With all the concern these days about the Roth IRA, traditional IRAs may be in danger of getting lost. But for many of the same reasons that a Roth IRA is so important, traditional IRAs continue to be valuable.

I admit it – I’m a big fan of the Roth IRA. I think everyone should have one. But there are times when a traditional IRA gets the job done.

It can be the better choice of the two if you’re currently a high tax bracket but expect to be in a much lower one when you retire. The tax savings from the current deduction can easily outweigh a lower level of tax savings in the retirement years.

So let’s give equal time to the traditional IRA. Below is everything you need to know about the traditional IRA rules, and how to best take advantage of the plan.

Table of Contents

- What Is a Traditional IRA?

- Traditional IRA Plan Eligibility

- Traditional IRA vs Roth IRA – Which One?

- Traditional IRA Plan Variations

- Traditional IRA Contribution Limits

- Tax Deductibility of Traditional IRA Contributions

- Tax-Deferral of Investment Earnings

- Traditional IRA Investment Options

- Best Places to Open (or Rollover) a Traditional IRA – Our Recommendations

- Taxability of IRA Withdrawals at Retirement

- Traditional IRA Early Withdrawal Rules

- Required Minimum Distribution (RMD) Rules

- Traditional IRA Rollovers

- Final Thoughts on Traditional IRA Rules and Limits

- FAQs on Traditional IRA Rules

What Is a Traditional IRA?

A traditional IRA (Individual Retirement Account) is a type of investment account that allows individuals to save for retirement on a tax-deferred basis. This means that contributions to the account may be tax-deductible and that any investment gains within the account will not be taxed until the funds are withdrawn in retirement.

It is one of the two main types of IRAs, the other being Roth IRA (more on it in a bit), which is a post-tax savings account.

Traditional IRA contributions are usually tax-deductible, and the account holder pays taxes on the money only when they withdraw it in retirement.

Traditional IRA Plan Eligibility

One of the biggest advantages with a traditional IRA is that almost anyone can set one up and contribute to it. The only requirement is that you must have earned income to be eligible. That’s income from salary, wages, self-employment or contract work.

Unfortunately, you can’t make contributions out of unearned income, like investment income, pensions or Social Security.

A traditional IRA is an excellent choice if you have a job and you’re not covered by an employer-sponsored plan at work. You can contribute every year, and deduct it from your income for tax purposes.

One of the biggest advantages with a traditional IRA is that it doesn’t require you to file any additional forms with the IRS. You can just show your deduction on page 1 of your federal 1040.

Now if you’re self-employed, there are other plans that will enable you to make much larger contributions. For example, you can contribute up to $69,000 per year to self-employment plans, such as a Solo 401(k) or a SEP IRA. There’s even the SIMPLE IRA that allows you to contribute up to $16,000 per year (or $19,500 if you are 50 or older with a $3,500 catch-up contribution).

Any one of these plans would be more appropriate if you’re self-employed. But a traditional IRA can be a good starter plan until that happens.

Traditional IRA vs Roth IRA – Which One?

A Traditional IRA and a Roth IRA are both types of individual retirement accounts (IRAs) that offer different tax benefits. The main difference between the two is when you pay taxes on the money you contribute and earn in the account.

Traditional IRA contributions are tax-deductible in the year they are made and the money grows tax-deferred.

This means you don’t pay taxes on the money until you withdraw it in retirement.

However, there are income limits on who can claim the tax deductions.

On the other hand, Roth IRA contributions are made with after-tax dollars, meaning you pay taxes on the money before you contribute it. The money in the account grows tax-free and withdrawals in retirement are also tax-free.

Another key difference is the age at which you can start taking money out without penalty. With Traditional IRA, you must wait until age 59.5 to make penalty-free withdrawals, and with Roth IRA, there are no age restrictions.

Which you choose will depend on your income and retirement goals. You can read our Roth IRA vs Traditional IRA resource to help you choose.

Traditional IRA Plan Variations

You can even set up a traditional IRA for members of your household. There are two special IRA variations allowing you to do this:

Spousal IRA

You can create and fund an IRA for your spouse, even if he or she isn’t employed outside the household.

Plan contributions must still come from earned income, but it can be your earned income as the source. It’s an excellent way for a non-working spouse to also have a tax-sheltered retirement plan.

For example, let’s say that you make an IRA contribution each year up to the maximum amount allowed – $6,500. You can also make a contribution on behalf of your spouse for up to the same amount. The only requirement is that you have sufficient earned income to fund both contributions.

In this case, you could make the maximum contribution for both you and your spouse as long as your earned income is at least $13,000 per year.

Custodial IRAs for Minors

Few people are aware of this type of IRA, but it opens the possibility of setting up an account for your minor children. The same rules apply to minors as they do to adults.

They can contribute to an IRA as long as they have earned income. And since so many teenagers have earned income, there are eligible to set up a custodial IRA.

It works similarly to any other type of custodial account. It’s set up in the name of the parent or guardian, who owns the account and manages it. But once the minor reaches the age of majority in their state – which is either 18 or 21 – the account reverts to the minor.

Traditional IRA Contribution Limits

The maximum contribution to a traditional IRA for 2024 is $7,000 per year. If you’re age 50 or older, there’s a “catch-up contribution” of $1,000 per year. Your total contribution will be $8,000 per year. These are the limits that also pertain to both the spousal IRA and the custodial IRA for your children.

There’s an important secondary contribution limit that may apply to people who have a very generous employer-sponsored retirement plan, or even multiple plans.

It’s particularly relevant for high-income taxpayers, who make larger than average retirement contributions.

The maximum contribution to all retirement plans is $69,000 for 2024, or $76,500 if you’re 50 or older, a $1,000 increase from 2022.

If you add up your contributions to all retirement plans, the total contributions – including employer matching contributions – cannot exceed $69,000. That includes 401(k), 403(b), 457, TSP, Solo 401(k), and SEP and SIMPLE IRAs. If your contributions to one or more of these plans exceeds the limits, you will not be eligible to contribute to a traditional IRA.

It’s possible that you will be eligible for a partial IRA contribution.

For example, if you are under 50, and you and your employer have contributed a total of $59,000 to other retirement plans, you will still be eligible to contribute up to $7,000 to a traditional IRA. That’s just below the maximum contribution of $69,000

| Traditional IRA Contribution Limits | Contribution Year |

| $7,000 | 2024 |

| $6,500 | 2023 |

| $6,000 | 2022 |

| $6,000 | 2021 |

| $6,000 | 2019 |

| $5,500 | 2018 |

| $5,500 | 2017 |

| $5,500 | 2016 |

| $5,500 | 2015 |

Tax Deductibility of Traditional IRA Contributions

Contributions to a traditional IRA are tax-deductible if you’re not covered by an employer-sponsored plan.

If you are, they may still be deductible, but it will be determined by your income level. Those income level limits also affect whether or not a spousal IRA will be tax-deductible.

There are two sets of income limits. The first applies if you are covered by a retirement plan at work. It’s based on modified adjusted gross income, or MAGI. It looks like this for 2024:

- Single or Head of Household: Fully deductible up to $146,000, partially deductible to $161,000, then no deduction permitted.

- Married Filing Jointly or Qualifying Widower: Fully deductible up to $230,000, partially deductible to $240,000, then no deduction permitted.

- Married Filing Separately: Partially deductible up to $10,000, then no deduction permitted.

The second set of income limits announced for 2024 is also based on MAGI. It applies if YOU are not covered by an employer plan, but your spouse is:

- Married Filing Jointly: fully deductible up to $230,000, phased out up to $240,000, then no deduction permitted.

- Married Filing Separately: Partial deduction up to $10,000, then no deduction permitted.

IMPORTANT: Even if you exceed the income limits, you can still make a non-deductible traditional IRA contribution. It just won’t be tax-deductible.

Here’s why…

Tax-Deferral of Investment Earnings

Hands down, this is the single biggest benefit of an IRA.

Obviously, it’s better if your contributions are also tax-deductible. But even if they aren’t, the tax deferral on investment earnings makes contributing to a traditional IRA worth doing. You get the benefit of accumulating investment income, without having to worry about some of it being reduced by income taxes each year.

That’s no small advantage. If you’re in the 25% tax bracket, a 10% rate of return on investment can be reduced to effectively 7.5% if you invest through a taxable account. A traditional IRA gives you the benefit of the full 10% annual return.

How much of a difference can that make?

Let’s take a simple example. Continuing with the numbers from above, if you invest $10,000 in a taxable account with a net annual return of 7.5%, after 30 years your investment will grow to $87,549.

But if you invest $10,000 in a traditional IRA with a net annual return of 10%, after 30 years your investment will grow to $174,491.

From this simple example, you can see how having the benefit of tax deferral on your investment earnings virtually doubles the value of your account after 30 years. You haven’t done anything extra or special, either. The entire benefit of the increased account value is due solely to tax deferral.

This is why it’s worth contributing to a traditional IRA, even if your contribution isn’t tax-deductible in the year that you make it.

Traditional IRA Investment Options

A traditional IRA is simultaneously the simplest retirement plan to have, but usually provides the largest number of investment options. They’re typically held in self-directed accounts, where you choose not only the trustee who holds the account, but also the investments that you make in it.

You’re also free to manage the account. You can buy investments for the long-term, or be an active trader. It’s completely up to you.

A traditional IRA can be held at just about any financial institution that offers them, and most do. Examples include:

- Banks

- Online Investment Brokers

- Mutual Fund Companies

- Investing Apps

- Professionally Managed Accounts

- Robo-advisors

- Peer-to-Peer Lending Platforms

- Real-Estate Crowdfunding Platforms

If you choose an investment broker, or even a professionally managed account, you’ll generally have almost unlimited investment options.

You can choose to invest in stocks, bonds, mutual funds, exchange traded funds (ETFs), futures and options, commodities, government securities and real estate investment trusts (REITs).

Other investment platforms will have a more limited selection. But you’ll choose those platform specifically because you’re interested in the options they offer.

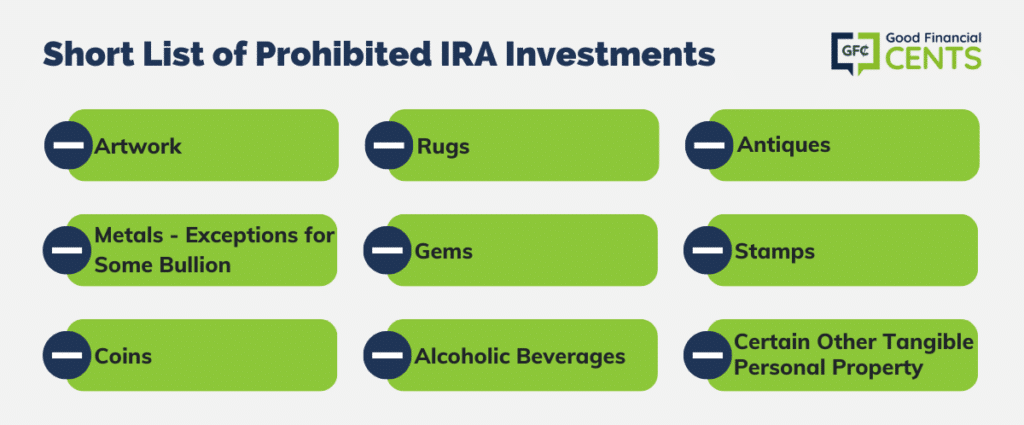

The IRS has a very short list of prohibited IRA investments. Those include:

- Artwork

- Rugs

- Antiques

- Metals – With Exceptions for Certain Kinds of Bullion

- Gems

- Stamps

- Coins – (But There Are Exceptions for Certain Coins)

- Alcoholic Beverages

- Certain Other Tangible Personal Property

Basically, any investments that are not included on the list above are potential options for your traditional IRA.

Best Places to Open (or Rollover) a Traditional IRA – Our Recommendations

Below are six IRA trustees that we highly recommend for your IRA account. We believe them to be the best in their fields – diversified investment brokers, robo-advisors, and peer-to-peer lending.

Any of the six are excellent platforms to either open traditional IRA, or to do a rollover of another retirement plan into an IRA. There’s no special order, it all depends on your own preference.

- E*TRADE DIY diversified investment broker

- Prosper, peer-to-peer lending

Taxability of IRA Withdrawals at Retirement

When people invest in retirement plans, including traditional IRAs, they sometimes confuse tax-free and tax-deferred. Except for Roth-type plans, virtually every other tax-sheltered retirement plan is tax-deferred.

That includes traditional IRAs.

Tax-Deferred Means That Taxes Will Be Paid at Some Point During the Process

Tax deferral takes place primarily during the accumulation phase. Your contributions are (usually) tax-deductible, and the investment income accumulates on a tax-deferred basis.

All of that tax deductibility and deferral comes due when you reach retirement, and begin taking withdrawals. We can sum it up by saying this: tax-deferred going in, taxable going out.

And so it is with traditional IRAs. You get the tax benefits prior to retirement. You’re eligible to begin making withdrawals from your account beginning at age 59 ½. As you take withdrawals, they’re added to your taxable income, and taxed at whatever your marginal income tax rate is at the time.

Under a perfect scenario, you’re getting the benefit tax deferral at a higher tax rate than what you’ll be paying on the withdrawals in retirement.

For example, during your working years, you may be getting the benefit of tax deferral with a 25% tax bracket. In retirement, you may be making withdrawals at a 10% tax rate.

Meanwhile, any funds remaining in your IRA continue to accumulate investment earnings on a tax-deferred basis.

Traditional IRA Early Withdrawal Rules

I just said that you’re eligible to begin making withdrawals from a traditional IRA beginning at age 59 ½. You can take withdrawals sooner, but they’re considered early withdrawals.

They’re subject to ordinary income tax, just as they would be if you took them after turning 59 ½. But they’re also subject to an early withdrawal penalty of 10%.

If you’re in the 25% tax bracket, and you make a withdrawal before turning 59 ½, your net federal tax rate will be 35%, when the penalty is included. A $10,000 early withdrawal will result in cash proceeds of just $6,500.

The balance will go to pay federal income tax on the withdrawal. And most likely, there will also be state income tax to pay.

There are a few exceptions to the early withdrawal penalty (but not ordinary income tax – you’ll still have to pay that). The IRS has a list of exceptions to the early withdrawal penalty. Two of the more common exceptions are qualified education expenses, and up to $10,000 toward a first-time home purchase.

Taxability of Non-deductible Traditional IRA Contributions

There may be situations where you will make non-deductible contributions to a traditional IRA. That will most likely happen if you’re covered by an employer plan, and you exceed IRS income limits to make a tax-deductible contribution, as we discussed earlier.

Since the Contributions Won’t Be Tax-Deductible When Made, They Will Not Be Subject to Income Tax When Withdrawn.

But it’s not exactly that simple. Your withdrawals will be subject to IRS Pro pro-rata rules, and they’re pretty complicated.

Basically, you’ll be able to withdraw your non-deductible contributions tax-free, but not all at once. The pro rata rules will require that the non-deductible portion is effectively spread out across all future withdrawals made.

Here’s how it works:

You have $100,000 in a traditional IRA. It includes $55,000 in contributions, of which $10,000 were made with non-deductible funds. The remaining $45,000 is tax-deferred investment income. You withdraw $10,000 from your plan.

Under the Pro-rata Rules, 90% Is Subject to Tax and Penalty

That’s because the $10,000 in non-deductible contributions represents 10% of your total IRA account value. That means only 10% of your withdrawal – any withdrawal, regardless of when taken – is a non-deductible contribution.

The remaining 90% is fully taxable. Of the $10,000 you withdraw, only 10% – or just $1,000 – won’t be subject to ordinary income tax. The remaining $9,000 will be taxable.

The moral of the story? Non-deductible contributions to a traditional IRA will help on withdrawal, but not as much as we’d like to believe.

Required Minimum Distribution (RMD) Rules

Like virtually all retirement plans (except the Roth IRA), traditional IRAs are subject to required minimum distributions (RMDs).

These are a technique in which the IRS forces tax-deferred retirement money out of tax-sheltered retirement plans, and onto your income tax return where they’re subject to ordinary income tax.

RMDs begin when you turn 73. They’re based on your remaining life expectancy at each age. Your first RMD, issued in the year that you turn 73, will be about 4% of your plan value.

The percentage will increase slightly each subsequent year as your life expectancy will be reduced a little bit each year.

You Don’t Need to Concern Yourself With Calculating the Amount of the RMD Each Year

The trustee of each plan will begin making the distributions as required by law. You can even opt to have income tax withheld from your distributions, similar to the way that you do with your paychecks now.

It’s also worth mentioning that while IRA distributions are subject to federal income tax, they’re not subject to the FICA tax. However, they will be subject to state income tax, if you live in a state that has one.

Traditional IRA Rollovers

One of the basic functions of a traditional IRA is that it serves as a destination for a number of different retirement plans. That is, to roll over the balance from just about any other type of retirement plan into a traditional IRA.

This includes both employer-sponsored retirement plans and other traditional IRAs.

This often happens when you either decide that you have too many retirement plans, or you leave an employer and need somewhere to move the employer plan to. A traditional IRA is usually a preferred destination, since there are no tax consequences to the rollover.

In addition, you’re often moving an employer plan over to a self-directed IRA. Your investment options expand immediately.

There’s one wrinkle when it comes to doing a rollover of one traditional IRA to another. Under IRS regulations, you can do only one rollover from one traditional IRA to another in a 12-month period. That is, when you rollover an IRA once, you can’t rollover the same IRA for at least 12 months (but you can rollover other IRAs, if you have them).

There two types of IRA rollovers to be aware of, direct and indirect.

Direct Rollover, or Trustee-To-Trustee Transfer

It’s where the funds from one retirement account are transferred directly into your IRA. You never take possession of the funds.

Indirect Rollover

This is where the funds from one retirement plan are distributed to you, and you transfer them into a traditional IRA at a later date.

Under IRS regulations, you have 60 days from the receipt of the funds to complete the rollover. You’ll then have to pay ordinary income tax on the amount of the distribution. If you’re under 59 ½, you may also have to pay the 10% early withdrawal penalty.

It’s always best to do a direct rollover. That avoids any potential tax consequences.

Final Thoughts on Traditional IRA Rules and Limits

A traditional IRA is the simplest type of retirement plan. It’s an excellent one to have if you’re not covered by an employer plan. It can even be preferred to the Roth IRA, if you’re in a high tax bracket now, and expect to be in a much lower one in retirement.

If nothing else, a traditional IRA can be a destination account for any other retirement plans you have, and want to move into a single plan.

FAQs on Traditional IRA Rules

A traditional IRA (Individual Retirement Account) is a type of investment account that allows individuals to save for retirement on a tax-deferred basis. This means that contributions to the account may be tax-deductible and that any investment gains within the account will not be taxed until the funds are withdrawn in retirement.

Anyone with an earned income and their spouses, if married and filing jointly, can contribute to a Traditional IRA. There is no age limit.

Yes, there are penalties for withdrawing funds from a traditional IRA before reaching age 59.5. These withdrawals are subject to a 10% early withdrawal penalty in addition to any applicable income taxes.

You can open a traditional IRA account through a financial institution such as a bank, credit union, or investment firm. You will need to provide personal information and choose how you want to fund the account (such as through a rollover or direct deposit).