If you’re deep in debt and struggling to find a way out, you may be considering a debt consolidation loan as a solution to your problem.

By consolidating multiple debts and outstanding balances into a new loan product, you can rid yourself of the need to make several payments each month, simplify your life, and even lower your monthly out-of-pocket expenses.

And if your debts were truly out of control, debt consolidation may even offer a way to save yourself from debt collections, poor or ruined credit, or bankruptcy.

But is debt consolidation the only way to go?

Table of Contents

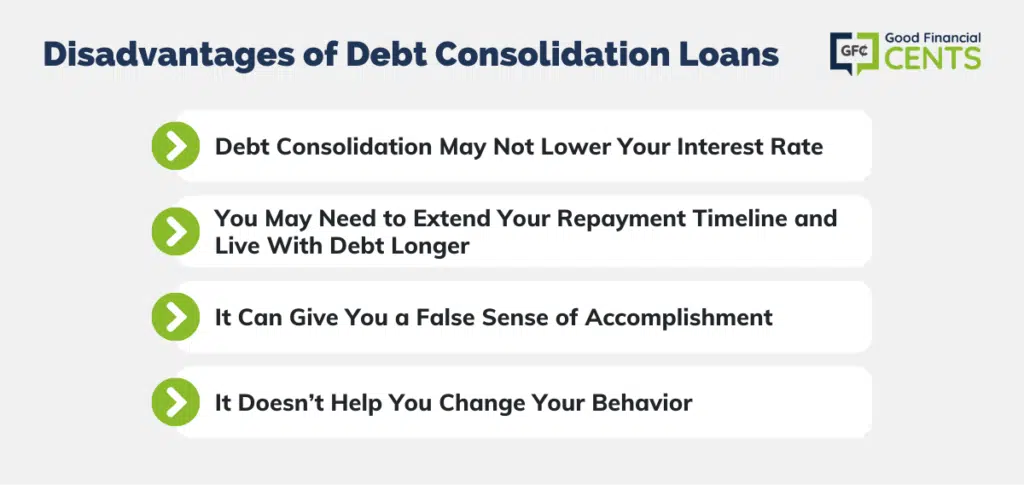

The Disadvantages of Debt Consolidation Loans

While consolidating your debts is one option to consider, it doesn’t make sense for everyone. In fact, debt consolidation often compounds the problem of too much debt for many people simply because of the way the process works.

Here are some of the main reasons debt consolidation is rarely the best way to get out of debt:

Debt Consolidation May Not Lower Your Interest Rate

While it’s true that debt consolidation can help you merge all of your debts by getting a loan with one monthly payment, you may not actually save money by the time you complete the process.

If you don’t secure an annual percentage rate, or APR, that is considerably lower than the weighted average interest rate you have now, you could pay the same amount of interest, or even more, over time depending on the details of your new loan.

You May Need to Extend Your Repayment Timeline and Live With Debt Longer

Depending on the terms of your new debt consolidation loan, you may actually extend your repayment timeline. If that’s the case, you’ll spend even more time in debt than you are spending now, plus potentially pay more interest as well.

It Can Give You a False Sense of Accomplishment

Debt consolidation usually leaves people feeling relieved they reduced the number of monthly payments they need to make each month. Since you still carry the same amount of debt, however, this feeling can give you a false sense of accomplishment. You didn’t pay any debt off by consolidating it; you merely moved it around.

It Doesn’t Help You Change Your Behavior

The biggest disadvantage that comes with debt consolidation is that it doesn’t help anyone change their behavior in the long run.

If you ran up dozens of credit card balances and consolidated them for peace of mind, what’s to convince you not to do the same thing again? Without a long-term plan to avoid debt and change your spending habits, you could easily end up worse off than when you began.

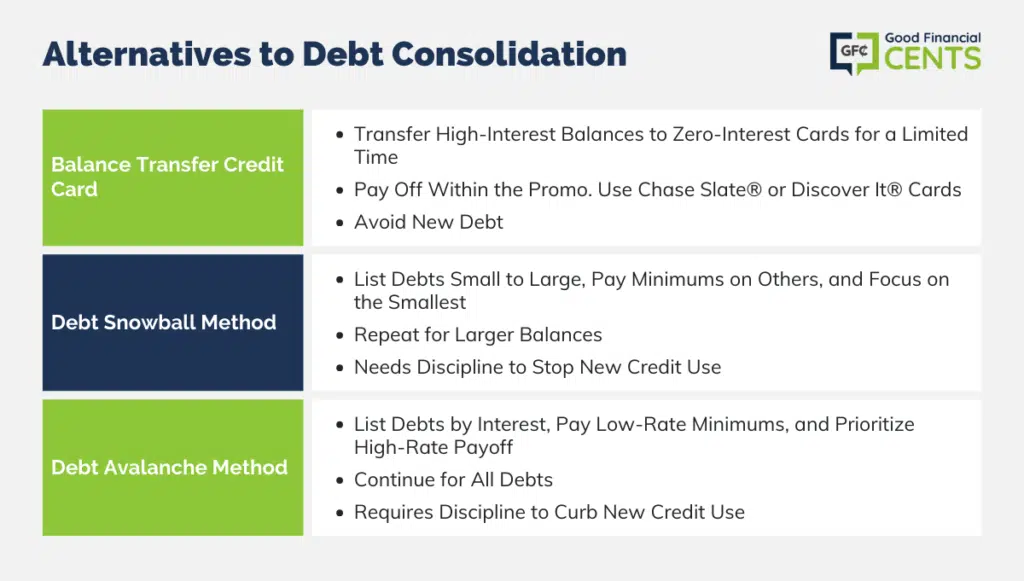

Alternatives to Debt Consolidation

If you’re worried that debt consolidation won’t actually leave you better off, there are several alternatives to consider instead. While each of these options also has its own set of disadvantages, they may make more sense in the long run.

Alternative #1: Sign Up for a Balance Transfer Credit Card

While formal debt consolidation offers a way to consolidate several credit card balances and loans into one new product with a single monthly payment, you can often accomplish the same thing with a balance transfer credit card.

And during the time your balance isn’t accruing any interest, every cent you pay towards your new loan goes directly towards the principal. While there are myriad balance transfer credit cards on the market, we wholeheartedly recommend two different cards:

Chase Slate®

If you’re looking for a balance transfer credit card that can help you get out of debt fast, look no further than the Chase Slate®. With this card, you’ll get 15 months with zero interest for both purchases and balance transfers.

Plus, you won’t even pay a balance transfer fee during the first 60 days you have the card. As an added bonus, this card doesn’t charge any type of annual fee.

Discover it®

The Discover it® takes a slightly different approach to balance transfers. With this card, you’ll get 18 months at zero percent interest and no annual fee.

Plus, you can earn between 1 to 5 percent on purchases made with the card thereafter. You will need to pay a balance transfer fee of 3 percent to transfer your outstanding debts over, however. Learn more about the Discover it®.

How to Make a Balance Transfer Credit Card Work for You

In a lot of ways, using a balance transfer credit card might be a band-aid solution. If you don’t use your time wisely and actually pay off your debt, you can end up in the same spot – with lots of debt at a high interest rate – once your introductory offer expires.

Here are some steps to take if you want to take full advantage of a balance transfer offer:

Make Sure You Get the Right Balance Transfer Credit Card for Your Needs

In addition to the two balance transfer credit cards featured in this post, there are many other top balance transfer credit cards to consider.

Make sure to research them all, noting the fine print and terms and conditions, but also taking special care to understand the terms of their introductory zero percent offer.

Related:

Transfer All of Your Debts to Your New Balance Transfer Credit Card

To get the most out of your new balance transfer credit card, make sure you transfer as many high-interest balances as you can. With as much of your debt at zero percent interest as possible, you’ll be in the best position to pay down your total debt load faster.

Pay as Much as You Can Towards Your New Balance Each Month

Once you transfer your high-interest balances to a card that offers zero percent interest, your minimum monthly payment on those debts should decrease.

However, you should keep paying as much as you can each month, no matter what. If you don’t repay your balances during the zero percent interest introductory offer, you won’t be much better off when it’s over.

Don’t Use Your Credit Card for Regular Spending, Use Cash Instead

Although some balance transfer credit cards offer rewards on your everyday spending, you shouldn’t use your new balance transfer credit card for purchases until you are debt-free.

If you keep using credit to buy items you cannot afford, you will never get out of debt. Period. Keep your balance transfer credit card in a drawer or in your freezer for safekeeping, and refrain from using any other credit cards while you’re still in debt.

Alternative #2: Debt Snowball and Debt Avalanche Methods

Debt consolidation can help you merge all of your debts into a single loan, but that doesn’t mean it will actually save you money.

Generally speaking, there are two ways to approach debt repayment – the debt snowball method and the debt avalanche method.

The debt snowball method is by far the most popular debt repayment method since it helps you score small wins right away. With this method, you’ll list out all of your debts in order from smallest to largest, regardless of their respective interest rates.

Once your debts are listed in this order, you’ll work up a budget that allows you to pay the minimum payment on all of your debts except for the smallest one. When it comes to your smallest debt, you’ll pay as much as you can each month until it’s paid off.

As each small balance gets knocked down to zero, you’ll move on to the next smallest balance, throwing all you can at it.

In the meantime, you’ll continue making minimum payments on the rest of your debts. Over time, your smallest balances will disappear, leaving only your largest balances in their wake.

The debt avalanche method, on the other hand, takes the opposite approach. Instead of listing your debts from smallest to largest, you’ll list your debts by interest rate instead.

With the debt avalanche, you’ll pay the minimum payment on all of your loans with the lowest interest rate every month while paying as much as you can towards the balance with the highest interest rate.

Over time, your loans with the highest rates will disappear, leaving only the loans and balances with the lowest interest rates.

With both the debt snowball and the debt avalanche, you’ll keep moving through the process until you are entirely debt-free – until no loans are left.

How to Make the Debt Snowball and Debt Avalanche Work for You

With both the debt snowball and debt avalanche methods, a certain amount of self-restraint is required for the process to work. Not only must you stick to the plan and work as hard as you can to repay your debts, but you have to stop digging as well. Here are some tips that can make paying off your debts the hard way a reality:

Stop Using Credit Altogether

One of the biggest problems people face when they try to get out of debt is avoiding new debt. If you’ve become accustomed to overspending, it’s hard to break that habit and focus on paying off debt instead.

Make Sure Your Partner or Spouse Is on Board

If you want to improve your chances for success, it’s smart to sit down with your spouse or partner to make sure everyone is on board. Without their support, you could end up making little progress or, worse, growing your debt load larger over time.

Sit down with your spouse or partner and discuss your future, showing them how getting out of debt can improve both your relationship and your lifestyle. With their help, your chances for success will increase tremendously.

Cut Your Spending to Get Out of Debt Faster

Since you’re in debt and already struggling, it’s safe to say you’re already spending more than you can afford each month. To get out of debt faster – and to give yourself peace of mind – it’s crucial to look for ways to cut your spending every month.

When you first get started, look for the low-hanging fruit. If you’re overspending on food or entertainment, those are areas that are fairly easy to cut.

Conversely, you can also check past month’s bank statements for other “budget drains,” including lifestyle habits like smoking or shopping.

Stick With the Plan Until You’re Entirely Debt-Free

Getting started on the debt snowball or debt avalanche method can feel exhilarating if you are tired of being in debt, but you have to commit to the program for the long haul if you want it to work.

If you don’t, you could easily wind up getting off track and racking up more debt.

Final Thoughts: Considering Debt Consolidation Loan

If you desperately want to pay off debt, it’s important to know that debt consolidation isn’t your only option.

In some cases, you might be much better off paying your debts off the hard way. In others, a zero-interest, balance transfer credit card might help you speed up the process.

At the end of the day, it’s up to you to figure out which option works best for your lifestyle and goals. And no matter what, there is no right answer for everyone.

Before you pull the trigger on a debt consolidation or balance transfer credit card, make sure you know what you’re getting into. In addition, you should make sure you understand yourself and your limits.

Have you ever done a debt consolidation loan or taken advantage of a balance transfer offer? Why or why not?

Great post Jeff. I’ve found doing balance transfers to a card with 0% apr is a great way to focus energy and get debts knocked out one by one. What works for some, may not work for others, but creating a plan and working that plan will ultimately help lead people out of the traps of debt.