At Sure Dividend, we are big proponents of investing in high-quality dividend growth stocks, such as the Dividend Aristocrats. This is a group of stocks that have increased their dividends for 25+ consecutive years, making them ideal candidates for investing for passive income.

The goal of most investors is to build enough wealth over time that they can stop working and retire.

After all, in order to retire, one needs a sizable portfolio, and unless drawing principal out of the account to pay living expenses is acceptable, investors in or near retirement generally look for ways to generate passive income.

That can be done a variety of ways, but we find the best way to do that is through buying high-quality dividend stocks.

In this article, we’ll take a look at why investors would want to invest for passive income, how it can be done, and the benefits of doing so. In addition, we’ll provide some examples of excellent dividend stocks we think are perfect for generating passive income.

Table of Contents

The Power of Dividends

While dividends are a great way to generate income in retirement, dividend income can be a tremendously powerful wealth-compounding tool for those that aren’t yet near retirement.

This method of compounding wealth can create a much bigger nest egg from which to draw passive income and, therefore, make it easier to achieve the goal of living off of that income.

Francisco Murillo, a Certified Financial Planner at Snowden Lane Partners, has experience in working with clients and their dividend portfolios. He offers,

“Aside from the economic aspect (income), think of some of the intangibles of investing in a dividend growth portfolio, especially one that is consistently increasing its payout. In order to do this year after year, a company has to have sufficient earnings and cash flow to pass on to its shareholders.

In many ways you can think of it as a barometer of a company’s “health.” A healthy company can translate to a healthy portfolio – and that bodes well for your retirement.”

Compounding is a simple concept; the investor sees larger dollar-based returns for the same percentage return each year the principal balance of the portfolio grows.

In other words, if an investor starts with $1,000 and earns a 5% return in the first year, whatever returns are produced in year two will be amplified by the fact that the starting balance is 5% higher than it was the previous year.

In our example, it’s a modest sum of $50, but over time and in larger amounts, this compounding can make an enormous difference to the balance of one’s portfolio.

In the above example, we assumed a capital gain of 5%, but dividends can play an important role in compounding as well because any funds received from shares the investor owns can be reinvested into the same stock or a different dividend stock.

This offers a sort of double compounding because not only does the balance grow, but it also means the investor owns more shares from which they can draw dividends.

This creates a virtuous cycle of investing and reinvesting that can have some truly staggering impacts on the balance of the portfolio over time.

We’ll touch more on that a bit later, but for now, let’s see the power of dividends.

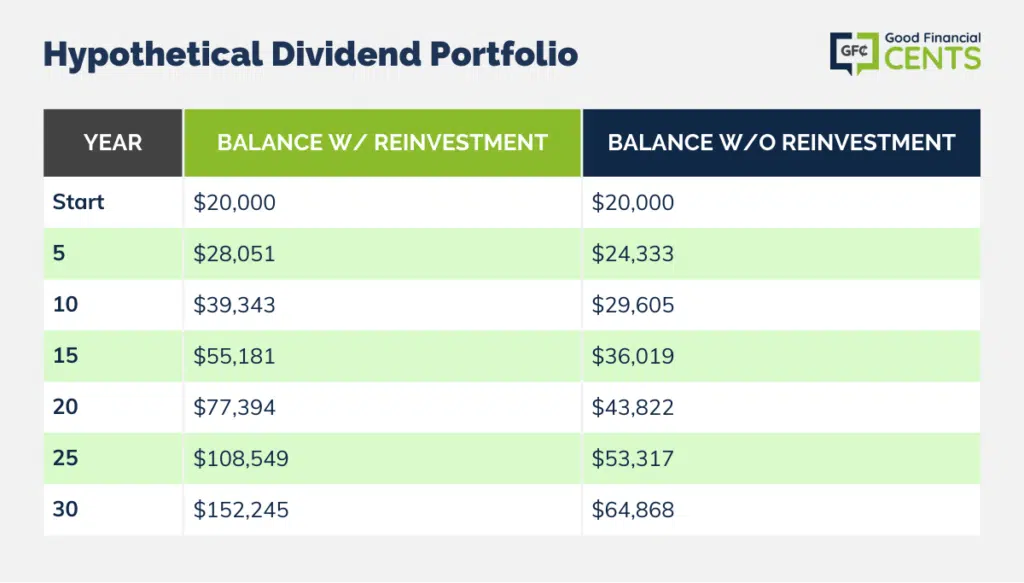

Below is a simple example where we make some basic assumptions about a hypothetical portfolio. For our purposes, and to keep things simple, we’ll ignore the impact of taxes (more on that below as well) and transaction costs.

We’ll also assume that this investor achieves a steady 3% annual average yield on their portfolio and achieves a steady 4% annual capital gain on the portfolio.

Of course, the real world isn’t this simple, but we are simply trying to demonstrate the power of compounding dividends over time.

Using those assumptions, we can see two scenarios below. The first one is where the investor takes the 3% of dividends received each year and reinvests them 100% back into the portfolio.

The second scenario assumes the investor removes the 3% in dividends from the account and, therefore, does not reinvest the proceeds. What we see is a powerful example of what compounding can do, specifically reinvesting dividends.

In this hypothetical example, we can see that the portfolio with reinvested dividends is worth more than twice that of the one that doesn’t reinvest over a period of 25 years or more.

There are no other differences in these scenarios other than the reinvesting of dividends, but the impact is profound, especially over longer time frames.

This is part of the reason why we think dividend stocks are the proven way to build wealth over time, and dividend stocks are not just for those who need income to live. Dividends are a terrific compounding tool as well.

Now, let’s take a look at the tax implications of dividends for investors.

Dividends and Taxes

Dividends – like just about any other kind of income – are subject to taxation. How they are taxed, however, depends on a few factors. And because of the effect of compounding, the amount of tax one pays on dividends can meaningfully impact the balance of a portfolio over time.

Let’s first start with the rates that investors must pay on qualified dividend income. Below we have 2024 tax rates for the various ways a taxpayer can file and for the income brackets.

Source: Investopedia

For those who earn $47,025 or less in terms of taxable income for the year, they’ll be subject to zero federal taxes on their dividend income. There are also 15% and 20% brackets, which vary by filing status and income amount.

However, the main point here is that dividends are taxed at much lower rates than capital gains or labor income in most cases.

That means that not only is it attractive because it is passively generated, but the taxation rate one owes on the proceeds is lower than most other forms of income. This makes dividends doubly attractive.

In addition to filing status and income bracket, dividend investors must also understand that some dividends are qualified and some are unqualified. The tax rates we see above are for qualified dividends only because unqualified dividends are taxed at the investor’s ordinary income rate.

Most dividends are qualified, but there are certain popular income methods that aren’t. This includes REITs, MLPs, and special dividends.

Dividends from these sources, or dividends from stocks that don’t meet the IRS’ holding period requirement, are subject to higher taxation than those of qualified dividends.

However, if an investor wants a lower tax rate on dividends, the majority of common stocks qualify so long as the investor isn’t trading in and out of those stocks frequently.

Dividend Investing for Passive Income

As with many things in life, there is certainly more than one way to generate passive income in retirement.

Examples include bonds that pay fixed amounts to holders, preferred stocks, which is perpetual equity that behaves like a bond, real estate investments, and, of course, dividend stocks.

We favor the latter because of the various options for passive income. It is the most likely to provide a strong mix of capital appreciation, growing amounts of income over time, and high yields.

In addition, investing in dividend stocks provides exceptional liquidity compared to the other options for passive income, so it truly is a great choice for generating income from a portfolio.

Jonathan Bednar, a Certified Financial Planner at WhatTheWealth.com shares his enthusiasm for passive income from dividends. He offers,

“What if you could passively increase your passive income? One of my favorite ways to focus on dividend investing is to dig a little deeper and look for those companies that concentrate on dividend growth.

These companies not only pay but also raise their dividends year after year. Dividend growth is a great way to passively increase your income and also combat inflation, which at currently around 8.5% is on everyone’s mind.”

The goal is to generate enough income that one can live off the proceeds, at least in part.

The options are numerous within the realm of dividend stocks, including finding those with the best dividend growth prospects, those with the safest payouts, the longest dividend increase streaks, or the highest current dividend yields.

Each of those strategies has its own merit, and depending upon each individual’s goals, the size of the portfolio, and risk tolerance, one of these strategies, or a combination, may best suit.

Now, we’ll take a look at some examples of high-quality dividend stocks we think are great additions to passive income portfolios.

Investments That Pay Dividends

In terms of ways to generate dividends, investors really only have one option in the strict sense of the term, and that’s owning a company’s stock.

Dividends are generally considered to be distributions of a company’s retained earnings, which simply means the company is returning profits it has made to shareholders through cash distributions.

There are other ways, however, of generating income from investments, although they aren’t dividends. For instance, bonds – including Treasuries – create fixed income for holders, but these are interest income, not dividends.

Treasury interest income isn’t taxed at the federal level at all, while the bonds of companies are taxed as interest income, which is simply taxed at the investor’s ordinary income rate.

Preferred stock is another option to generate fixed payouts that are similar to a bond. Preferred stock is essentially debt that never matures, so they generally pay a fixed dividend each quarter (or annually) to holders in exactly the same way a bond does.

These fixed-income instruments are fine for those who are extremely risk-averse – such as for holding in retirement or on corporate balance sheets – but for those with a longer time horizon, we believe dividend common stocks are far superior.

What Is a Good Dividend Yield?

Whether a dividend yield is “good” or not is really in the eye of the beholder. For instance, whether a yield is good enough is based upon many factors, including how focused an investor is on capital gain potential, dividend growth potential, dividend safety, and more.

To help us understand this, let’s look at a few examples. For our first example, let’s assume a 25-year-old investor that has 40 years until they retire.

This investor would do well to focus on dividend growth potential and companies that can stand the test of time in terms of dividend longevity.

These companies, however, tend to have lower current yields because investors bid up the stock’s valuation in anticipation of future growth. Thus, a yield of 1.5% or 2.0% may be deemed to be sufficient for this investor.

On the other end of the spectrum, let’s say we have an investor who is 65 years old and has just retired. This person is almost certainly not particularly interested in dividend growth potential and is likely much more focused on dividend safety and current yield.

Thus, this investor may have a “good enough” hurdle rate of 4%, or even 5% or 6% depending upon their needs.

Therefore, there is no “right” answer in terms of what dividend yield is good enough because the answer is different for every investor. One must take into consideration their portfolio size, their investment time horizon, their goals, their risk tolerance, and numerous other factors.

The Best Stocks for Passive Income

If an investor is looking for high-quality dividend stocks, the most logical place to start is with those that have stood the test of time when it comes to paying – and raising – dividends for shareholders. As mentioned previously, the Dividend Aristocrats are a great place to look for passive income.

However, there is an even more exclusive group of dividend stocks with even longer track records of dividend growth.

The Dividend Kings are the best-of-the-best when it comes to dividend longevity, and for investors looking for passive income, there are a few better places to start the search.

Each of these companies has raised its dividend for at least 50 consecutive years, putting the group of just 40 stocks in a truly rare company.

There is also a variety of strategies that can be pursued with Dividend Kings, including high yield, high dividend growth, different sector exposures, and more.

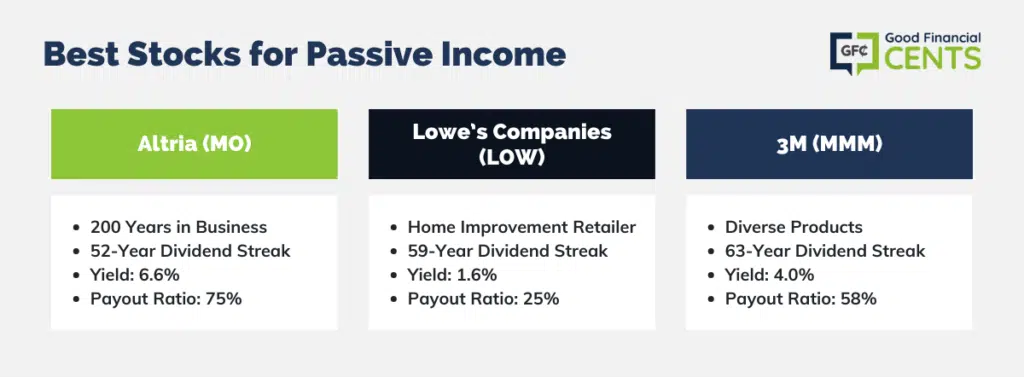

Dividend Stock #1: Altria

Our first stock for passive income is a high-yield example in Altria (MO). This is a tobacco company that has been operating for 200 years and, for the last 52 years in a row, has raised its dividend payments to shareholders.

Altria’s history of raising the dividend is quite strong in terms of magnitude as well, averaging almost 8% annually in the past decade. That has led to a current yield of 6.6%, which is about five times that of the S&P 500.

On a pure yield basis, Altria is exceptional. Its payout ratio is about 75% for this year, which is high, but given the predictable nature of its revenue and earnings, we don’t have any concerns at the moment that the dividend may be at risk.

Dividend Stock #2: Lowe’s Companies

Our next example of stock for passive income is in the consumer discretionary sector in Lowe’s Companies (LOW). Lowe’s is a mass-market home improvement retailer that operates about 2,000 stores across the US.

The company has raised its payout for 59 consecutive years, and over the past decade, its average increase is a staggering 18% annually. That not only puts Lowe’s in exclusive company for longevity, but dividend growth as well.

This sort of growth in the payout can be attractive for those who are further from retirement, as it allows the income generated from the stock to expand over time.

The tradeoff is that the current yield is lower at just 1.6%. That’s still better than the S&P 500’s average yield but is on the other end of the spectrum from a stock like Altria.

Lowe’s also offers a huge amount of dividend safety, given its payout is only about one-quarter of earnings. That means that combined with the company’s strong growth profile, investors should see decades of further dividend expansion without undue stress on the financials.

Dividend Stock #3: 3M

Our next stock is 3M (MMM), a highly diversified industrial that makes a huge variety of products for consumers, industrials, healthcare, transportation, and much more.

3M has acquired or developed a portfolio of thousands of products over the decades to somewhat insulate it from economic shocks and weakness in particular industries, and that has helped it boost its dividend for 63 consecutive years.

We see 3M as a blend of high current yield and growth prospects, offering an attractive mix of those characteristics rather than picking one or the other.

The current yield is 4.0%, more than three times that of the S&P 500. In addition, it has raised its dividend by almost 10% annually on average over the past decade, so it’s a dividend growth story as well. And like Lowe’s, its payout is very safe at just 58% of earnings for this year.

With the company’s growth profile, predictable earnings, and high yield, we like 3M for passive income.

How Much Would You Need to Live Off Dividends?

Similar to the discussion on what a good enough dividend yield is, the answer to how much one needs to live off of dividends depends upon many factors.

The good news is that these factors are generally pretty easy to measure (or estimate), and therefore, the question of how much is needed can be determined by even novice investors.

The basic components one needs to determine how much is needed to live off of dividends include how much annually is spent on living expenses and what kind of average portfolio yield can be achieved.

Other factors such as risk tolerance, fees, taxes, and other considerations should be taken into account as well, but the primary components really are how much the investor needs to live off of and what kind of return is reasonable to expect.

As an example, let’s assume an investor wants to earn $40,000 annually to live off of in retirement. How much it takes to generate that level of income depends greatly on the average yield the investor expects to achieve.

The table below shows the different portfolio sizes needed in order to achieve $40,000 in dividend income at various portfolio yields.

| Portfolio | Average Yield | Annual Dividends |

| $2,000,000 | 2% | $40,000 |

| $1,333,333 | 3% | $40,000 |

| $1,000,000 | 4% | $40,000 |

| $666,667 | 6% | $40,000 |

| $500,000 | 8% | $40,000 |

As we can see, even relatively small differences in portfolio yield can create massive gaps in the amount of money that is required to generate a particular level of annual income.

The gap between earning 2% and 3% is the difference of almost $700k in portfolio value to produce the same $40,000 of annual income, for instance.

Thus, for those investors looking for enough money to live on, erring on the side of a higher current yield certainly makes a lot of sense.

Final Thoughts on Living off Your Dividends

While there are lots of options for investors looking to generate passive income, we believe the best path is to find high-quality dividend stocks with safe payouts and, preferably, higher yields.

Three examples that offer different characteristics are Altria for high yield, Lowe’s for dividend growth, and 3M for a blend of the two.

In constructing a portfolio for passive income, we see these characteristics as paramount to success, and the Dividend Kings are a great place to start.