The Roth IRA vs. traditional IRA – they’re basically the same plan, right?

Not exactly.

While they do share some similarities, there are enough distinct differences between the two that they can just as easily qualify as completely separate and distinct retirement plans.

To clear up the confusion between the two, let’s look at where Roth IRAs and traditional IRAs are similar, and where they’re different.

Roth IRA vs. Traditional IRA – Where They Are Similar

Table of Contents

Roth IRA vs traditional IRA – they’re similar only in the most basic ways. This is what often leads to confusion between the two plans and even a lack of awareness of the very specific benefits of each.

Plan Eligibility

Virtually anyone can contribute to an IRA, Roth, or traditional. The most basic requirement is that you have earned income.

Earned income is from salary and wages, contract work, or self-employment.

Unearned income – such as interest and dividends, pensions and Social Security, capital gains, and rental income – are not eligible income sources.

Even your kids can make contributions to either a Roth or traditional IRA. Though they can’t legally own an account, an IRA can be set up as a custodial account.

The account is in the name of the minor but is technically owned and managed by a parent or guardian. Upon reaching the age of majority – 18 or 21, depending on your state – ownership of the account transfers to the minor.

Either plan is an excellent choice, particularly if you’re not covered by an employer-sponsored retirement plan. It’s also the most basic type of retirement plan, which makes it very easy to open and manage.

In the normal course, you don’t even need to file any additional tax or reporting documents with the IRS.

One minor difference between traditional and Roth IRAs used to be that you couldn’t make contributions to traditional IRAs after age 73, though you could still contribute to a Roth IRA. But that distinction was eliminated for tax years beginning in 2020 and beyond.

You can now contribute to either a traditional or Roth IRA at any age, as long as you have earned income.

With both IRAs, the IRS has announced some 2023 changes that could benefit you.

Roth and Traditional IRA Contribution Limits

The two plans have identical contribution limits.

For 2023, IRS regulations allow you to make an annual contribution of $7,000. If you’re age 50 or older, there is a “catch-up contribution” of $1,000 per year, in which case your total contribution will be $8,000 per year.

There’s a secondary contribution limit that doesn’t apply to most taxpayers. However, it could affect high-income taxpayers who are covered by an employer plan.

| Contribution Year | 49 and Under | 50 and Over (Catch Up) |

|---|---|---|

| 2023 | $7,000 | $8,000 |

| 2022 | $6,000 | $7,000 |

| 2020 | $6,000 | $7,000 |

| 2019 | $6,000 | $7,000 |

The maximum contribution to all retirement plans in 2024 is $69,000 ($76,500 including catch-up contributions).

That includes contributions to an employer-sponsored 401(k), 403(b), 457 plan, or the federal government TSP plan. It also includes contributions made to self-employment plans, such as a Solo 401(k), or a SEP or SIMPLE IRA.

The combination of your contributions – including employer matching contributions – to any of these plans, including an IRA, can’t exceed these thresholds.

Tax-Deferral of Investment Earnings

Both a Roth IRA and a traditional IRA enable your funds to accumulate investment income on a tax-deferred basis.

This is a powerful investment advantage since it enables you to invest without regard for tax consequences. It means you get the full benefit of investment earnings and the extra compounding they provide.

Even if your contributions are not tax-deductible, the investment income earned will still be tax-deferred. This is the kind of advantage that can result in a 10% return on investment in an IRA account, compared to say, 7.5% in a taxable account (assuming a 25% tax rate).

Now if you’re already familiar with how a Roth IRA works, you’re probably thinking he’s wrong, Roth IRA investment income isn’t tax-deferred, it’s tax-free – he’s wrong! That’s partially true, and we’ll get to that in a little bit

You must be at least 59 ½ years old and have been in the plan for at least five years to be able to withdraw investment earnings tax-free.

If you withdraw money sooner, investment income will be fully taxable. So yeah, Roth IRA investment income is also tax-deferred, at least during the accumulation phase.

Investment Options

This is one of the biggest advantages of IRA plans, both Roth and traditional. As the owner of an IRA account, you’re free to invest any way you like.

You can choose the trustee, which can include any of the following:

- Mutual fund companies

- Professionally managed accounts

In fact, just about anywhere that you can invest money, you can set up an IRA account.

For example, peer-to-peer lending platforms, like Prosper allow IRA accounts. You can invest in personal loans through an IRA by doing this. You can also invest in online real estate crowdfunding platforms in your IRA using companies like Fundrise.

Within many of these accounts, you also have nearly unlimited investment options. This includes stocks and bonds, mutual funds and exchange-traded funds (ETFs), futures and options, commodities, government securities, and real estate investment trusts (REITs).

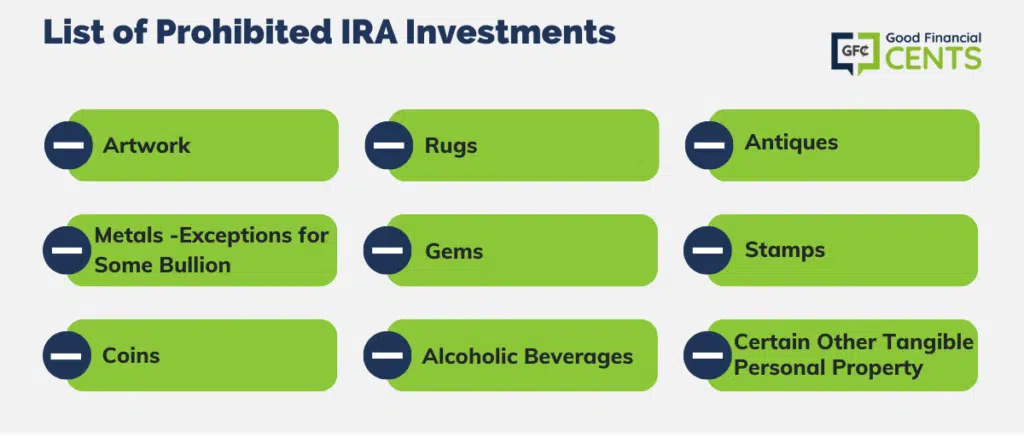

The IRS has a very short list of prohibited IRA investments. Those include:

Virtually everything else is fair game! And it makes no difference if it’s a Roth or traditional IRA.

Early Withdrawal Rules

This is where the comparison between the Roth IRA vs traditional IRA gets a bit technical.

Both plans provide for eligible withdrawals beginning at age 59 ½. If you take withdrawals sooner, they’ll be subject to ordinary income tax in the year of withdrawal, plus a 10% early withdrawal penalty tax.

| Roth IRA vs Traditional IRA difference: There’s an exception here with the Roth IRA. Income tax and the penalty will only apply to the amount of investment earnings withdrawn before turning 59 ½. The contributions themselves will not be taxable, nor will they be subject to a penalty. |

There are exceptions to the early withdrawal penalty, but not ordinary income tax.

Even if an early withdrawal qualifies for an exception, you will still have to pay ordinary income tax on the amount of the withdrawal. Only the penalty is waived.

The IRS has a list of exceptions to the early withdrawal penalty. Two of the more common exceptions are qualified education expenses and up to $10,000 toward a first-time home purchase.

Roth IRA vs. Traditional IRA – Where They Are Different

So far, we’ve covered how the Roth IRA and traditional IRA are similar. Now let’s move on to where they’re different. And in many cases – very different!

Tax Deductibility of Contributions

We don’t need to spend a lot of time on this one. The difference here is simple:

- Contributions to a traditional IRA are usually deductible.

- Contributions to a Roth IRA are never deductible.

The one wrinkle in a simple formula is the word usually with the traditional IRA.

Contributions are fully deductible if neither you nor your spouse are covered by an employer-sponsored retirement plan. But if one or both are, then the contributions are either non-deductible or only partially deductible.

This leads nicely into the next difference…

Income Limits for IRA Contributions

The IRS has income limits, beyond which you’re not eligible to make a Roth IRA contribution at all.

The income limits for 2023 for Roth IRA contributions are as follows, and based on adjusted gross income (AGI):

- Married filing jointly, permitted to $230,000, phased out to $240,000, then no contribution permitted.

- Married filing separately, phased out to $10,000, then no contribution permitted.

- Single, head of household, or married filing separately and you did not live with your spouse at any time during the year, permitted to $146,000, phased out to $161,000, then no contribution permitted.

The income limits for traditional IRAs are loosely similar but work very differently. There are two sets of income limits.

The first applies if you’re covered by a retirement plan at work. It’s based on modified adjusted gross income or MAGI. It looks like this for 2024:

- Single or head of household, fully deductible up to $77,000, partially deductible to $87,000, then no deduction permitted.

- Married filing jointly or qualifying widower, fully deductible up to $123,000, partially deductible to $143,000, then no deduction permitted.

- Married filing separately, partially deductible up to $10,000, then no deduction permitted.

There’s a second set of income limits, also based on MAGI, if you’re not covered by an employer plan, but your spouse is:

- Married filing jointly, fully deductible up to $230,000, phased out up to $240,000, then no deduction permitted.

- Married filing separately, a partial deduction up to $10,000, then no deduction permitted.

If you exceed the income limits, you can still make a non-deductible traditional IRA contribution.

Income Limits for Roth IRAs

Roth IRAs have a different set of income limitations. They are as follows for 2024:

- Married filing jointly, fully deductible up to $230,000, partially deductible up to $240,000, then no deduction permitted.

- Married filing separately, fully deductible up to $10,000, then no deduction permitted.

- Single or head of household, fully deductible up to $146,000, partially deductible up to $161,000, then no deduction permitted.

One of the major differences between traditional and Roth IRAs is that once you reach the income threshold for a Roth IRA, no contribution is permitted at all.

No contribution is permitted for a Roth IRA if you exceed the income limits.

Taxability of Non-deductible Contributions

Roth IRA contributions are not tax-deductible, so withdrawals are not taxable. This works neatly within IRS ordering rules.

This applies specifically to Roth IRAs, and it enables you to make withdrawals based on the following priority:

- IRA participant contributions

- Taxable conversions

- Non-taxable conversions

- Investment earnings

This means the first withdrawals made from a Roth IRA are considered contributions and are therefore not taxable upon withdrawal.

It works like this…

You have $50,000 in a Roth IRA account. $30,000 are your contributions. The remaining $20,000 is accumulated investment earnings. You need to withdraw $15,000, and you’re under 59 ½.

Under IRS ordering rules, there will be no tax or penalties on the withdrawal, since the amount withdrawn is less than the $30,000 in plan contributions.

The withdrawal amount is considered to be a return of your contributions – and not tax deductible when made – and not subject to tax.

This arrangement is unique to the Roth IRA. No other retirement plan withdrawals, including traditional IRAs, have the same arrangement.

If you have a traditional IRA that includes non-deductible contributions, you can withdraw those funds without paying income tax on the distribution. However, the withdrawal will be subject to IRS Pro pro-rata rules.

It works like this…

You have $50,000 in a traditional IRA. It includes $30,000 in contributions, of which $5,000 were made with non-deductible funds. (The balance is tax-deferred investment income.). You withdraw $5,000 from your plan.

That means that out of the $5,000 you withdraw, $500 (10% of $5,000) will not be subject to tax. The remaining $4,500 will be fully taxable.

Taxability of Withdrawals

Here’s where we get to the part about Roth IRAs that everybody loves best, including me!

Withdrawals taken from a Roth IRA are completely tax-free, as long as you’re at least 59 ½, and have been in the plan for at least five years. This is the tax-free magic of the Roth IRA and its biggest single advantage.

The situation is very different with traditional IRA withdrawals, which are fully tax-deferred, but not tax-free.

The only exception is the withdrawal of non-deductible contributions, which are subject to the IRS pro-rata rules discussed above. Everything else – your tax-deductible contributions, and your accumulated investment earnings – are fully taxable upon withdrawal.

To give the simplest example possible, if you’re 59 ½, and have had a Roth IRA account for at least five years, you can withdraw $20,000 from the plan, and not have to pay a penny in income tax.

Under the same scenario, if you withdraw $20,000 from a traditional IRA, the entire amount must be included in your taxable income for the year of withdrawal (except the pro rata percentage made up of non-deductible contributions).

For most people, especially those with mature IRAs, that will be incredibly small.

Required Minimum Distribution (RMD) Rules – Definitely Different

This is another fairly simple topic in the Roth IRA vs traditional IRA analysis.

Required minimum distributions (RMDs) are a technique by which the IRS forces tax-deferred retirement money out of your plan, and onto your income tax return.

They are mandatory on all retirement accounts, including traditional IRAs, beginning when you turn 73.

Except for the Roth IRA.

Because distributions from a Roth IRA are not taxable, they are not subject to RMDs. This is a big advantage because it allows you to continue accumulating money in the plan, virtually throughout your life.

You may do this either to keep yourself from outliving your money or to leave a larger estate for your children.

Another Big Advantage:

RMDs are based on your remaining life expectancy at each age. Roughly speaking, about 4% of your retirement plans will need to be distributed when you turn 73.

The percentage will increase slightly each subsequent year, due to the fact that your life expectancy will be reduced going forward.

This is a consideration with traditional IRAs, but not with a Roth IRA.

Key Differences Between Traditional IRAs vs. Roth IRAs

| Traditional IRA | Roth IRA |

|---|---|

| Contributions are tax-deductible | Contributions are NOT tax-deductible |

| Require mandatory distributions at age 73 | Do not require mandatory distributions at age 73 |

| Withdrawals are taxed as ordinary income | Withdrawals are generally tax-free |

| Contributions must stop when an individual reaches age 73 | No such requirement |

Rollovers and Conversions

You can move funds into or out of Roth or traditional IRAs. For example, you can move funds from a 401(k) to either a traditional or Roth IRA.

With a traditional IRA, this is a rollover.

Generally speaking, it’s a transfer of funds between two retirement accounts that have equal tax treatment.

Funds moved from a 401(k) to a traditional IRA is a transfer between two tax-deferred accounts. The transfer can take place without tax consequences, which is why it’s a rollover.

You can similarly do a rollover from one Roth IRA account to another. But if you’re moving money from any other retirement plan, it’s a transfer of funds from plans that have unequal tax treatment.

Except in the case of a Roth 401(k), Roth 403(b), or Roth 457, you’re moving funds from a tax-deferred plan, to what will ultimately be a tax-free plan.

This has tax consequences.

Roth IRA Conversion Example

Moving funds from a traditional IRA or a 401(k) plan to a Roth IRA is referred to as a conversion because the rollover involves converting the funds from tax-deferred to tax-free.

In order to make the transfer, the funds coming out of a tax-deferred plan will be subject to ordinary income tax in the year of conversion.

Let’s say you move $100,000 from a 401(k) plan into a Roth IRA. The 401(k) is entirely tax-deductible contributions and accumulated investment earnings.

If you move the entire balance to the Roth IRA in the same year, then you will have to include $100,000 in your taxable income. If you’re in the 25% tax bracket, this will result in a federal income tax of $25,000.

Once the funds have been converted, and the taxes paid, it will be a Roth IRA. Once you’re in the plan for at least five years, and at least 59 ½, you can begin taking tax-free withdrawals.

That last sentence describes why Roth IRA conversions are so popular, despite the immediate tax consequences.

You’re exchanging a tax liability now, for tax-free income in retirement. It’s what makes Roth IRAs perhaps the best retirement plan available.

Final Thoughts on the Roth IRA vs. Traditional IRA

So there you have it, two plans with similar names, but very little else in common.

Generally speaking, traditional IRAs are preferred if you’re currently in a high tax bracket, and expect to be in a much lower one in retirement. You’re getting the benefit of tax deferral at a high tax rate now, in exchange for a lower rate on distributions in retirement.

The Roth IRA is preferred if you don’t expect your tax bracket in retirement to be much lower than it is right now. You’re giving up tax deductibility now, in exchange for a tax-free income later.

Both plans have their virtues, but I’ll bet on the Roth IRA in most cases! If you’re looking for an account where you can open a Roth IRA, check out our guide on the best places to open a Roth IRA.

Thanks for the great read. As someone who started IRA’s back in the 80’s for myself and spouse it looked like 13% interest growth was a great addition to my future military retirement. Let the appearance of ROTH go too much un-noticed. Never thought about future taxes on required withdrawals including growth. After so many years gains are way beyond contributions. At this point making an effort to convert some each year to ROTH. Hopefully, I will be able to erase that horrible IRA. Advantage is mostly for future for spouse and eventually the children. Having to be careful with conversion creating income problems like Medicare surcharges. “Gotta have a plan.”

Thanks again.

r/

Bob