can’t find info on it anywhere on the web.

Hi Laura – Every plan is different, and especially with government sponsored plans. If that’s the limitation they have written into the plan contract, then yes, it is true. But you might want to do some specific research to confirm it. At a minimum, ask for the paperwork that explains the forfeiture.

great article…very informative. your comment on RMD not applicable after 70-1/2 if you are still working is correct, but if you no longer work for that company, the plan administrator will transfer the RMD to your personal account by March of the following year.

Thanks for the information Darrell!

I’m 68, my tax liability for this year is currently $0 because we lived off SS. We’re thinking about converting $50,000 from IRA to Roth IRA which would make our tax liability $8,200. How do you decide if the additional taxes are worth it?