Want to know how to avoid borrowing from your bank? The Internet has created a new environment where it is possible to get loans without using traditional sources like banks.

Dozens of peer-to-peer (P2P) lenders have sprung up across the Internet, offering loans to borrowers that are often under terms more favorable than what is available through banks.

P2P lending sites bring borrowers together on the same website as the investors who will fund their loans.

It is basically removing the middleman, which is the bank, and creates a mutually beneficial financial arrangement.

The borrower makes a request for a loan, and that request is made available to investors, who will then fund the loan.

Those loan fundings are typically referred to as “notes,” and an investor can hold as many notes as he or she decides to invest in. Since there is no bank involved in the process, the borrower often pays less interest than would be the case with a bank loan.

Meanwhile, the investor earns a much higher rate of return than would be possible on investments held through a bank.

The Prosper Loans Marketplace, better known simply as Prosper, was one of the first P2P lending platforms established. Prosper is an excellent example of a generally well-regarded P2P site. But there are even Prosper complaints out there.

This Prosper review will show you how to avoid your bank for both investing and borrowing.

Since it began operations in 2005, Prosper has funded more than $6 billion in loans and has more than 2 million members. The company is based in San Francisco and runs its loans through WebBank, a Utah-chartered, FDIC-member industrial bank.

Prosper acts as the servicing agent on the loans, handling the technical details of each loan, collecting payments, and remitting repayments to investors. Legally known as Prosper Funding LLC, Prosper is a wholly-owned subsidiary of Prosper Marketplace, Inc.

Table of Contents

- Is Prosper Legit?

- What Kinds of Loans Does Prosper Make?

- How the Loan Process Works

- Prosper Personal Loan Requirements

- Prosper Personal Loan Pricing

- The Prosper Loan Application Process

- Complaints Against Prosper

- What the Better Business Bureau Reports on Prosper

- Evaluations From Respected Sources

- Putting Prosper Complaints Into Perspective

- Prosper Works Especially Well for Credit Card Debt

- The Bottom Line: Should You Apply for a Loan With Prosper?

Is Prosper Legit?

In a word, YES! Prosper has been around for thirteen years now in the world of the Internet, which is an eternity. Prosper has also been BBB accredited for the last 7 years, with an A+ rating.

As we cover the reviews of Prosper for borrowers and lenders, you will see that this is a well-maintained and viable way to invest and borrow money. Prosper is subject to state and federal regulations, just like any loan-producing organization is.

To put an even more legitimate light on the company, all loans originating through Prosper.com are made by WebBank. This is an industrial bank that is chartered in Utah and a member of the FDIC.

On a more personal level, I have personally been investing in Prosper for several years now. A couple of years ago, I started a comparison of Prosper vs. Lending Club and had very good results from both companies on my investments.

Lending Club is the number one competitor to prosper in the peer-to-peer loan market. I have had very good luck with them, and you can use my Lending Club review to do a full comparison of the two.

I also offer other great reviews on different options to you, such as the Betterment and Motif Investing Review.

What Kinds of Loans Does Prosper Make?

For the most part, Prosper makes one type of loan – personal loans. But they can be used for just about any purpose you can imagine. For example, you can use a Prosper personal loan for:

- Debt consolidation

- Home Improvement

- To cover medical or dental expenses

- For business purposes

- To make large purchases, such as buying an automobile

- To cover household expenses

- For the purchase of an automobile, motorcycle, recreational vehicle, or boat

- To pay for special occasions, such as engagement rings and weddings

- To cover vacation costs

- To pay taxes

- “Green loans” – to purchase energy-efficient equipment for your home

- Short-term and Bridge Loans

- Baby and adoption expenses

While these are specific purposes for loans, the basic loan setup remains the same. Each loan is a fixed rate, unsecured, payable over three or five years, and has no prepayment penalties.

Prosper will lend between a minimum of $2,000 ($6,000 in Massachusetts) up to a maximum of $50,000. All loans have terms of three years or five years and are fixed-rate, fixed-payment installment loans that will be paid in full at the end of the term.

In addition to offering standard loans with competitive rates, Prosper is always working to improve its products. In a press release back in 2018, Prosper unveiled its new digital HELOC plan, set to roll out in 2019.

The new product aimed to streamline the application process, provide a quick prequalification rate, and eliminate origination fees.

How the Loan Process Works

Applying for a loan is a simple multi-step process that looks something like this:

- Create your loan listing – you provide basic information, then Prosper will obtain your credit score and determine your rate and terms.

- Based on your credit score and other information Prosper will obtain, you will be assigned a credit grade from AA to HR.

- You then create a loan listing, which is your request for a loan. You will add a description of your loan purpose and financial situation. It will appear on the platform to be reviewed by investors.

- Once the loan listing is fully funded and your information has passed Prosper’s verification process, you will receive your loan.

- The listing will stay active for 14 days or until the loan funds.

- Loan funds are deposited directly into your bank account within days.

- You begin making your monthly payments.

Open a Personal Loan Account with Prosper

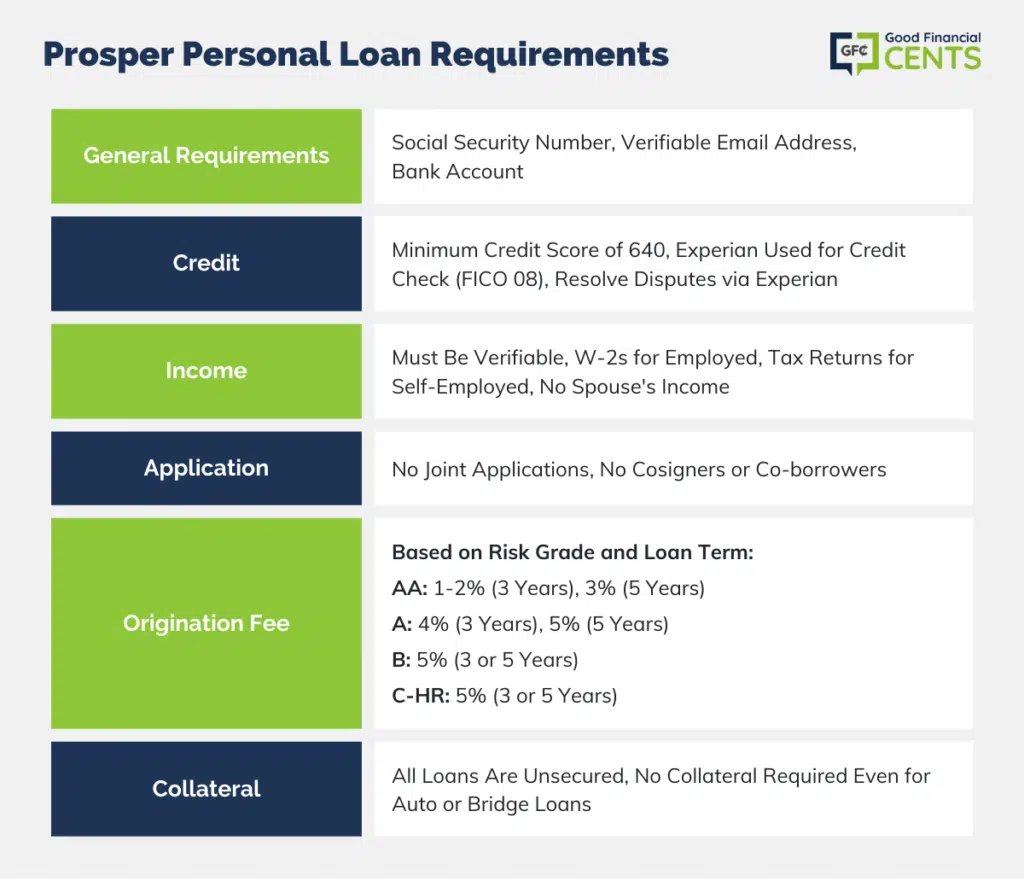

Prosper Personal Loan Requirements

You must also have a Social Security number, a verifiable email address, and a bank account.

- Credit: In order to qualify for a loan with Prosper, you must have a minimum credit score of 640.

Prosper uses Experian to determine your credit score (FICO 08), so if you pull a credit score on your own and it’s from some source other than Experian, you may not be approved for a loan. Even if the score from another agency is above the 640 minimum requirement, the loan might not be approved if the Experian score is showing less than 640.

Since your credit will depend upon your credit report and credit score as provided by Experian, you will have to resolve any credit disputes through Experian, not Prosper.

- Income: Any income that you declare on your loan application must be verifiable. That means pay stubs and W-2s if you’re employed, copies of recent income tax returns if you are self-employed, or third-party documentation of retirement or investment income.

You cannot use your spouse’s income for qualification purposes. Since Prosper loans are personal loans, you cannot make a joint application. Prosper does not allow the use of either cosigners or co-borrowers.

- Origination Fee: When you borrow through Prosper, you will be subject to an origination fee. The fee is based on your risk grade, as well as the term of your loan, and looks something like this:

- Risk grade AA – 1% to 2% for a three-year term, 3% for a five-year term

- Risk grade A – 4% for a three-year term, 5% for a five-year term

- Risk grade B – 5% for either a three-year or five-year term

- Risk grades C through HR – 5% for either a three-year or five-year term

- Collateral: All loans made through Prosper are unsecured; therefore, no collateral is ever required. That includes auto loans and bridge loans, even though such loans are typically secured by collateral. Prosper makes personal loans available for the purchase of physical assets, but the loans are not specifically auto loans or bridge loans, just personal loans that you can use to purchase those assets.

Prosper Personal Loan Pricing

When you apply for a loan with Prosper, the platform determines your Prosper Rating. This is a proprietary rating system similar to a credit score in that it is predictive of the likelihood of loan default. Prosper uses this rating in setting the pricing on your loan.

The Prosper Rating is determined by a combination of factors, including your FICO score, the term of the loan, the expected loss rate, the economic environment, and the competitive environment.

The top Prosper Rating is AA. With that rating, if you were to take out a $10,000 loan on a 3-year term, you would see an interest rate of 5.31 and a 2.41% origination fee. At the opposite end of the spectrum, HR is the lowest Prosper Rating and has a maximum rate of 35.99% APR for a three-year loan. Five-year term loans are available at all Prosper Rating levels, but only a three-year term is available on an HR-graded loan.

There are no application fees or prepayment penalty fees with Prosper, but they do charge an origination fee of between 1% and 5% of the loan. That fee is deducted from the loan proceeds once your loan is funded so that you do not have to pay it as an upfront fee out-of-pocket.

If you’re not familiar with P2P loans, understand that charging origination fees is typical in the industry. As well the range between 1% and 5% is also the industry standard.

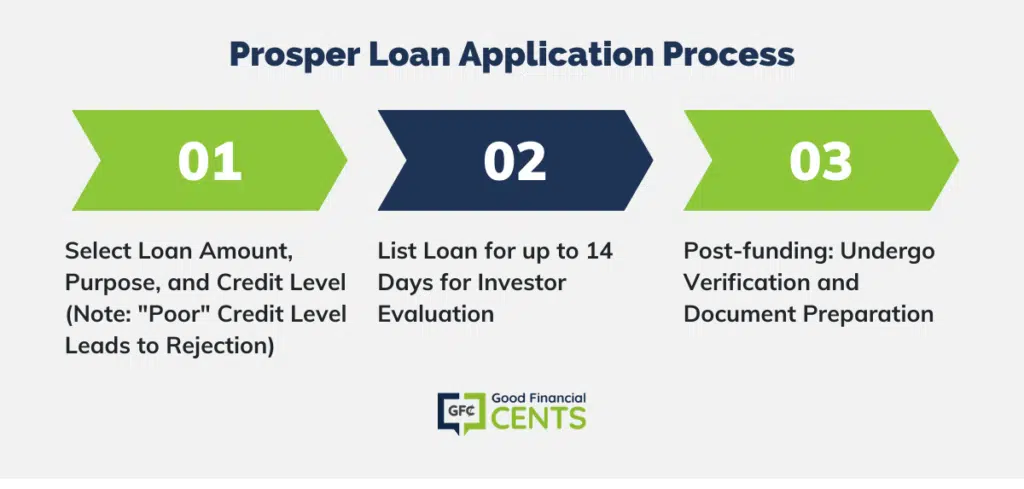

The Prosper Loan Application Process

Applying for a loan with Prosper is a three-step process:

- You choose a loan amount, state the purpose of the loan, and indicate your credit level – Excellent, Good, Fair, or Poor (FYI, Poor is an automatic rejection).

- Your loan is listed, which makes it available for inspection and evaluation by potential investors; a loan listing can be active for up to 14 days.

- Once your loan is fully funded by investors, the verification process will take place, as well as the loan review and loan documents will be prepared.

Simply having your loan listed results only in a “soft credit pull,” so your credit report will not be hit with an inquiry. During the verification process, your credit report will be pulled, and your income will be verified, as well as your identity.

Much of the verification process is based on documentation that you provide to Prosper. You can do this by uploading documents (payroll, tax, and other information) to the “My Account” screen on the Prosper website, or you can email them to [email protected].

If everything checks out with the way that you disclosed it on the loan application, your loan will be closed, and you will receive your funds. Receipt of funds generally takes place between two days and eight days after the loan is fully funded by investors, and all of your loan information is verified. Loan proceeds are transferred to you electronically using the automated clearing house banking network (ACH).

- Multiple Prosper Loans: You can have more than one loan on the platform at the same time. However, your credit score must be at least 640 when you apply for the second loan, and the combined loan limit of both loans is limited to $50,000 in total.

In addition, your first loan must be current, and there can be no late payments within the last 60 days. You also cannot have a payment that was more than 15 days late within the past year, nor can you have more than two returned loan payments within the past three years. There are other specific requirements, but they are based on your credit score.

- Loan Repayment Methods: You will have two options to make your monthly payments. The first is electronic funds transfer, in which the payments will be automatically deducted from your bank account on the due date. The second is by bank draft, which will enable you to pay your loan directly through your bank account.

Prosper tries to discourage payment methods other than the two listed above. However, at their discretion, they may accept payments either via pay-by-phone or by ground mail. Either payment option will require a processing fee of up to $15.

- Site Security: There should be no complaints about Prosper in this regard. Prosper equips all servers with an Extended Validation (EV) Secure Socket Layer (SSL) certificate so that you will be certain you are actually on the Prosper website and that all data entered will be transmitted in a secure encrypted channel.

Data security is provided by a combination of firewalls, intrusion detection systems, a malware detection system, and a data loss prevention system. Data is stored in a highly secure data center that is audited based on SSAE 16 Type II and/or SOC 2 Type II standards.

- Speed: Prosper has worked hard to streamline their application process as much as possible. They know the loan process can be a headache, but they made it as simple as possible. For most people, they can get the whole application completed in a few days. You don’t have to worry about going to the bank every day, which means you can do it on your own time.

- Early Payoff: If you decide you want to pay off your loan early to avoid the interest (hopefully you can), you’re not going to pay any fees. You shouldn’t be penalized for paying off your loan early.

Complaints Against Prosper

Every loan option is going to have some drawbacks. Prosper is no exception. When you’re looking for a loan, you need to consider every possible pro and con of the lender.

Virtually every business in existence has complaints against it. That’s true for bad businesses especially, but even good ones get them, too. If you do enough transactions, sooner or later, there is going to be a conflict between the company and the customer. Do enough transactions, and there will be several.

One of the complaints a lot of people have is having their applications rejected. Of course, applicants always face the risk of being declined depending on their requirements.

We showed you the requirements for the Prosper loans, which can be a problem for some applicants. In most cases, the requirements are easier compared to other options, but some people don’t meet the credit score requirement. If you’re one of those applicants, there are other loan options, like Prosper.

Another drawback of Prosper is its limit on loans. Unlike a traditional bank or other loan sites, Prosper has a lower loan ceiling. They only offer loans up to $35,000.

For most people who are trying to consolidate their credit card debts, this should be enough. If it’s not, you’ll need to find another source for your loan.

There are also some complaints about uploading documents. Some users reported problems getting their documents to go through, but those complaints were rare.

What the Better Business Bureau Reports on Prosper

The Better Business Bureau (BBB) is always the first source to check out when you’re looking for complaints against any business. It’s probably the most respected such source in the US, and it also serves as a platform in which consumers can file complaints that will be addressed by the company in question. That makes it more of an equal exchange than people simply slinging mud at a company where they had a bad experience.

With that in mind, BBB rates Prosper with an A+ – Excellent – on a scale of A+ to F. Prosper has been accredited by BBB since November 2012.

BBB had this to say about Prosper:

“BBB has determined that Prosper.com meets BBB accreditation standards, which include a commitment to make a good faith effort to resolve any consumer complaints. BBB Accredited Businesses pay a fee for accreditation review/monitoring and for support of BBB services to the public.”

When you are executing many thousands of transactions over the course of a year, there are bound to the breakdowns and misunderstandings that will result in consumer complaints. But a company’s willingness to address those complaints to the satisfaction of the consumer is a very positive sign that the company values its reputation.

BBB states that Prosper “makes a good faith effort to resolve any consumer complaints,” and that’s all you can ask for.

Specific factors cited in Prosper’s BBB rating include:

- Length of time business has been operating.

- Complaint volume filed with BBB for a business of this size.

- Response to 164 complaint(s) filed against business.

- Resolution of complaint(s) filed against business.

The third factor seems especially relevant. Prosper has had 164 complaints filed against it through the BBB – but it has also had at least 250,000 customer interactions since the business began operating in 2005. 164 represents some fraction that is ridiculously lower than 1% of all customer interactions. On that score, we have to acknowledge that Prosper comes up smelling like a rose.

The complaints are categorized as follows:

- Advertising/Sales issues, 53

- Billing/Collection issues, 38

- Delivery issues, 1

- Guarantee/Warranty issues, 3

- Problems with Product/Service, 69

I spent some time sifting through a large sampling of the complaints filed under advertising/sales, billing/collection, and problems with product/service, mostly looking for patterns of consistency in the complaints.

Complaint patterns are apparent and fall into three categories: origination fees, credit reporting issues, and deducting a monthly payment more than once.

Origination fees are common complaints with P2P lenders. Almost all charge them, but borrowers don’t seem to understand or realize what they are. Having a reasonable level of experience with P2P lenders, we can’t count origination fee complaints against Prosper. They make it clear on the website that these fees are charged.

Nonetheless, in most instances, Prosper did return the origination fee in question to the borrower upon dispute.

Credit reporting issues are legitimate complaints, and a certain number will happen with all lenders who report to the credit bureaus. It’s unfortunate, but it happens. And it seems that Prosper worked to correct those situations, and the corrections were accepted by the borrowers.

Deducting monthly payments more than once is a more complicated problem. There are several complaints against Prosper for this, and it seems to be an area where they need to make improvements.

In each case, they returned the excess payment. However, a double collection of a monthly loan payment causes a series of other missed financial transactions that can result in non-sufficient funds charges by banks and bounced checks and payments to other parties. Even if the financial side of the problem is fixed, the damage done to reputation is not easily remedied.

The double deduction of monthly payments is a problem that Prosper needs to address in a very deliberate way.

Evaluations From Respected Sources

These days you can find evaluations on just about any business on Yelp, including P2P lending platforms. I checked out Yelp San Francisco – Prosper’s hometown, and 17 reviews came up.

There was more of a consistent pattern to the complaints on Yelp than elsewhere. The most common is poor customer service/communication. There were also several reviews that gave the company a good rating.

But there were several that were at least a little bit unsettling. Several are from investors, and all indicated that Lending Club is a superior investment platform to Prosper. I’d be willing to bet that a similar set of reviews in regard to Lending Club might say the same thing in reverse.

In a formal review of Prosper as an investing platform, InvestorJunkie.com owner Larry Ludwig relates his hands-on experience with the site. He reports a similar advantage to Lending Club over Prosper from an investment standpoint:

“Prosper loans are slightly riskier than Lending Club. This is based upon doing the number crunching I did on LendStats.com.”

Since Larry is known for providing some of the deepest and most objective product reviews on the Internet, I take this observation seriously. Larry isn’t dissing Prosper – he’s just pointing out that his experience and that verified with LendStats.com shows Lending Club to be the better of the two platforms from an investment standpoint, if only by a small margin.

Nerdwallet, another well-respected website, did a review on Prosper late in 2015, focusing primarily on the lending side. The review is generally positive but offers the following conclusion:

“Keep in mind that its personal loan approval process is more complicated than companies that fund loans with their own money rather than through individual investors. Prosper usually serves borrowers with good credit profiles. If you have a good credit history, you might have cheaper options, such as 0% interest credit cards or secured personal loans.”

That conclusion gives at least some credibility to the reviews on Yelp and elsewhere that indicated issues relating to customer service and communication, as well as credit levels. You can see our full review of Prosper to get more details about how the company works.

Putting Prosper Complaints Into Perspective

Considering how many business transactions Prosper handles in any given year, the number of complaints against them – from various sources – is surprisingly small. We have to say that on balance this is an excellent company to do business with.

But there are certain complaints that seem to come up on a fairly consistent basis. The biggest may be that the platform isn’t quite as good with investments as its primary competitor, Lending Club, is.

Deducting multiple payments from borrowers’ accounts, as reported by the Better Business Bureau, is also worthy of concern. There were also a fair number of people who complained about poor customer service and a lack of communication.

None of these occurred in sufficient numbers to shoot up a red flag. But they are worth paying attention to and dealing with should they become a problem in working with Prosper.

Prosper Works Especially Well for Credit Card Debt

One of the most popular purposes for Prosper’s personal loans is to pay off credit card debt. The most obvious advantage is debt consolidation – consolidating several credit card lines in a single loan with one monthly payment.

Here’s why that loan purpose is so popular:

Saving on Interest

Since Prosper personal loans are installment debts, you are also converting revolving loans with variable interest rates – that can go as high as 29.99% under certain circumstances – into fixed-rate debt where the rate will never increase.

Converting credit card debt with an average interest rate of 20% into a personal loan at 12% will save you a lot of money by itself.

Getting off the Revolving Debt Merry-Go-Round

The fact that you will pay the loan off within five years will save you even more interest.

There’s a reason why credit card debt is set up to be revolving; it’s a revolving door of debt that is very difficult to get out of. That’s because even while you are making efforts to pay off your credit cards, it’s likely that you are re-using credit lines again and again anytime you have a need for extra cash.

The five-year time limit on Prosper loans means that your debt will be gone for good at the end of that term.

The credit score surge. There is a secondary benefit to consolidating credit card debt through a debt consolidation installment loan. Many borrowers experience an increase in their credit scores shortly after doing the consolidation.

This has to do with the credit utilization ratio that the major credit bureaus use. It is heavily based on credit cards, and it is calculated by dividing the amount of credit card debt owed by your total credit card available balances.

So, for example, if you have total credit lines available of $40,000 on five credit cards, and you owe combined balances of $30,000, your credit utilization ratio is 75% ($30,000 divided by $40,000).

FICO scoring models like a credit utilization ratio of not more than 30%. If you have one that is 75%, it can have a significant negative impact on your credit score.

But by paying off the $30,000 outstanding balance and consolidating debt using a debt consolidation loan, your combined credit card balances go to zero immediately. That means that you will have a credit utilization ratio on your credit cards of zero, which typically results in a sudden increase in your credit scores.

Additional improvement comes from the fact that by paying off five credit cards, you’ve lowered the number of debts where you have outstanding balances immediately as well. This is also a positive factor in determining your credit scores.

Though there is somewhat of a decline to your credit score due to the fact that you have a brand-new installment loan – on which there is no history of successful payments – that is typically more than offset by the improvement in your credit utilization ratio and the decline in the number of debts with outstanding balances on them.

That’s why borrowers who consolidate credit card debt through a Prosper personal loan typically see a quick improvement in their credit scores.

The Bottom Line: Should You Apply for a Loan With Prosper?

If you are in the process of applying for a loan, you will no doubt investigate several sources. If you’ve been having difficulty getting a loan from banks or other traditional sources, check out Prosper, and see if you can’t do better. I’m betting that you can.

Prosper should be one of the leading sources that you check out. Loan purposes are practically unlimited, no collateral is required, and all loans are fixed-rate installment loans with a maximum term of five years. You may also find that the credit score requirement minimum of 640 is more flexible than you will find with banks and other loan sources.

Check out Prosper and see what they can offer you. There is no application fee, no obligation, and no inquiry will show up on your credit report for listing your loan.

Some big flaws with Prosper. I’ve had two loans.

1. The payoff balance is the entire amount of the loan including ALL interest, even though you’re paying off really early.

2. No flexibility on monthly payments. My balance is almost $25k. I called because I want to pay off $20k of it. But what does that do for me? Nothing. I would still have to pay the rest monthly at the SAME monthly payment, even though I owe much less. This is going to force me to pay off the whole thing, which will create some problems for me.

I doubt I would ever take out another peer-to-peer loan due to the lack of flexibility.

Hello Mr. Rose,

I am wondering if I would be able to meet with you to go over some Financial steps/ options that I am planning to take to embetter my financial situation. If that is, in any way possible, you will do me a great favor. I love to watch your videos but I want to act and make my first steps towards financial freedom. I trust that you are one of the very few who provide 100% accurate content and I trust that I will never regret asking for your guidance. Also, I know how busy you are between your personal and professional life. However, I trust that you would be able to spare some of your valuable time to guide a beginner –

a 39 old, single mother- starting from scratch, like myself. Thank you in advance

Can you right off the interest ?

Hi Robert – Generally no, unless it’s a business loan.

I have a 5100.00 debt credit card with a 22.65 interest can you help me?

Hi Christine – Apply with Prosper and see how it goes. I can’t tell you in advance, since I don’t make the loan decisions.

If I invest 50k 30 high risk, 10k medium risk, 10k no risk .. what will it be my cash return every month ?? Average ?? Prospect or landing club

Hi Leo – That will depend entirely on the interest rates you’re earning in each risk class. You’ll have to crunch the numbers and see what they’ll pay.