Imagine if what you know now, you knew way back in high school. How much better off would you be? When I was in high school, I didn’t learn anything about money, budgeting, or investing.

While I’m a financial planner now, I didn’t learn most financial basics until my junior year of college.

What’s crazy is I did take a financial basics course at one point. Unfortunately, it wasn’t even remotely helpful.

The course took place during my senior year of high school, and they called it “home economics.” While I can’t tell you a thing I learned during that class, I can tell you what I didn’t learn.

I didn’t learn about investing, credit scores, calculating interest on debt, or the magic of compounding interest.

That’s right; I sat through a year of classes, yet I didn’t learn a single money skill that could apply to my life.

While I want to believe more money skills are being taught in schools than what I experienced back in the day (er, not too long ago), what I’m hearing from parents is that not much has changed.

While some schools offer a home economics class or something similar, they’re still failing to impart a basic financial education that I believe is necessary for a successful, financially stable life outside of school.

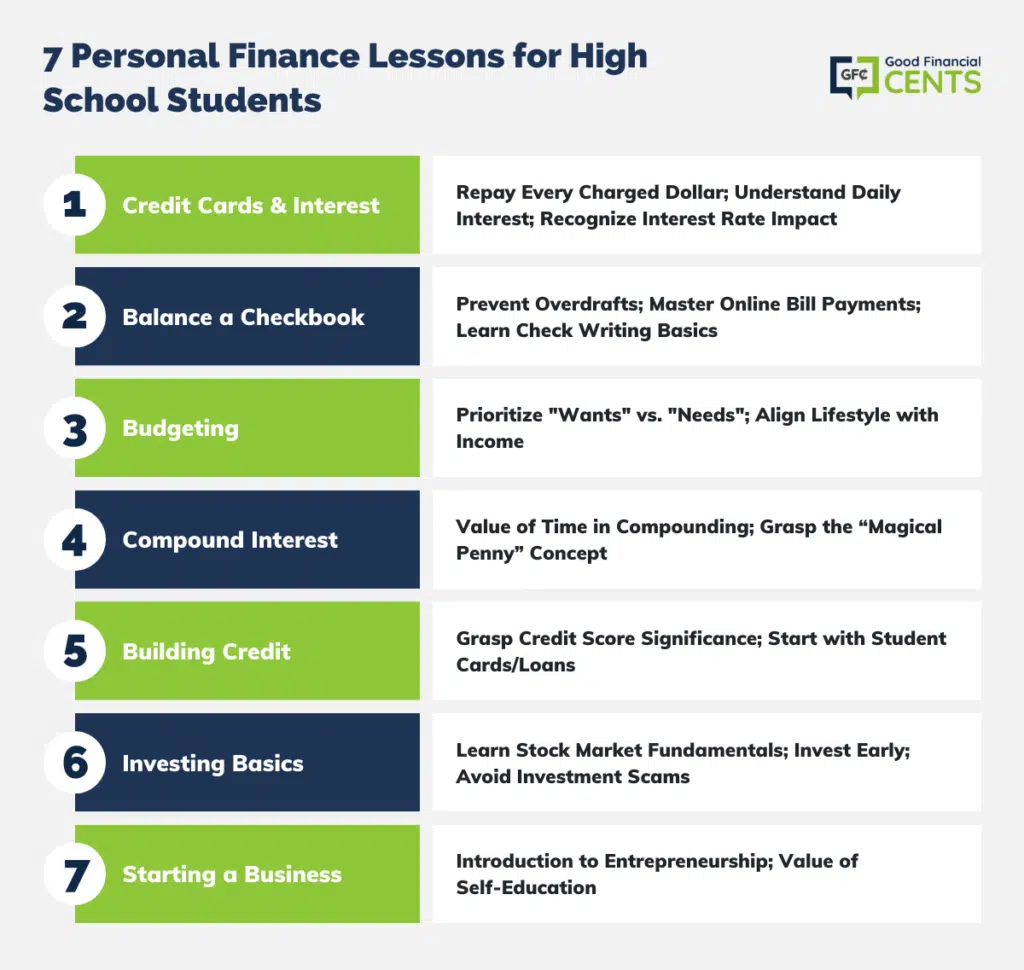

Here’s a look at some of the essentials I wish I would have learned in high school and I think should be taught today:

#1: How Credit Cards and Interest Rates Work

Since you can normally get your own credit card at around 18 years old, it seems like common sense to teach high school students about the intricacies of credit. As a financial advisor, I’ve seen far too many young people run up huge credit card balances early when they don’t have a good understanding of how credit works.

Heck, I was once one of them! By the time I was in my early twenties, I had $20,000 in credit card debt. Fortunately, I learned more about credit as I aged and worked diligently to become a financial advisor.

These days, I use credit regularly as a financial tool for things I know I can pay off quickly without incurring debt and interest.

If we taught high school students a few basic lessons about credit cards and interest rates, we could potentially save many students from a lifetime of financial stress.

Credit can be a useful tool when you’re paying it back every month. However, interest on credit can work against you when you carry a heavy balance.

The credit lessons we teach don’t need to be overly complex, either. At the very least, young people need to understand that

- You have to pay back every dollar you charge

- Credit card interest accrues daily when you carry a balance

- Your interest rate can play a huge role in your monthly bill if you aren’t paying your charges completely off each month

Lastly, high school students should understand that it’s not a good idea to use credit to buy things they can’t afford. Instead, they should save for what they want and aim to use credit only when it serves their interests. Young adults can use credit wisely to meet goals and build up a healthy credit profile, but it’s key to ensure that when you use credit, you can pay it back.

Understanding responsible use of credit from the moment a teen gets their first credit card can go a long way to building a solid financial future.

While it’s smarter to avoid debt in the first place, young people should be educated on the many tools they can use to rebound if they fall behind with their bills.

#2: How to Balance a Checkbook

While the days of writing checks for most bills are clearly over, young people still should learn how to balance a checkbook. Even if they stick to debit and credit, they could really benefit from learning how to manage their cash flow and outflow to avoid overdraft fees.

I learned this the hard way when I bounced three checks when I was 19 years old. Ouch! It was the first time I was introduced to “overdraft charges,” and it wasn’t pleasant.

A lesson on online bill pay services might also help students who lean on technology to manage their money. And yes, students still need to learn check-writing basics, such as how to fill checks out – at least for now. Sometimes, people still need to write a check, believe it or not.

#3: Budgeting Basics

Budgeting is one of the most important skills anyone can learn, yet you’ll barely hear a peep about it while you’re in school. Unfortunately, not learning about budgeting can leave you at a disadvantage once you graduate high school and move out on your own.

Without any knowledge of how to manage bills and separate “wants” from “needs,” many people may spend their lives enduring one financial hardship after another.

At the very least, I think high school students should learn how to plan a lifestyle that actually jives with the income they earn. That may include knowing how to plan for – and pay – bills like rent, utilities, insurance, and car payments while making sure there is money left for groceries, savings, etc.

Here’s the thing: I actually hate budgeting. I know it’s necessary, but I don’t like tracking every penny we spend.

What we do instead is what I like to call “tactical budgeting” – as in, we sit down to create a financial plan any time a major life event is coming our way. This type of budgeting doesn’t require you to watch every penny, but it can help you achieve your goals and spend less over time.

Bottom line:

#4: The Power of Compound Interest

While young people may not reach their income potential for years, they have one major advantage over the rest of us when it comes to investing – time. With time on their side, they can take advantage of the full potential of opening and adding to a savings account to tap into the power of compound interest.

By putting even small sums of money in a high-interest savings account while they’re young, high school students, graduates, and college students can start building wealth that will compound over and over again.

Here’s an awesome example:

A few weeks ago, I spoke about investing at my alma mater. To show the crowd the power of compound interest, I introduced the “magical penny concept.”

I asked the crowd one simple question:

Not surprisingly, more than half of the class said they would rather have the cash. Of course!

The thing is, the magical penny would actually leave them much better off. Due to the magic of compound interest, a penny that doubles in value every day would be worth more than $10 million after only a month!

We need students to not only understand the power of compounding but to know how to take advantage when they can.

#5: How to Build Credit

Your credit score is an important part of your overall financial health, and it can make a huge difference in how you manage your finances as an adult. With good credit on your side, it’s a lot easier to buy a house or qualify for an apartment. With bad credit (or no credit), on the other hand, most of life’s biggest milestones can be harder to reach.

Students need to know why credit is important, but also how to build credit while they’re young. Most of the time, getting a basic student credit card or student loan, for example, can provide an introduction to building credit for students who need to get started.

But that doesn’t mean building credit is easy. Sometimes, it’s difficult for young people to get approved for a credit card or any type of loan.

My old intern, Kevin, found himself in this exact scenario several years ago. Kevin listened to his parents and avoided credit cards altogether. But, when Kevin decided to start his adult life on solid financial footing and buy a house and his own car, his credit wasn’t established enough to get approved for the loans he needed to purchase these things.

Fortunately, Kevin stumbled onto the idea of signing up for a secured credit card. With a secured credit card, he had to put down a cash deposit equal to his credit limit. But, once he started using his card regularly, he was able to boost his credit score by an amazing 100 points within six months!

How did he do it?

While secured credit cards require a cash deposit to get started, they do report all of your credit movements to the three credit reporting agencies – Experian, Equifax, and TransUnion. Over time, Kevin’s responsible credit use let him build his credit from scratch and help him accomplish his goals of buying a house and car!

#6: Investing and Stock Market Basics

As a financial planner, I meet with many full-fledged adults who don’t know the first thing about the stock market or investing in general. While we can’t do anything about that now, we can help young people start their own lives with a basic understanding of how investing works.

While we probably want to avoid overwhelming students with too many details, I recommend that we introduce them to investing concepts they can rely on as they get older. They need to understand what the stock market is and how investors make (and lose) money. And yes, I think they need to understand how investing could make them rich.

Here’s an awesome example:

Earlier this year, I showed a 16-year-old how to turn $500 into $520,367. While he thought I was crazy at first, he got it once I showed him how investing worked.

Basically, I used historical data to show him how even a crappy, $500-valued, front-loaded mutual fund purchased in 1970 could grow to $68,684 with average earning returns and then eventually total $520,367.

That’s pretty good, right?

The thing is, this $68,684 figure could grow even more if he added just a nominal amount of money every month. If he invested $25 extra to this fund every month (or $300 per year), then the total investment would surge to that sweet $520,367 over roughly the same timeline.

It would be a shame for young people to miss out on building wealth with stocks, especially since you don’t need to invest a lot of money if you start early enough.

On the other hand, it’s important for students to know the difference between safe investing and investing scams. While investing with a reputable company like Vanguard or Fidelity can be smart, young people need to know to choose reputable firms when investing their money. It pays to research any company you plan to invest with, read reviews, and make sure you know what you’re getting into.

I’d also say that it’s important for students to know how much risk they are willing to take with their money. Investing in a start-up company with lower stock share prices, for instance, could eventually reap big returns but also could be more likely to fail, with the stock value dropping. This is called a higher risk, higher reward.

Those students looking for a more conservative investment option should consider investing in established companies or a compound of companies called a mutual fund. This is a longer-term investment strategy that could grow money over the decades consistently.

#7: How to Start a Business

I understand that starting a business might be A LOT for any high schooler to take in, but what better opportunity to get an introduction?

I didn’t come from a family that had business-building expertise. And neither did my friends. Thankfully, someone put books in front of me like Rich Dad, Poor Dad that at least gave me a basic intro to these concepts.

The Bottom Line

Personal finance is such an important part of life that I can’t believe we don’t teach students more about money in school. When you really think about it, it’s no wonder household debt levels are at all-time highs.

When people don’t know better, they don’t do better.

Let’s try to make a positive difference in our students’ financial futures now by teaching our children financial basics – and to advocate for more financial education in schools.

#4 is super powerful. I spent some time analysing Bond ETFs for protection in order to make the most of #4 and avoid any losses.

The information you have is spot on, and wish I knew out of high school. I’m now 68 and want to join your revolution in enlightening young people and also myself, any advice.

That was extremely helpful I wish I learned it earlier 2 but I guess it’s never too late to start

Most high school graduates can’t even write a check much less balance a checking account statement because they cannot sign their name in cursive. How much does a high school education cost these day’s?

The great thing about the PF blogosphere today is that people are at least increasingly talking about it and generating awareness. In India, where I live, the bad financial habits are just beginning to creep in and financial awareness seems a long long way away.

For instance, my brother-in-law did his MBA and got his first credit card. Every month he was simply paying the “Minimum amount due” even though he had all the cash required to pay the bill, just because that was the minimum amount due.

Here’s hoping for some change in my country and the financial education there as well.

Hi Jeff! I am a high school business teacher and teach a class called Money Matters. I teach all of these topics and more…but unfortunately this class is not a graduation requirement. ALL students should have to take Money Matters! We’re going over budgets right now and students are seeing how quickly expenses add up…some of them are saying…I’m broke and I haven’t even put in all my expenses! It’s the real world kiddo! 🙂 If you have any budget/financial forms that you could pass along to I would greatly appreciate it.

Really good article. I literally knew nothing about finance before I read this editorial. It has cleared up an impressive amount of financial concepts for me and really opened my eyes to the world of business. Thank You!

Hi Jeff, you mention that investing with bigger companies like Vanguard and Fidelity “can be smart”. Is there a downside to using these big companies?

Hi Tien – Not really. The big companies have tremendous advantages, like unlimited investment options. About the only negative that I can think of is if you need a lot of assistance. If you do, you might be better off investing through a robo-advisor, since they will handle all of the investing for you. But if you are a self-directed investor, the big companies are fine.

Another factor is if you are a very active trader. The bigger platforms don’t have the lowest commissions. In that case, you might be better off going with one of the less well-known platforms, that charge less than $5 per trade.

Thank you Jeff! I really appreciate the feedback, and your blog and podcasts are great resources.