If you need to borrow money, but your credit score is lower than it should be, you will probably have to apply for a bad credit loan. This type of loan is geared toward individuals who may have made mistakes with their credit in the past, and they typically come with higher interest rates and loan fees as a result. Bad credit loan customers may also be limited in how much they can borrow, as well as the payment plans available to them.

That said, the best bad credit loans are still a lot better than nothing — particularly for people who need money quickly and don’t have access to other sources of funding. Fortunately, we took the time to compare more than 20 bad credit lenders to find loan options with the best rates and terms, plus reasonable eligibility requirements.

If you need money quickly and you’re looking for a bad credit loan you can actually qualify for, read on to learn about our top picks.

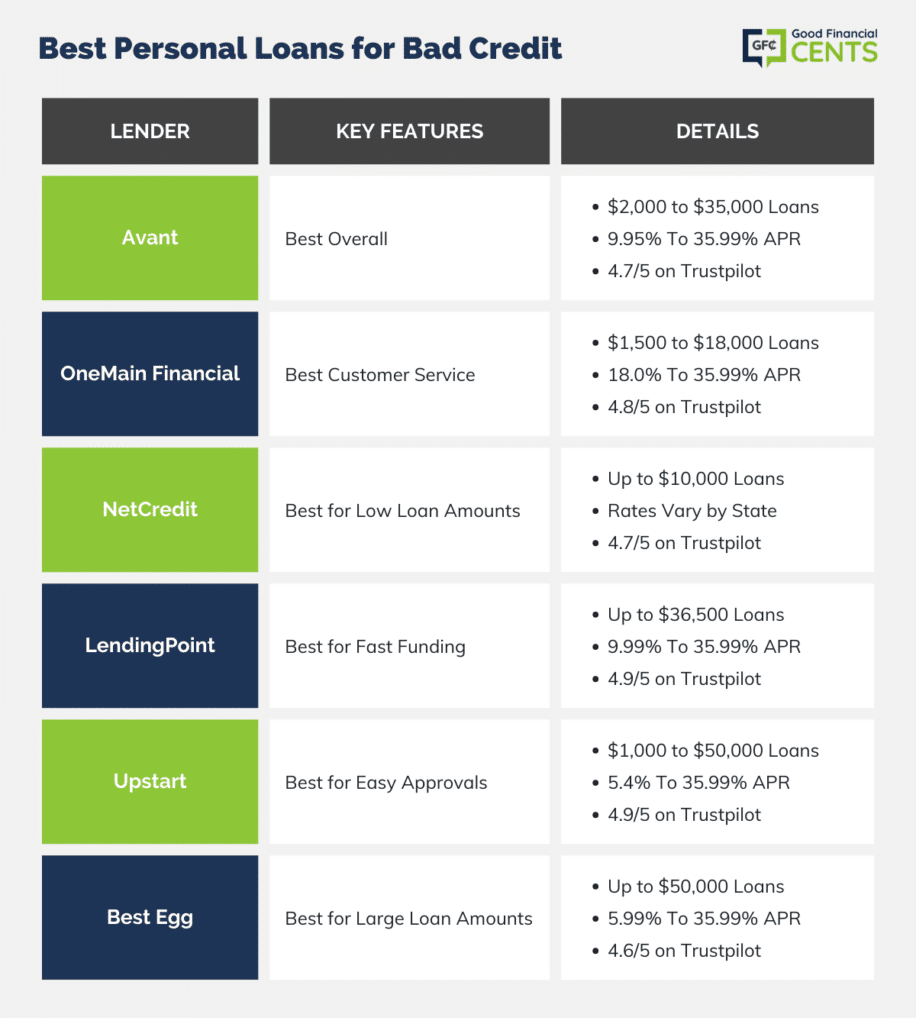

Our Picks for Best Personal Loans for Bad Credit

- Avant: Best Overall

- OneMain Financial: Best Customer Service

- NetCredit: Best for Low Loan Amounts

- LendingPoint: Best for Fast Funding

- Upstart: Best for Easy Approvals

- Best Egg: Best for Large Loan Amounts

Table of Contents

- Our Picks for Best Personal Loans for Bad Credit

- Bad Credit Loan Guide

- What Is a Bad Credit Score?

- How to Fix a Bad Credit Score

- Consequences of Having a Bad Credit Score

- How We Found the Best Bad Credit Loans of 2024

- Summary of the Best Bad Credit Loans of 2024

- Bottom Line – Best Bad Credit Loans: 6 Lenders to Get Approved

Avant is easily one of the top lenders in the bad credit loan space, and it shows in their reviews from past users. In fact, this lender currently boasts an average star rating of 4.7 out of 5 stars across more than 21,000 user reviews on Trustpilot.

Borrowers who choose to work with Avant can borrow anywhere from $2,000 to $35,000, and they can repay their loans over 24 to 60 months. Current interest rates fall between 9.95% and 35.99% depending on creditworthiness, although an administrative fee of up to 4.75% can also push up the costs of each loan.

One major benefit of Avant is the fact this company lets you get prequalified without a hard inquiry on your credit report. This step lets you gauge your approval odds and find out how much you may be able to borrow before you take the time to apply.

OneMain Financial made our ranking of the best bad credit loans due to their customer service options and user reviews. This company has more than 1,400 physical branches around the country, so you can visit an office and speak with a loan professional in person if you want to.

Borrowers who choose OneMain Financial may be able to borrow anywhere from $1,500 to $18,000, and interest rates can range from 18.0% to 35.99%, depending on creditworthiness. Loans can be paid off over 24, 36, 48, or 60 months as well, so it’s possible to tailor monthly payments to fit the borrower’s budget and goals.

On the downside, bad credit loans from this company come with an origination fee of up to 10% of the loan amount.

If you need to borrow up to $10,000 and you need your money quickly, NetCredit is also worth considering. This lender lets you check your rate and approval odds with no impact on your credit, and you can borrow up to $10,000 in most states. NetCredit also has an average star rating of 4.7 out of 5 stars across more than 7,500 user reviews on Trustpilot, which shows they care about customer satisfaction.

The rates and terms of online loans from NetCredit depend on the state an applicant lives in. In the state of Florida, for example, borrowers can access $1,000 to $10,000 in funding with an APR of 34.99% to 99%. In South Dakota, borrowers can also access up to $10,000, but interest rates range from 34% to 36%.

If you choose to go with NetCredit, make sure to check for origination fees that can cost up to 5% of the loan amount.

LendingPoint is another company that offers bad credit loans to consumers who need financing. Loans from LendingPoint come with APRs between 9.99% and 35.99%, and origination fees can add up to 7% to each loan amount. Fortunately, LendingPoint has some pretty good reviews across all major platforms, including an average star rating of 4.9 out of 5 stars across more than 6,000 reviews on Trustpilot.

Repayment options from LendingPoint range from 24 to 60 months, and borrowers may be able to access up to $36,500 in funding. Borrowers can also check their rates online before they apply and without any impact on their credit scores. That said, you do need a minimum credit score of 580 to qualify for a bad credit loan from this provider.

Upstart is an online lender that claims to have helped more than 2.1 million customers access the funding they need. This company also has a slew of positive reviews and rankings online, including an average star rating of 4.9 out of 5 stars across more than 35,000 reviews on Trustpilot.

This company lists a minimum credit score of 300 for applicants, and they use data other than credit scores as consideration for approval. In fact, Upstart says the following on their website:

“At Upstart, our model considers other factors such as your education and employment in addition to your financial background.”

If you choose Upstart for your bad credit loan, you may be able to borrow $1,000 to $50,000 and repay your loan over 3 to 5 years. Interest rates range from 5.4% to 35.99% depending on creditworthiness, and an origination fee of up to 10% of the loan amount can apply.

Best Egg is another top lender that offers bad credit loans, as well as loans for people with fair credit and good credit. This lender lets borrowers access up to $50,000 in funding, and they have an average star rating of 4.6 out of 5 stars across more than 6,000 reviews on Trustpilot.

Borrowers can check their rate on Best Egg without any impact on their credit scores, and two repayment plans are available — 3 years or 5 years. Interest rates fall between 5.99% and 35.99% depending on creditworthiness. However, borrowers should watch out for origination fees of up to 5.99%, which can make loans from this company more costly over the long run.

Bad Credit Loan Guide

As you compare the best personal loans for your credit profile, you should try to learn as much as you can about bad credit and the steps you can take to improve it. Read on to learn the ins and outs of credit scores, steps you can take to increase your credit score incrementally, and what happens if your credit score stays low over the long term.

What Is a Bad Credit Score?

There are several different credit scoring models that are commonly used, including the VantageScore and the FICO scoring model. However, we’ll use the FICO scoring model as an example here since it’s the most popular type of credit score that is used by 90% of top lenders.

Generally speaking, a bad credit score is any FICO score below 580 on a scale of 300 to 850. According to the Fair Isaac Corporation (myFICO.com), FICO credit scores fall into the following ranges:

- Exceptional: 800+

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 580 and below

If your credit score is in the “poor” range, this typically means you have limited credit history, or you have made credit mistakes in the past. Common credit mistakes that can cause your credit score to drop include late payments on your bills and using too much of your available credit.

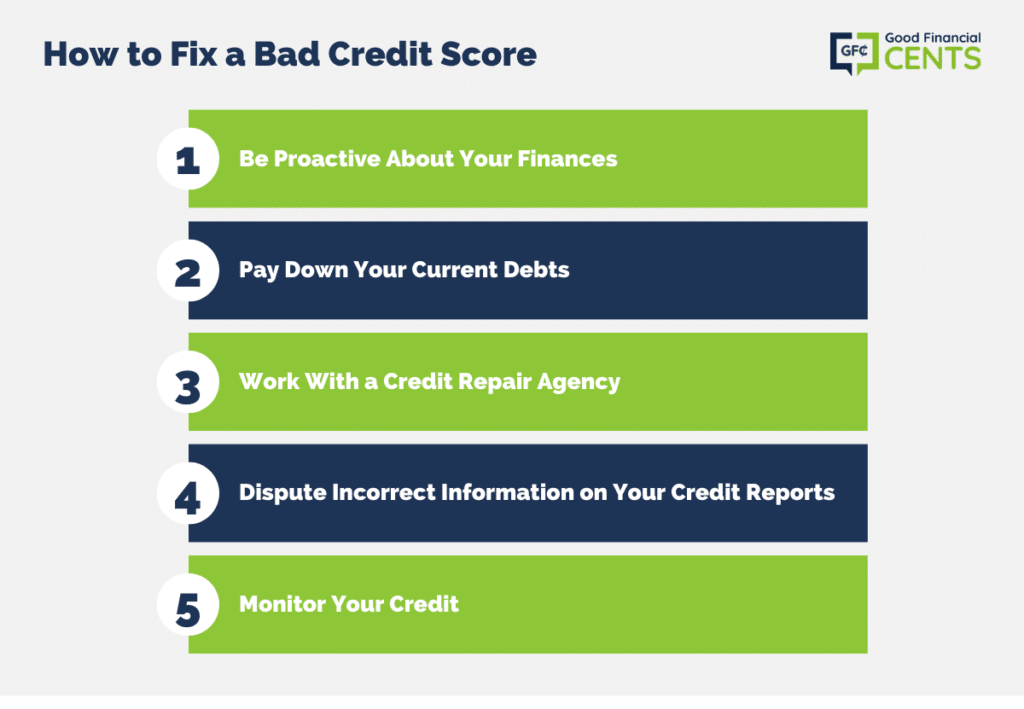

How to Fix a Bad Credit Score

If you’re wondering how to build your credit score, you should know that many different strategies can help. Most importantly, you’ll want to use any credit you have access to responsibly, which means paying all your bills early or on time with no exceptions.

Other steps you can take to repair your credit include the following:

- Be Proactive About Your Finances. If you want to improve your credit score over time, you should start by getting serious about your finances. Take the time to create a monthly budget that works, start building an emergency fund, avoid racking up too much debt, and make sure all your bills are paid early or on time.

- Pay Down Your Current Debts. If you have been wondering how to get out of debt, you should also know that paying off unsecured debts like credit card debt can help you boost your score. For the best results, experts suggest keeping your credit utilization rate below 30% of your available credit.

- Work With a Credit Repair Agency. The best credit repair agencies can help you find the biggest problems with your credit so you can fix them. They’ll also take on a ton of credit repair tasks for you, such as negotiating with your creditors and disputing incorrect information on your credit reports.

- Dispute Incorrect Information on Your Credit Reports. Also, be aware that you can and should dispute false information on your credit reports that could be harming your score. You can check your credit reports from all three credit bureaus — Experian, Equifax, and TransUnion — for free at AnnualCreditReport.com. From there, you can dispute negative items and have them removed.

- Monitor Your Credit. Make sure you keep an eye on your credit so you know if any negative information has been reported, including negative reporting that results from identity theft. Also, note that the best identity theft protection services can help you spot problems with your credit in real-time as they occur.

Consequences of Having a Bad Credit Score

If you never take steps to improve your credit score, you’ll be stuck dealing with the consequences of bad credit for a lifetime. These consequences can make life more expensive and stressful, so you should strive to avoid them if you can.

Higher Interest Rates and Loan Fees

While there are plenty of bad credit loans to choose from, online loans for people with poor credit always come with higher interest rates and loan fees. High APRs can make interest charges considerably more expensive when compared to loans for good credit, and many bad credit loans come with origination fees that can cost up to 10% of the loan amount upfront.

Fewer Loan Options in General

People with bad credit also have fewer borrowing options in general. Not only can they access only a handful of companies that offer personal loans, but they may be limited to credit cards for bad credit, too.

Higher Auto Insurance Rates

Many auto insurance companies consider your credit score when determining your auto insurance rates. Not surprisingly, your rates can come in higher than average if you have a low credit score.

Missed Career Opportunities

Federal law allows employers to request a modified version of your credit reports for hiring purposes. If you have a low credit score or troublesome information in your credit reports, you could miss out on a job you really wanted.

Difficulty Renting an Apartment

Landlords can also do a credit check before they rent you an apartment or a home, and having a low credit score will not help your cause. You may not be able to rent from some landlords at all if you have poor credit, or you may need a cosigner in order to qualify.

How We Found the Best Bad Credit Loans of 2024

To find the best bad credit loans of 2024, we searched for lenders that have a low minimum credit score requirement or no requirement at all. We also looked for lenders that offer the lowest interest rates and fees for borrowers with poor credit, as well as companies that properly disclose their fees and loan terms.

Lenders that made our ranking were also required to have a star rating of at least 4.5 out of 5 stars among their user reviews on Trustpilot. All lenders in our ranking also have a “B” rating or better from the Better Business Bureau (BBB).

Finally, we looked for companies that let borrowers get prequalified online without any impact on their credit scores. All the companies in our ranking also offer an entirely online loan process for borrowers who do not want to apply for funding in person.

Summary of the Best Bad Credit Loans of 2024

- Avant: Best Overall

- OneMain Financial: Best Customer Service

- NetCredit: Best for Low Loan Amounts

- LendingPoint: Best for Fast Funding

- Upstart: Best for Easy Approvals

- Best Egg: Best for Large Loan Amounts

Bottom Line – Best Bad Credit Loans: 6 Lenders to Get Approved

Navigating the realm of bad credit loans can be challenging, especially given the higher interest rates and fees associated with them.

Despite these obstacles, there are lenders available that offer reasonable rates and terms even for those with less-than-perfect credit.

Our research highlights six top lenders, from Avant’s comprehensive offering to Best Egg’s suitability for larger loan amounts.

Crucially, these lenders allow potential borrowers to check eligibility without impacting their credit scores.

Borrowers should prioritize improving their credit to access better terms in the future. Meanwhile, for immediate financial needs, the options listed here provide viable avenues to consider.